The Bi-weekly Mileage Log Excel Template for Delivery Drivers simplifies tracking miles driven during two-week periods, enhancing accuracy for expense reporting and tax deductions. This template includes fields for date, starting and ending mileage, purpose of trip, and total miles, ensuring comprehensive record-keeping. Using this tool helps delivery drivers maintain organized records vital for reimbursement and compliance with IRS regulations.

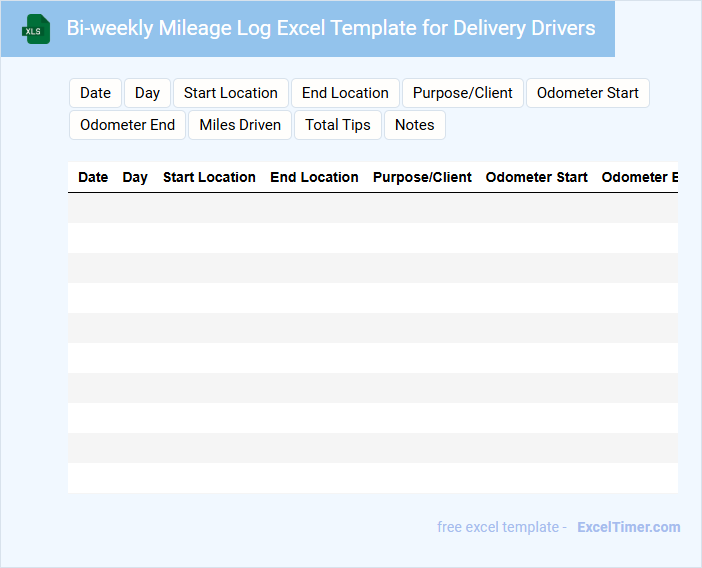

Bi-weekly Mileage Log with Distance Tracker for Delivery Drivers

The Bi-weekly Mileage Log is a detailed record that helps delivery drivers track the distances they travel every two weeks. It typically includes start and end locations, date, and total miles driven for each trip.

This document is essential for accurate fuel reimbursement and tax deductions related to vehicle use. Ensuring consistent and precise entries will maximize benefits and simplify record-keeping.

Bi-weekly Mileage Log Excel Template for Delivery Drivers

What information is typically included in a Bi-weekly Mileage Log Excel Template for Delivery Drivers? This document usually contains detailed records of miles driven between specific dates, locations traveled, and corresponding delivery details. It helps drivers track their routes for reimbursement, tax deductions, and performance analysis.

Why is it important to maintain accurate entries in this mileage log? Accurate data ensures compliance with company policies and IRS regulations, preventing potential disputes or audits. Additionally, it supports efficient route planning and helps optimize fuel consumption and time management.

