The Bi-weekly Budget Excel Template for Personal Finance helps users manage their income and expenses by tracking finances every two weeks, promoting better cash flow control. This template includes customizable categories and automatic calculations, making budget adjustments simple and efficient. It is essential for maintaining financial discipline and achieving savings goals with regular, structured planning.

Bi-weekly Budget Tracker for Personal Finance

A bi-weekly budget tracker for personal finance is a document used to monitor income and expenses every two weeks. It helps individuals stay on top of their financial goals and manage their spending effectively.

- Record all sources of income consistently for accurate tracking.

- Categorize expenses to identify spending patterns clearly.

- Review and adjust the budget regularly to stay aligned with financial objectives.

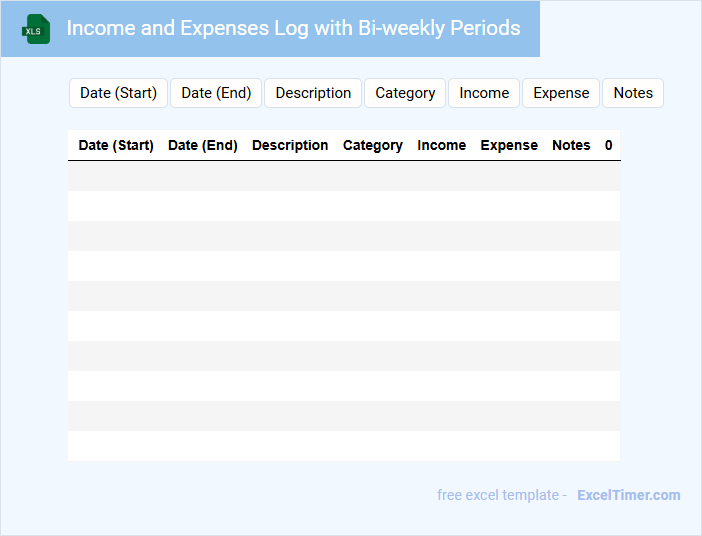

Income and Expenses Log with Bi-weekly Periods

Income and Expenses Logs with Bi-weekly Periods typically contain detailed records of earnings and expenditures tracked every two weeks to help manage personal or business finances effectively.

- Consistent entries: Maintain regular updates to accurately reflect financial activity within each bi-weekly period.

- Clear categorization: Separate income and expenses into distinct categories for easier analysis and budgeting.

- Summary totals: Include periodical summaries to quickly assess financial health and trends over time.

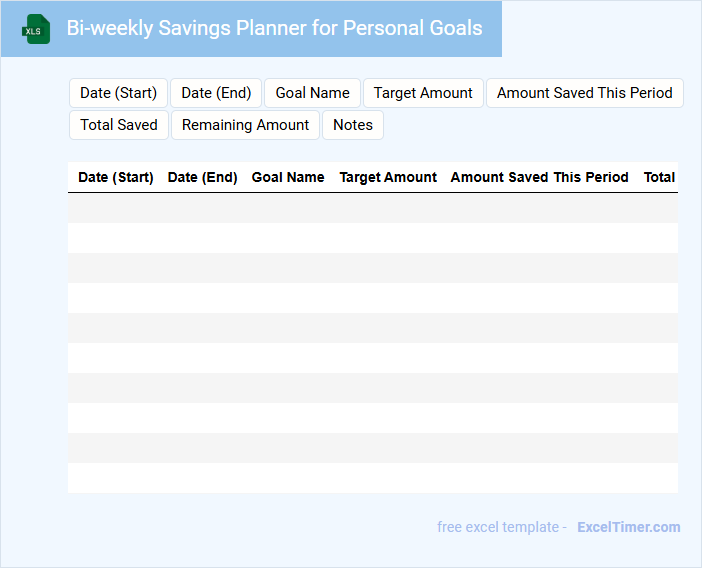

Bi-weekly Savings Planner for Personal Goals

What does a bi-weekly savings planner for personal goals typically contain? This type of document usually includes a detailed schedule outlining saving amounts every two weeks, alongside specific personal financial goals to be achieved. It helps in tracking progress and ensuring consistent saving habits towards those goals.

Why is setting clear milestones important in a bi-weekly savings planner? Clear milestones provide motivation and measurable checkpoints, making it easier to adjust saving strategies if necessary. This ensures a more disciplined approach and increases the likelihood of successfully reaching financial targets.

