The Bi-weekly Excel Template for Contractor Payments streamlines tracking payments, ensuring accurate and timely compensation for contractors. This template includes essential fields for hours worked, rates, and total amounts, reducing errors and enhancing financial management. Utilizing this tool helps maintain organized records and supports efficient payroll processing every two weeks.

Bi-weekly Excel Template for Contractor Payments

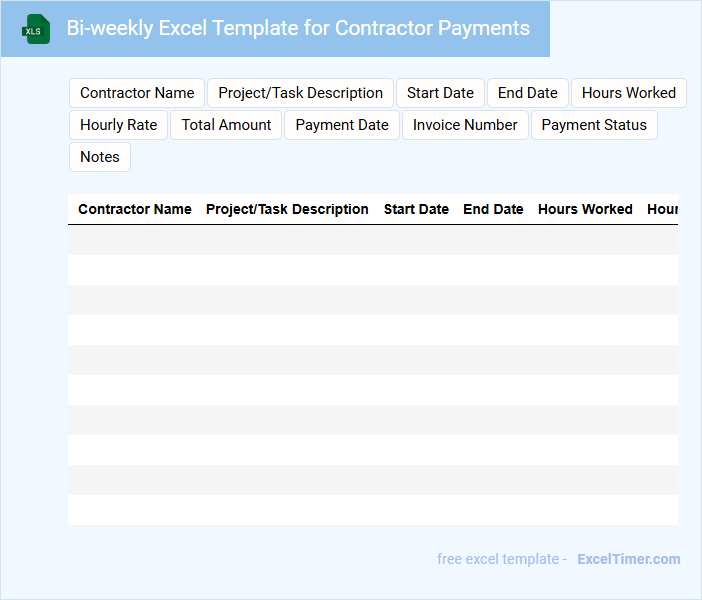

This document, known as a Bi-weekly Excel Template for Contractor Payments, is commonly utilized to systematically track and manage payments made to contractors every two weeks. It typically contains sections for contractor names, payment dates, invoice numbers, work descriptions, hours worked, rates, and total amounts due. Key suggestions for this template include ensuring accuracy in data entry, incorporating automated calculations, and maintaining clear records for auditing and financial tracking purposes.

Bi-weekly Payment Tracker for Contractors

A Bi-weekly Payment Tracker for contractors is a document used to monitor and record payments made every two weeks. It typically contains details such as payment dates, amounts, and outstanding balances to ensure transparency and accurate financial management.

This tracker helps both contractors and employers maintain organized records of payment schedules and avoid disputes. Including sections for payment confirmation and notes on discrepancies is an important feature to enhance clarity and accountability.

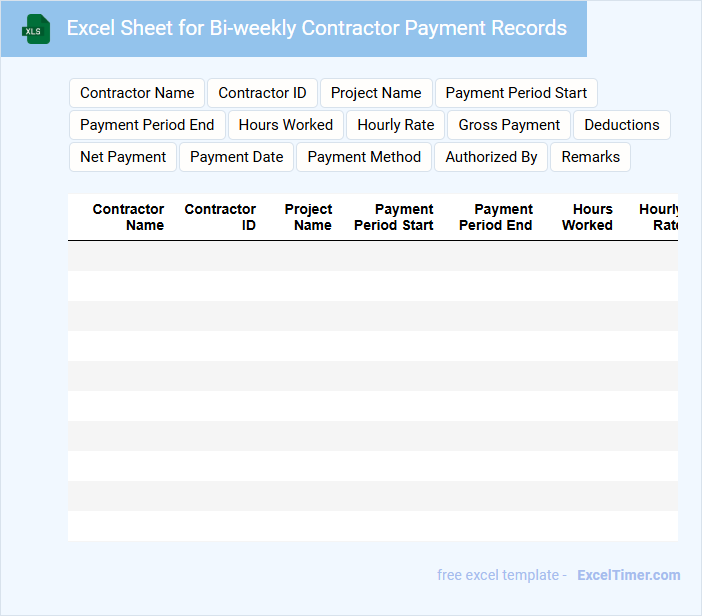

Excel Sheet for Bi-weekly Contractor Payment Records

An Excel Sheet for Bi-weekly Contractor Payment Records is a document designed to track and manage payments made to contractors every two weeks. It typically contains columns for contractor names, payment amounts, dates, and project descriptions. Ensuring accuracy and timely updates in this sheet is crucial for financial transparency and proper record-keeping.

