![]()

The Bi-weekly Expense Tracking Excel Template for Startup Companies simplifies financial management by allowing startups to monitor expenses every two weeks accurately. This template helps identify spending patterns and maintain budget control, crucial for early-stage business growth. Customizable categories and automated calculations ensure efficient and error-free tracking of cash flow.

Bi-weekly Expense Tracking Excel Template for Startup Companies

This document typically contains detailed bi-weekly financial records designed to help startup companies monitor and control their expenses efficiently.

- Expense Categories: Clearly defined categories to track different types of expenditures for better budget management.

- Date and Amount Entries: Accurate input fields for dates and amounts to maintain timely and precise records.

- Summary Section: A consolidated overview of total expenses to assess financial health and make informed decisions.

Bi-weekly Expense Report Template for Startup Business

A Bi-weekly Expense Report Template for startup businesses is designed to help track and categorize expenses incurred every two weeks. It provides a clear overview of spending patterns, ensuring financial accountability and informed decision-making.

This type of document usually contains sections for date, expense description, amount, payment method, and category. Regularly updating this report helps startups monitor cash flow and identify cost-saving opportunities early.

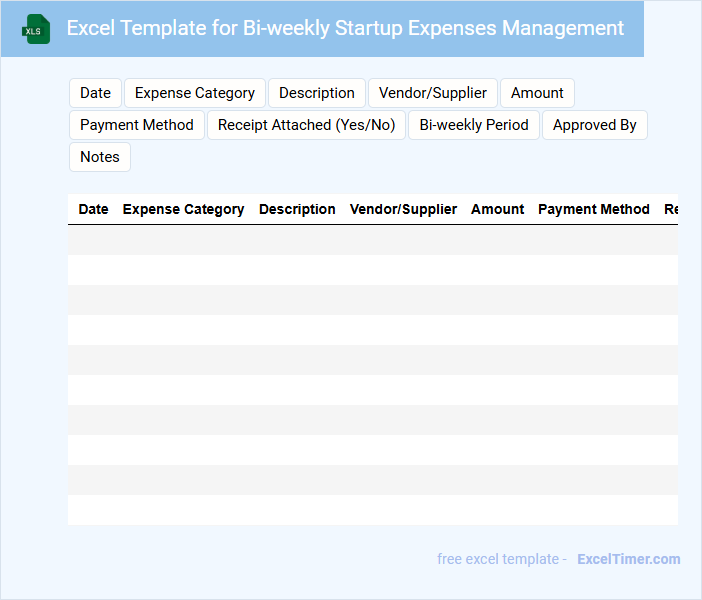

Excel Template for Bi-weekly Startup Expenses Management

An Excel template for bi-weekly startup expenses management typically contains categorized expense trackers, budget comparison sheets, and cash flow summaries. It helps startups monitor spending habits and ensure they stay within their financial plans. The template often includes sections for fixed costs, variable expenses, and notes for financial adjustments or upcoming payments.

Startup Expense Tracker with Bi-weekly Summaries

A Startup Expense Tracker is a financial document designed to monitor and manage the costs incurred during the early stages of a new business. It typically contains detailed records of expenses categorized by type and date, allowing entrepreneurs to keep an accurate budget. Including bi-weekly summaries helps in analyzing spending patterns and making informed financial decisions.

