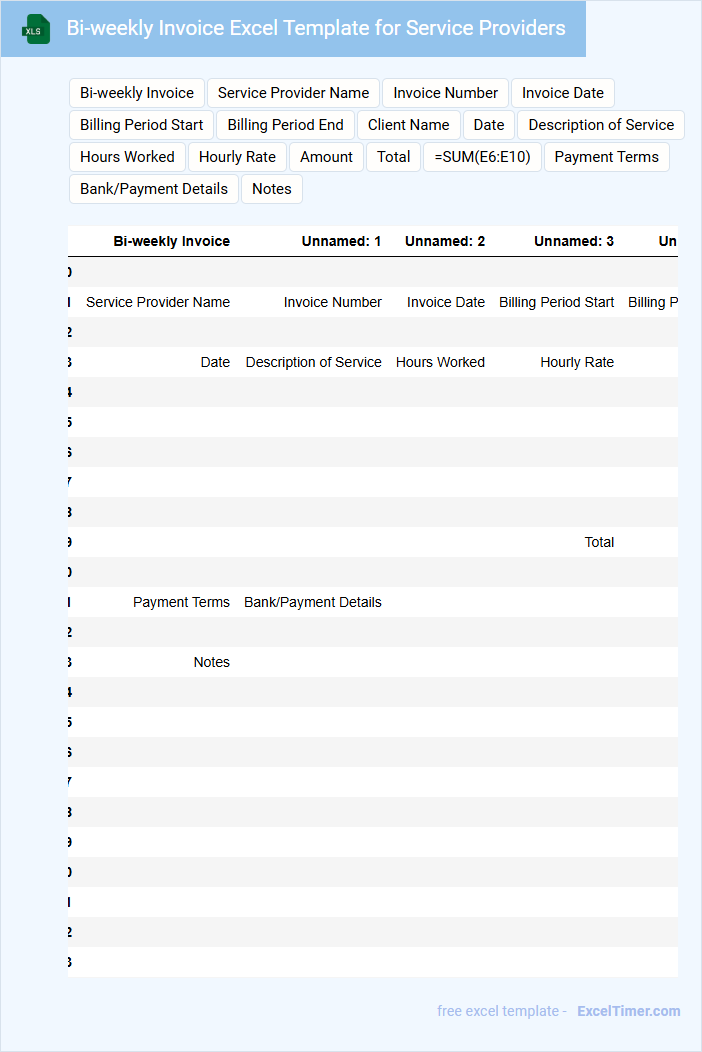

The Bi-weekly Invoice Excel Template for Service Providers streamlines billing by allowing easy tracking of payments and services rendered every two weeks. It features customizable fields for client details, service descriptions, rates, and totals, ensuring accuracy and professionalism in invoicing. Using this template helps service providers maintain organized records and improve cash flow management efficiently.

Bi-weekly Invoice Excel Template for Service Providers

A bi-weekly invoice Excel template is typically used by service providers to bill clients every two weeks for the services rendered. This document usually contains detailed descriptions of work performed, hours logged, and corresponding rates. It is essential to ensure accuracy and clarity in the invoice to maintain professional client relationships and prompt payments.

