The Bi-weekly Excel Template for Invoice Management streamlines tracking and organizing invoices every two weeks, ensuring timely payments and accurate financial records. It includes automated calculations and customizable fields to fit diverse business needs, reducing manual errors and saving valuable time. This template is essential for improving cash flow management and maintaining clear communication with clients.

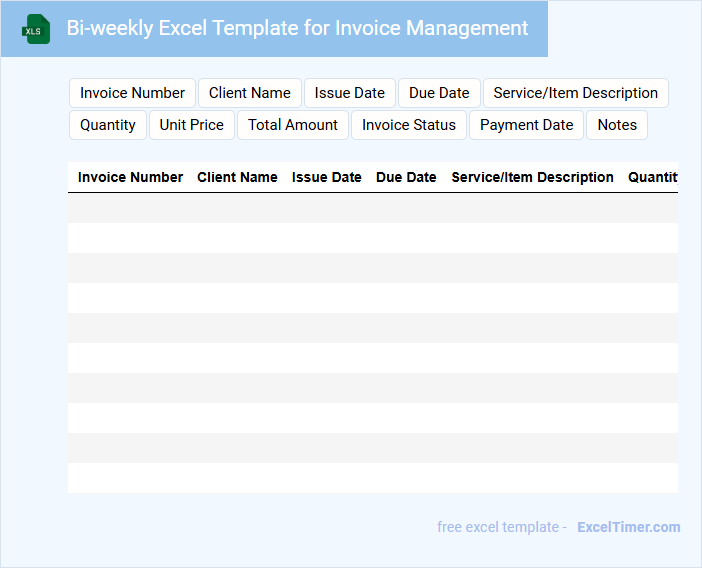

Bi-weekly Excel Template for Invoice Management

A Bi-weekly Excel Template for Invoice Management is designed to help businesses track and organize invoices efficiently every two weeks. It typically includes sections for invoice details, payment status, and totals calculation.

- Include columns for invoice number, date, client name, and amount.

- Ensure there is a status indicator for paid, pending, or overdue invoices.

- Add automated formulas to calculate totals and outstanding balances.

Bi-weekly Invoice Tracking Sheet for Small Business

What information is typically included in a Bi-weekly Invoice Tracking Sheet for a small business? This document usually contains details such as invoice numbers, client names, invoice dates, payment due dates, amounts billed, and payment status. It helps small businesses monitor outstanding invoices, ensure timely payments, and maintain accurate financial records.

What important aspects should be considered when creating this tracking sheet? It is essential to include clear columns for payment status updates and due date alerts to avoid missed payments. Additionally, regularly updating and reviewing the sheet ensures accurate cash flow management and helps identify any recurring billing issues early.

Excel Invoice Register with Bi-weekly Tracking

An Excel Invoice Register with bi-weekly tracking is a comprehensive document used to record and monitor invoices over specific two-week periods. It typically contains details such as invoice numbers, dates, amounts, payment statuses, and vendor information. This register streamlines financial oversight by enabling timely tracking and reconciliation of payments within each bi-weekly cycle.

