The Bi-weekly Hours Worked Excel Template for Part-time Employees simplifies tracking and calculating work hours with accurate time entries. It ensures streamlined payroll processing by automatically totaling hours and supporting compliance with labor regulations. This template enhances efficiency and reduces errors for managing part-time employee schedules effectively.

Bi-weekly Hours Worked Tracking Sheet for Part-time Employees

This document typically contains detailed records of hours worked by part-time employees on a bi-weekly basis to ensure accurate payroll and compliance.

- Employee identification: Each entry should clearly include the employee's name and ID number for proper tracking.

- Hours logged: Exact hours worked each day must be recorded to calculate total bi-weekly hours accurately.

- Approval signatures: Supervisor or manager approvals are essential to verify the accuracy and authenticity of the timesheet.

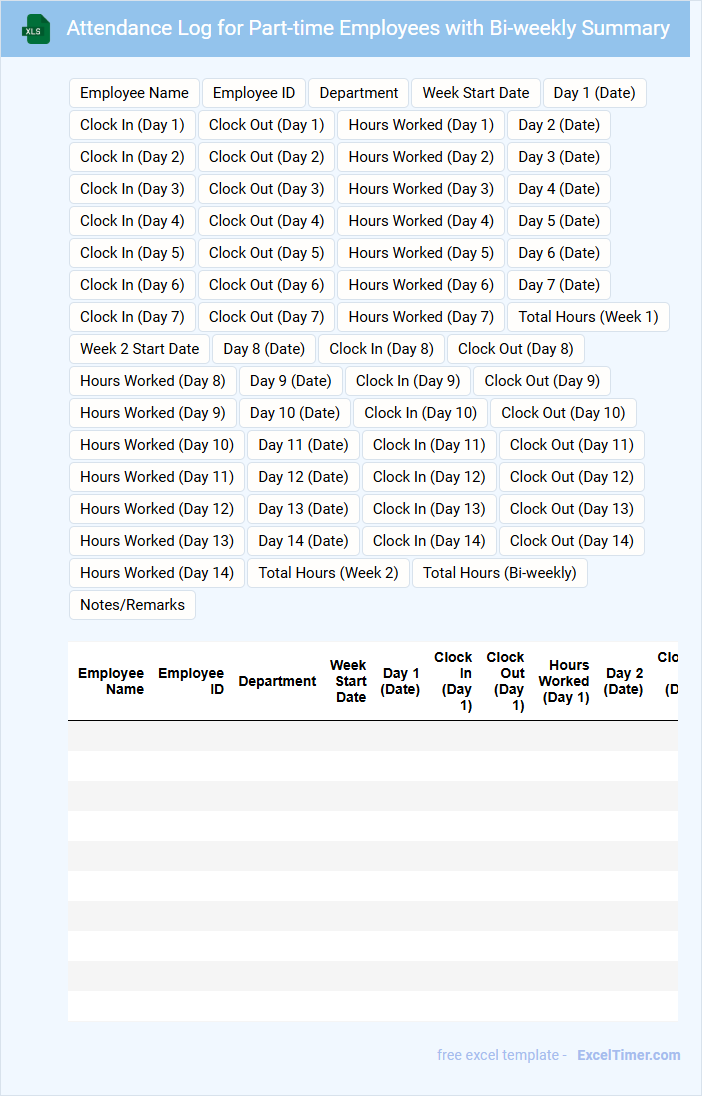

Attendance Log for Part-time Employees with Bi-weekly Summary

An Attendance Log for part-time employees typically records daily clock-in and clock-out times, capturing exact working hours. It also includes absences, tardiness, and leave taken to ensure accurate payroll processing.

The Bi-weekly Summary compiles total hours worked over a two-week period, highlighting overtime and attendance patterns. This summary aids in performance evaluation and schedule adjustments.

Ensure timely updates and accuracy for compliance and efficient workforce management.

