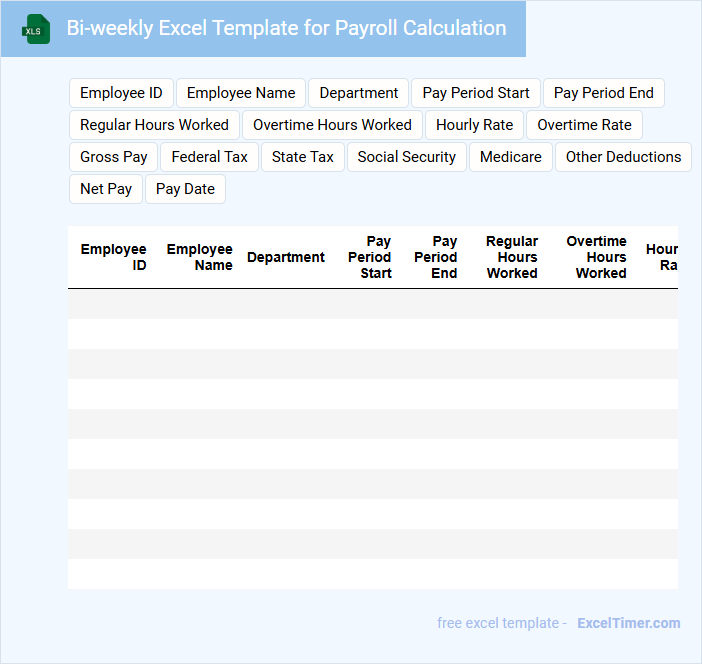

The Bi-weekly Excel Template for Payroll Calculation simplifies tracking employee hours, calculating wages, and managing deductions efficiently. It ensures accurate payroll processing every two weeks, reducing errors and saving time. Customizable features allow businesses to tailor the template to specific pay rates and tax regulations.

Bi-weekly Excel Template for Payroll Calculation

What information is typically included in a bi-weekly Excel template for payroll calculation? This type of document usually contains employee details, hours worked, pay rates, deductions, and net pay calculations. It helps streamline payroll processing by organizing data systematically and ensuring accuracy in payments.

What important factors should be considered when using a bi-weekly Excel payroll template? Accuracy in data entry, proper formula usage for calculations, and regular updates to tax or deduction rates are crucial. Additionally, protecting sensitive employee information within the spreadsheet is essential for maintaining confidentiality.

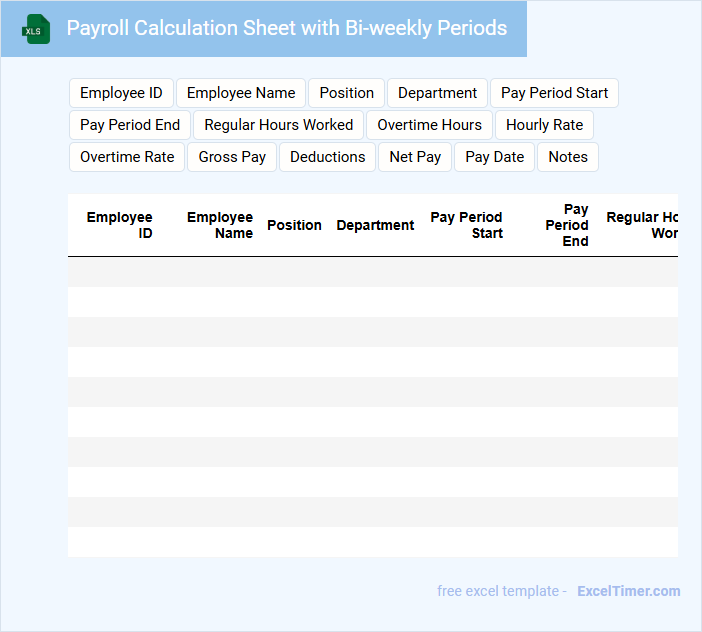

Payroll Calculation Sheet with Bi-weekly Periods

A Payroll Calculation Sheet with bi-weekly periods typically contains detailed records of employee wages, hours worked, deductions, and net pay for every two-week cycle. It ensures accurate payroll processing aligned with the company's pay schedule for transparency and compliance.