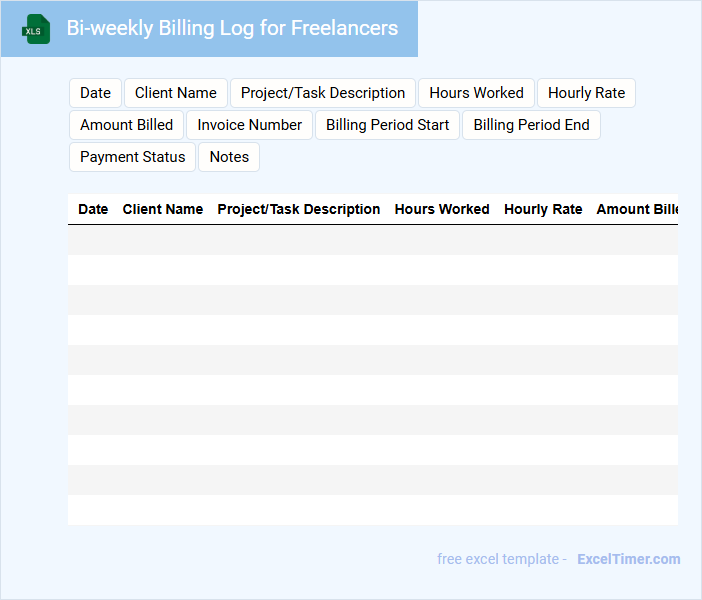

Bi-weekly Billing Log for Freelancers

A Bi-weekly Billing Log for freelancers is a crucial document that tracks all billable hours and expenses within a two-week period. It typically includes dates, project descriptions, hours worked, rates, and total amounts due. Maintaining accurate records in this log ensures timely invoicing and helps freelancers manage their cash flow effectively.

For optimal use, ensure all entries are detailed and consistently updated to avoid discrepancies. Include a clear breakdown of tasks and corresponding rates to enhance transparency with clients. Regularly reviewing the log can also help identify billing patterns and improve time management.

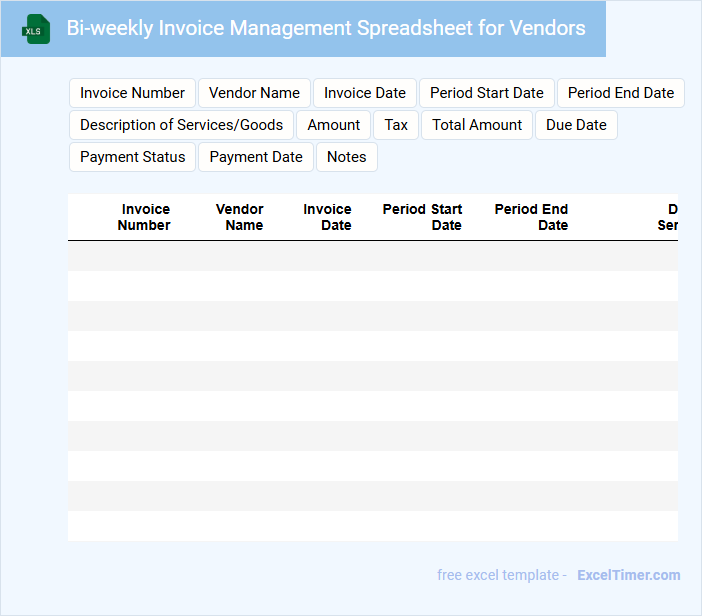

Bi-weekly Invoice Management Spreadsheet for Vendors

A Bi-weekly Invoice Management Spreadsheet for vendors typically contains detailed records of invoices issued and payments made within a two-week period. It helps businesses track outstanding payments, monitor cash flow, and ensure accurate financial reporting. Important aspects include clear vendor information, invoice dates, amounts due, and payment status to maintain organized and timely financial management.

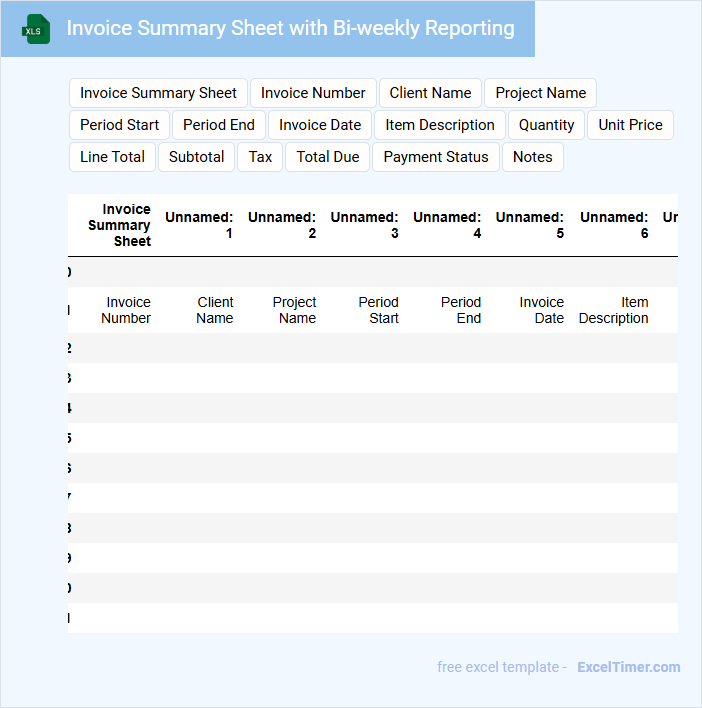

Invoice Summary Sheet with Bi-weekly Reporting

An Invoice Summary Sheet typically contains detailed records of billed services or products, including dates, amounts, and client information. It provides a consolidated view of all invoices generated within a specific bi-weekly period for efficient financial tracking.