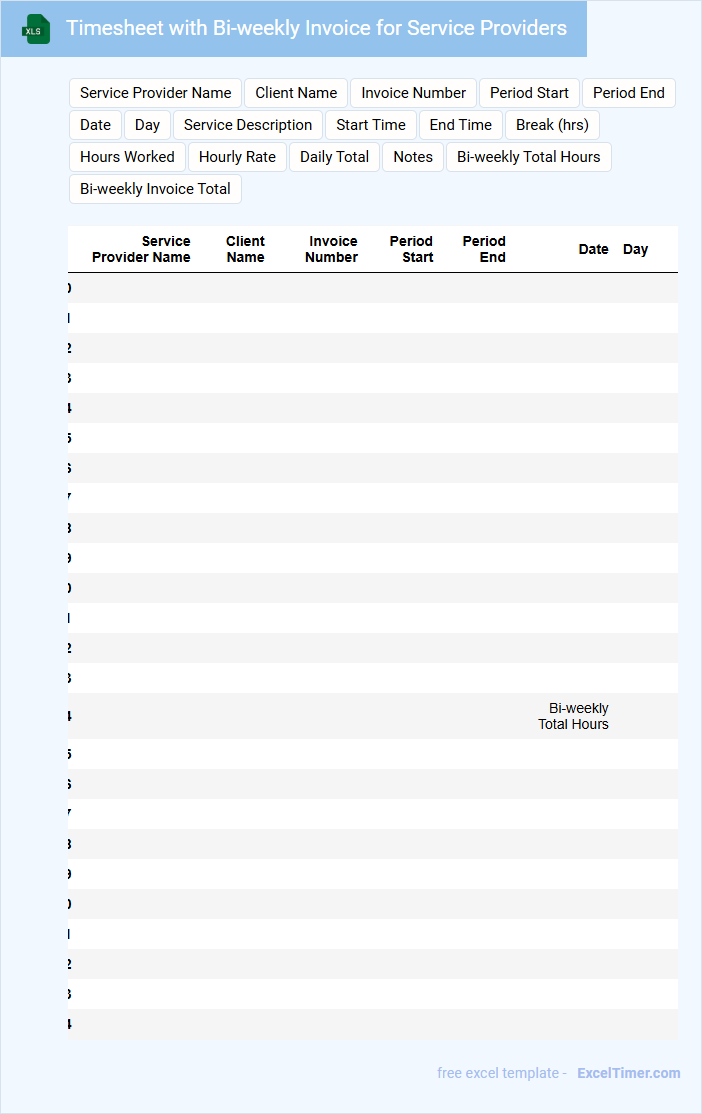

Timesheet with Bi-weekly Invoice for Service Providers

A Timesheet with Bi-weekly Invoice for Service Providers is a document that records the hours worked by service providers over a two-week period and details the corresponding charges. It serves as a proof of work completed and a basis for payment processing.

This document typically includes the service provider's name, dates worked, hours logged daily, hourly rates, and total amount due. Ensuring accuracy in time tracking and clear itemization of tasks performed is crucial.

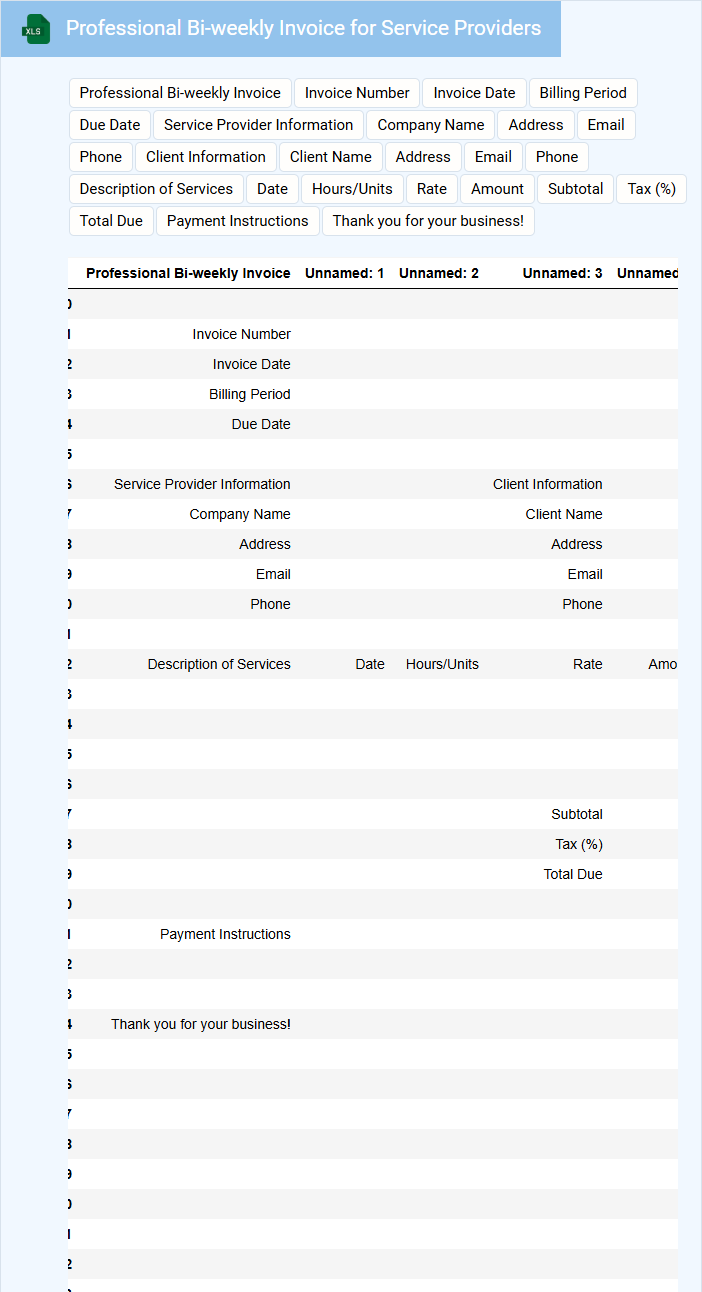

Professional Bi-weekly Invoice for Service Providers

What does a professional bi-weekly invoice for service providers typically contain? This document usually includes detailed descriptions of the services rendered, the billing period, and corresponding payment amounts. It ensures clear communication between service providers and clients, facilitating timely and accurate payments.

What are the important elements to include in such an invoice? Key components include the provider's contact information, client details, invoice number, dates of service, itemized service descriptions, rates, total amounts due, payment terms, and methods. Including these elements improves professionalism and reduces payment disputes.

