The Bi-weekly Excel Template for Employee Payroll streamlines payroll calculations by automatically tracking hours worked, deductions, and net pay every two weeks. It enhances accuracy and saves time, reducing manual errors in employee salary processing. Customizable features allow businesses to tailor the template to their specific payroll policies and tax regulations.

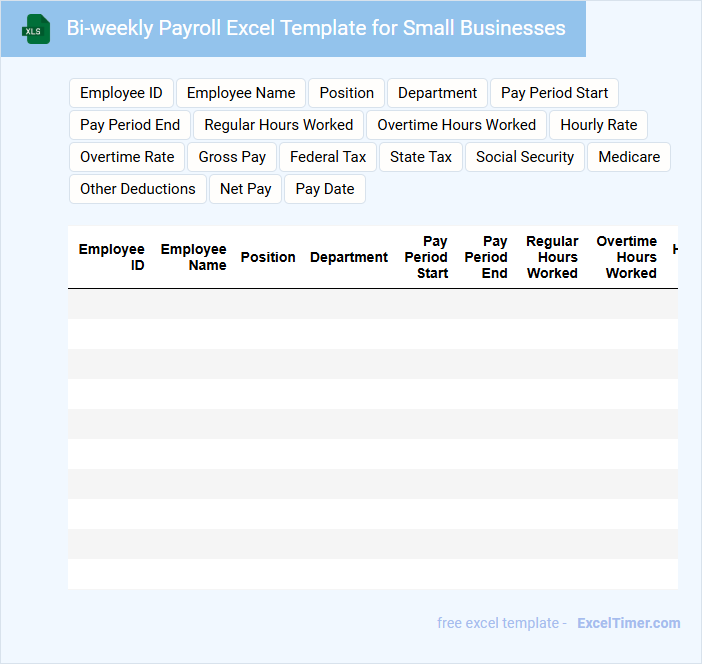

Bi-weekly Payroll Excel Template for Small Businesses

A Bi-weekly Payroll Excel Template for Small Businesses typically contains employee payment details, tax calculations, and attendance tracking to streamline payroll processing.

- Employee Information: Ensure accurate recording of names, IDs, and payment rates.

- Tax and Deductions: Automate calculations for taxes, benefits, and other deductions.

- Payment Summary: Maintain a clear summary of pay periods, hours worked, and total earnings.

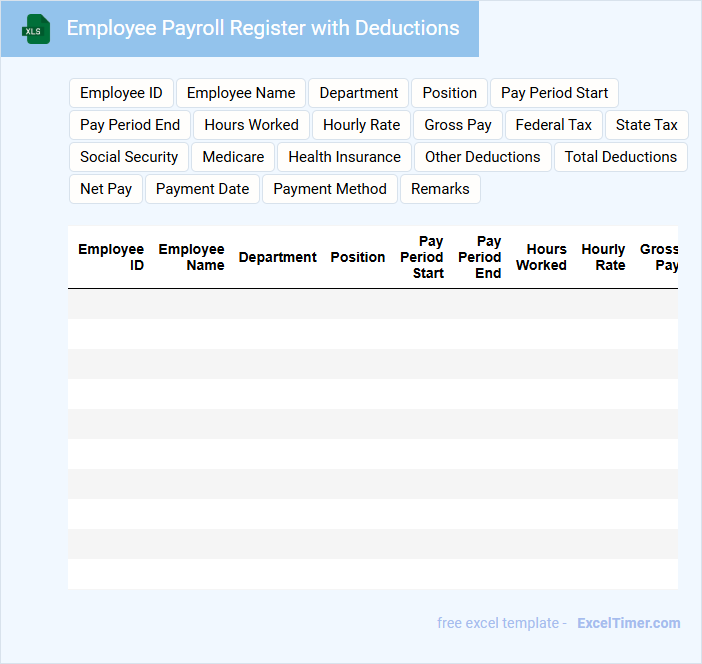

Employee Payroll Register with Deductions

An Employee Payroll Register with Deductions is a detailed record that tracks employee earnings and the various deductions applied to their paychecks. It helps organizations maintain accurate payroll information and ensure compliance with tax and legal requirements.

- Contains employee names, pay periods, gross wages, and net pay after deductions.

- Includes itemized deductions such as taxes, insurance, retirement contributions, and other withholdings.

- Helps in auditing payroll processes and supports accurate reporting for financial and tax purposes.

Bi-weekly Payroll Sheet for Hourly Employees

The Bi-weekly Payroll Sheet for hourly employees typically contains detailed records of hours worked, pay rates, and total wages earned over a two-week period. It also includes deductions, taxes, and net pay figures to ensure accurate compensation.

