![]()

The Bi-weekly Excel Template for Budget Tracking is designed to help users manage their finances by organizing income and expenses on a two-week basis. It simplifies cash flow monitoring, enabling precise planning and reducing the risk of overspending. Key features include customizable categories, automatic calculations, and clear visual summaries for efficient budget management.

Bi-Weekly Excel Template for Budget Tracking

What information is typically included in a Bi-Weekly Excel Template for Budget Tracking? This type of document usually contains sections for income, expenses, savings, and financial goals readjusted every two weeks to reflect short-term budget management. It is designed to help users monitor their cash flow regularly and adjust spending habits promptly.

What important features should be considered when using this template? It is crucial to include automated calculations for totals and variances, clear categories for different types of expenses, and a summary section to provide a quick overview of financial health. Including visual aids like charts can also enhance understanding and tracking effectiveness.

Bi-Weekly Household Budget Tracker with Expense Categories

The Bi-Weekly Household Budget Tracker is a document designed to help individuals or families monitor their income and expenses every two weeks. It typically contains detailed expense categories such as groceries, utilities, transportation, and entertainment for better financial clarity. To maximize its effectiveness, it is important to consistently update the tracker and review spending patterns to identify areas for potential savings.

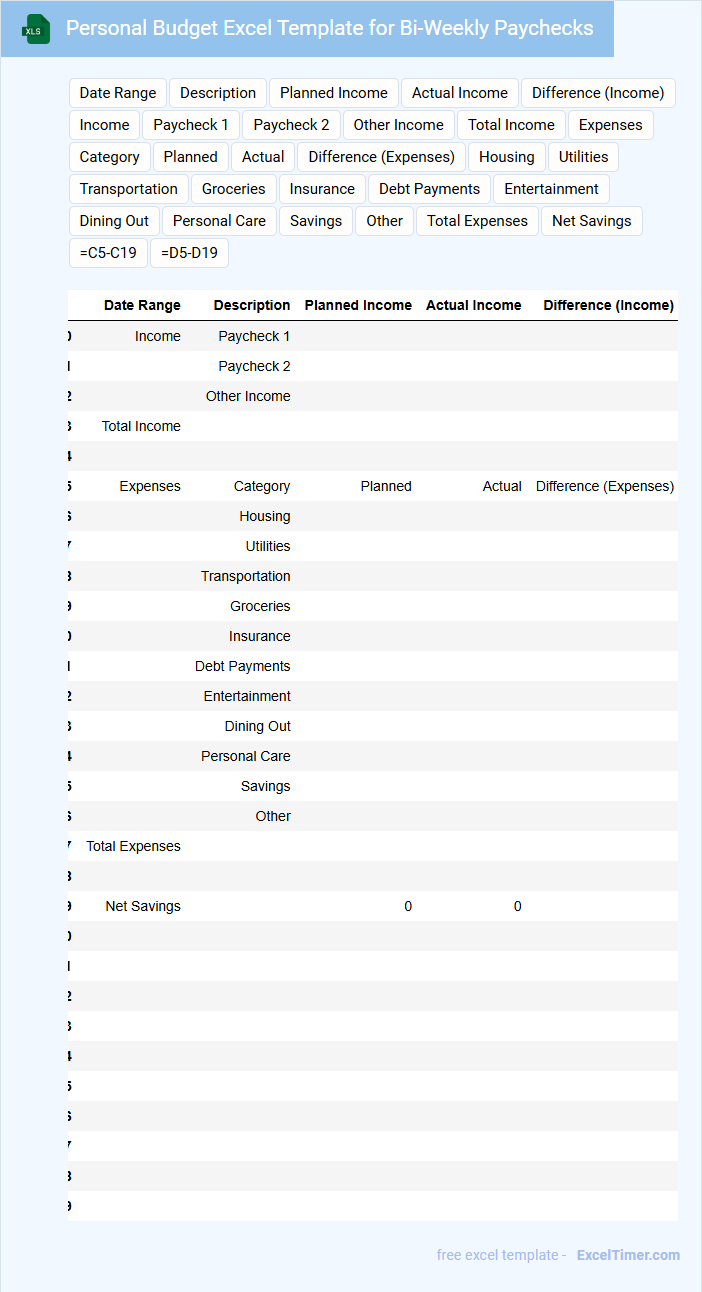

Personal Budget Excel Template for Bi-Weekly Paychecks

A Personal Budget Excel Template for Bi-Weekly Paychecks is typically designed to help individuals manage their finances accurately by tracking income and expenses every two weeks. It usually contains sections for listing sources of income, fixed and variable expenses, savings goals, and debt repayments. This document is essential for maintaining financial discipline and ensuring that no paycheck is overlooked during budget planning.

