The Bi-weekly Pay Calculator Excel Template for Hourly Workers offers an easy way to accurately track and calculate earnings based on hours worked every two weeks. This template simplifies payroll management by automatically totaling hours, accounting for overtime, and applying the correct hourly rate. It is essential for ensuring precise payment calculations and reducing payroll errors for hourly employees.

Bi-weekly Pay Calculator with Overtime Tracker

A Bi-weekly Pay Calculator with Overtime Tracker is a tool designed to help employees and employers accurately calculate wages for every two-week period, including any overtime hours worked. This type of document typically contains fields for regular hours, overtime hours, pay rates, and total earnings. It is important to ensure that the calculator accounts for legal overtime rules and clearly differentiates between regular and overtime pay.

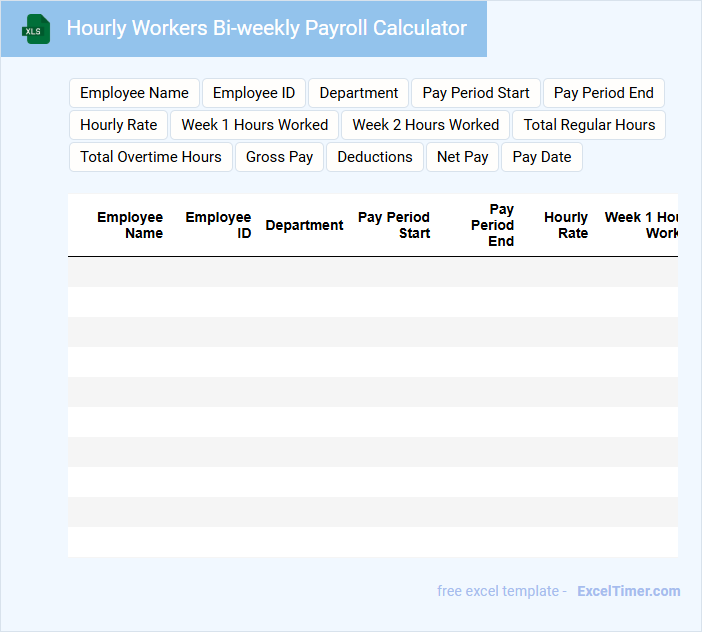

Hourly Workers Bi-weekly Payroll Calculator

What information is typically included in an Hourly Workers Bi-weekly Payroll Calculator? This type of document usually contains fields for hours worked, hourly rate, overtime hours, and applicable deductions. It is designed to accurately calculate the total earnings and net pay for hourly employees over a two-week period.

What are the most important considerations when using a bi-weekly payroll calculator for hourly workers? Ensuring correct input of work hours and overtime is crucial, as well as accounting for taxes and other deductions. Accurate data entry guarantees compliance with labor laws and precise employee compensation.

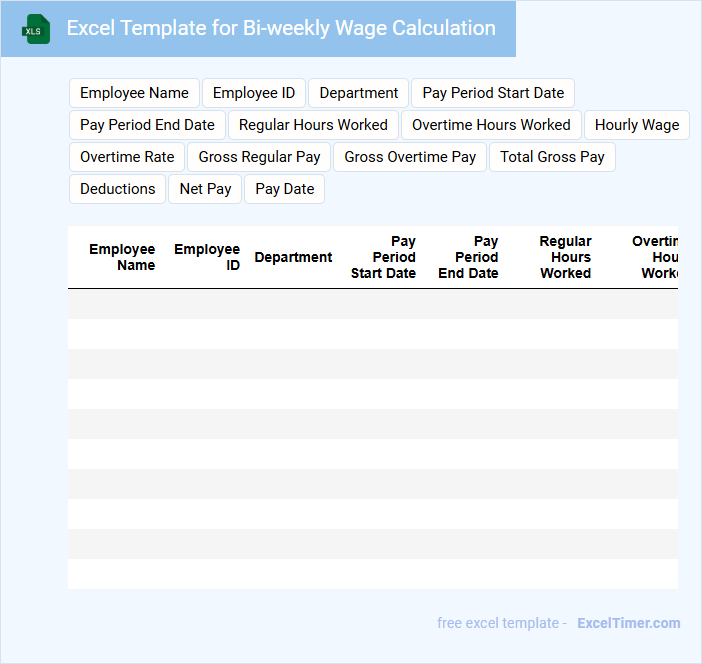

Excel Template for Bi-weekly Wage Calculation

This type of document usually contains structured data for tracking employee hours and calculating wages over a bi-weekly period.

