The Bi-weekly Invoicing Excel Template for Consultants streamlines the billing process by allowing consultants to easily track services and payments every two weeks. It includes customizable fields for client details, work hours, rates, and totals, ensuring accuracy and professionalism. Using this template helps maintain timely invoicing, improves cash flow management, and reduces administrative errors.

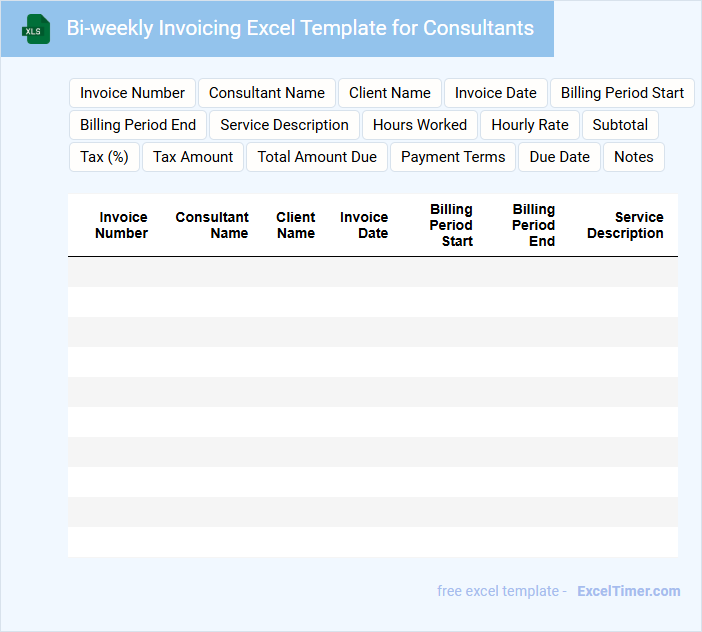

Bi-weekly Invoicing Excel Template for Consultants

A Bi-weekly Invoicing Excel Template for consultants typically contains detailed sections for tracking hours worked, billing rates, and client information. It also includes automated calculations to generate total amounts due for each billing period.

These templates help streamline the payment process by ensuring accurate and timely invoicing. It is important to include clear invoice numbers and payment terms to avoid any confusion with clients.

Invoice Tracker with Bi-weekly Schedule for Consultants

What information does an Invoice Tracker with Bi-weekly Schedule for Consultants typically contain?

This document usually includes a detailed record of all invoices issued to consultants, organized by bi-weekly periods to ensure timely payments and accurate financial tracking. It helps in monitoring payment status, due dates, amounts, and services rendered, facilitating efficient budget management and cash flow forecasting.

For optimal use, it is important to include clear consultant details, invoice numbers, billing periods, payment status updates, and any notes on discrepancies or approvals. Additionally, regular updates and integration with calendar reminders can enhance accuracy and ensure adherence to payment schedules.

