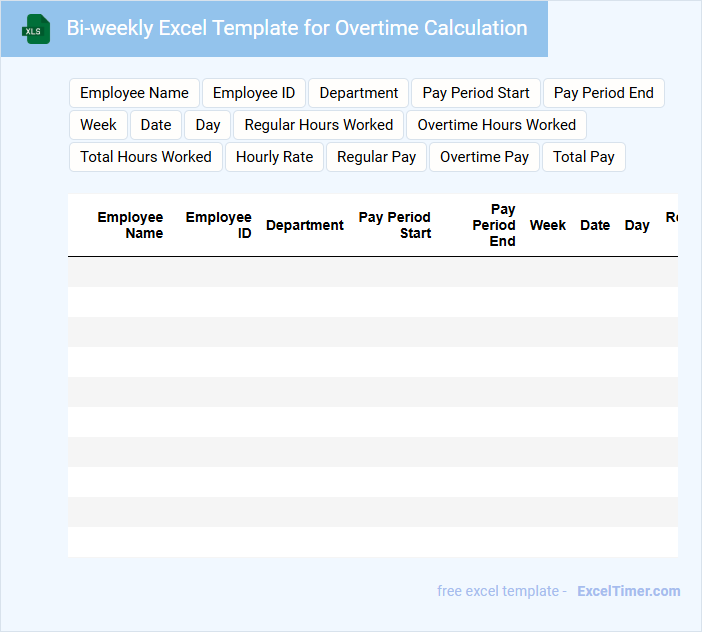

The Bi-weekly Excel Template for Overtime Calculation simplifies tracking employee hours by automatically computing overtime based on customizable pay rules. This template enhances payroll accuracy and helps ensure compliance with labor laws by clearly distinguishing regular and overtime hours. Using this tool reduces manual errors and saves time during bi-weekly payroll processing.

Bi-weekly Excel Template for Overtime Calculation

What is typically included in a bi-weekly Excel template for overtime calculation? This type of document commonly contains fields for recording daily work hours, regular hours, and overtime hours for each employee over a two-week period. It also includes formulas to automatically calculate total overtime pay based on established rates and hours worked.

What are important considerations when using this template? Accuracy in inputting data and clearly defining overtime rules are essential to ensure precise calculations, and it's crucial to include sections for employee identification and approval signatures for accountability and record-keeping.

