![]()

The Bi-weekly Expense Tracker Excel Template for Nonprofits streamlines financial management by enabling organizations to accurately monitor and categorize expenses every two weeks. This template is essential for maintaining transparency, budgeting effectively, and ensuring compliance with nonprofit financial regulations. Customizable fields allow easy tracking of donations and expenditures, promoting accountability and fiscal responsibility.

Bi-weekly Expense Tracker Excel Template for Nonprofits

What information does a Bi-weekly Expense Tracker Excel Template for Nonprofits typically include?

This document usually contains detailed records of all expenses incurred every two weeks by the nonprofit, categorized by type such as supplies, salaries, and operational costs. It helps organizations maintain financial transparency and ensures accurate budgeting for future periods. Key features often include date entries, expense descriptions, vendor details, amounts, and total calculations for thorough expense monitoring.

Important Suggestions:

- Ensure clear categorization of expenses to simplify financial analysis and reporting.

- Include automated formulas for summing totals and tracking budget adherence.

- Maintain consistency in date and vendor entries to avoid discrepancies.

- Regularly update and review the template to reflect actual spending patterns.

- Consider adding notes or comments sections for context on unusual expenses.

Expense Tracking Spreadsheet with Summary for Nonprofits

An Expense Tracking Spreadsheet for nonprofits is designed to systematically record all financial expenditures, ensuring transparency and accountability. It typically contains detailed logs of costs, categorized by type, date, and purpose to facilitate easy monitoring and reporting.

The summary section provides a concise overview of total expenses, helping organizations quickly assess their financial health and budget adherence. Including clear categories and regular updates is crucial for accurate financial management and donor trust.

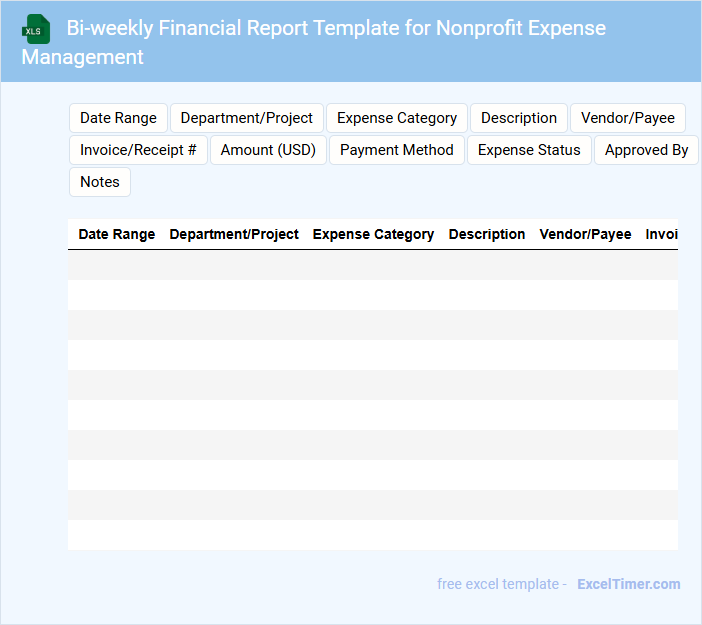

Bi-weekly Financial Report Template for Nonprofit Expense Management

A Bi-weekly Financial Report for nonprofit organizations typically contains detailed records of income and expenses over a two-week period, helping track financial health. It includes summaries of donations received, operational costs, and budget variances to ensure transparency. Maintaining accurate and timely financial data is essential for effective nonprofit expense management and regulatory compliance.

When using this template, prioritize clear categorization of expenses and regular reconciliation with bank statements. Highlight significant variances from the budget to identify potential issues early. Consistent updates and thorough documentation support better financial decision-making and stakeholder trust.