Bi-weekly reporting ensures consistent monitoring of cash flow and outstanding payments, helping maintain accurate accounting records. It is important to regularly verify the accuracy of invoice totals and payment statuses to avoid discrepancies and facilitate timely collections.

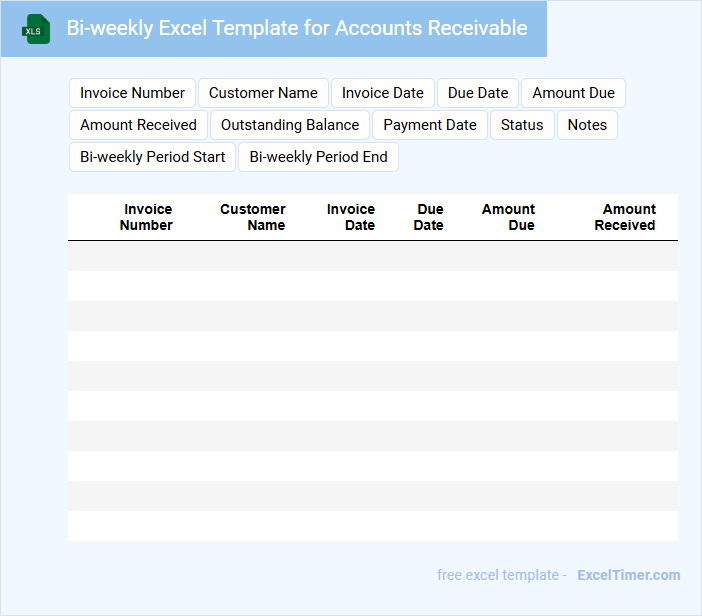

Bi-weekly Excel Template for Accounts Receivable

What information is typically included in a Bi-weekly Excel Template for Accounts Receivable? This type of document usually contains detailed records of outstanding invoices, payments received, and aging reports to track overdue accounts. It helps businesses monitor cash flow and manage customer credit efficiently by providing a clear overview of amounts owed within each bi-weekly period.