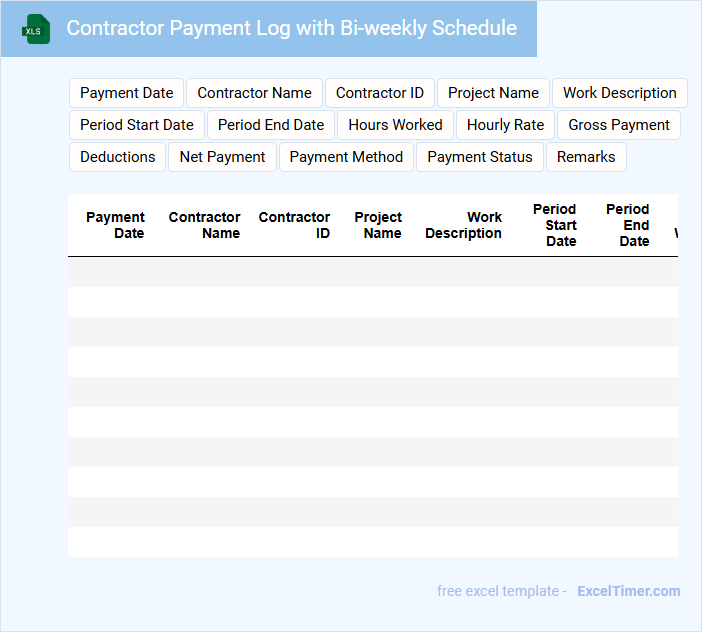

Contractor Payment Log with Bi-weekly Schedule

What information is typically included in a Contractor Payment Log with a Bi-weekly Schedule? This type of document usually contains detailed records of payments made to contractors, including dates, amounts, and payment descriptions aligned with the bi-weekly payment periods. It helps track financial transactions efficiently and ensures timely payments.

Why is maintaining accurate entries in a Contractor Payment Log crucial? Accurate records prevent payment disputes, improve budgeting accuracy, and provide clear documentation for auditing purposes. Regular updates aligned with the bi-weekly schedule are essential for transparency and financial control.

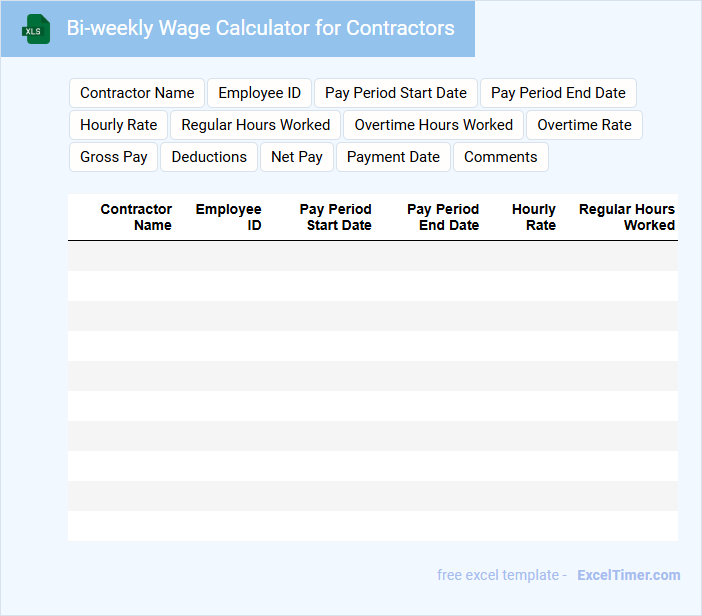

Bi-weekly Wage Calculator for Contractors

A Bi-weekly Wage Calculator for Contractors is a specialized tool designed to help contractors accurately compute their wages every two weeks. This document usually contains fields for hourly rates, hours worked, and applicable deductions such as taxes or benefits. It is essential to ensure accuracy and transparency to maintain trust and streamline payment processes.