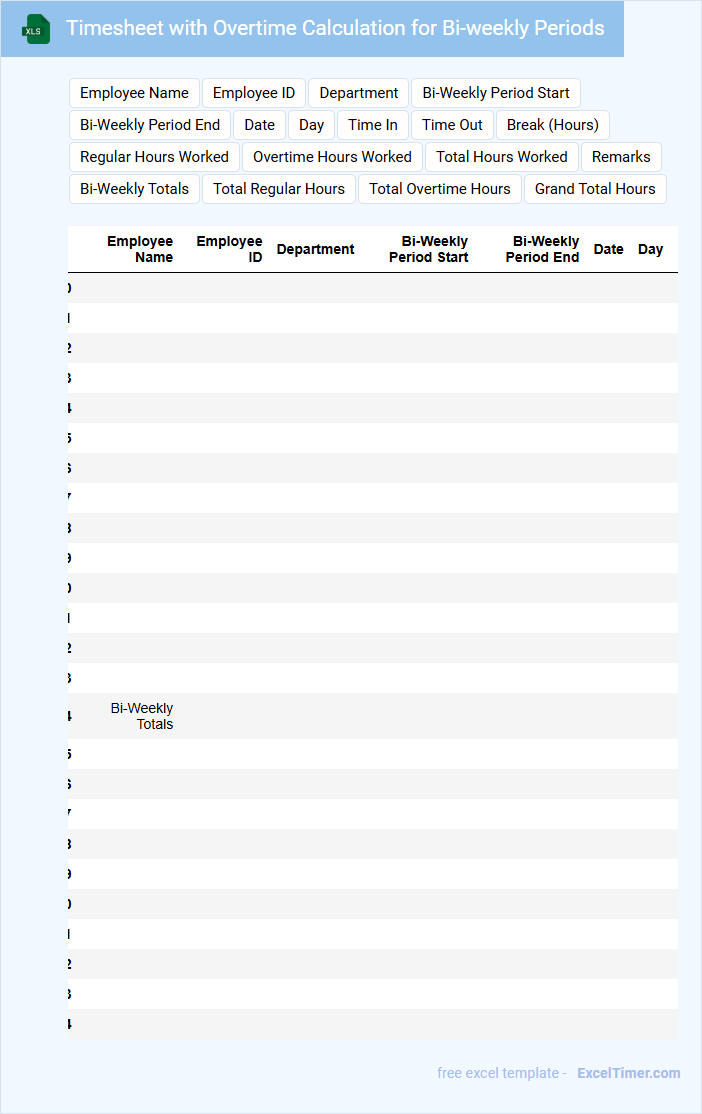

Timesheet with Overtime Calculation for Bi-weekly Periods

A timesheet with overtime calculation for bi-weekly periods is a document used to accurately record employee work hours over a two-week span. It typically includes regular hours, overtime hours, and total time worked for each day, ensuring precise payroll processing. This document is essential for ensuring compliance with labor laws and transparent compensation practices.

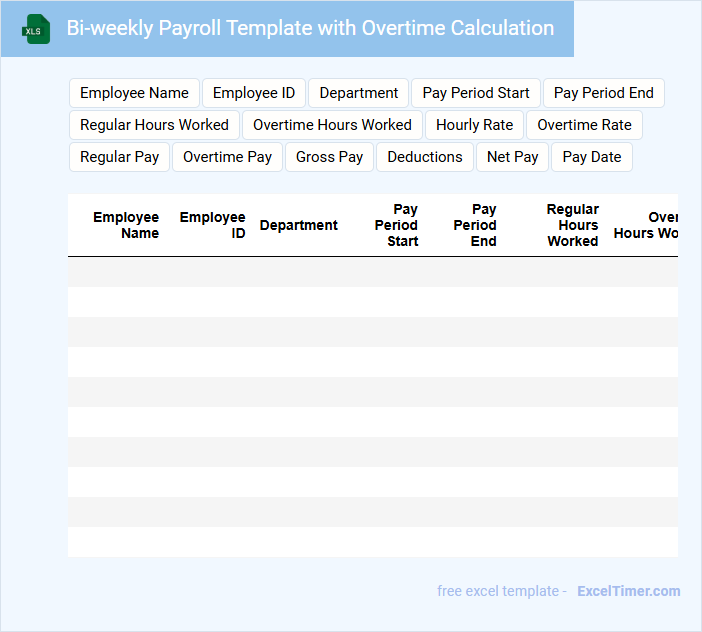

Bi-weekly Payroll Template with Overtime Calculation

A bi-weekly payroll template with overtime calculation is a document used to accurately record employee earnings over a two-week period, including any overtime hours worked. It helps ensure employees are paid correctly and simplifies accounting processes.

- Include clear fields for regular hours, overtime hours, and corresponding pay rates to avoid calculation errors.

- Use formulas to automatically calculate overtime pay based on pre-defined rules such as 1.5x regular rate.

- Incorporate columns for taxes and deductions to provide a comprehensive view of net pay.

Overtime Hours Tracker for Bi-weekly Employees

An Overtime Hours Tracker for bi-weekly employees is a document that records the extra hours worked beyond the standard schedule within a two-week pay period. It helps in monitoring employee labor and ensuring accurate compensation for additional time worked.

This tracker typically includes employee names, dates, hours worked each day, and total overtime hours. It is important to maintain accurate entries and regularly review the data to comply with labor laws and payroll requirements.