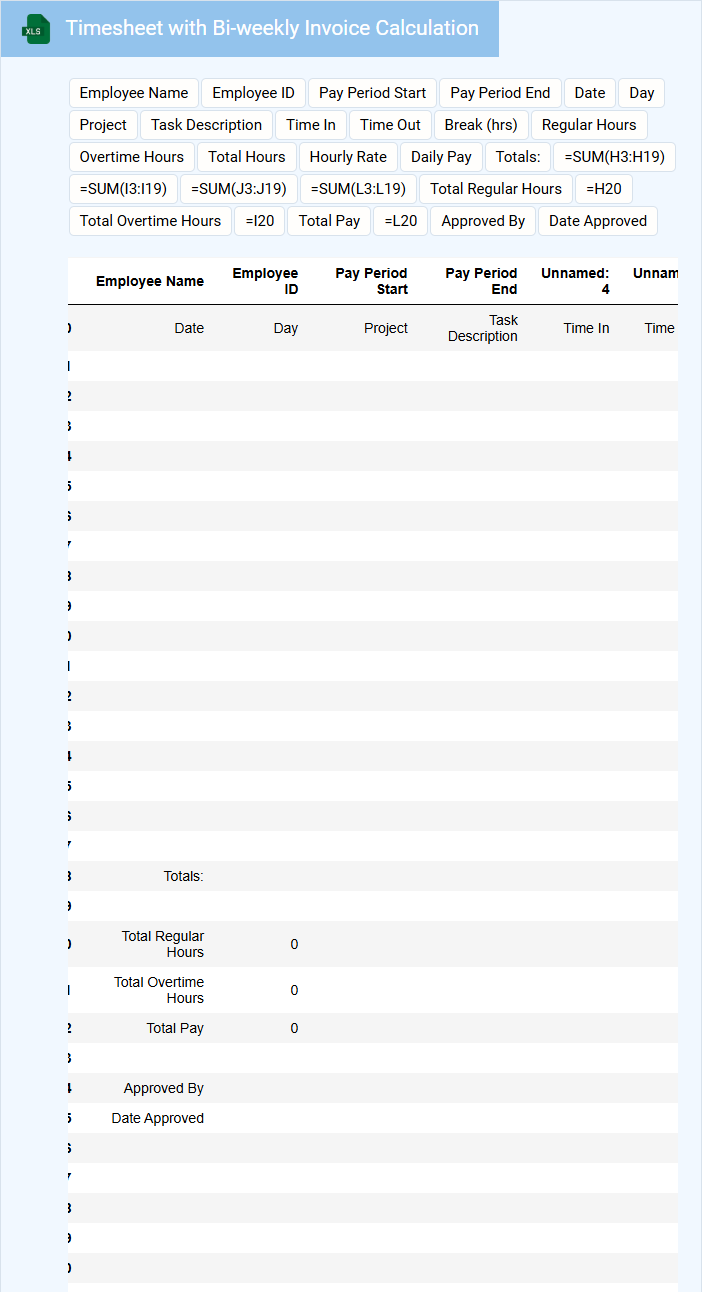

Timesheet with Bi-weekly Invoice Calculation

What is typically included in a Timesheet with Bi-weekly Invoice Calculation document? This document usually contains detailed records of hours worked by an employee or contractor over a two-week period, including dates, tasks, and total hours. It also includes calculated invoice amounts based on agreed hourly rates for accurate payment processing and financial tracking.

