The Bi-weekly Salary Slip Excel Template for NGOs streamlines payroll management by providing an organized format to calculate and record employee salaries every two weeks. It helps NGOs maintain transparency, accuracy, and compliance with labor laws by including essential details such as deductions, allowances, and net pay. This template is crucial for ensuring timely payments and efficient financial tracking within nonprofit organizations.

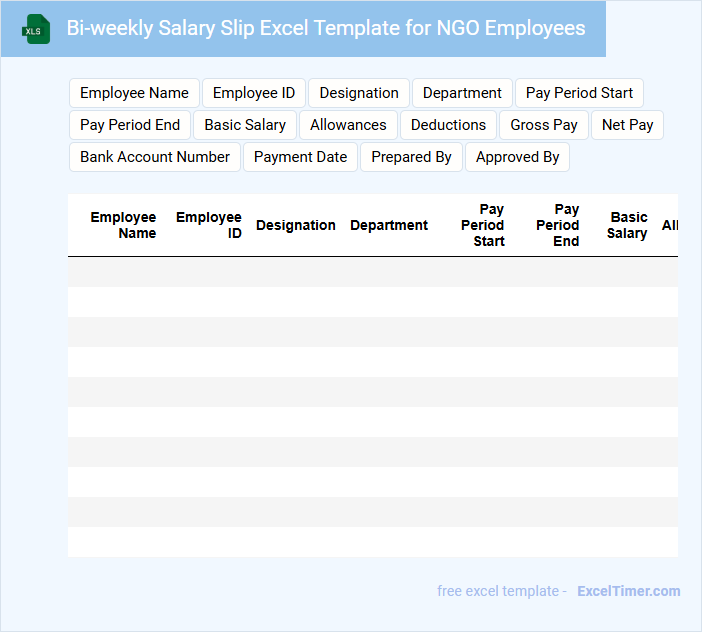

Bi-weekly Salary Slip Excel Template for NGO Employees

What information is typically included in a Bi-weekly Salary Slip Excel Template for NGO Employees?

This document usually contains employee details, salary components, deductions, and net pay for each bi-weekly period. It provides a clear breakdown of earnings such as basic pay, allowances, taxes, and any other deductions relevant to NGO policies. Such templates are designed to ensure accurate and transparent payroll management for NGO employees.

Important Suggestions

- Include clear sections for employee details, pay period, and payment summary to maintain clarity and records.

- Incorporate formulas for automatic calculations of deductions and net salary to minimize errors and save time.

- Ensure the template complies with local labor laws and NGO-specific payment policies.

