The Bi-weekly Excel Template for Contractor Invoicing streamlines payment tracking by organizing hours worked and rates into a clear, easy-to-read format. This template ensures accurate calculations and timely invoicing, reducing errors and improving cash flow management. Customizable fields allow contractors to tailor the invoice to specific projects and client requirements.

Bi-Weekly Invoice Template for Contractors

A Bi-Weekly Invoice Template for contractors typically includes details such as work performed, hours logged, payment rates, and total amount due for the two-week period. It ensures clear communication of billing information between contractors and clients.

Important elements to include are contractor details, client information, invoice number, date, and payment terms. Keeping the invoice organized and professional helps expedite timely payments and maintain accurate records.

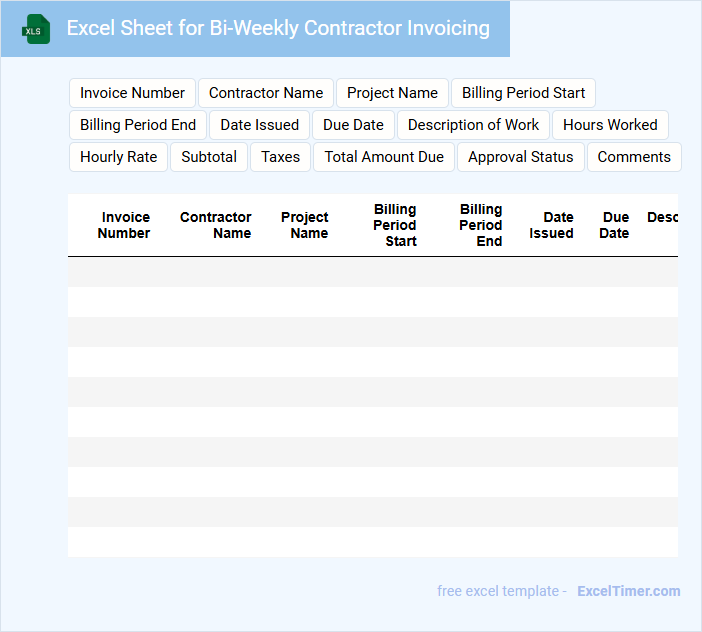

Excel Sheet for Bi-Weekly Contractor Invoicing

An Excel Sheet for Bi-Weekly Contractor Invoicing typically contains detailed records of hours worked, rates applied, and total payments due for each contractor over a two-week period. It helps streamline the payment process by providing clear and organized financial data. Ensuring accuracy in entries and maintaining up-to-date information are crucial for efficient invoicing and timely contractor payments.