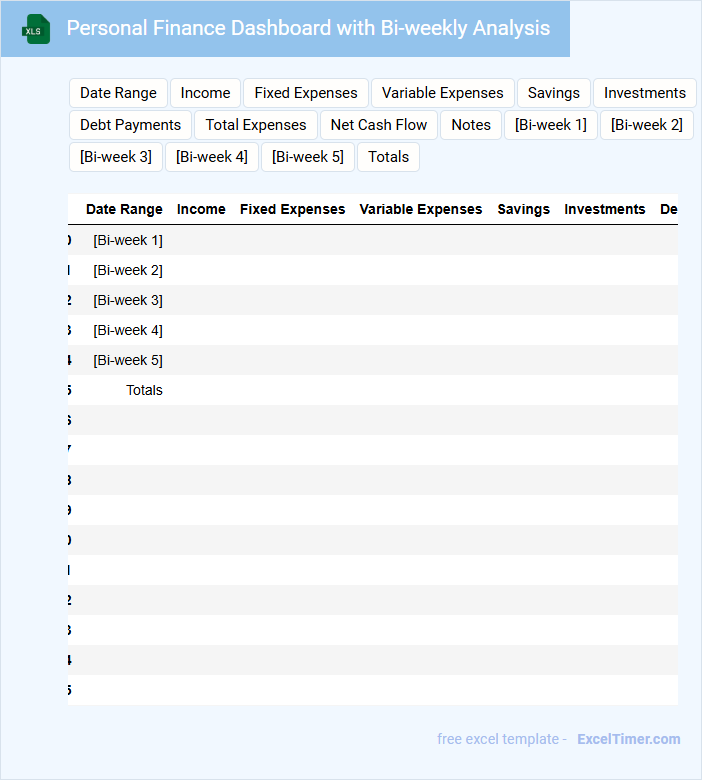

Personal Finance Dashboard with Bi-weekly Analysis

A Personal Finance Dashboard typically contains detailed insights into income, expenses, savings, and investments, providing a clear overview of an individual's financial health. It often includes bi-weekly analysis to track spending patterns, cash flow, and budget adherence over short periods. This frequent monitoring helps users make timely adjustments and achieve their financial goals effectively.

Important elements to include are categorized transaction summaries, visual charts for income versus expenses, and alerts for upcoming bills or unusual spending. Integrating goal tracking with progress indicators ensures motivation and accountability. Lastly, ensuring data security and privacy is crucial for protecting sensitive financial information.

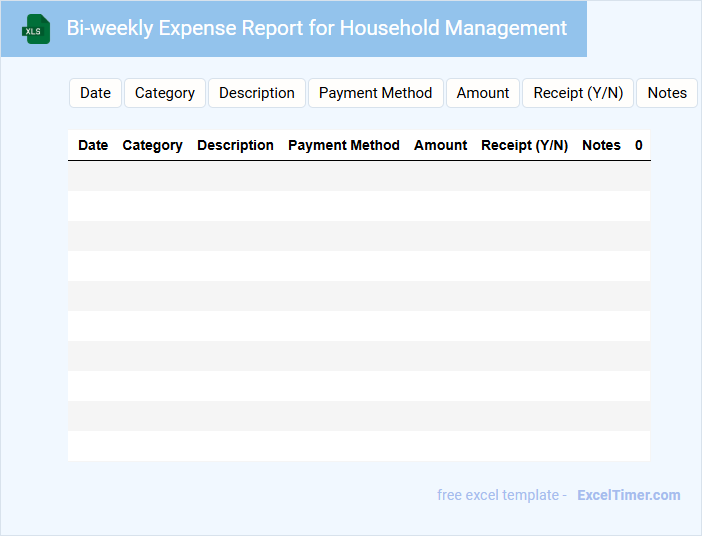

Bi-weekly Expense Report for Household Management

The Bi-weekly Expense Report for Household Management is a document that tracks all expenses incurred over a two-week period. It helps in monitoring spending patterns and managing the household budget effectively.

This report usually contains categories such as groceries, utilities, transportation, and miscellaneous costs. Ensuring accuracy and timely updates are important for maintaining financial control.

