The Bi-weekly Excel Template for Personal Budget helps users track income and expenses every two weeks, ensuring accurate financial management. It provides customizable categories and automated calculations to simplify budget planning and monitoring. Regular use of this template promotes better spending habits and financial discipline.

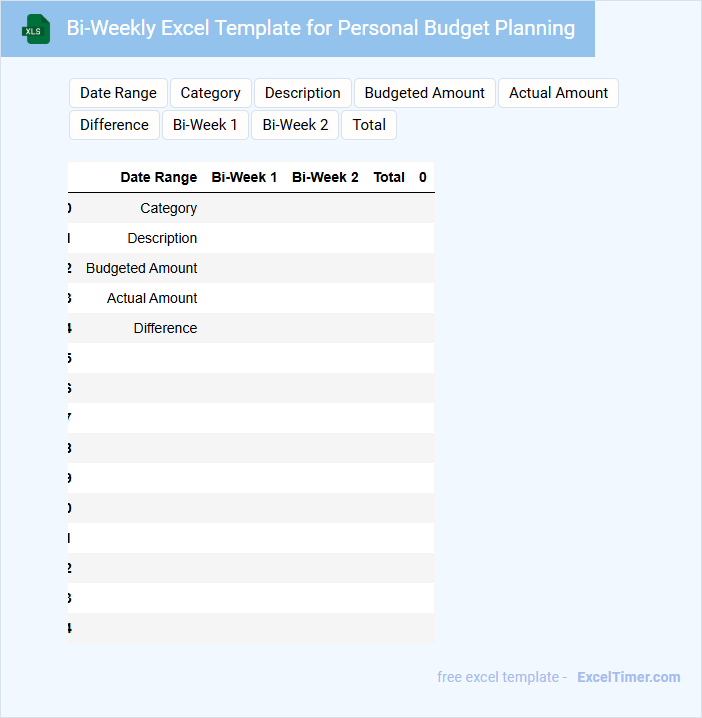

Bi-Weekly Excel Template for Personal Budget Planning

What information is typically contained in a Bi-Weekly Excel Template for Personal Budget Planning? This document usually includes categorized income and expense sections, tracking bi-weekly inflows and outflows to help manage finances more effectively. It often features automatic calculations for savings, balances, and budget variances to provide a clear overview of financial health every two weeks.

What important factors should be considered when using this template? Users should ensure all recurring and irregular expenses are accurately recorded to avoid budget gaps, and regularly update income details to maintain precision. Additionally, incorporating goal-setting features and reminders can enhance budgeting discipline and financial planning success.

Simple Bi-Weekly Excel Sheet for Budget Tracking

A Simple Bi-Weekly Excel Sheet for Budget Tracking is a document designed to help individuals or families monitor their income and expenses every two weeks efficiently.

- Income Entries: Record all sources of income received within each bi-weekly period to have a clear financial overview.

- Expense Categories: Organize expenses into categories like groceries, utilities, and entertainment to identify spending patterns.

- Balance Tracking: Calculate the remaining balance after expenses to ensure spending stays within budget limits.