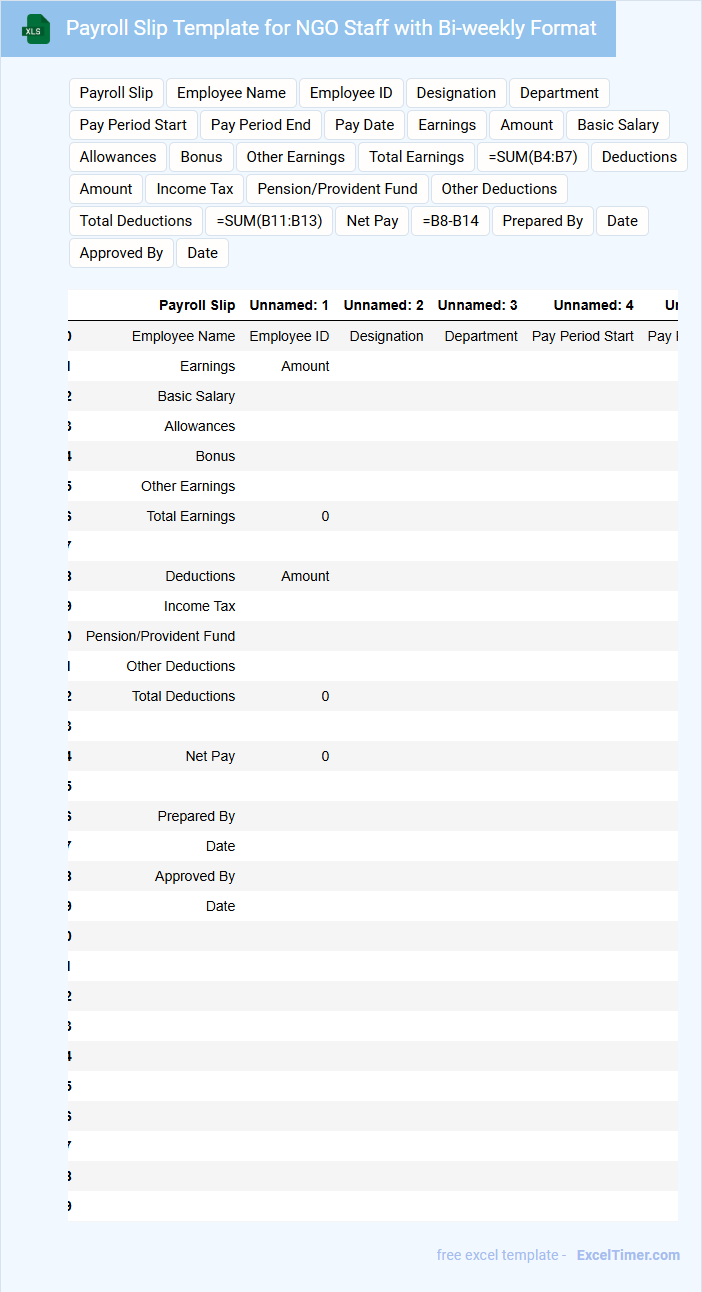

Payroll Slip Template for NGO Staff with Bi-weekly Format

Payroll slips for NGO staff in a bi-weekly format typically contain detailed information about an employee's earnings, deductions, and net pay for a two-week period. These documents are essential for transparency and financial record-keeping within non-governmental organizations.

- Include clear identification details of the employee and pay period.

- Itemize all earnings, taxes, and other deductions precisely.

- Ensure compliance with local labor laws and NGO policies.

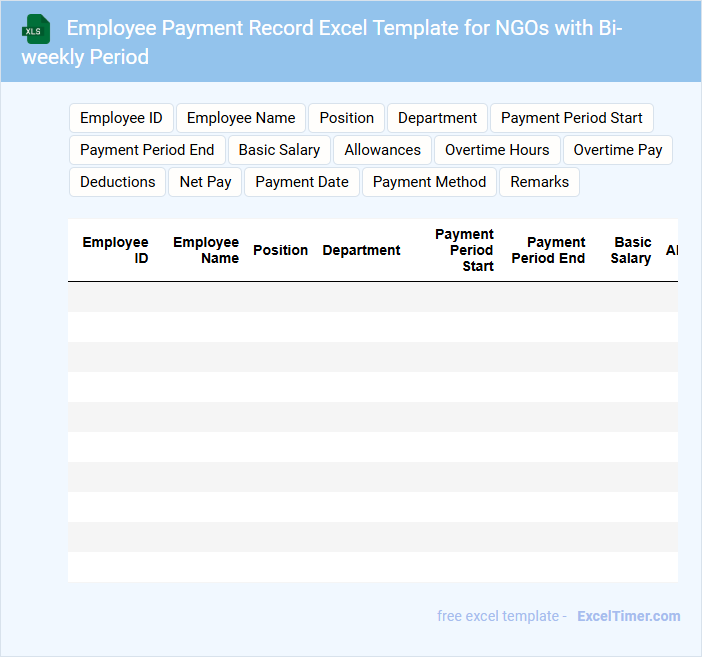

Employee Payment Record Excel Template for NGOs with Bi-weekly Period

An Employee Payment Record Excel Template is designed to keep accurate and organized records of employee wages and deductions over bi-weekly periods. This document typically contains employee details, payment amounts, tax withholdings, and other relevant salary information. For NGOs, it is crucial to ensure transparency and easy accessibility for auditing purposes.

