The Bi-weekly Excel Template for Household Expenses helps efficiently track and manage your income and spending every two weeks, ensuring accurate budgeting. It features customizable categories, automatic calculations, and visual charts to monitor cash flow and identify savings opportunities. Using this template promotes financial discipline and prevents overspending within bi-weekly pay periods.

Bi-Weekly Budget Tracker for Household Expenses

A Bi-Weekly Budget Tracker for Household Expenses typically contains detailed records of income and expenditures over two-week periods. It helps in monitoring spending habits and ensuring expenses do not exceed earnings.

This document often includes categorized expense entries such as groceries, utilities, and entertainment, along with total calculations for each category. Consistent updating and reviewing are important to maintain accurate financial awareness and control.

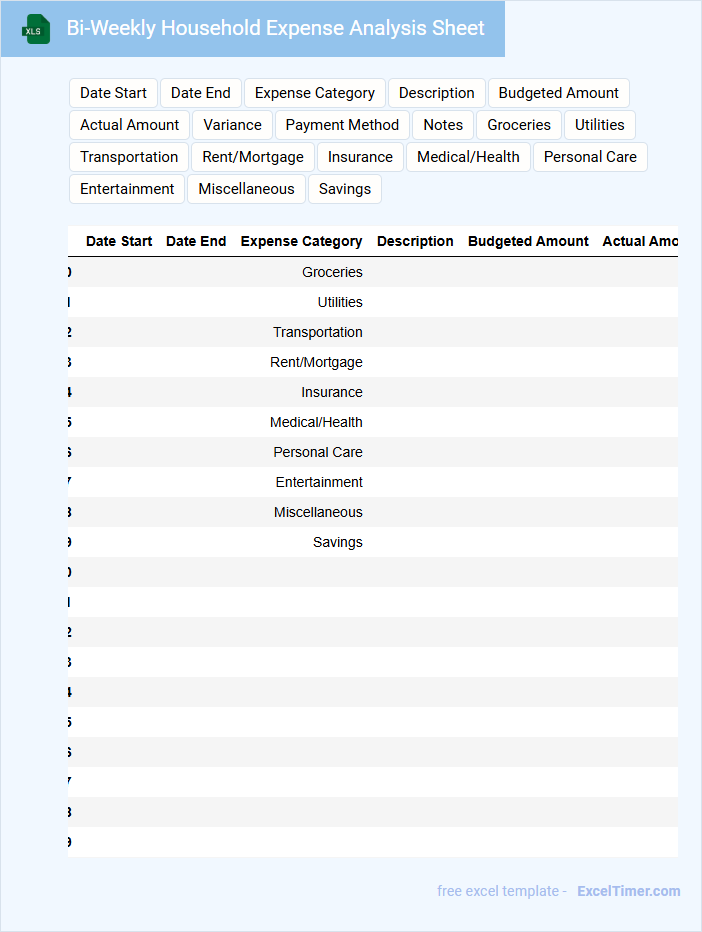

Bi-Weekly Household Expense Analysis Sheet

A Bi-Weekly Household Expense Analysis Sheet is a document used to track and review household expenditures every two weeks to manage and optimize budgeting effectively. It helps individuals or families understand their spending patterns and make informed financial decisions.

- Include categories for all regular expenses such as utilities, groceries, and transportation.

- Record dates and amounts for each transaction to identify spending trends.

- Compare actual expenses against budgeted amounts to spot discrepancies and adjust spending.