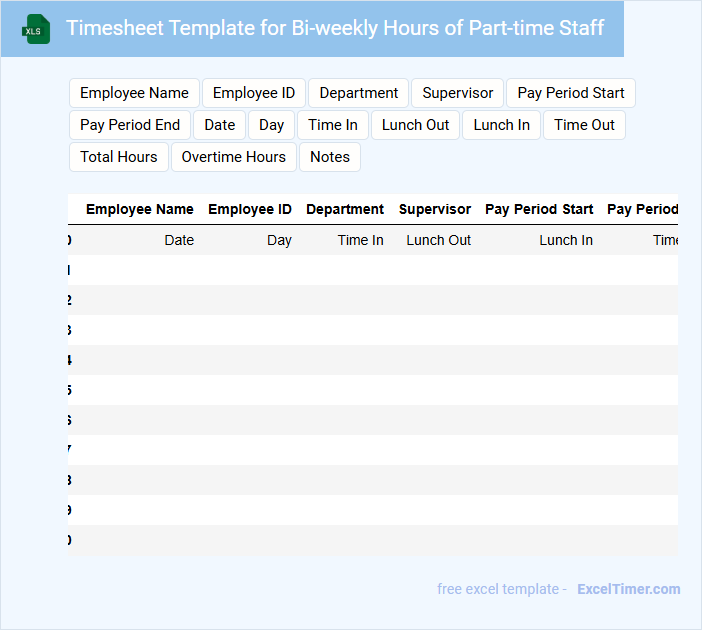

Timesheet Template for Bi-weekly Hours of Part-time Staff

A Timesheet Template for bi-weekly hours of part-time staff is a structured document used to accurately record the work hours of employees over a two-week period. It typically includes fields for dates, clock-in and clock-out times, total hours worked, and space for employee and supervisor signatures. An important suggestion for this template is to incorporate clear sections for breaks and overtime to ensure comprehensive tracking and payroll accuracy.

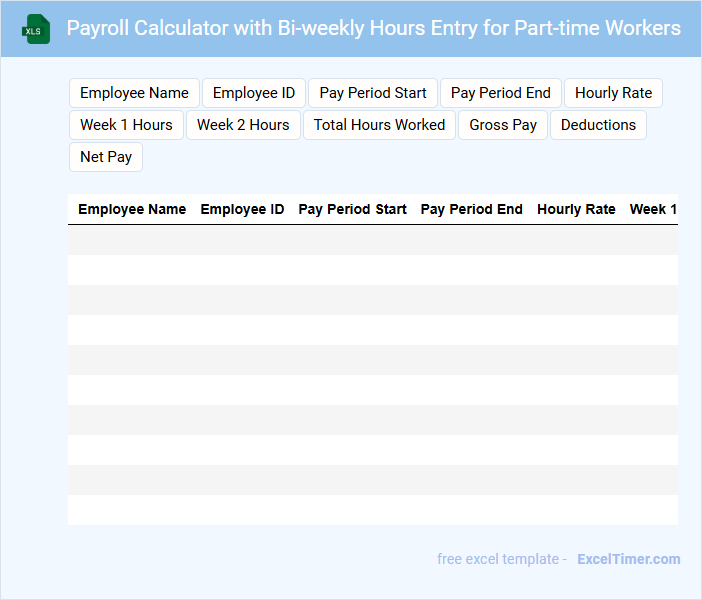

Payroll Calculator with Bi-weekly Hours Entry for Part-time Workers

What information is typically included in a Payroll Calculator with Bi-weekly Hours Entry for Part-time Workers? This document usually contains fields for entering employee details, hours worked per bi-weekly period, and applicable pay rates. It is designed to calculate earnings accurately while considering overtime or part-time status.

For optimal use, it is important to ensure proper input validation to avoid errors in hours or rates. Additionally, including automatic tax deductions and benefits calculations can enhance its accuracy and usefulness for payroll management.