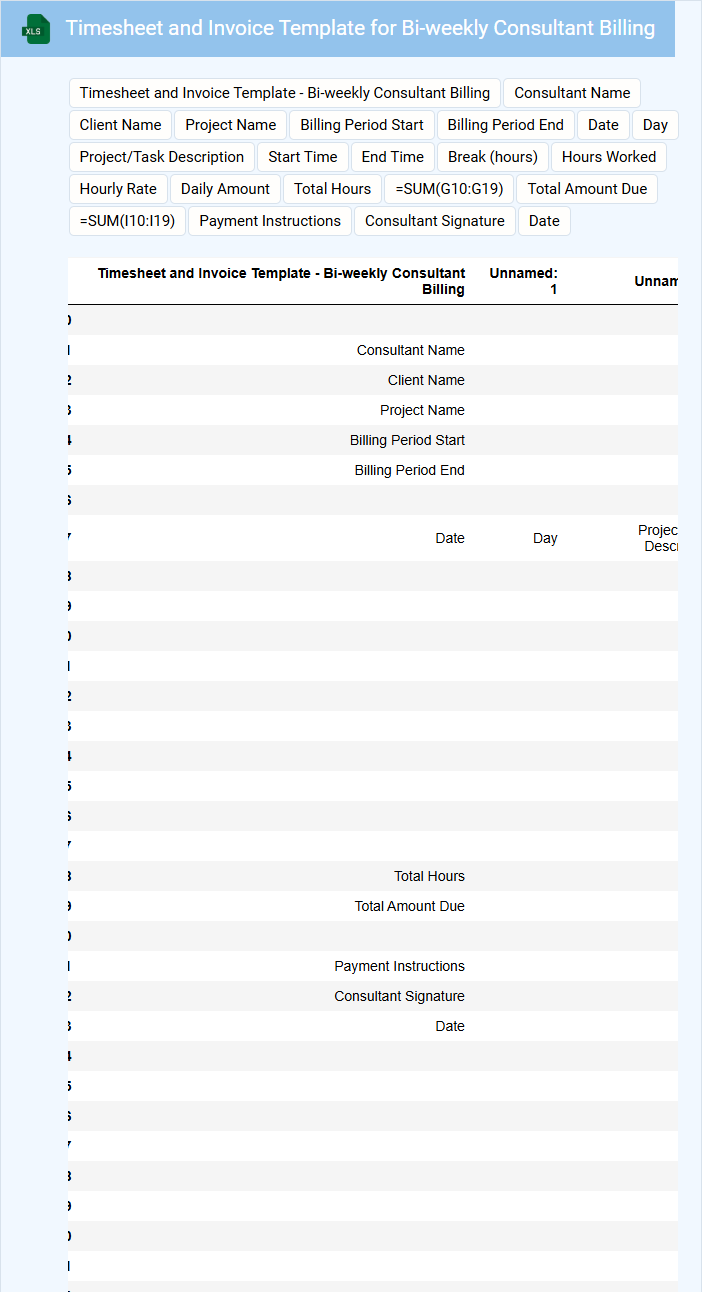

Timesheet and Invoice Template for Bi-weekly Consultant Billing

What is typically included in a Timesheet and Invoice Template for Bi-weekly Consultant Billing?

This type of document usually contains detailed records of hours worked, task descriptions, and billing rates for a two-week period. It also includes invoice information such as client details, payment terms, and total amount due. Ensuring accuracy and clarity in these elements helps streamline consultant payment and client communication.

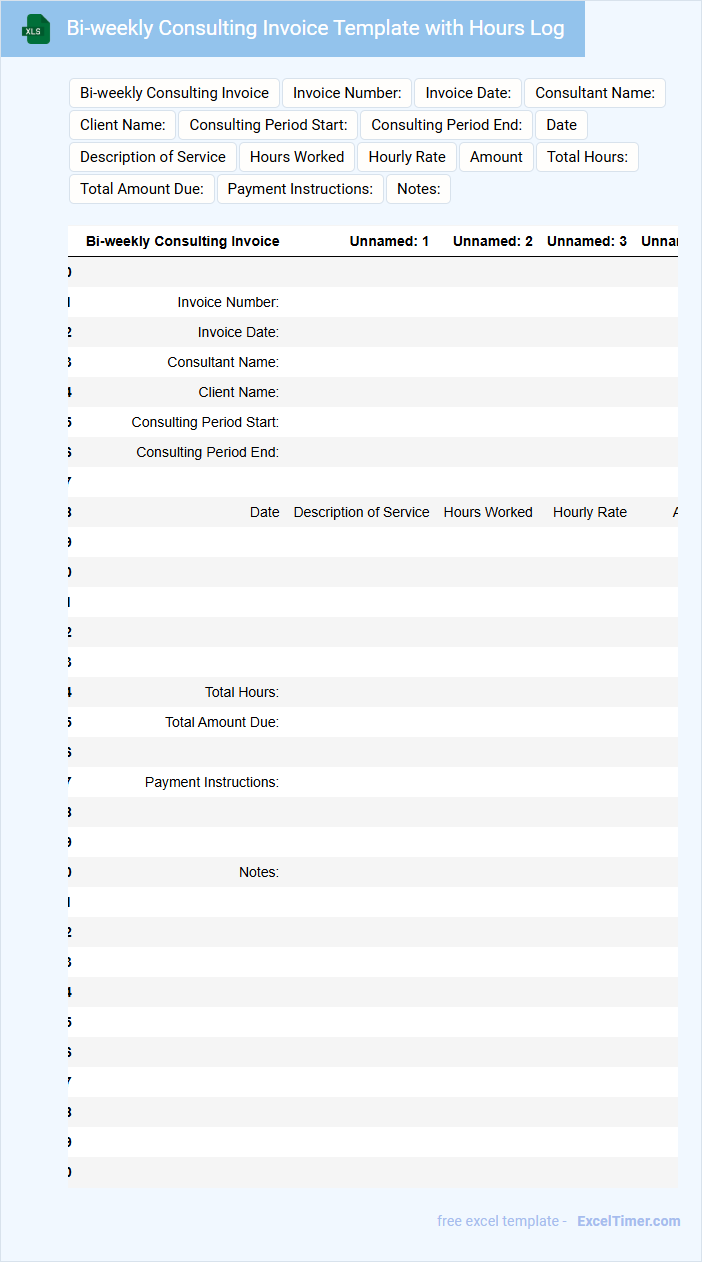

Bi-weekly Consulting Invoice Template with Hours Log

What information is typically included in a Bi-weekly Consulting Invoice Template with Hours Log?