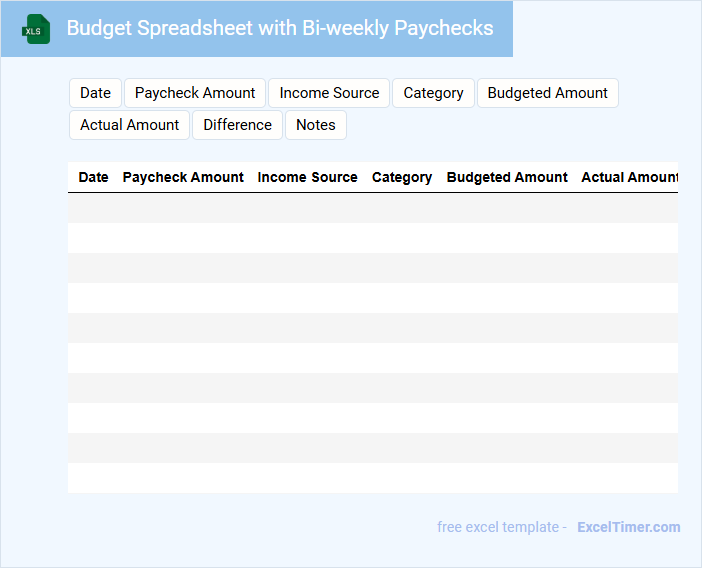

Budget Spreadsheet with Bi-weekly Paychecks

A Budget Spreadsheet with bi-weekly paychecks is designed to track income and expenses on a detailed timeline that matches pay periods. This helps in managing cash flow efficiently by aligning expenses with the receipt of income. It should include sections for income, fixed expenses, variable expenses, and savings goals. The spreadsheet often contains formulas to calculate totals, balances, and budget variances automatically. Important considerations include incorporating all sources of income and categorizing expenses accurately to avoid overspending. Regular updates and review of the data ensure the budget remains realistic and effective.

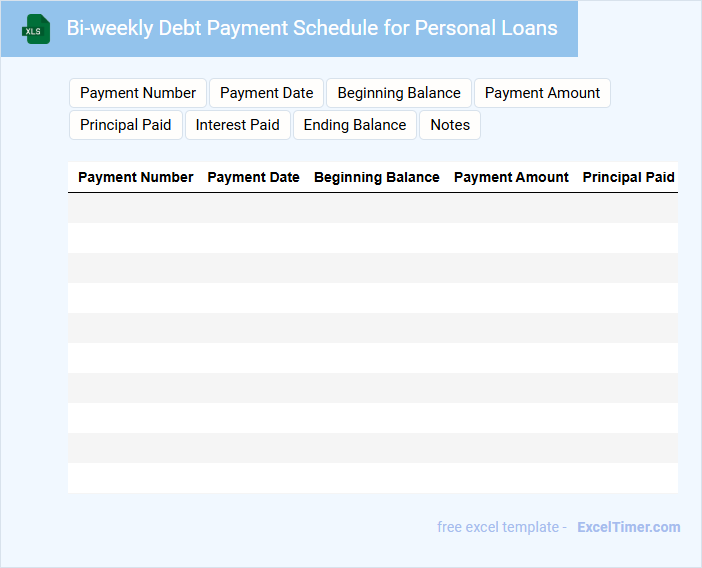

Bi-weekly Debt Payment Schedule for Personal Loans

What information is typically included in a Bi-weekly Debt Payment Schedule for Personal Loans? This document usually contains a detailed timeline of payment dates, amounts due every two weeks, and the remaining balance after each payment. It provides borrowers with a clear, organized plan to manage and track loan repayments efficiently.

Why is it important to ensure accuracy and consistency in the payment schedule? Accurate and consistent entries help avoid missed or late payments, reducing the risk of penalties and improving credit score. It is crucial to update the schedule promptly with any changes in interest rates or payment terms to maintain financial control.

