The Bi-weekly Financial Statement Excel Template for Startups simplifies cash flow and expense tracking with clear, organized spreadsheets tailored for early-stage businesses. Accurate bi-weekly reporting helps startups monitor financial health, manage budgets, and make informed decisions quickly. Customizable features ensure the template adapts to specific startup needs, enhancing financial planning efficiency.

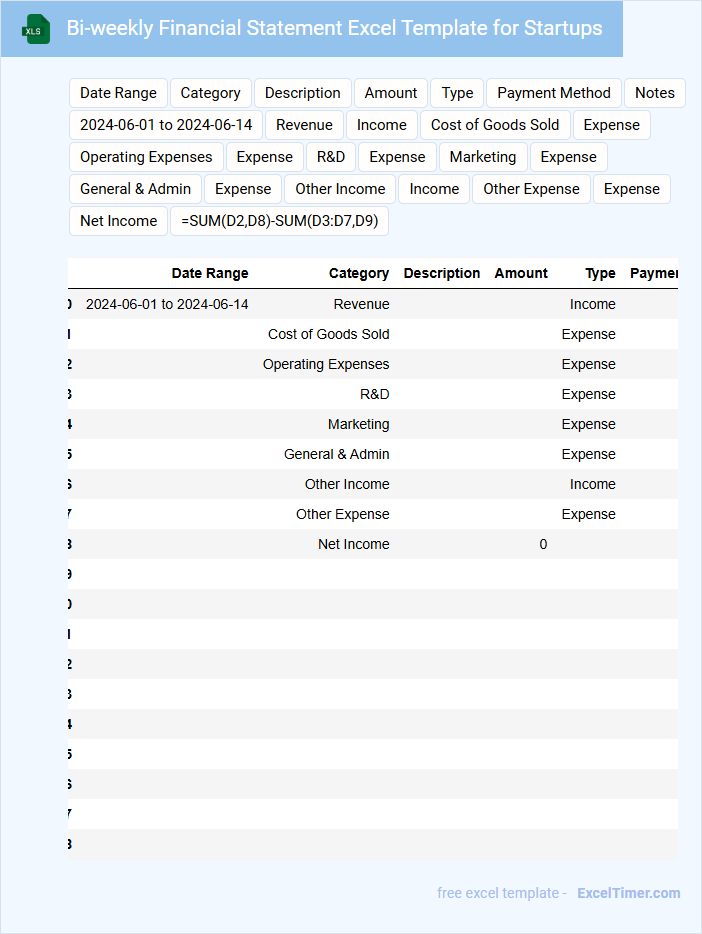

Bi-weekly Financial Statement Excel Template for Startups

A Bi-weekly Financial Statement Excel Template for startups typically contains detailed income and expense records, cash flow summaries, and balance sheets updated every two weeks. It helps entrepreneurs track financial performance and make informed decisions rapidly. Key suggestions include ensuring accuracy, incorporating cash flow forecasts, and maintaining clear categorization for expenses and revenues.

Cash Flow Tracker with Bi-weekly Updates for Startup Founders

This document typically contains detailed records of a startup's cash inflows and outflows updated bi-weekly to help founders make informed financial decisions.

- Accurate cash flow data: Ensure all income and expenses are recorded precisely to maintain clarity.

- Regular bi-weekly updates: Consistently update the tracker every two weeks to reflect the latest financial status.

- Forecasting and budgeting: Use the data to predict future cash positions and guide budget adjustments accordingly.