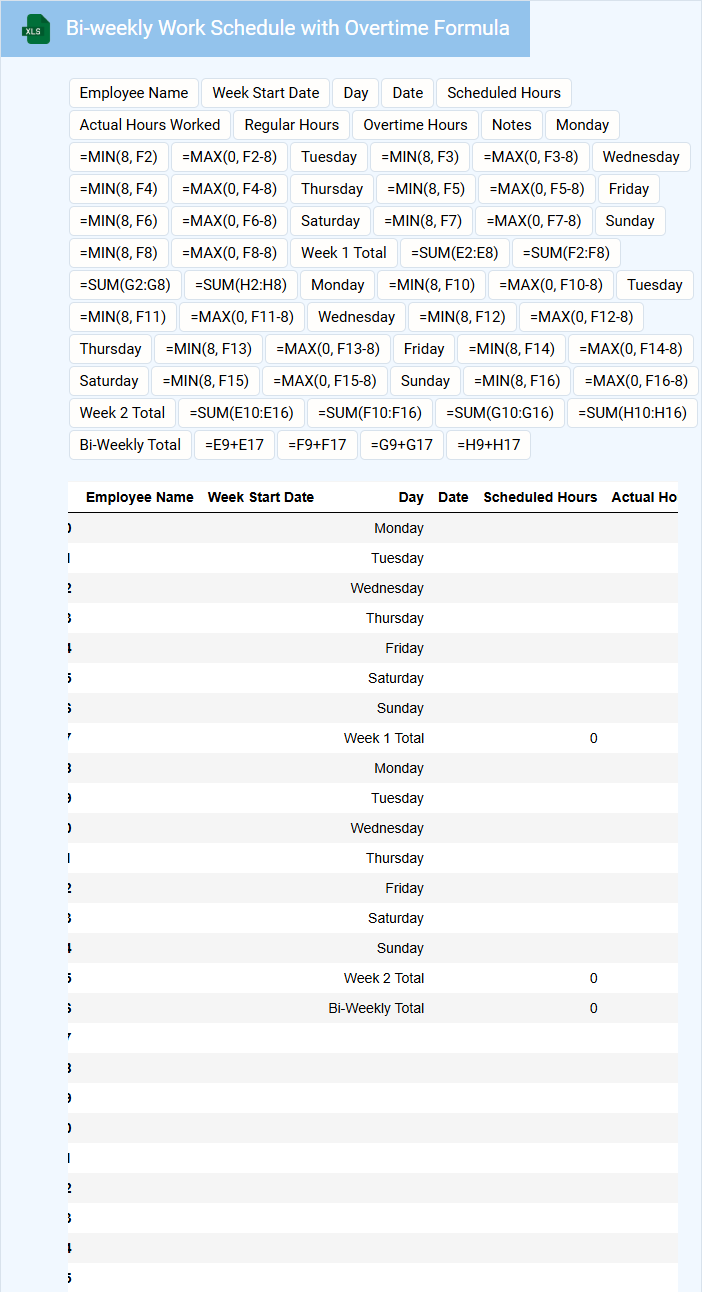

Bi-weekly Work Schedule with Overtime Formula

What information is typically included in a bi-weekly work schedule with an overtime formula? This document usually outlines the employee's work hours across a two-week period, detailing regular and overtime hours. It also incorporates a formula to calculate overtime pay based on hours worked beyond standard time, ensuring accurate compensation tracking.

Why is it important to include an overtime calculation formula? Including a clear formula helps employers and employees understand how overtime pay is determined, promoting transparency and compliance with labor laws. Additionally, it aids in efficient payroll processing and prevents disputes regarding overtime compensation.

Excel Tracker for Bi-weekly Overtime Pay

An Excel Tracker for Bi-weekly Overtime Pay typically contains detailed records of employee work hours, overtime calculations, and payment summaries to ensure accurate and timely compensation.

- Accurate Time Entries: Ensure all regular and overtime hours are logged precisely for each pay period.