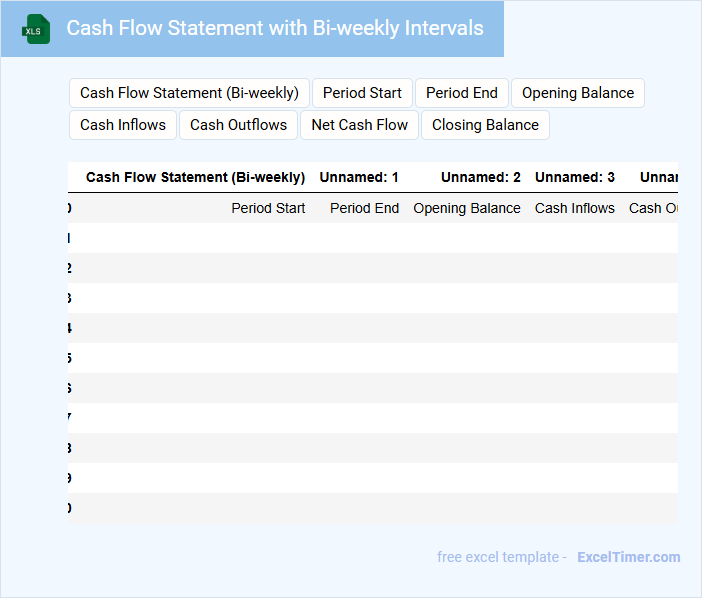

Cash Flow Statement with Bi-weekly Intervals

What information is typically included in a Cash Flow Statement with Bi-weekly Intervals? This document usually contains detailed records of cash inflows and outflows tracked every two weeks to provide a granular view of liquidity. It helps businesses manage operational cash flow more effectively by aligning financial activities with bi-weekly periods.

Why is it important to include accurate timing and categorization in a Bi-weekly Cash Flow Statement? Precise timing ensures cash movements are recorded in the correct intervals, allowing for better forecasting and budget control. Proper categorization of inflows, outflows, operating, investing, and financing activities is essential to understand cash sources and uses clearly.

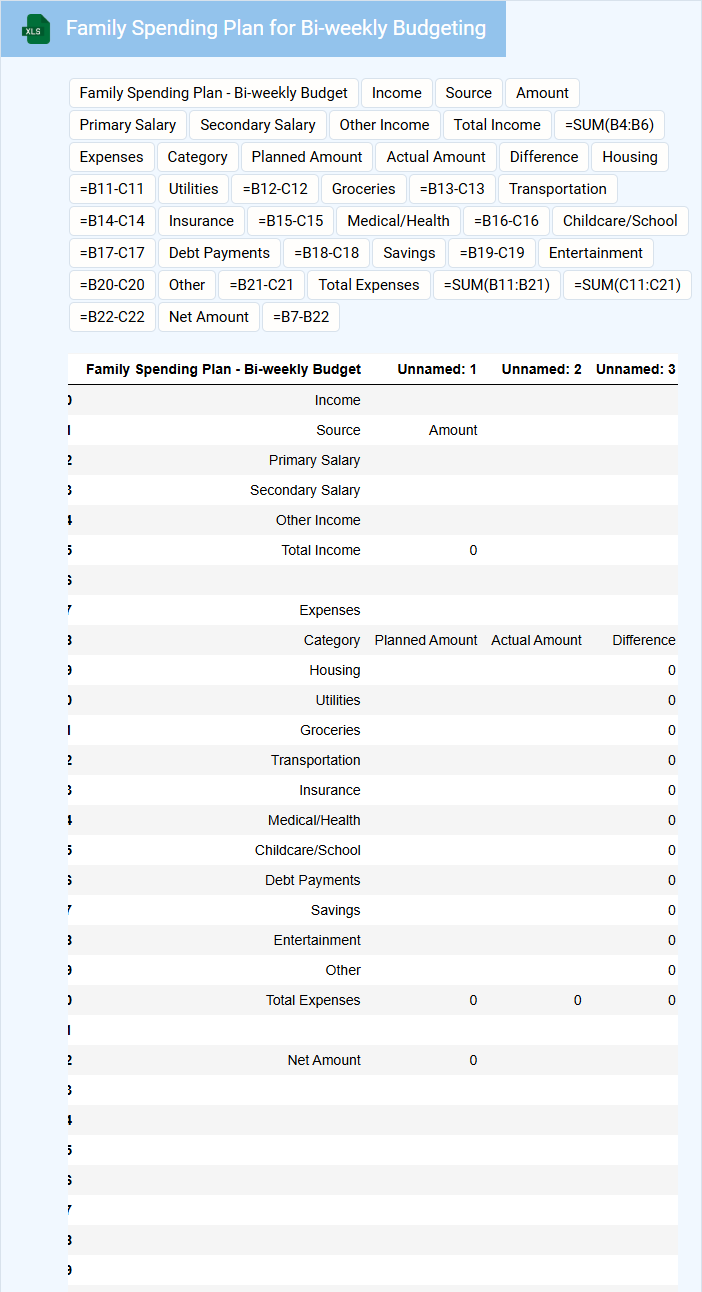

Family Spending Plan for Bi-weekly Budgeting

A Family Spending Plan for bi-weekly budgeting typically includes income sources, fixed expenses, and variable costs organized within two-week periods. This document helps families track spending habits and allocate funds efficiently.

