The Bi-weekly Salary Calculator Excel Template for Part-time Employees simplifies payroll management by accurately calculating wages based on hours worked every two weeks. It ensures precise salary tracking, accounting for overtime and deductions, which reduces errors and saves time for HR professionals. This template is highly customizable, making it ideal for businesses with varying part-time schedules.

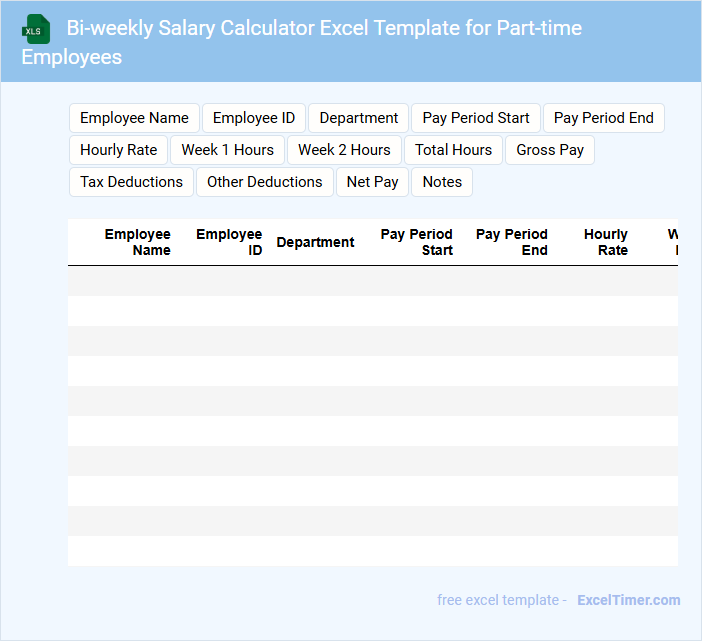

Bi-weekly Salary Calculator Excel Template for Part-time Employees

This Bi-weekly Salary Calculator Excel Template is designed to simplify payroll calculations for part-time employees by automating hours worked and wage inputs. It typically contains fields for hourly rates, total hours worked, deductions, and net pay calculations. Ensuring accurate data entry and including tax considerations are important for effective use of this document.

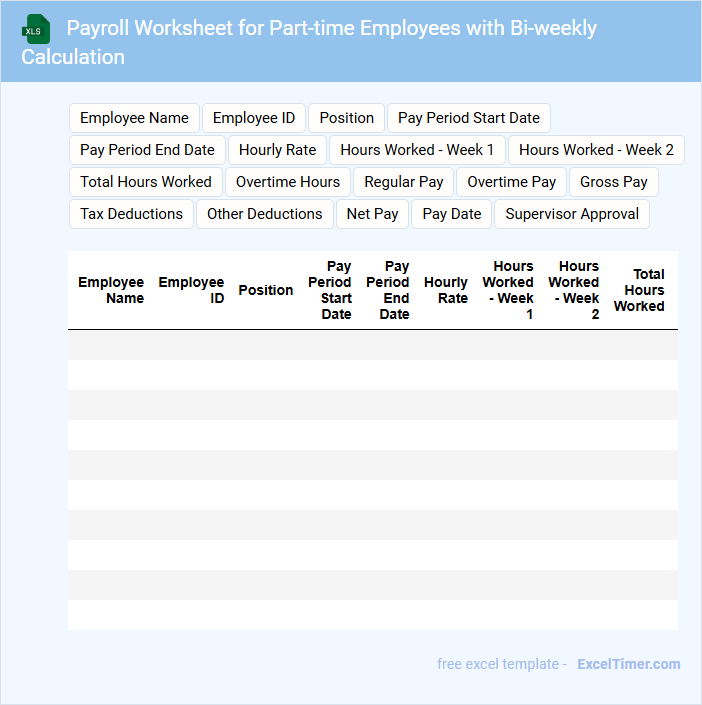

Payroll Worksheet for Part-time Employees with Bi-weekly Calculation

Payroll worksheets for part-time employees with bi-weekly calculation typically contain detailed records of hours worked, wages, deductions, and net pay.

- Accurate Hours Tracking: Ensure all hours worked, including overtime, are precisely recorded to avoid payroll errors.

- Deductions and Taxes: Clearly list all applicable deductions such as taxes, benefits, and other withholdings.

- Summary and Verification: Include a summary section for total pay and a verification area for employee and employer signatures.