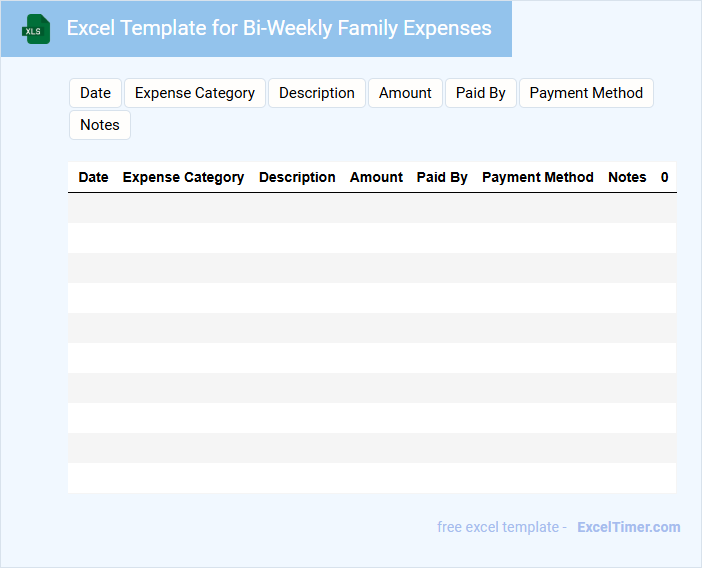

Excel Template for Bi-Weekly Family Expenses

An Excel Template for Bi-Weekly Family Expenses typically contains categorized expense fields, income tracking, and automatic calculations for budgeting purposes. It helps families organize their finances efficiently by breaking down expenses into manageable two-week periods. Using this template can provide clear insights into spending habits, aiding in better financial decisions.

Simple Bi-Weekly Tracker for Household Spending

A Simple Bi-Weekly Tracker for household spending is a document designed to monitor income and expenses over two-week periods, helping users maintain financial awareness. It usually contains categories such as groceries, utilities, transportation, and entertainment to organize spending efficiently.

Including a summary of total income and expenses helps visualize cash flow and identify savings opportunities. Regular updates and accurate entries are important to ensure the tracker reflects true spending habits.

Bi-Weekly Planner with Categories for Home Expenses

What information is typically included in a bi-weekly planner with categories for home expenses? This type of document usually contains detailed sections for tracking income, savings, and various household expenditures within two-week periods. It helps organize spending by categorizing expenses such as groceries, utilities, rent, and entertainment, allowing for better financial management and budgeting.

What is an important consideration when using a bi-weekly planner for home expenses? Ensuring accurate and consistent categorization of expenses is crucial to identify spending patterns and adjust budgets effectively. Additionally, regularly updating and reviewing the planner can help maintain control over finances and avoid overspending.

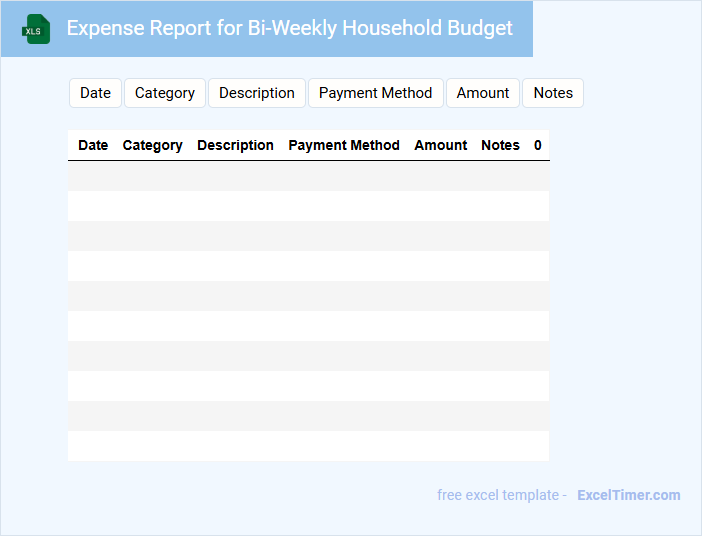

Expense Report for Bi-Weekly Household Budget

An Expense Report for a bi-weekly household budget typically contains detailed records of all income and expenditures within a two-week period. It helps track spending patterns, manage finances, and ensure that expenses do not exceed the available budget. Important elements include categorized expenses, total amounts, and notes explaining unusual or significant transactions.