This type of document usually contains details such as the consultant's name, client information, invoice number, billing period, hourly rates, and a detailed log of hours worked each day. It provides a clear breakdown of services rendered and total charges for the bi-weekly period.

Important elements to include are accurate time tracking, clear descriptions of tasks performed, and a summary of total hours and payment due to ensure transparency and ease of payment processing.

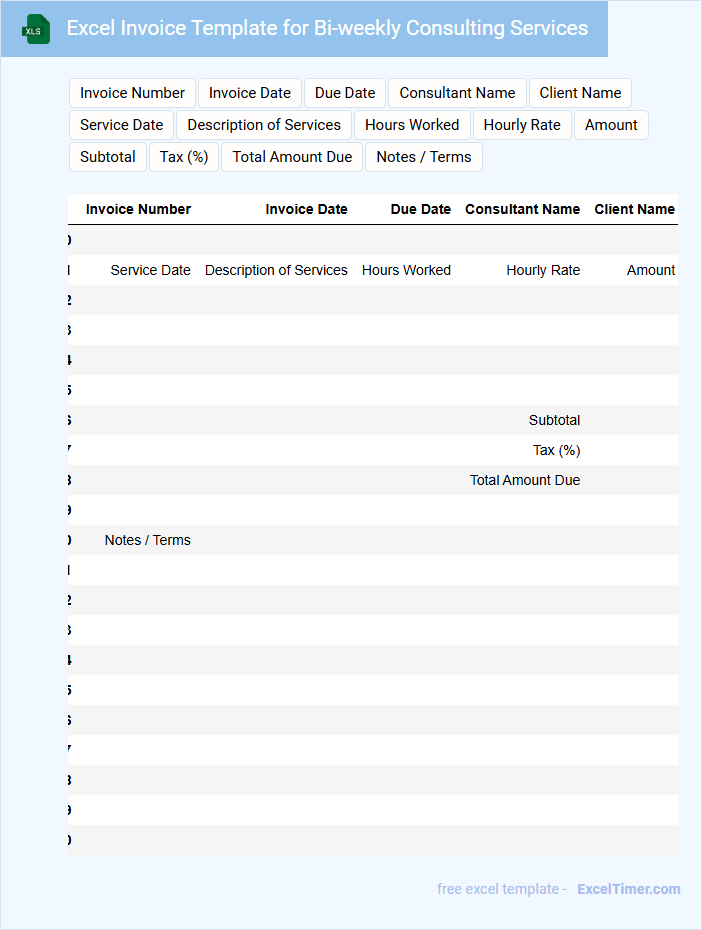

Excel Invoice Template for Bi-weekly Consulting Services

An Excel Invoice Template for Bi-weekly Consulting Services typically contains detailed information about the consulting tasks performed over each two-week period. It includes fields for client details, service descriptions, hours worked, and payment terms to ensure clarity and accuracy. Using a structured template helps maintain consistent billing and facilitates easier financial tracking for both consultants and clients.

Important elements to include are clear date ranges for each billing period, an itemized list of services with corresponding hourly rates, and a summary of total charges. Additionally, incorporating payment terms and contact information enables smoother communication and timely payments. Ensuring the template is customizable allows it to adapt to various consulting arrangements and client needs.

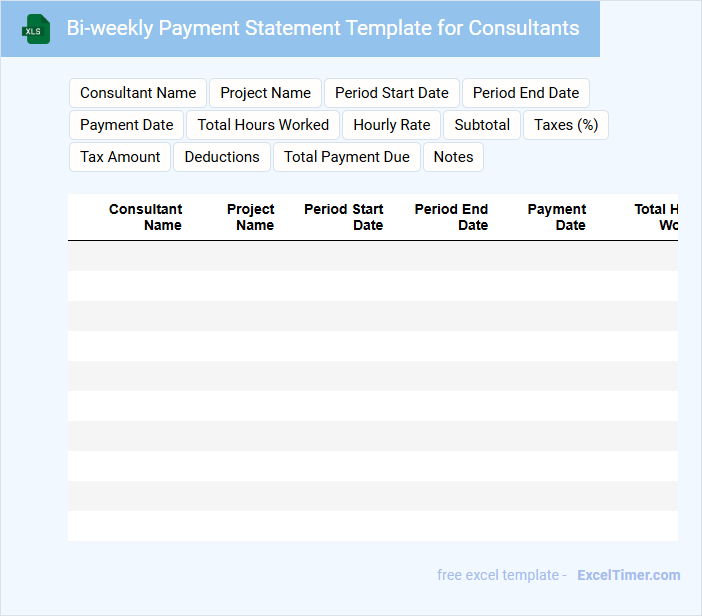

Bi-weekly Payment Statement Template for Consultants

A Bi-weekly Payment Statement Template for Consultants typically contains detailed information on the consultant's earnings and deductions for each pay period.