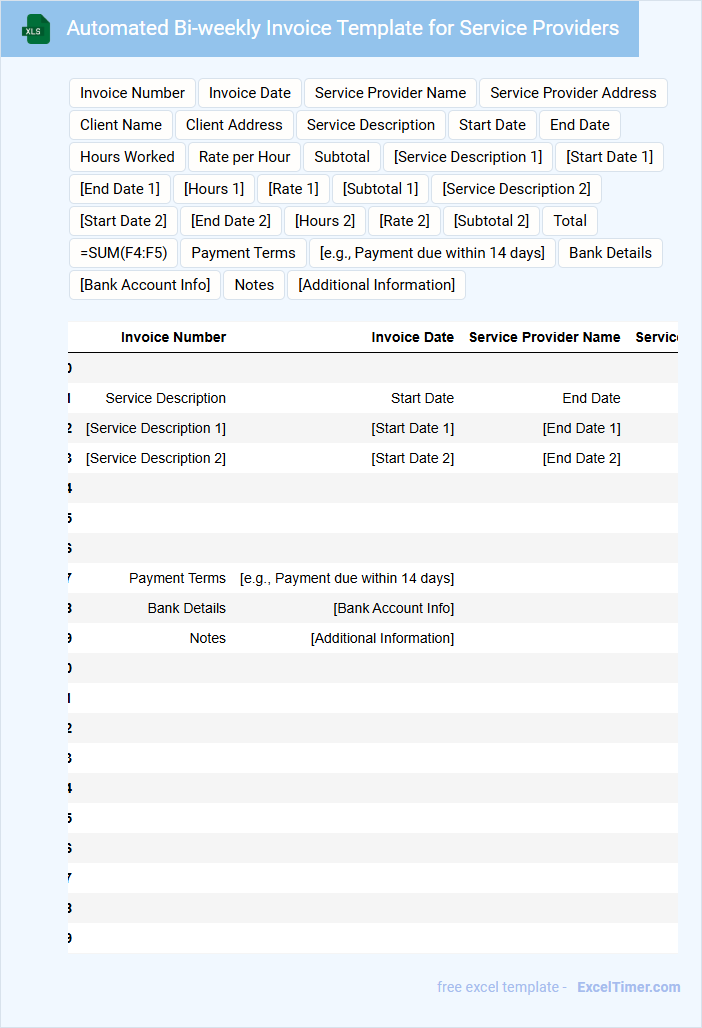

Automated Bi-weekly Invoice Template for Service Providers

An Automated Bi-weekly Invoice Template for Service Providers typically includes detailed billing information such as service descriptions, hours worked, rates, and total amounts due. It ensures consistent and accurate invoicing every two weeks to streamline payment processes.

Important elements to include are client details, invoice numbers, payment terms, and methods to avoid confusion or delayed payments. Automating this template helps maintain professionalism and reduces administrative workload.

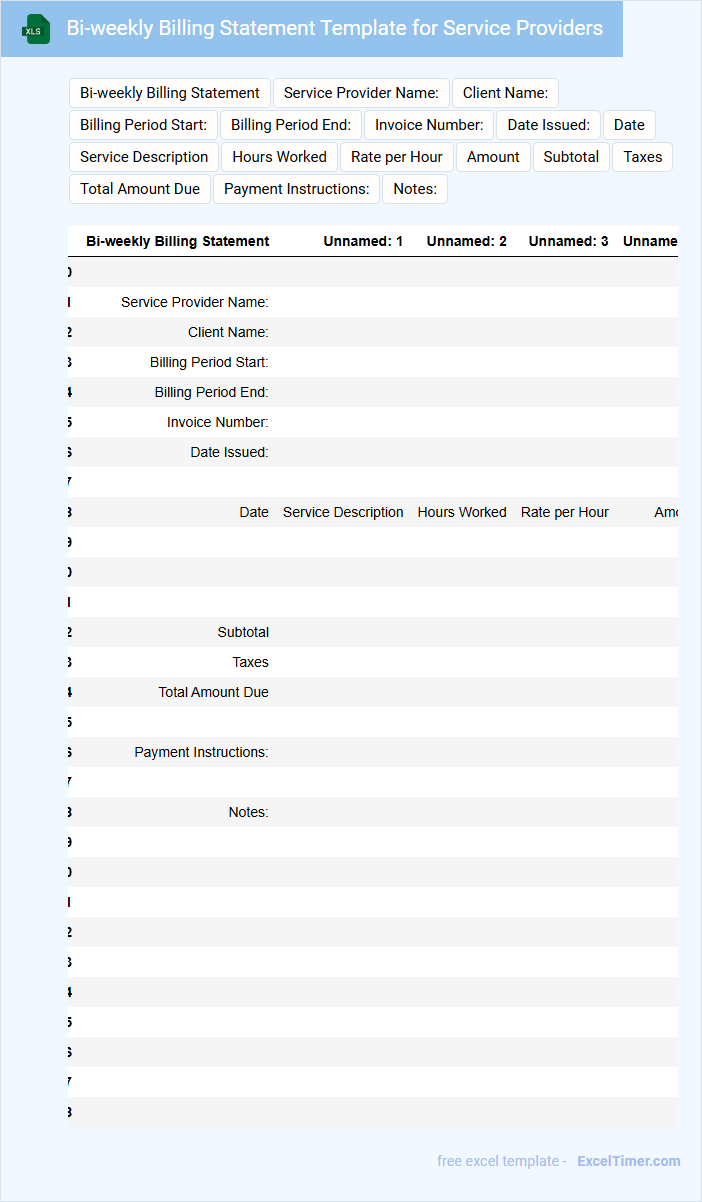

Bi-weekly Billing Statement Template for Service Providers

A Bi-weekly Billing Statement Template for Service Providers typically contains detailed records of services rendered over a two-week period along with corresponding charges.