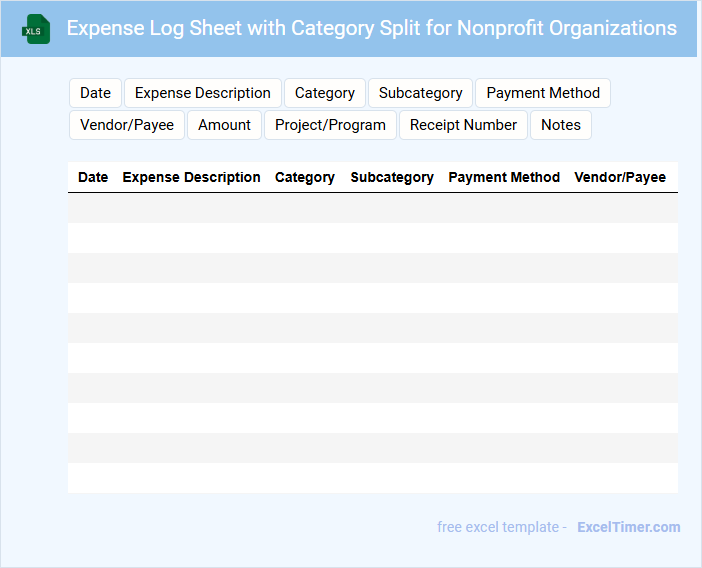

Expense Log Sheet with Category Split for Nonprofit Organizations

An Expense Log Sheet for nonprofit organizations is a crucial document used to systematically record all financial expenditures. It typically categorizes expenses to ensure clear tracking and budget management across different program areas. This structured approach helps maintain transparency and accountability in financial reporting.

When designing an expense log sheet, it's important to include columns for the date, description, category, amount, and approval status. Categories should reflect the specific areas of spending relevant to the nonprofit's mission, such as fundraising, administration, and program services. Additionally, incorporating a summary section to calculate totals by category enhances financial overview and decision-making.

To optimize this document, nonprofits should ensure regular updates and audits are performed, and digital templates are used for accuracy and ease of sharing. Clear guidelines on categorization and entry procedures help maintain consistency across users. Finally, linking the expense log to overall budget and grant reporting systems is essential for comprehensive financial management.

Nonprofit Bi-weekly Expense and Income Tracker Template

This Nonprofit Bi-weekly Expense and Income Tracker Template is designed to systematically record and monitor the financial transactions occurring every two weeks. It typically contains sections for income sources, expense categories, dates, and balances to ensure transparency and accuracy in budgeting.

Using this template helps nonprofits maintain a clear overview of their cash flow and financial health during bi-weekly periods. It is important to regularly update entries and categorize expenses precisely to facilitate effective financial analysis and reporting.

Excel Template for Tracking Bi-weekly Nonprofit Expenditures

An Excel Template for tracking bi-weekly nonprofit expenditures is designed to organize and monitor financial outflows efficiently. It typically contains categorized expense fields, date ranges, and summary totals to ensure accurate budget management. This document helps nonprofits maintain transparency and control over their spending patterns.

Important elements to include are clearly labeled categories, automated calculations for totals and subtotals, and date filters for bi-weekly periods. Incorporating conditional formatting to highlight overspending and a section for notes or explanations can enhance usability. Regular updates and data validation are essential to maintain accuracy and reliability.

Donation and Expense Tracker for Nonprofits with Bi-weekly View

This document, commonly known as a Donation and Expense Tracker, is designed to systematically record all financial activities within a nonprofit organization. It typically contains detailed entries of donations received, expenses incurred, and summarized balances over specific periods. For effective management, including a bi-weekly view helps nonprofits monitor cash flow closely and make timely financial decisions.