- Employee Information: Include names, IDs, and job titles for accurate identification.

- Work Hours and Rates: Record daily hours worked along with regular and overtime hourly rates.

- Automatic Calculations: Use formulas to compute total wages, deductions, and net pay efficiently.

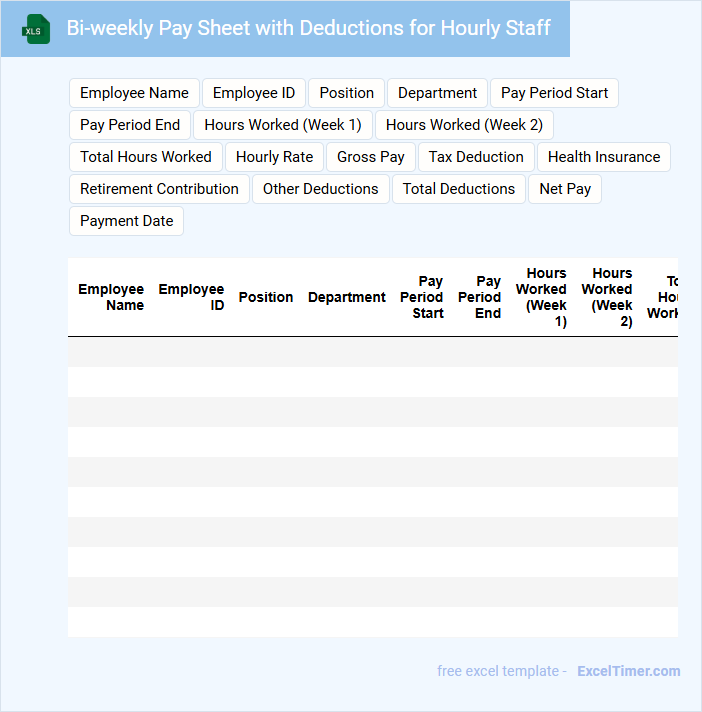

Bi-weekly Pay Sheet with Deductions for Hourly Staff

What information is typically included in a Bi-weekly Pay Sheet with Deductions for Hourly Staff? This document usually contains detailed records of hours worked, hourly rates, gross pay, and itemized deductions such as taxes and benefits. It provides transparency and ensures accuracy in employee compensation over a two-week period.

Why is it important to carefully review deductions on the pay sheet? Accurate deduction tracking helps prevent payroll errors and ensures legal compliance with tax and labor regulations. It is essential to verify that all deductions are properly authorized and correctly calculated for fair employee reimbursement.