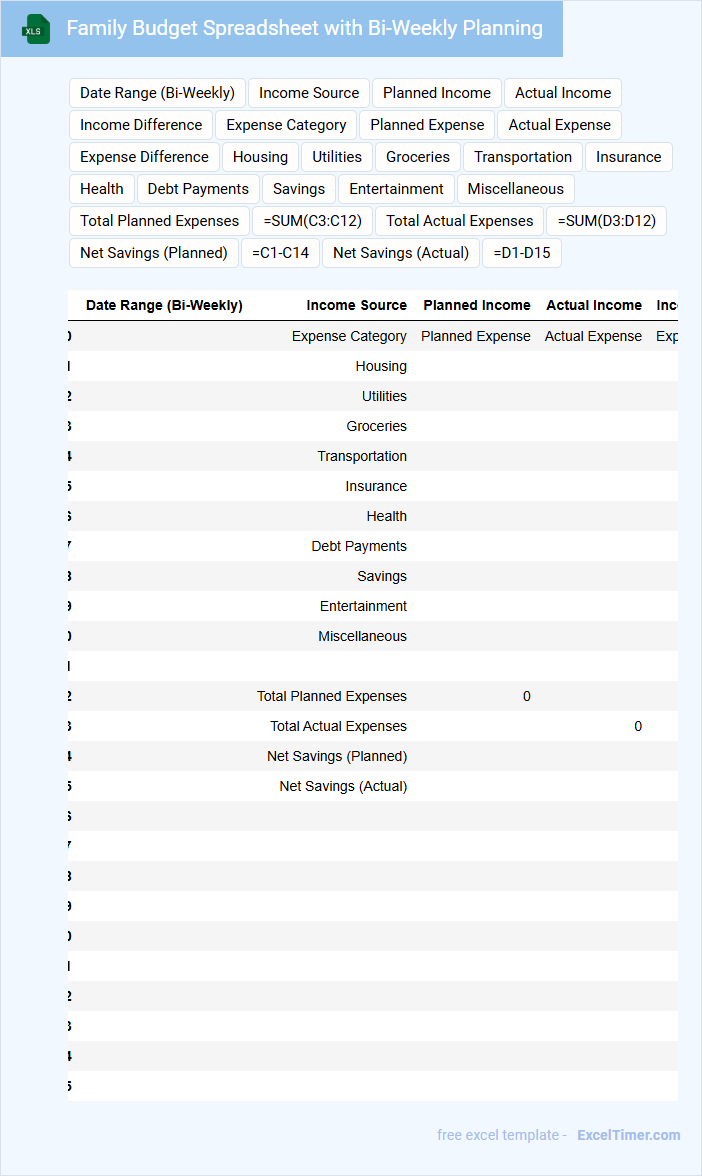

Family Budget Spreadsheet with Bi-Weekly Planning

A Family Budget Spreadsheet with bi-weekly planning typically contains detailed income and expense tracking split into two-week periods. It helps families monitor cash flow more accurately by aligning with common pay schedules.

Important elements include categorized expenses, savings goals, and recurring bills scheduled every two weeks. Consistent updates and review ensure the budget reflects real financial behavior and adjusts for upcoming needs.

Bi-Weekly Expense Tracker for Students

What information is typically included in a Bi-Weekly Expense Tracker for Students? This type of document usually contains detailed records of all expenses incurred by a student over a two-week period, including categories such as food, transportation, and entertainment. Tracking these expenses helps students manage their budget effectively and avoid overspending during their academic term.

What is an important suggestion for using a Bi-Weekly Expense Tracker effectively? It is essential to update the tracker regularly and categorize expenses accurately to gain a clear understanding of spending habits. Additionally, setting spending limits for each category can help students maintain financial discipline and achieve their saving goals.