- Client Information: Includes the name, contact details, and billing address of the service recipient.

- Service Details: Lists each service provided with dates, descriptions, and individual costs.

- Payment Terms: Specifies payment methods, due dates, and any applicable late fees or discounts.

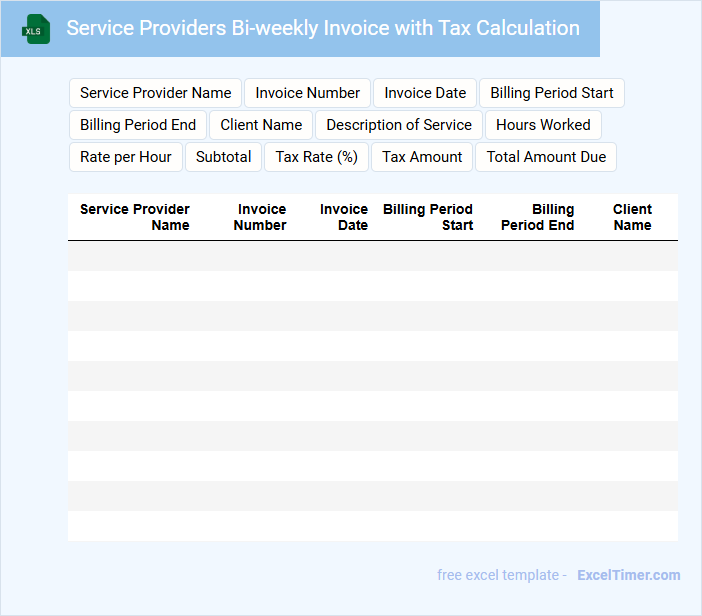

Service Providers Bi-weekly Invoice with Tax Calculation

A Service Providers Bi-weekly Invoice with Tax Calculation is a detailed financial document issued every two weeks that records the services rendered and the corresponding charges. It typically includes the invoice date, service descriptions, hours worked, unit costs, subtotal, tax applied, and the total amount due. Ensuring accurate tax computation and clear itemization is crucial for maintaining transparent records and smooth payment processing.

Bi-weekly Invoice for Service Providers with Hours Tracker

A Bi-weekly Invoice for Service Providers with Hours Tracker typically contains detailed billing information along with tracked service hours for accurate payment processing.

- Invoice Summary: Clear identification of service period and total amount due.

- Hours Tracker: Detailed log of hours worked, including dates and descriptions of tasks.

- Payment Instructions: Clear methods and deadlines for payment to ensure timely transactions.

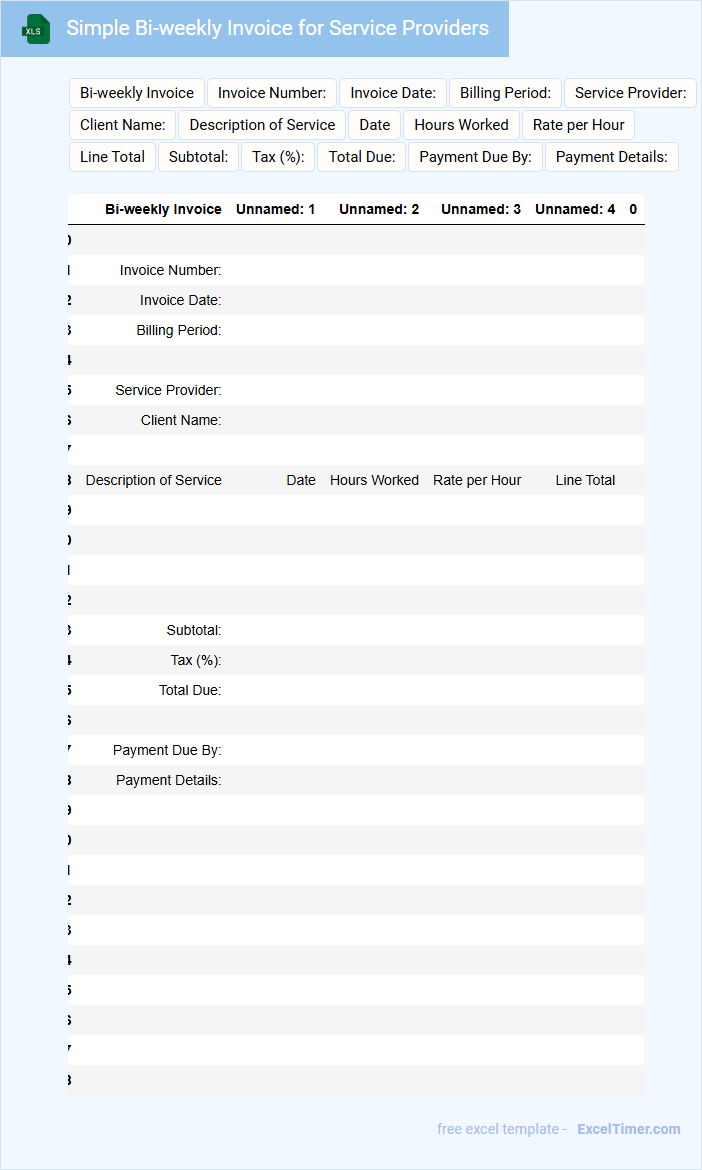

Simple Bi-weekly Invoice for Service Providers

A Simple Bi-weekly Invoice for Service Providers typically includes a detailed account of services rendered over a two-week period. It outlines the hours worked, rates applied, and the total amount due.