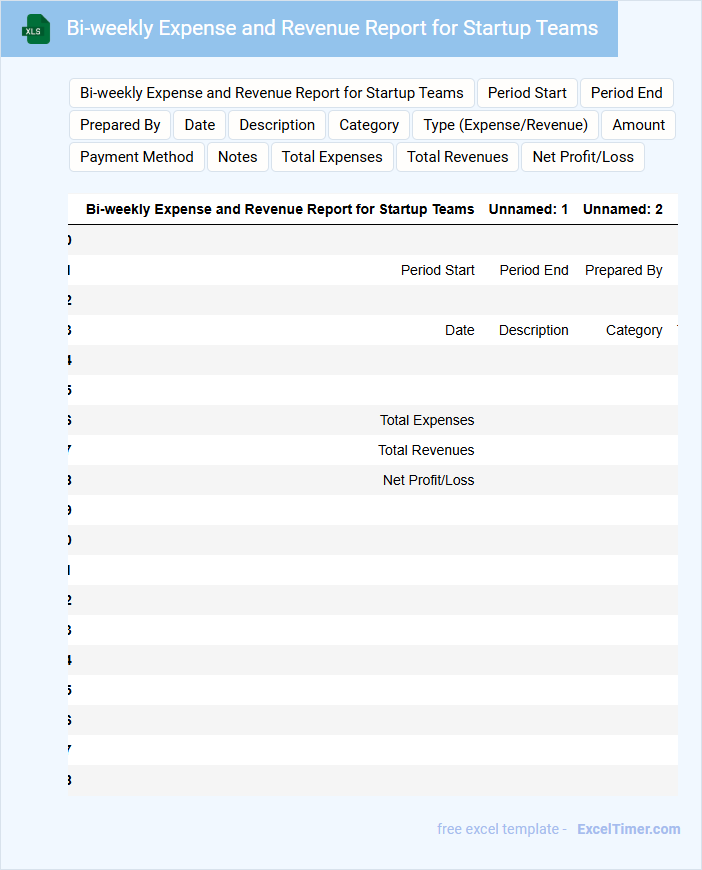

Bi-weekly Expense and Revenue Report for Startup Teams

What information is typically included in a Bi-weekly Expense and Revenue Report for Startup Teams? This type of document usually contains detailed records of all expenses and revenues incurred during the two-week period, helping teams track financial performance effectively. It also highlights budget variances and financial trends to assist in strategic decision-making and resource allocation.

What important elements should be considered when preparing this report? Ensuring accuracy in data entry and categorizing expenses and revenues clearly are vital for transparency. Additionally, including visual aids like charts or graphs can improve understanding, while providing a summary of key insights supports quick evaluation by stakeholders.

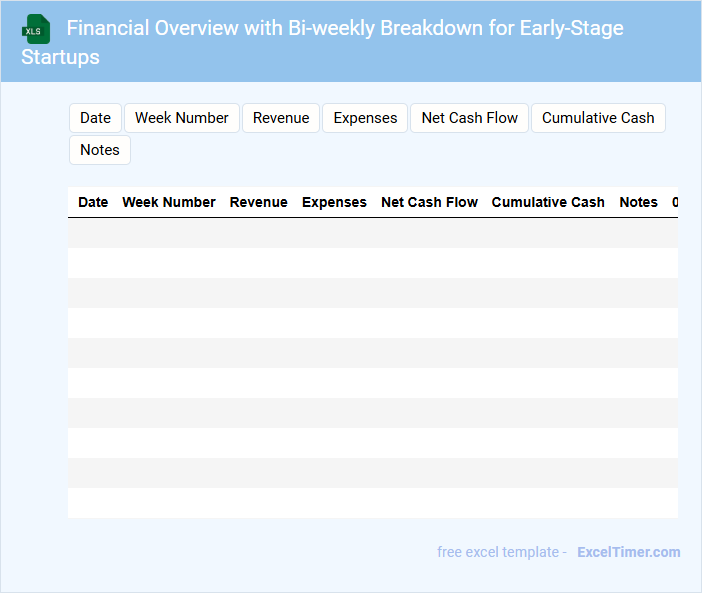

Financial Overview with Bi-weekly Breakdown for Early-Stage Startups

This document provides a detailed financial summary, broken down bi-weekly, to help early-stage startups track their cash flow and make informed decisions.

- Revenue Tracking: Monitor incoming funds regularly to assess business growth and sustainability.

- Expense Management: Identify and control costs to maintain a healthy cash runway.

- Cash Flow Forecasting: Project future finances to anticipate funding needs and avoid shortfalls.