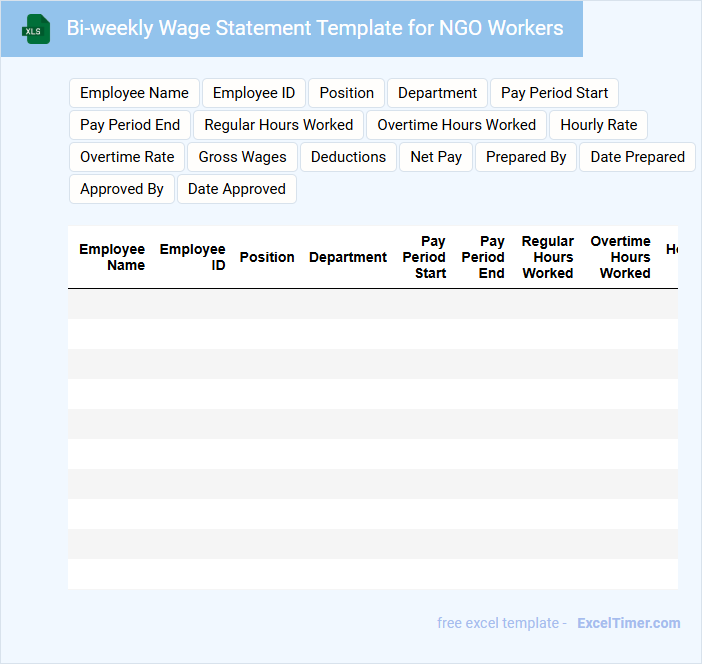

Bi-weekly Wage Statement Template for NGO Workers

What information is typically included in a bi-weekly wage statement template for NGO workers? A bi-weekly wage statement for NGO workers usually contains details such as employee identification, pay period dates, hours worked, wage rates, deductions, and net pay. This document helps ensure transparency, accurate record-keeping, and facilitates timely wage payments within NGO operations.

What important elements should be considered when creating this wage statement template? It is crucial to include clear breakdowns of earnings and deductions, comply with relevant labor laws, and provide space for signatures or acknowledgments. Additionally, ensuring the template is easily understandable and accessible to NGO workers enhances trust and prevents payment disputes.

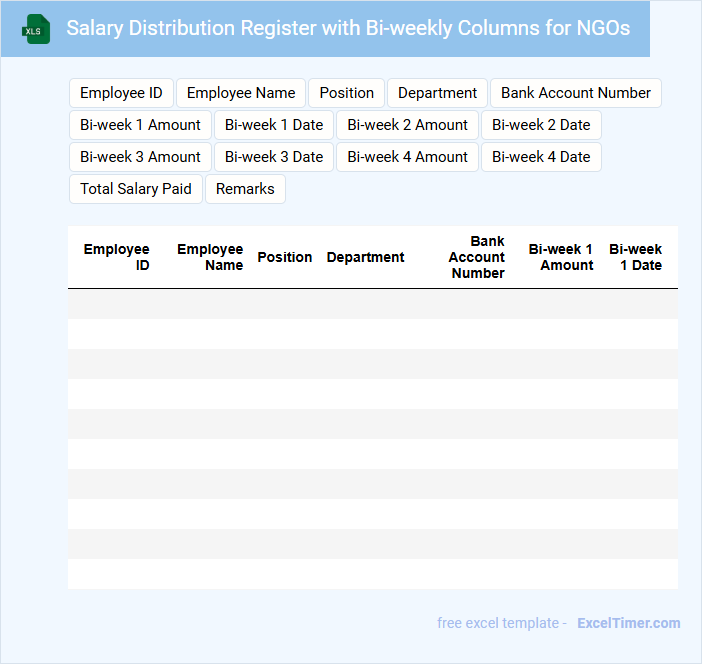

Salary Distribution Register with Bi-weekly Columns for NGOs

What information is typically included in a Salary Distribution Register with Bi-weekly Columns for NGOs? This document usually contains detailed records of employee salaries distributed every two weeks, including names, positions, payment dates, amounts, and deductions. It helps ensure transparency, accuracy in payroll management, and compliance with financial regulations.