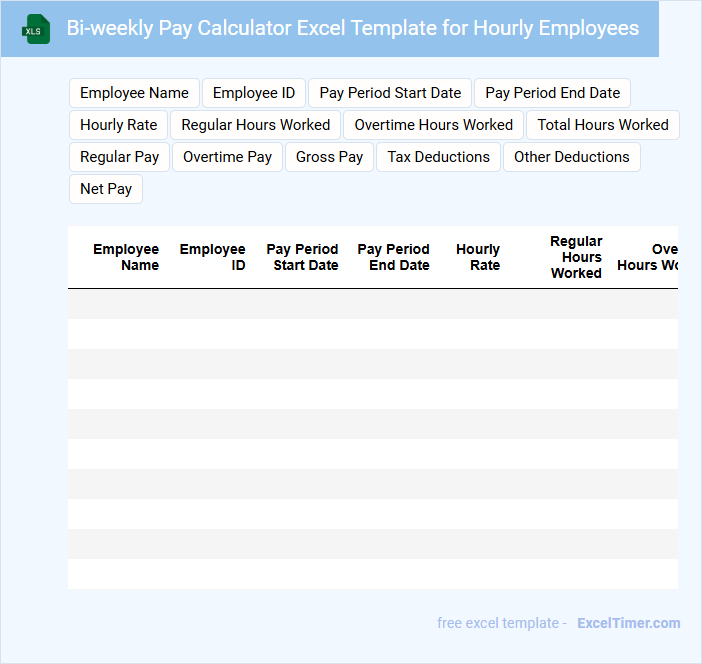

Bi-weekly Pay Calculator Excel Template for Hourly Employees

This document typically contains a structured Excel template designed to calculate bi-weekly pay for hourly employees accurately and efficiently.

- Input Fields: Include hours worked, hourly rate, and overtime details to ensure precise calculations.

- Formulas and Functions: Utilize Excel formulas for automatic computation of gross pay, deductions, and net pay.

- Summary Section: Provide an easy-to-read pay summary to help employees and employers track earnings and deductions.

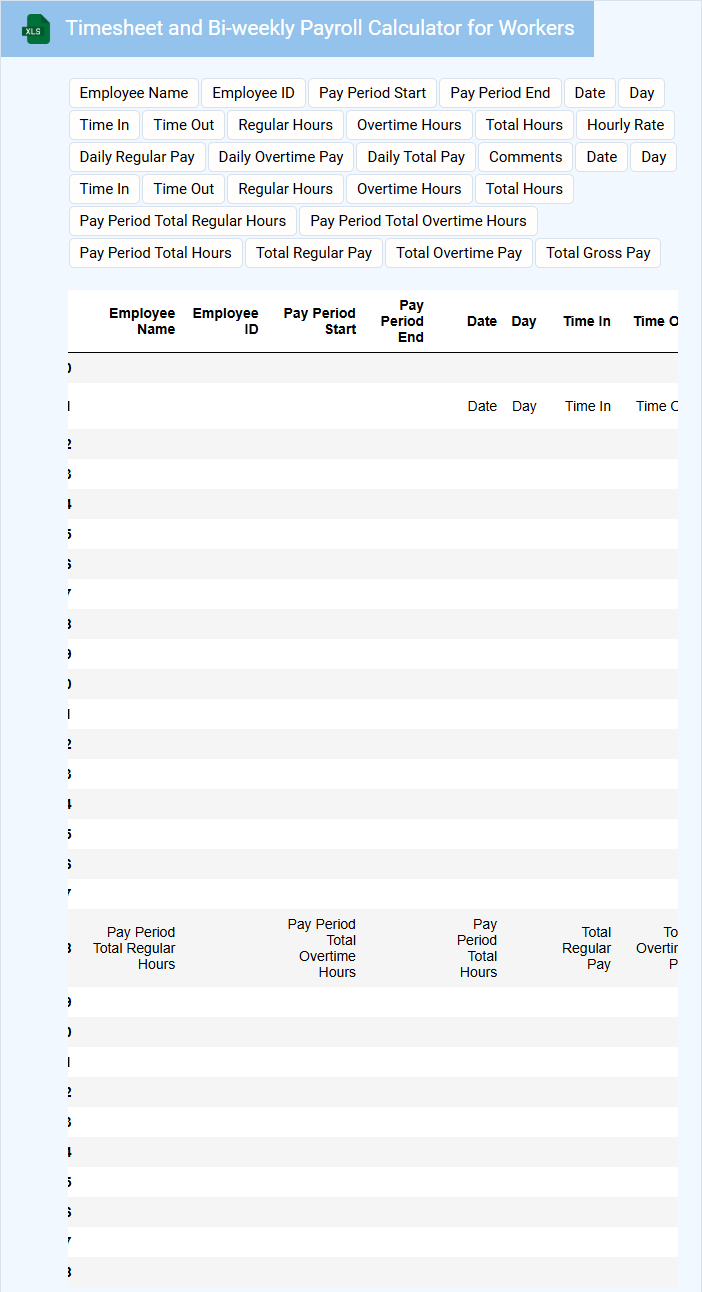

Timesheet and Bi-weekly Payroll Calculator for Workers

What information is typically included in a Timesheet and Bi-weekly Payroll Calculator for Workers? This document usually contains details such as employee hours worked, overtime, and pay rates to accurately track work time and calculate wages. It helps ensure timely and precise payroll processing while maintaining compliance with labor laws and company policies.