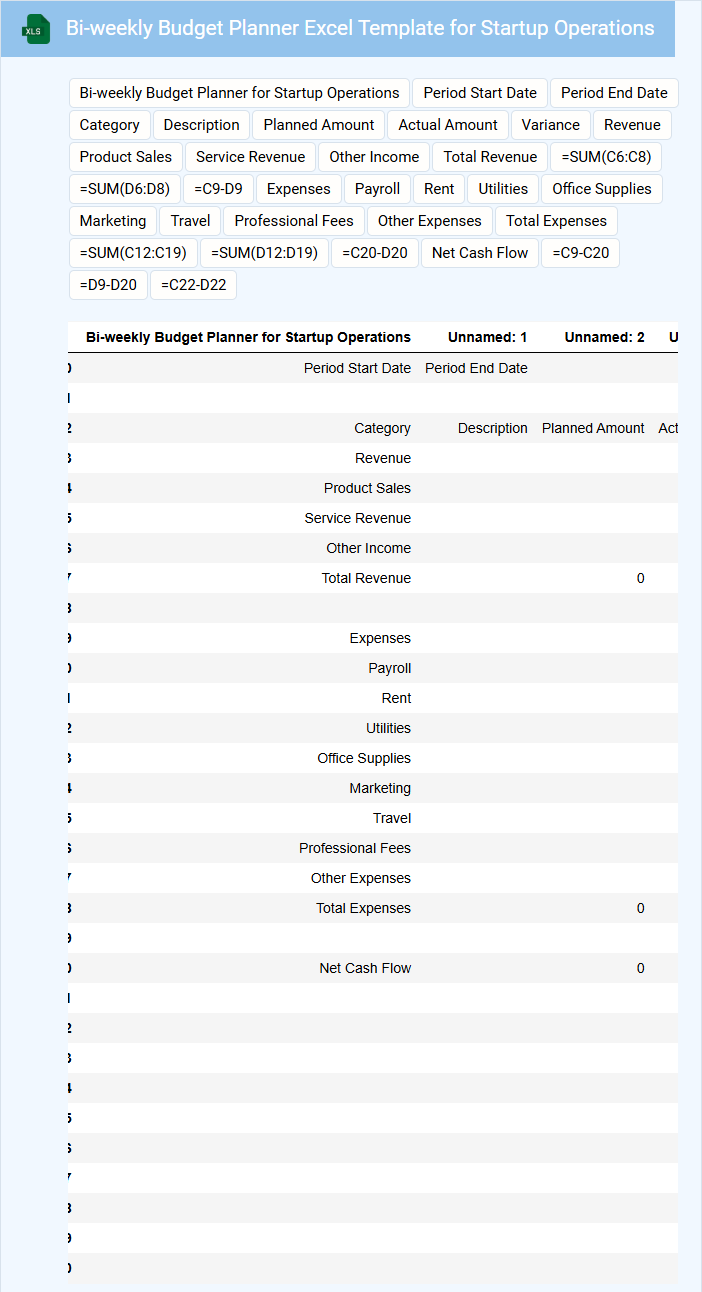

Bi-weekly Budget Planner Excel Template for Startup Operations

What information is typically included in a Bi-weekly Budget Planner Excel Template for Startup Operations? This document usually contains detailed income and expense categories, cash flow projections, and financial goals tailored to a startup's bi-weekly cycle. It helps track operational costs, forecast budget needs, and manage resources efficiently to maintain financial stability.

What key elements should be emphasized in this template? It is important to include sections for revenue streams, fixed and variable expenses, and contingency funds. Additionally, incorporating formulas for automatic calculations and visual charts aids in quick analysis and informed decision-making.