- Earnings Breakdown: It should clearly list all sources of income including hourly rates or project fees.

- Deductions and Taxes: Important to include all applicable deductions such as taxes, benefits, or fees for transparency.

- Payment Details: Must specify payment dates, totals, and any outstanding balances for accurate financial tracking.

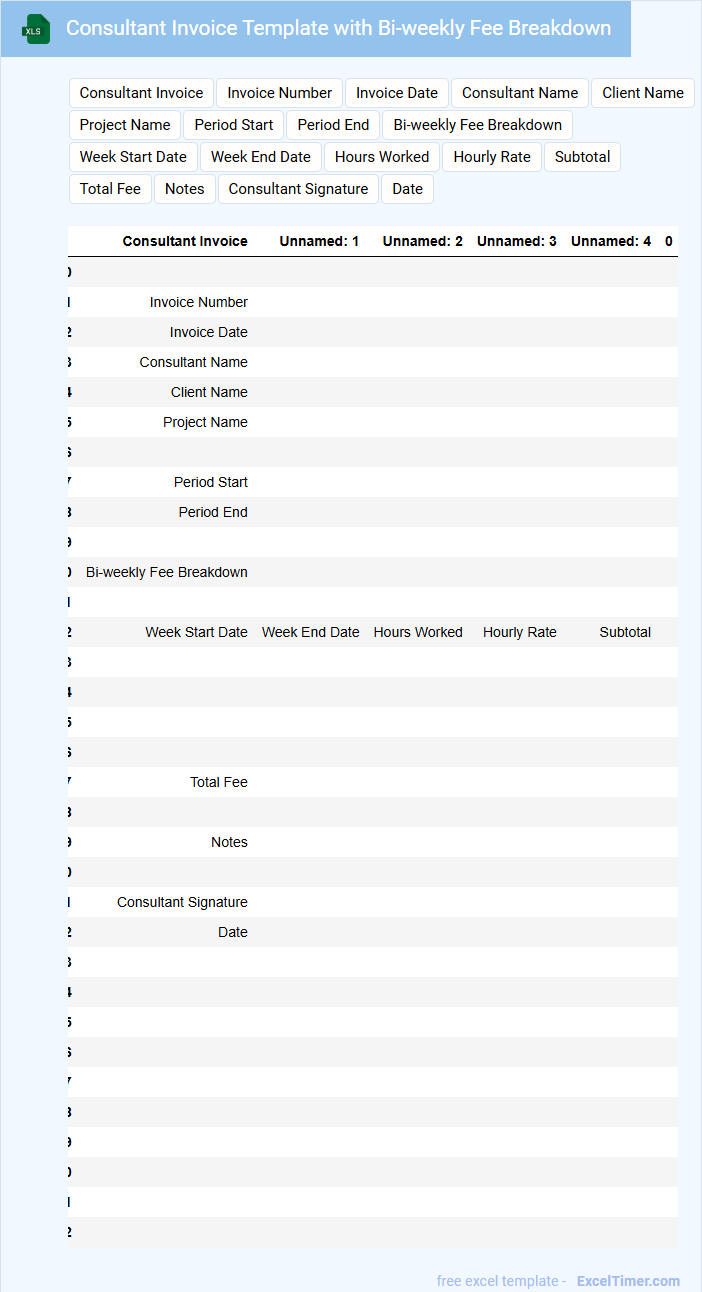

Consultant Invoice Template with Bi-weekly Fee Breakdown

A Consultant Invoice Template with a bi-weekly fee breakdown is designed to clearly outline the charges for consulting services over two-week periods. It typically includes client details, service descriptions, hourly rates, hours worked, and total fees due.

This document helps both consultants and clients track payments efficiently and maintain transparent financial records. Important elements to include are payment terms, invoice number, and a detailed breakdown of services rendered every two weeks.