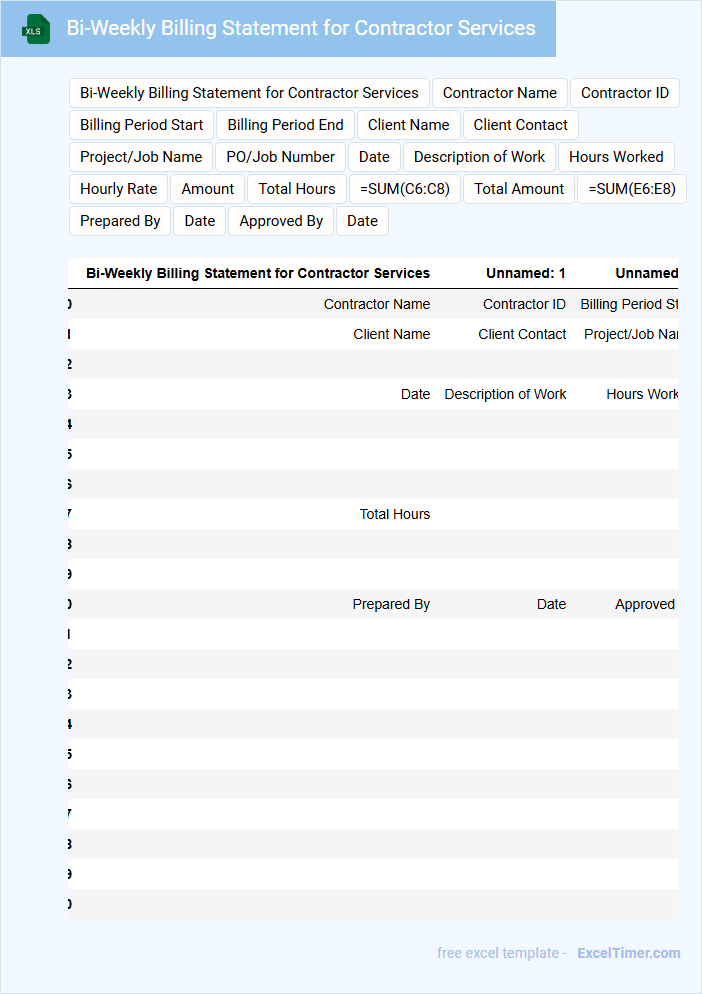

Bi-Weekly Billing Statement for Contractor Services

What information is typically included in a Bi-Weekly Billing Statement for Contractor Services? A Bi-Weekly Billing Statement usually contains details such as the contractor's name, the billing period dates, hours worked, hourly rates, and the total amount due. It serves as a clear record of services provided and ensures transparent communication between contractors and clients.

What important elements should be considered when preparing this billing statement? It is essential to accurately log all hours worked and provide itemized descriptions of tasks completed. Additionally, including payment terms, due dates, and contact information helps prevent misunderstandings and facilitates timely payments.

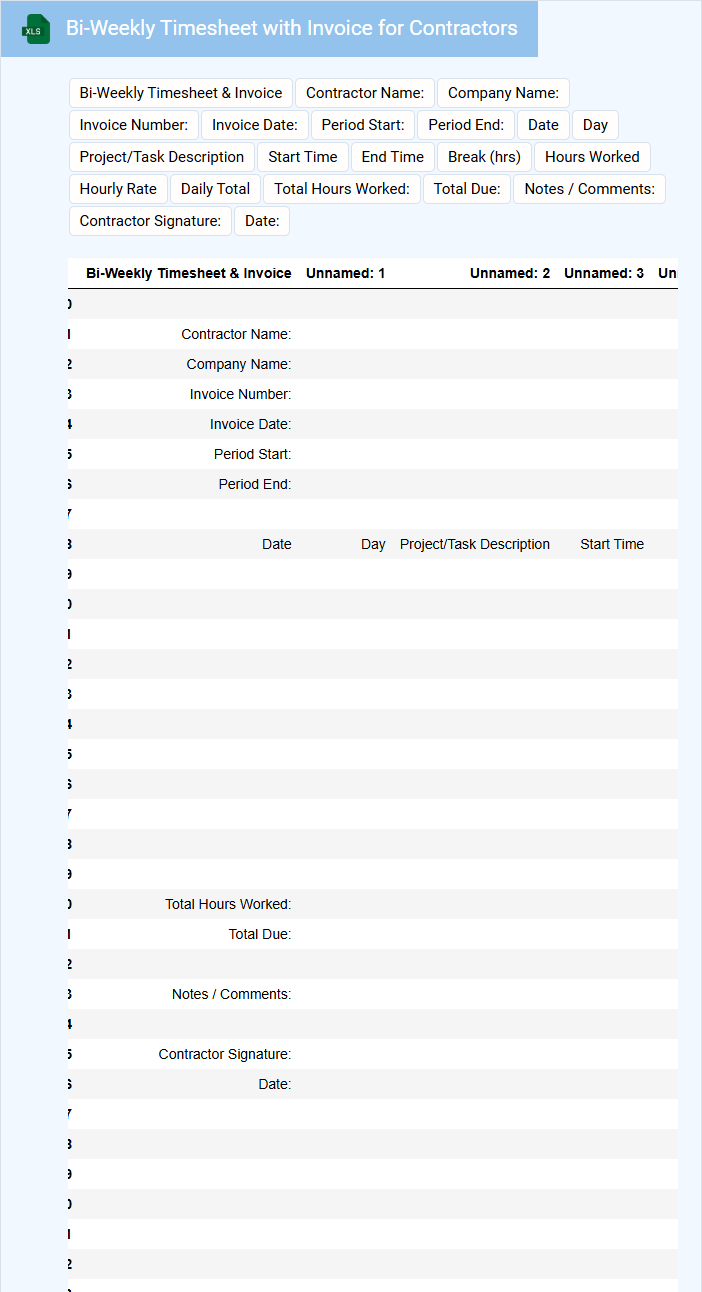

Bi-Weekly Timesheet with Invoice for Contractors

A Bi-Weekly Timesheet with Invoice for Contractors is a document that tracks hours worked and requests payment for services rendered over a two-week period.

- Accurate Time Tracking: Ensure all hours worked are precisely recorded and categorized by project or task.

- Invoice Details: Include clear payment terms, rates, and a breakdown of billed amounts to avoid disputes.

- Approval and Signatures: Obtain necessary approvals from both contractor and client to validate the timesheet and invoice.