Important elements to consider are clear categorization of expenses and regular review of the budget to ensure financial goals are met. Prioritizing savings and emergency funds is essential for a resilient financial plan.

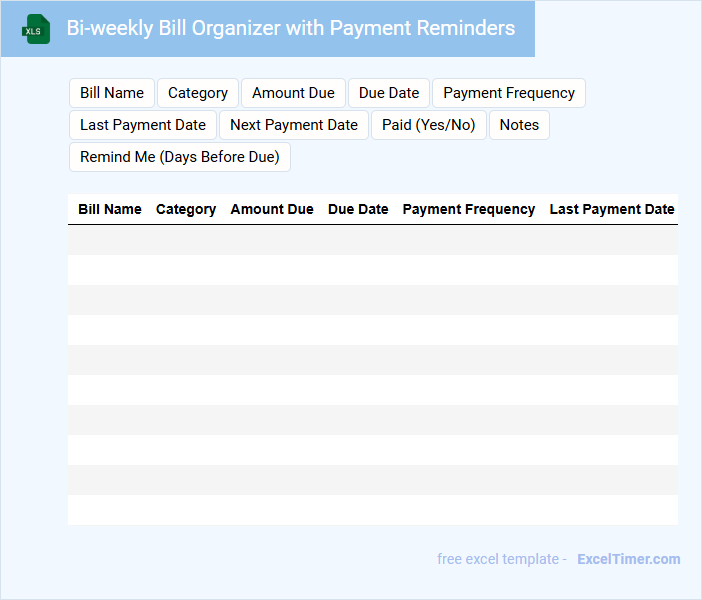

Bi-weekly Bill Organizer with Payment Reminders

What information is typically included in a bi-weekly bill organizer with payment reminders? This type of document usually contains a schedule of all recurring bills, including due dates, amounts, and payment methods, organized on a bi-weekly basis. It helps individuals track their financial obligations efficiently and ensures timely payments through automated or manual reminders.

What important features should a bi-weekly bill organizer have? Key features include clear categorization of bills, space for noting payment confirmation, and customizable reminder alerts to avoid missed payments and late fees. Additionally, providing sections for tracking budget impact and outstanding balances can enhance financial management.

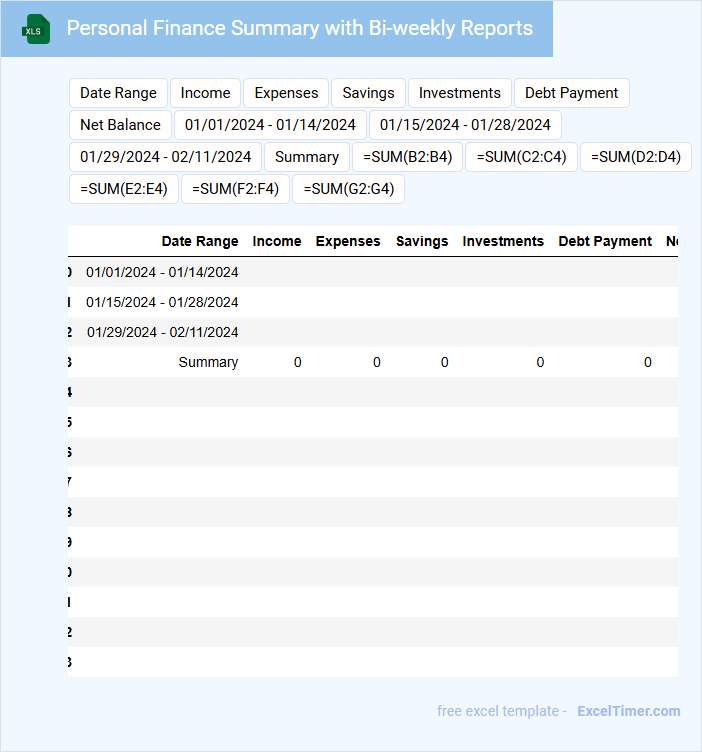

Personal Finance Summary with Bi-weekly Reports

What information is typically included in a Personal Finance Summary with Bi-weekly Reports? This document usually contains detailed summaries of income, expenses, savings, and investments updated every two weeks to track financial progress accurately. It helps individuals monitor their cash flow, make informed budgeting decisions, and adjust financial goals as needed.