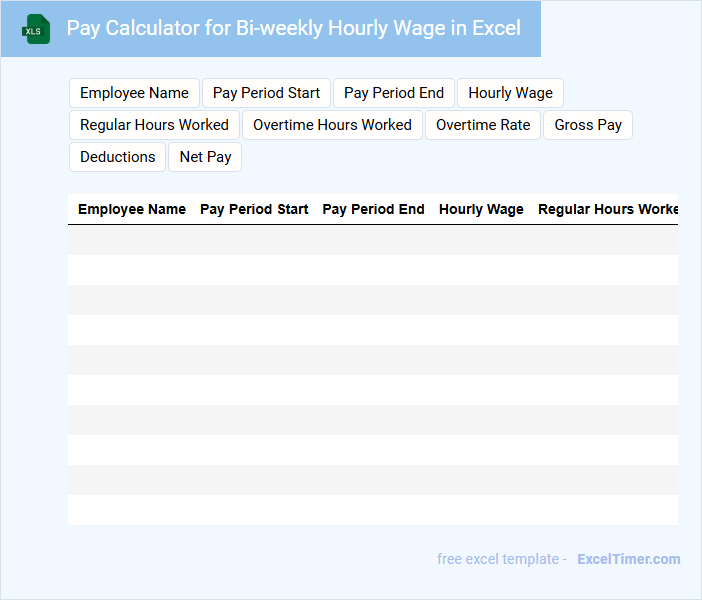

Pay Calculator for Bi-weekly Hourly Wage in Excel

This document typically contains a pay calculator designed for bi-weekly hourly wage calculations, allowing users to input hours worked and hourly rates to determine earnings. It often includes formulas and functions optimized for accuracy and ease of use in Excel spreadsheets.

Important features include clear input fields for regular and overtime hours, as well as automatic tax deductions or benefits calculations for precise net pay estimations. Ensure the spreadsheet includes validation for input errors and easy-to-read formatting for quick reference by users.

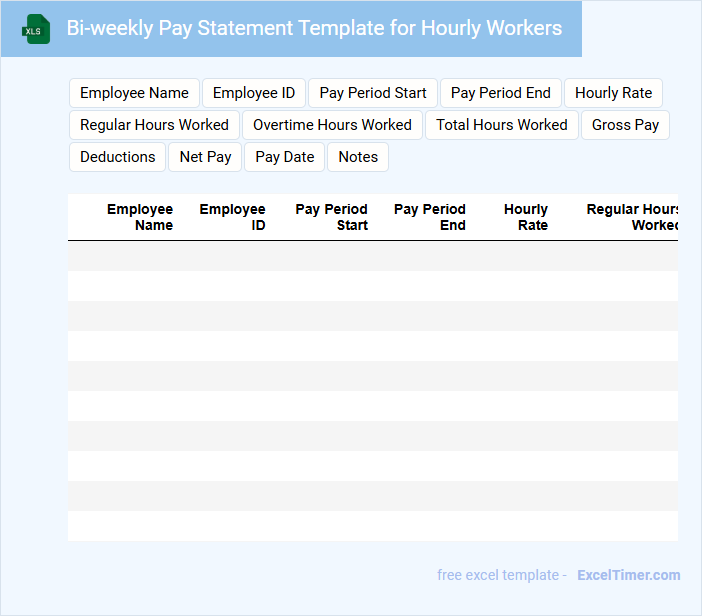

Bi-weekly Pay Statement Template for Hourly Workers

A Bi-weekly Pay Statement Template for Hourly Workers is a document that details the earnings and deductions for employees paid every two weeks. It provides a clear record of hours worked, wages earned, and taxes withheld.