Payment Tracker for Bi-Weekly Contractor Invoicing

What information is typically contained in a Payment Tracker for Bi-Weekly Contractor Invoicing? This document usually includes details such as invoice dates, contractor names, amounts due, payment status, and due dates. It helps in organizing and monitoring timely payments to contractors on a bi-weekly schedule.

What is an important suggestion for maintaining an effective Payment Tracker? Ensure real-time updates and clear categorization of paid versus unpaid invoices to prevent delays and avoid payment discrepancies. Consistent tracking fosters transparency and streamlined financial management.

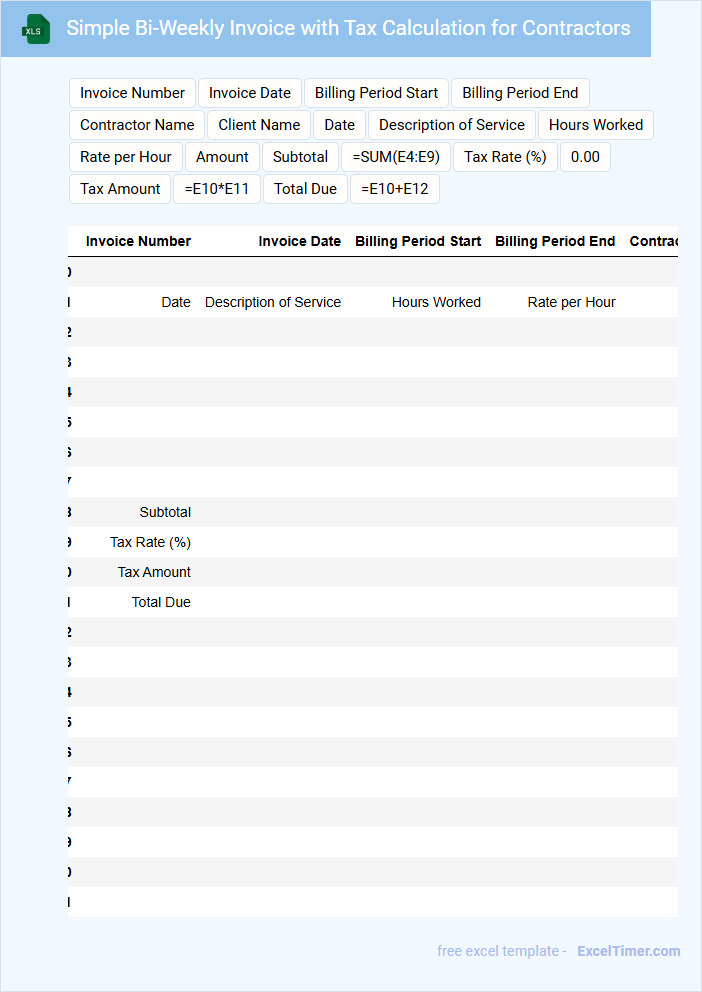

Simple Bi-Weekly Invoice with Tax Calculation for Contractors

A Simple Bi-Weekly Invoice is a document used by contractors to bill their clients for services rendered every two weeks. It typically includes a detailed list of tasks completed, hours worked, and the agreed-upon rates.

Including a Tax Calculation section is essential for clarity and compliance, showing the applied tax rate and the total tax amount. This helps ensure accurate payments and proper financial records for both parties.

Make sure to clearly state the payment terms and contact information for any queries to facilitate smooth transactions and timely payments.