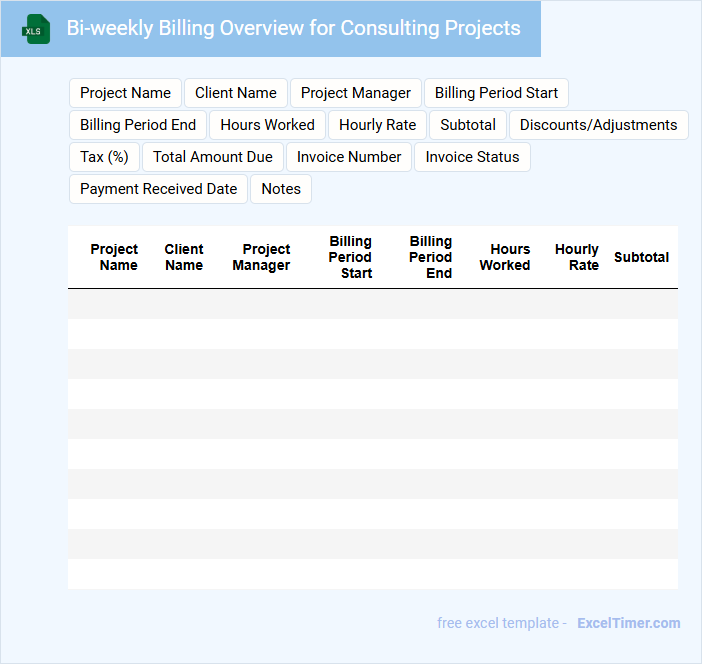

Bi-weekly Billing Overview for Consulting Projects

The Bi-weekly Billing Overview document summarizes all billable activities for consulting projects over a two-week period. It includes detailed time entries, rates, and total amounts due.

This overview helps ensure accurate invoicing and transparent client communication. Important to include are clear project codes, hours logged, and any adjustments or discounts applied.

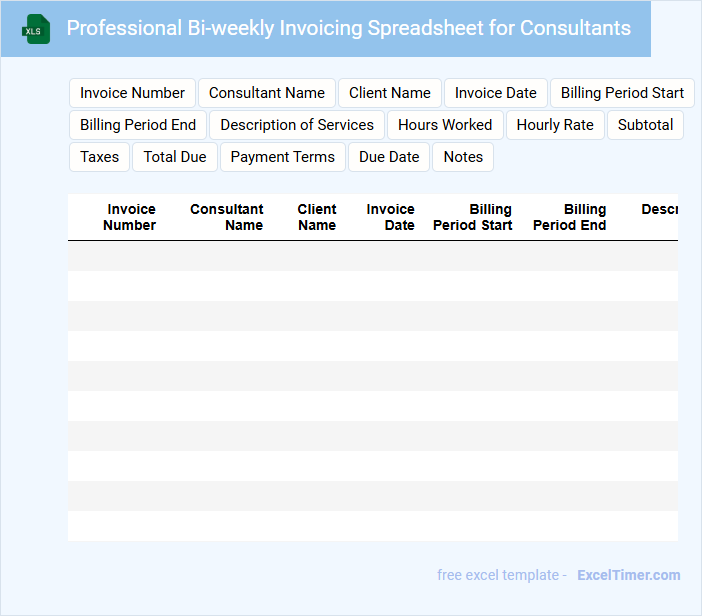

Professional Bi-weekly Invoicing Spreadsheet for Consultants

A Professional Bi-weekly Invoicing Spreadsheet for Consultants typically contains organized financial data to facilitate accurate and timely billing.

- Client Details: Essential contact and project information for each client is clearly listed.

- Time Tracking: Records of billable hours or services rendered within the bi-weekly period are meticulously maintained.

- Payment Summary: Totals and payment status are tracked to ensure prompt invoicing and follow-up.