Important elements include employee identification, pay rates, overtime, tax withholdings, and benefits deductions for each period. Regular updates and error checks are recommended to maintain accuracy and meet legal requirements.

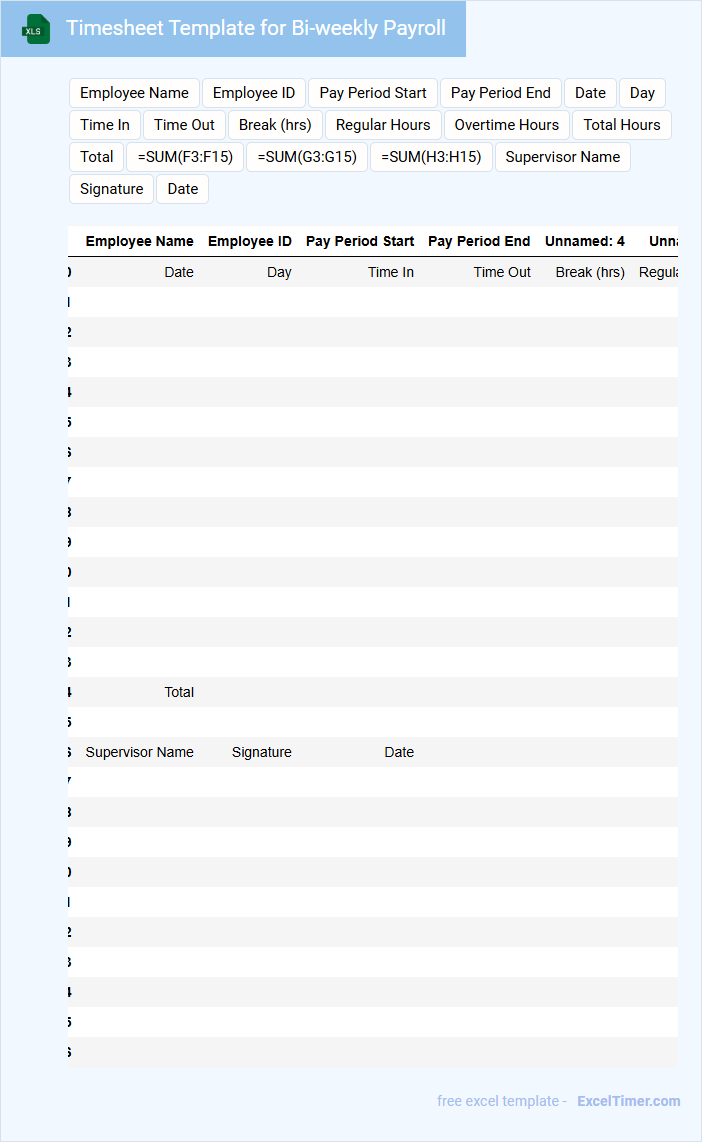

Timesheet Template for Bi-weekly Payroll

Timesheet templates for bi-weekly payroll are used to accurately record employees' working hours over a two-week period, ensuring precise wage calculations. They streamline payroll processing and help maintain compliance with labor regulations.

- Include employee details and a clear date range for the bi-weekly period.

- List daily hours worked, including regular and overtime hours separately.

- Provide a section for supervisor approval and employee signatures.