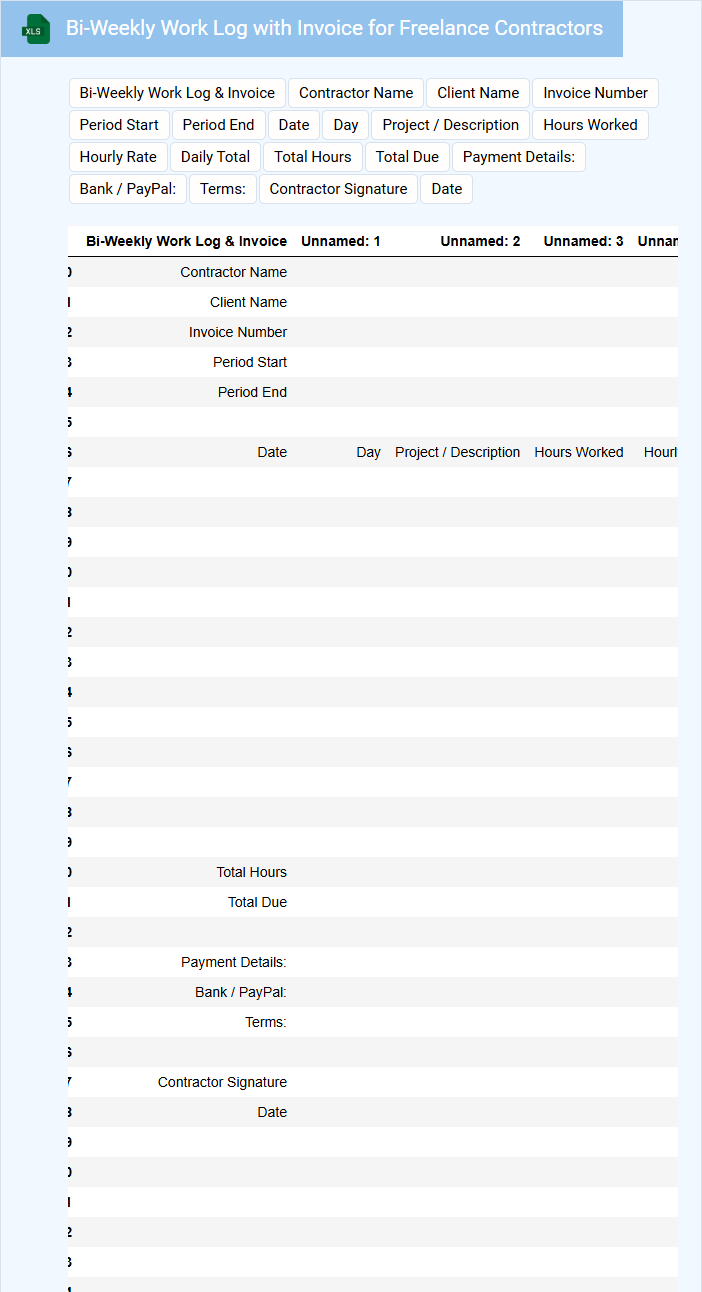

Bi-Weekly Work Log with Invoice for Freelance Contractors

What information is typically included in a Bi-Weekly Work Log with Invoice for Freelance Contractors?

This type of document usually contains a detailed record of tasks completed, hours worked, and corresponding dates within a two-week period. It also includes an invoice section outlining payment terms, rates, and total amount due to ensure clear communication between the contractor and client.

To optimize its effectiveness, it is important to consistently track daily activities and provide precise descriptions along with accurate billing information to avoid disputes and facilitate timely payments.

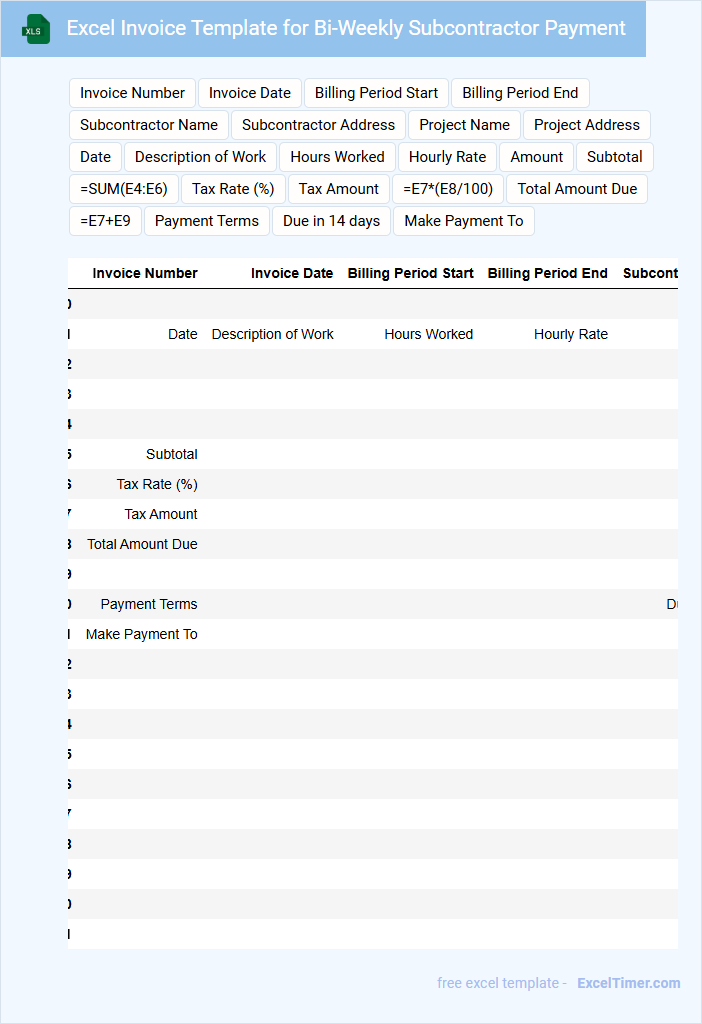

Excel Invoice Template for Bi-Weekly Subcontractor Payment

An Excel Invoice Template for Bi-Weekly Subcontractor Payment is designed to streamline the billing process by detailing work completed and payment due every two weeks. This document typically includes sections for labor hours, rates, materials used, and total costs, ensuring clear communication between subcontractors and clients. Important elements to include are invoice number, payment terms, and a breakdown of services provided for accurate and timely payments.