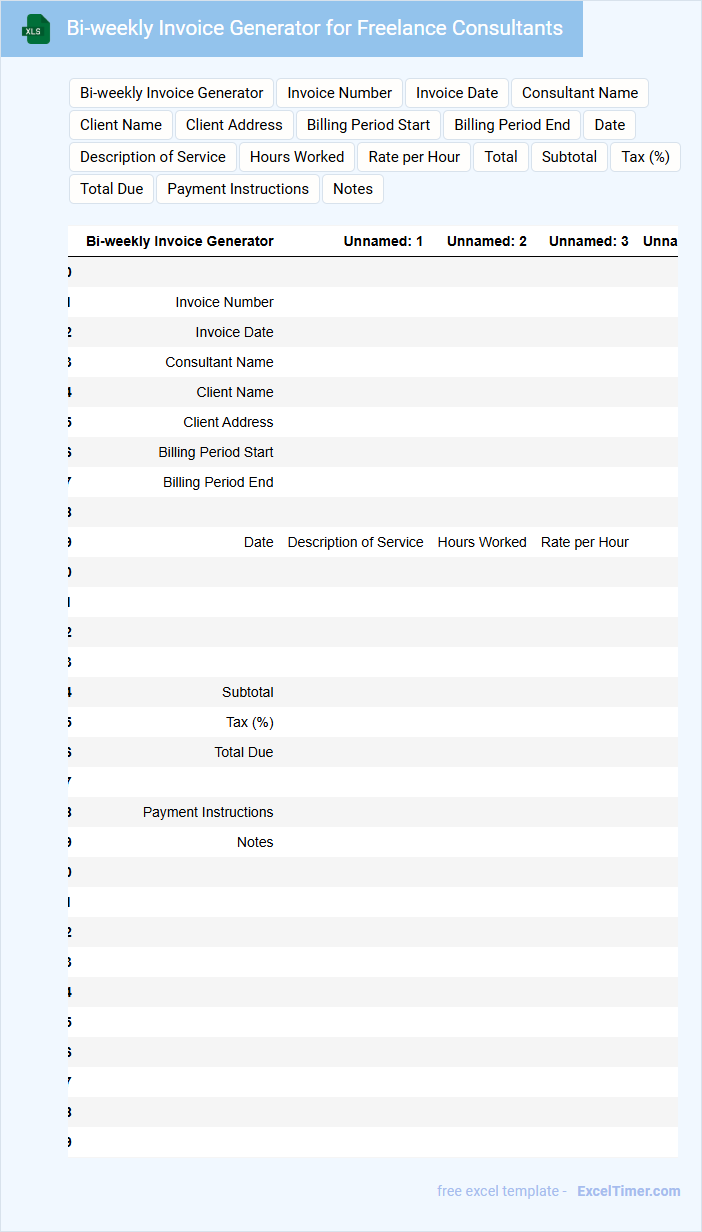

Bi-weekly Invoice Generator for Freelance Consultants

A bi-weekly invoice generator is a document designed to streamline the billing process for freelance consultants by creating invoices every two weeks. It typically contains details such as the consultant's name, services provided, hours worked, and payment terms. To ensure accuracy, it's important to include clear descriptions of tasks, rates, and the invoice period.

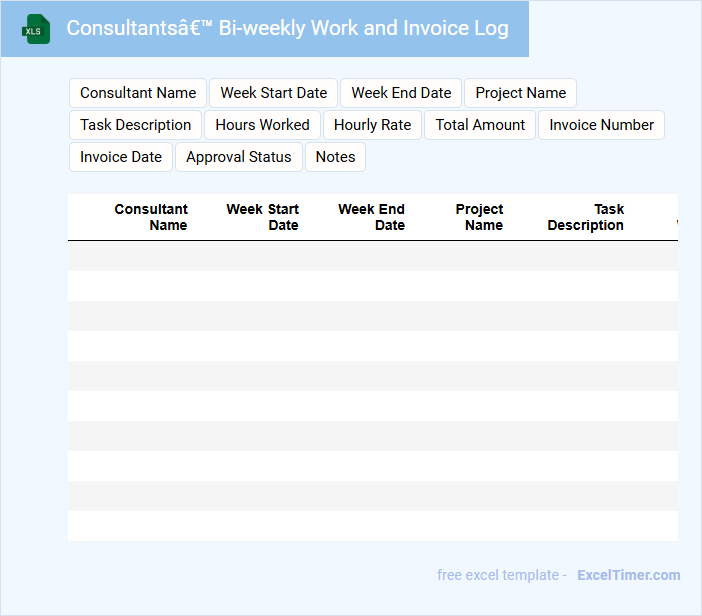

Consultants’ Bi-weekly Work and Invoice Log

Consultants' Bi-weekly Work and Invoice Log typically contains detailed records of tasks performed and corresponding billing information to ensure transparent and accurate client invoicing.

- Task Documentation: A clear description of the work completed during each bi-weekly period.

- Time Tracking: Accurate recording of hours spent on each task to facilitate proper billing.

- Invoice Details: Breakdown of charges and payment terms linked to the documented work sessions.