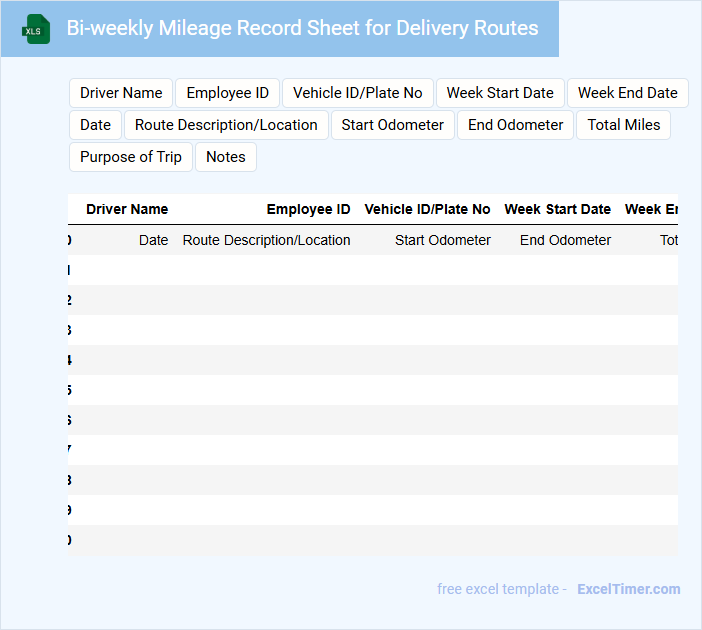

Bi-weekly Mileage Record Sheet for Delivery Routes

The Bi-weekly Mileage Record Sheet for delivery routes is a crucial document that tracks the distances traveled by delivery drivers over a two-week period. It typically includes details such as the date, starting and ending mileage, route taken, and purpose of the trip. Maintaining accurate records ensures proper reimbursement and efficient route management.

Key suggestions for this document include consistently logging daily mileage, verifying odometer readings to prevent errors, and including a section for driver signatures to validate entries. Emphasizing accuracy and completeness supports both operational transparency and financial accountability.

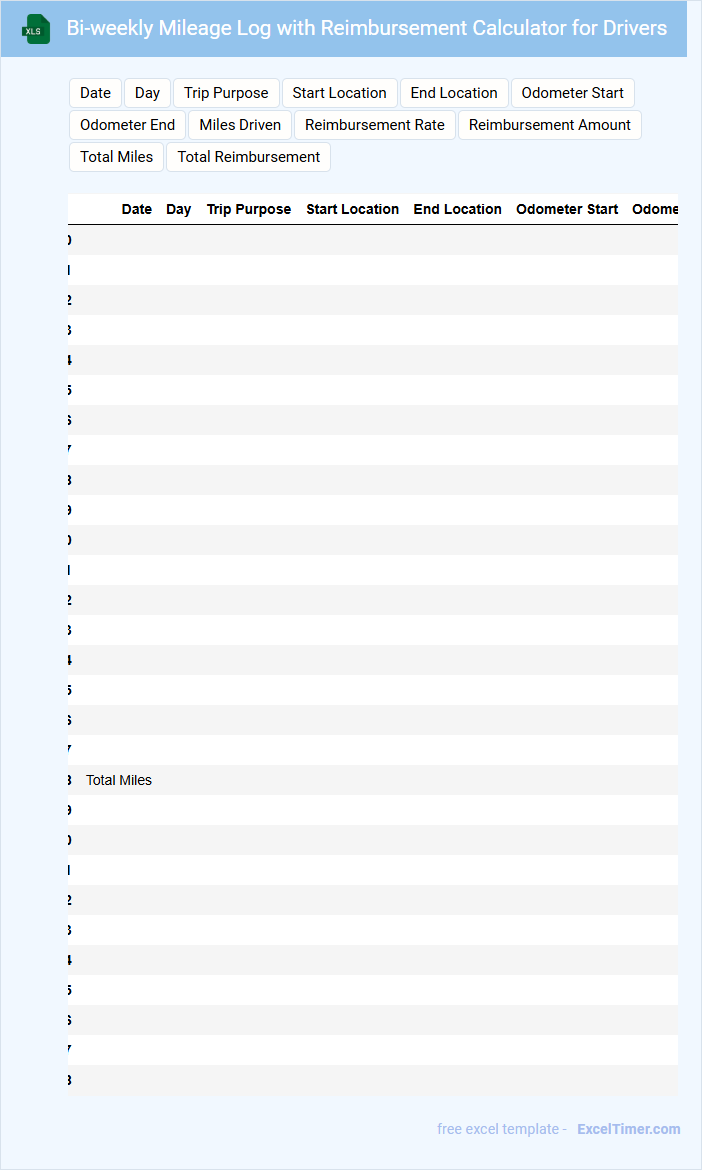

Bi-weekly Mileage Log with Reimbursement Calculator for Drivers

A Bi-weekly Mileage Log with Reimbursement Calculator is a document used by drivers to track their traveled miles over a two-week period. It typically contains details such as trip dates, starting and ending locations, mileage totals, and purpose of each trip. This log helps ensure accurate calculation of reimbursements based on the miles driven.