An important aspect of this document is the attendance verification, which helps prevent errors and discrepancies in employee pay. Regularly updating and reviewing this sheet can improve payroll accuracy and employee satisfaction.

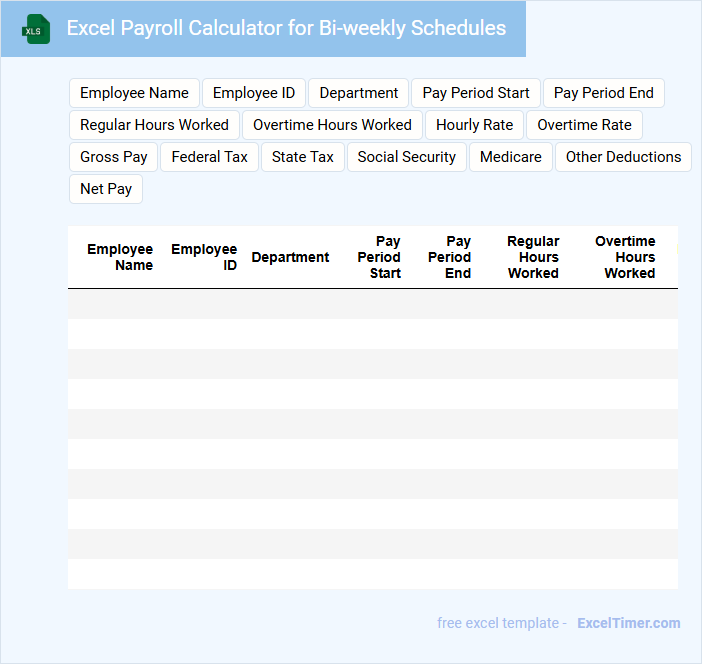

Excel Payroll Calculator for Bi-weekly Schedules

An Excel Payroll Calculator for bi-weekly schedules is a document designed to streamline employee wage calculations by automating hours worked, overtime, and deductions. It typically contains fields for employee information, pay rates, hours worked each period, and tax withholdings. For accuracy, it's important to regularly update tax rates and verify formula integrity to ensure precise payroll management.

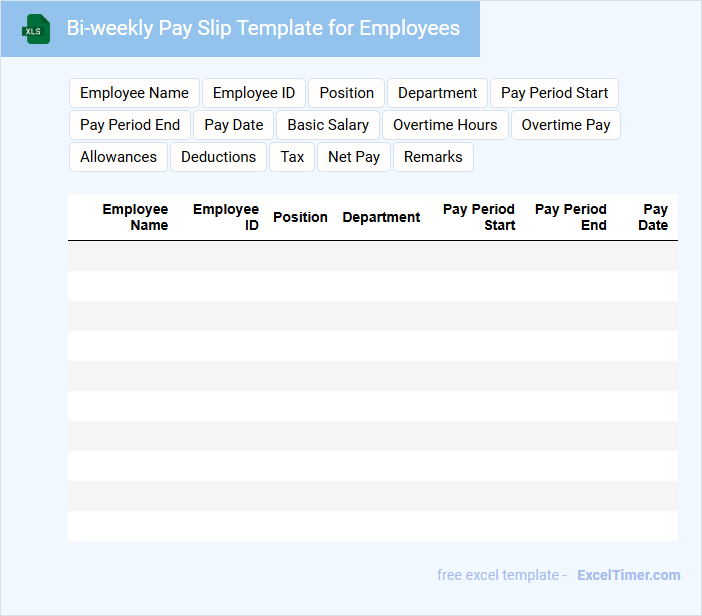

Bi-weekly Pay Slip Template for Employees

A Bi-weekly Pay Slip Template typically contains detailed information about an employee's earnings and deductions for a two-week period. It includes key elements such as gross pay, taxes withheld, and net pay to ensure transparent communication. This document is essential for both employees and employers to maintain accurate payroll records and resolve any payment discrepancies.

Overtime Tracker with Bi-weekly Payroll

Overtime Tracker with Bi-weekly Payroll is a document used to accurately record the extra hours employees work beyond their regular schedule. It typically contains employee names, dates, hours worked, overtime calculations, and pay rate details. This ensures precise payroll processing and compliance with labor laws for bi-weekly payment cycles.