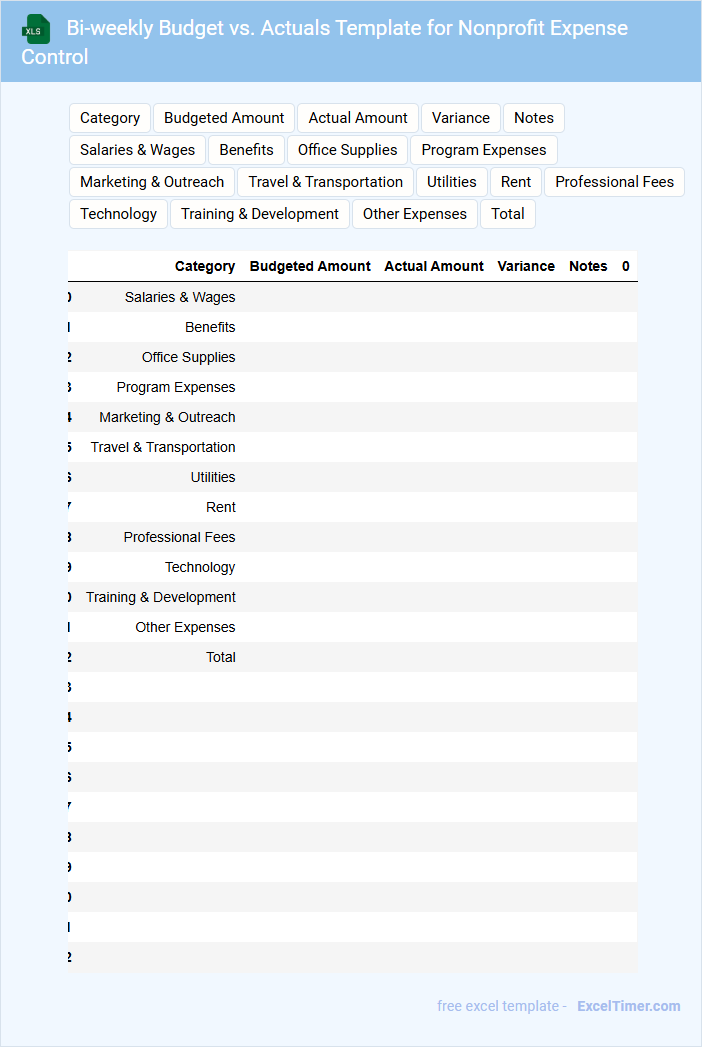

Bi-weekly Budget vs. Actuals Template for Nonprofit Expense Control

The Bi-weekly Budget vs. Actuals Template is a vital document used by nonprofits to track and compare their planned expenses against actual spending over two-week periods. This type of record typically contains detailed categories of expenditures, budgeted amounts, actual costs, and variances to highlight discrepancies. Monitoring these figures regularly helps organizations maintain financial control and ensure resources are used efficiently.

For effective use, it is important to consistently update the template with accurate transaction data and review it with relevant team members. Emphasizing transparency and accountability in expense management supports the nonprofit's mission and donor trust. Additionally, setting alerts for significant variances can preempt financial issues and promote proactive budgeting decisions.