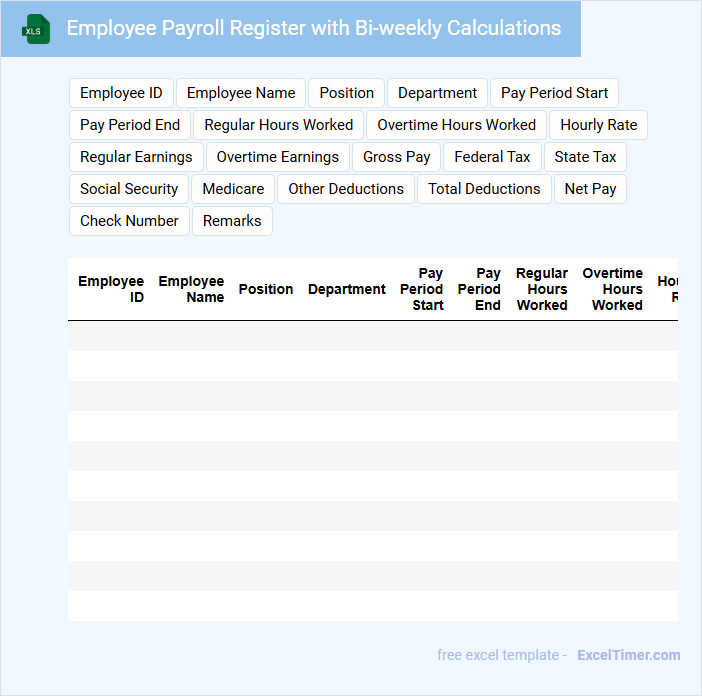

Employee Payroll Register with Bi-weekly Calculations

An Employee Payroll Register with Bi-weekly Calculations typically contains detailed records of employee earnings, deductions, and net pay for each bi-weekly pay period.

- Accurate payroll data: Ensure all employee hours, rates, and bonuses are correctly recorded to avoid payroll errors.

- Comprehensive deductions: Include all applicable taxes, benefits, and other withholdings for precise net pay calculations.

- Regular updates: Keep the register updated with changes in employee status, pay rates, and tax regulations.

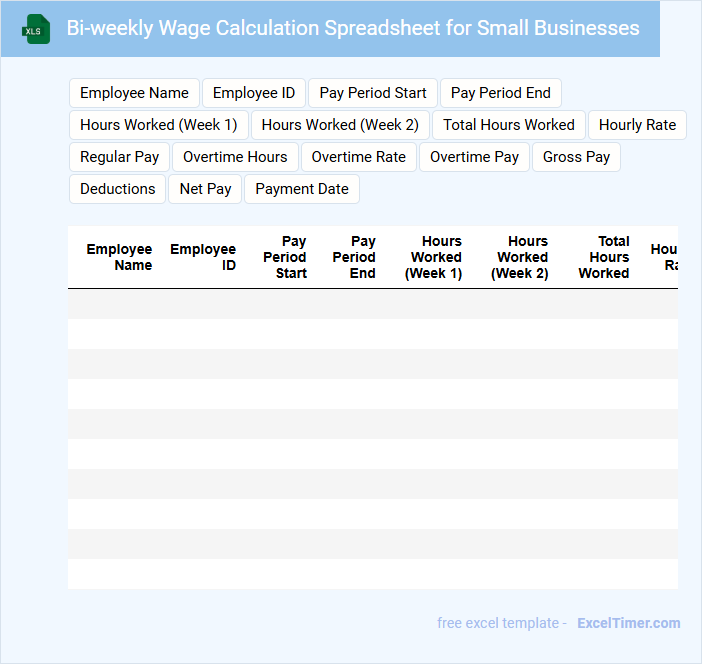

Bi-weekly Wage Calculation Spreadsheet for Small Businesses

A Bi-weekly Wage Calculation Spreadsheet is a document that helps small businesses track employee wages every two weeks. It typically contains employee names, hours worked, pay rates, deductions, and net pay.

This spreadsheet ensures accurate and timely payroll processing, reducing errors and saving administrative time. Important considerations include updating tax rates, overtime rules, and clearly documenting all calculations.