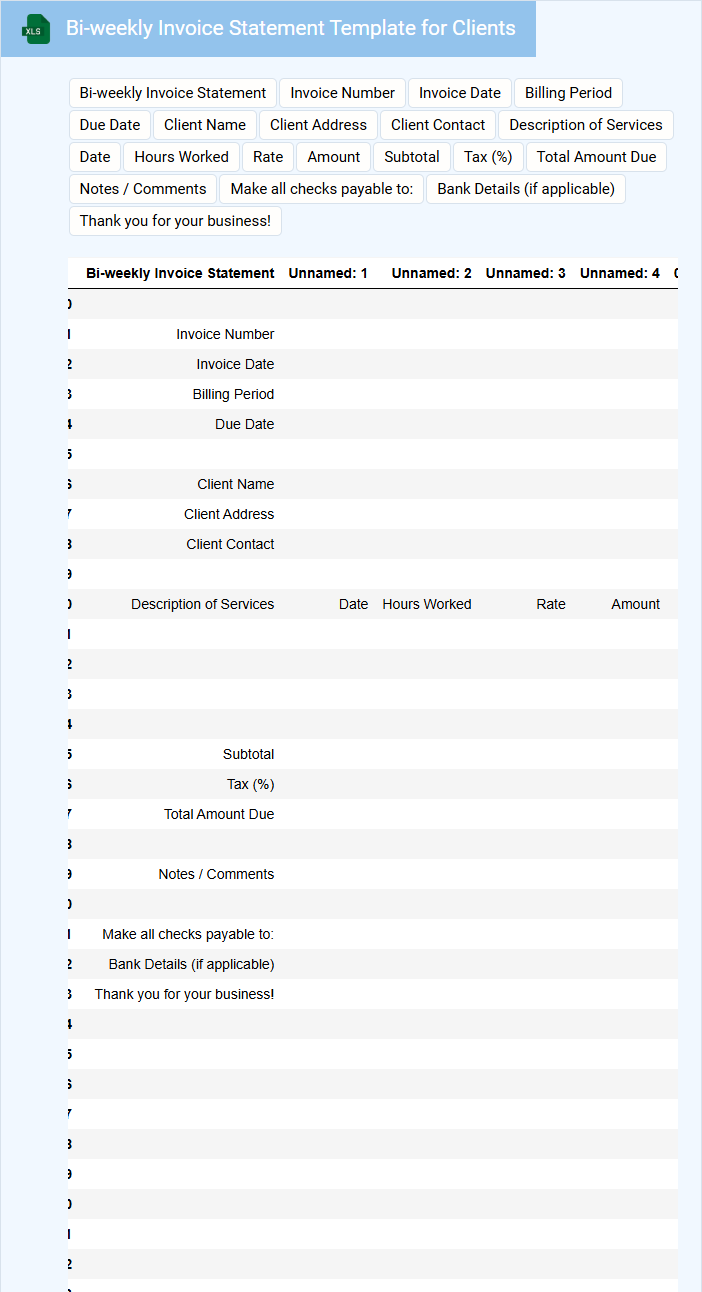

Bi-weekly Invoice Statement Template for Clients

What information does a bi-weekly invoice statement template for clients typically contain? This type of document usually includes details such as the invoice number, date, client information, list of services or products provided, payment terms, and the total amount due. It serves as a clear record of transactions between a business and its clients over a two-week period, helping to ensure timely payments and accurate financial tracking.

What is an important element to include in a bi-weekly invoice statement template? It is crucial to incorporate clear payment instructions and due dates to avoid any confusion and to encourage prompt payments. Additionally, providing a breakdown of charges enhances transparency, making it easier for clients to verify the invoice details and maintain trust.

Bi-weekly Payment Tracker for Invoicing

What information does a Bi-weekly Payment Tracker for Invoicing typically contain? This document usually includes a detailed list of invoices issued within the bi-weekly period, payment statuses, due dates, and amounts received. It helps businesses monitor cash flow and ensure timely follow-ups on outstanding payments.

What is an important consideration when creating a Bi-weekly Payment Tracker? Ensuring accuracy and up-to-date information is crucial, along with categorizing payments by client or project to streamline financial tracking and reporting.

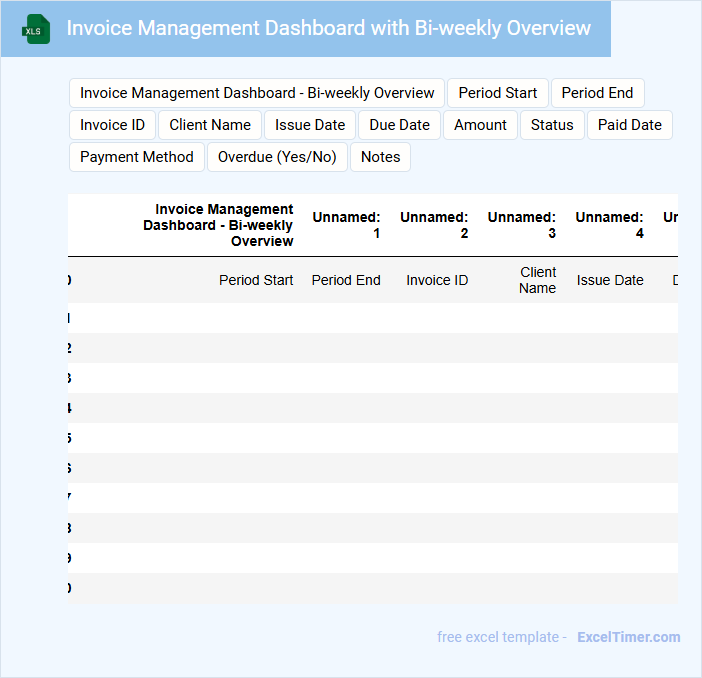

Invoice Management Dashboard with Bi-weekly Overview

An Invoice Management Dashboard is a centralized platform that provides a comprehensive overview of invoice statuses, payment deadlines, and financial transactions. It typically contains detailed data on issued invoices, pending payments, and overdue accounts. For a Bi-weekly Overview, the dashboard highlights trends and alerts for the current two-week period to streamline financial tracking and decision-making.