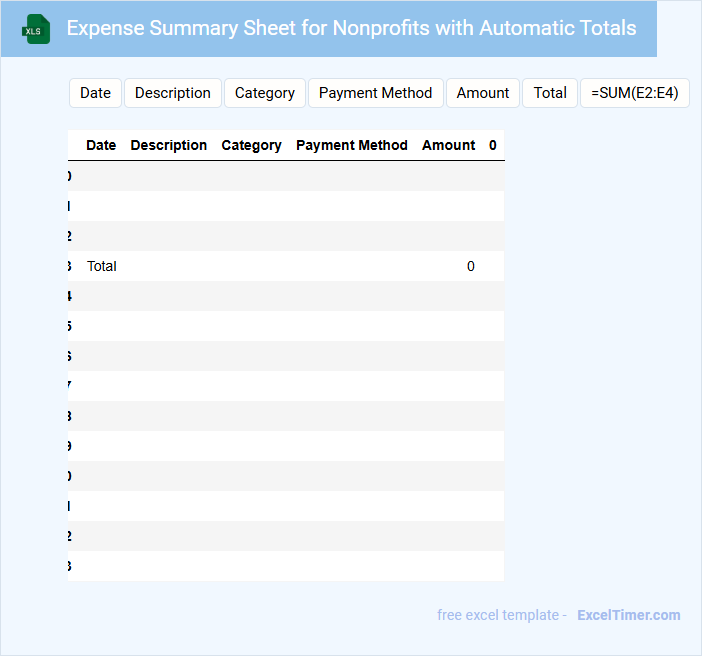

Expense Summary Sheet for Nonprofits with Automatic Totals

What is typically included in an Expense Summary Sheet for Nonprofits with Automatic Totals? This document usually contains categorized expense entries, dates, payment methods, and vendor information to track all financial outflows clearly. It also features calculated totals that update automatically to provide an accurate financial overview at any time.

What important aspects should be considered when creating this sheet? Ensuring clear categorization of expenses and maintaining accurate data entry are crucial for transparency and accountability. Additionally, incorporating automatic totals helps reduce errors and saves time during financial reporting and audits.

Bi-weekly Cash Flow Tracker with Expense Categories for Nonprofits

A Bi-weekly Cash Flow Tracker with Expense Categories for Nonprofits is a document designed to monitor and manage the inflow and outflow of funds every two weeks, categorized to enhance financial clarity.

- Accurate Classification: Ensure all expenses and incomes are categorized correctly for precise financial analysis.

- Regular Updates: Update the tracker bi-weekly to maintain current and actionable financial data.

- Transparency: Use clear labels and descriptions to promote accountability and easy understanding among stakeholders.

Nonprofit Budget Planning with Bi-weekly Expense Recording Excel

A Nonprofit Budget Planning document typically contains detailed financial projections and allocations tailored to the organization's mission and goals. It includes expense categories, expected income sources, and contingency plans to ensure sustainable operations.

The Bi-weekly Expense Recording Excel tracks actual expenditures against the budget in a systematic, timely manner to maintain financial accuracy and accountability. Regular updates help identify overspending or underspending patterns early.

It is important to maintain clarity, use consistent categories, and review the data frequently to support informed decision-making and effective resource management.

Reimbursement Tracker for Nonprofit Staff with Bi-weekly Reports

A Reimbursement Tracker for nonprofit staff typically contains detailed records of expenses incurred and approved for reimbursement, organized by date and category. It facilitates transparency and accountability by providing bi-weekly reports that summarize transactions and outstanding claims. Importance lies in ensuring timely approval, accurate documentation, and clear communication between staff and accounting teams.

Bi-weekly Expense Log with Grant Tracking for Nonprofits

A Bi-weekly Expense Log with Grant Tracking for Nonprofits is a document that records and monitors expenses alongside grant usage every two weeks to ensure accurate financial management and compliance.

- Expense categories: Clearly list and categorize all incurred expenses for easy tracking and reporting.

- Grant allocation: Detail the specific grants funding each expense to maintain transparency and accountability.

- Regular updates: Consistently update the log bi-weekly to detect discrepancies and manage budgets effectively.