- Include employee information such as name, ID, and pay period dates.

- List hours worked, hourly rate, and total gross pay.

- Detail all deductions including taxes, benefits, and any other withholdings.

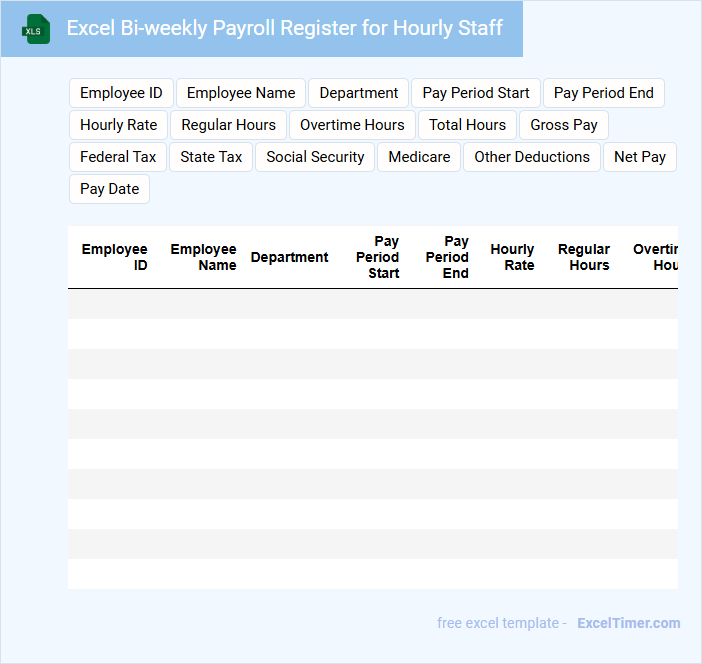

Excel Bi-weekly Payroll Register for Hourly Staff

The Excel Bi-weekly Payroll Register for Hourly Staff is a document that records the wages paid to hourly employees over a two-week period. It usually contains detailed information such as employee names, hours worked, pay rates, deductions, and net pay. This register is essential for accurate payroll processing and compliance with labor laws.

Important elements to include are clear categorization of regular versus overtime hours, precise tax and benefit deductions, and a summary of total payroll expenses. Ensuring data accuracy and consistency helps in audits and financial reporting. Regular updates and secure storage of this register safeguard sensitive employee information.

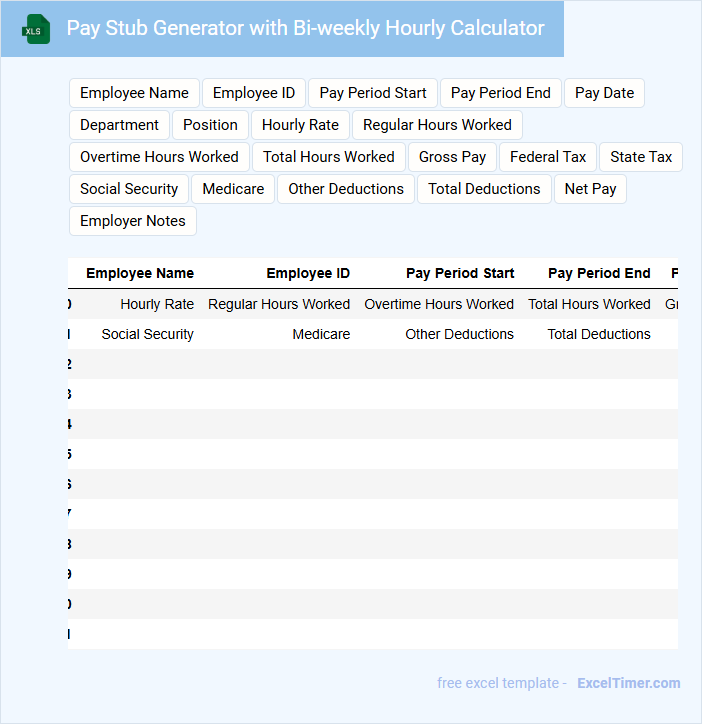

Pay Stub Generator with Bi-weekly Hourly Calculator

A Pay Stub Generator with a Bi-weekly Hourly Calculator typically contains detailed employee earnings, tax deductions, and net pay information. It helps both employers and employees keep transparent and accurate records of work hours and payments over each pay period. An important consideration is ensuring correct tax rates and overtime calculations for compliance and accuracy.