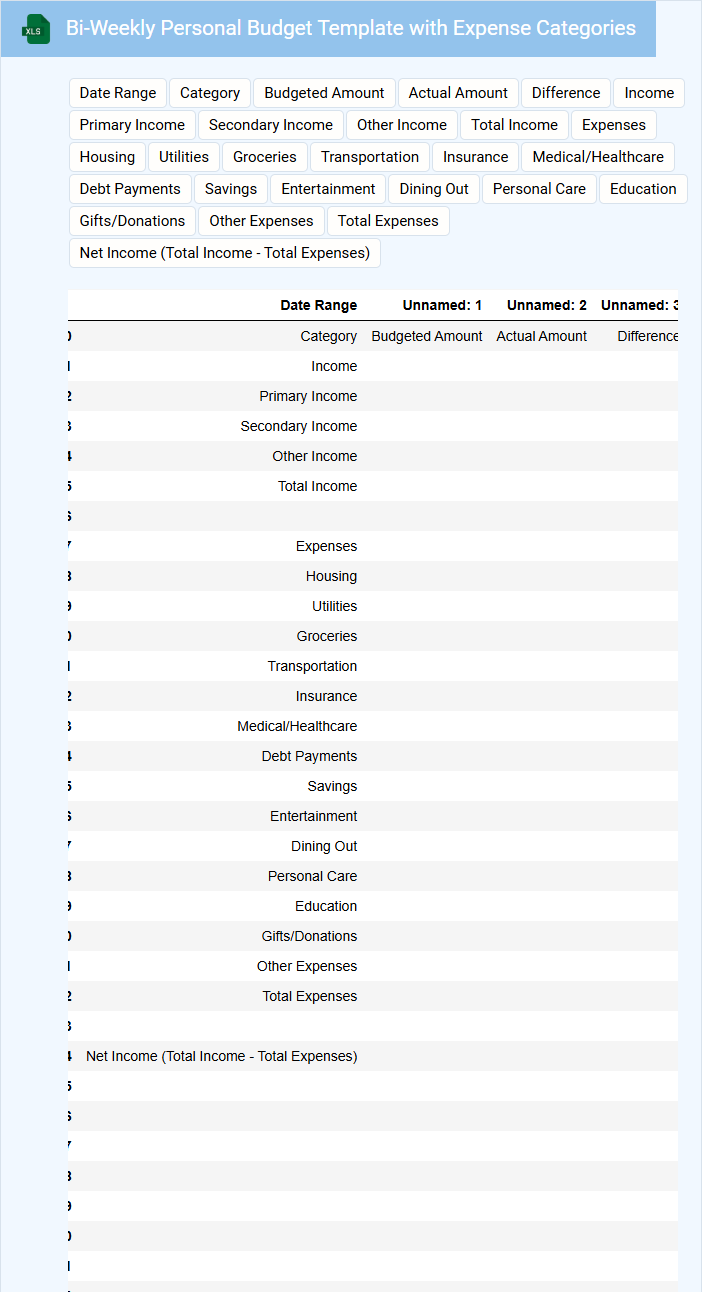

Bi-Weekly Personal Budget Template with Expense Categories

A Bi-Weekly Personal Budget Template helps individuals track their income and expenses every two weeks, fostering better financial management. It typically includes detailed expense categories such as housing, utilities, groceries, transportation, and entertainment to organize spending effectively.

Using such a template encourages consistent budgeting habits and helps identify areas for saving or adjustment. It is important to regularly update the template to reflect changes in income or expenses for accurate financial planning.

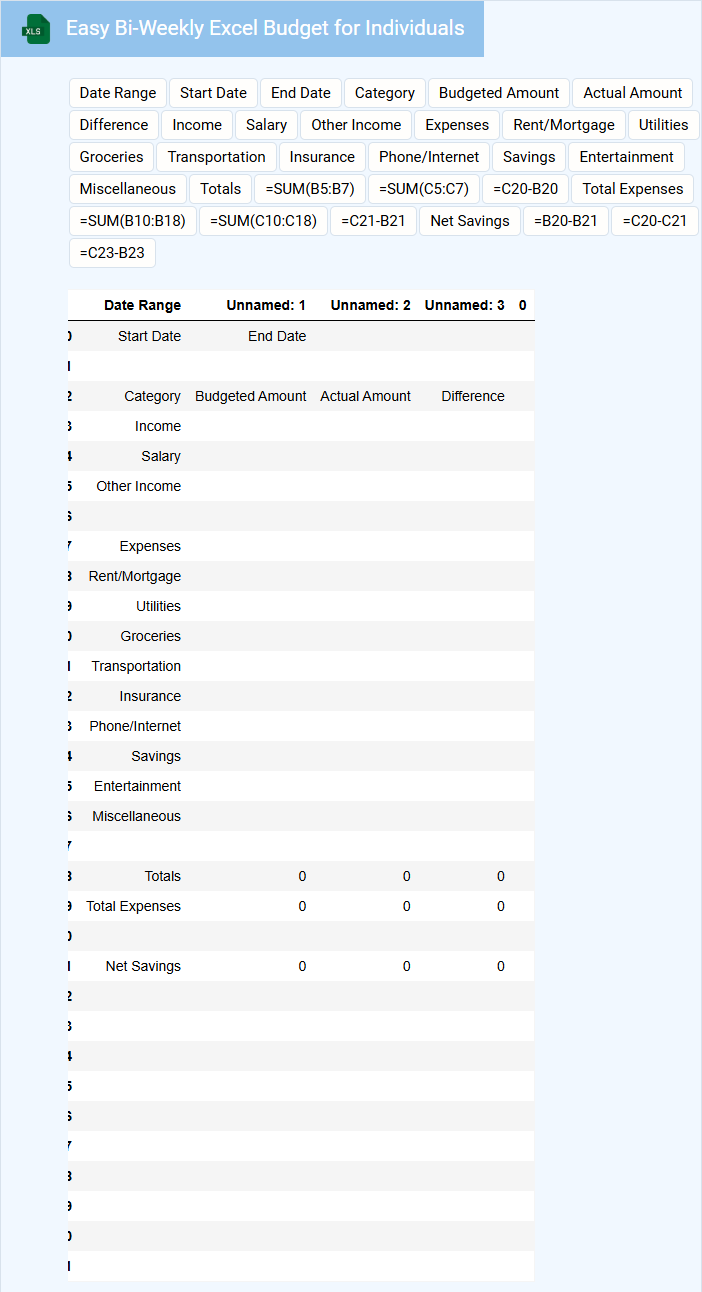

Easy Bi-Weekly Excel Budget for Individuals

An Easy Bi-Weekly Excel Budget for individuals is typically a spreadsheet designed to help manage income and expenses every two weeks. It usually contains sections for tracking paychecks, fixed costs, variable spending, and savings goals. This type of document simplifies financial planning by breaking down the budget into manageable periods.

To maximize its effectiveness, include clear categories for income and expenses, built-in formulas to automatically calculate totals and balances, and space for notes or financial goals. Regularly updating the budget ensures accurate tracking and better control over personal finances. Visual aids like charts or color coding can also enhance understanding and motivation.