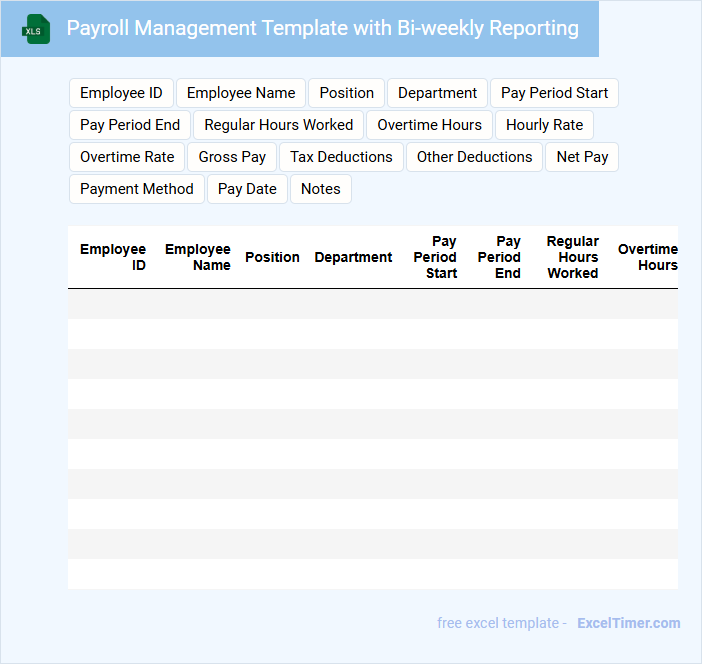

Payroll Management Template with Bi-weekly Reporting

Payroll Management Templates with Bi-weekly Reporting typically include employee details, salary information, tax deductions, and benefits in a streamlined format. The document ensures accurate salary calculation every two weeks, facilitating timely payments and compliance with legal requirements. Payroll Management is critical for maintaining financial accuracy and employee satisfaction within an organization.

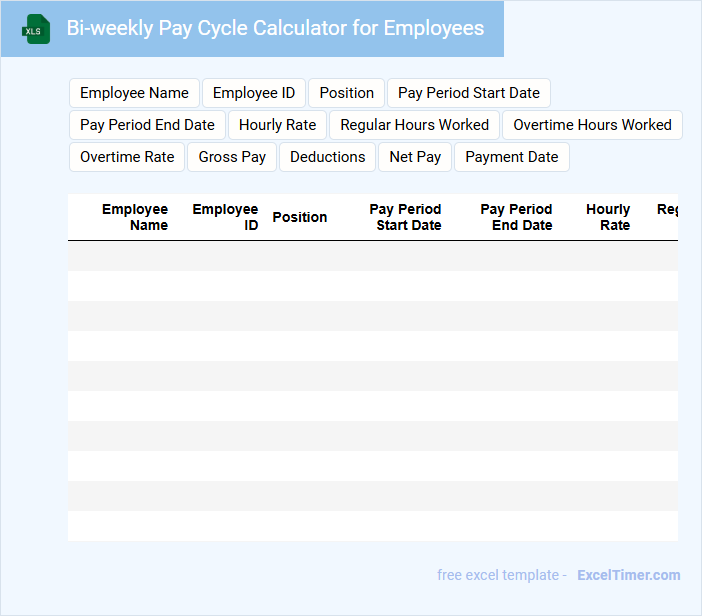

Bi-weekly Pay Cycle Calculator for Employees

The Bi-weekly Pay Cycle Calculator is a practical tool designed to help employees accurately estimate their earnings every two weeks. This type of document typically includes fields for hourly rates, hours worked, and deductions to provide a clear paycheck summary. It is important to ensure the calculator accounts for taxes, benefits, and overtime to deliver precise results.