Bi-Weekly Spreadsheet for Tracking Household Outflows

What is typically included in a Bi-Weekly Spreadsheet for Tracking Household Outflows? This document usually contains detailed records of all household expenses incurred every two weeks, categorized by type such as utilities, groceries, transportation, and miscellaneous costs. It helps in monitoring and managing cash flow effectively by providing a clear overview of expenditure trends over time.

What important elements should be considered when creating this spreadsheet? It is crucial to ensure accurate categorization and timely updates to reflect real spending, along with incorporating formulas for automatic calculations of totals and averages. Additionally, including a comparison feature with budgeted amounts can help identify overspending and optimize financial planning.

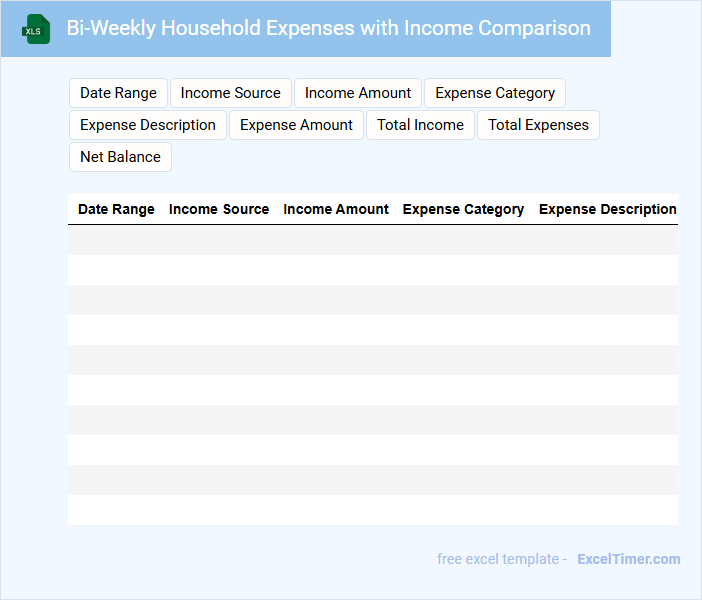

Bi-Weekly Household Expenses with Income Comparison

This document typically contains a detailed record of household expenses tracked every two weeks to monitor spending patterns and manage budgets effectively. It also includes a comparison with bi-weekly income to ensure financial balance and highlight areas needing adjustment.

Important elements to include are categorized expense lists and total income summaries for clear visibility. Regular updates and accurate data entry are crucial for maintaining meaningful insights and making informed financial decisions.