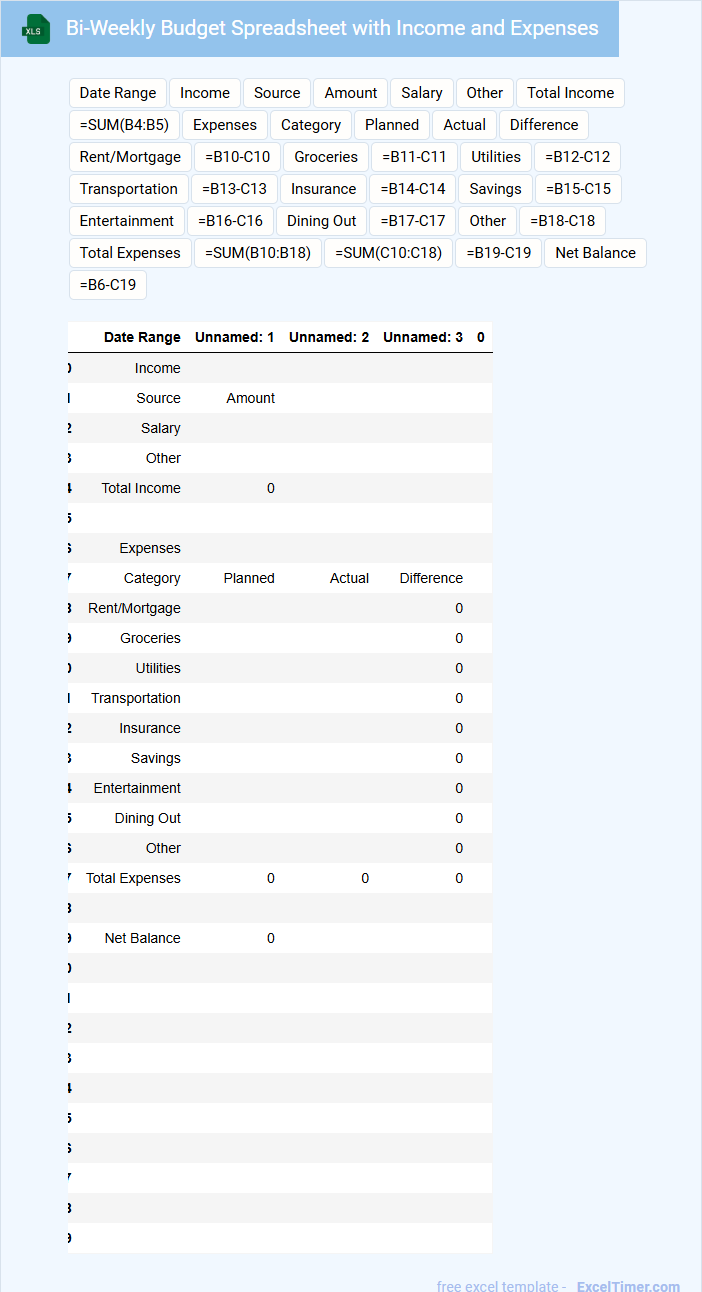

Bi-Weekly Budget Spreadsheet with Income and Expenses

A Bi-Weekly Budget Spreadsheet typically contains detailed records of income and expenses tracked over two-week periods to help users manage their finances more effectively. It usually includes categories for various income sources and expense types, allowing for clear comparisons and adjustments. This type of document is essential for maintaining financial discipline and ensuring that cash flow is balanced within each pay period.

For optimal use, it's important to include clear labels for each category, date ranges for tracking periods, and a section for notes or adjustments. Incorporating formulas to automatically calculate totals and differences between income and expenses can enhance accuracy and usability. Regularly updating the spreadsheet and reviewing spending habits will contribute to better financial planning and goal setting.