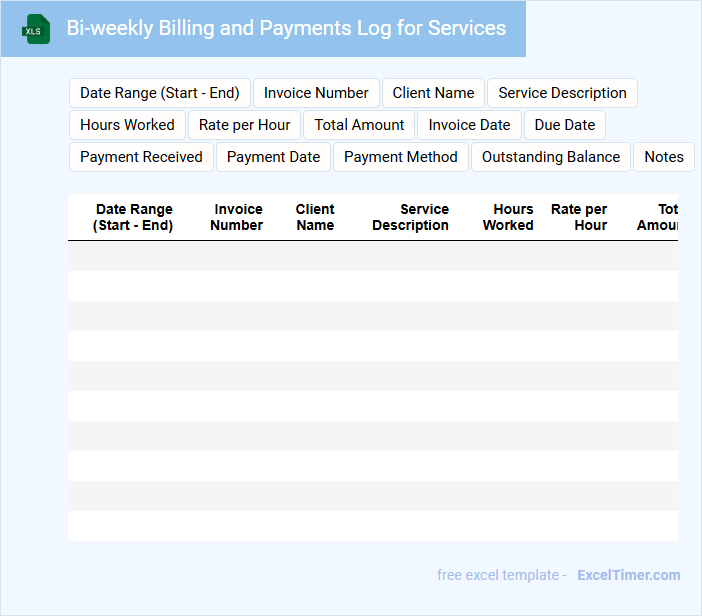

Bi-weekly Billing and Payments Log for Services

The Bi-weekly Billing and Payments Log is a crucial document used to track all financial transactions related to services rendered over a two-week period. It typically includes details such as invoice numbers, payment dates, amounts due, and payment status to ensure accurate financial management.

This log helps maintain transparency and accountability between service providers and clients by systematically recording billing and payment activities. It is important to regularly update the log and reconcile it with bank statements to avoid discrepancies and ensure timely payments.

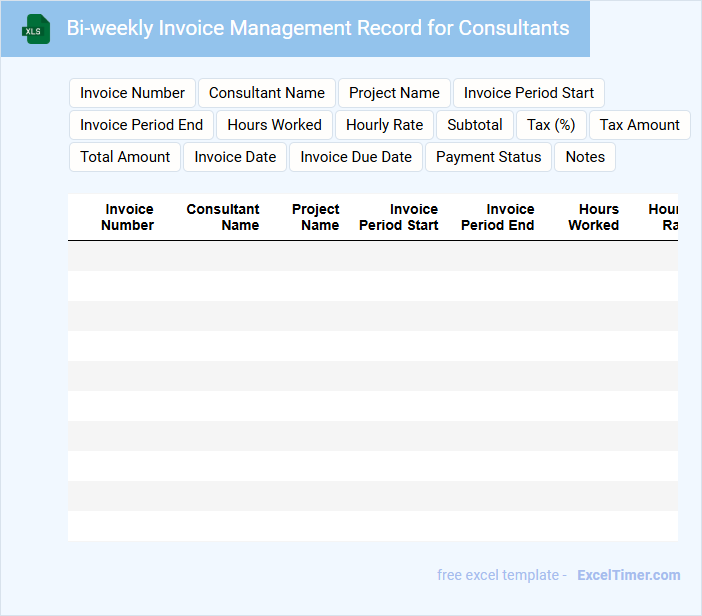

Bi-weekly Invoice Management Record for Consultants

The Bi-weekly Invoice Management Record for consultants typically contains detailed entries of all invoices issued within the two-week period, including invoice numbers, dates, amounts, and payment status. This document is crucial for tracking financial transactions and ensuring timely payments.

It often includes consultant names, project details, and approval signatures, which help maintain transparency and accountability. Regularly updating and reviewing this record prevents discrepancies and supports efficient financial management.