- Overtime Rate Calculations: Include formulas that automatically compute overtime pay based on company policy and labor laws.

- Summary Reports: Provide clear bi-weekly summaries that highlight total hours worked and corresponding overtime payments.

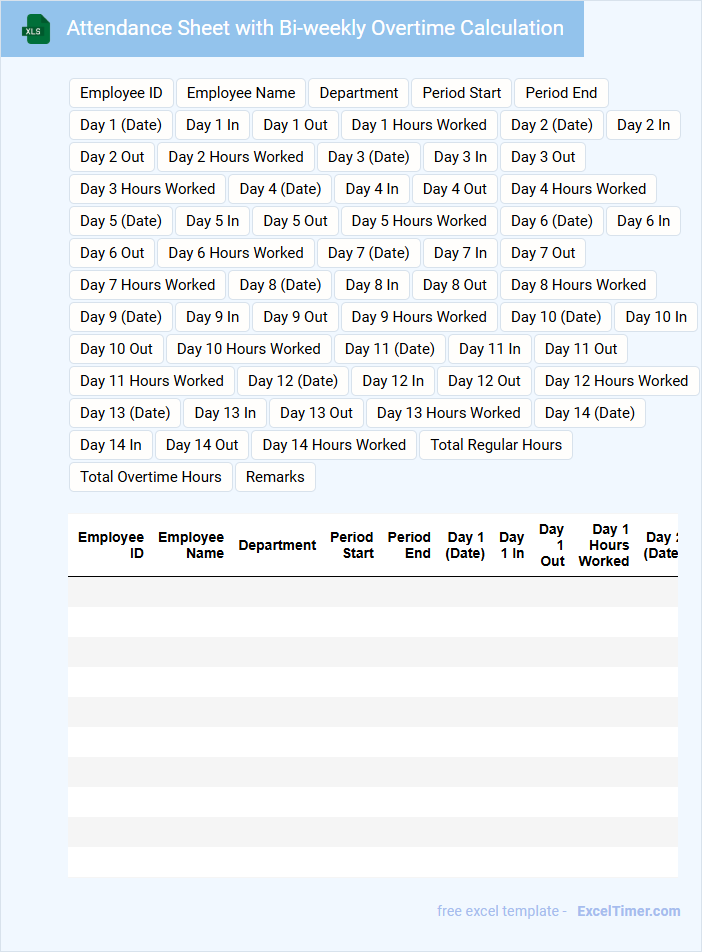

Attendance Sheet with Bi-weekly Overtime Calculation

What information is typically included in an Attendance Sheet with Bi-weekly Overtime Calculation? This document usually contains employee names, dates, hours worked each day, and recorded overtime hours within a two-week period. It helps track attendance accurately while calculating overtime pay based on company policies.

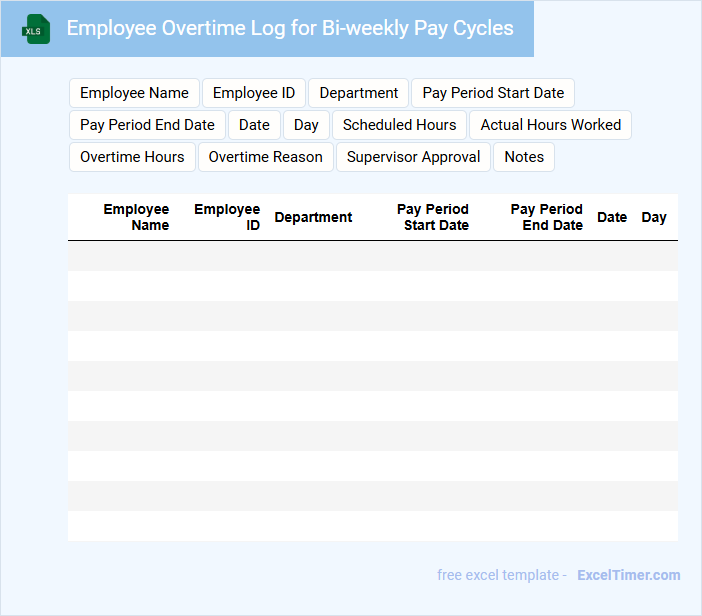

Employee Overtime Log for Bi-weekly Pay Cycles

An Employee Overtime Log for bi-weekly pay cycles typically contains detailed records of hours worked beyond the standard schedule. It includes employee names, dates, start and end times, and total overtime hours to ensure accurate compensation.