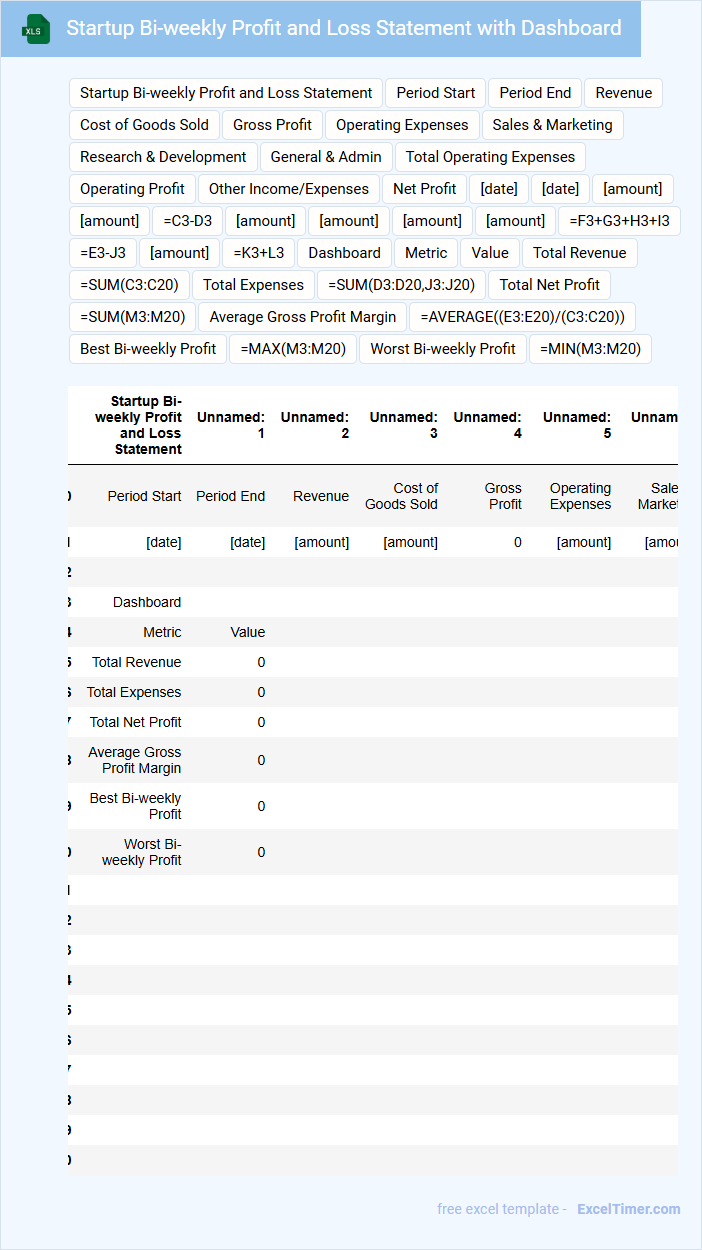

Startup Bi-weekly Profit and Loss Statement with Dashboard

What information does a Startup Bi-weekly Profit and Loss Statement with Dashboard typically contain? This document usually includes detailed records of income, expenses, and net profit over a two-week period for a startup. The integrated dashboard visually summarizes key financial metrics, trends, and variances to facilitate quick decision-making and performance tracking.

What important considerations should be made when preparing this statement? Ensuring accurate categorization of revenue and expenses is crucial to reflect true financial health. Additionally, the dashboard should highlight critical KPIs such as gross margin, operating costs, and cash flow to provide actionable insights for stakeholders.

Bi-weekly Capital Tracking Spreadsheet for New Businesses

What information is typically contained in a Bi-weekly Capital Tracking Spreadsheet for New Businesses? This document usually includes detailed records of capital inflows and outflows, categorized by various business activities over two-week periods. It helps new businesses monitor their financial health and make informed decisions based on updated cash flow data.

What is an important consideration when using this type of spreadsheet? Accuracy and consistency in recording transactions are crucial to ensure reliable tracking, and including clear notes for irregular expenses or unexpected revenue can provide valuable context. Additionally, regularly updating the sheet helps maintain a real-time overview of capital status.

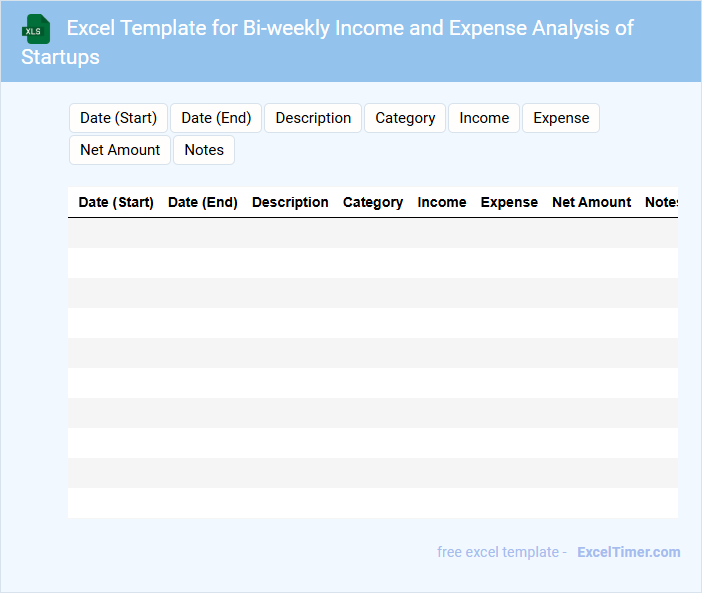

Excel Template for Bi-weekly Income and Expense Analysis of Startups

What information is typically included in an Excel Template for Bi-weekly Income and Expense Analysis of Startups? This type of document usually contains detailed sections for recording income sources and expense categories over two-week periods, allowing startups to monitor their cash flow effectively. It also includes built-in formulas and tables to summarize and compare financial data, helping entrepreneurs make informed decisions.