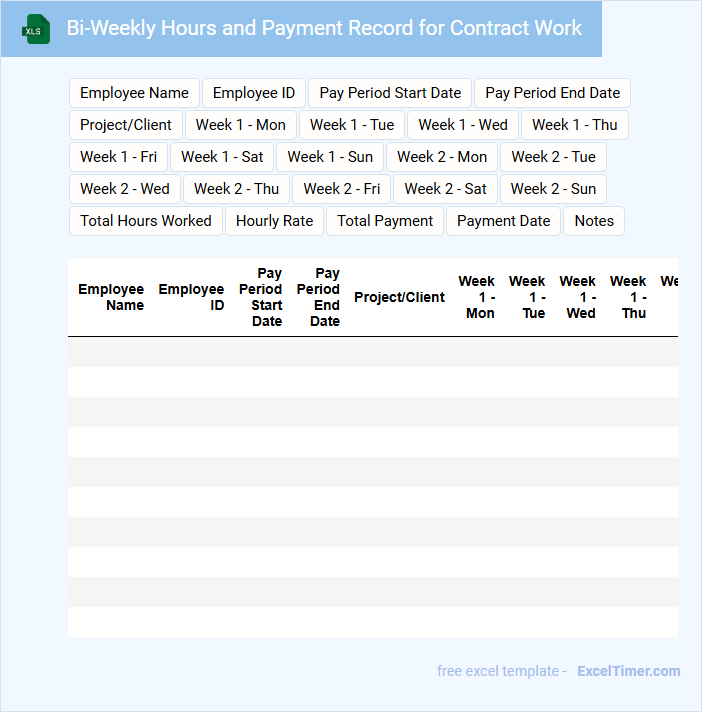

Bi-Weekly Hours and Payment Record for Contract Work

A Bi-Weekly Hours and Payment Record for contract work serves as a detailed log tracking the hours worked by contractors over a two-week period. It typically includes dates, tasks performed, hours logged each day, and total payment due based on agreed rates. Maintaining accurate records ensures transparent compensation and helps in resolving any payment disputes efficiently.

Bi-Weekly Billing Summary with Expense Tracking for Contractors

What information does a Bi-Weekly Billing Summary with Expense Tracking for Contractors typically contain? This document usually includes a detailed record of services provided by contractors over a two-week period, alongside corresponding expenses incurred. It helps ensure accurate billing and comprehensive expense management, facilitating clear communication between contractors and clients.

Why is it important to include expense tracking in this summary? Tracking expenses alongside billing provides transparency and accountability, making it easier to verify costs and prevent disputes. Including itemized expenses, dates, and related receipts enhances trust and supports efficient financial reconciliation.