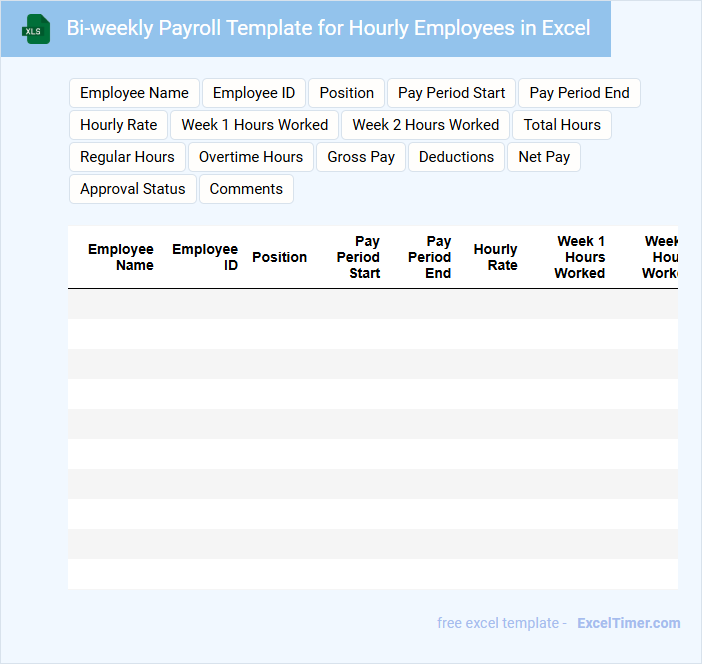

Bi-weekly Payroll Template for Hourly Employees in Excel

A Bi-weekly Payroll Template for hourly employees in Excel typically contains employee hours worked, hourly rates, and total earnings to ensure accurate and timely payments. The document also includes deductions such as taxes and benefits, along with net pay calculations. It is essential for maintaining organized payroll records and complying with labor regulations.

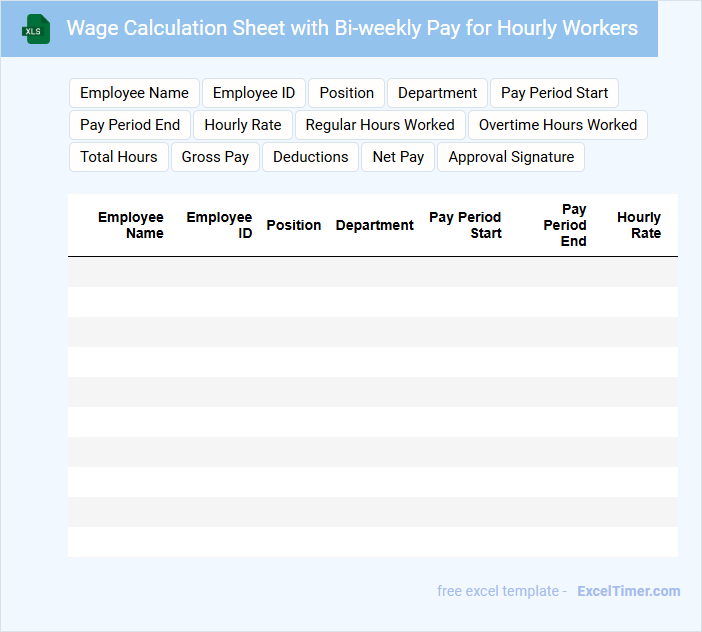

Wage Calculation Sheet with Bi-weekly Pay for Hourly Workers

A Wage Calculation Sheet with Bi-weekly Pay for Hourly Workers is a document used to track employee hours, calculate wages, and record deductions over a two-week period. It ensures accurate payroll processing and compliance with labor regulations.