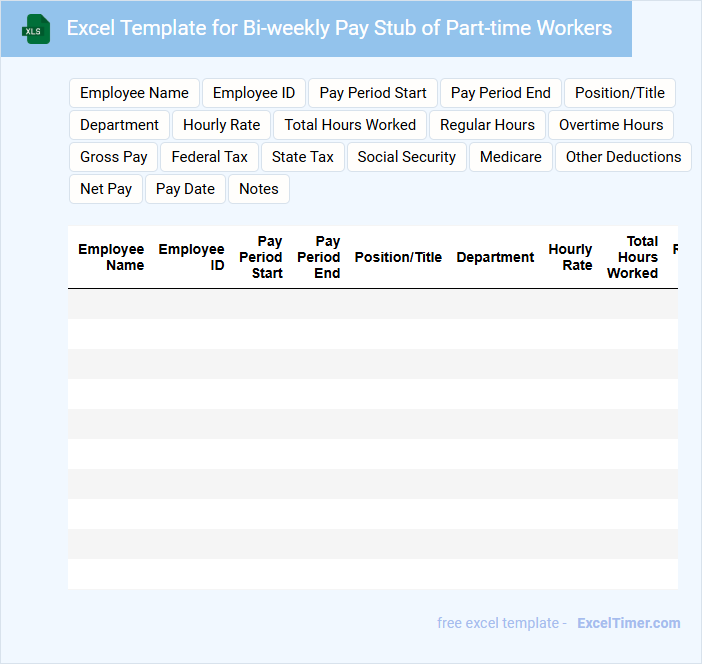

Excel Template for Bi-weekly Pay Stub of Part-time Workers

The Excel Template for Bi-weekly Pay Stub of Part-time Workers is typically used to document employee earnings and deductions over a two-week period. It contains fields for hours worked, pay rates, taxes, and other deductions to accurately calculate net pay. This type of document helps maintain transparent and organized payroll records.

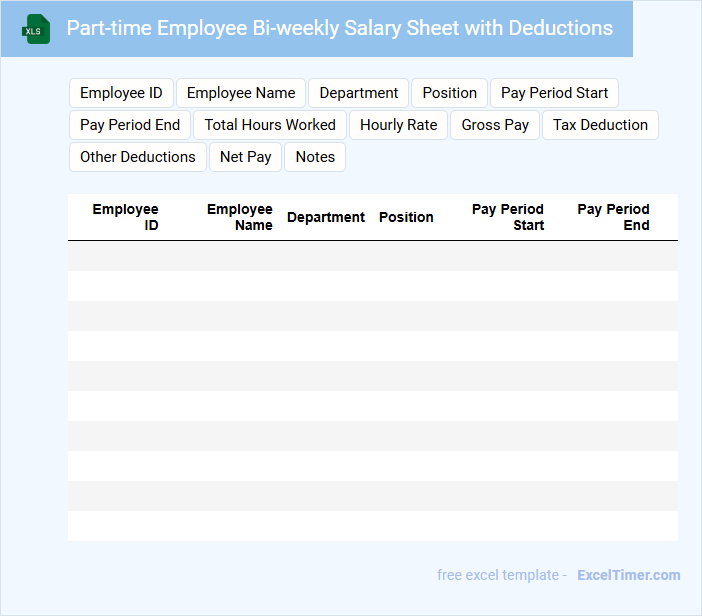

Part-time Employee Bi-weekly Salary Sheet with Deductions

Part-time Employee Bi-weekly Salary Sheet with Deductions typically contains detailed earnings, deductions, and net pay information for each pay period.

- Accurate Earnings Records: Include all hours worked and corresponding pay rates for precise salary calculation.

- Comprehensive Deductions: Clearly list tax withholdings, benefits contributions, and any other deductions applied.

- Net Pay Summary: Provide the final amount payable after all deductions for transparency and record keeping.