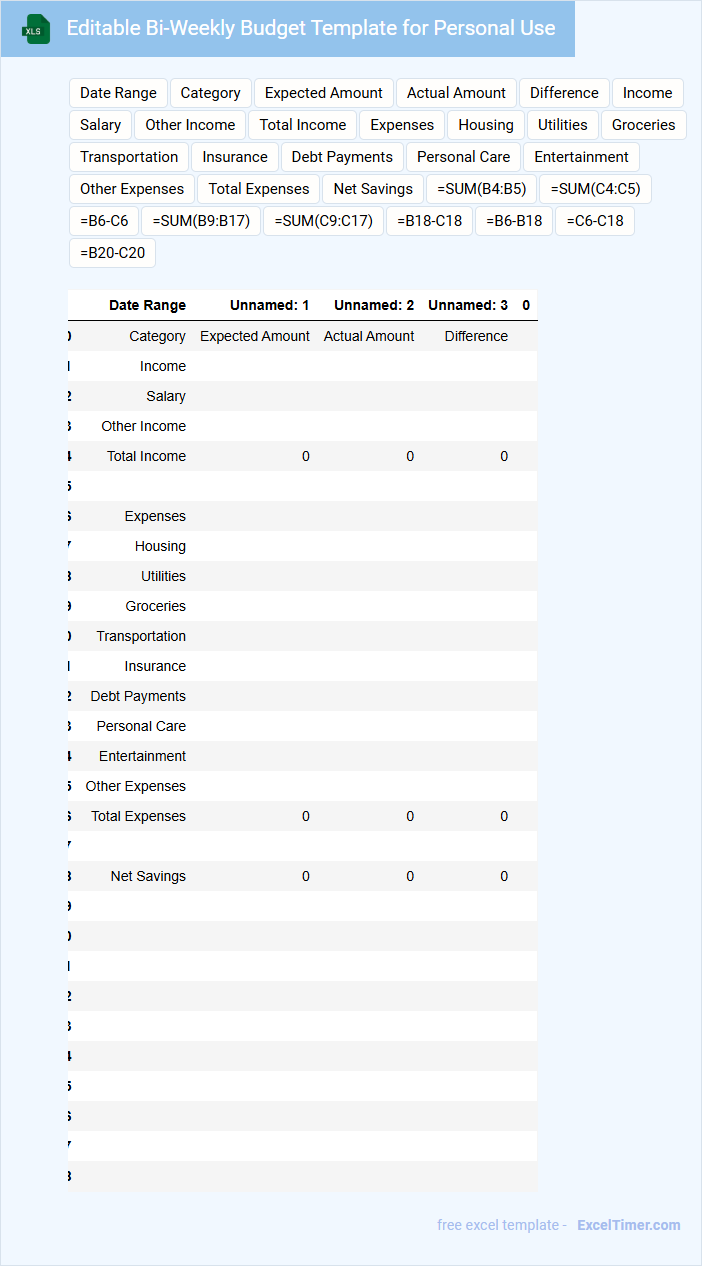

Editable Bi-Weekly Budget Template for Personal Use

An Editable Bi-Weekly Budget Template is a document designed to help individuals track their income and expenses every two weeks. It typically includes categories for bills, savings, and discretionary spending to provide a clear financial overview.

This type of template is essential for personal use as it promotes consistent budgeting and helps manage cash flow efficiently. Including sections for unexpected expenses and financial goals can make the document more effective.

Free Bi-Weekly Excel Budget with Savings Tracker

What information is typically included in a Free Bi-Weekly Excel Budget with Savings Tracker? This document usually contains detailed income and expense categories organized on a bi-weekly basis to help users plan and monitor their finances effectively. It also features a savings tracker section to encourage consistent saving habits and track progress towards financial goals.

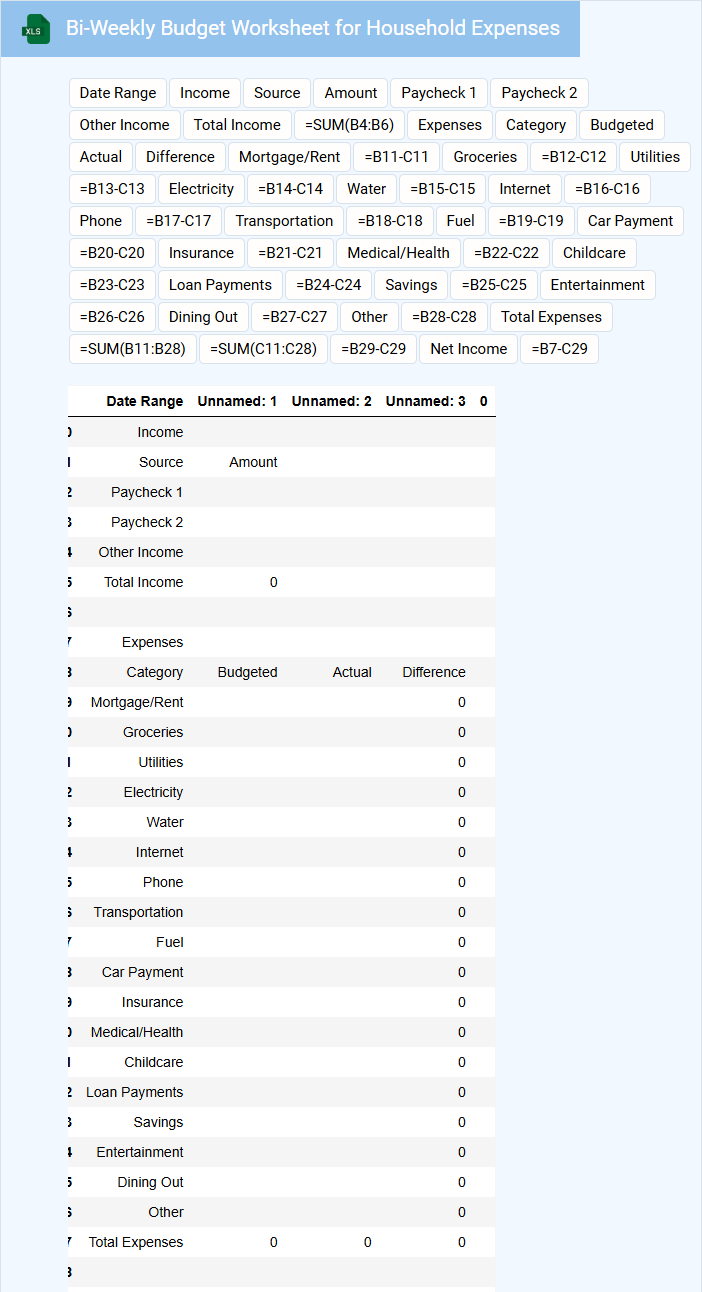

Bi-Weekly Budget Worksheet for Household Expenses

A Bi-Weekly Budget Worksheet for household expenses is a financial tool designed to track and manage income and spending every two weeks. It typically includes categories such as utilities, groceries, transportation, and savings to ensure balanced spending. Using this worksheet helps individuals maintain financial discipline and plan for upcoming expenses effectively.

