The Bi-weekly Pay Calculator Excel Template for Hourly Employees streamlines wage calculation by accurately accounting for hours worked and overtime in a two-week period. This template helps ensure precise payroll management and reduces errors in manual calculations. It is essential for businesses seeking efficient, transparent, and standardized employee compensation tracking.

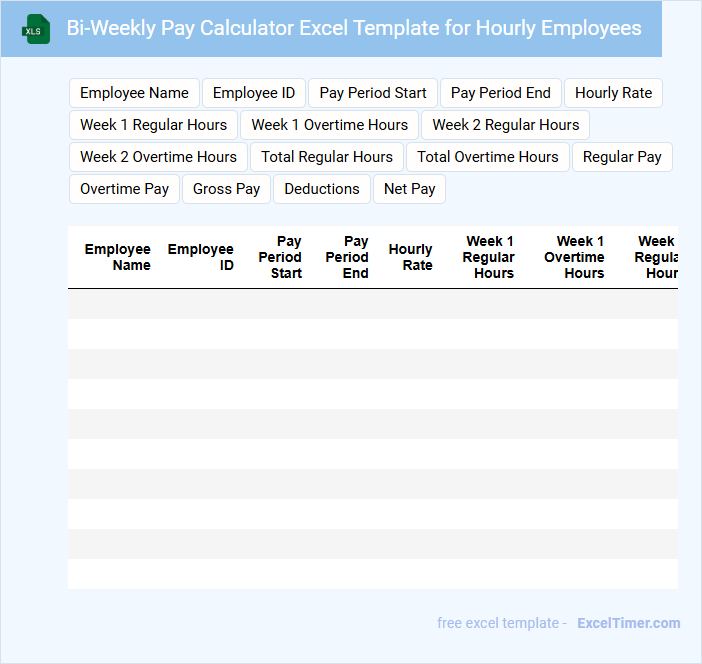

Bi-Weekly Pay Calculator Excel Template for Hourly Employees

What information is typically included in a Bi-Weekly Pay Calculator Excel Template for Hourly Employees? This document usually contains sections for inputting employee hours worked, hourly pay rates, and applicable deductions. It calculates total earnings and net pay for each bi-weekly period, helping ensure accurate and efficient payroll processing.

What important features should be considered for this template? It's essential to include fields for overtime calculations, tax deductions, and benefits contributions. Additionally, making the layout user-friendly and incorporating automated formulas will improve accuracy and save time for payroll administrators.

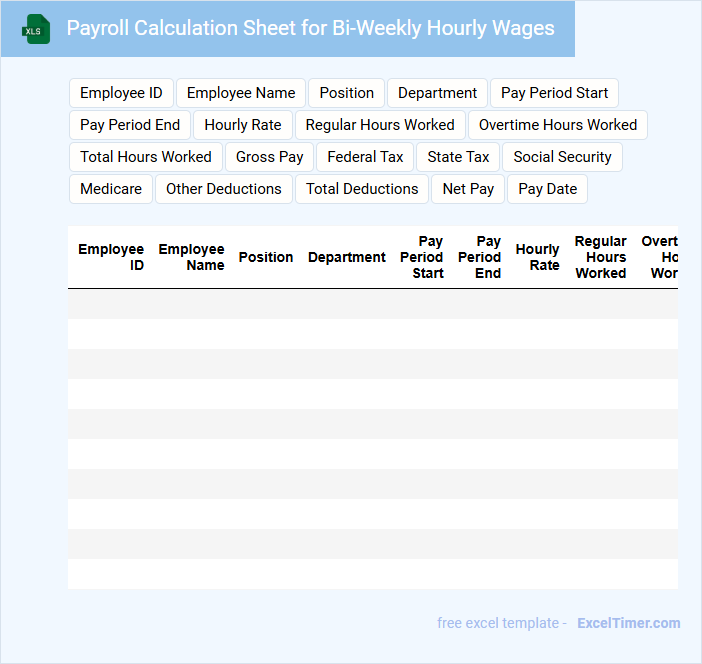

Payroll Calculation Sheet for Bi-Weekly Hourly Wages

Payroll Calculation Sheets for Bi-Weekly Hourly Wages typically contain detailed records of employee hours worked, wage rates, and deductions to ensure accurate paycheck processing.

- Employee hours tracked: Precise recording of hours worked during the bi-weekly period is crucial for calculating wages correctly.