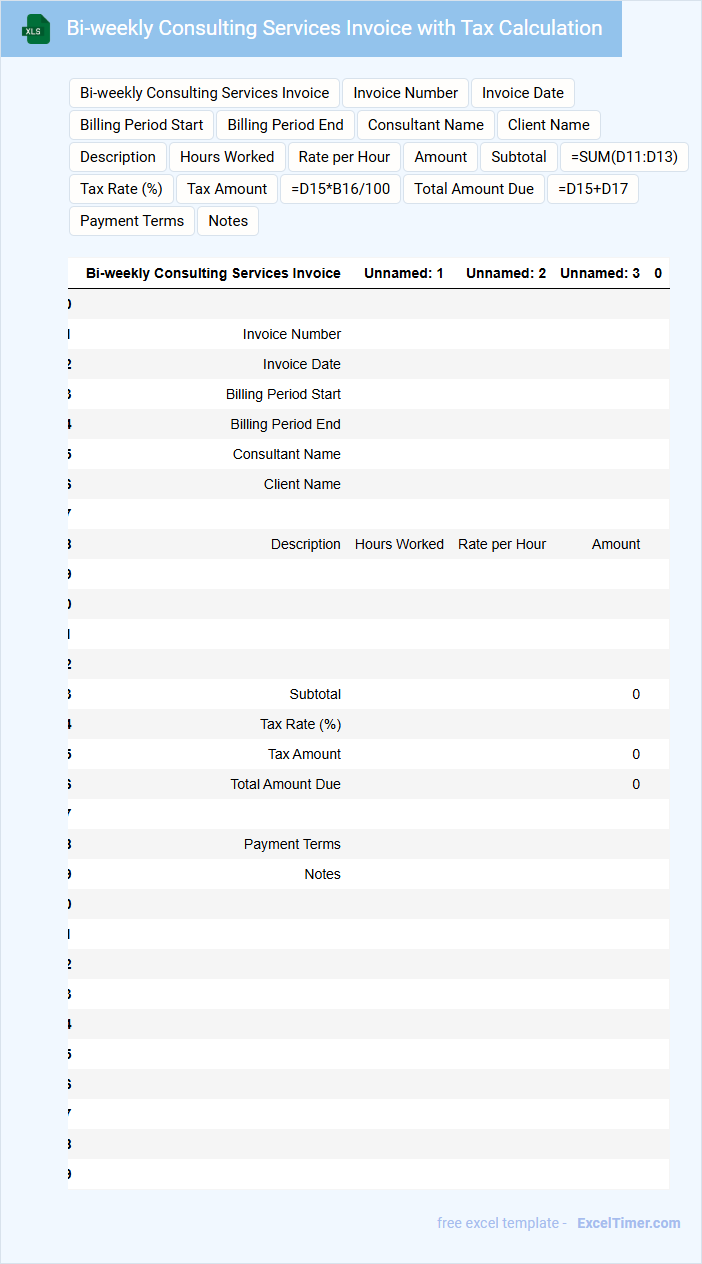

Bi-weekly Consulting Services Invoice with Tax Calculation

A Bi-weekly Consulting Services Invoice with Tax Calculation typically outlines the services rendered in two-week periods and includes detailed tax computations.

- Service Description: Clearly list each consulting service provided within the bi-weekly timeframe.

- Tax Details: Include precise tax rates and calculations applied to the subtotal for transparency.

- Payment Terms: Specify payment deadlines and acceptable payment methods to ensure timely settlement.

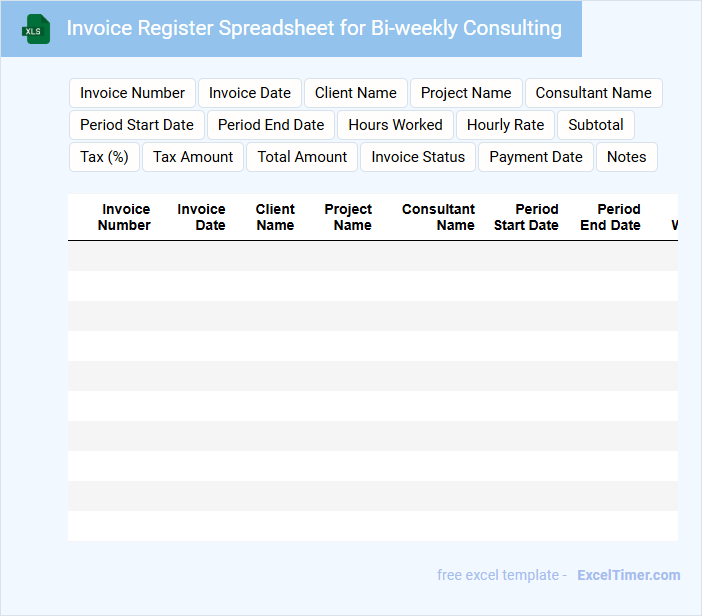

Invoice Register Spreadsheet for Bi-weekly Consulting

An Invoice Register Spreadsheet is a document used to systematically record all invoices generated during a specific period, ensuring accurate financial tracking. It typically contains fields such as invoice number, date, client details, description of services, hours worked, rate, and total amount. Maintaining this register helps in managing payments and auditing expenses efficiently.

For a Bi-weekly Consulting invoice register, it is crucial to include clear date ranges and detailed service descriptions to avoid payment discrepancies. Tracking payment status and due dates within the spreadsheet enhances timely follow-ups. Consistently updating the register supports financial accuracy and client transparency.