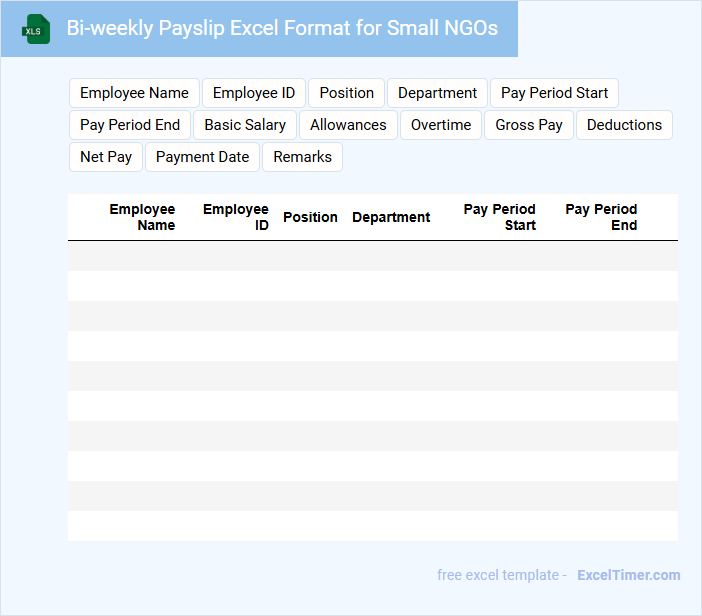

Bi-weekly Payslip Excel Format for Small NGOs

A Bi-weekly Payslip Excel Format for Small NGOs is a document designed to record and summarize employee salary details every two weeks. It ensures transparency and accuracy in payroll management tailored for non-profit organizations.

- Include employee identification, pay period, and detailed earnings and deductions.

- Incorporate sections for tax, benefits, and any NGO-specific allowances.

- Ensure formulas are preset for automatic calculations to minimize errors.

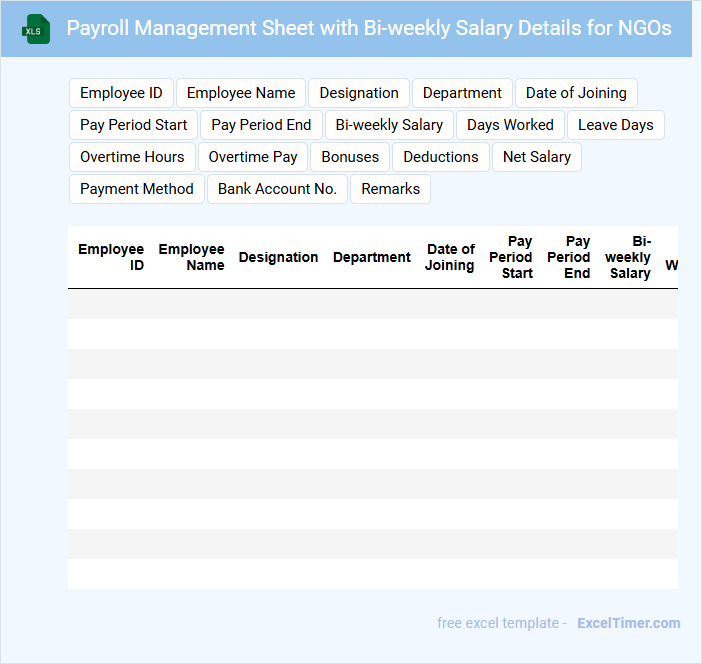

Payroll Management Sheet with Bi-weekly Salary Details for NGOs

What information is typically included in a Payroll Management Sheet with Bi-weekly Salary Details for NGOs? This document usually contains detailed employee salary records, including hours worked, deductions, and net pay calculated on a bi-weekly basis. It is essential for maintaining transparency, ensuring accurate payments, and facilitating financial audits within non-governmental organizations.

What important aspects should be considered when creating this payroll sheet? Accuracy in data entry, compliance with relevant labor laws, and clear documentation of allowances and benefits are crucial to avoid discrepancies and support smooth financial management in NGOs.