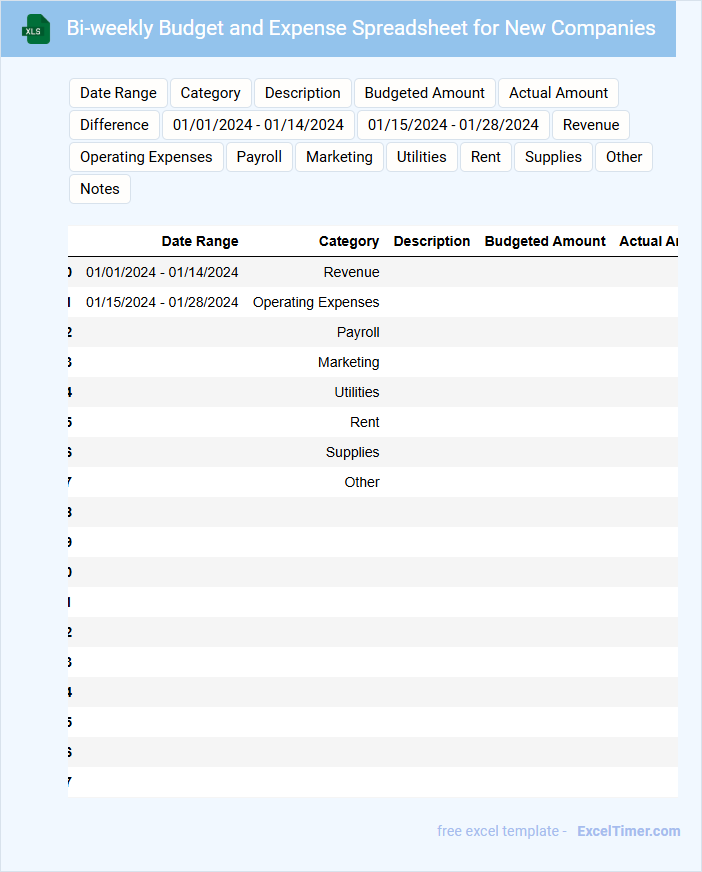

Bi-weekly Budget and Expense Spreadsheet for New Companies

The Bi-weekly Budget and Expense Spreadsheet is a crucial document designed to track and manage the financial activities of new companies on a regular basis. It typically contains detailed records of income, expenses, and budget allocations to maintain financial accuracy and control.

For new companies, it is important to include categories for unexpected costs and revenue forecasts to better anticipate financial fluctuations. Consistent updates and reviews of the spreadsheet help ensure financial stability and informed decision-making.

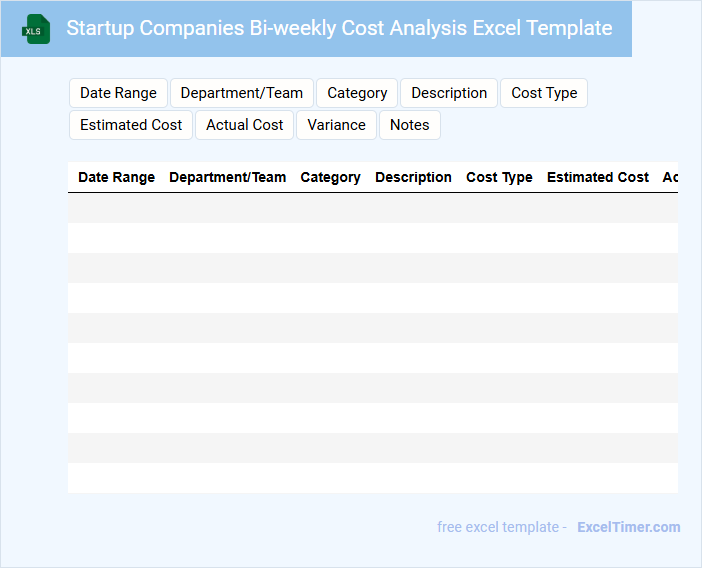

Startup Companies Bi-weekly Cost Analysis Excel Template

What information is typically included in a Startup Companies Bi-weekly Cost Analysis Excel Template? This document usually contains detailed records of all expenses incurred by the startup within a two-week period, including operational costs, salaries, marketing spend, and miscellaneous expenditures. It helps track financial performance regularly, making it easier to manage budgets and identify areas where costs can be optimized for better cash flow management.

What is an important consideration when using this template? Ensuring accurate and timely data entry is crucial for maintaining reliable insights, and including categorized expense lines with clear labels enhances clarity. Additionally, incorporating visual charts or graphs can help stakeholders quickly understand spending trends and make informed decisions.

