![]()

The Bi-weekly Expense Tracker Excel Template for Freelancers helps manage and monitor expenses efficiently every two weeks, ensuring accurate budgeting and financial control. It simplifies tracking of income and expenditures, making tax preparation easier and reducing financial errors. Freelancers benefit from organized financial data, leading to improved cash flow management and informed business decisions.

Bi-weekly Expense Tracker with Category Summary

A Bi-weekly Expense Tracker is a document designed to monitor and categorize personal or business expenses over a two-week period. It typically includes sections for listing individual expenses, categorizing them by type, and summarizing totals for each category. This helps users maintain financial awareness and manage budgets effectively by identifying spending patterns.

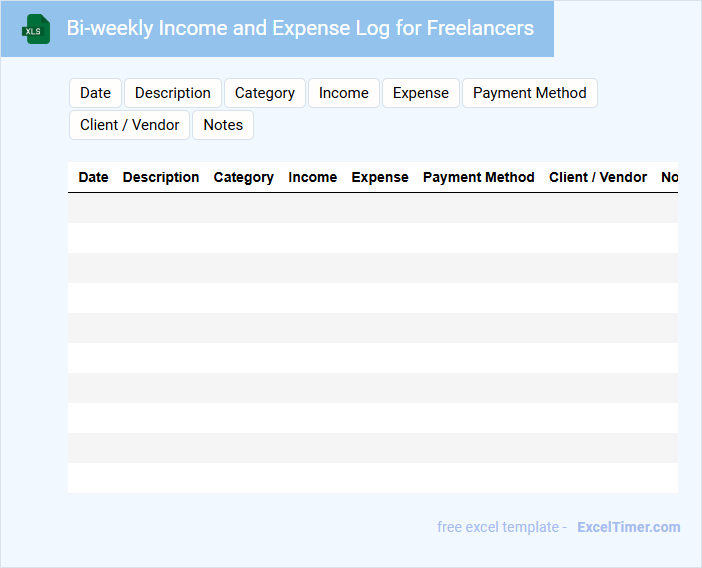

Bi-weekly Income and Expense Log for Freelancers

A Bi-weekly Income and Expense Log for freelancers is a crucial document that tracks all earnings and expenditures within a two-week period. It helps in maintaining accurate financial records and managing cash flow effectively. Consistency and detailed entries are important for maximizing its benefits.

Expense Tracking Spreadsheet for Bi-weekly Freelance Projects

An Expense Tracking Spreadsheet for bi-weekly freelance projects is a crucial tool for organizing income and expenditures efficiently. It typically includes categories such as project fees, materials, and miscellaneous costs to maintain a clear financial overview.

Maintaining accurate records helps freelancers manage their budget and prepare for tax season effortlessly. Including date, payment status, and client details in the spreadsheet enhances transparency and accountability.

Bi-weekly Cash Flow Tracker with Detailed Analysis

The Bi-weekly Cash Flow Tracker is a financial document that records all cash inflows and outflows within a two-week period, helping individuals or businesses monitor liquidity. It usually contains income sources, expenses, and net cash flow figures to provide a clear picture of financial health.

Detailed analysis in this document highlights trends, irregularities, and potential cash shortages, enabling better budgeting decisions. It is important to include accurate categorization and timely updates for effective cash management.

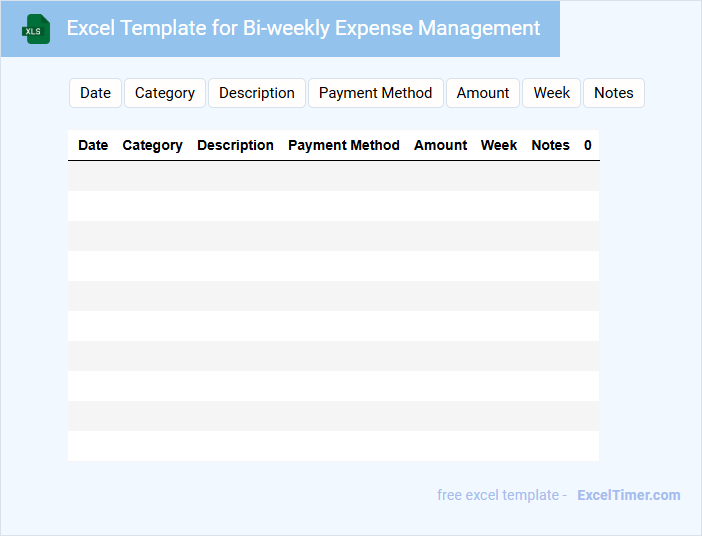

Excel Template for Bi-weekly Expense Management

An Excel Template for Bi-weekly Expense Management is typically used to track and organize expenses over a two-week period. It contains predefined columns for dates, categories, descriptions, amounts, and totals to simplify budgeting. This document helps individuals or businesses monitor spending patterns and maintain financial control efficiently.