To optimize its use, it's important to include clear fields for date, odometer readings, and trip descriptions. Incorporating an automatic calculation feature for reimbursement rates saves time and reduces errors. Lastly, maintaining organized and consistent records supports compliance with tax regulations and company policies.

Bi-weekly Mileage Tracking Sheet for Delivery Drivers

The Bi-weekly Mileage Tracking Sheet is a vital document used by delivery drivers to accurately record their mileage over a two-week period. It typically contains columns for dates, starting and ending odometer readings, and total miles driven each day.

This document helps ensure precise reimbursement and efficient route planning. Including sections for vehicle information and notes on fuel usage enhances overall tracking effectiveness.

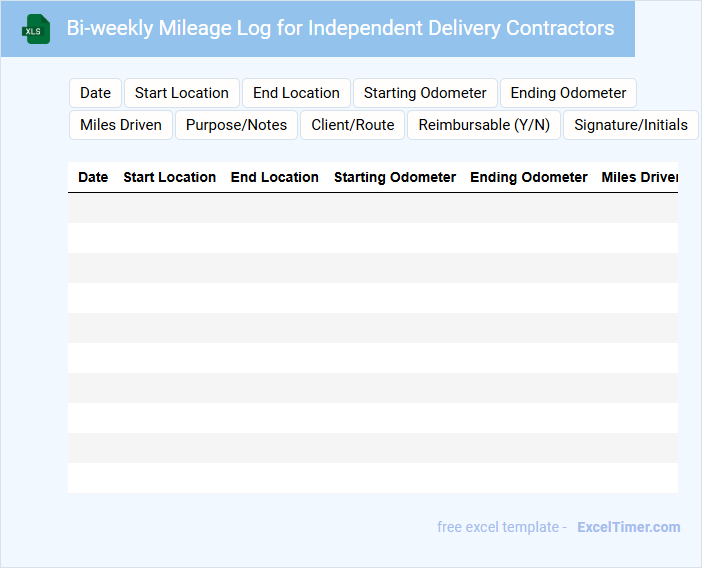

Bi-weekly Mileage Log for Independent Delivery Contractors

A Bi-weekly Mileage Log for Independent Delivery Contractors typically contains detailed records of distances traveled during work-related deliveries. It includes dates, starting and ending locations, mileage totals, and purpose of each trip to ensure accurate tracking for reimbursement and tax purposes. Maintaining this log is crucial for verifying expenses and optimizing route efficiency.