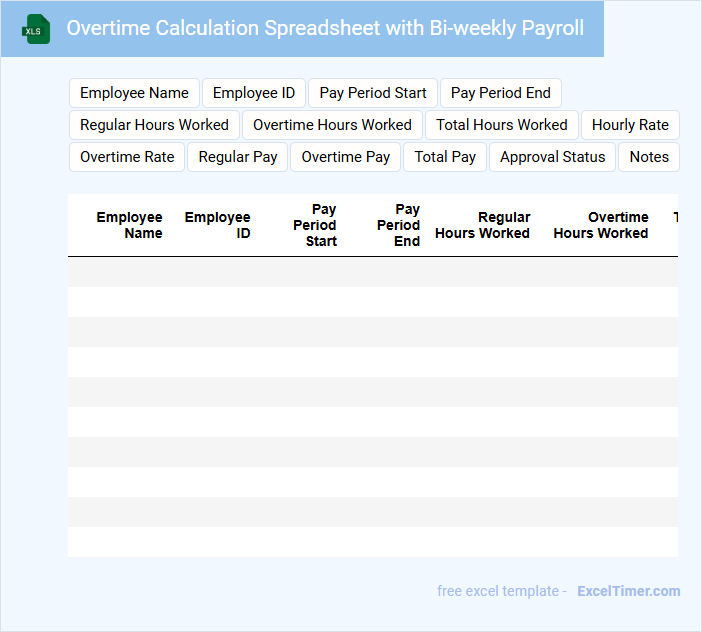

Overtime Calculation Spreadsheet with Bi-weekly Payroll

What information is typically included in an Overtime Calculation Spreadsheet with Bi-weekly Payroll? This type of document usually contains employee work hours, regular hours, overtime hours, and corresponding pay rates calculated on a bi-weekly basis. It organizes payroll data to ensure accurate payment tracking and helps businesses comply with labor laws for overtime compensation.

What is an important aspect to consider when managing this spreadsheet? Ensuring accurate input of work hours and verifying overtime eligibility rules are crucial to prevent payroll errors and avoid legal issues. Additionally, integrating clear formulas and regularly updating pay rates maintains the spreadsheet's reliability and efficiency.

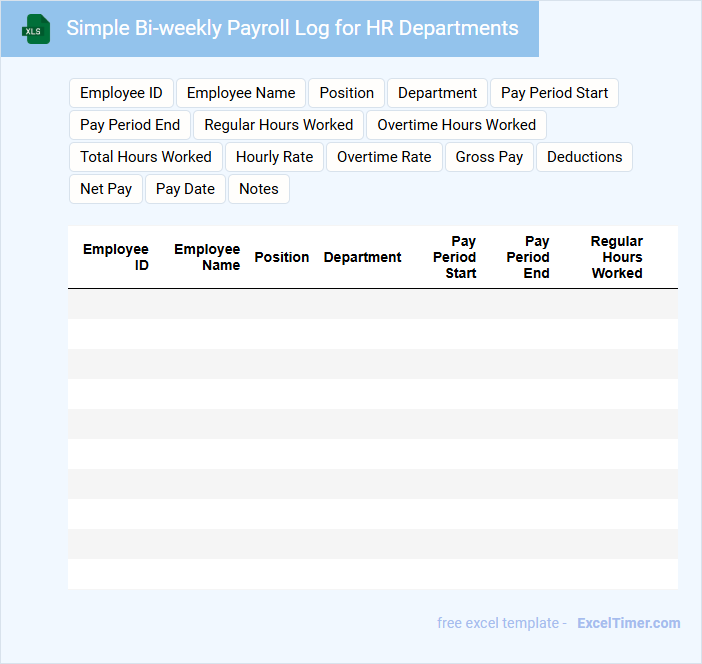

Simple Bi-weekly Payroll Log for HR Departments

A Simple Bi-weekly Payroll Log typically contains detailed records of employee hours, wages, and deductions for each pay period. It helps HR departments track payment accuracy and maintain compliance with labor laws efficiently. Ensuring accuracy in data entry and timely updates is crucial for smooth payroll processing.