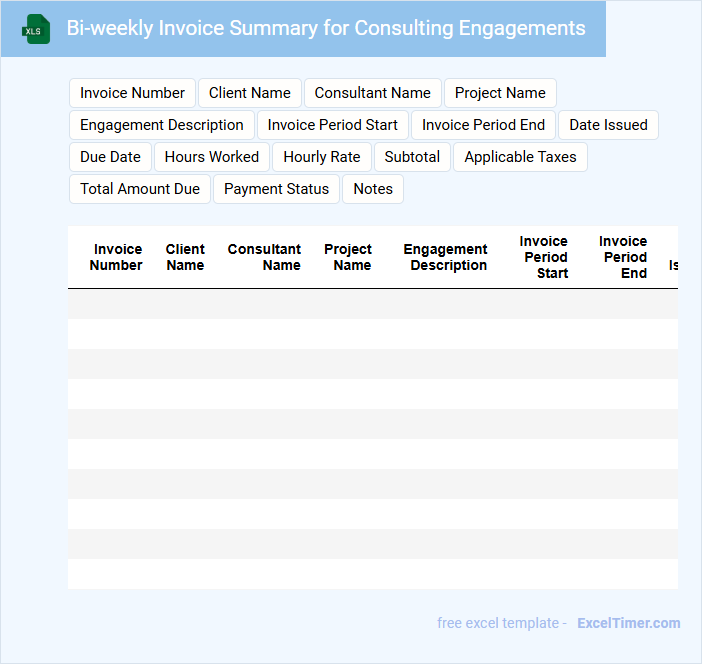

Bi-weekly Invoice Summary for Consulting Engagements

A Bi-weekly Invoice Summary for consulting engagements typically contains detailed records of hours worked, services rendered, and corresponding billing rates over a two-week period. This document is crucial for transparent communication between consultants and clients, ensuring accurate and timely payments. It is important to include clear project descriptions, dates of service, and total amounts due to avoid disputes and streamline financial reconciliation.

Simple Bi-weekly Invoicing Spreadsheet for Consultants

A Simple Bi-weekly Invoicing Spreadsheet for Consultants typically contains essential billing details organized for easy tracking and management.

- Client Information: Clear identification of client names and contact details ensures accurate invoicing.

- Service Description: Detailed entries of hours worked and services rendered provide transparency.

- Payment Tracking: Sections for invoice dates, payment status, and totals help monitor cash flow efficiently.

What are the essential columns to include in a bi-weekly invoicing for consultants?

Essential columns in a bi-weekly invoicing Excel template for consultants include Consultant Name, Invoice Number, Invoice Date, Billing Period, Hours Worked, Hourly Rate, Total Amount, Payment Status, and Payment Due Date. Including Project or Client Name helps track invoicing details accurately. Your template should also feature Notes or Comments for any additional billing information.

How do you calculate and display billable hours and corresponding rates for each bi-weekly period?

Calculate billable hours by summing daily recorded hours for each consultant within the bi-weekly period using Excel's SUMIFS function. Multiply total billable hours by the consultant's hourly rate stored in a separate lookup table employing VLOOKUP or INDEX-MATCH for dynamic rate retrieval. Display results in a summary table showing consultant names, total billable hours, hourly rates, and calculated invoice amounts for clear bi-weekly invoicing.

What is the best way to track payment status and due dates in a bi-weekly invoicing Excel sheet?

The best way to track payment status and due dates in a bi-weekly invoicing Excel sheet is to create separate columns for invoice date, due date, payment status, and amount due. Use conditional formatting to highlight overdue invoices automatically and data validation dropdowns for consistent payment status entries like "Paid," "Pending," or "Overdue." You can ensure accuracy and quick updates in your bi-weekly invoicing process with these structured tracking methods.

How can you automate the subtotal, tax, and final amount calculations for each invoice period?

Use Excel formulas like SUM to calculate subtotals for each bi-weekly period by summing relevant invoice amounts. Apply tax calculations by multiplying the subtotal with the specified tax rate using a formula such as =Subtotal * TaxRate. Calculate the final amount by adding the subtotal and tax using =Subtotal + TaxAmount, and automate these across all invoice periods with consistent cell referencing or named ranges.

What methods can ensure client details and invoice numbers remain consistent and unique in each bi-weekly invoice?

Implementing a centralized database or secure Excel sheet with locked cells for client details and invoice numbers ensures consistency and uniqueness in each bi-weekly invoice. Using data validation and automatic numbering formulas like COUNTA or ROW functions minimizes errors and duplicates. Your invoices maintain accuracy and professionalism by integrating these methods within the bi-weekly invoicing workflow for consultants.