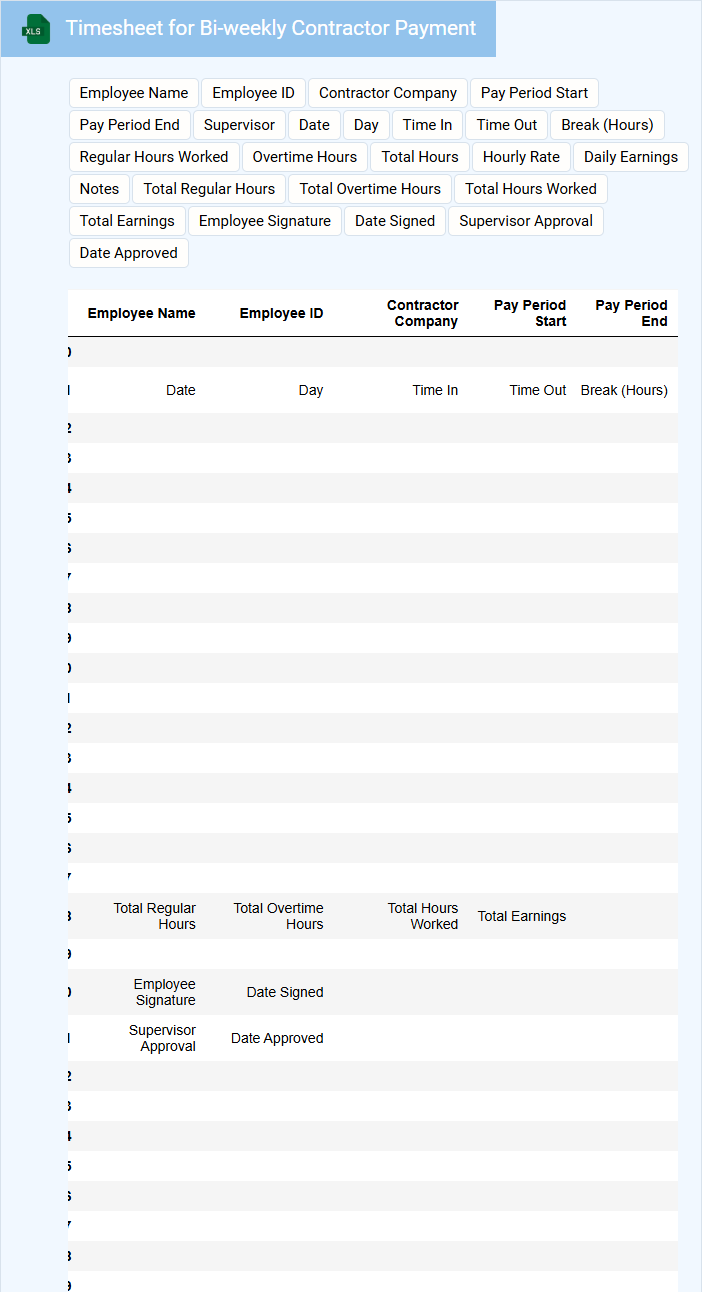

Timesheet for Bi-weekly Contractor Payment

Timesheets for bi-weekly contractor payments typically document hours worked and tasks completed to ensure accurate and timely compensation.

- Detailed hour tracking is essential to verify the exact time spent on each project or task.

- Clear project descriptions help confirm the work done aligns with contract requirements.

- Authorization signatures are important to validate the accuracy and approval of the submitted timesheet.