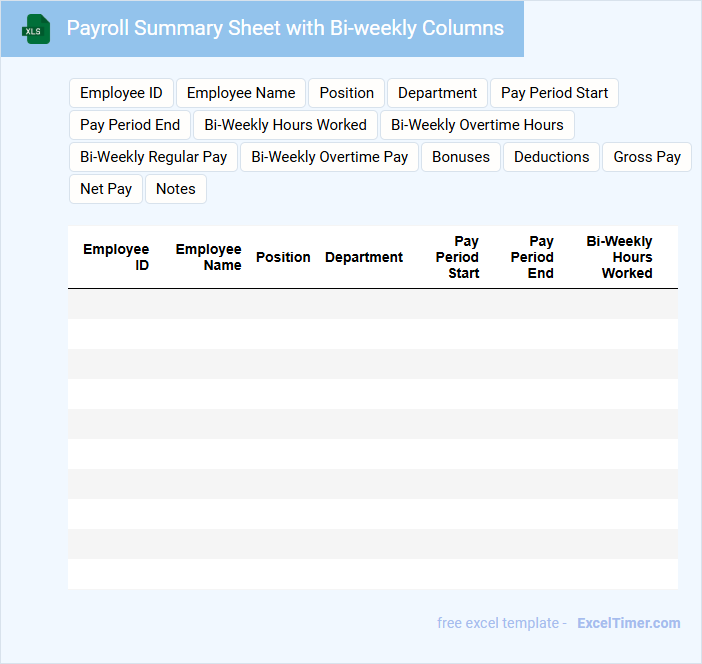

Payroll Summary Sheet with Bi-weekly Columns

A Payroll Summary Sheet with Bi-weekly Columns is a document used to track employee earnings, deductions, and net pay over two-week periods. It helps ensure accurate and timely payroll processing for each pay cycle.

- Include employee names, identification numbers, and pay rates for clarity.

- List gross wages, taxes withheld, and other deductions in separate bi-weekly columns.

- Summarize totals at the bottom for easy verification and reporting.

Bi-weekly Employee Attendance and Payroll Tracker

A Bi-weekly Employee Attendance and Payroll Tracker is a crucial document used to monitor employees' work hours and calculate their wages over a two-week period. It typically contains detailed records of daily attendance, hours worked, leave taken, and any overtime. Ensuring accuracy in this tracker is important for timely payroll processing and compliance with labor regulations.

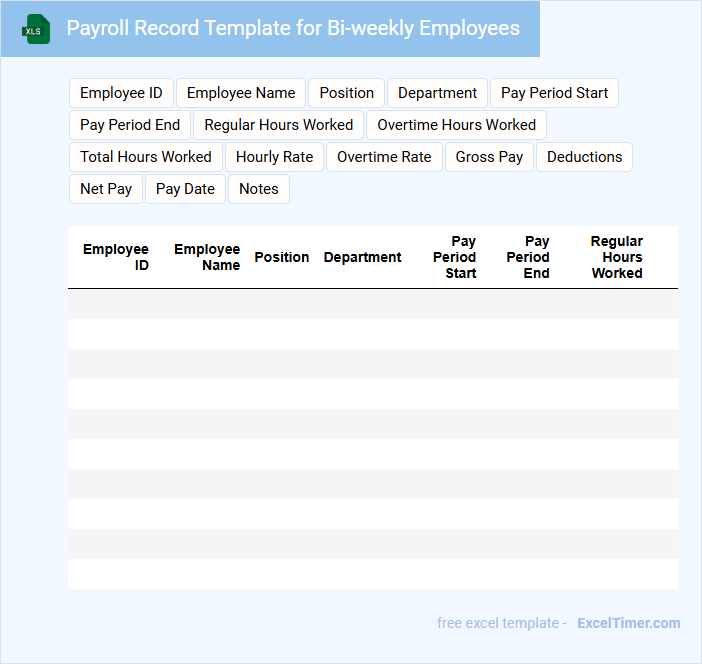

Payroll Record Template for Bi-weekly Employees

A Payroll Record Template for bi-weekly employees typically contains detailed information about employee hours, wages, deductions, and net pay for each two-week period. It ensures accurate tracking of payroll data, compliance with tax regulations, and facilitates smooth payroll processing. Important elements to include are employee identification, pay period dates, hourly rates, overtime calculations, and tax withholdings.