Important considerations for this document include regularly updating expense entries, categorizing all costs accurately, and reviewing the worksheet to identify potential savings. Consistency is key to gaining insights into spending habits and staying within budget limits. Additionally, setting clear financial goals enhances the worksheet's effectiveness in managing household finances.

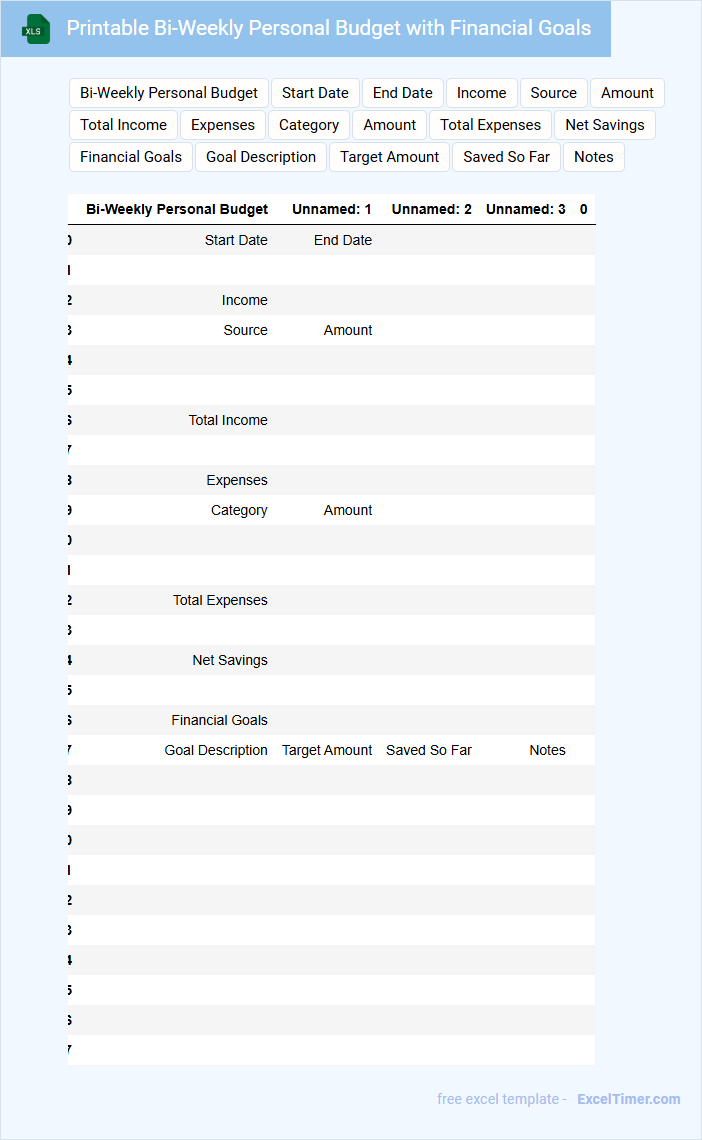

Printable Bi-Weekly Personal Budget with Financial Goals

A Printable Bi-Weekly Personal Budget is a structured financial document designed to track income and expenses every two weeks, helping individuals manage their finances efficiently. It typically contains sections for recording various income sources, fixed expenses, variable spending, and savings contributions. Including financial goals in the document helps prioritize spending and promotes disciplined savings to achieve both short-term and long-term objectives.