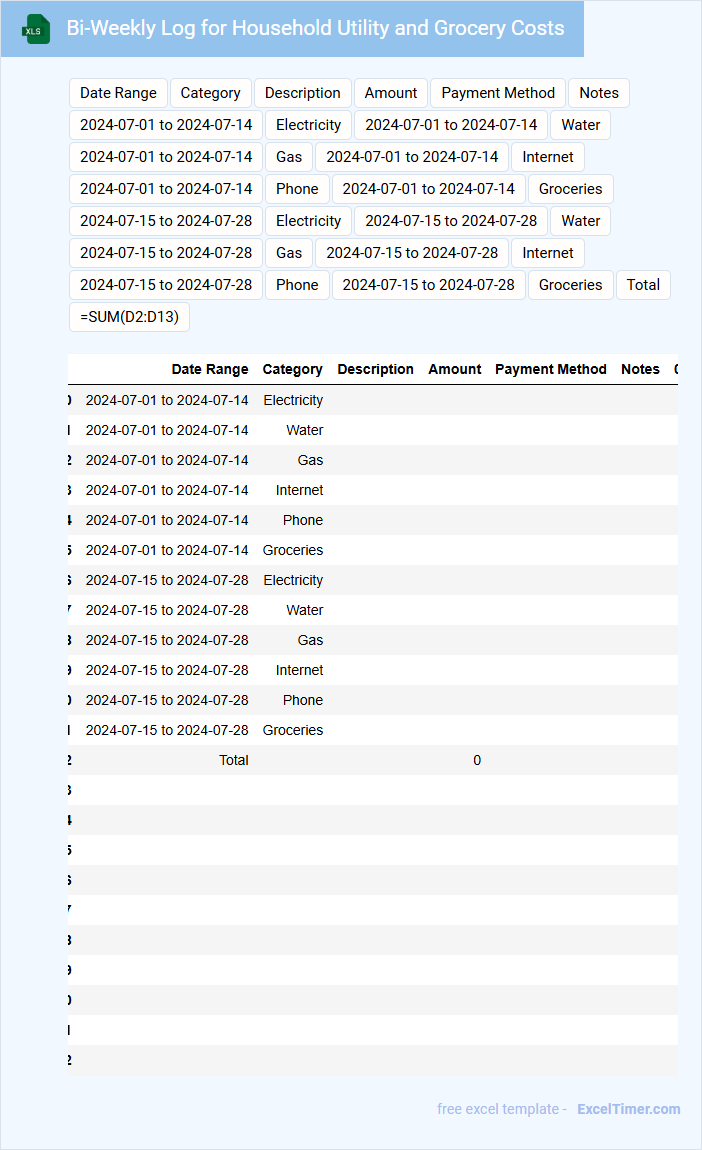

Bi-Weekly Log for Household Utility and Grocery Costs

A Bi-Weekly Log for Household Utility and Grocery Costs typically contains detailed records of all expenses incurred every two weeks. It includes entries for utilities like electricity, water, gas, and internet, alongside grocery purchases. Keeping this log helps monitor spending patterns and manage the household budget efficiently.