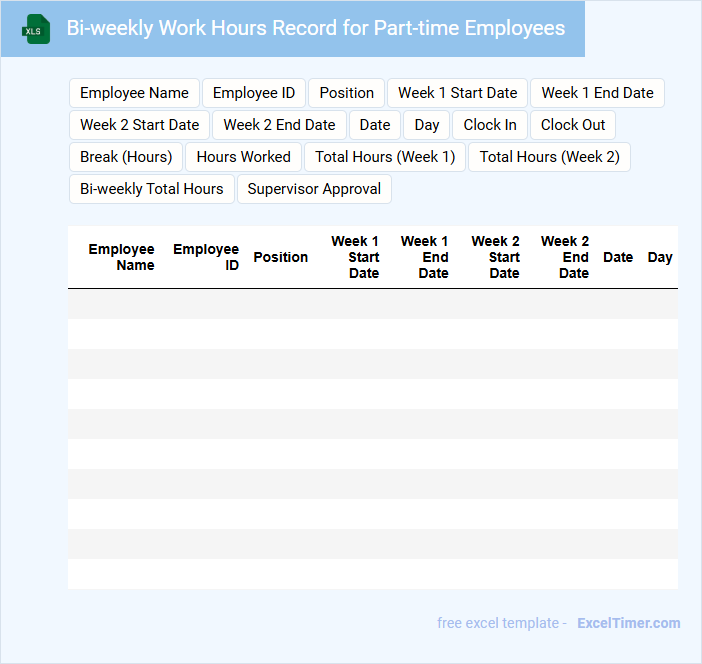

Bi-weekly Work Hours Record for Part-time Employees

A Bi-weekly Work Hours Record for part-time employees typically contains detailed entries of hours worked each day over a two-week period. It usually includes employee names, dates, clock-in and clock-out times, and total hours per shift to ensure accurate payroll processing. This document is essential for tracking attendance, calculating wages, and maintaining compliance with labor regulations.

Bi-weekly Timesheet for Scheduling and Tracking Part-time Employee Hours

A Bi-weekly Timesheet is a document used for scheduling and tracking the hours worked by part-time employees over a two-week period. It typically contains employee names, dates, clock-in and clock-out times, and total hours worked. Ensuring accuracy and timely submission is crucial for payroll and compliance purposes.

Bi-weekly Employee Hours Log with Overtime for Part-time Positions

A Bi-weekly Employee Hours Log is a document used to track the total working hours of part-time employees over a two-week period. It typically includes regular hours worked, overtime hours, and dates of shifts to ensure accurate payroll processing. Maintaining precise records helps employers comply with labor laws and manage workforce productivity effectively.

Excel Timesheet Template for Tracking Bi-weekly Hours of Part-time Staff

An Excel Timesheet Template is a structured document designed to record and monitor the hours worked by employees, specifically tailored for bi-weekly tracking. This type of template usually includes sections for employee names, dates, hours worked each day, and total hours for the pay period. For part-time staff, it's important to ensure accuracy in start and end times to properly calculate pay and avoid discrepancies.