This document is essential for tracking extra work time and verifying compliance with labor laws. It is important to regularly update the log and maintain clear records to avoid payment disputes.

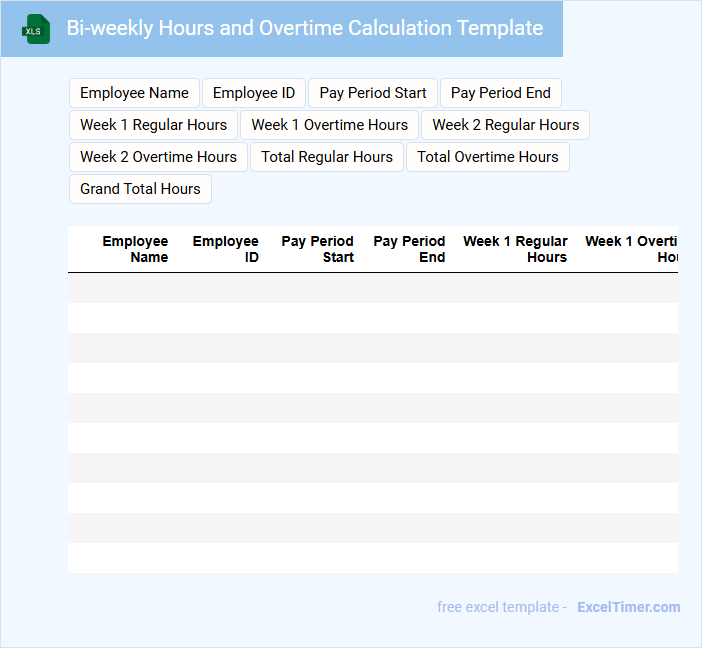

Bi-weekly Hours and Overtime Calculation Template

This document is typically used to track and calculate employee working hours and overtime on a bi-weekly basis. It helps ensure accurate payroll processing and compliance with labor regulations.

- Include columns for regular hours, overtime hours, and total hours worked each day.

- Incorporate formulas to automatically calculate overtime based on company or legal thresholds.

- Provide space for employee names, dates, and supervisor approval signatures.