- Wage rate application: The sheet must apply the correct hourly rate to the hours worked, including overtime calculations if applicable.

- Deductions and taxes: Accurate calculation of taxes and any other deductions is essential for compliance and net pay accuracy.

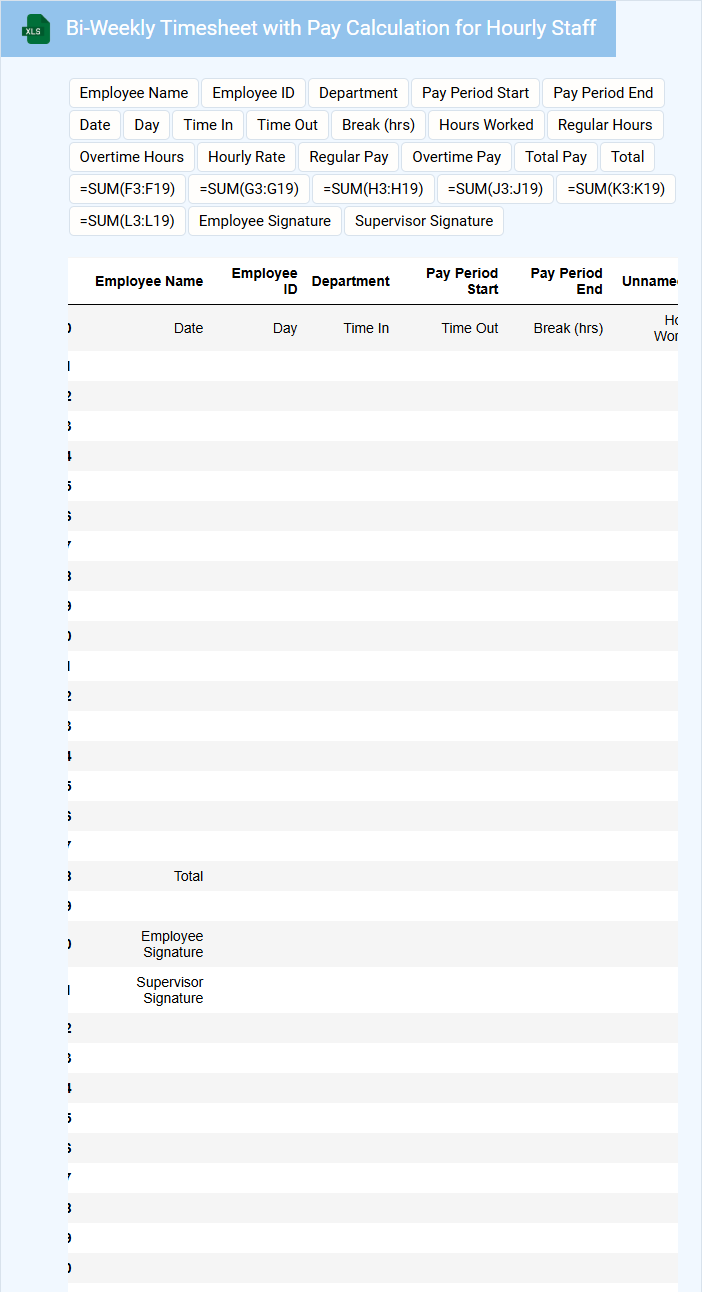

Bi-Weekly Timesheet with Pay Calculation for Hourly Staff

A Bi-Weekly Timesheet with pay calculation for hourly staff typically includes recorded working hours for a two-week period, detailing regular and overtime hours. It serves as an essential tool for accurate payroll processing and time management. Ensuring accurate input of hours and proper calculation methods is critical for both compliance and employee satisfaction.

Earnings Tracker for Bi-Weekly Paid Hourly Employees

This document serves as an earnings tracker specifically designed for bi-weekly paid hourly employees, helping to monitor wages efficiently. It captures hours worked, pay rates, and calculates total earnings over each period.

Important elements include accurate time entries and clear documentation of overtime or bonuses to ensure correct payment. Regular updates and verification are essential for payroll accuracy and employee transparency.