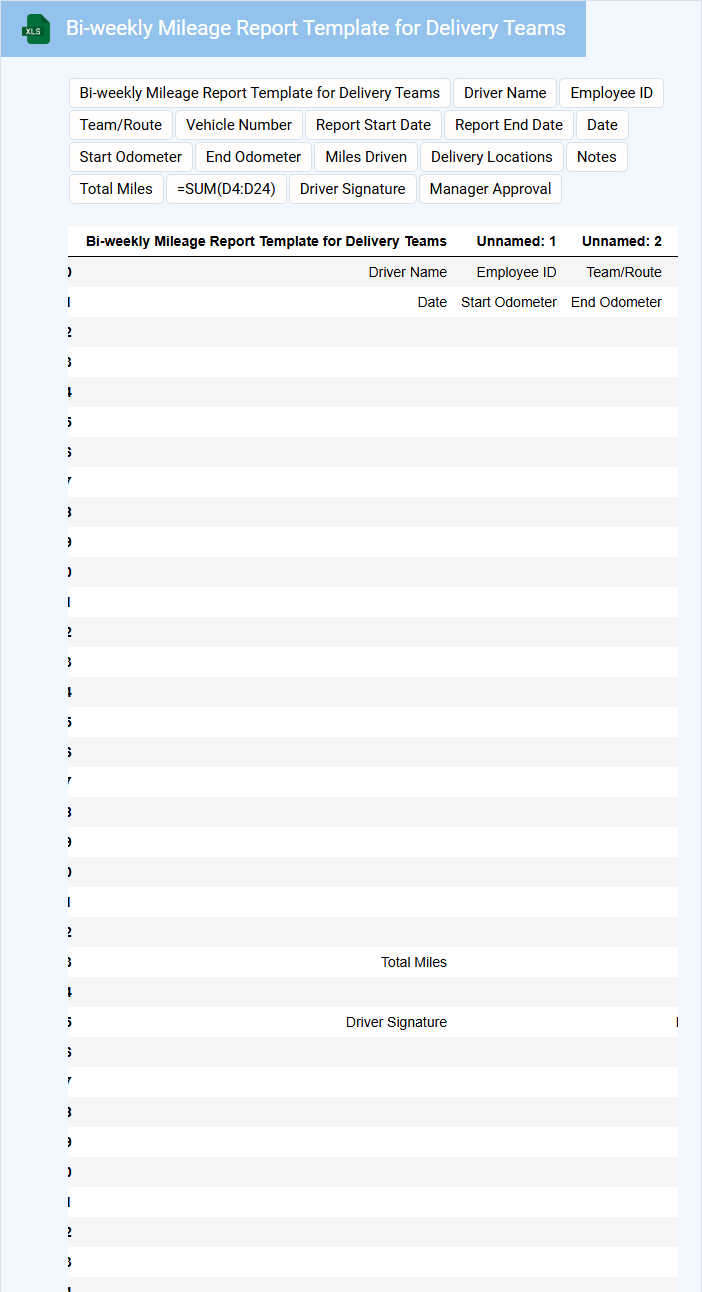

Bi-weekly Mileage Report Template for Delivery Teams

A Bi-weekly Mileage Report Template for Delivery Teams typically contains records of distances traveled by each team member over a two-week period. This document helps track mileage for reimbursement and operational efficiency purposes.

- Include accurate dates and driver names for proper record-keeping.

- Document starting and ending odometer readings for each trip.

- Summarize total miles traveled and categorize trips by delivery type.

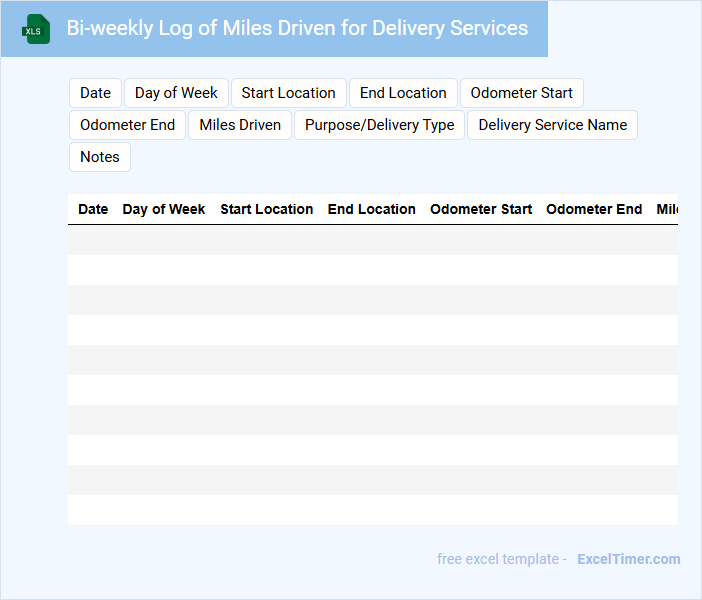

Bi-weekly Log of Miles Driven for Delivery Services

The Bi-weekly Log of Miles Driven for delivery services is a detailed record that tracks the total distance traveled by delivery vehicles over a two-week period. This document is essential for monitoring fuel usage, vehicle maintenance schedules, and driver performance. Maintaining accurate entries ensures compliance with company policies and regulatory requirements.

Such logs typically include the date, starting and ending odometer readings, total miles driven, and purpose of each trip. It is important to regularly verify the data to detect discrepancies or unauthorized usage. Consistent and thorough logging supports cost control and operational efficiency in delivery services.