Important features to include are automated formulas for calculating totals, categorized expense sections, and a clear summary dashboard. Ensure the template is user-friendly with customizable categories and date ranges. Regular updates and data validation can improve accuracy and usefulness.

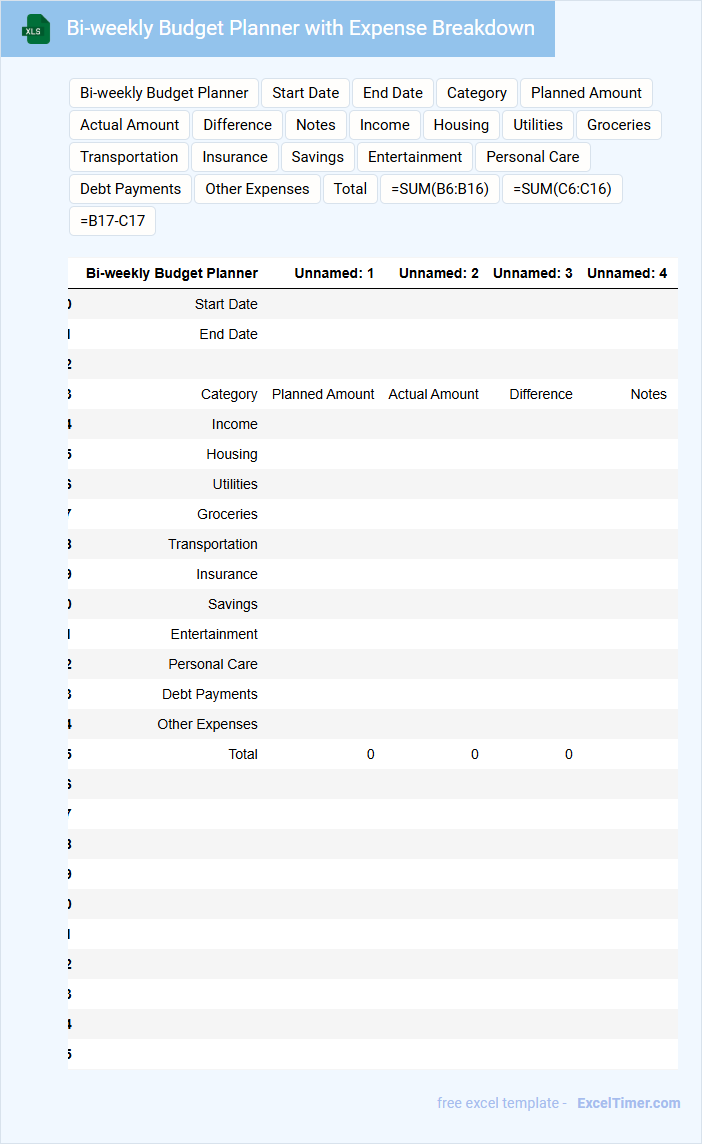

Bi-weekly Budget Planner with Expense Breakdown

A Bi-weekly Budget Planner typically contains detailed sections for tracking income, fixed expenses, and variable spending across two-week periods. It often includes an expense breakdown to categorize costs such as groceries, utilities, transportation, and entertainment. This type of document helps users monitor financial habits and maintain control over their spending cycles efficiently.

When creating or using a bi-weekly budget planner, it is important to ensure accurate income recording to reflect true cash flow. Additionally, categorizing expenses clearly allows for better identification of saving opportunities. Finally, incorporating a review section for unexpected costs can improve budget flexibility and overall financial planning.

Tax Deduction Tracker for Bi-weekly Freelance Expenses

A Tax Deduction Tracker for bi-weekly freelance expenses typically contains detailed records of all business-related costs incurred every two weeks. This document is essential for ensuring accurate financial reporting and maximizing deductible expenses.

It often includes categories such as equipment, travel, software subscriptions, and office supplies, helping freelancers organize their finances efficiently. Consistently updating this tracker can simplify tax filing and increase potential refunds.

To optimize its use, include clear dates, amounts, and detailed descriptions for each expense to maintain thorough documentation.

Bi-weekly Expense Tracker for Invoicing and Receipts

This document typically contains a detailed record of all expenses incurred over a two-week period, organized to support accurate invoicing and receipt verification. It helps streamline financial tracking and ensures transparency in business transactions.