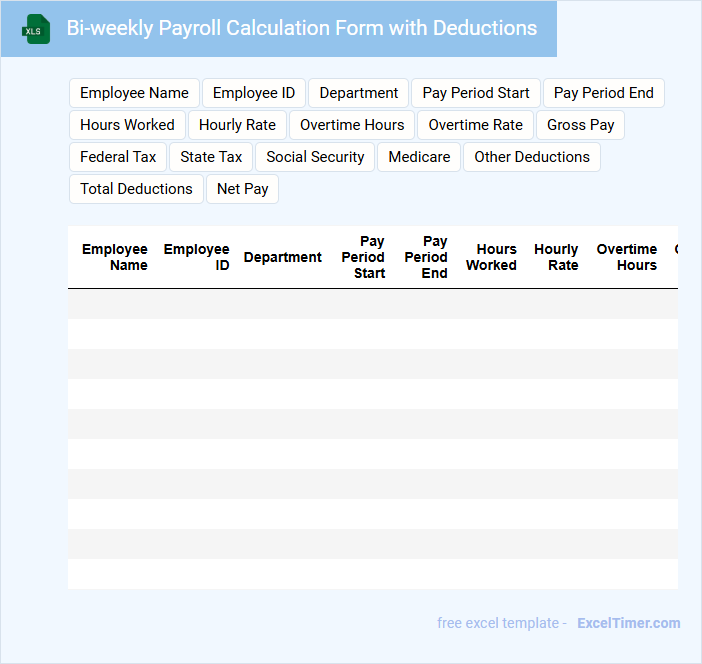

Bi-weekly Payroll Calculation Form with Deductions

Bi-weekly Payroll Calculation Forms with Deductions are essential documents used to accurately compute employee wages and account for any applicable deductions over a two-week period. These forms ensure transparency and compliance with payroll laws by detailing earnings and subtractions.

- Include all employee hours worked alongside overtime and leave details for precise wage calculation.

- List all statutory and voluntary deductions such as taxes, insurance premiums, and retirement contributions.

- Maintain clear spaces for signatures and dates to verify authorization and audit trails.

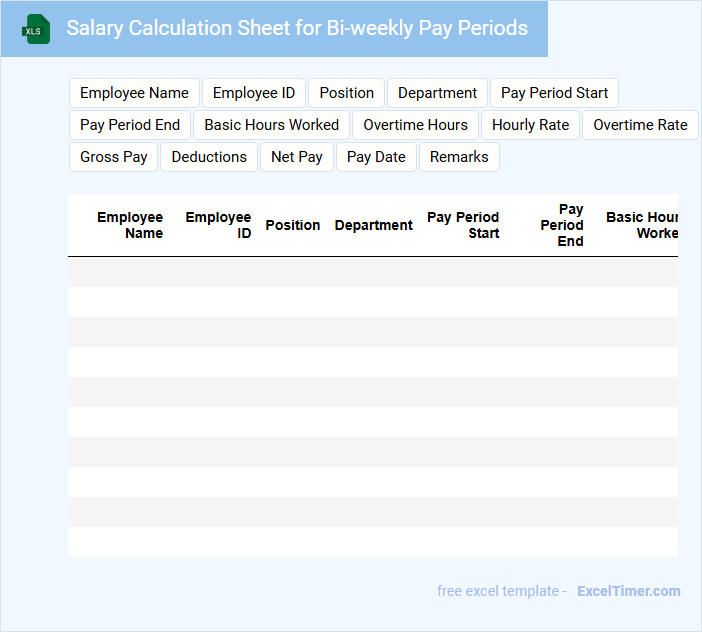

Salary Calculation Sheet for Bi-weekly Pay Periods

The Salary Calculation Sheet for bi-weekly pay periods typically contains detailed employee wage information, hours worked, and deductions. It serves as an essential tool for accurate payroll processing and compliance with labor laws. Important elements include base pay, overtime, taxes, and benefits calculations to ensure transparency.