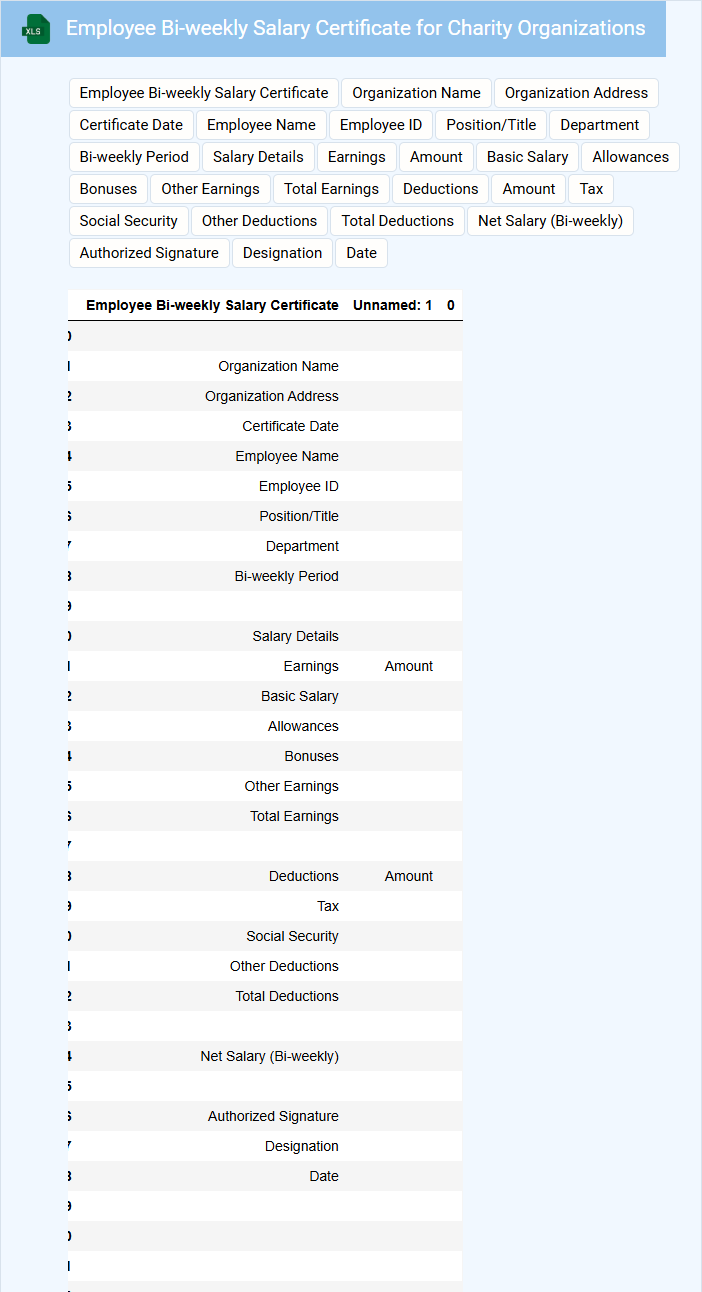

Employee Bi-weekly Salary Certificate for Charity Organizations

An Employee Bi-weekly Salary Certificate is a formal document issued by an employer to certify the salary details of an employee for a specific two-week period. It usually contains information such as the employee's name, designation, salary amount, pay period, and employer's details.

For Charity Organizations, this certificate often helps in financial verifications for aid eligibility or tax purposes. It is important to ensure accuracy and include official stamps or signatures for authenticity.

Bi-weekly Salary Calculation Template with Allowances for NGO Staff

This document is a Bi-weekly Salary Calculation Template designed to accurately compute staff wages including regular hours and additional allowances. It ensures transparent and efficient payroll management tailored for NGO staff, accounting for varied compensation elements.

Important considerations include clearly listing all applicable allowances such as travel, housing, and hardship supplements. Regular updates and audit trails enhance accuracy and compliance with organizational policies.