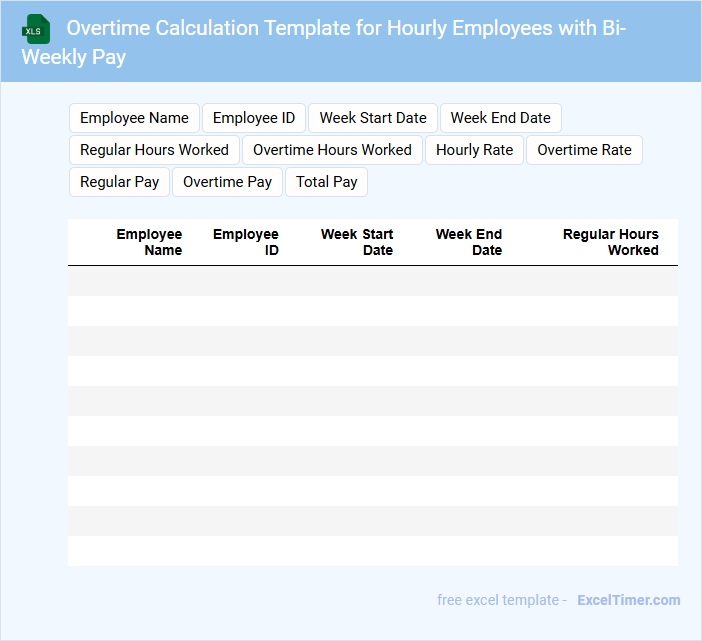

Overtime Calculation Template for Hourly Employees with Bi-Weekly Pay

An Overtime Calculation Template for hourly employees with bi-weekly pay is designed to track and calculate extra hours worked beyond regular schedules. It typically contains fields for recording daily hours, total hours, and overtime hours per pay period. Including clear formulas ensures accurate computation of overtime pay based on company policies and labor laws.

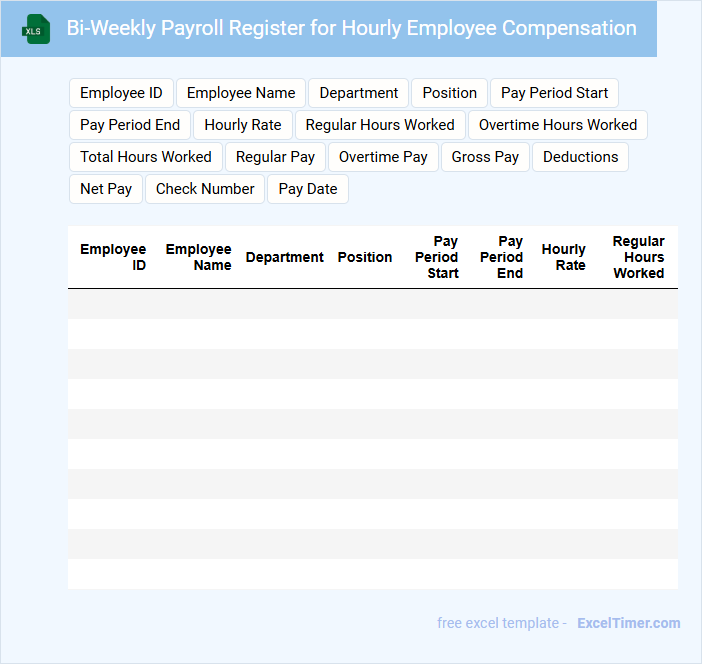

Bi-Weekly Payroll Register for Hourly Employee Compensation

The Bi-Weekly Payroll Register for hourly employee compensation is a detailed document that records all payments made to hourly workers over a two-week period. It typically includes hours worked, wage rates, deductions, and net pay for each employee.

This register is essential for accurate payroll processing and compliance with labor laws. Ensuring precise time tracking and timely updates on tax regulations are important for maintaining its reliability.

Hourly Wage Calculator with Bi-Weekly Payment Tracking

An Hourly Wage Calculator with Bi-Weekly Payment Tracking is a practical tool designed to help employees and employers accurately calculate wages based on hours worked. It typically includes fields for inputting hourly rates, total hours, and tracks payments made every two weeks. For optimal use, it is important to ensure precise input of working hours and clearly distinguish regular hours from overtime.