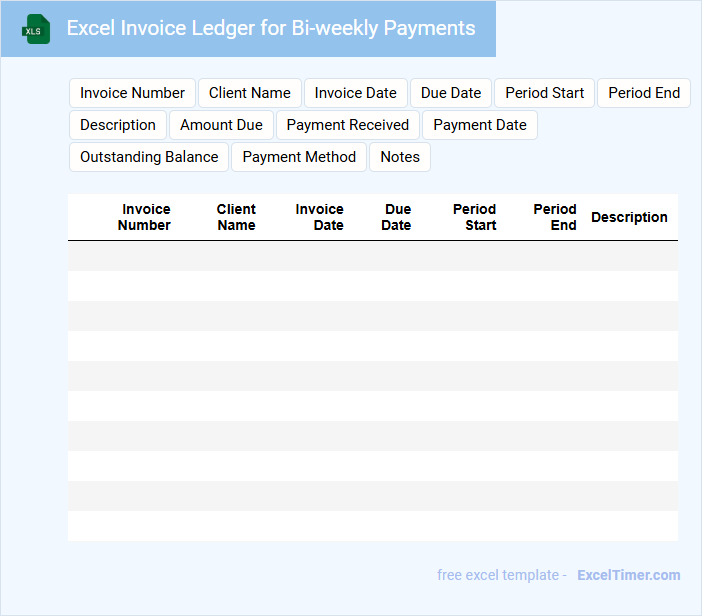

Excel Invoice Ledger for Bi-weekly Payments

What information is typically included in an Excel Invoice Ledger for Bi-weekly Payments? This type of document usually contains detailed records of invoices issued and payments received every two weeks, including dates, amounts, and client details. It helps in tracking financial transactions systematically and ensures timely billing and payment follow-ups.

What essential elements should be included in an Excel Invoice Ledger for Bi-weekly Payments? Important features include clear invoice numbers, payment status indicators, due dates, total amounts, and client contact information to maintain accuracy and support efficient financial management.

Bi-weekly Income and Invoice Tracker for Contractors

The Bi-weekly Income and Invoice Tracker is a document designed to monitor payments and invoices over a two-week period, helping contractors maintain clear financial records. It typically includes detailed entries of received income, pending invoices, and payment statuses to ensure accuracy and accountability.

This tracker is essential for contractors to manage cash flow efficiently and avoid missed payments or discrepancies. Keeping it updated regularly aids in budgeting and forecasting future earnings.

What is the definition and significance of "bi-weekly" in the context of invoice generation and payment schedules in Excel?

Bi-weekly in invoice management refers to generating and scheduling payments every two weeks, ensuring consistent cash flow and accurate tracking of financial obligations in Excel. This frequency helps your business streamline invoice processing by providing regular intervals for reviewing and managing outstanding payments. Properly setting up bi-weekly schedules in Excel optimizes financial planning and reduces the risk of delayed payments.

How can you automate bi-weekly invoice tracking using formulas or templates in Excel?

You can automate bi-weekly invoice tracking in Excel by using built-in templates designed for invoice management and customizing them with formulas like SUMIFS to calculate total amounts per period. Date functions such as WEEKNUM and MOD help identify and separate bi-weekly intervals automatically. Implementing conditional formatting highlights overdue payments, streamlining your tracking process efficiently.

What are the key columns and data fields required for effective bi-weekly invoice management in an Excel document?

Key columns for bi-weekly invoice management in Excel include Invoice Number, Client Name, Invoice Date, Due Date, Payment Status, Amount Due, and Payment Received. Data fields should capture detailed descriptions, tax amounts, and payment method for accurate tracking. Including columns for Payment Date and Notes enhances follow-up and reconciliation processes.

How do you calculate outstanding balances and payment due dates for bi-weekly invoices in Excel?

To calculate outstanding balances and payment due dates for bi-weekly invoices in Excel, use formulas that subtract payments from total invoice amounts and add 14 days to invoice dates for due dates. Your Excel sheet should include columns for invoice date, payment amount, total invoice value, outstanding balance, and due date. Employ the SUM and DATE functions to automate balance tracking and ensure accurate billing cycles.

What best practices should be followed to ensure accuracy and avoid duplication when managing bi-weekly invoices in Excel?

Use unique invoice IDs and apply data validation rules to prevent duplicate entries in the bi-weekly invoice Excel sheet. Implement conditional formatting to highlight inconsistencies or missing information for immediate correction. Regularly reconcile invoice totals with payment records to maintain accuracy in bi-weekly invoice management.