Bi-weekly Mileage Sheet for Delivery Vehicle Tracking

A Bi-weekly Mileage Sheet for Delivery Vehicle Tracking is a document used to record the distances traveled by delivery vehicles over a two-week period. It helps monitor vehicle usage, manage fuel consumption, and optimize routes.

- Include accurate starting and ending odometer readings for each trip.

- Record the date, driver's name, and purpose of each journey.

- Summarize total miles driven bi-weekly to identify patterns and anomalies.

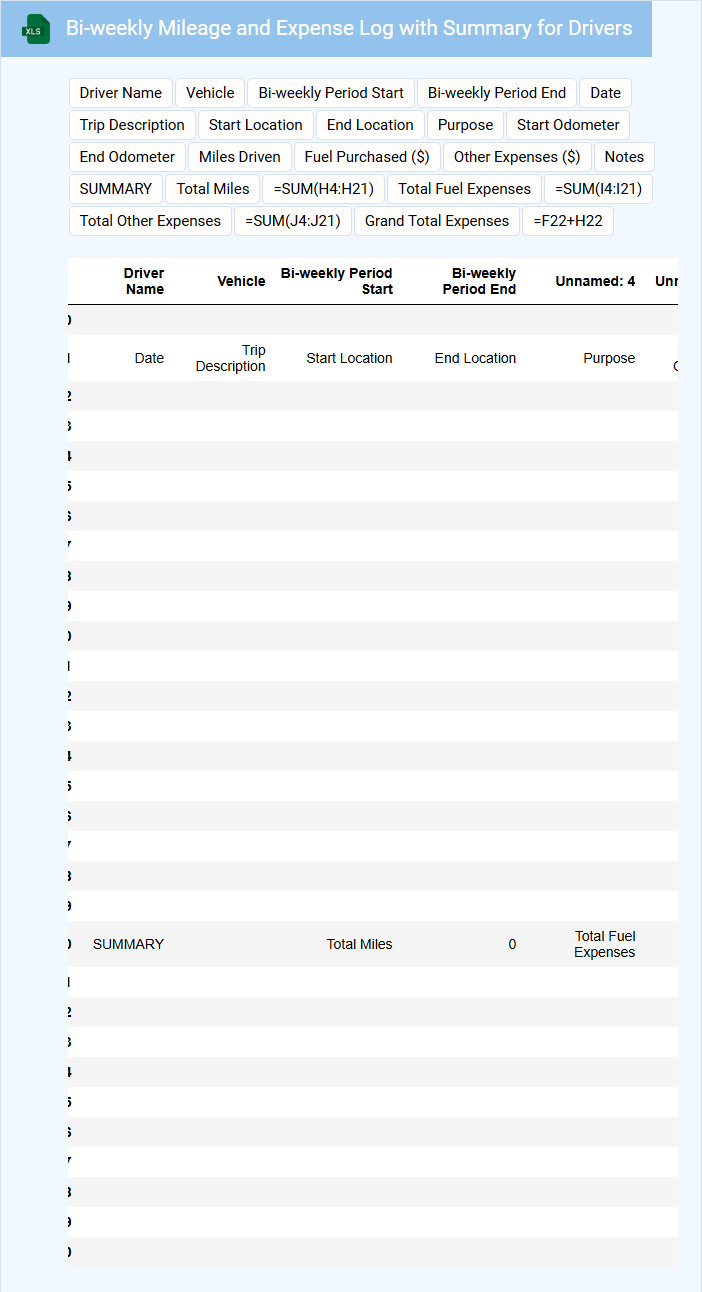

Bi-weekly Mileage and Expense Log with Summary for Drivers

A Bi-weekly Mileage and Expense Log is a document used by drivers to record their travel distances and associated costs over a two-week period. It provides a detailed account of mileage, fuel purchases, tolls, and other work-related expenses. This log helps track expenses for reimbursement and tax purposes.