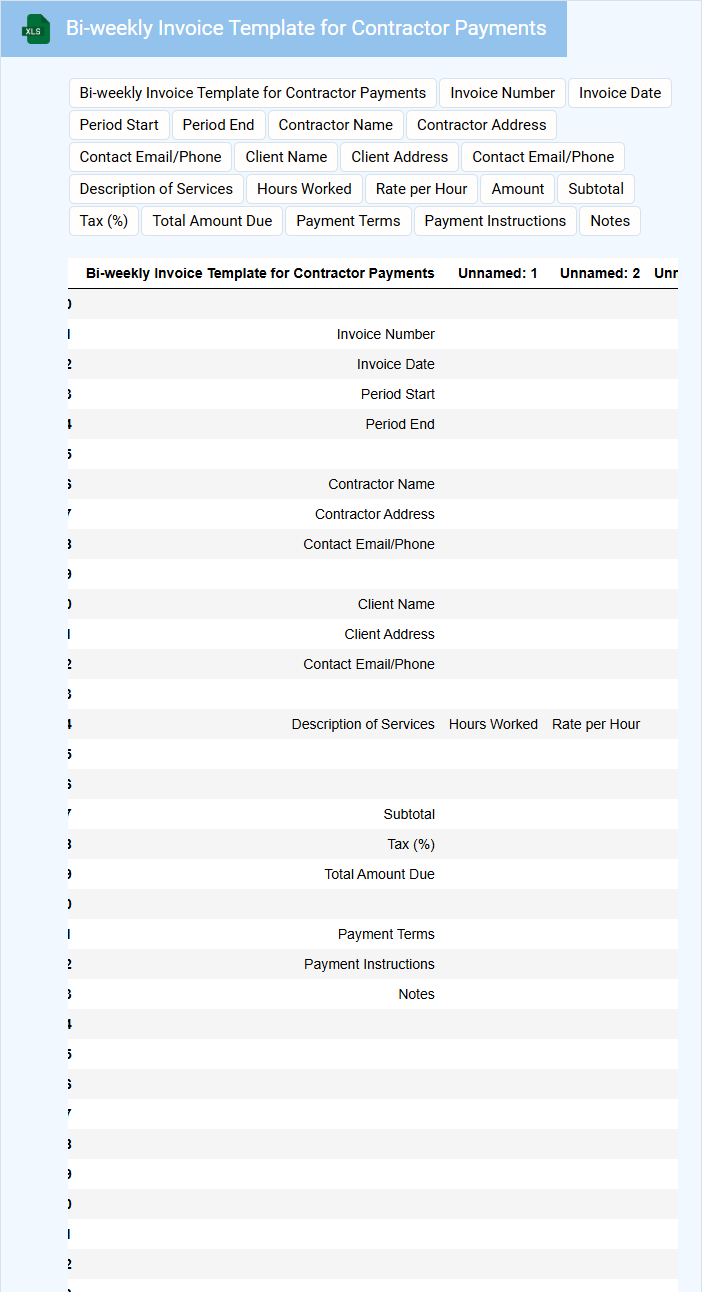

Bi-weekly Invoice Template for Contractor Payments

What information is typically included in a bi-weekly invoice template for contractor payments? This type of document usually contains details such as the contractor's name and contact information, the billing period, a breakdown of tasks performed or hours worked, rates applied, and the total payment due. It also includes payment terms and any relevant notes to ensure clarity and prompt processing.

Why is it important to include accurate descriptions and timestamps in the bi-weekly invoice? Precise descriptions and timestamps help avoid disputes by clearly showing the work completed within the billing period, making payment processing smoother and fostering trust between contractors and clients.

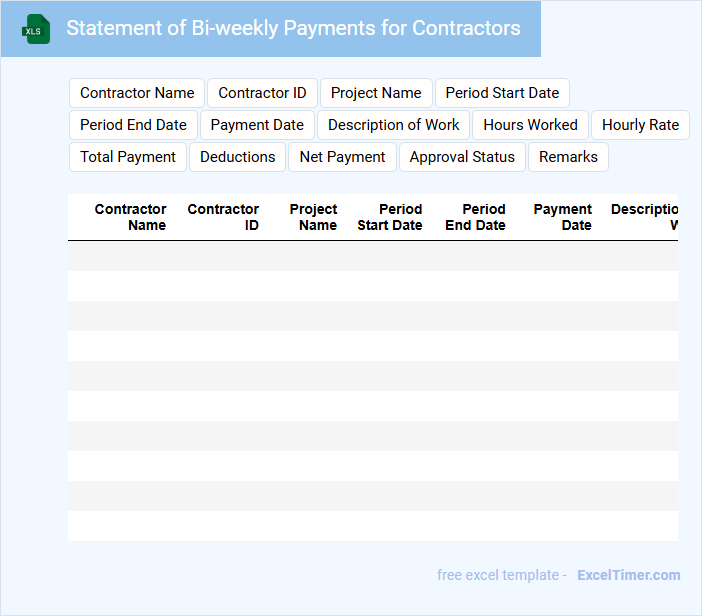

Statement of Bi-weekly Payments for Contractors

A Statement of Bi-weekly Payments for Contractors typically contains detailed records of payments issued to contractors over a two-week period to ensure accurate tracking and financial transparency.