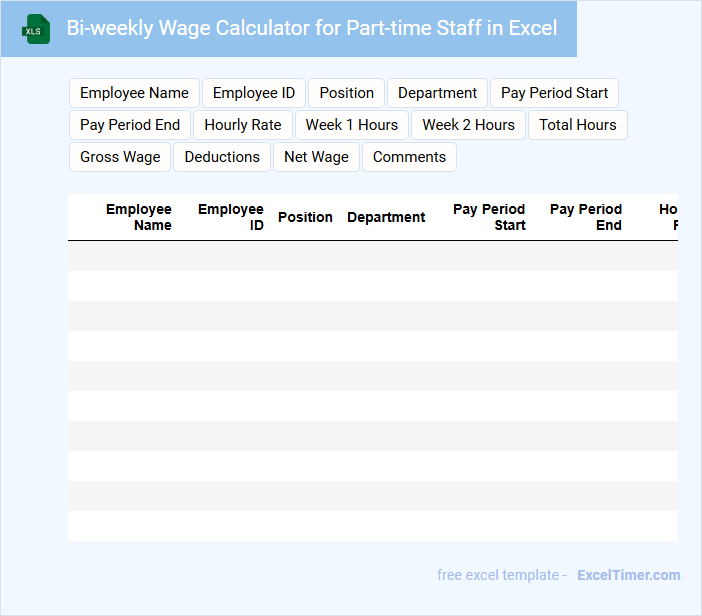

Bi-weekly Wage Calculator for Part-time Staff in Excel

This document typically contains a spreadsheet designed to calculate wages for part-time staff based on bi-weekly hours worked and pay rates.

- Accurate hourly rate input is essential for correct wage calculations.

- Tracking total hours worked ensures payroll accuracy over the bi-weekly period.

- Incorporating deductions and bonuses provides a complete net pay calculation.

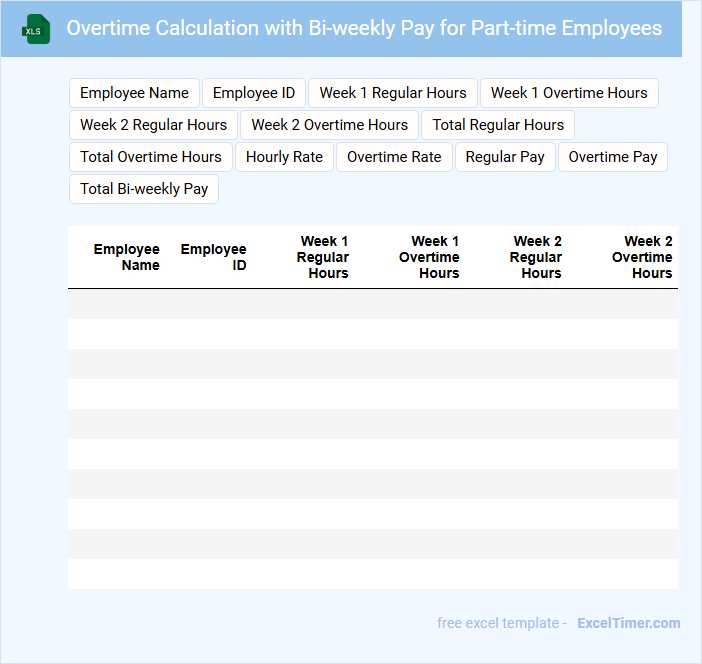

Overtime Calculation with Bi-weekly Pay for Part-time Employees

This document typically contains a detailed explanation of the overtime calculation method specifically tailored for part-time employees who receive bi-weekly pay. It outlines the criteria for qualifying hours, the overtime rate, and methods to accurately track hours worked beyond the standard schedule.

It also includes guidelines for compliance with labor laws and payroll policies to ensure fair compensation. A key suggestion is to maintain precise timekeeping records to support accuracy in overtime payments and avoid disputes.