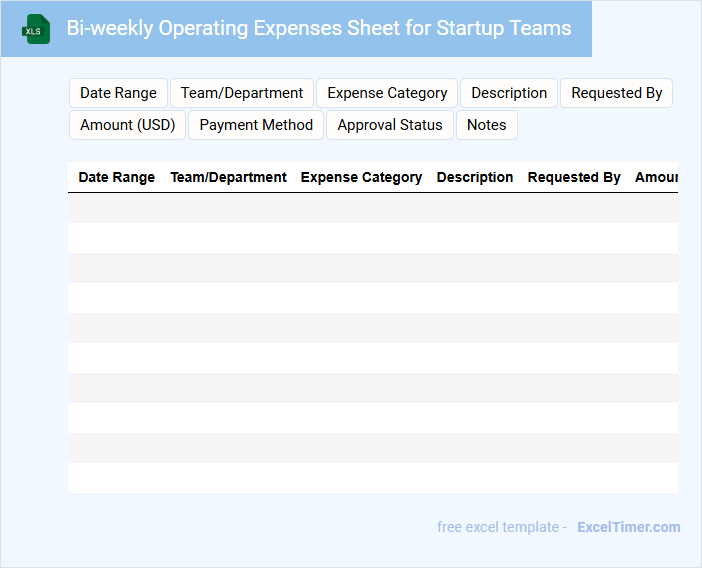

Bi-weekly Operating Expenses Sheet for Startup Teams

The Bi-weekly Operating Expenses Sheet is a crucial document that records all outflows related to startup operations within a two-week period. It typically includes categories such as salaries, rent, utilities, and office supplies to provide a clear financial snapshot. This helps teams monitor spending and maintain budgeting discipline.

For startup teams, an accurate tracking system and consistent updating are essential to avoid financial discrepancies. Detailed categorization and timestamping of each expense ensure transparency and aid in forecasting future costs. Regular reviews improve cash flow management and support strategic decision-making.

Expense Tracking Excel for Startup Companies (Bi-weekly)

An Expense Tracking Excel document for startup companies typically contains detailed records of all incurred expenses organized on a bi-weekly basis. It includes categories such as operational costs, salaries, marketing expenses, and miscellaneous spending to maintain accurate financial oversight. This document helps startups monitor cash flow, manage budgets efficiently, and identify cost-saving opportunities early on.

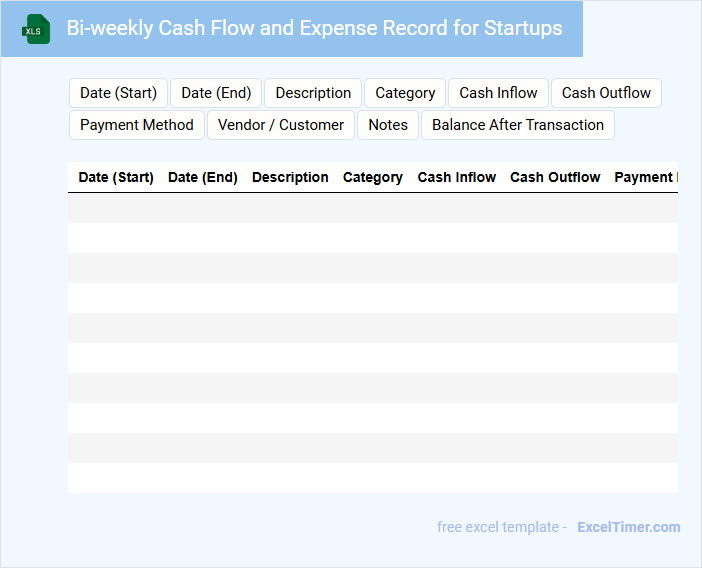

Bi-weekly Cash Flow and Expense Record for Startups

A Bi-weekly Cash Flow and Expense Record for startups typically contains detailed tracking of incoming revenues and outgoing expenses every two weeks. This document helps monitor the financial health and liquidity of the startup regularly.

It usually includes categories such as operational costs, payroll, investments, and income sources. Maintaining accuracy and timeliness in these records is crucial for informed decision-making and budgeting.