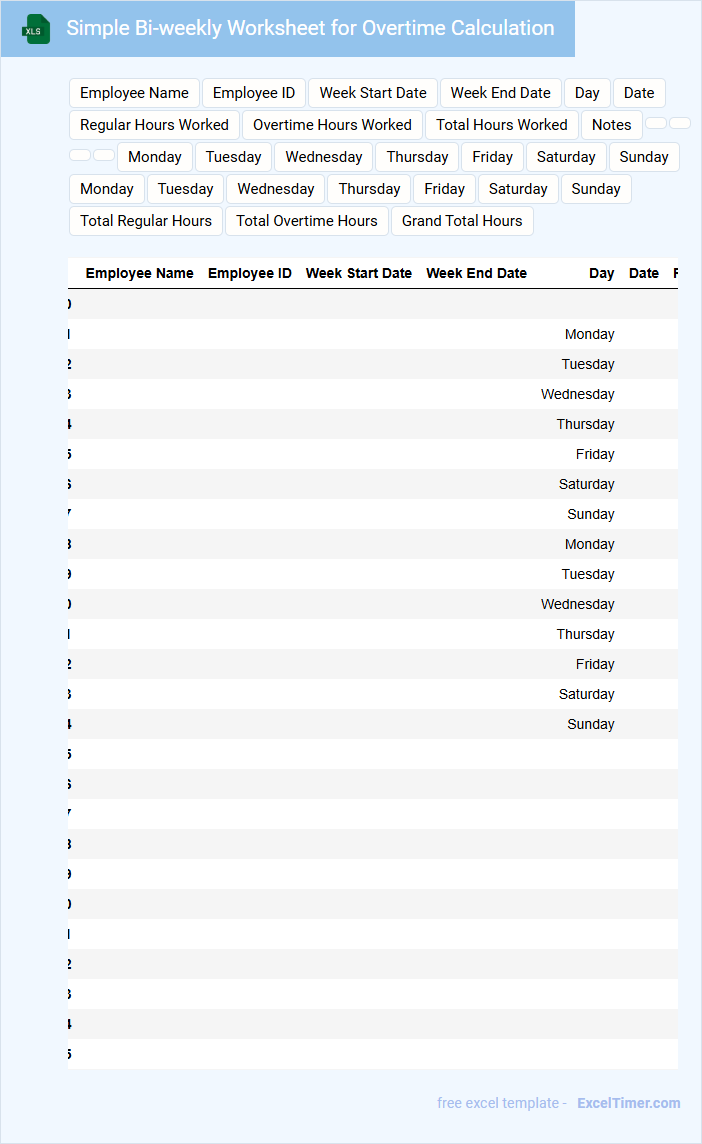

Simple Bi-weekly Worksheet for Overtime Calculation

A Simple Bi-weekly Worksheet for overtime calculation typically contains fields for tracking hours worked each day across two weeks, including regular and overtime hours. It helps employees and employers accurately record and manage work time for payroll purposes. Including clear date ranges and employee identification is essential.

This document often features sections for total regular hours, overtime hours, and corresponding pay rates to ensure proper compensation. Calculations are streamlined to distinguish between standard and extra hours worked. Ensuring accuracy in time entry and overtime policy details is highly recommended.