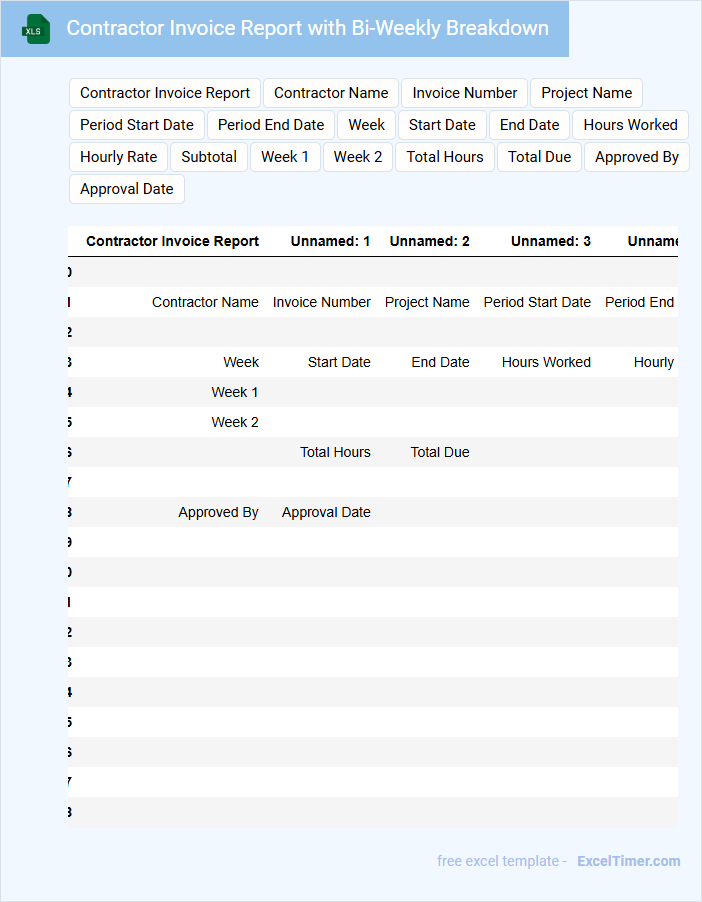

Contractor Invoice Report with Bi-Weekly Breakdown

The Contractor Invoice Report typically contains detailed information about the work performed, hours logged, and payment amounts due for contractors. It includes a transparent breakdown of costs to ensure accurate and timely payments.

This report is often organized with a bi-weekly breakdown to facilitate regular financial tracking and budgeting. Ensuring clarity and accuracy in each period's entries is crucial for effective expense management.

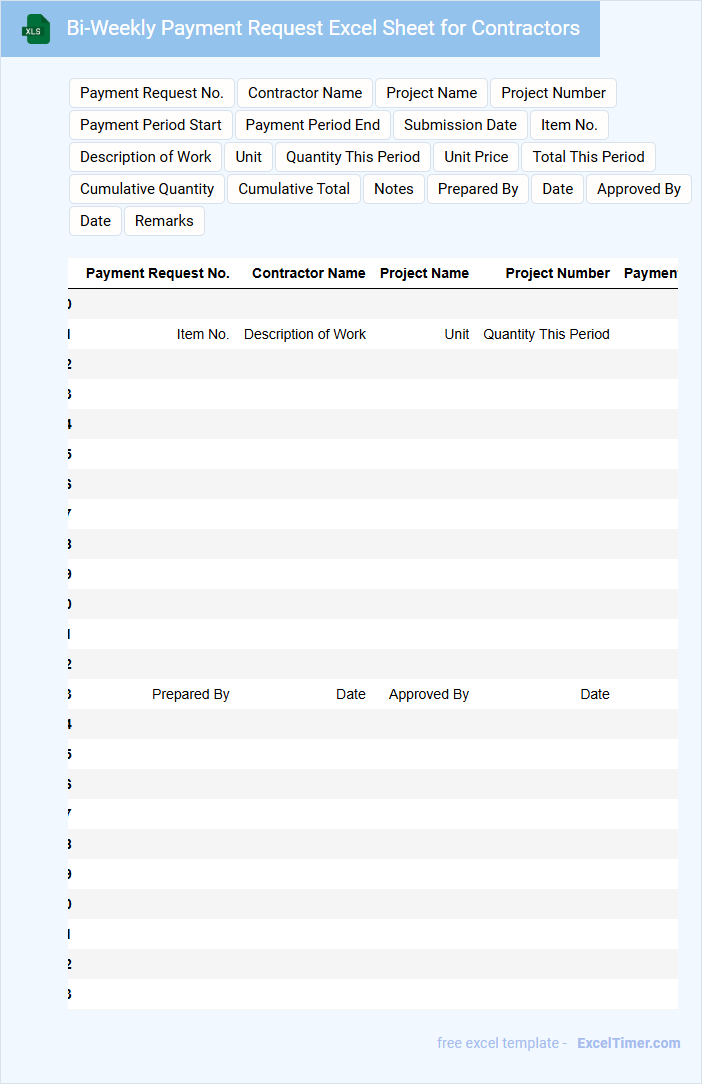

Bi-Weekly Payment Request Excel Sheet for Contractors

A Bi-Weekly Payment Request Excel Sheet for Contractors is a document used to track and request payments for work completed during a two-week period. It organizes labor, hours worked, rates, and total payment due in a clear, concise format.

- Include detailed labor descriptions to avoid payment disputes.

- Ensure accurate calculation of hours and rates for precise payment amounts.

- Maintain a running total and previous payment history for transparency.