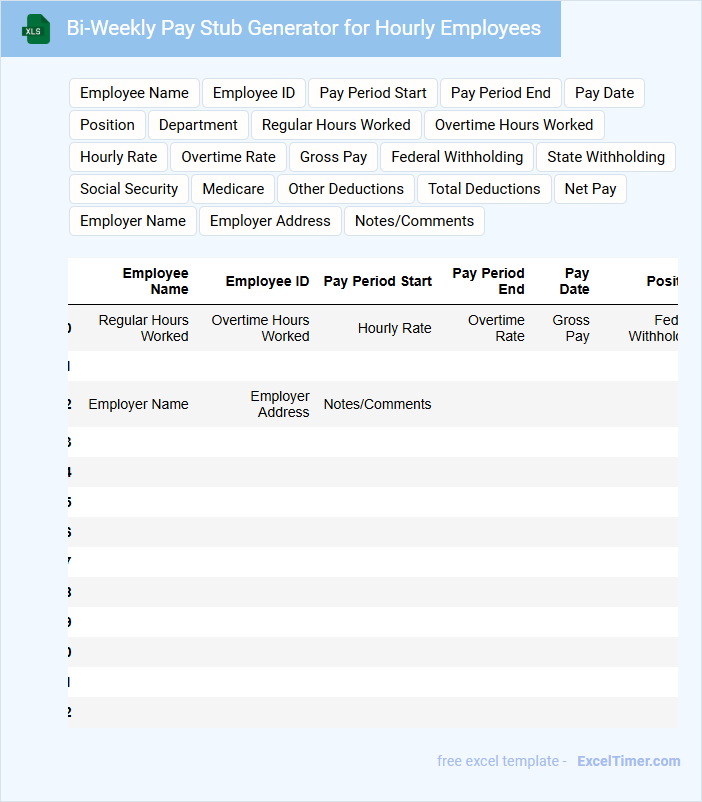

Bi-Weekly Pay Stub Generator for Hourly Employees

A Bi-Weekly Pay Stub Generator for hourly employees is a tool designed to accurately calculate and display earnings every two weeks. This document typically includes hours worked, hourly rates, gross pay, deductions, and net pay. It is essential for both employers and employees to maintain clear records of payment and tax information.

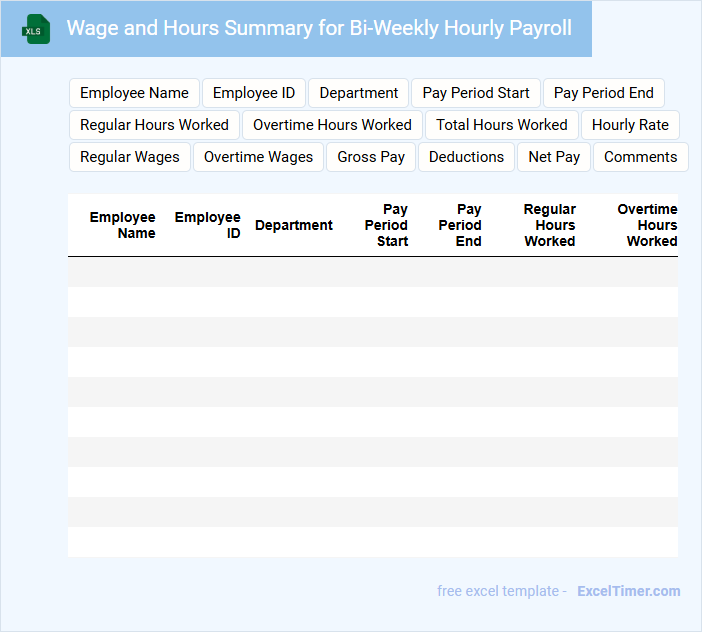

Wage and Hours Summary for Bi-Weekly Hourly Payroll

The Wage and Hours Summary for a Bi-Weekly Hourly Payroll document typically contains detailed records of employee working hours, wages earned, and any deductions applied during the two-week pay period. It provides a clear breakdown of regular hours, overtime, and total earnings to ensure accurate payroll processing. This summary is essential for maintaining compliance with labor laws and facilitating transparent employee compensation.