This document is essential for maintaining clear financial records and ensuring timely payment. Including accurate contact information and invoice numbers is important for easy tracking and communication.

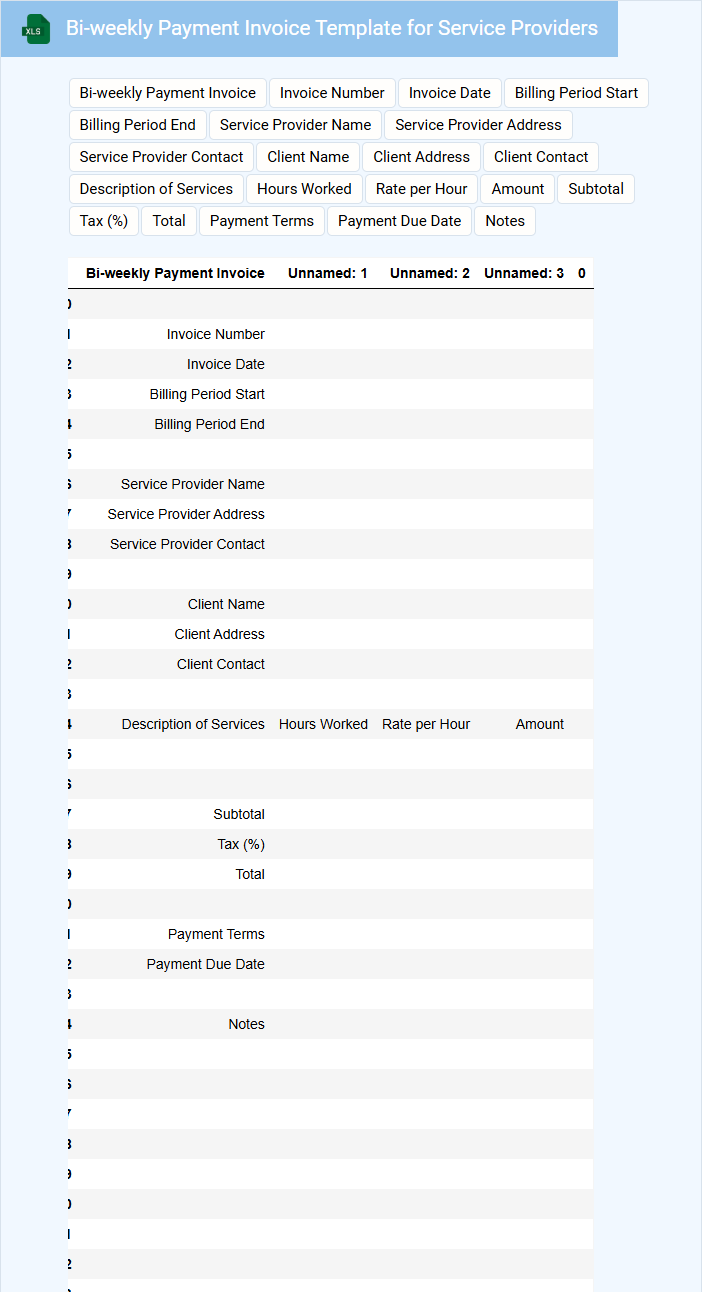

Bi-weekly Payment Invoice Template for Service Providers

What information does a bi-weekly payment invoice template for service providers usually contain? This type of document typically includes the service provider's details, client information, a description of services rendered, the billing period, payment amount, and payment terms. It helps ensure clear communication and accurate payment tracking between service providers and clients on a bi-weekly basis.

What is an important aspect to consider when using a bi-weekly payment invoice template? It is essential to accurately detail the service dates and hours worked to avoid payment disputes. Including clear payment instructions and due dates can also streamline the payment process and improve cash flow management.

Bi-weekly Service Invoice with Expense Tracking for Providers

A Bi-weekly Service Invoice with Expense Tracking for Providers typically contains detailed records of services rendered and associated costs over a two-week period. It includes itemized charges, dates of service, and any reimbursable expenses incurred by the provider. This document is essential for accurate billing and financial transparency between service providers and clients.