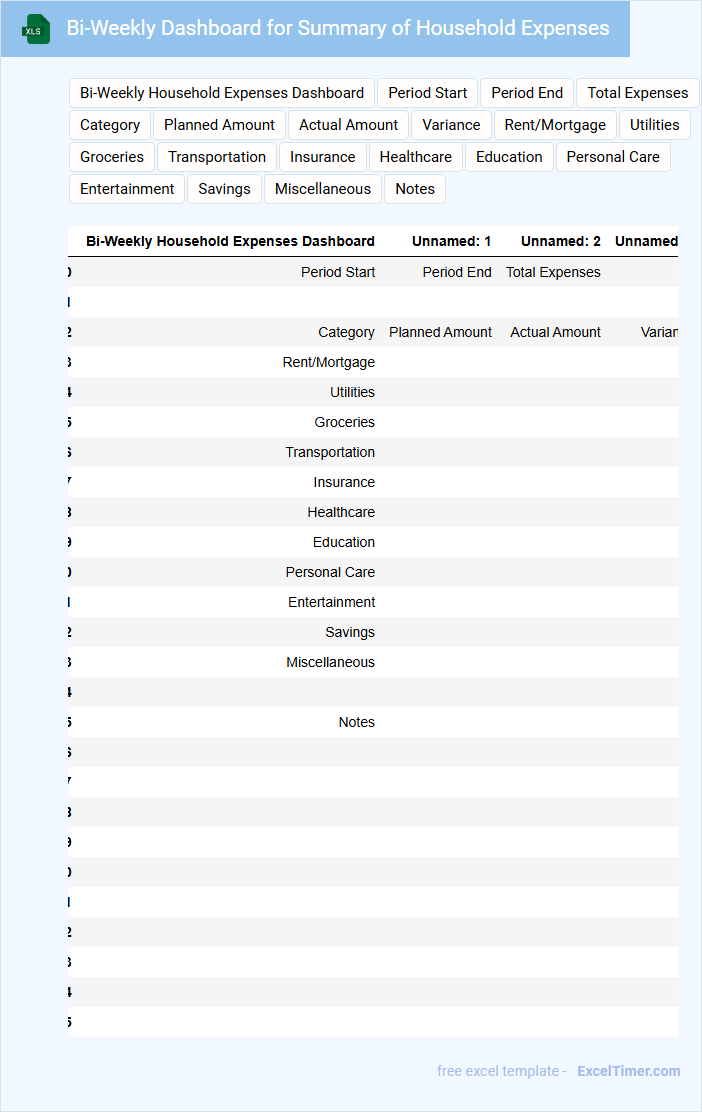

Bi-Weekly Dashboard for Summary of Household Expenses

A bi-weekly dashboard for summary of household expenses typically contains detailed tracking of income and expenditures over a two-week period, helping users to monitor their financial health consistently. It includes categorized expense data, visual charts for quick insights, and comparison with budgeted amounts to ensure spending stays within limits. An important suggestion is to regularly update the dashboard and highlight any unusual or significant transactions to maintain accurate budgeting.

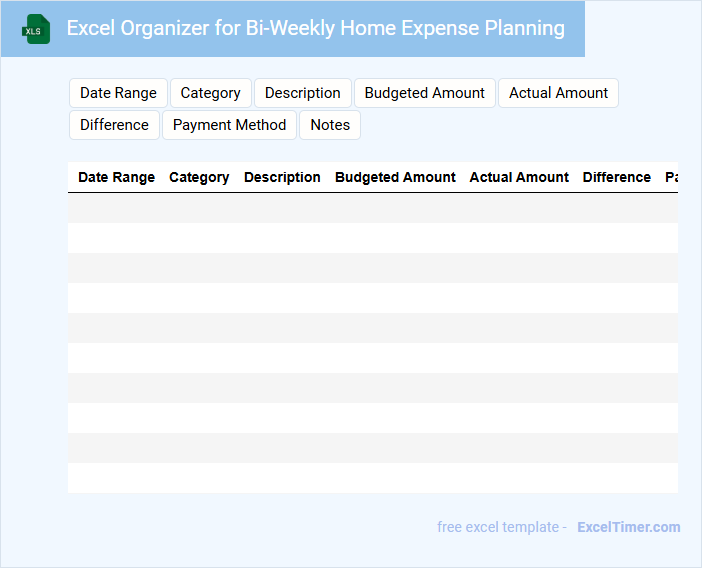

Excel Organizer for Bi-Weekly Home Expense Planning

An Excel Organizer for Bi-Weekly Home Expense Planning is a structured spreadsheet designed to track and manage household finances every two weeks. It typically contains categories for income, fixed expenses, variable costs, and savings goals.

Using clear formulas and organized tables ensures accurate and efficient budgeting. Important elements to include are expense categorization, payment due dates, and a summary for quick financial overview.

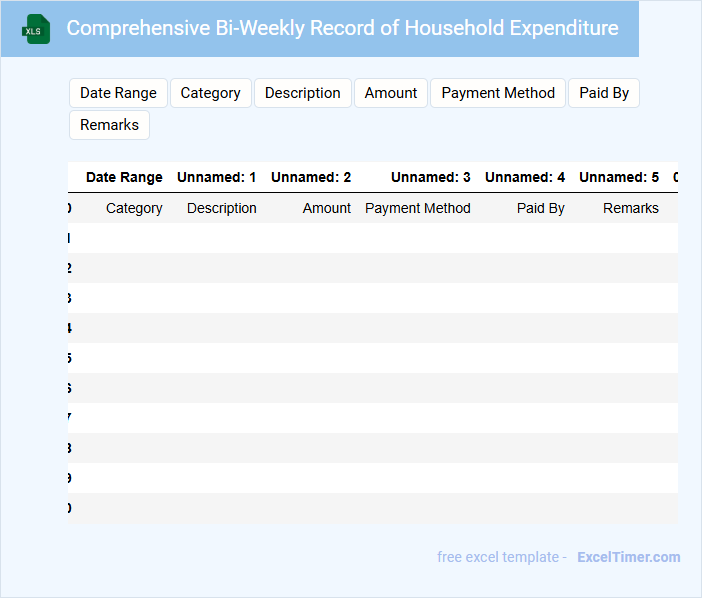

Comprehensive Bi-Weekly Record of Household Expenditure

What information is typically included in a Comprehensive Bi-Weekly Record of Household Expenditure? This document usually contains detailed records of all household spending over a two-week period, including categories such as groceries, utilities, rent, transportation, and entertainment. It helps in tracking financial habits, budgeting effectively, and identifying potential areas for saving.