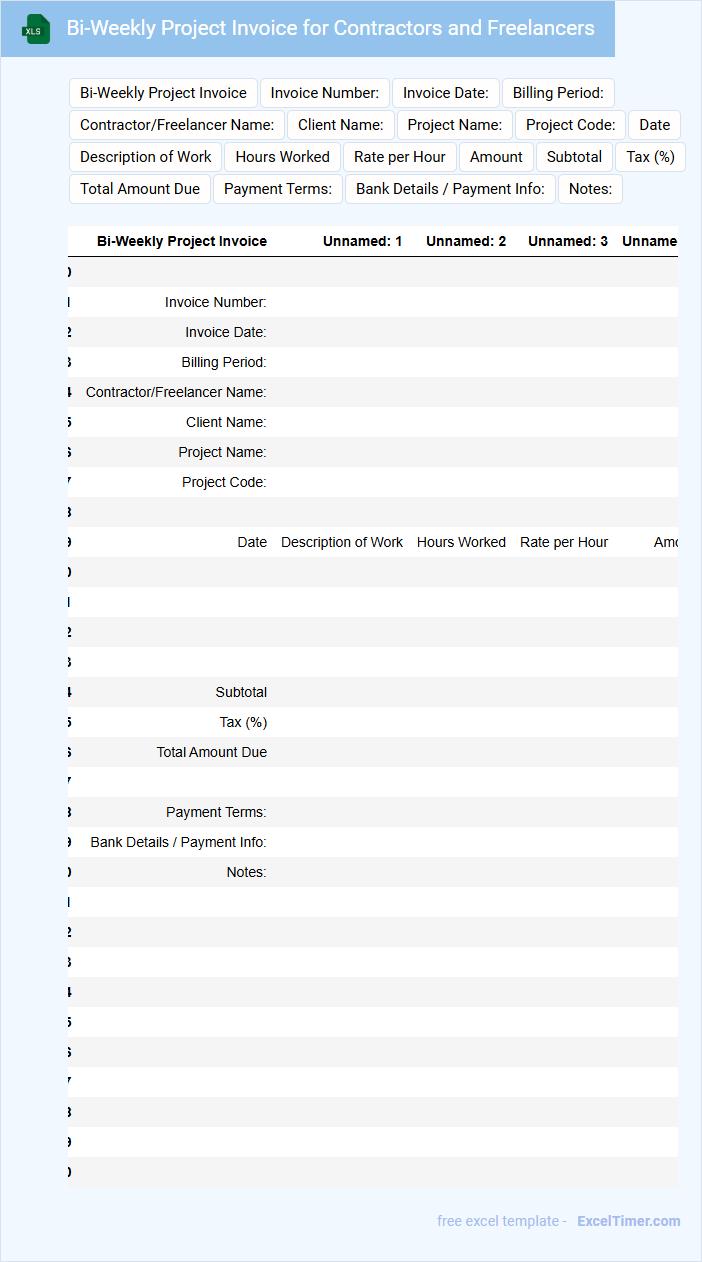

Bi-Weekly Project Invoice for Contractors and Freelancers

A Bi-Weekly Project Invoice for Contractors and Freelancers typically contains detailed billing information to ensure timely and accurate payments.

- Itemized services: clearly list all tasks or milestones completed within the bi-weekly period.

- Payment terms: specify due dates and accepted payment methods to avoid delays.

- Contact information: include both contractor and client details for effective communication.

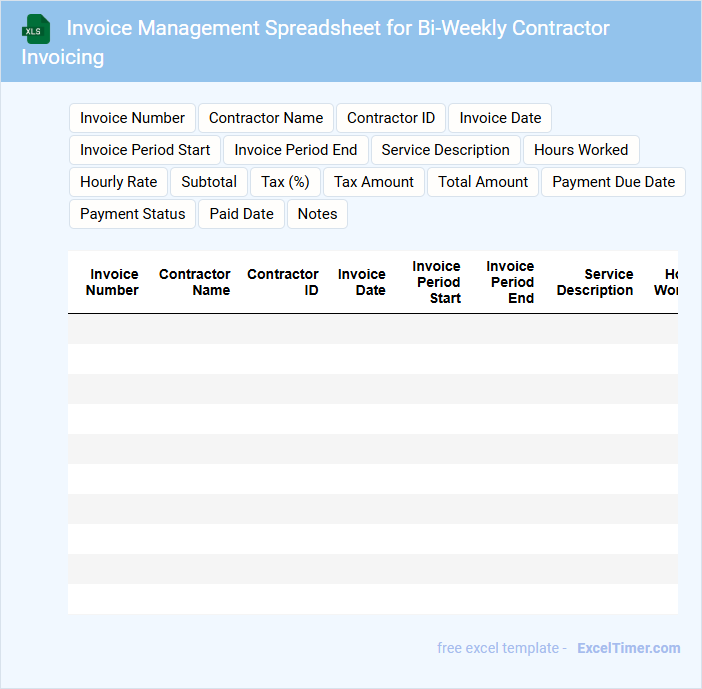

Invoice Management Spreadsheet for Bi-Weekly Contractor Invoicing

An Invoice Management Spreadsheet is typically used to organize and track contractor payments efficiently. It contains essential details such as invoice dates, amounts, payment status, and contractor information. This document ensures timely payment and accurate financial record-keeping for bi-weekly invoicing cycles.