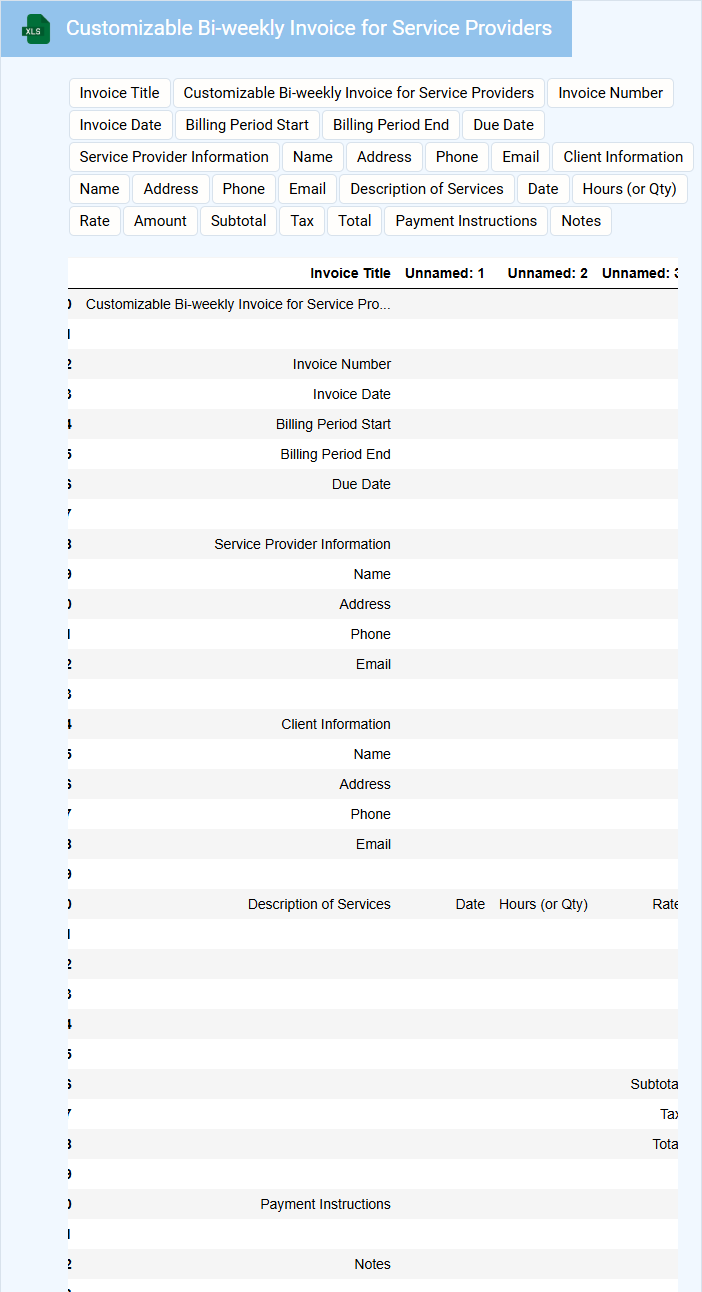

Customizable Bi-weekly Invoice for Service Providers

What information is typically included in a customizable bi-weekly invoice for service providers? This type of document usually contains details such as the service provider's contact information, client details, a description of services rendered, hours worked or service units, rates, total amount due, and payment terms. Including these elements ensures clarity, facilitates timely payments, and maintains accurate financial records.

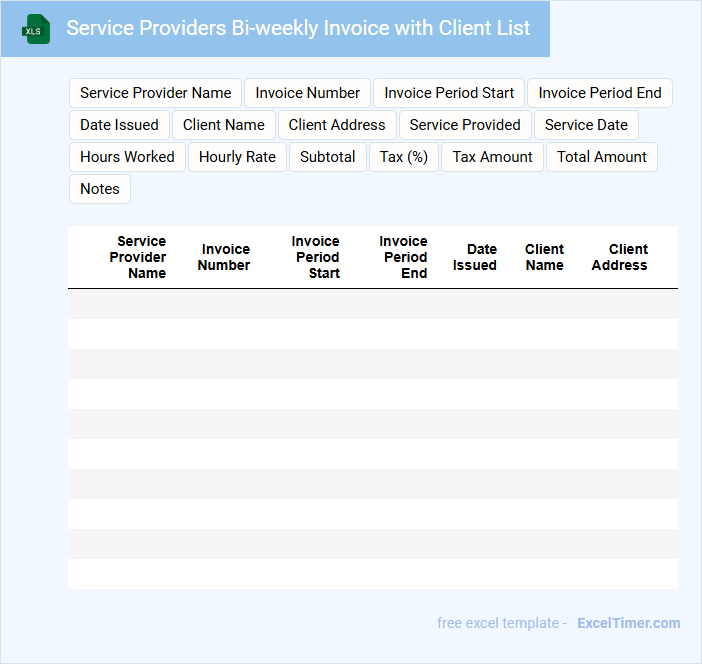

Service Providers Bi-weekly Invoice with Client List

The Service Providers Bi-weekly Invoice typically contains detailed records of services rendered over a two-week period, including dates, descriptions, and corresponding costs. It summarizes billable activities to ensure accurate and timely payment from clients.

The Client List section includes contact information, service agreements, and any outstanding balances for each client. It helps maintain organized communication and efficient tracking of invoicing history.

Ensuring accuracy in service details and client data is crucial for seamless financial operations and effective client management.