- Include detailed hourly rates and total hours worked for each pay period.

- Clearly itemize any overtime, bonuses, or deductions such as taxes and benefits.

- Maintain a summary section to verify gross pay, deductions, and net pay for easy review.

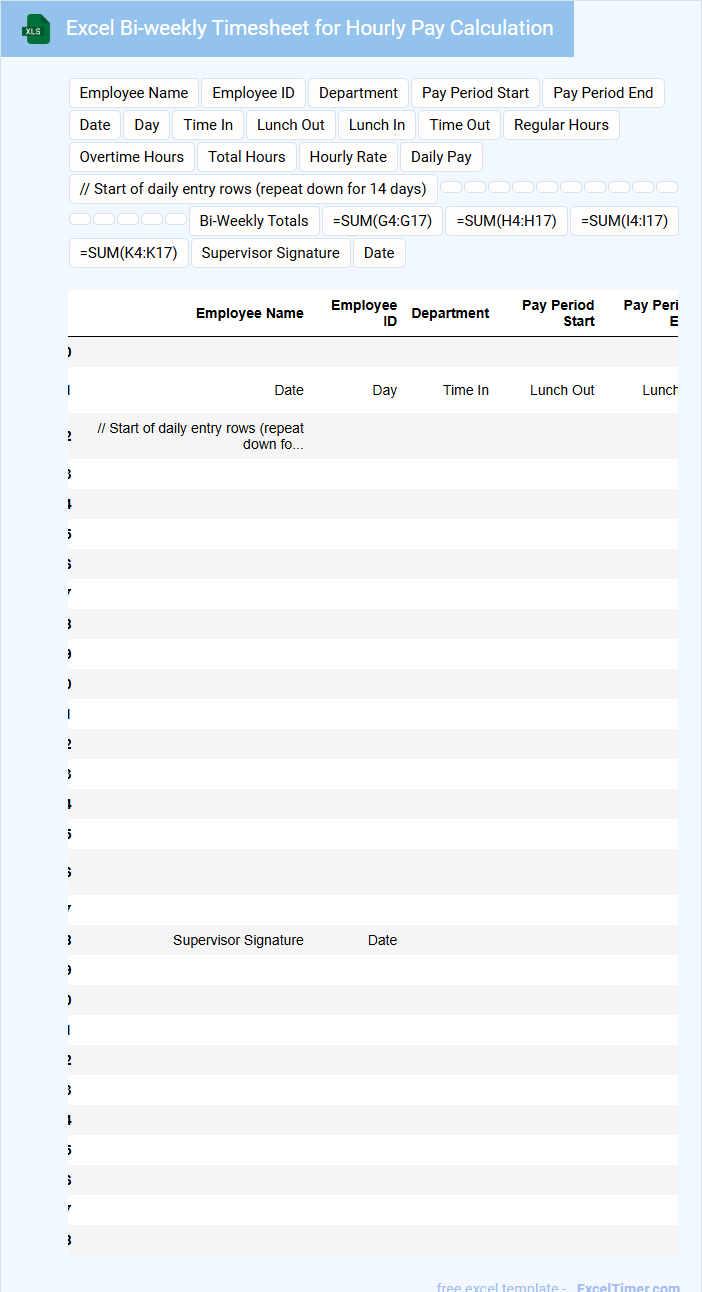

Excel Bi-weekly Timesheet for Hourly Pay Calculation

An Excel Bi-weekly Timesheet for Hourly Pay Calculation is a document used to track employee work hours over a two-week period to accurately calculate earnings based on hourly rates. This type of timesheet helps in maintaining organized payroll records and ensures proper payment.

- Include columns for date, hours worked, and hourly rate to facilitate precise calculations.

- Use formulas to automatically total hours and compute gross pay.

- Provide spaces for employee and supervisor signatures for verification purposes.