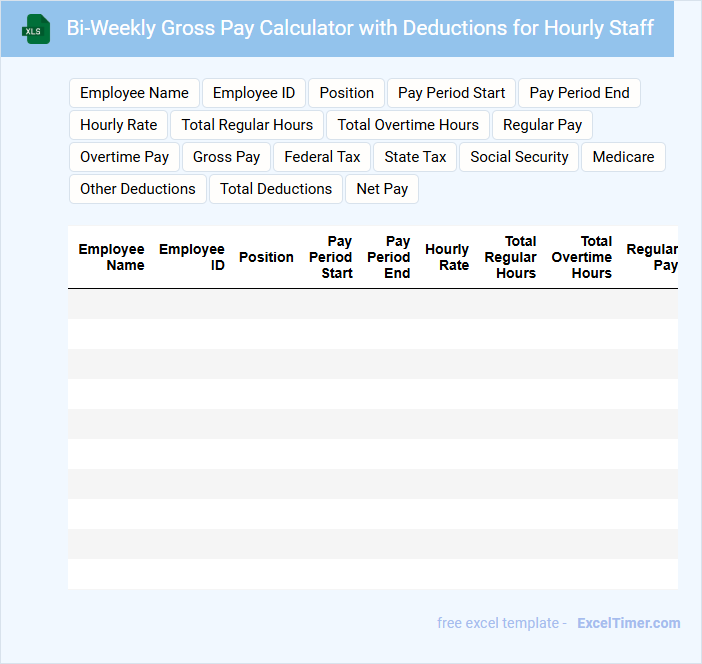

Bi-Weekly Gross Pay Calculator with Deductions for Hourly Staff

What information is typically included in a Bi-Weekly Gross Pay Calculator with Deductions for Hourly Staff? This type of document usually contains details about the employee's hourly rate, total hours worked during the bi-weekly period, and applicable deductions such as taxes and benefits. It helps employees and employers accurately calculate net pay after subtracting mandatory and voluntary deductions.

What important factors should be considered when using this calculator? It's essential to ensure accurate input of hours worked, including any overtime, and to account for all relevant deductions like federal, state, and local taxes, as well as insurance or retirement contributions. Regularly updating deduction rates and confirming compliance with labor laws guarantees precise and fair payroll processing.

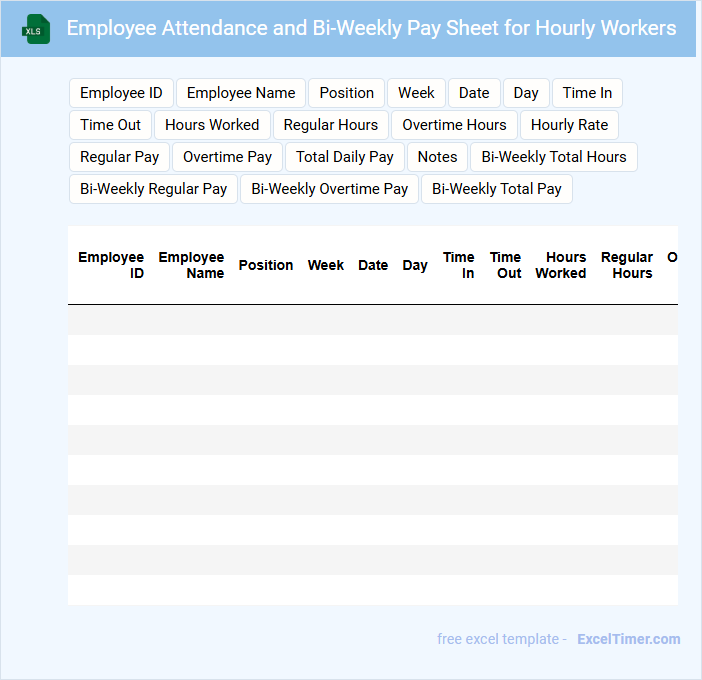

Employee Attendance and Bi-Weekly Pay Sheet for Hourly Workers

What does an Employee Attendance and Bi-Weekly Pay Sheet for Hourly Workers typically contain? This document usually includes detailed records of each employee's daily hours worked, attendance status, and calculated earnings for a bi-weekly period. It helps ensure accurate payroll processing and monitoring of employee attendance patterns.

What important elements should be included in this document? Key components include employee names, dates, clock-in and clock-out times, total hours worked, overtime hours if any, hourly rates, and total pay for the period. Including clear headers and a summary section improves readability and facilitates payroll verification.