Why is it important to maintain accurate and consistent entries in a Comprehensive Bi-Weekly Record of Household Expenditure? Accurate records ensure clear visibility of financial flows, enabling better decision-making and avoiding overspending. Consistency in recording expenses also allows for reliable comparisons across periods to monitor progress and adjust budgets accordingly.

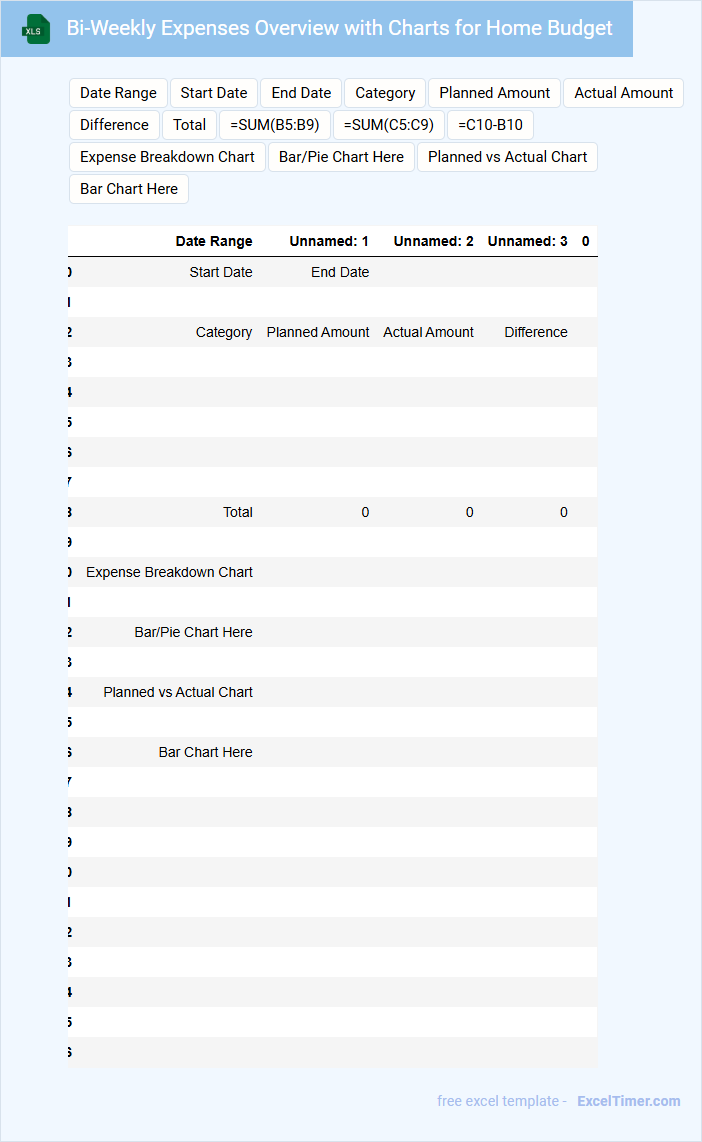

Bi-Weekly Expenses Overview with Charts for Home Budget

The Bi-Weekly Expenses Overview document typically contains detailed records of income and expenditures over two-week periods, highlighting spending patterns and budget adherence. It often includes visual charts such as pie charts and bar graphs to provide quick insights into where money is allocated. This document is essential for monitoring financial health and making informed adjustments to optimize home budgets.