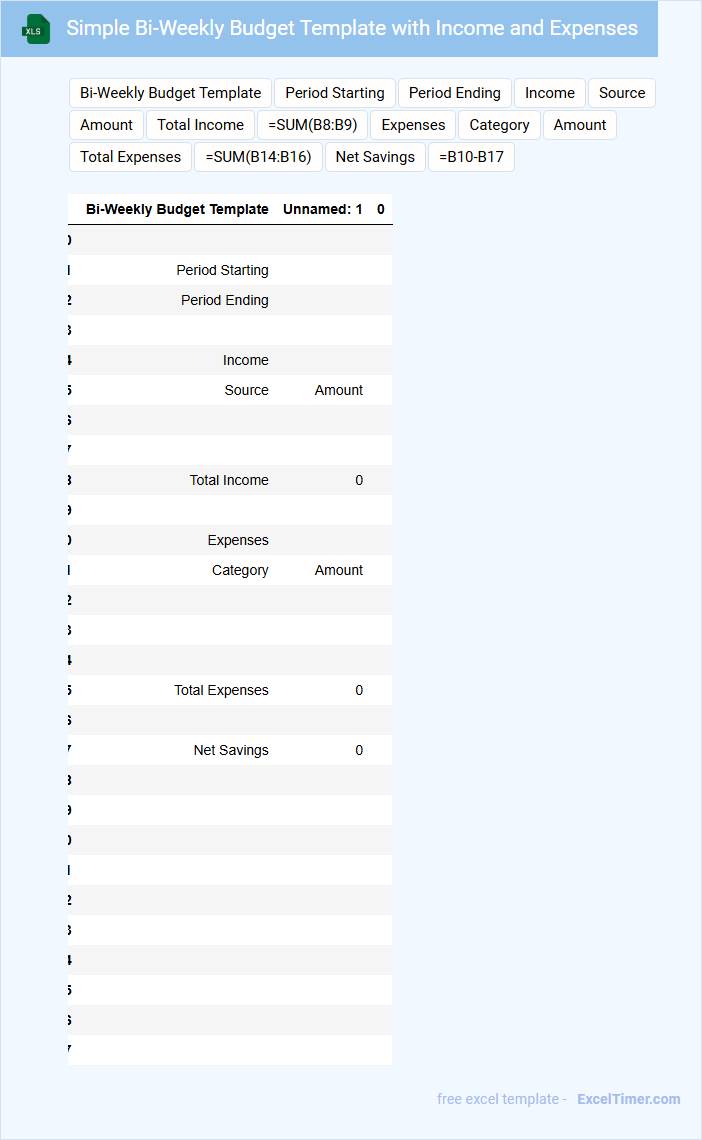

Simple Bi-Weekly Budget Template with Income and Expenses

A Simple Bi-Weekly Budget Template typically contains sections for tracking both income and expenses over a two-week period. It helps individuals manage their cash flow by listing sources of income and categorizing expenses such as bills, groceries, and savings. This type of document is essential for maintaining financial discipline and avoiding overspending.

When using this template, it is important to include all sources of income accurately and categorize expenses clearly to spot spending patterns. Regularly updating the template ensures that the budget reflects real-time financial status. Additionally, setting goals for savings alongside expenses can improve financial planning.

Bi-Weekly Budget Tracking Sheet for Small Businesses

What information does a Bi-Weekly Budget Tracking Sheet for Small Businesses typically contain? This document usually includes detailed records of income, expenses, and cash flow over a two-week period to help businesses monitor their financial health. It allows business owners to quickly identify spending patterns, allocate resources effectively, and make informed budgeting decisions to ensure profitability and sustainability.

Why is it important to focus on accuracy and regular updates in this tracking sheet? Accurate entries and timely updates ensure that financial data reflects the current state of the business, enabling proactive management of funds and avoidance of cash shortages. Consistency in tracking helps small businesses maintain control over their budget, plan for upcoming expenses, and adjust strategies to meet financial goals efficiently.

Bi-Weekly Savings Plan Template with Goal Tracker

This type of document generally includes a detailed savings schedule that breaks down contributions every two weeks to help users systematically accumulate funds. It also features a goal tracker section to monitor progress towards specific financial objectives.

Important elements to include are clear target amounts and deadlines to maintain motivation. Additionally, incorporating visual progress indicators enhances user engagement and accountability.