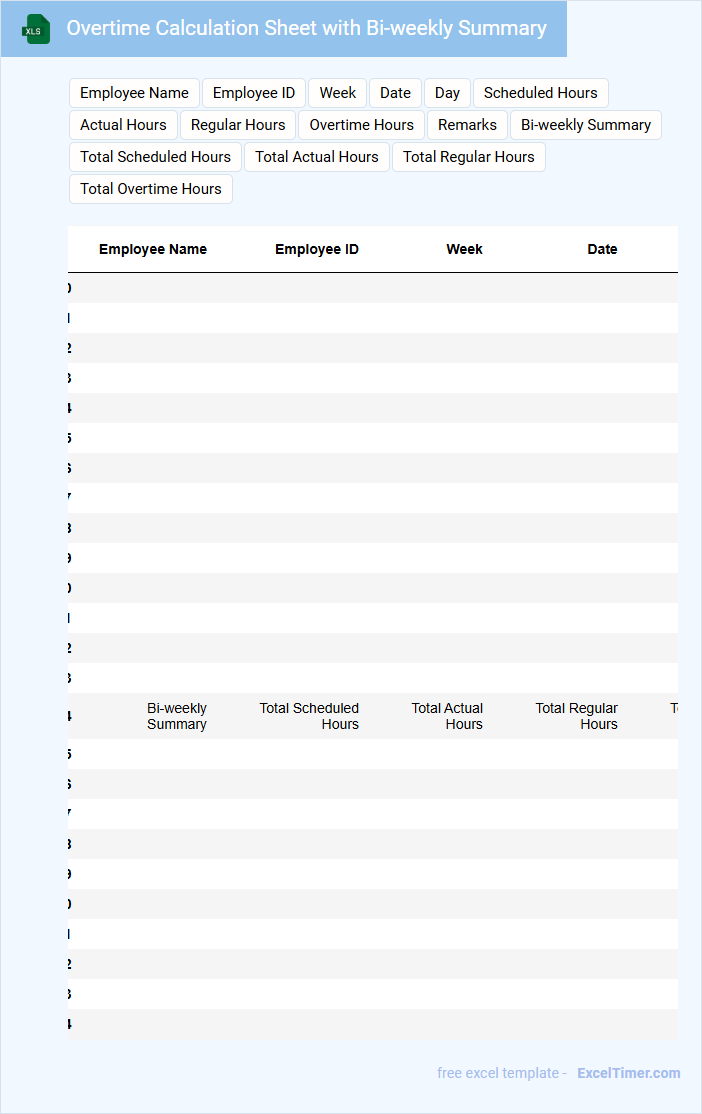

Overtime Calculation Sheet with Bi-weekly Summary

What information is typically included in an Overtime Calculation Sheet with Bi-weekly Summary? This document usually contains detailed records of each employee's overtime hours worked during a bi-weekly pay period, including dates, hours worked, and rates applied. It also summarizes total overtime accrued to help payroll process accurate compensation and monitor labor cost efficiently.

Bi-weekly Employee Pay with Overtime Tracker

Bi-weekly Employee Pay with Overtime Tracker documents employee hours and calculates regular and overtime pay for accurate compensation.

- Employee Details: Include names, IDs, and pay rates for personalized tracking.

- Hours Worked: Record regular and overtime hours separately for precise calculations.

- Payment Summary: Summarize gross pay, deductions, and net pay for transparent payroll processing.

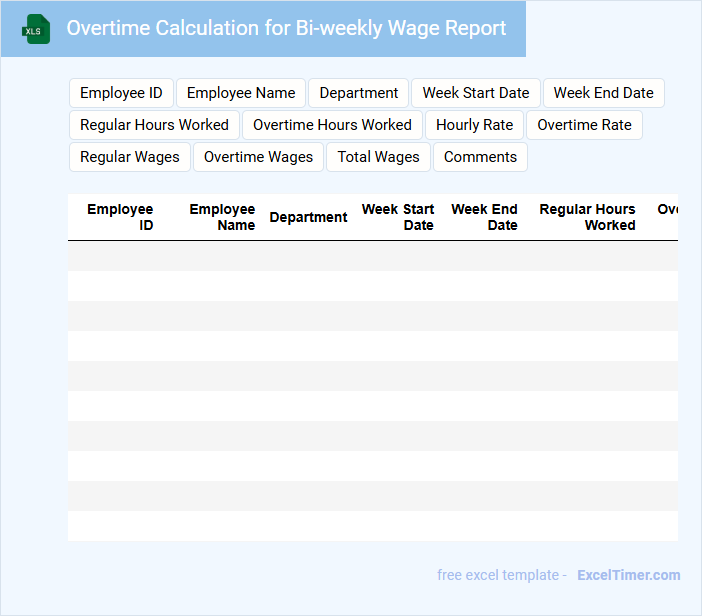

Overtime Calculation for Bi-weekly Wage Report

Overtime Calculation for Bi-weekly Wage Report typically includes detailed records of hours worked beyond regular shifts to ensure accurate employee compensation.

- Accurate Time Tracking: Ensure all overtime hours are precisely recorded and verified for consistency.

- Compliance with Labor Laws: Confirm overtime calculations adhere to the applicable labor regulations and company policies.

- Clear Documentation: Maintain transparent and organized records for easy payroll processing and audits.

Staff Schedule with Bi-weekly Overtime Calculation

A Staff Schedule with Bi-weekly Overtime Calculation typically contains a detailed timetable of employee shifts along with recorded hours worked each day. It highlights regular hours versus overtime hours within a two-week pay period to ensure accurate payroll processing. Including clear distinctions between standard and overtime hours helps to maintain compliance with labor laws and optimize workforce management.