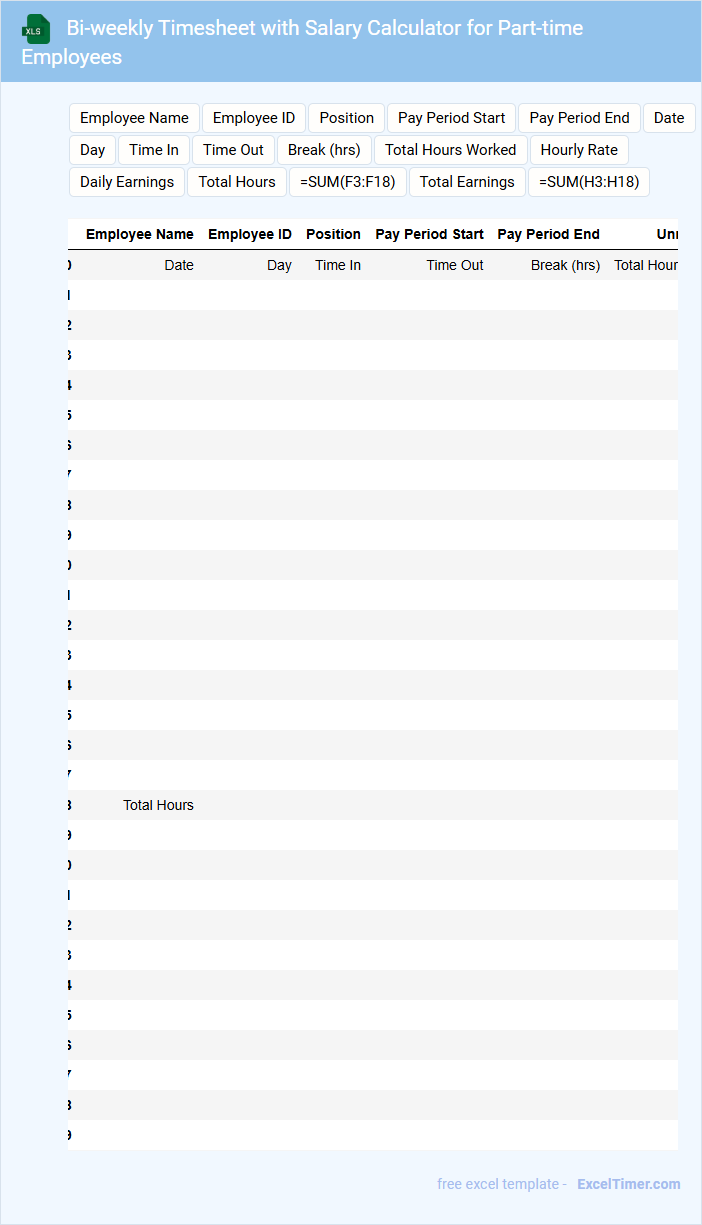

Bi-weekly Timesheet with Salary Calculator for Part-time Employees

What information is typically included in a bi-weekly timesheet with a salary calculator for part-time employees? This type of document usually contains employee details, hours worked each day, total hours for the pay period, and the corresponding salary calculation based on hourly rates and any applicable deductions or bonuses. It helps ensure accurate tracking of work hours and simplifies payroll processing for both employees and employers.

What are important considerations when using this timesheet? It is crucial to maintain precise recording of hours to avoid payment errors and to update hourly rates or salary rules promptly to reflect changes in employment terms or legal requirements. Additionally, integrating validation checks and clear instructions improves usability and reduces mistakes.

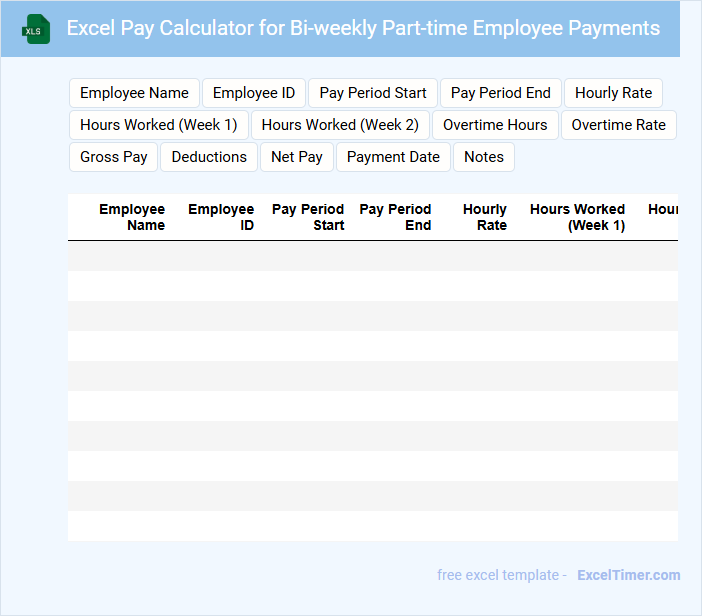

Excel Pay Calculator for Bi-weekly Part-time Employee Payments

What information is typically included in an Excel Pay Calculator for Bi-weekly Part-time Employee Payments? This type of document usually contains employee work hours, pay rates, and calculated total earnings for each pay period. It helps ensure accurate and efficient payroll processing by automating calculations and tracking payment details.

What is an important consideration when using this Excel Pay Calculator? It is essential to include fields for overtime, deductions, and tax calculations to reflect accurate net pay. Additionally, maintaining clear labels and instructions improves usability and minimizes errors in payroll computation.