It is important to consistently update this document and review it with the team to align financial strategies with business goals.

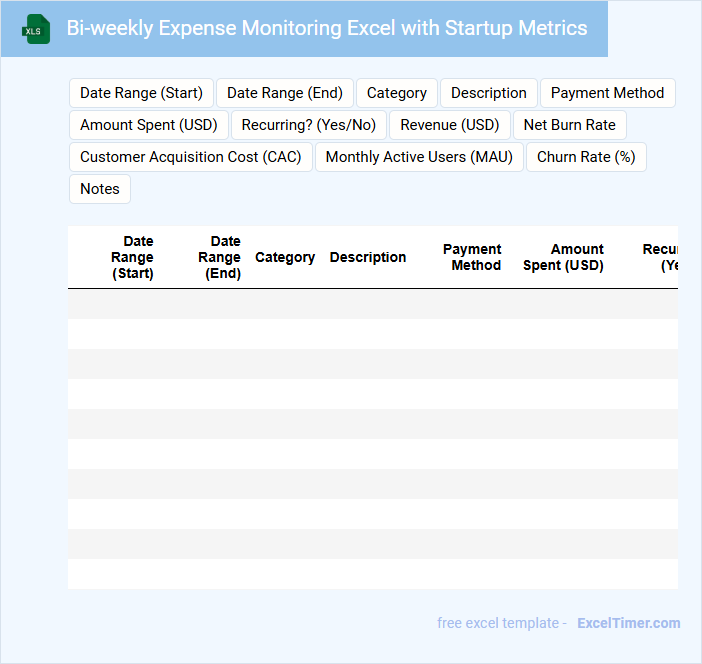

Bi-weekly Expense Monitoring Excel with Startup Metrics

The Bi-weekly Expense Monitoring Excel is a crucial document for tracking and managing startup finances regularly. It typically contains detailed records of income, expenses, and key financial transactions over two-week periods. Including startup metrics in this document helps founders measure performance and make informed decisions efficiently.

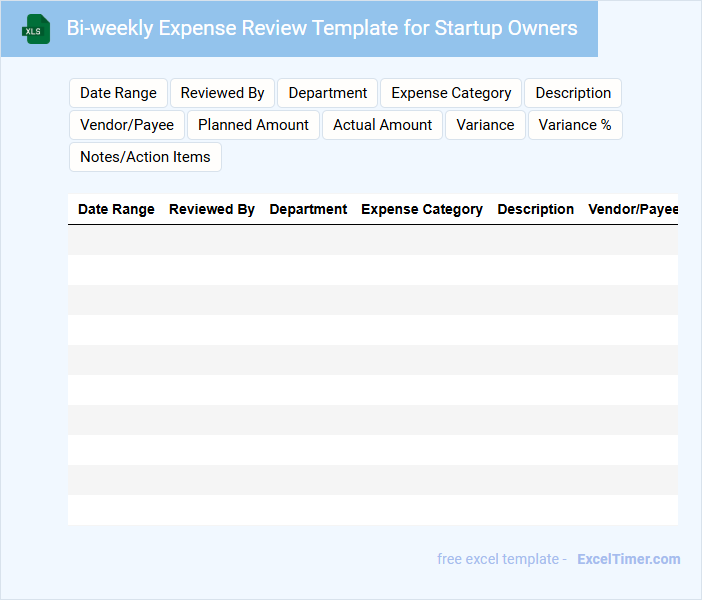

Bi-weekly Expense Review Template for Startup Owners

This bi-weekly expense review template for startup owners systematically tracks and analyzes company expenditures to maintain financial health and optimize budgeting.

- Expense Categorization: Organize expenses into categories like operational costs, marketing, and salaries for clear visibility.

- Trend Analysis: Compare current expenses with previous periods to identify spending patterns and anomalies.

- Actionable Insights: Highlight areas for cost reduction and reallocation to improve overall financial efficiency.

Startup Payroll and Expenses Tracker with Bi-weekly Tabs

This document primarily contains detailed records of a startup's payroll and expenses, organized systematically to manage financial flows efficiently. It includes bi-weekly tabs to allow precise tracking of salary payments, deductions, and operational costs over set periods.