Bi-weekly Savings Goals Tracker for Individuals

A Bi-weekly Savings Goals Tracker for Individuals is a document designed to help people monitor and manage their savings efforts every two weeks. It typically includes records of income, expenses, and amounts set aside towards specific financial goals.

This type of tracker emphasizes consistent saving habits and progress tracking over short periods. Including clear deadlines and milestone markers is an important feature to maintain motivation and accountability.

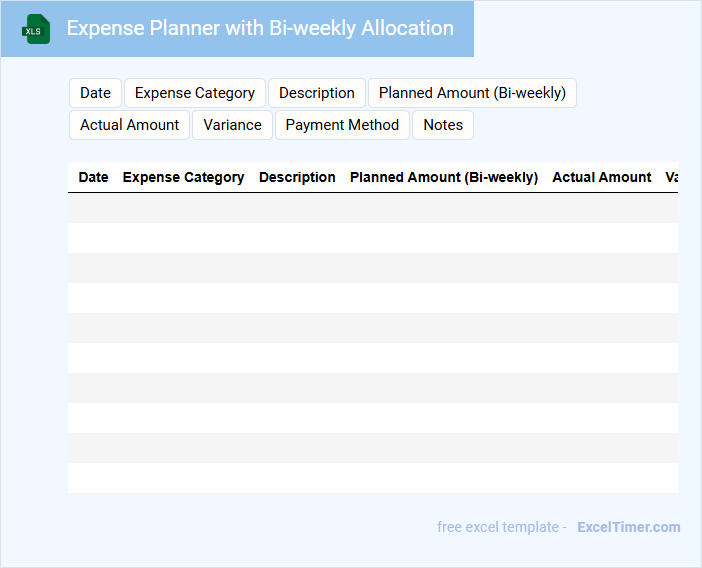

Expense Planner with Bi-weekly Allocation

What does an Expense Planner with Bi-weekly Allocation typically contain? This document usually includes detailed sections for tracking income, fixed and variable expenses, and savings goals, all divided into bi-weekly periods. It helps individuals manage their finances by aligning their budget with bi-weekly paychecks, ensuring accurate allocation of funds throughout the month.

What is an important consideration when using this type of planner? It is crucial to account for irregular expenses and to adjust allocations in case of changes in income or unexpected costs. Regularly reviewing and updating the planner will maintain financial accuracy and promote better money management.

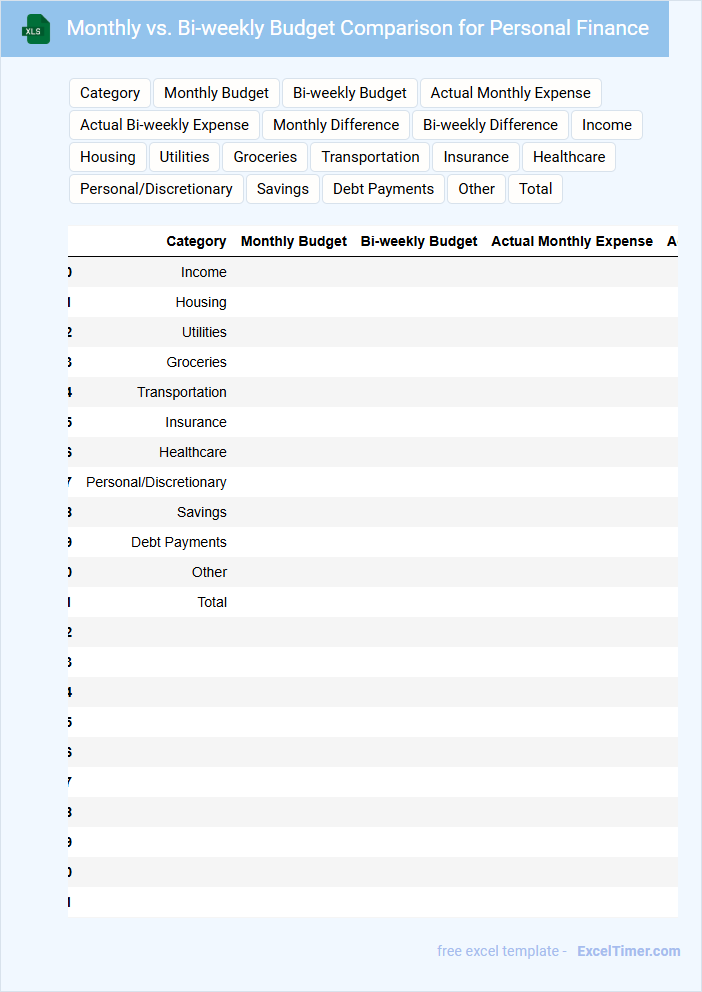

Monthly vs. Bi-weekly Budget Comparison for Personal Finance

This document typically contains a detailed comparison of income, expenses, and savings to help individuals manage their finances effectively on a monthly versus bi-weekly basis.