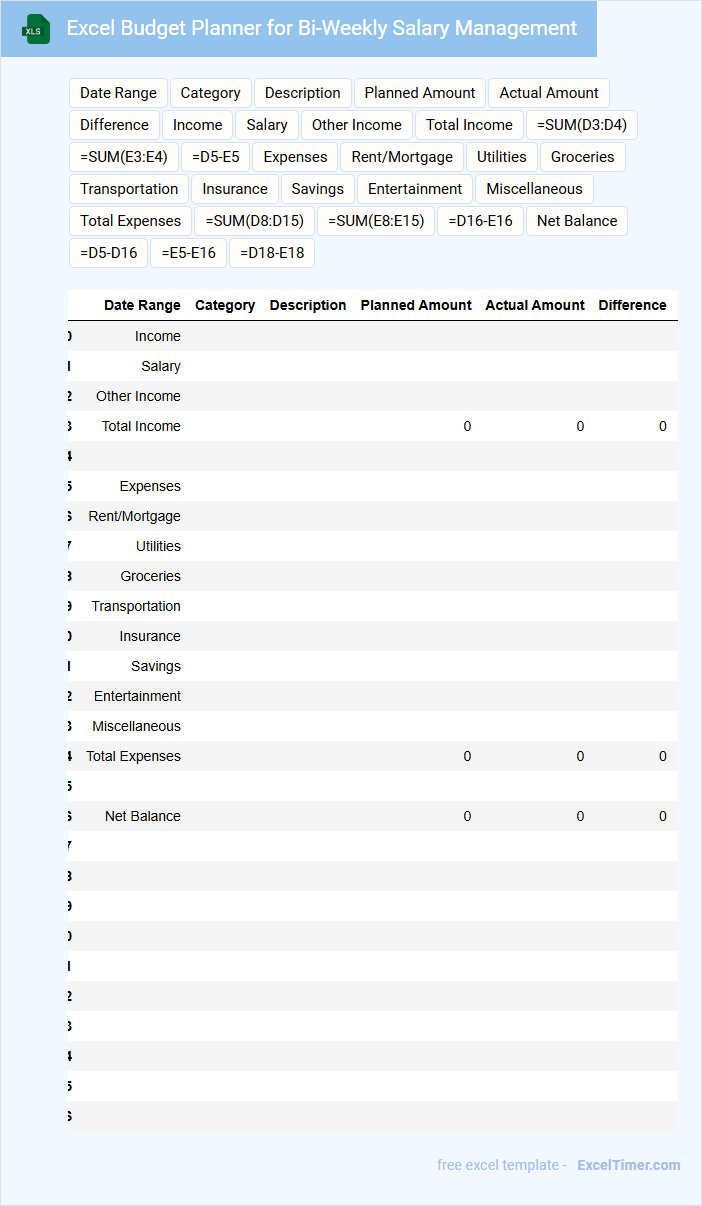

Excel Budget Planner for Bi-Weekly Salary Management

This document is an Excel Budget Planner designed specifically for managing bi-weekly salaries. It typically contains income tracking, expense categorization, and savings goals to streamline financial planning. Users benefit from organized data input, automated calculations, and clear visual summaries to maintain budget control.

Bi-Weekly Bill Payment Tracker with Reminders

A Bi-Weekly Bill Payment Tracker with Reminders is a document designed to help individuals organize and monitor their bill payments every two weeks to avoid late fees and maintain financial stability.

- Payment Dates: The document should clearly list all due dates for bills occurring bi-weekly to ensure timely payments.

- Reminder Alerts: Incorporate automatic reminder notifications to prompt users before each payment is due.

- Payment Status: Include columns or sections to mark paid, pending, or overdue bills for better tracking and accountability.

Monthly and Bi-Weekly Budget Tracker for Couples

A Monthly and Bi-Weekly Budget Tracker for couples typically contains detailed income entries, categorized expenses, savings goals, and debt tracking. It helps partners manage their finances together by visualizing cash flow over different periods.

Important things to focus on include clear communication, setting joint financial goals, and regularly updating the tracker for accuracy. This ensures transparency and strengthens financial planning within the relationship.