- Payment Breakdown: It itemizes each payment made, specifying dates and amounts for clear accountability.

- Contractor Details: It includes contractor names and contact information for proper identification and communication.

- Approval Signatures: It requires authorized signatures to validate the accuracy and authorization of payments.

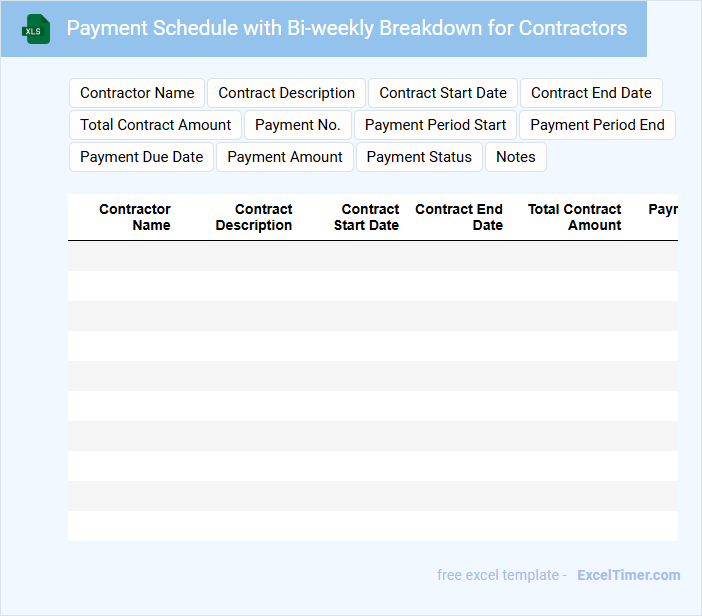

Payment Schedule with Bi-weekly Breakdown for Contractors

What information is typically included in a Payment Schedule with Bi-weekly Breakdown for Contractors? This type of document usually outlines the timing and amounts of payments to contractors, detailed in a bi-weekly format for clear tracking. It helps ensure transparency and timely remuneration aligned with project milestones or work completed.

What is an important consideration when creating this schedule? It is crucial to include precise dates, payment amounts, and conditions for release to avoid disputes and maintain smooth cash flow management. Additionally, specifying penalties for late payments and clearly defining deliverables linked to each payment enhances accountability.

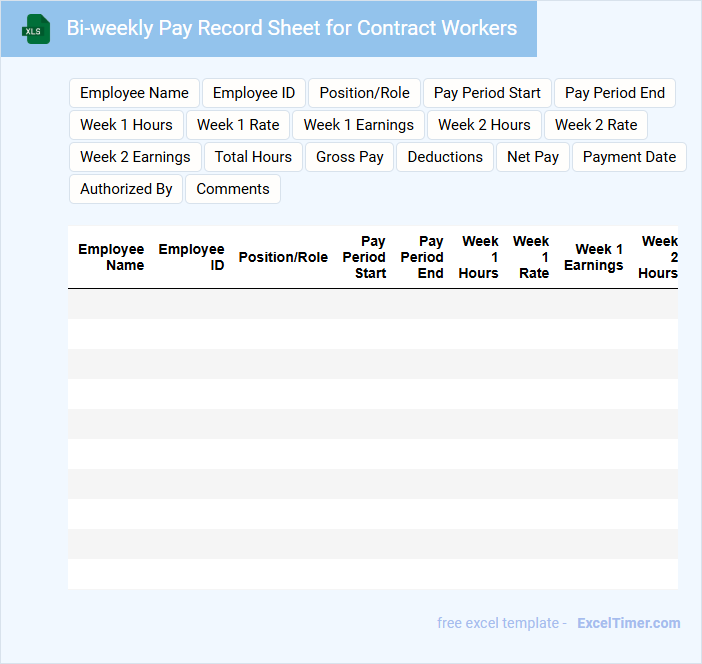

Bi-weekly Pay Record Sheet for Contract Workers

The Bi-weekly Pay Record Sheet for contract workers is a crucial document used to track the working hours and payments made every two weeks. It typically contains details such as employee names, hours worked, pay rates, deductions, and net pay. Maintaining accurate records ensures transparency and compliance with labor regulations.