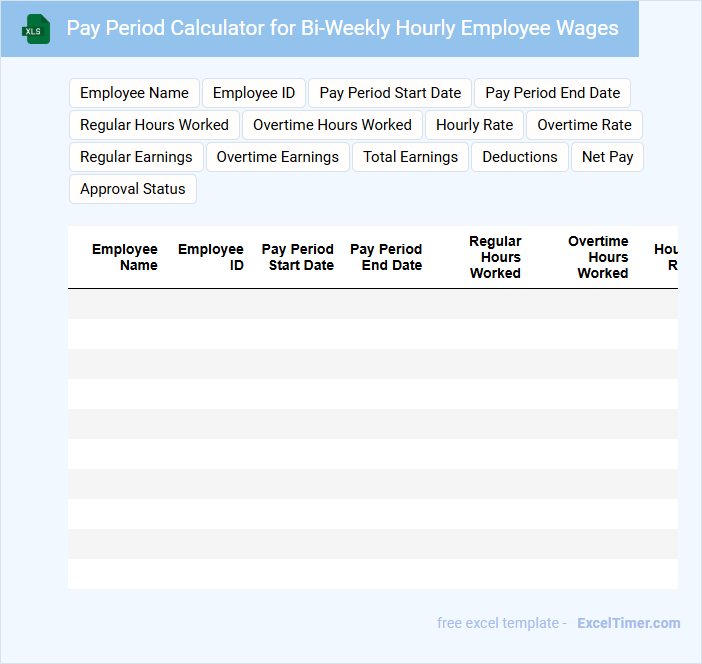

Pay Period Calculator for Bi-Weekly Hourly Employee Wages

A Pay Period Calculator for bi-weekly hourly employee wages is a tool designed to accurately compute earnings based on hours worked within a specific bi-weekly timeframe. Typically, this document contains fields for entering total hours, hourly rates, and deductions or bonuses applicable during the pay period. Its primary function is to ensure precise payroll processing and help employees understand their wage breakdown.

Important considerations include verifying the correct bi-weekly pay dates, accounting for overtime hours, and incorporating any applicable tax withholdings or benefits. Including a clear summary of gross pay, deductions, and net pay enhances transparency and usability. Additionally, ensuring ease of use and accuracy with automated calculations is crucial for both employers and employees.

Bi-Weekly Time and Pay Log for Hourly Staff

What information is typically included in a Bi-Weekly Time and Pay Log for Hourly Staff? This document usually contains detailed records of hours worked by employees over a two-week period, including regular hours, overtime, and breaks. It also summarizes earnings and deductions to ensure accurate payroll processing.

Why is accuracy important when maintaining this log? Accurate time and pay logs help prevent payroll errors, ensure compliance with labor laws, and provide clear documentation for both employers and employees. Regularly verifying entries and obtaining employee signatures can further enhance reliability and transparency.

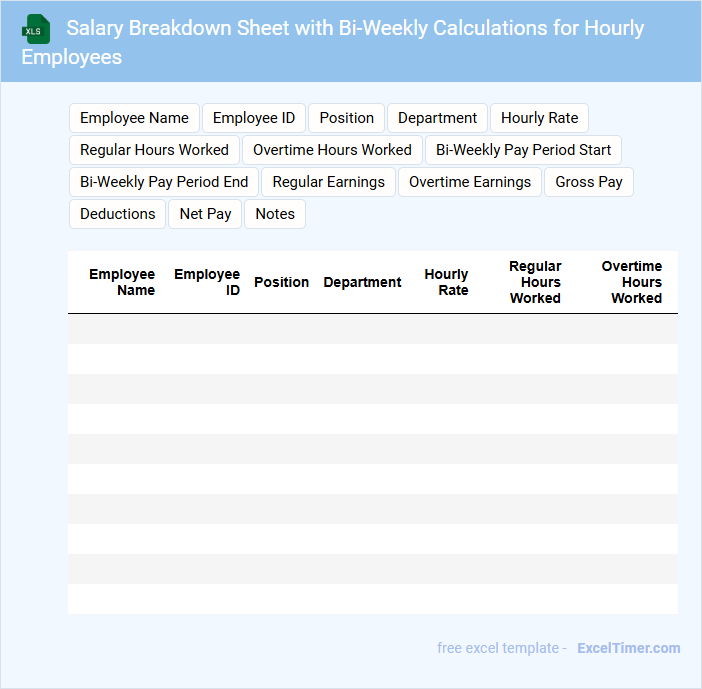

Salary Breakdown Sheet with Bi-Weekly Calculations for Hourly Employees

A Salary Breakdown Sheet with Bi-Weekly Calculations for Hourly Employees typically includes detailed wage information and calculated earnings based on hours worked over two weeks. It helps employees and employers clearly understand pay components and deductions.

- Include hours worked per day and total bi-weekly hours for accurate pay calculation.

- List all deductions such as taxes, insurance, and retirement contributions separately.

- Provide net pay clearly after all deductions to avoid confusion.