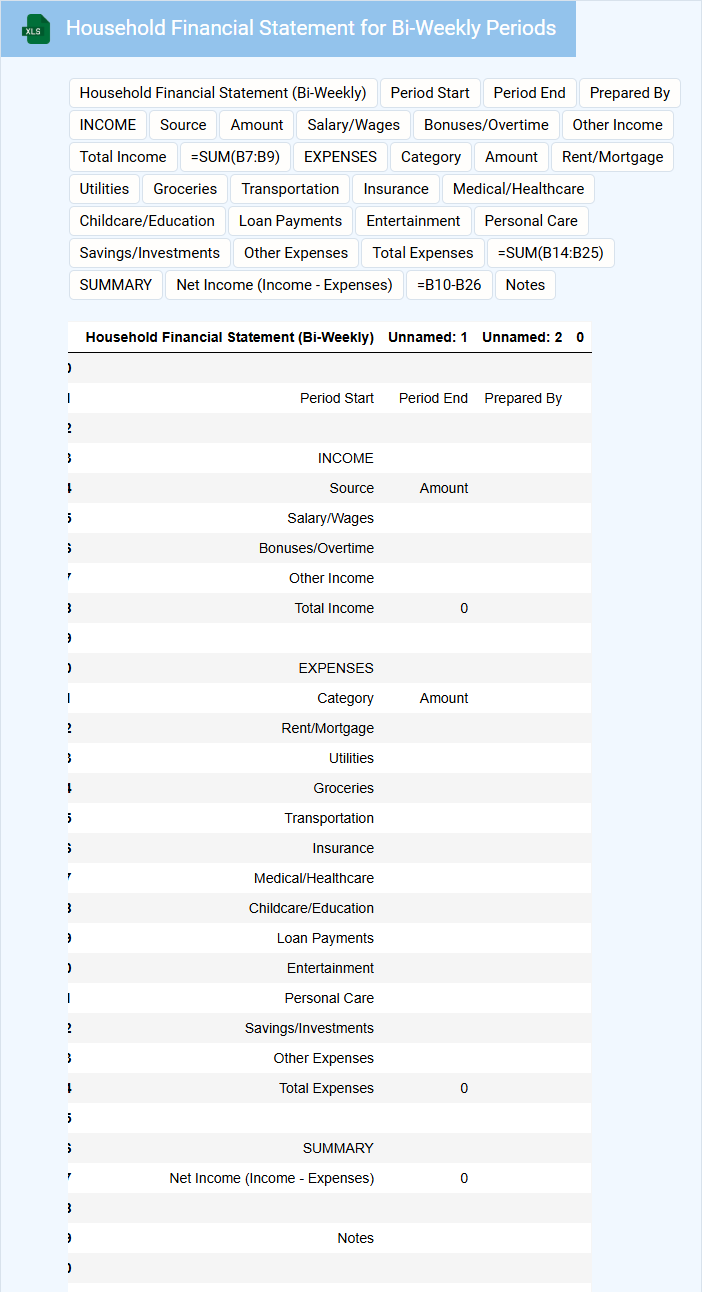

Household Financial Statement for Bi-Weekly Periods

What information is typically included in a Household Financial Statement for Bi-Weekly Periods? This document usually contains detailed records of income, expenses, assets, and liabilities tracked every two weeks to provide a clear snapshot of a household's financial health. It helps in budgeting effectively and identifying patterns in spending and saving within short intervals.