- Include dates, descriptions, and amounts for each expense to maintain clarity.

- Attach or reference corresponding receipts for validation and audit purposes.

- Summarize totals per category to facilitate easy invoicing and budget analysis.

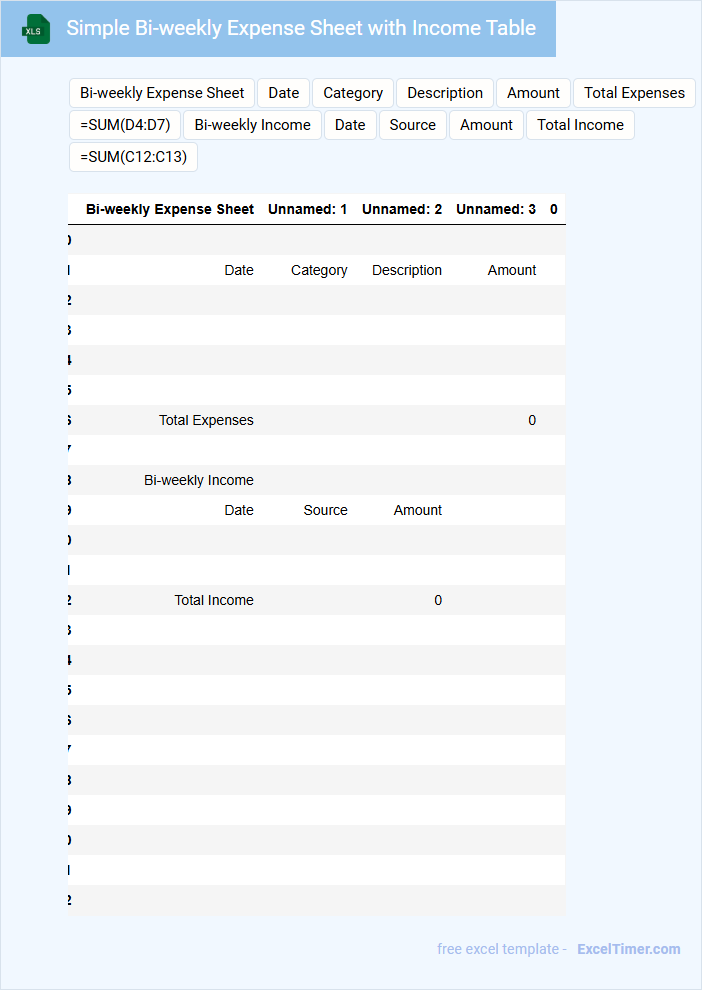

Simple Bi-weekly Expense Sheet with Income Table

A Simple Bi-weekly Expense Sheet with Income Table typically contains rows for tracking income sources and categories for various expenses over a two-week period. It helps users monitor their cash flow, ensuring all earnings and expenditures are accounted for. Important elements include dates, amounts, descriptions, and a running balance for accurate financial overview and budgeting.

Bi-weekly Spending Tracker for Freelancers

A Bi-weekly Spending Tracker for freelancers is a document designed to monitor and manage expenses over a two-week period. It helps freelancers maintain financial control by recording all income and expenditures systematically.

The tracker usually contains categories such as project costs, office supplies, software subscriptions, and personal expenses. Tracking these details ensures accurate budgeting and timely tax preparation.

Including a summary section for total income versus total expenses is important to quickly assess financial health.