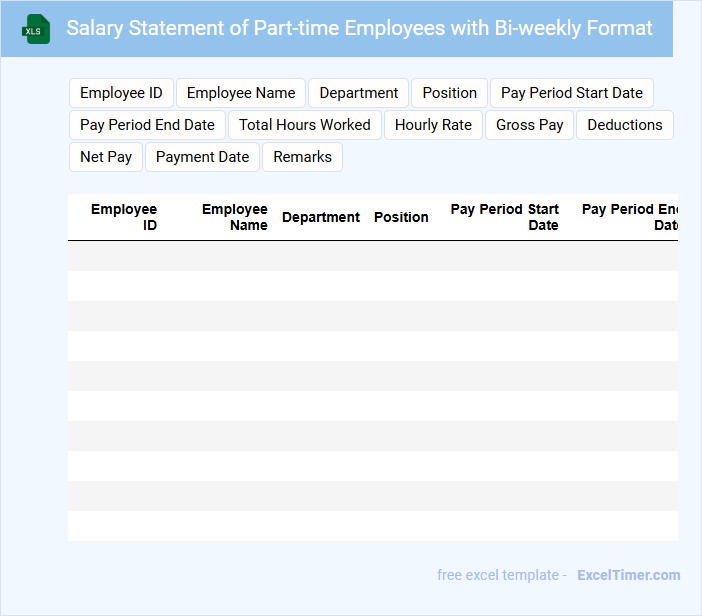

Salary Statement of Part-time Employees with Bi-weekly Format

A Salary Statement for part-time employees typically contains detailed information about the employee's earnings over a specific period, usually including hours worked, rate of pay, and deductions. This document follows a bi-weekly format, meaning it covers payments for every two-week period, helping both employers and employees track compensation regularly. It is crucial to ensure accuracy and transparency in reporting all wage components to maintain trust and comply with labor regulations.

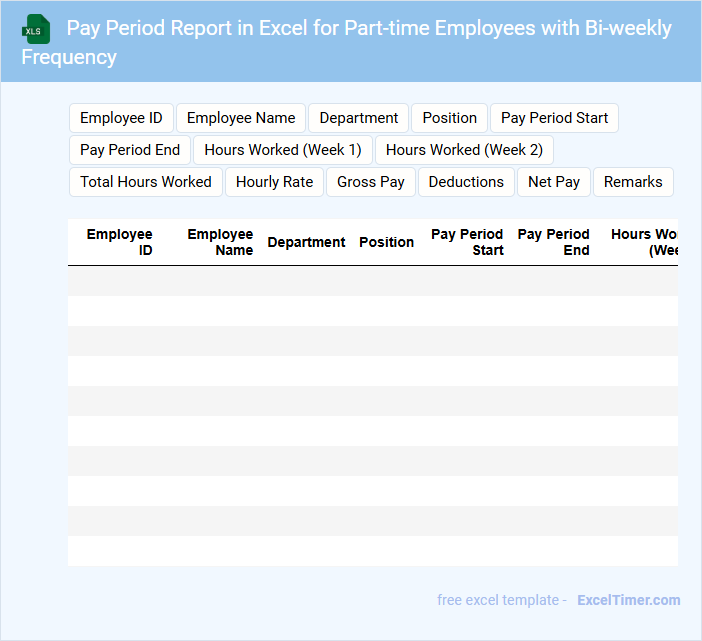

Pay Period Report in Excel for Part-time Employees with Bi-weekly Frequency

What information is typically included in a Pay Period Report in Excel for Part-time Employees with Bi-weekly Frequency? This document usually contains employee names, hours worked per pay period, hourly rates, total pay, and deductions. It is designed to summarize earnings and ensure accurate payroll processing for each bi-weekly cycle.

What important factors should be considered when preparing this report? Ensuring accurate tracking of hours worked and differentiating overtime or holiday pay are essential. Additionally, including clear date ranges for each pay period and verifying employee classification can help maintain compliance and payroll accuracy.