Maintaining this tracker helps ensure accurate budgeting and financial compliance for early-stage companies. Regular updates and reconciliation are important to prevent errors and support financial decision-making.

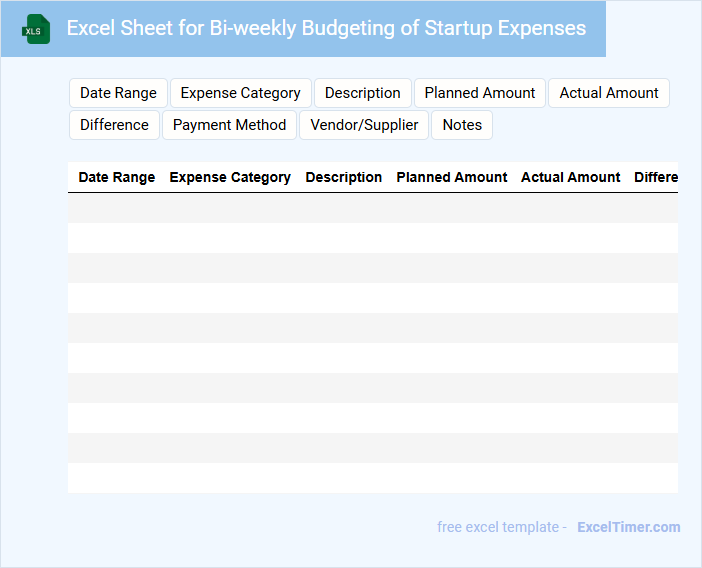

Excel Sheet for Bi-weekly Budgeting of Startup Expenses

An Excel Sheet for Bi-weekly Budgeting of startup expenses typically contains detailed records of income streams and categorized expense items. This document helps track financial performance on a regular basis to ensure effective cash flow management.

Important elements include projections for variable and fixed costs, as well as contingency funds for unexpected expenses. Having clearly defined budget categories and regular updates is crucial for accurate financial planning and decision-making.

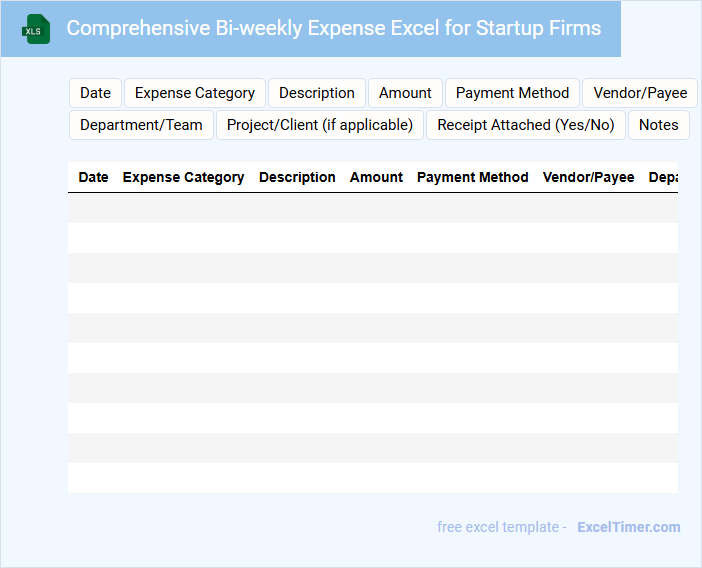

Comprehensive Bi-weekly Expense Excel for Startup Firms

What information does a Comprehensive Bi-weekly Expense Excel for Startup Firms typically contain? This document usually includes detailed records of all expenses incurred by the startup over a two-week period, categorized by type such as operational costs, salaries, marketing, and miscellaneous expenditures. It helps startups track cash flow, manage budgets, and identify spending patterns for better financial planning.

What important features should be included in this Excel sheet? Key elements include clear categorization of expenses, date and description fields for each transaction, automated total and subtotal calculations, and visual summaries like charts or graphs to easily interpret spending trends. Ensuring data accuracy and regular updating is essential for maintaining reliable financial records.