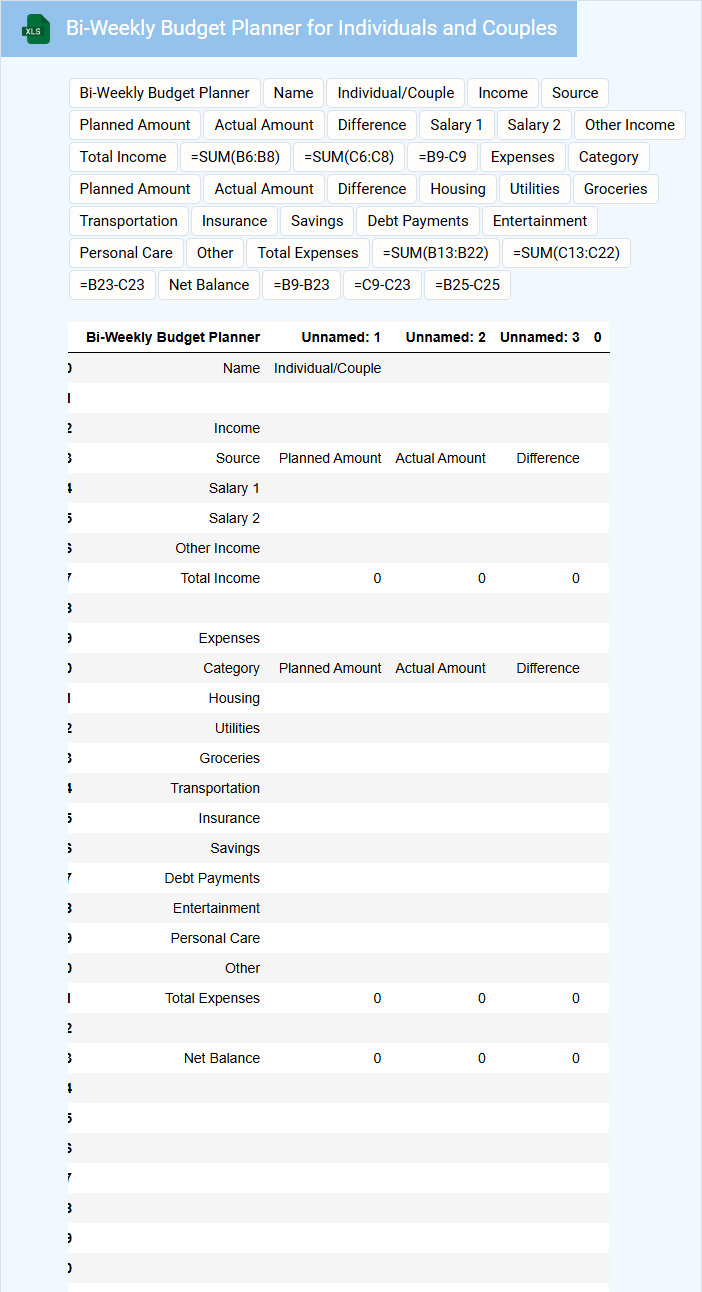

Bi-Weekly Budget Planner for Individuals and Couples

A Bi-Weekly Budget Planner for Individuals and Couples typically contains detailed income and expense tracking to help manage finances effectively.

- Income Sources: Clearly list all bi-weekly income streams to account for total earnings.

- Expense Categories: Include fixed, variable, and discretionary expenses to monitor spending habits.

- Savings Goals: Set and track short-term and long-term savings objectives to ensure financial stability.

Automated Bi-Weekly Excel Template for Money Management

This type of document typically contains structured financial data and formulas designed to automate tracking and managing money on a bi-weekly basis.

- Income and Expense Categories: Clearly defined sections to input and categorize all sources of income and expenditures.

- Automated Calculations: Built-in formulas that calculate totals, balances, and projections automatically without manual input.

- Visual Summaries: Charts or tables that provide a quick overview of financial status to enable informed decision-making.

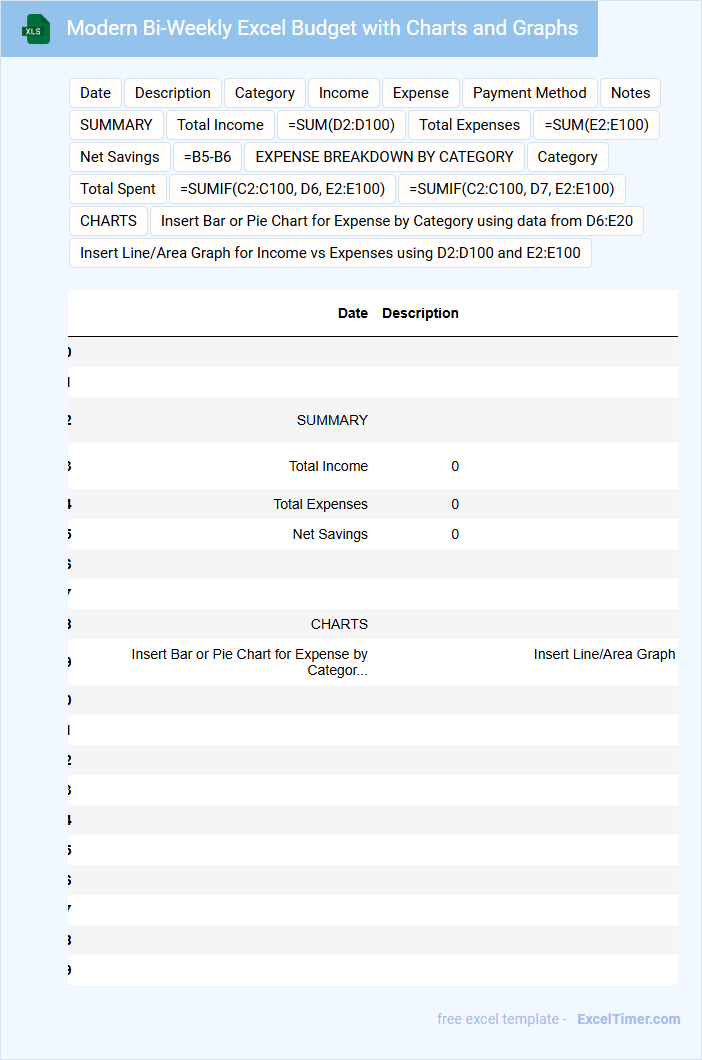

Modern Bi-Weekly Excel Budget with Charts and Graphs

What does a Modern Bi-Weekly Excel Budget with Charts and Graphs typically contain? It usually includes detailed income and expense tracking segmented into bi-weekly periods, allowing for precise financial planning. The document also features dynamic charts and graphs to visually represent spending patterns and budget adherence.