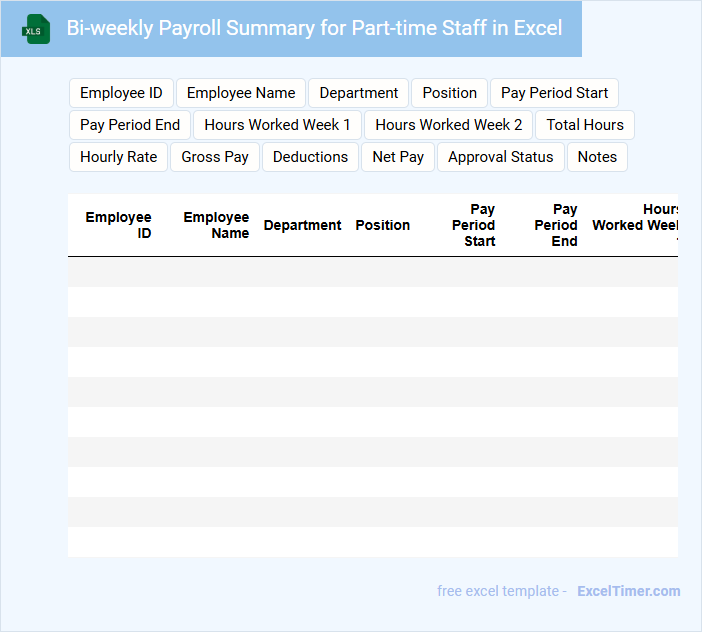

Bi-weekly Payroll Summary for Part-time Staff in Excel

What information is typically included in a bi-weekly payroll summary for part-time staff in Excel? This document usually contains detailed records of employee hours worked, pay rates, total earnings, deductions, and net pay for each employee over a two-week period. It provides a clear overview of payroll calculations, ensuring accuracy and compliance with labor regulations.

What important aspects should be considered when preparing this summary? Ensure accurate time tracking, double-check pay rates and deductions, and maintain confidentiality of personal and financial data. Using Excel's functions for automation and error checking can enhance reliability and efficiency.

Earnings Tracker with Bi-weekly Salary for Part-time Employees

An earnings tracker for part-time employees is a document designed to monitor and record the bi-weekly salary payments accurately. It helps in maintaining transparency and ensures consistent payroll management.

Such documents typically contain employee details, hours worked, pay rates, deductions, and net salary. Including a section for overtime and bonuses is also a valuable addition for comprehensive tracking.

Part-time Employee Bi-weekly Wage Tracker Excel Template

A Part-time Employee Bi-weekly Wage Tracker Excel template is designed to efficiently record and manage the wages of part-time employees on a bi-weekly basis. It typically contains details such as employee names, hours worked, pay rates, and total earnings for each pay period. Using this tracker helps ensure accurate payroll calculations and timely payments.

Important elements to include are clear columns for work hours and overtime, automatic wage calculations, and space for deductions or bonuses. Additionally, implementing data validation and protected cells can reduce errors when entering information. Regularly updating and reviewing the tracker supports compliance with labor laws and improves payroll transparency.

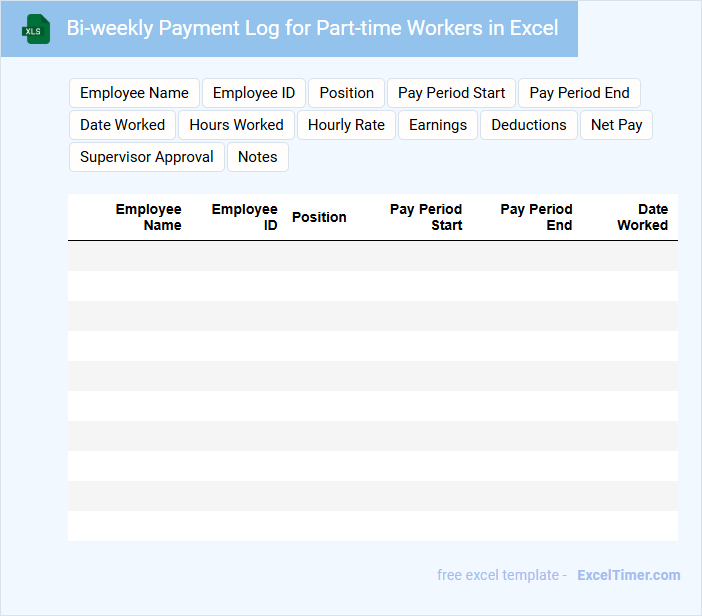

Bi-weekly Payment Log for Part-time Workers in Excel

A Bi-weekly Payment Log for part-time workers is a crucial document that tracks employee hours and payment details every two weeks. It usually contains employee names, dates worked, hours logged, pay rates, and total compensation. Maintaining accuracy in this log ensures timely payments and simplifies payroll management.