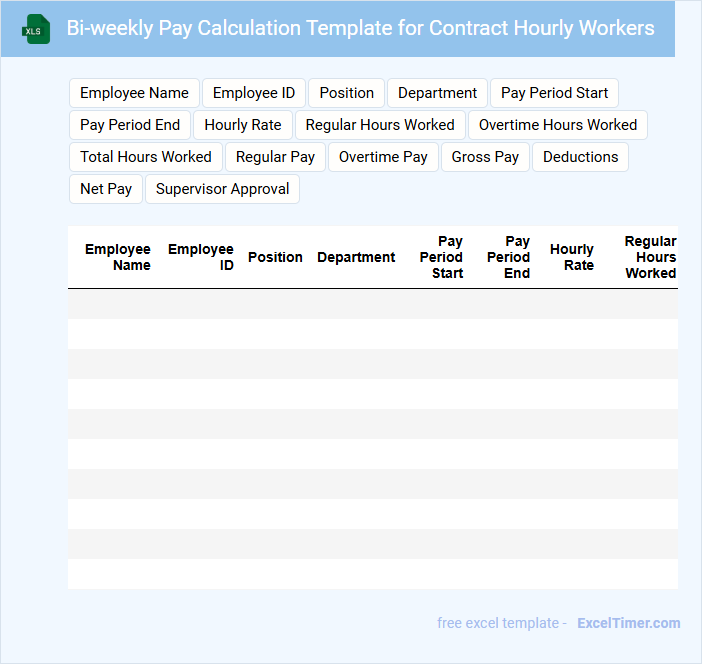

Bi-weekly Pay Calculation Template for Contract Hourly Workers

A Bi-weekly Pay Calculation Template for contract hourly workers typically contains detailed records of hours worked, hourly rates, and total earnings for each pay period. It includes sections for overtime, deductions, and applicable taxes to ensure accurate compensation. This document is essential for maintaining clear and consistent payment tracking for hourly employees under contract agreements.

Budget and Bi-weekly Payroll Record with Hourly Wage Tracking

This type of document is primarily used for financial management and employee compensation tracking. It contains detailed records of expenses, incomes, and payroll data, including hourly wage calculations. Such documents help ensure accuracy in salary payments and budget adherence.

What formula calculates total bi-weekly pay based on hourly rate and hours worked?

Use the formula =Hourly_Rate * Hours_Worked to calculate total bi-weekly pay. Replace Hourly_Rate with the cell containing the hourly wage and Hours_Worked with the cell showing hours worked in two weeks. This formula provides accurate total earnings for bi-weekly pay periods based on hourly input data.

How can overtime hours and rates be included in the Excel calculator?

Include overtime hours by adding a separate input field labeled "Overtime Hours" next to regular hours. Set an overtime rate field that multiplies the standard hourly wage by the overtime multiplier (commonly 1.5). Use a formula combining regular pay (Regular Hours x Hourly Rate) and overtime pay (Overtime Hours x Overtime Rate) for accurate bi-weekly earnings.

Which Excel functions ensure accurate tax deductions from bi-weekly pay?

Excel functions like SUMPRODUCT and VLOOKUP ensure accurate tax deductions from bi-weekly pay by calculating withholdings based on tax brackets and rates. The IF function helps apply conditional logic for varying deduction rules, while ROUND prevents rounding errors in tax calculations. Combining these functions maintains precise and compliant payroll deductions for hourly workers.

What cell references should be used to automatically update net pay calculations?

Use cell references for hours worked (e.g., B2) and hourly rate (e.g., C2) to ensure your net pay calculations automatically update. Include deductions in another cell (e.g., D2) and reference these cells in your formula for accurate bi-weekly pay results. This approach streamlines adjustments and maintains accuracy across your worksheet.

How can you use data validation to prevent input errors in hours and rates?

Use data validation to set numeric ranges for hours worked (e.g., 0 to 80) and hourly rates (e.g., minimum wage to a reasonable maximum). Apply whole number or decimal restrictions to ensure only valid inputs are accepted. Custom error messages can guide users to enter accurate data in the Bi-weekly Pay Calculator for Hourly Workers.