What is an important aspect to consider when using this type of budget? Ensuring accurate and consistent data entry is crucial for reliable analytics, and customizing categories to fit personal financial goals enhances the budget's effectiveness.

Bi-Weekly Budget Log for Personal Finance Tracking

A Bi-Weekly Budget Log for Personal Finance Tracking is a document used to record income and expenses every two weeks to help manage personal finances effectively. It aims to provide a clear overview of spending patterns and savings goals over short intervals.

- Include categories for all income sources and expense types to ensure comprehensive tracking.

- Regularly compare actual spending against budgeted amounts to identify areas for adjustment.

- Update the log consistently every two weeks to maintain accurate and current financial data.

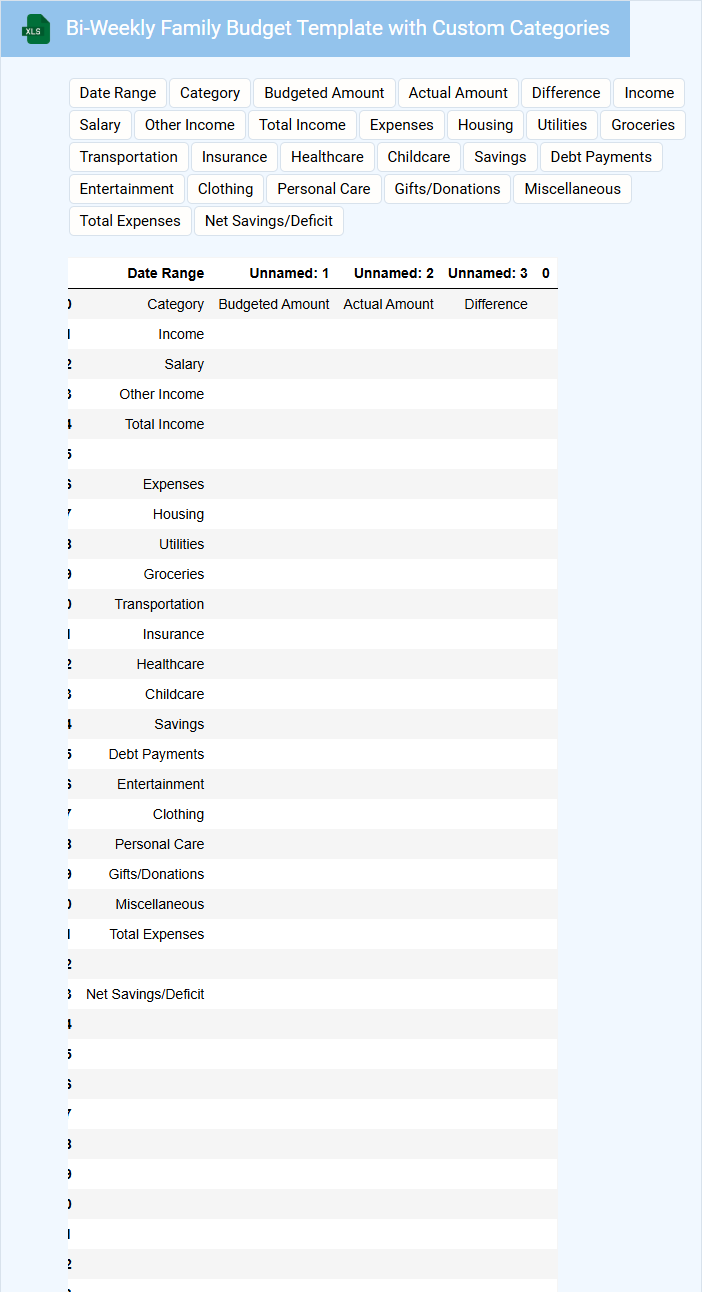

Bi-Weekly Family Budget Template with Custom Categories

The Bi-Weekly Family Budget Template is a practical tool designed to track income and expenses over two-week periods. It usually contains sections for income sources, fixed and variable expenses, and savings goals, all organized by customizable categories. This template helps families manage finances effectively by providing a clear overview of spending habits and budgeting needs.