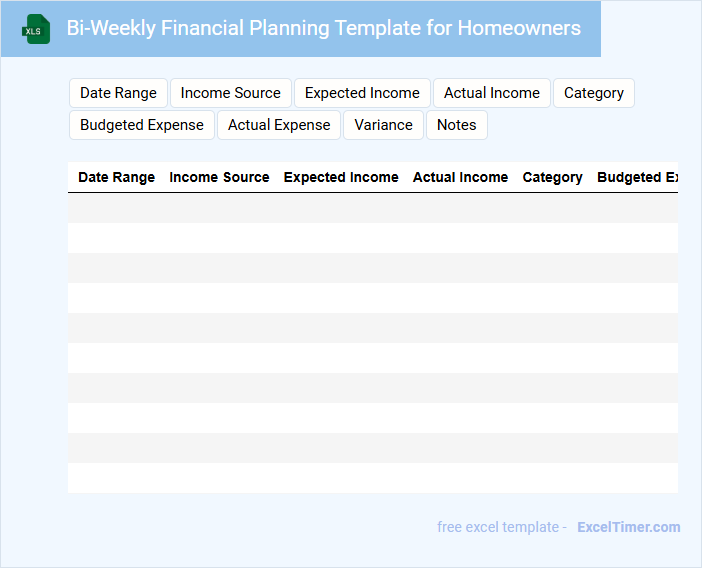

Bi-Weekly Financial Planning Template for Homeowners

A Bi-Weekly Financial Planning Template for homeowners is designed to help track income and expenses every two weeks, ensuring effective budget management. It typically contains sections for mortgage payments, utility bills, and savings goals that are crucial for maintaining financial stability. This document is vital for identifying spending patterns and making informed decisions to improve home-related financial health.

Bi-Weekly Debt Repayment Tracker with Progress Chart

The Bi-Weekly Debt Repayment Tracker is a financial document designed to monitor debt payments made every two weeks. It typically contains a detailed breakdown of payment amounts, due dates, and remaining balances. Including a progress chart visually represents the reduction of debt over time, making it easier to stay motivated and on track.

Project Budget Tracking Template for Bi-Weekly Review

A Project Budget Tracking Template for Bi-Weekly Review is a crucial document used to monitor and control project expenses over a two-week period. It typically contains detailed sections for budget allocation, actual spending, and variance analysis. This template helps ensure financial accountability and timely adjustments to keep the project on track.

Important elements to include are clearly defined budget categories, columns for planned vs. actual costs, and a summary of overruns or savings. Incorporating automated calculations and conditional formatting can enhance accuracy and visibility. Additionally, regular updates and notes on changes improve communication among stakeholders.

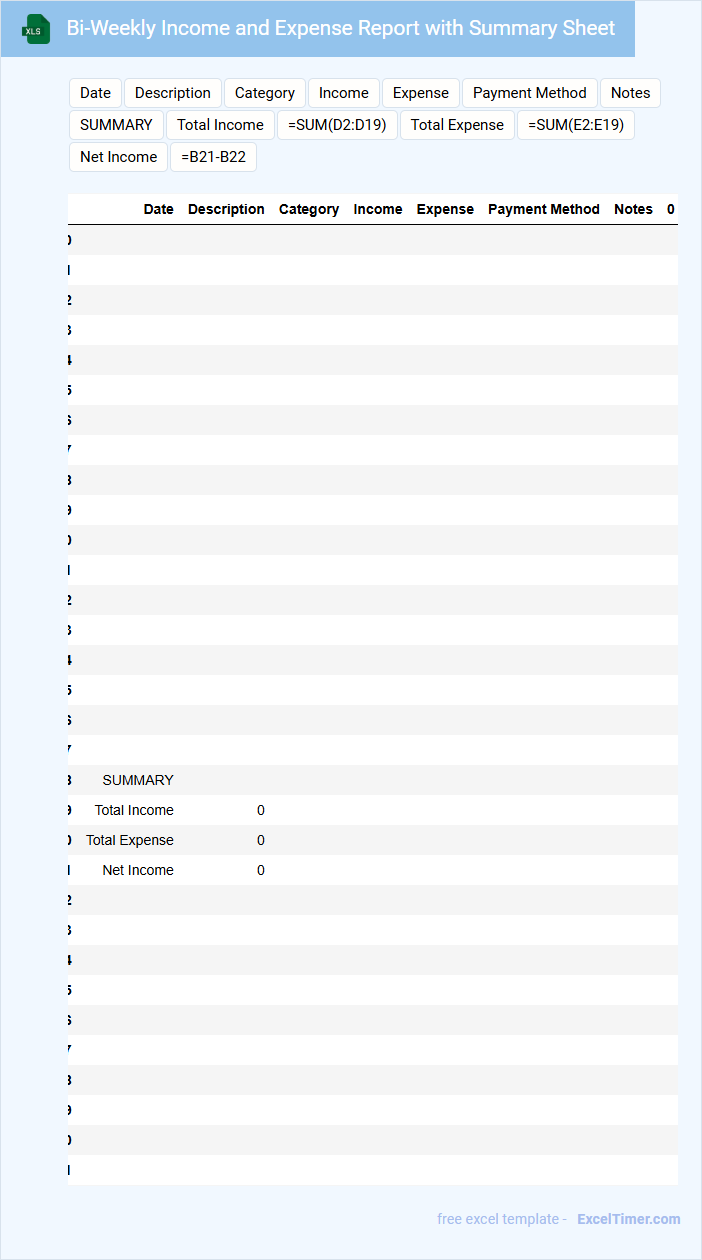

Bi-Weekly Income and Expense Report with Summary Sheet

A Bi-Weekly Income and Expense Report with Summary Sheet typically contains detailed records of all income and expenses incurred over a two-week period, appended with a summary sheet that highlights overall financial performance.