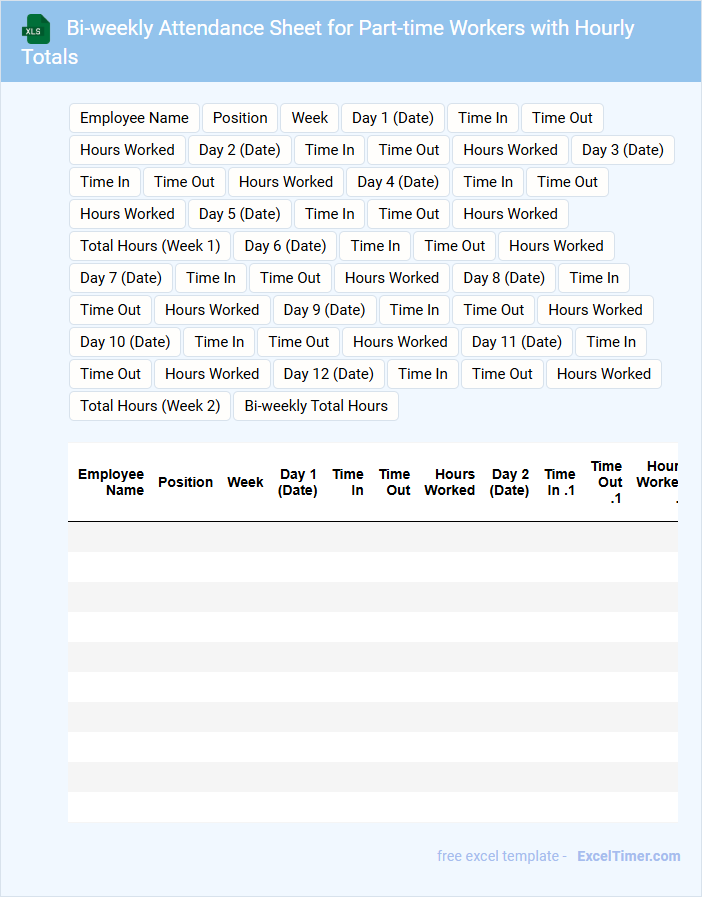

Bi-weekly Attendance Sheet for Part-time Workers with Hourly Totals

What information is typically included in a Bi-weekly Attendance Sheet for Part-time Workers with Hourly Totals? This document usually contains the names of part-time workers, dates for each day in the two-week period, and the number of hours worked daily. It is essential to accurately record start and end times to calculate total hours and ensure proper payroll processing.

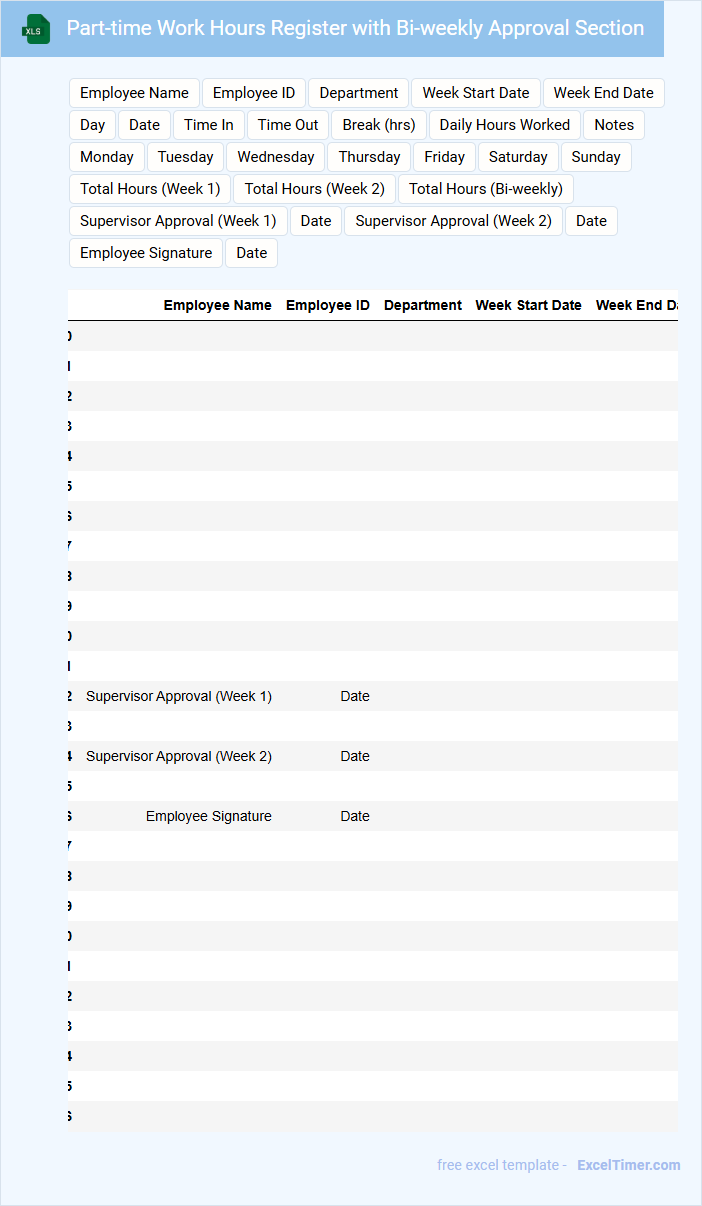

Part-time Work Hours Register with Bi-weekly Approval Section

A Part-time Work Hours Register is a crucial document that records the hours worked by part-time employees, ensuring accurate tracking of their attendance and workload. This register typically includes employee names, dates, hours worked each day, and total hours for the pay period. It is essential for maintaining transparency, calculating wages, and complying with labor regulations.

The bi-weekly approval section is an important feature that allows supervisors or managers to review and verify the recorded hours before processing payroll. This section should include spaces for signatures, dates, and any comments or discrepancies noted during the review. Including this approval step helps prevent errors and fosters accountability in timekeeping practices.