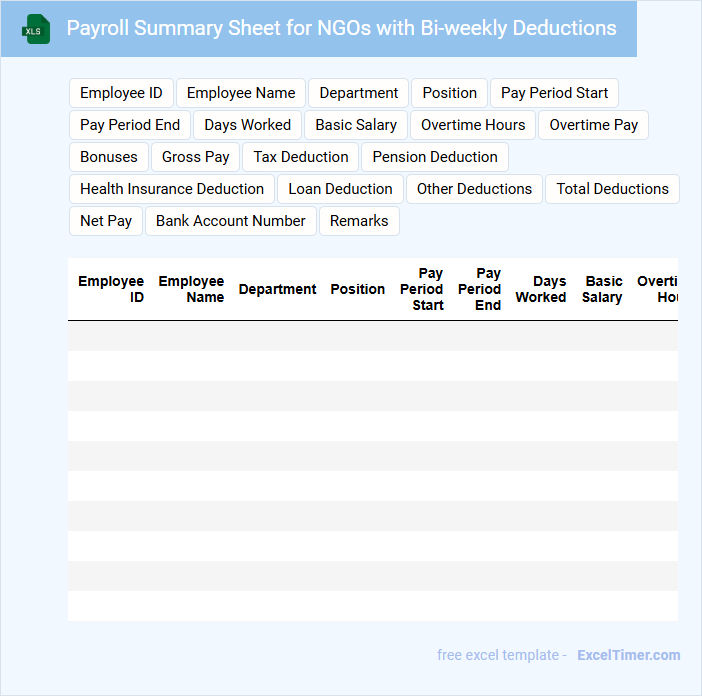

Payroll Summary Sheet for NGOs with Bi-weekly Deductions

What information does a Payroll Summary Sheet for NGOs with Bi-weekly Deductions typically contain? This type of document usually includes detailed employee payment records, such as wages, taxes, and other statutory or voluntary deductions calculated on a bi-weekly basis. It helps ensure accurate and transparent tracking of salaries and deductions, aiding compliance and financial management within the NGO.

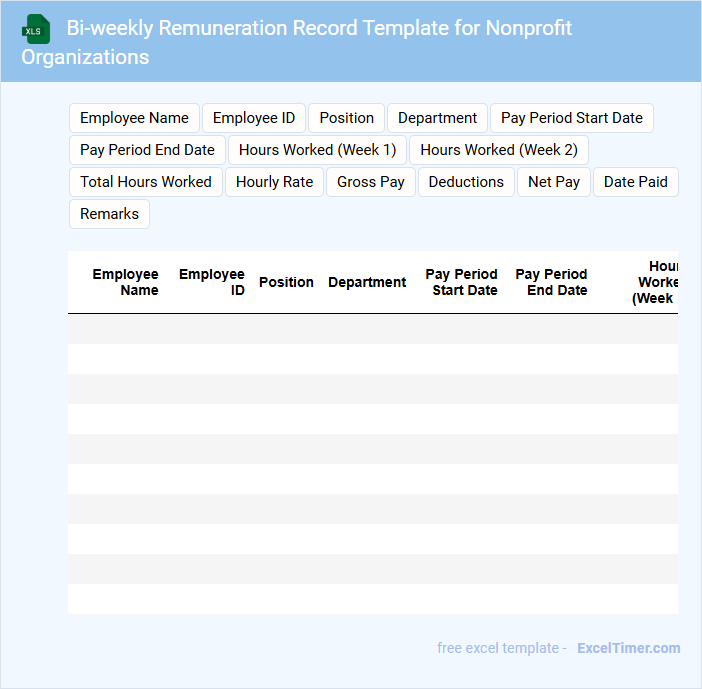

Bi-weekly Remuneration Record Template for Nonprofit Organizations

This document typically contains detailed records of payroll and remuneration transactions for nonprofit organizations on a bi-weekly basis. It is designed to ensure accurate tracking and compliance with financial and employment regulations.

- Include employee names, hours worked, and corresponding pay rates.

- Record deductions, benefits, and net pay for transparency.

- Ensure timely updates and proper authorization signatures.