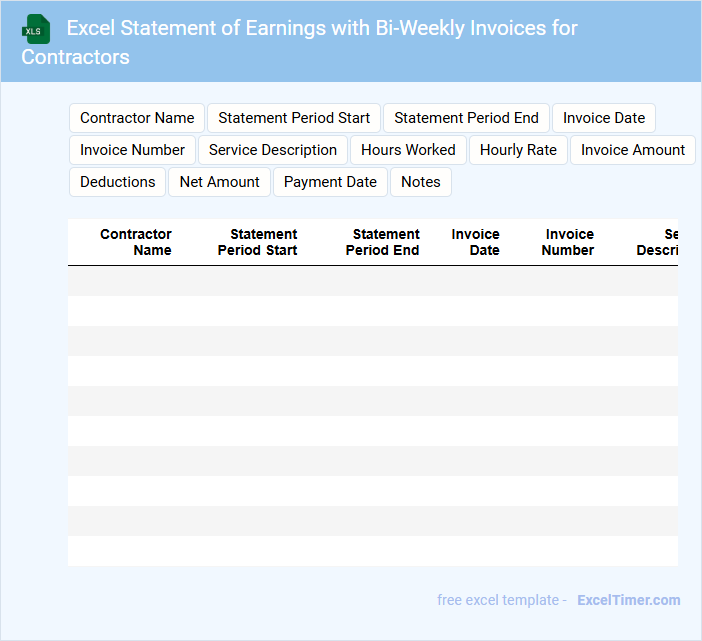

Excel Statement of Earnings with Bi-Weekly Invoices for Contractors

What information does an Excel Statement of Earnings with Bi-Weekly Invoices for Contractors typically contain?

This document usually includes detailed records of hours worked, rates applied, and total earnings for contractors over bi-weekly periods. It serves as both a payroll overview and an invoice summary, ensuring transparent and accurate payment tracking.

Important considerations include verifying the accuracy of hours logged, ensuring tax and deduction details are clearly outlined, and maintaining consistent formatting for easy review by both contractors and accounting teams.

What is the standard definition of a bi-weekly invoicing period for contractors in Excel?

A bi-weekly invoicing period for contractors in Excel typically refers to a 14-day span used to track hours worked and generate payment requests every two weeks. This period starts on a specific day of the week and repeats consistently, allowing precise calculation of billable time and costs. Excel templates often include date ranges, total hours, hourly rates, and payment amounts to streamline invoicing accuracy.

How do you set up dynamic date ranges to accurately calculate bi-weekly periods in Excel?

To set up dynamic date ranges for bi-weekly periods in Excel, use the formula `=A1 + 14` to increment the start date every two weeks, where A1 contains your initial invoice date. Apply the `WEEKDAY` function to align dates with your billing cycle, ensuring accurate period boundaries. This method streamlines your contractor invoicing by automating date calculations in your bi-weekly schedule.

Which Excel formulas are best for automatically summing hours or fees within each bi-weekly cycle?

Use the SUMIFS formula in Excel to automatically sum hours or fees within each bi-weekly cycle by setting criteria based on date ranges. Apply the formula: =SUMIFS(range_to_sum, date_range, ">=start_date", date_range, "<=end_date") where start_date and end_date define each bi-weekly period. This method ensures precise aggregation of contractor hours or fees for accurate bi-weekly invoicing.

What columns are essential to include in a bi-weekly contractor invoice template for clarity and compliance?

Include essential columns such as Contractor Name, Invoice Number, Billing Period, Hours Worked, Hourly Rate, Total Amount Due, and Payment Terms to ensure clarity and compliance. Your invoice should also feature Project or Task Description and Date of Service for accurate record-keeping. These columns provide a comprehensive overview for efficient bi-weekly contractor invoicing.

How can you efficiently track and reference bi-weekly invoice numbers sequentially in Excel?

Use an Excel spreadsheet with a dedicated column for invoice numbers, starting with the initial number and applying a formula like =A2+1 to increment sequentially for each bi-weekly period. Incorporate date stamps to align invoices with specific weeks, ensuring accuracy and easy referencing. This method allows you to maintain organized and efficient bi-weekly contractor invoicing.