To optimize this document, ensure it is easy to fill out, clearly organized, and securely stored to protect employee privacy. Using consistent formatting and providing clear instructions can improve accuracy and user compliance. Additionally, integrating digital approval options can streamline the verification process and reduce administrative workload.

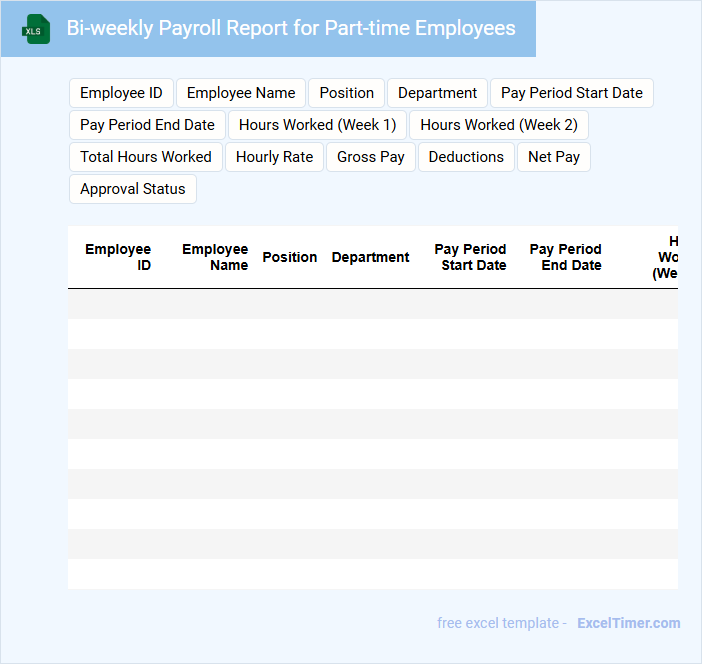

Bi-weekly Payroll Report for Part-time Employees

What information is typically included in a Bi-weekly Payroll Report for Part-time Employees? This document generally contains details such as employee names, hours worked, hourly rates, total wages, deductions, and net pay for each pay period. It is crucial for accurately tracking compensation and ensuring compliance with labor laws.

What key considerations should be taken into account when preparing this report? Ensuring precise time tracking, verifying correct pay rates, and including any applicable overtime or benefit deductions are important to avoid payroll errors and maintain employee trust.

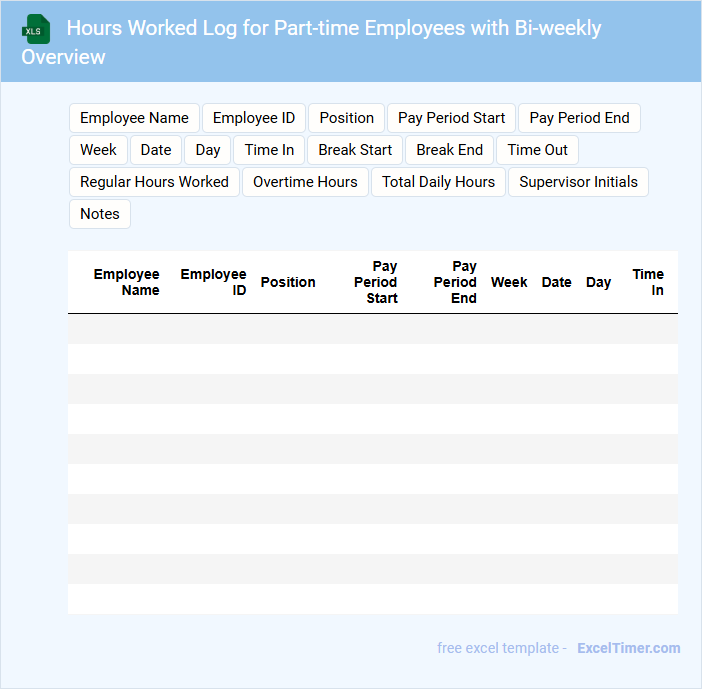

Hours Worked Log for Part-time Employees with Bi-weekly Overview

An Hours Worked Log for part-time employees typically contains detailed records of hours worked each day over a bi-weekly period. It includes start and end times, total daily hours, and any overtime or breaks taken. This document helps ensure accurate payroll processing and compliance with labor regulations.