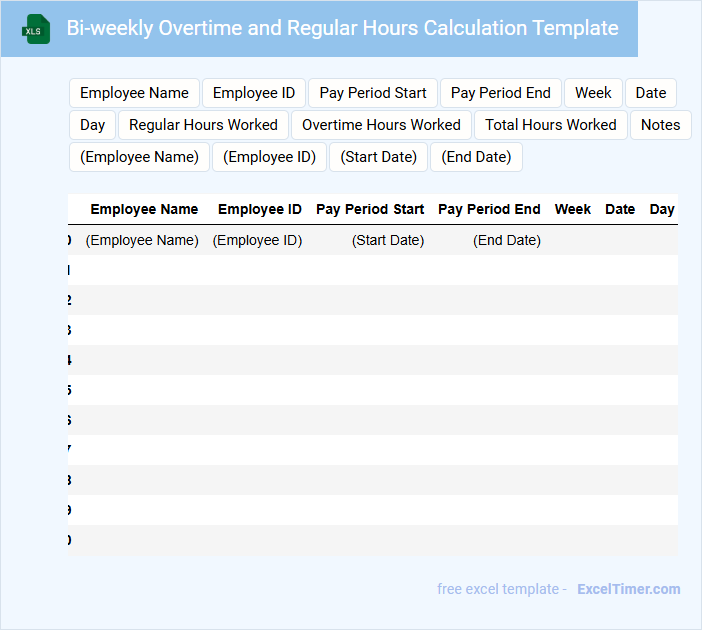

Bi-weekly Overtime and Regular Hours Calculation Template

A Bi-weekly Overtime and Regular Hours Calculation Template typically contains fields for tracking employee work hours, including regular time and overtime. It organizes hours worked over a two-week period to ensure accurate payroll processing and compliance with labor laws. This template often includes formulas to automatically compute total hours and distinguish between regular and overtime pay rates. Important considerations include ensuring accurate daily time entries, clearly defining overtime thresholds, and maintaining up-to-date pay rate information to prevent payroll errors.

How does Excel calculate overtime hours for bi-weekly pay periods using formulas?

Excel calculates overtime hours for bi-weekly pay periods by summing total hours worked over 80 hours and subtracting regular hours using formulas like =MAX(0, TotalHours - 80). It uses functions such as SUM or SUMPRODUCT to aggregate daily hours across 14 days and applies conditional logic to distinguish overtime from regular time. This approach ensures accurate overtime payment based on bi-weekly thresholds commonly set by payroll policies.

What function can identify regular vs. overtime hours in a bi-weekly Excel timesheet?

The IF function combined with SUM and logical operators can identify regular versus overtime hours in your bi-weekly Excel timesheet. By setting a threshold, such as 80 hours for two weeks, the formula calculates hours up to 80 as regular and any excess as overtime. This approach ensures accurate overtime calculation for payroll and time management.

How do you apply conditional formatting to highlight overtime entries in a bi-weekly report?

To apply conditional formatting for highlighting overtime entries in a bi-weekly Excel report, select the overtime hours column, then use a formula-based rule such as =A2>40 to identify hours exceeding 40 per week. Your formatting rule should highlight these cells with a distinct color to easily visualize overtime. This method ensures accurate tracking of overtime within the bi-weekly calculation framework.

What is the Excel formula to sum bi-weekly total hours and separate overtime across multiple employees?

Use the formula =SUMIFS(HoursRange, DateRange, ">="&StartDate, DateRange, "<="&EndDate) to sum total bi-weekly hours per employee. Calculate overtime by applying =MAX(0, TotalHours-80) assuming 80 hours is the bi-weekly threshold. Separate totals for multiple employees using SUMIFS with an additional criteria range for EmployeeID or Name.

How can pivot tables be used in Excel to analyze overtime trends within bi-weekly intervals?

Pivot tables in Excel efficiently summarize and analyze overtime hours by grouping data into bi-weekly intervals, highlighting patterns and peak periods. You can quickly filter and compare overtime across departments or employees to identify trends and anomalies. Leveraging this tool streamlines your bi-weekly overtime calculation and decision-making process.