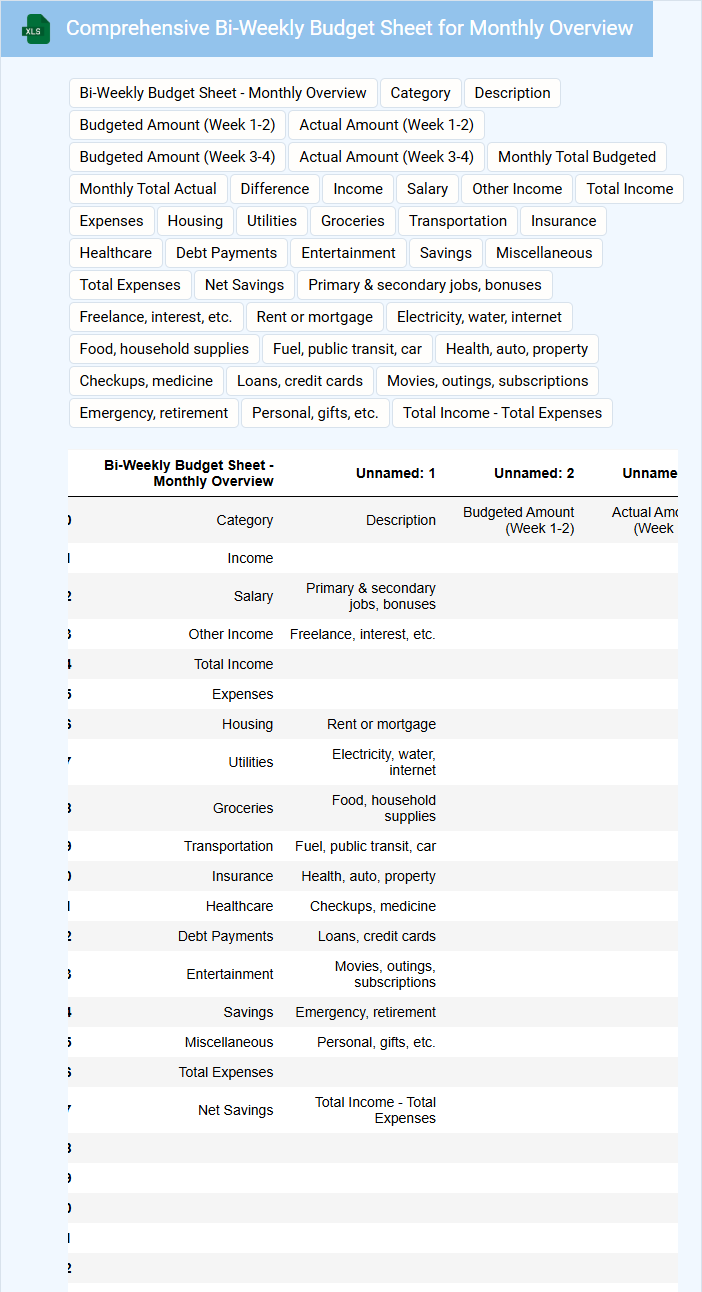

Comprehensive Bi-Weekly Budget Sheet for Monthly Overview

A Comprehensive Bi-Weekly Budget Sheet for Monthly Overview is a detailed financial document designed to track income and expenses every two weeks. It helps in maintaining a clear and organized view of finances to promote better budgeting decisions.

- Include all sources of income and categorize expenses for accurate tracking.

- Update the sheet regularly to reflect real-time financial status and avoid overspending.

- Use summary sections to compare bi-weekly spending against monthly budget goals.

What is the significance of setting a bi-weekly budget period in an Excel personal budget document?

Setting a bi-weekly budget period in your Excel personal budget document aligns with common pay cycles, allowing for precise income and expense tracking every two weeks. This method enhances cash flow management by matching budget entries to actual payment dates, reducing the risk of overspending. Accurate bi-weekly budgeting supports better financial planning and timely bill payments, improving overall financial health.

How do you calculate bi-weekly income and expenses using Excel formulas?

Calculate bi-weekly income by entering your annual salary in a cell (e.g., A1) and using the formula `=A1/26`. Sum bi-weekly expenses by listing individual costs in a range (e.g., B1:B10) and applying `=SUM(B1:B10)`. Use these formulas to analyze and balance your Personal Budget efficiently.

Which Excel functions help track variances between planned and actual bi-weekly spending?

Excel functions like SUMIFS and OFFSET efficiently calculate planned versus actual bi-weekly spending totals, highlighting variances. The IF and ABS functions help identify and quantify discrepancies, enabling accurate budget tracking. Combining conditional formatting with these functions visually emphasizes spending differences in a personal budget template.

How do automated running totals for bi-weekly savings work in Excel?

Automated running totals for bi-weekly savings in Excel use a formula like =SUM($B$2:B2) to cumulatively add savings amounts entered every two weeks. This formula dynamically updates as new bi-weekly savings data is entered, tracking the total saved over time. Conditional formatting and date functions can enhance accuracy by aligning entries with specific bi-weekly periods.

What Excel tools can visualize bi-weekly cash flow trends in a personal budget sheet?

Excel tools like PivotTables and PivotCharts effectively visualize bi-weekly cash flow trends in a personal budget sheet by summarizing income and expenses over specified periods. Conditional Formatting highlights spending patterns and anomalies within bi-weekly intervals, enhancing trend identification. Using line charts or bar graphs with bi-weekly date groupings provides clear visual representation of cash flow fluctuations over time.