Such logs typically include sections for date, starting and ending odometer readings, purpose of the trip, and expense categories, along with a summary to overview total costs. Accurate and timely entries are essential for compliance and financial accuracy. Drivers should ensure all information is clear and regularly updated.

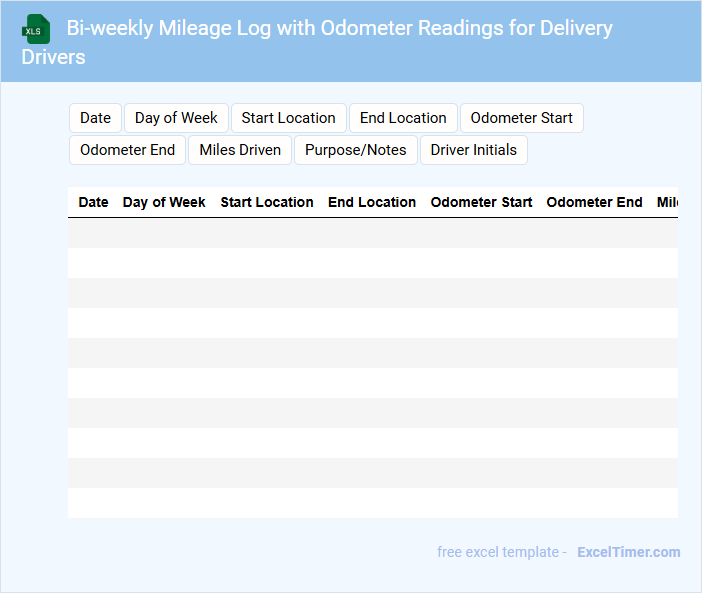

Bi-weekly Mileage Log with Odometer Readings for Delivery Drivers

What information is typically recorded in a Bi-weekly Mileage Log with Odometer Readings for Delivery Drivers? This document usually contains detailed entries of starting and ending odometer readings for each delivery trip, along with dates and purposes of the trips. It helps in accurately tracking mileage for vehicle maintenance, fuel reimbursement, and tax deduction purposes, ensuring accountability and efficiency in delivery operations.

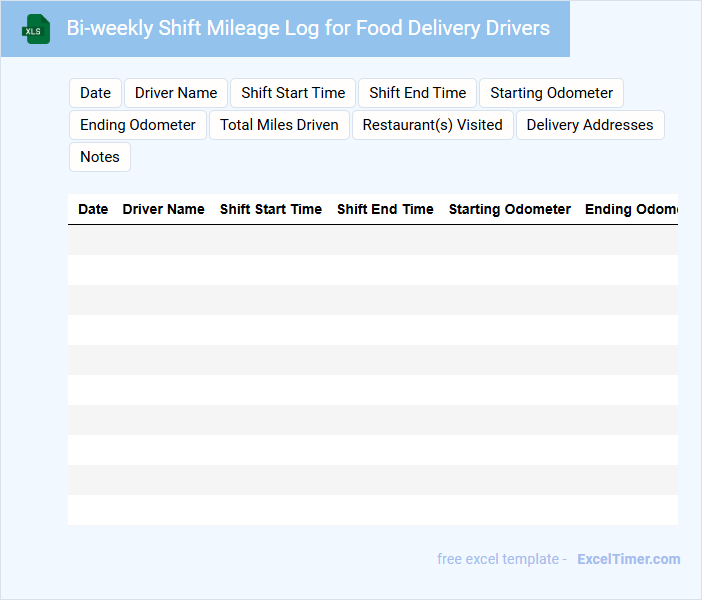

Bi-weekly Shift Mileage Log for Food Delivery Drivers

The Bi-weekly Shift Mileage Log is a document used to track the total miles driven by food delivery drivers over a two-week period. It helps in monitoring vehicle usage and calculating reimbursements or allowances accurately.