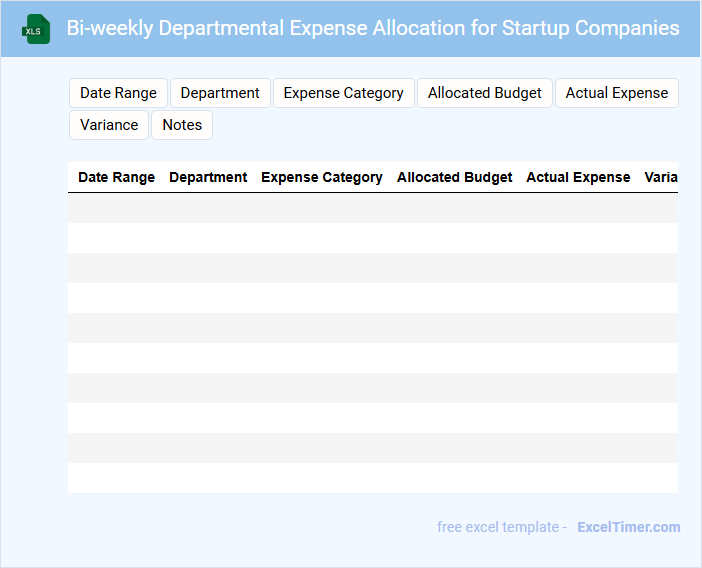

Bi-weekly Departmental Expense Allocation for Startup Companies

The Bi-weekly Departmental Expense Allocation document outlines the distribution of expenses across various departments within a startup company every two weeks. It provides a clear financial overview to ensure accurate budgeting and spending control.

Key components typically include expense categories, department names, and allocated amounts. For startups, it is important to maintain detailed records and regularly review allocations to optimize cash flow management.

What are the essential categories to include for bi-weekly expense tracking in a startup's Excel document?

Essential categories for bi-weekly expense tracking in your startup's Excel document include Payroll, Office Supplies, Marketing Costs, Software Subscriptions, Rent and Utilities, Travel Expenses, and Miscellaneous Costs. Accurate categorization ensures clear financial insights and efficient budget management. Each category should have corresponding columns for date, amount, payment method, and notes for detailed tracking.

How can formulas be used to automate the calculation of total and category-wise expenses in Excel?

Formulas like SUM and SUMIF in Excel automate the calculation of total and category-wise expenses by dynamically adding amounts based on criteria you set. Using ranges and criteria, these formulas update your bi-weekly expense tracking instantly as you enter new data. Your startup can save time and reduce errors by leveraging these Excel functions for accurate financial monitoring.

What methods can be implemented in Excel to flag or highlight expenses that exceed budget allocations for the period?

Use Excel's Conditional Formatting with formulas to highlight expenses exceeding your budget allocations, such as applying a red fill when costs surpass set limits. Implement data validation rules to prevent entries beyond budgeted amounts, ensuring accurate tracking. PivotTables and charts can summarize and visually flag overspending trends in your bi-weekly expense tracking.

How should the Excel sheet be structured to allow easy comparison of expenses across multiple bi-weekly periods?

Structure the Excel sheet with columns for Date, Expense Category, Vendor, Amount, and Bi-Weekly Period Identifier to group expenses by two-week intervals. Use pivot tables to summarize total expenses per category and period, enabling quick cross-period comparisons. Implement consistent data validation and standardized category lists to ensure accurate filtering and analysis.

What data validation techniques can be applied in Excel to ensure accurate and consistent expense entries?

Applying data validation in your bi-weekly expense tracking Excel sheet ensures accurate and consistent entries by restricting input types, such as allowing only numerical values for amounts and dropdown lists for expense categories. Implementing date validation restricts entries to specific bi-weekly periods, preventing incorrect date inputs. Using conditional formatting highlights anomalies, such as duplicate expenses or unusually high amounts, enhancing reliability in startup expense tracking.