- Comprehensive Income Tracking: Document all sources of income clearly to ensure accurate financial analysis.

- Detailed Expense Categorization: Categorize expenses precisely to identify spending patterns and areas for cost-saving.

- Summary Sheet Overview: Provide a concise summary of net income and major financial metrics for quick review.

What does "bi-weekly" mean in the context of budget tracking in an Excel document?

In an Excel document for budget tracking, "bi-weekly" refers to financial activities or expenses recorded every two weeks. This schedule helps you accurately monitor cash flow and manage your budget within consistent, 14-day periods. Tracking bi-weekly transactions ensures timely updates and better financial planning throughout the month.

How do you structure your Excel budget to accurately record bi-weekly income and expenses?

Structure your Excel budget using separate columns for bi-weekly income dates, income amounts, expense categories, and expense amounts. Use formulas like SUMIFS to aggregate bi-weekly totals and track cumulative budget balances. Incorporate drop-down lists for categories and conditional formatting to highlight overspending or income shortfalls.

Which Excel formulas or functions can automate the calculation of bi-weekly totals?

Use the SUMIFS function to calculate bi-weekly totals by summing values within specific date ranges. Combine WEEKNUM or EOMONTH with DATE functions to define bi-weekly periods dynamically. Pivot Tables with date grouping can also automate bi-weekly budget tracking effectively.

How can you differentiate and visualize bi-weekly spending patterns using charts in Excel?

Use a clustered bar chart to display bi-weekly spending amounts across different categories, highlighting variations over each two-week period. Apply conditional formatting to the data table for quick identification of high or low spending weeks. Incorporate a line chart to visualize trends and fluctuations in total bi-weekly expenditures over time.

What is the best way to set up recurring bi-weekly transactions in your Excel budget template?

Set up recurring bi-weekly transactions in your Excel budget template by creating a dedicated table with columns for transaction name, amount, category, and date, then use formulas to auto-fill dates every 14 days. Apply conditional formatting to highlight upcoming or overdue transactions, ensuring you stay on top of your budget. Linking this table to summary sheets enables seamless tracking of bi-weekly expenses and helps maintain accurate financial planning.

How is a bi-weekly pay schedule calculated and tracked in your Excel budget sheet?

A bi-weekly pay schedule is calculated by recording income every two weeks, totaling 26 pay periods annually. Your Excel budget sheet tracks this by categorizing income into bi-weekly intervals and automatically updating balances for accurate budget monitoring. Formulas such as SUM and IF functions help manage and analyze pay cycles efficiently.

What formulas can automate the summing of bi-weekly income and expenses in Excel?

Use the SUMIFS formula to automate bi-weekly income and expenses summing by specifying date ranges in Excel. Implement SUMIFS(range_sum, range_date, ">=start_date", range_date, "<=end_date") for precise bi-weekly calculations. Combine with named ranges or dynamic date functions for efficient budget tracking automation.

How do you set up categories for recurring bi-weekly expenses in an Excel budget tracker?

To set up categories for recurring bi-weekly expenses in your Excel budget tracker, create a dedicated column labeled "Expense Category" and list each recurring expense, such as rent, utilities, and subscriptions. Use Excel formulas like SUMIF to total expenses within each category every two weeks, ensuring accurate tracking. Organize expenses by date and category to streamline budget analysis and optimize financial planning.

What is the best way to visualize bi-weekly budget variances using Excel charts or graphs?

Use clustered column charts to compare actual versus budgeted amounts for each bi-weekly period, highlighting variances with color-coded bars. Incorporate a line graph overlay to show cumulative budget trends over time, providing a clear visual of overspending or savings. Apply conditional formatting to the data table to instantly identify significant positive or negative variances.

How can conditional formatting in Excel help identify bi-weekly overspending patterns?

Conditional formatting in Excel highlights bi-weekly overspending by automatically changing cell colors based on your budget thresholds. This visual cue enables quick identification of patterns where expenses exceed allocated amounts. By applying rules to bi-weekly data, you can efficiently track and control spending habits.