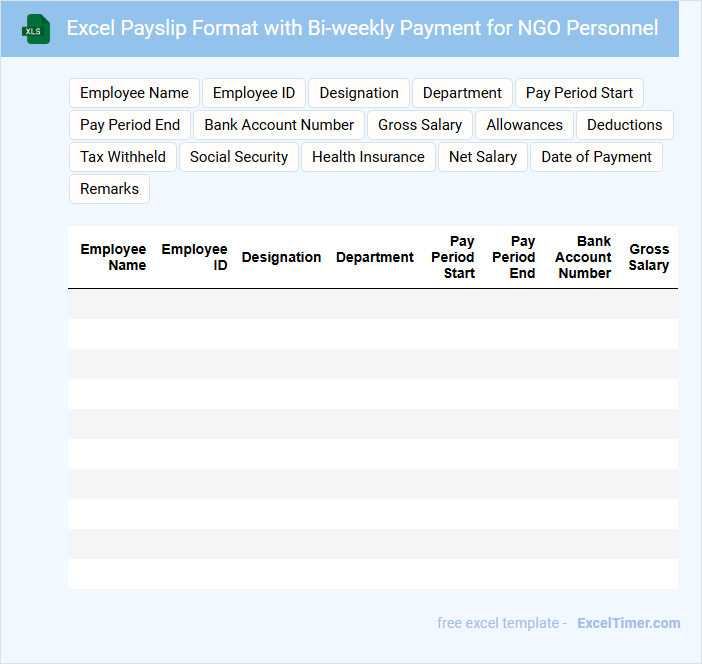

Excel Payslip Format with Bi-weekly Payment for NGO Personnel

This document typically contains detailed payment information formatted in Excel, tailored for NGO personnel receiving bi-weekly salary payments.

- Employee Details: Essential personal and job-related information for accurate identification and payment processing.

- Payment Breakdown: Clear division of earnings, deductions, and net pay to ensure transparency and accurate financial records.

- Compliance Information: Inclusion of relevant tax codes and organizational policies to meet regulatory requirements and maintain consistency.

Payroll Tracking Sheet for NGOs with Bi-weekly Salary Structure

The Payroll Tracking Sheet for NGOs is a crucial document that ensures accurate record-keeping of employee salaries, deductions, and benefits, specifically tailored for a bi-weekly salary structure. It systematically organizes payment dates, amounts, and individual employee details to maintain transparency and compliance.

Essential components include employee identification, salary slabs, tax deductions, and payment approval status to avoid discrepancies. For efficient management, it is important to regularly update the sheet and integrate automated calculations where possible.

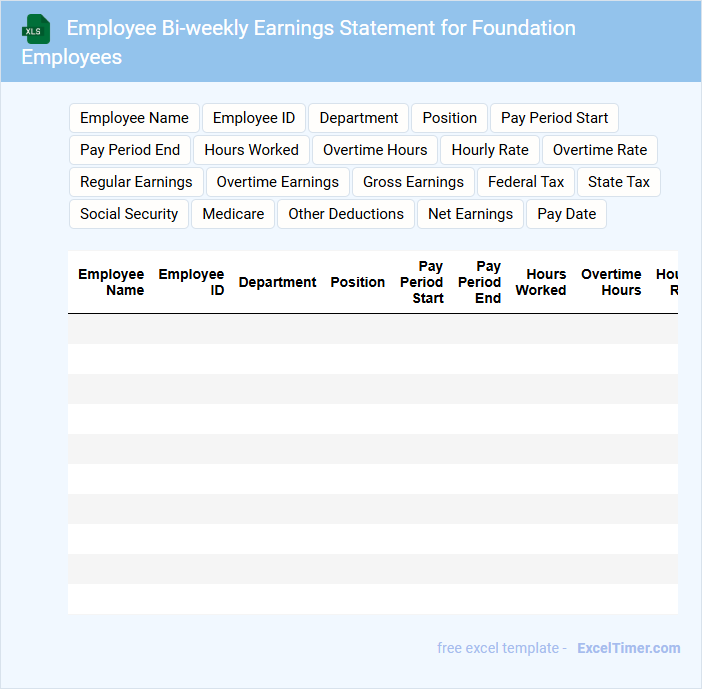

Employee Bi-weekly Earnings Statement for Foundation Employees

The Employee Bi-weekly Earnings Statement for Foundation Employees typically contains detailed information about an employee's earnings, deductions, and net pay for a specific two-week period. This document serves as a vital record for both the employee and employer to verify compensation and compliance with labor laws.

- Include clear breakdowns of gross pay, taxes, and other deductions.

- Provide the pay period dates and employee identification details.

- Ensure transparency by listing year-to-date earnings and deductions.