It's important to consistently update the log daily to maintain accuracy and avoid payroll discrepancies. Including employee names, job roles, and supervisor approvals enhances accountability. Additionally, using a standardized format simplifies data review and reporting for management.

Excel Tracker for Bi-weekly Working Hours of Part-time Employees

An Excel tracker for bi-weekly working hours of part-time employees typically contains detailed logs of hours worked, employee names, and pay rates. It helps manage payroll accuracy and monitor employee attendance efficiently.

- Include columns for employee ID, dates, daily hours, and total bi-weekly hours.

- Incorporate formulas for automatic calculation of total hours and overtime.

- Add conditional formatting to highlight missing entries or discrepancies.

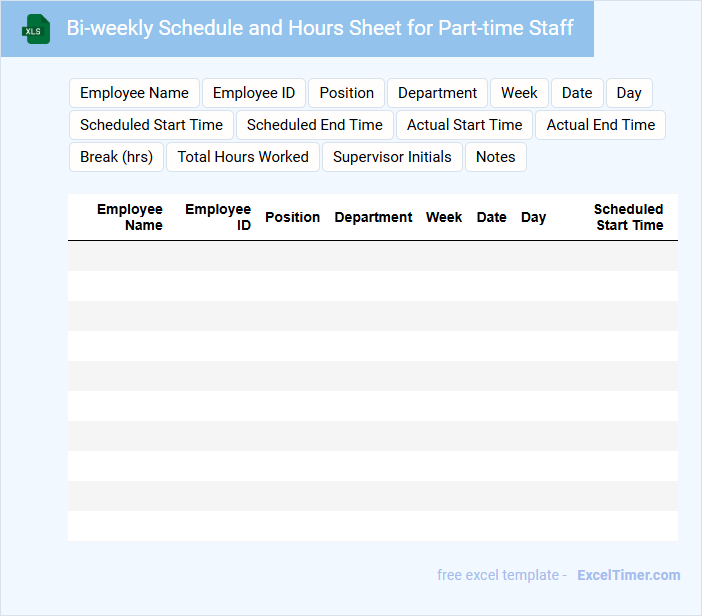

Bi-weekly Schedule and Hours Sheet for Part-time Staff

What information is typically included in a Bi-weekly Schedule and Hours Sheet for Part-time Staff? This document usually contains details about employees' work shifts and total hours worked within a two-week period. It helps track attendance, manage payroll accuracy, and ensure proper staffing levels.

What are important considerations when creating this document? It is essential to clearly specify dates, shift times, and employee names while including fields for approval signatures to maintain accountability. Additionally, regularly updating the sheet and ensuring accessibility to both staff and management improves communication and scheduling efficiency.