Important elements to include are clearly defined pay periods, accurate time entries, and a verification section for both the employer and employee signatures. Additionally, consistent formatting and secure storage of the sheet help prevent discrepancies and facilitate audits. Regular updates and reviews improve payroll accuracy and worker satisfaction.

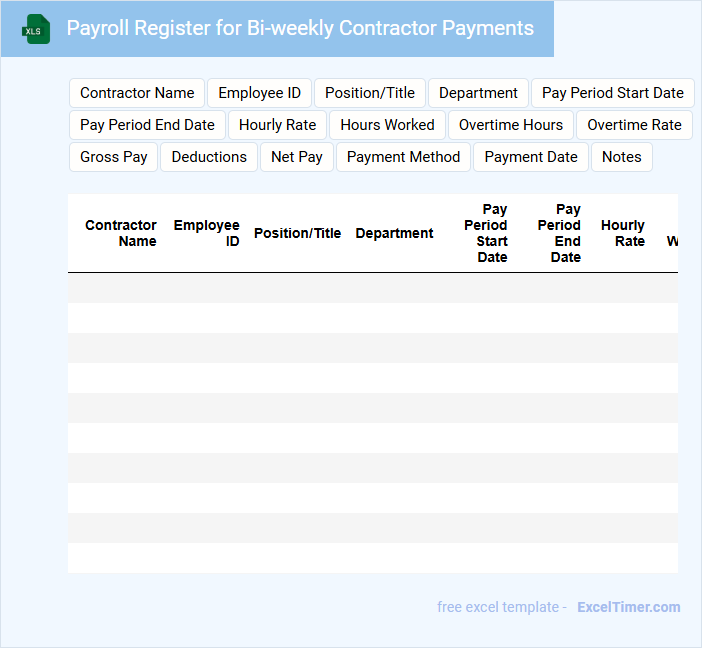

Payroll Register for Bi-weekly Contractor Payments

What information is typically included in a Payroll Register for Bi-weekly Contractor Payments? This document usually contains detailed records of each contractor's payments made during the bi-weekly period, including hours worked, payment rates, deductions, and net pay. It serves as a crucial tool for tracking financial transactions and ensuring accurate and timely compensation for contractors involved.

What important aspects should be considered when maintaining a Payroll Register for Bi-weekly Contractor Payments? It is essential to ensure accuracy in recording hours and payment details to avoid discrepancies and potential disputes. Additionally, maintaining confidentiality and compliance with tax regulations is vital to protect both the company and the contractors.