This log typically contains the date, driver's name, starting and ending odometer readings, and total miles traveled each shift. It is important to maintain accurate and timely entries to ensure proper record-keeping and cost management.

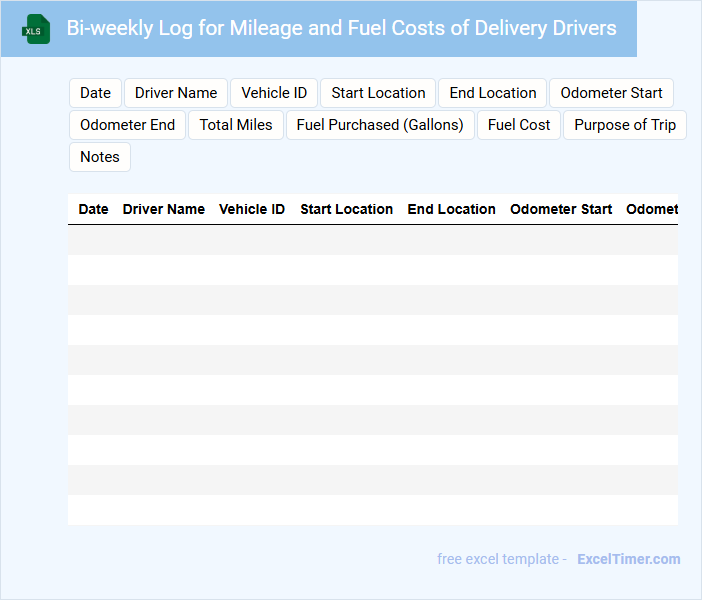

Bi-weekly Log for Mileage and Fuel Costs of Delivery Drivers

The Bi-weekly Log for mileage and fuel costs is a crucial document used to track the travel distances and fuel expenses of delivery drivers over a two-week period. It helps companies monitor operational efficiency and manage transportation budgets effectively.

This type of document typically contains details such as date, driver name, starting and ending odometer readings, total miles driven, fuel purchased, and associated costs. Maintaining accuracy and consistency in recording these entries is essential for reliable reporting and reimbursement.

Ensure that all entries are promptly updated and verified to prevent discrepancies and facilitate smooth auditing processes.

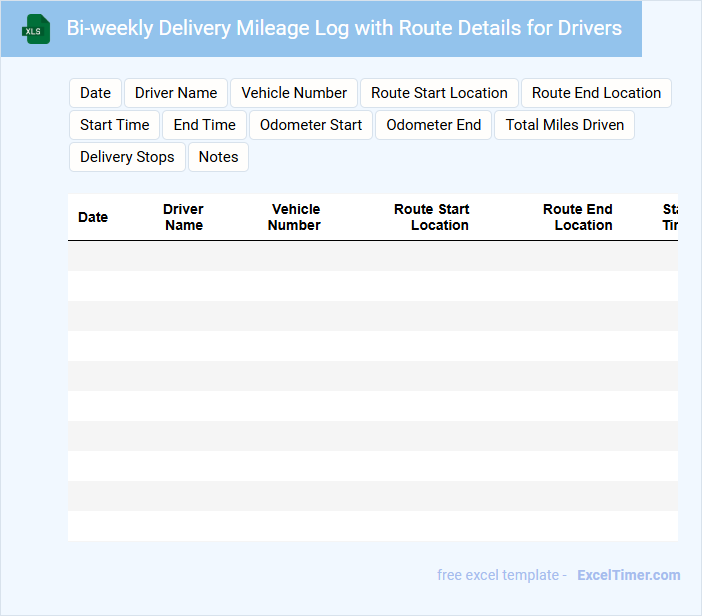

Bi-weekly Delivery Mileage Log with Route Details for Drivers

The Bi-weekly Delivery Mileage Log is a document used to track the distance covered by drivers during delivery routes over a two-week period. It typically contains detailed route information, dates, starting and ending mileage, and notes on any deviations or issues encountered. This log helps ensure accurate record-keeping for operational efficiency and reimbursement purposes.