What important aspects should be considered when creating this template? It is essential to ensure that the template is easy to update regularly, includes customizable categories tailored to the startup's business model, and provides clear visualizations like charts or graphs for quick financial insights.

Bi-weekly Financial Health Tracker for Startup Growth

A Bi-weekly Financial Health Tracker is a critical document that provides a snapshot of a startup's financial status every two weeks. It typically contains income statements, cash flow analysis, and key financial ratios to monitor growth and stability. Consistent use of this tracker helps startups make informed decisions and manage risks proactively.

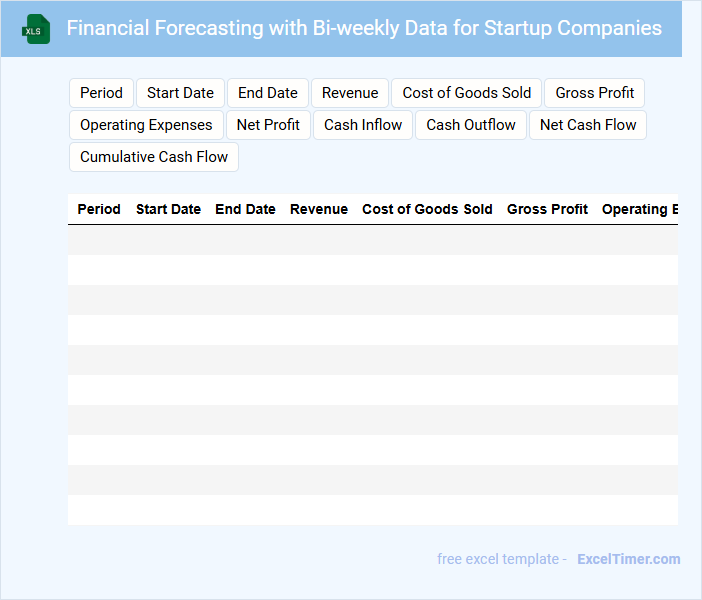

Financial Forecasting with Bi-weekly Data for Startup Companies

What information is typically included in a financial forecasting document with bi-weekly data for startup companies? This document usually contains detailed revenue projections, expense estimates, and cash flow analysis broken down into two-week intervals to closely monitor financial performance. It helps startups anticipate funding needs and adjust strategies for sustained growth.