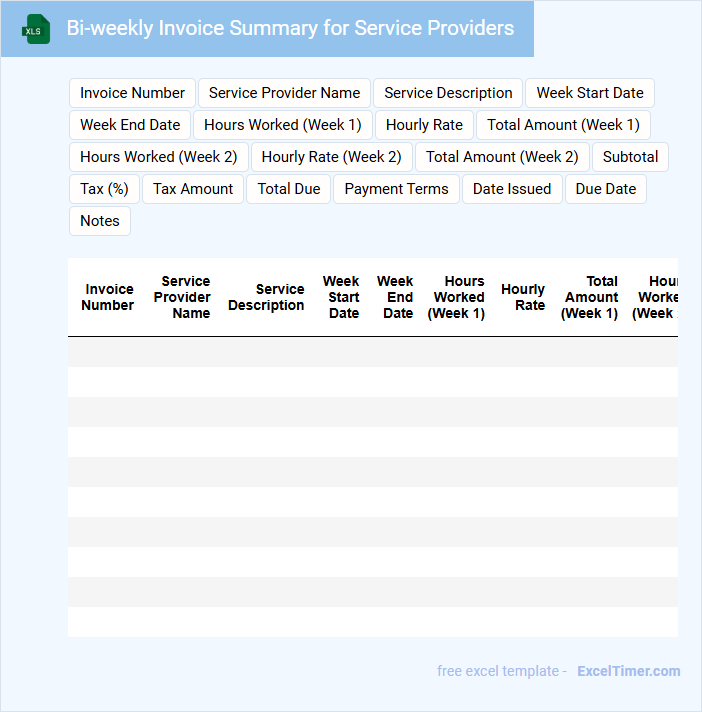

Bi-weekly Invoice Summary for Service Providers

A Bi-weekly Invoice Summary for Service Providers typically contains a detailed record of services rendered and payments due within a two-week period.

- Invoice Details: Clear listing of each invoice including dates, amounts, and service descriptions.

- Payment Status: Updated information on which invoices have been paid or are outstanding.

- Summary Totals: Aggregated totals for all invoices to provide a concise financial overview.

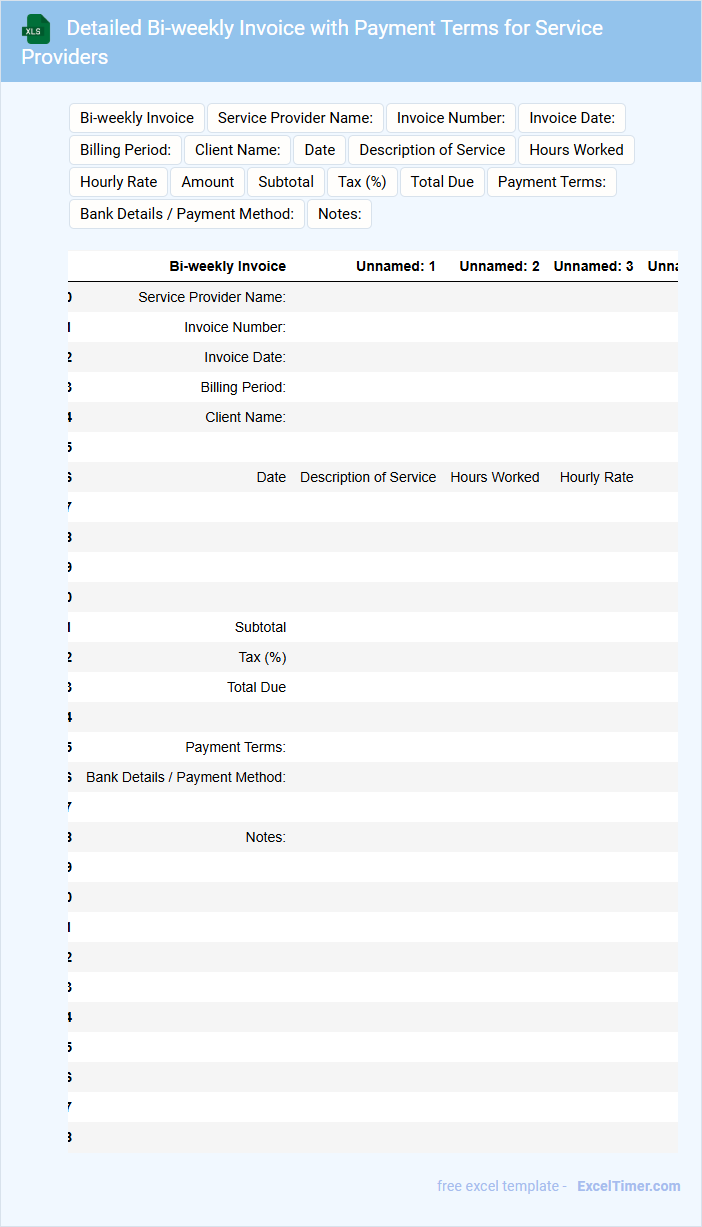

Detailed Bi-weekly Invoice with Payment Terms for Service Providers

Detailed Bi-weekly Invoices with Payment Terms for Service Providers typically include a comprehensive summary of services rendered, billing details, and explicit payment conditions. They serve as a formal request for payment while clarifying terms to avoid disputes.