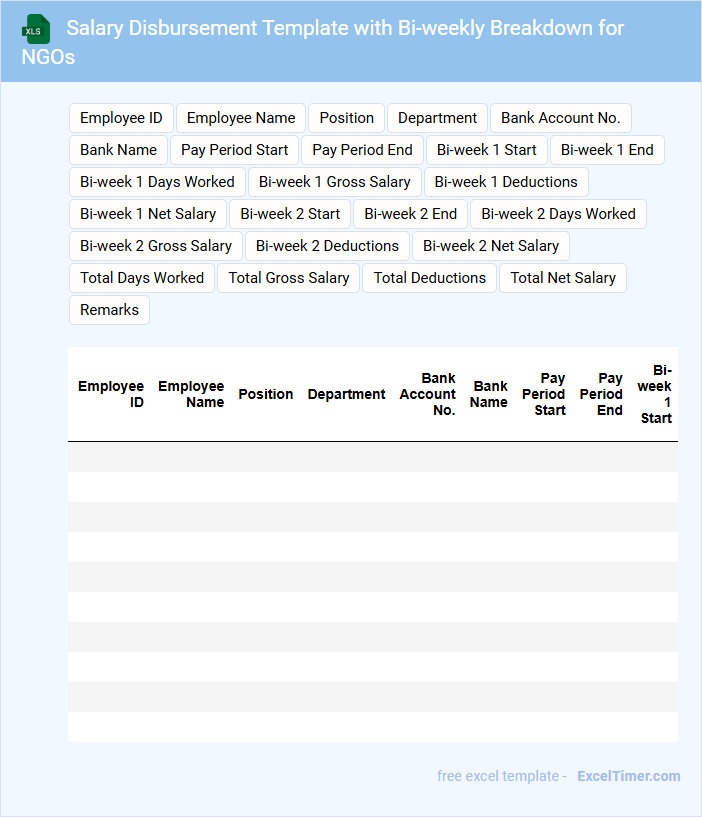

Salary Disbursement Template with Bi-weekly Breakdown for NGOs

A Salary Disbursement Template with Bi-weekly Breakdown for NGOs typically contains detailed records of employee salaries distributed every two weeks, including deductions and net pay. It helps maintain transparent payroll management and supports accurate financial reporting.

- Include employee details, payment dates, and payment methods for clarity.

- Ensure all statutory and organizational deductions are accurately accounted for.

- Provide summary totals to track overall salary expenses efficiently.

What key information should be included in a bi-weekly salary slip for NGO employees?

A bi-weekly salary slip for NGO employees should include your personal details, salary period, gross salary, deductions like taxes and social security, and net pay. It must specify the NGO's name, employee identification number, and payment date. Including details on allowances, overtime, and leave balances ensures transparency and accurate record-keeping.

How are statutory deductions (such as taxes and social security) represented in a salary slip document?

Statutory deductions like taxes and social security are itemized in your bi-weekly salary slip as separate line entries, showing precise amounts withheld for each category. These deductions are calculated based on current government regulations and clearly displayed to ensure transparency and compliance. Your salary slip provides a detailed breakdown, highlighting gross pay, total deductions, and net salary for accurate financial tracking.

What is the significance of separating gross pay and net pay on a bi-weekly salary slip?

Separating gross pay and net pay on a bi-weekly salary slip provides clear visibility of total earnings before deductions and the actual amount received after taxes and contributions. This distinction helps employees understand mandatory withholdings such as taxes, social security, and retirement funds. For NGOs, transparent salary slips ensure compliance with labor laws and foster trust by clearly documenting payroll calculations.

How should overtime, bonuses, or allowances be itemized in an NGO bi-weekly salary slip?

Overtime, bonuses, and allowances should be clearly itemized as separate line items in your NGO bi-weekly salary slip to ensure transparency and accurate payroll tracking. Each component must include a detailed description, corresponding hours or rates, and the total amount earned for the pay period. Proper categorization helps maintain compliance with organizational policies and simplifies financial auditing.

Why is transparency in salary slip formatting crucial for NGO financial compliance and employee trust?

Transparency in salary slip formatting ensures accurate financial reporting and adherence to NGO regulatory standards. Clear documentation of your bi-weekly salary builds employee trust by providing detailed breakdowns of earnings, deductions, and benefits. This accountability supports NGO compliance with audit requirements and promotes a fair work environment.