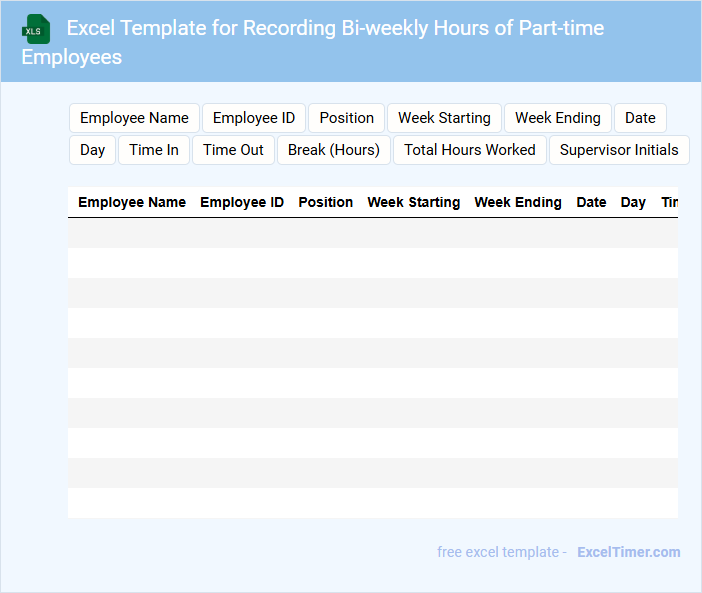

Excel Template for Recording Bi-weekly Hours of Part-time Employees

An Excel Template for recording bi-weekly hours of part-time employees typically contains fields for employee names, dates, hours worked each day, and total hours. It often includes formulas to calculate pay based on hourly rates and to ensure compliance with labor regulations.

This document is crucial for accurate time tracking and payroll processing. It helps managers monitor work hours efficiently and avoid errors in compensation.

For best results, ensure the template includes validation checks, clear instructions, and accommodations for overtime or leave.

What essential columns should be included in an Excel bi-weekly salary calculator for part-time employees?

Essential columns for a bi-weekly salary calculator for part-time employees include Employee Name, Employee ID, Pay Period Start Date, Pay Period End Date, Hours Worked, Hourly Rate, Overtime Hours, Overtime Rate, Gross Pay, Taxes Deducted, Other Deductions, and Net Pay. These columns ensure accurate tracking of work hours, pay rates, deductions, and final salary calculations. Including Date and Department can enhance data organization and reporting.

How do you accurately calculate bi-weekly gross pay based on varying part-time hours worked?

To accurately calculate bi-weekly gross pay for part-time employees, multiply the total hours worked during the two-week period by the employee's hourly wage rate. Include any overtime hours by applying the appropriate overtime pay rate, typically 1.5 times the regular hourly rate. Ensure all hours are correctly tracked in the Excel document to automate precise bi-weekly gross pay calculations.

Which formulas are necessary to deduct taxes and other withholdings in the salary calculation?

Essential formulas in a Bi-weekly Salary Calculator for part-time employees include calculating gross pay by multiplying hours worked by the hourly rate, then subtracting tax withholdings such as federal income tax using VLOOKUP with tax tables, Social Security tax (6.2% of gross pay), Medicare tax (1.45%), and any state or local taxes. Use SUM functions to total deductions and subtract these from gross pay to derive net pay. Incorporate IF statements to handle tax exemptions or thresholds based on employee details for accurate withholding calculations.

How can overtime hours and rates be integrated for part-time employees in the Excel calculator?

Integrate overtime hours and rates by adding columns for "Overtime Hours" and "Overtime Rate" to the Excel sheet. Use formulas to calculate overtime pay by multiplying overtime hours by the overtime rate, then add this to the regular salary calculation. Ensure clear labels and data validation for accurate input and automated total salary computation.

What conditional formatting can highlight pay discrepancies or missing data in the bi-weekly salary sheet?

Use conditional formatting rules like "Highlight Cells Rules" to flag pay discrepancies by comparing expected and actual salary figures, and apply "Blank Cells" formatting to identify missing data in Your bi-weekly salary calculator. Setting rules to highlight negative values or unusually high payments helps detect calculation errors or anomalies instantly. This approach ensures accurate tracking and timely correction of salary details for part-time employees.