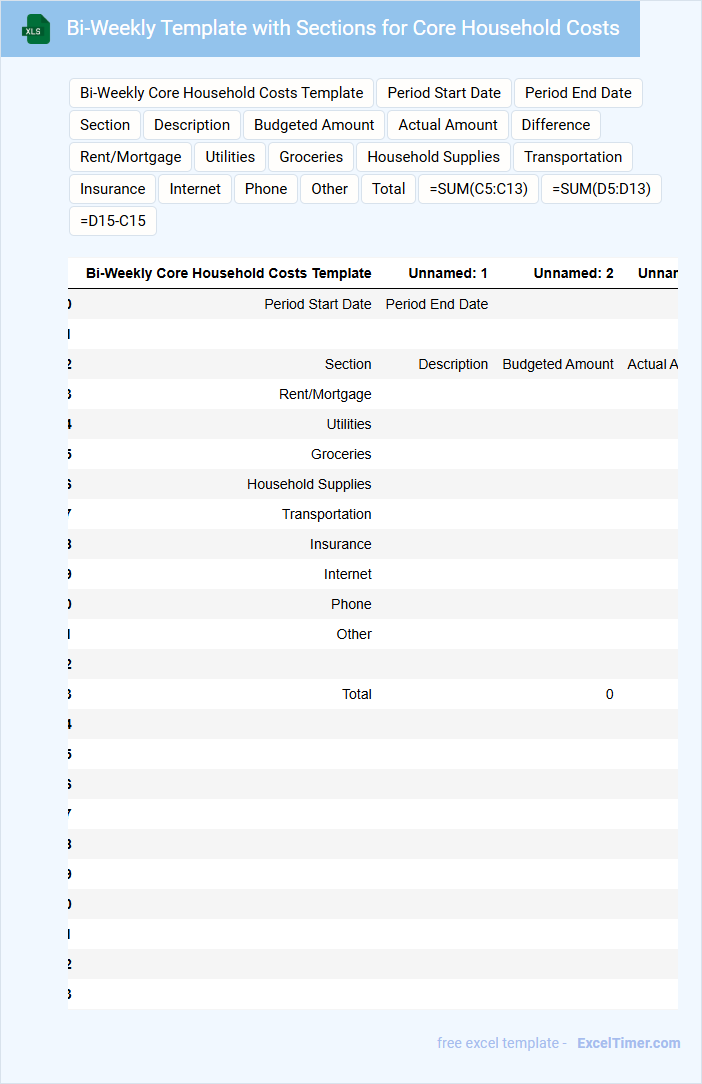

Bi-Weekly Template with Sections for Core Household Costs

What information is typically included in a bi-weekly template with sections for core household costs? This type of document usually contains detailed categories for recurring expenses such as rent or mortgage, utilities, groceries, and transportation, organized on a bi-weekly schedule. It helps users track and manage their spending efficiently by breaking down costs into manageable bi-weekly intervals, ensuring better budgeting and financial planning.

What is an important consideration when using this template? It is crucial to regularly update the template with accurate expense data to maintain a clear overview of your household finances. Additionally, including a section for unexpected or variable costs can improve the template's usefulness and adaptability.

What is the total bi-weekly budget allocated for each household expense category in your Excel document?

The total bi-weekly budget allocated for each household expense category is clearly detailed in your Excel document, providing precise amounts for categories such as groceries, utilities, transportation, and entertainment. These totals ensure effective financial planning and help track spending within each category. This structured allocation supports managing household finances efficiently every two weeks.

How do you calculate and track bi-weekly spending versus your planned bi-weekly amounts?

To calculate and track bi-weekly spending versus your planned amounts, enter your expected expenses and actual payments into separate columns for each two-week period in the Excel document. Use formulas to sum totals and calculate variances to identify overspending or savings. Your bi-weekly tracking ensures accurate budgeting and financial control over household expenses.

What formula is used in Excel to sum bi-weekly expenses for accurate monitoring?

Use the SUMIF formula to total bi-weekly expenses efficiently in Excel. Apply =SUMIF(DateRange, ">=StartDate", ExpenseRange) combined with a condition for bi-weekly intervals. This formula ensures accurate monitoring by aggregating expenses within specific bi-weekly periods.

How often do you update and review your Excel document for bi-weekly expense adjustments?

Your Excel document for bi-weekly household expenses should be updated and reviewed every two weeks to ensure accurate tracking and budgeting. Consistent data entry helps identify spending patterns and adjust allocations effectively. Regular reviews optimize your financial management and prevent overspending.

How does tracking expenses bi-weekly in Excel help with overall household financial planning?

Tracking expenses bi-weekly in Excel provides a clear overview of your cash flow and spending patterns within each pay period. This method helps identify areas to save and ensures bills and essentials are covered on time. Using Excel's customizable features enhances budgeting accuracy and supports informed household financial decisions.