- Income Tracking: Accurately record and compare all sources of income within each budgeting period.

- Expense Categorization: Categorize and analyze spending to identify patterns and areas for potential savings.

- Savings Goals: Set clear savings targets and monitor progress relative to the chosen budget frequency.

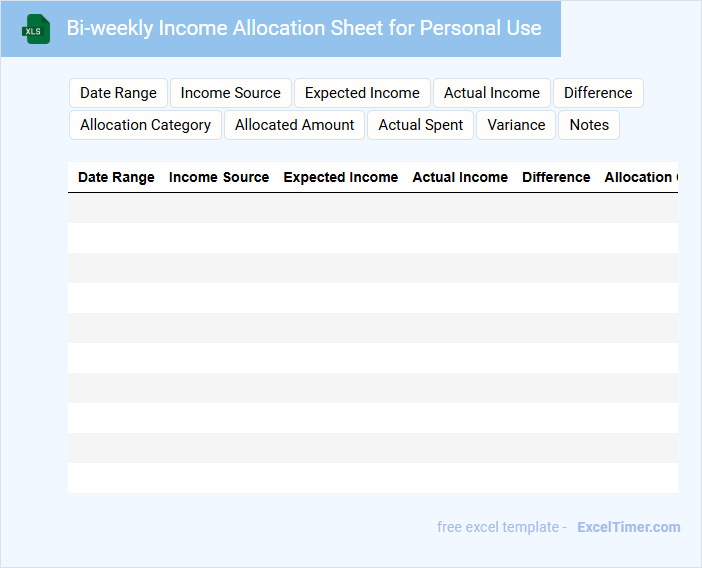

Bi-weekly Income Allocation Sheet for Personal Use

A Bi-weekly Income Allocation Sheet is a financial document used to systematically distribute income earned every two weeks. It typically contains detailed categories such as savings, expenses, investments, and discretionary spending to ensure balanced financial management. For personal use, it is important to regularly update the sheet to accurately track spending habits and adjust allocations accordingly.

What are the key income sources to include in a bi-weekly personal budget Excel sheet?

Key income sources to include in a bi-weekly personal budget Excel sheet are your salary or wages, freelance or side job earnings, and any regular investment dividends. Rental income and government benefits such as social security or unemployment payments should also be tracked. Accurately logging these sources ensures your bi-weekly budget reflects your true financial inflows.

Which expense categories should be tracked for effective bi-weekly budgeting?

Track essential expense categories such as housing, utilities, groceries, transportation, healthcare, entertainment, and savings for effective bi-weekly budgeting. Monitoring these categories helps identify spending patterns and prioritize financial goals. Your consistent tracking ensures better control over cash flow and timely expense management.

How can you set up conditional formatting to highlight overspending in your Excel budget?

Set up conditional formatting in your bi-weekly Excel budget by selecting expense cells and applying a rule to highlight values exceeding your budgeted amount. Use the "Greater Than" rule under Conditional Formatting and enter the budget limit to automatically flag overspending. Customize the format with a red fill or bold font to visually emphasize costs that surpass your set budget.

What Excel formula helps calculate the remaining balance after each bi-weekly period?

Use the formula `=Starting_Balance - SUM(Expenses_Range)` to calculate the remaining balance after each bi-weekly period in a personal finance budget. Replace `Starting_Balance` with the initial amount for the period and `Expenses_Range` with the cells containing bi-weekly expenses. This formula helps track spending and available funds efficiently.

How can you utilize charts in Excel to visualize bi-weekly spending patterns?

Use Excel charts such as line graphs or bar charts to display bi-weekly spending trends clearly, highlighting fluctuations in categories like groceries, utilities, and entertainment. Incorporate pivot charts to dynamically analyze and compare expenses over multiple bi-weekly periods. Visualizing data with charts enhances budget tracking and helps identify areas for potential savings effectively.