- Include a clear breakdown of services with dates and rates.

- Specify payment due dates and accepted payment methods.

- Mention any late payment penalties or discounts for early payment.

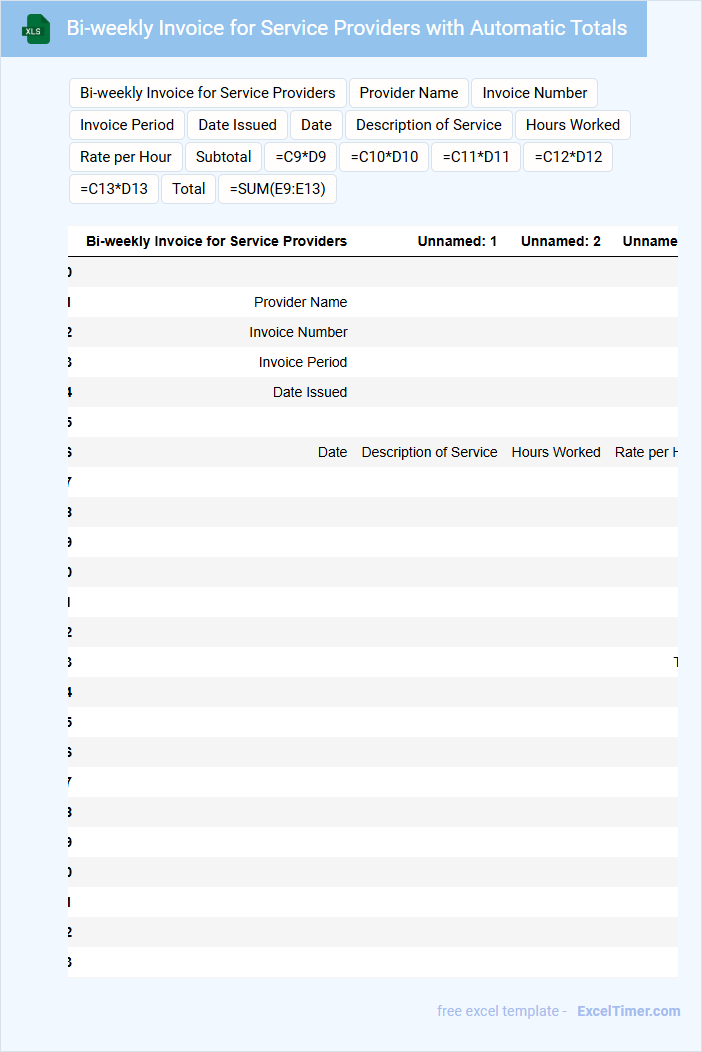

Bi-weekly Invoice for Service Providers with Automatic Totals

A Bi-weekly Invoice for Service Providers typically contains detailed records of services rendered over a two-week period, including descriptions, quantities, and rates. It automatically calculates totals to ensure accuracy and efficiency, reducing manual errors. Essential elements include client details, service dates, payment terms, and a clear breakdown of charges with taxes and discounts applied.

What information must be included in a bi-weekly invoice for service providers (e.g., dates, hours worked, rates)?

A bi-weekly invoice for service providers must include the invoice period dates, total hours worked, hourly rates, and a detailed description of the services performed. Your invoice should also feature the provider's name, contact information, payment terms, and the total amount due. Clear documentation of these elements ensures accurate billing and timely payments.

How should taxes and deductions be calculated and displayed on a bi-weekly invoice in Excel?

Taxes and deductions on a bi-weekly invoice in Excel should be calculated using predefined formulas based on your service rates and applicable tax percentages. Display each tax and deduction as separate line items with clear labels to ensure transparency and accuracy. You can use Excel functions like SUM and PRODUCT to automate these calculations and present total payable amounts.

What formula can be used to automatically calculate total payment for each pay period based on hours and rates?

Use the formula =Hours*Rate to automatically calculate total payment for each pay period in your bi-weekly invoice Excel document. This formula multiplies the number of hours worked by the hourly rate to generate accurate payment totals. You can copy this formula across rows to calculate payments for multiple service providers efficiently.

How can Excel track outstanding payments and paid invoices for bi-weekly cycles?

Excel can track outstanding payments and paid invoices for bi-weekly cycles by using formulas and pivot tables to categorize invoice statuses based on due dates and payment records. Your bi-weekly invoice document can include columns for invoice dates, payment deadlines, payment status, and amounts, allowing automatic calculation of outstanding balances and payment history. Conditional formatting highlights overdue invoices, ensuring clear visibility of unpaid and paid entries within each bi-weekly period.

What is the best practice for categorizing and summarizing services rendered within each bi-weekly period?

Best practice for categorizing and summarizing services in a bi-weekly invoice includes grouping services by type, date, and project for clear organization and easy tracking. Use standardized codes or labels to maintain consistency across periods and facilitate quick reference. Ensure Your invoice highlights total hours, rates, and subtotals to provide a transparent and concise summary of work performed.