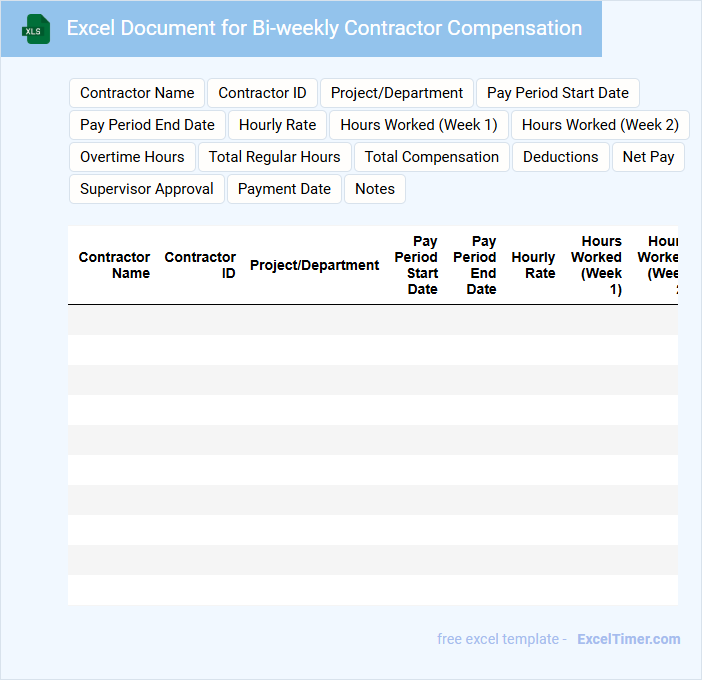

Excel Document for Bi-weekly Contractor Compensation

An Excel Document for Bi-weekly Contractor Compensation typically contains detailed records of contractor hours worked, pay rates, and total payments due every two weeks. It serves as a crucial tool for ensuring accurate and timely compensation while maintaining transparency between contractors and management. Key elements often include timesheets, payment calculations, and summary reports to facilitate payroll processing and financial tracking.

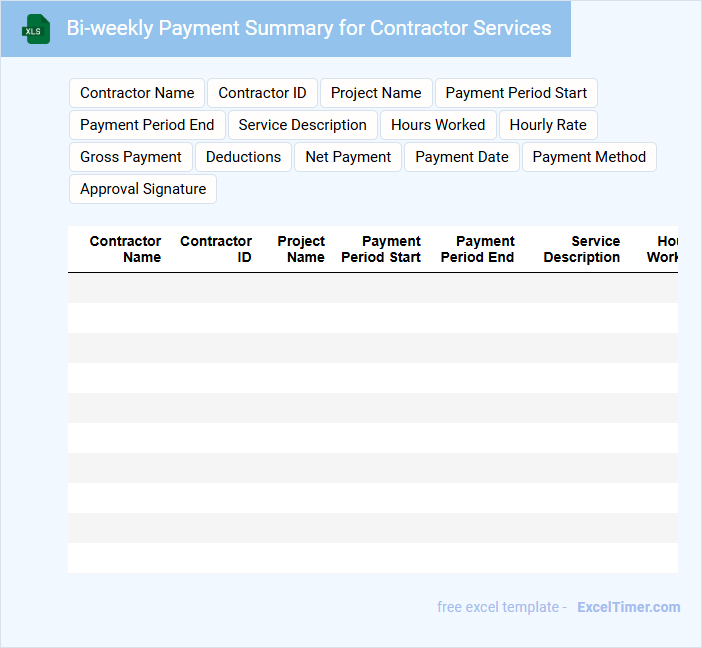

Bi-weekly Payment Summary for Contractor Services

This type of document typically contains summarized payment details for contractor services rendered during a bi-weekly period.

- Payment Dates: Clearly list the payment period covered to ensure accurate tracking of service durations.

- Contractor Details: Include the contractor's name and identification for proper attribution and record-keeping.

- Payment Breakdown: Provide a detailed summary of hours worked, rates, and total amounts paid for transparency.

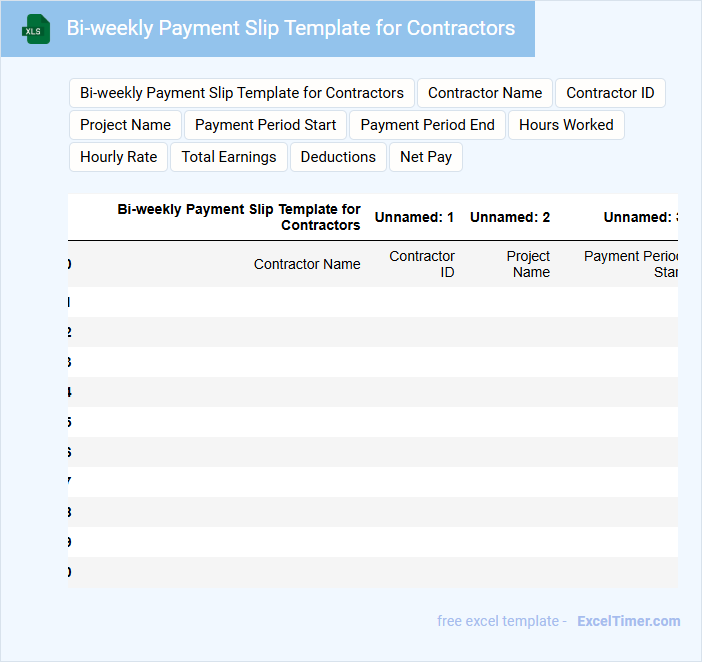

Bi-weekly Payment Slip Template for Contractors

A Bi-weekly Payment Slip Template for Contractors typically contains detailed information about the contractor's earnings and deductions over a two-week period. It includes specifics such as hours worked, pay rate, taxes withheld, and net pay.