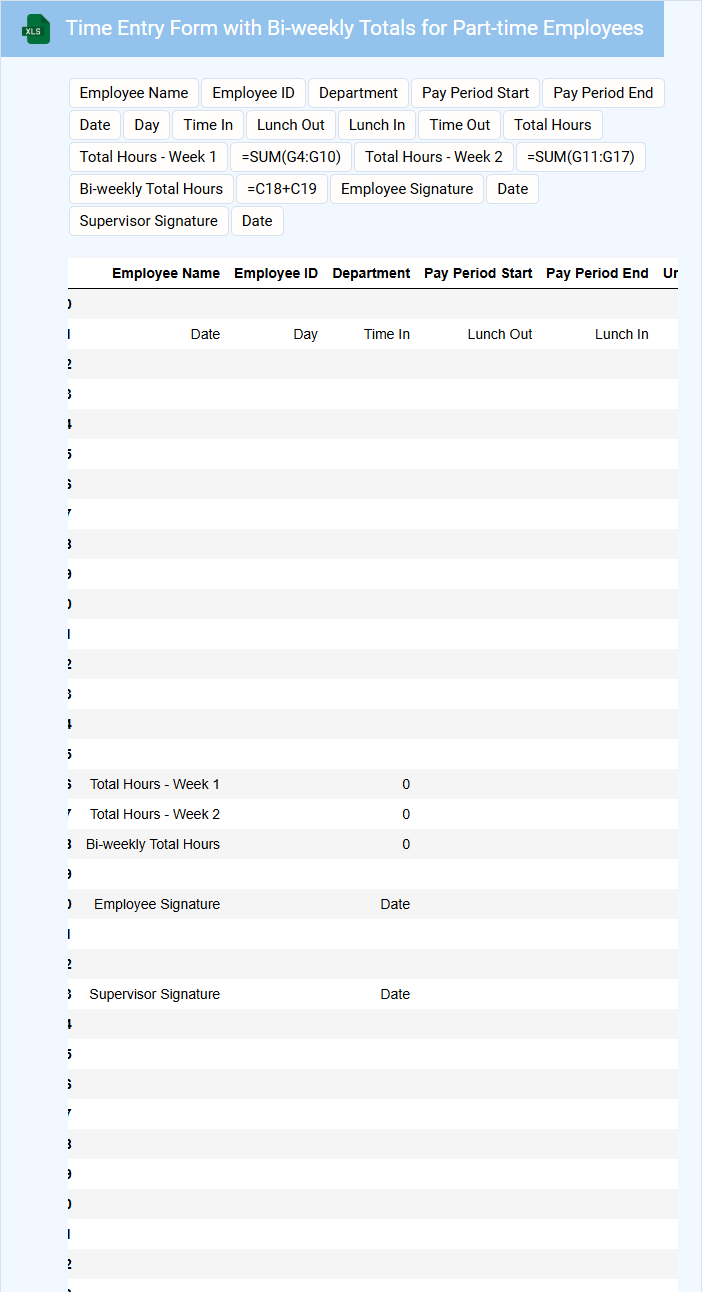

Time Entry Form with Bi-weekly Totals for Part-time Employees

A Time Entry Form with bi-weekly totals is typically used to record the hours worked by part-time employees over a two-week period. It includes detailed daily entries of start and end times, breaks, and total hours worked each day. This document helps in accurately calculating wages and ensuring compliance with labor regulations.

Important suggestions for this form include clearly labeling each day and time field, providing a running total of hours worked bi-weekly, and including a space for employee and supervisor signatures to verify accuracy. Ensuring ease of use and clarity will minimize errors and streamline payroll processing. Additionally, incorporating overtime tracking can be beneficial for managing irregular work schedules.

How do you accurately calculate bi-weekly hours worked for each part-time employee in Excel?

To accurately calculate bi-weekly hours worked for each part-time employee in Excel, input the clock-in and clock-out times in separate columns and use the formula =SUM(end_time-start_time)*24 to convert time differences to hours. Ensure the cell format is set to number for proper hour representation. Your Excel sheet will then provide precise total hours worked every two weeks.

What formula can be used to sum individual daily hours over a bi-weekly pay period?

To sum individual daily hours over a bi-weekly pay period in Excel, use the SUM function spanning all relevant cells. For example, if daily hours are recorded from cells B2 to O2, the formula =SUM(B2:O2) calculates the total bi-weekly hours. This approach helps you accurately track part-time employees' hours in your bi-weekly payroll document.

How do you identify and flag overtime hours in a bi-weekly hours worked Excel sheet?

Identify overtime hours in a bi-weekly hours worked Excel sheet by comparing total hours against the standard 80-hour threshold for part-time employees. Use a formula like =IF(SUM(range)>80, SUM(range)-80, 0) to calculate overtime hours. Apply conditional formatting to highlight overtime cells for quick visual identification.

What is the best way to automate rounding of daily hours to the nearest quarter-hour in Excel?

To automate rounding of daily hours to the nearest quarter-hour in your Excel document for bi-weekly hours worked by part-time employees, use the formula =MROUND(cell, 0.25). This formula rounds the time value in the specified cell to the nearest 0.25 hours, or 15 minutes. Applying this across your dataset ensures consistent and accurate tracking of part-time work hours.

How can you efficiently organize and filter bi-weekly hours by department or employee role in the spreadsheet?

To efficiently organize and filter bi-weekly hours worked by department or employee role in your Excel spreadsheet, use Excel's Filter and Sort features combined with Table formatting for dynamic data management. Apply filters on columns containing department and role information to quickly display relevant records, while Excel Tables enable easy updates and automatic filter application. Utilize PivotTables to summarize total hours by department or role, providing clear insights into part-time employee work patterns.