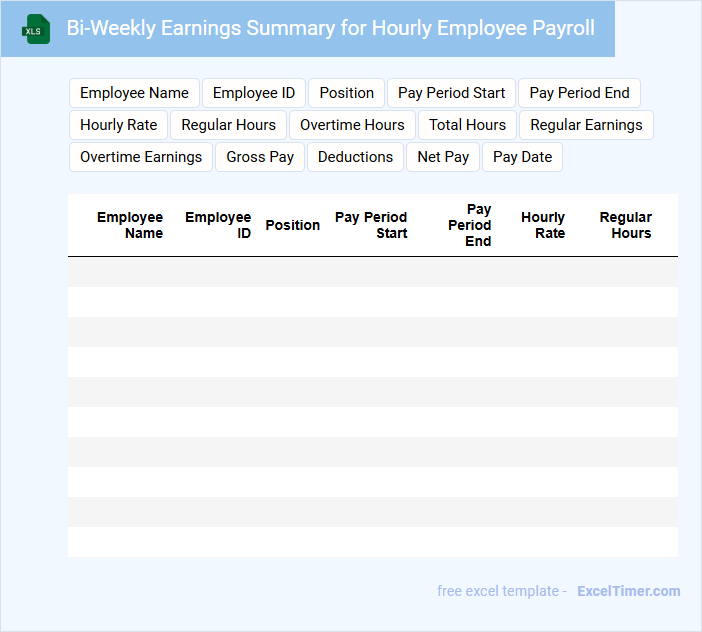

Bi-Weekly Earnings Summary for Hourly Employee Payroll

A Bi-Weekly Earnings Summary document typically contains detailed records of an hourly employee's worked hours and corresponding pay for a two-week period. It includes itemized entries such as regular hours, overtime, deductions, and net pay to provide a clear financial overview. This document is essential for payroll accuracy and employee transparency.

Important elements to include are the employee's identification details, hourly rates, gross earnings, tax withholdings, and any additional deductions or bonuses. Ensuring clarity and accuracy in this summary helps avoid payroll disputes and supports effective financial planning. Regular review and timely distribution of this report enhance payroll compliance and employee trust.

What formulas are required in Excel to accurately calculate bi-weekly pay for hourly employees, including regular and overtime hours?

Use the formula =MIN(Hours_Worked, 80)*Hourly_Rate to calculate regular pay for bi-weekly periods, assuming 80 regular hours in two weeks. For overtime pay, apply =MAX(Hours_Worked - 80, 0)*Hourly_Rate*Overtime_Rate, where Overtime_Rate is typically 1.5 or 2 times the regular rate. Sum both results with =Regular_Pay + Overtime_Pay to obtain the total bi-weekly pay for hourly employees.

How can you use Excel functions to automatically deduct taxes and other withholdings from an employee's gross bi-weekly pay?

Use Excel functions such as SUMPRODUCT to calculate taxes and withholdings based on predefined tax rates and deduction percentages. Apply the IF function to handle different tax brackets or exemptions automatically within the spreadsheet. Subtract the total deductions from the gross bi-weekly pay cell to get the net pay for hourly employees.

Which essential columns should be included in an Excel sheet to effectively track employee hours, rates, and total bi-weekly earnings?

Include columns for Employee Name, Employee ID, Hourly Rate, Regular Hours Worked, Overtime Hours, Overtime Rate, and Total Bi-Weekly Earnings. Add Date Range or Pay Period to specify the two-week span. Incorporate columns for Deductions and Net Pay to provide comprehensive payroll tracking.

How can Excel's conditional formatting be used to flag errors or inconsistencies in entered hours or pay rates?

Excel's conditional formatting can highlight cells with invalid or inconsistent data by applying rules such as flagging hours entered below 0 or above 80 per week, or pay rates outside a specified range. Setting data validation rules for hourly entries and pay rates helps ensure input accuracy and flags irregularities instantly. Visual alerts like color changes improve error detection in bi-weekly pay calculations for hourly employees.

What methods in Excel can ensure accurate calculations if employees have varying hourly rates or multiple job roles within the same pay period?

Use Excel's VLOOKUP or INDEX-MATCH functions to reference hourly rates based on employee IDs or job roles, ensuring correct pay calculations. Implement SUMPRODUCT to multiply hours worked by corresponding rates for employees with multiple roles within a pay period. Apply data validation and named ranges to maintain data accuracy and enable dynamic updates when rates or roles change.