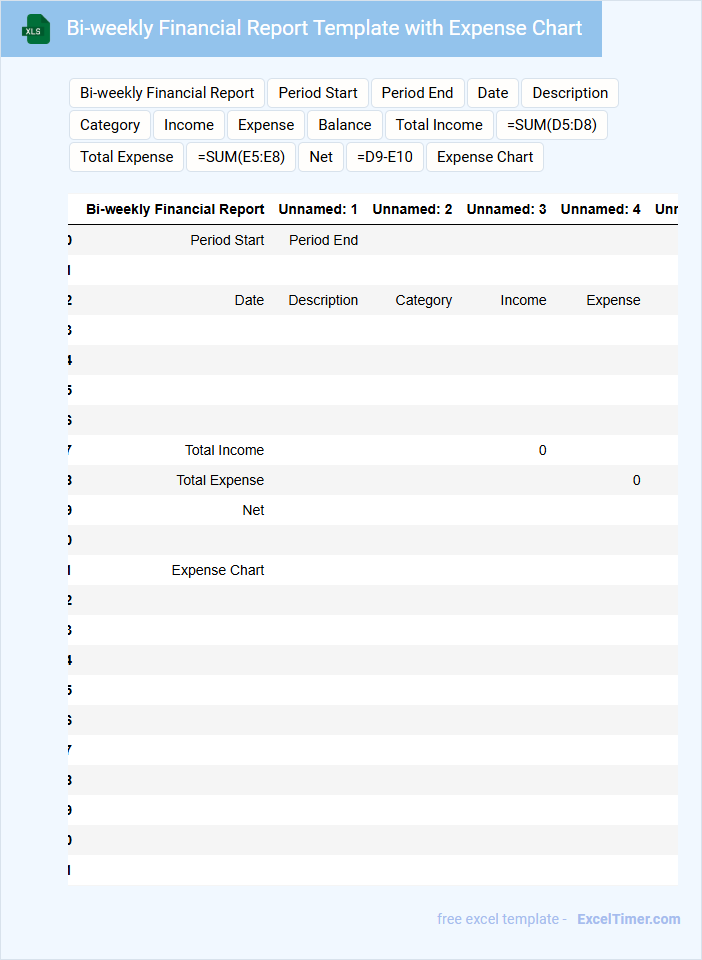

Bi-weekly Financial Report Template with Expense Chart

The Bi-weekly Financial Report Template typically contains detailed records of income, expenses, and budget variances over a two-week period. It summarizes financial activities and provides insights into cash flow management. Including an Expense Chart visually enhances understanding of spending patterns and budget adherence.

Key elements to include are categorized expenses, revenue sources, and comparative analysis with previous periods for trend identification. Ensure clarity with concise summaries and highlight any anomalies or significant changes. Incorporating actionable insights and recommendations improves decision-making and financial control.

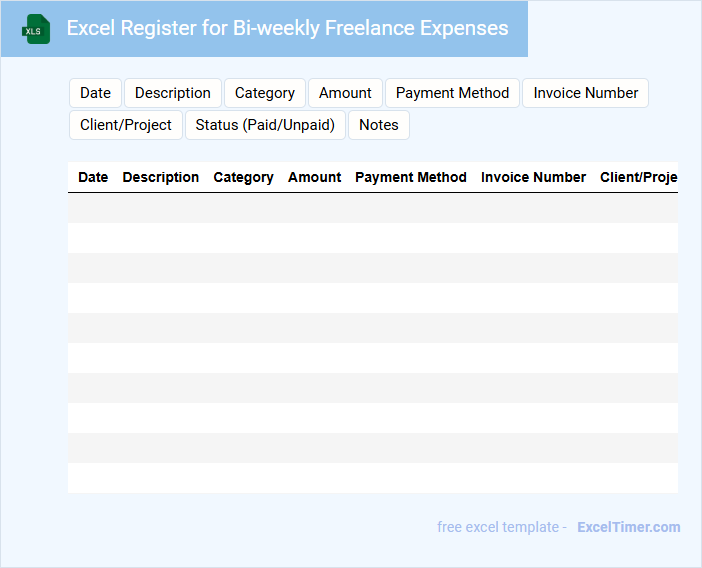

Excel Register for Bi-weekly Freelance Expenses

What is typically included in an Excel Register for Bi-weekly Freelance Expenses? This document usually contains detailed records of all expenses incurred during each bi-weekly period, including dates, descriptions, amounts, and categories. It helps freelancers track their spending accurately and manage their budget effectively.

Automated Bi-weekly Expense Tracker with Formulas

An Automated Bi-weekly Expense Tracker typically contains detailed records of income and expenditures organized by date and category. It uses formulas to automatically calculate totals, variances, and trends, providing clear insights into financial habits. This document is essential for budgeting, financial planning, and identifying areas for cost reduction.

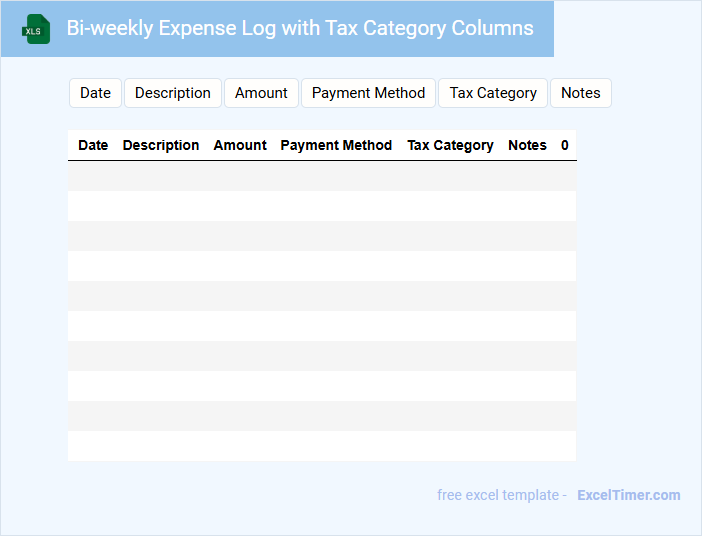

Bi-weekly Expense Log with Tax Category Columns

A Bi-weekly Expense Log with Tax Category Columns is a financial document used to record and categorize expenses every two weeks for better tax tracking and budgeting.