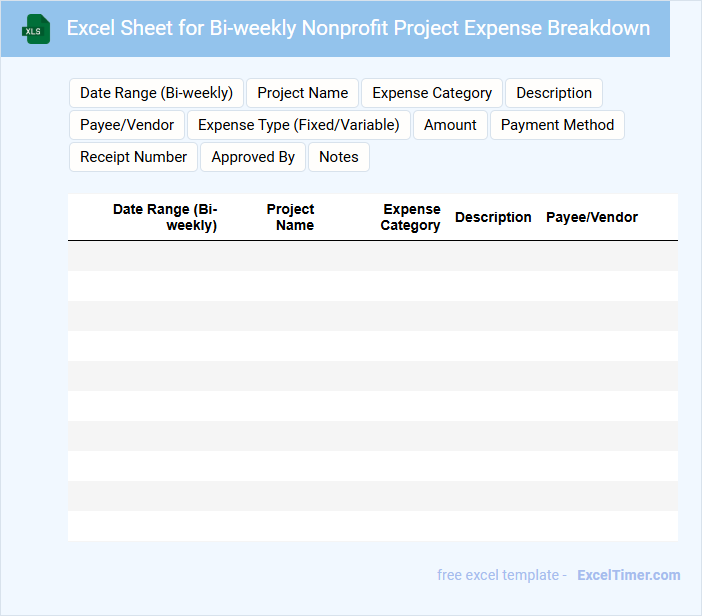

Excel Sheet for Bi-weekly Nonprofit Project Expense Breakdown

What information is typically included in an Excel sheet for bi-weekly nonprofit project expense breakdown? This document usually contains detailed records of expenses incurred over two weeks, categorized by project activities and cost types. It helps nonprofits track spending, ensure budget adherence, and maintain financial transparency for ongoing projects.

What is an important consideration when preparing this type of expense sheet? Accuracy in recording dates, amounts, and descriptions is essential to prevent discrepancies and support effective financial reporting. Additionally, including categories for both fixed and variable costs will improve budget analysis and resource allocation.

Operational Expense Tracker with Bi-weekly Reporting for Nonprofit Use

An Operational Expense Tracker with Bi-weekly Reporting for Nonprofit Use is a document designed to monitor and report on the regular expenses incurred by a nonprofit organization. It helps in maintaining financial transparency and effective budget management over short reporting periods.

- Ensure all expenses are categorized accurately to facilitate clear financial analysis.

- Include detailed notes for any unusual or one-time expenses to provide context.

- Regularly update the tracker bi-weekly to keep financial data current and actionable.

What key categories should be included in a bi-weekly expense tracker to ensure comprehensive financial monitoring for nonprofits?

A bi-weekly expense tracker for nonprofits should include key categories such as operational costs, program expenses, fundraising costs, and administrative overhead. Tracking payroll, grant disbursements, and in-kind donations ensures detailed financial monitoring. Your tracker must also capture miscellaneous and unexpected expenses to maintain accurate budgeting and reporting.

How can formulas or functions be used in Excel to automatically calculate total expenses and remaining budgets?

Excel formulas like SUM can automatically calculate total expenses by adding values across selected cells, while functions such as SUMIF help track specific expense categories in your Bi-weekly Expense Tracker for Nonprofits. Applying these functions allows you to subtract total expenses from allocated budgets, providing a real-time view of your remaining funds. You can enhance budget monitoring by using conditional formatting to highlight overspending or budget limits efficiently.

What methods can ensure accurate entry and tracking of recurring versus one-time expenses in the spreadsheet?

Implement data validation rules and dropdown lists to categorize expenses as recurring or one-time with consistent entries. Use separate columns or sheets to record frequency, enabling automated formulas to distinguish and summarize recurring costs. Regularly audit and reconcile entries against bank statements to ensure accuracy and completeness.

Which data visualization tools in Excel (e.g., charts, conditional formatting) best highlight spending patterns and flag overspending?

Excel's PivotCharts and line charts effectively highlight spending patterns by visualizing expense trends over time, while conditional formatting flags overspending by applying color-coded alerts to cells exceeding budget thresholds. You can use data bars and icon sets within conditional formatting to create intuitive visuals that instantly identify financial anomalies. Combining these tools enhances your bi-weekly expense tracker for nonprofits by making financial analysis more actionable and clear.

How can user access and permissions be managed to protect sensitive financial data in a shared nonprofit expense tracker Excel file?

To protect sensitive financial data in your Bi-weekly Expense Tracker for Nonprofits Excel file, manage user access by setting password protection and limiting file editing permissions through Excel's built-in security features. Use OneDrive or SharePoint to control sharing settings, assigning specific view or edit rights to authorized team members only. Regularly audit access logs and employ Excel's workbook protection to prevent unauthorized changes to critical financial data.