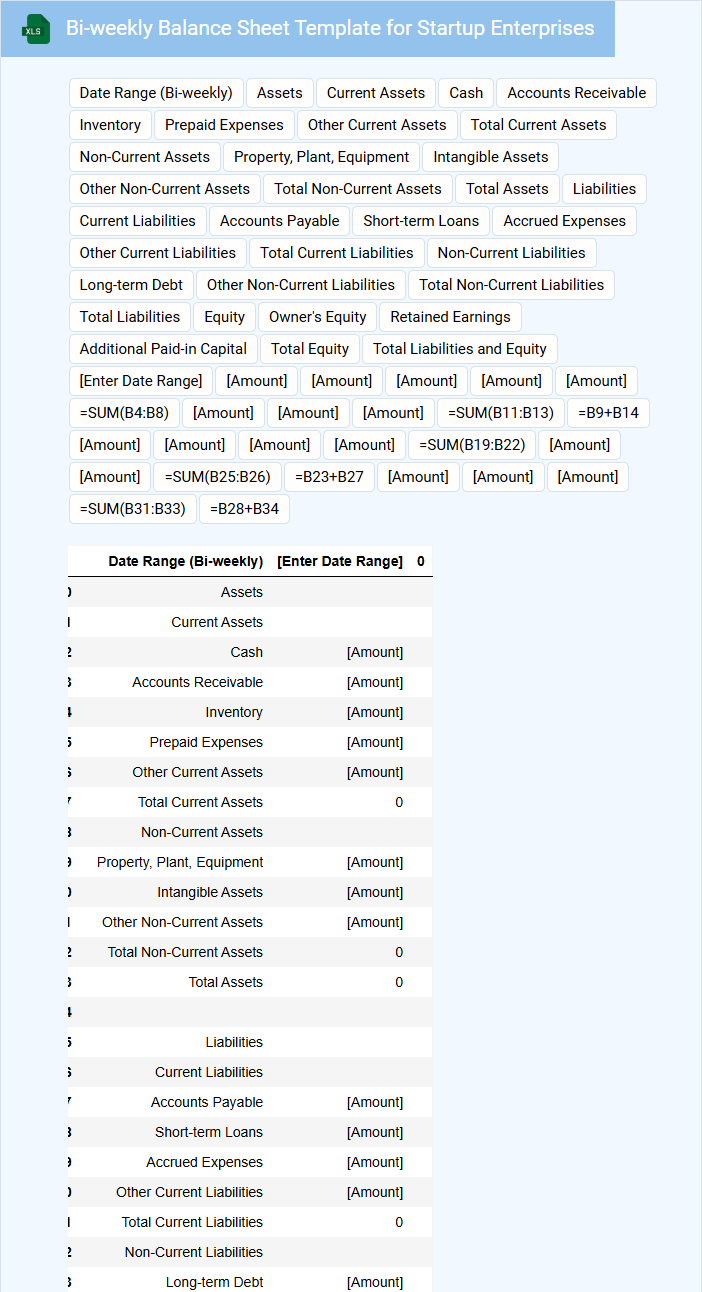

Bi-weekly Balance Sheet Template for Startup Enterprises

A bi-weekly balance sheet template for startup enterprises is a structured financial document that helps track assets, liabilities, and equity every two weeks. It enables startups to maintain up-to-date financial health insights, ensuring better cash flow management and decision-making. Regularly updating this document is crucial for identifying financial trends and preparing for investor reviews or funding rounds.

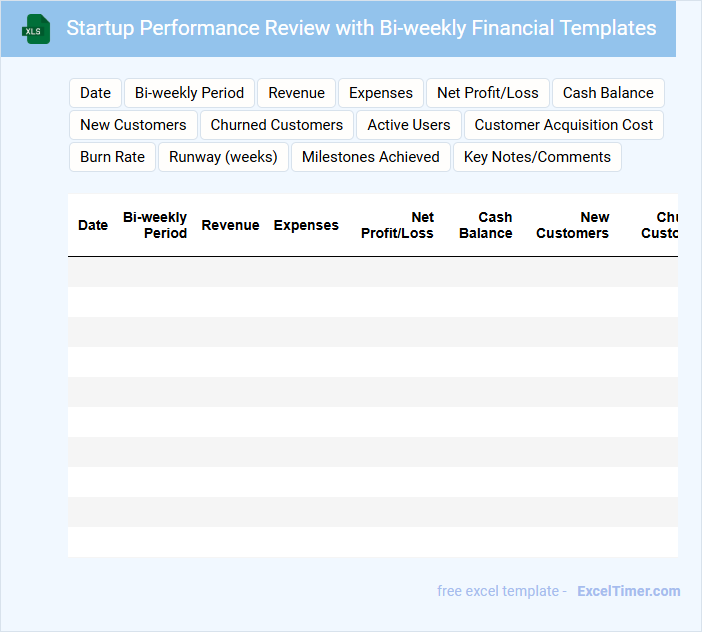

Startup Performance Review with Bi-weekly Financial Templates

A Startup Performance Review with Bi-weekly Financial Templates typically contains key metrics and financial data to evaluate the company's progress and fiscal health regularly. It helps stakeholders make informed decisions by providing a clear snapshot of operational and financial performance.

- Include key performance indicators (KPIs) relevant to growth and revenue generation.

- Ensure accurate and timely financial data for each bi-weekly period.

- Highlight variances and actionable insights to guide strategic adjustments.

Bi-weekly Earnings & Spending Log for Startup Management

The Bi-weekly Earnings & Spending Log is a crucial document that tracks the financial performance of a startup every two weeks. It details income sources and expenses to maintain transparency and control over cash flow.

This log helps startup management monitor trends, identify potential financial issues early, and make informed budgeting decisions. Consistently updating the log ensures accurate financial analysis and effective resource allocation.