- Detailed entries: Ensure each expense includes the date, amount, and description for accurate record-keeping.

- Tax categories: Use clearly defined columns for different tax categories to simplify tax calculations and reporting.

- Regular updates: Maintain consistent bi-weekly updates to avoid missing any expenses and ensure up-to-date financial monitoring.

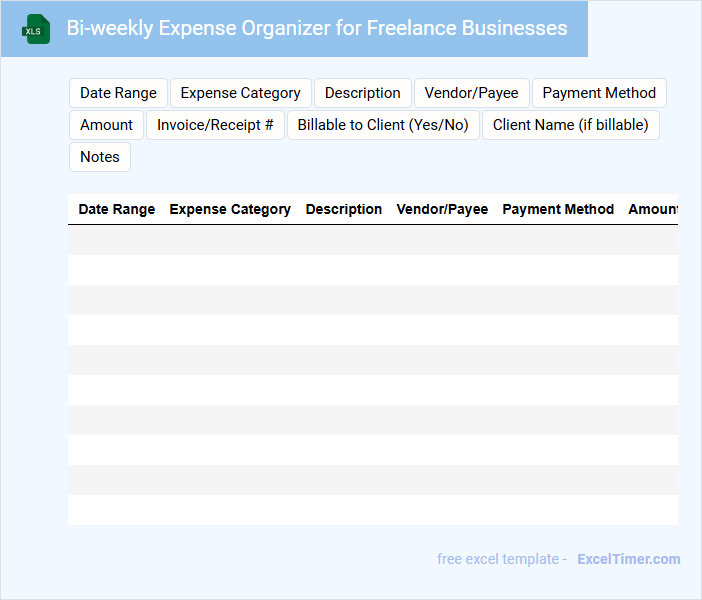

Bi-weekly Expense Organizer for Freelance Businesses

The Bi-weekly Expense Organizer for freelance businesses is a crucial document designed to track all income and expenditures every two weeks, helping freelancers maintain financial clarity. It typically includes sections for categorizing expenses, noting dates, and recording payment methods to ensure comprehensive record-keeping. Regularly updating this organizer aids in budgeting, tax preparation, and identifying spending patterns essential for financial health.

How does the bi-weekly expense tracker calculate total expenses and income for each pay period?

The bi-weekly expense tracker calculates total expenses by summing all recorded costs within each 14-day pay period. Income is totaled by aggregating all freelance payments received during the same timeframe. This structured approach ensures accurate financial tracking aligned with bi-weekly earnings and expenditures.

What formula is used to automatically update remaining budget after each new entry?

The formula used to automatically update the remaining budget in a Bi-weekly Expense Tracker for Freelancers is =Initial Budget - SUM(Expenses). This subtracts the total expenses recorded from the set budget. Applying this formula ensures real-time tracking of the budget balance after each new expense entry.

Which columns should be included to categorize and filter freelance expenses efficiently?

Include columns such as Date, Expense Category, Payment Method, Vendor/Client, Amount, Project Name, and Receipt Attached to categorize and filter freelance expenses efficiently. These columns enable easy sorting by time, type, and project, helping you track cash flow and budget accurately. Clear labels and standardized entries in these fields optimize data analysis and reporting.

How can you use conditional formatting to highlight overspending in any category?

Use conditional formatting in Excel by selecting the expense cells and setting a rule to highlight values exceeding your budget limit for each category. Apply a formula like =B2>C2, where B2 is the expense amount and C2 is the budgeted amount, to trigger color changes. This visual cue helps freelancers quickly identify overspending in their bi-weekly expense tracker.

What method enables quick visualization of spending trends across multiple bi-weekly periods?

Using pivot tables in Excel enables quick visualization of spending trends across multiple bi-weekly periods by summarizing and categorizing expenses efficiently. Conditional formatting highlights significant spending patterns, making trends immediately visible. Incorporating line or bar charts further enhances trend analysis by displaying expense fluctuations over time.