Ensuring clarity and accuracy in the payment slip helps maintain transparent financial records and prevents disputes. It is important to include contractor identification and payment dates for proper documentation.

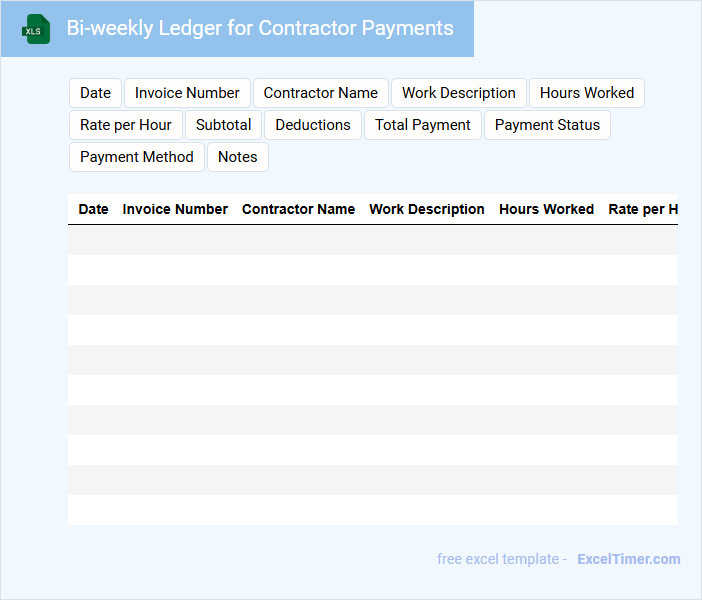

Bi-weekly Ledger for Contractor Payments

A Bi-weekly Ledger for Contractor Payments typically contains detailed records of all payments made to contractors within a two-week period. It includes information such as payment dates, amounts, contractor names, and descriptions of completed work or services. Maintaining accuracy and timely updates in this ledger ensures clear financial tracking and smooth project financing.

What is the meaning and calculation method of a bi-weekly payment schedule in Excel?

A bi-weekly payment schedule in Excel refers to payments made every two weeks, totaling 26 payments per year. To calculate bi-weekly payments, divide the annual salary or total payment amount by 26. Excel formulas like =AnnualAmount/26 or using the DATE function to generate payment dates every 14 days automate this calculation effectively.

How do you track and record contractor work hours for bi-weekly payments in Excel?

Track and record contractor work hours in Excel by creating a bi-weekly timesheet template with columns for dates, hours worked, and task descriptions. Use formulas to calculate total hours and payment amounts based on hourly rates to ensure accuracy. Your organized Excel sheet simplifies bi-weekly contractor payments and improves financial tracking.

Which Excel functions can automatically calculate bi-weekly payment amounts for contractors?

Excel functions like SUMPRODUCT and IF combined with DATE functions can automatically calculate bi-weekly payment amounts for contractors by tracking pay periods and hours worked. Using your payment schedule, the NETWORKDAYS function helps determine eligible workdays within each bi-weekly period. These functions streamline accurate and timely contractor payments.

How do you set up payment due dates for every two weeks using Excel formulas?

To set up bi-weekly payment due dates in Excel, enter the first payment date in a cell (e.g., A1) and use the formula =A1+14 in the next cell to calculate the next payment date. Drag the formula down to generate subsequent due dates every 14 days. This method ensures automatic bi-weekly contractor payment schedules.

What are the key data columns needed in an Excel sheet for managing bi-weekly contractor payments?

Key data columns for managing bi-weekly contractor payments in Excel include Contractor Name, Payment Period Start and End Dates, Hours Worked, Hourly Rate, Total Amount Due, Payment Status, and Payment Date. Your spreadsheet should also track Invoice Number and Project Code to maintain accurate financial records. Including a Notes column helps capture any specific details or discrepancies for each payment cycle.