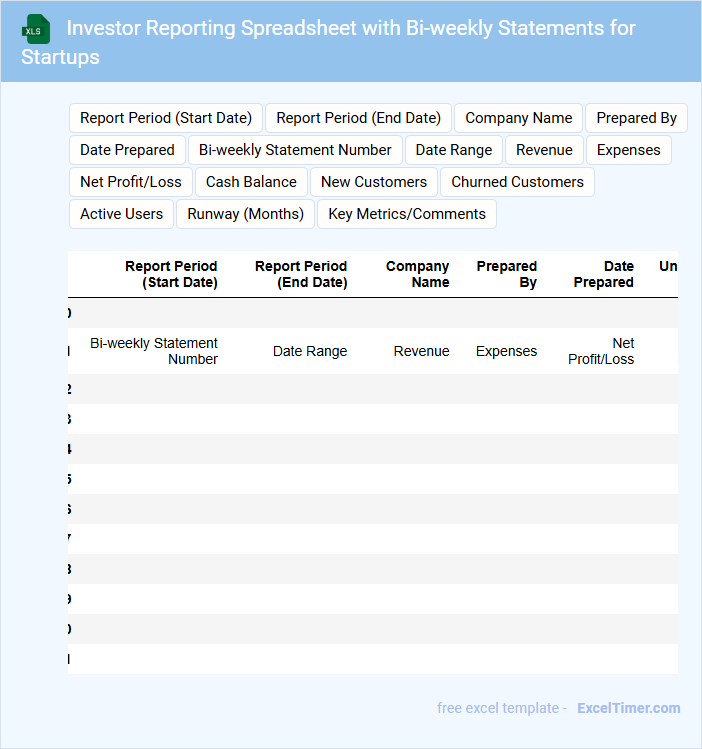

Investor Reporting Spreadsheet with Bi-weekly Statements for Startups

An Investor Reporting Spreadsheet is a structured document that consolidates key financial and performance data of startups, typically updated bi-weekly. It contains detailed statements including cash flow, burn rate, runway projections, and key milestones to keep investors informed. Ensuring accuracy and clarity is essential for fostering trust and transparency between startups and their investors.

Bi-weekly Operational Cost Tracker for Startup Projects

What information is typically included in a Bi-weekly Operational Cost Tracker for Startup Projects? This document usually contains detailed records of all expenses incurred within a two-week period, categorized by departments or project activities. It helps startups monitor their spending patterns, identify cost-saving opportunities, and ensure budget alignment with financial goals.

What are important considerations when creating this tracker? Accuracy and timeliness are crucial to maintain reliable financial data, while clarity in categorization improves analysis. Additionally, integrating visual summaries like charts and regularly updating the tracker ensures better decision-making and resource allocation.

What key financial data should be included in a startup's bi-weekly financial statement for accurate cash flow tracking?

A startup's bi-weekly financial statement should include key data such as cash inflows from sales, investor funding, and loans, alongside cash outflows like operational expenses, payroll, and vendor payments. Accurately tracking accounts receivable and accounts payable ensures precise cash flow management. Including beginning and ending cash balances helps stakeholders monitor liquidity over the two-week period.

How do bi-weekly financial statements help startups monitor burn rate and runway?

Bi-weekly financial statements provide startups with frequent insights into cash flow and expenses, enabling precise tracking of burn rate. Monitoring these statements helps identify spending patterns and adjust budgets to extend the startup's runway. This proactive financial management supports sustainable growth and informed decision-making.

Which metrics in a bi-weekly financial statement are most critical for early-stage investor updates?

Key metrics in a bi-weekly financial statement for startups include cash burn rate, runway, revenue growth, and operating expenses. Monitoring your gross margin and customer acquisition costs also provides valuable insights into financial health and scalability. These data points enable early-stage investors to assess liquidity, operational efficiency, and growth potential effectively.

How should startup founders categorize income and expenses for clear financial analysis in bi-weekly reports?

Startup founders should categorize income into primary revenue streams such as product sales, service fees, and investment income, while expenses should be divided into fixed costs, variable costs, and one-time expenditures. Accurate categorization enables clear tracking of cash flow, profitability, and operational efficiency in bi-weekly financial statements. Implementing standardized account codes and detailed descriptions for each transaction enhances consistency and simplifies financial analysis.

What are the best practices for automating data entry and reducing errors in bi-weekly financial statements using Excel?

Automate data entry in your bi-weekly financial statements by using Excel features like Data Validation, PivotTables, and Power Query to streamline data imports and ensure consistency. Implement error-checking formulas such as IFERROR and conditional formatting to quickly identify and correct discrepancies. Regularly update and audit linked data sources to maintain accuracy and reduce manual errors.