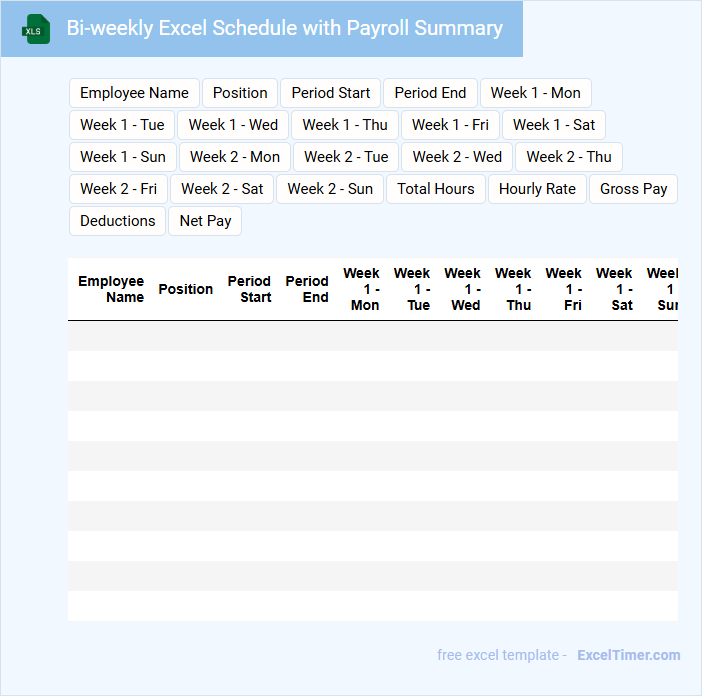

Bi-weekly Excel Schedule with Payroll Summary

A Bi-weekly Excel Schedule typically contains detailed work hours, employee shifts, and task assignments for a two-week period. This document helps in tracking attendance and managing daily operations efficiently. Including clear headers and consistent formatting enhances readability and usability.

Alongside the schedule, a Payroll Summary provides a concise overview of employee earnings, deductions, and net pay for the corresponding time frame. It ensures transparent and accurate compensation processing. It's important to regularly update formulas to maintain data accuracy and compliance.

What formula can you use in Excel to calculate bi-weekly gross wages from an annual salary?

Use the formula =AnnualSalary/26 to calculate bi-weekly gross wages from an annual salary in Excel. This divides the annual salary by 26 pay periods, reflecting a bi-weekly payroll cycle. The calculation ensures accurate payroll processing based on a standard calendar year.

How do you set up a date sequence in Excel to reflect bi-weekly pay periods?

To set up a date sequence in Excel for bi-weekly payroll calculation, start by entering your initial pay period start date in the first cell. Use the formula "=A1 + 14" to add 14 days, creating a two-week interval, and drag the formula down to auto-fill subsequent pay periods. This method ensures your bi-weekly payroll dates are accurately sequenced for consistent calculation and tracking.

Which Excel function helps identify if a given date falls within a specific bi-weekly pay range?

The Excel function `IF` combined with `AND` can determine if a given date falls within a specific bi-weekly pay range by checking if the date is greater than or equal to the start date and less than or equal to the end date of that pay period. Using `=IF(AND(A1>=StartDate, A1<=EndDate), "Within Pay Period", "Outside Pay Period")` helps accurately identify payroll dates. This approach ensures your bi-weekly payroll calculation is precise and automated.

How can you automate overtime calculation for bi-weekly periods using Excel formulas?

Automate overtime calculation for bi-weekly payroll by using Excel formulas like =IF(TotalHours>80,(TotalHours-80)*OvertimeRate,0), where TotalHours sums hours worked over 14 days and 80 is the regular bi-weekly hour limit. Use SUMIFS to aggregate daily hours within the bi-weekly date range, ensuring accurate overtime detection. Define constants for regular hours and overtime rates to maintain formula flexibility across payroll periods.

What is the best method in Excel to summarize total bi-weekly deductions for payroll processing?

The best method in Excel to summarize total bi-weekly deductions for payroll processing is using the SUMIFS function. You can set criteria based on the bi-weekly pay periods to accurately calculate total deductions. This approach ensures Your payroll calculations are both precise and efficient.