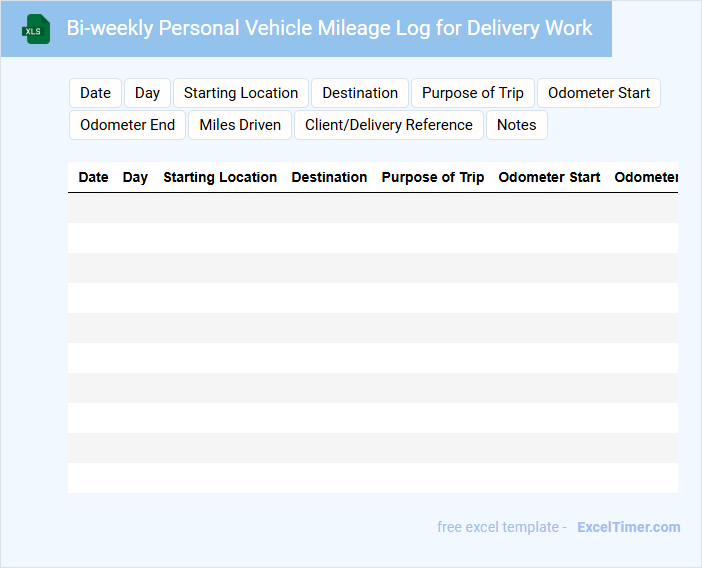

Bi-weekly Personal Vehicle Mileage Log for Delivery Work

A Bi-weekly Personal Vehicle Mileage Log for delivery work is a detailed record of miles driven over a two-week period, used to track travel for business purposes. It typically contains dates, starting and ending odometer readings, purpose of each trip, and total miles driven. Maintaining this log accurately ensures proper reimbursement, tax deductions, and compliance with company policies.

What essential columns should be included in a bi-weekly mileage log for delivery drivers in Excel?

Essential columns in a bi-weekly mileage log for delivery drivers include Date, Driver Name, Vehicle ID, Starting Odometer, Ending Odometer, Total Miles Driven, Delivery Route, Purpose of Trip, and Notes. These columns ensure accurate tracking of mileage, vehicle usage, and delivery details for efficient record-keeping. Adding columns for Fuel Consumption and Maintenance Status can further optimize vehicle management.

How can you use Excel formulas to automatically calculate total miles driven each day and for the pay period?

Use Excel formulas like SUM to automatically calculate total miles driven each day by summing the daily start and end odometer readings. Implement SUMIF or SUMIFS functions to aggregate total miles for the entire bi-weekly pay period based on date ranges. You can easily track and verify mileage totals for accuracy in your Bi-weekly Mileage Log.

What Excel features help track and prevent duplicate or missing trip entries in a bi-weekly mileage log?

Excel's Data Validation feature helps prevent duplicate trip entries by restricting repeated values in key fields like trip ID. You can use Conditional Formatting to highlight missing or inconsistent mileage data, ensuring accurate record-keeping. PivotTables offer a summary view to quickly identify any gaps or irregularities in your bi-weekly delivery logs.

How can conditional formatting in Excel highlight outlier mileage entries for review?

Conditional formatting in Excel can highlight outlier mileage entries by applying rules based on statistical functions such as standard deviation or quartiles. For example, use a formula like =ABS(A2-AVERAGE($A$2:$A$100))>2*STDEV.P($A$2:$A$100) to flag mileages that deviate significantly from the average. This visual cue helps managers quickly identify and review anomalous delivery distances in the bi-weekly mileage log.

What information is necessary for tax deduction purposes in a delivery driver's bi-weekly mileage Excel log?

A bi-weekly mileage log for delivery drivers must include the date, starting and ending odometer readings, total miles driven, and the purpose of each trip to qualify for tax deductions. Recording the vehicle make and model, along with client or destination details, supports accurate mileage tracking. Maintaining consistent entries for each trip ensures compliance with IRS requirements and maximizes deductible expenses.