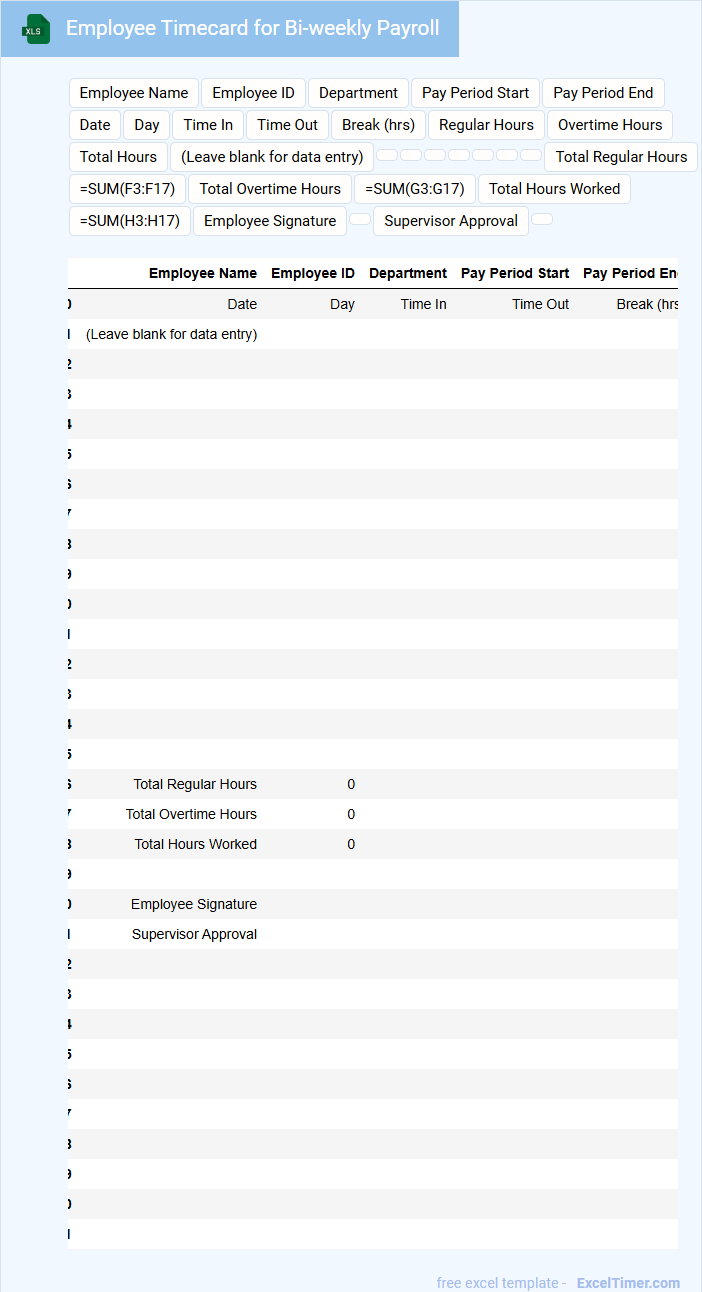

Employee Timecard for Bi-weekly Payroll

What information is typically included in an Employee Timecard for Bi-weekly Payroll? This document usually contains detailed records of an employee's hours worked over a two-week period, including start and end times, breaks, and total hours. It is essential for accurate calculation of wages and compliance with labor regulations.

Why is it important to track employee time carefully? Precise time tracking ensures employees are compensated fairly for their work, helps employers manage labor costs, and supports auditing and payroll accuracy. Including clear instructions and an easy-to-use format enhances reliability and reduces errors.

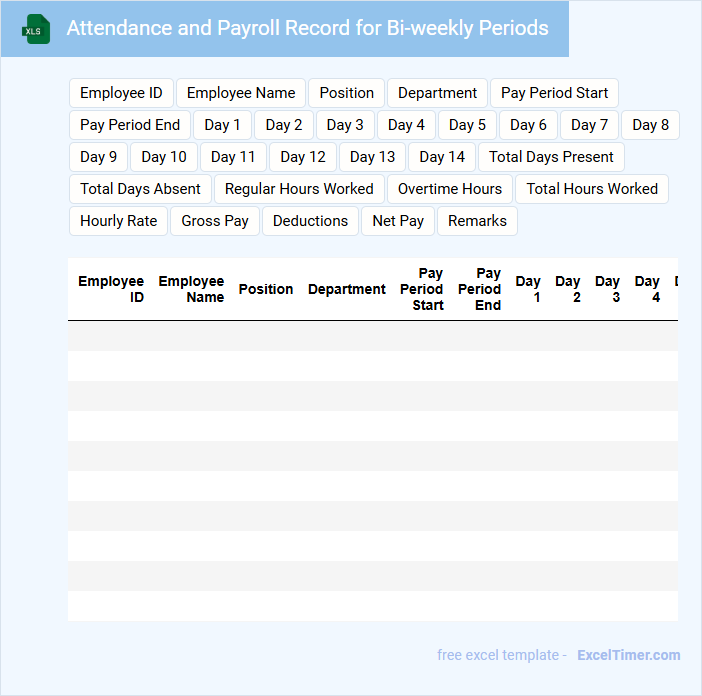

Attendance and Payroll Record for Bi-weekly Periods

An Attendance and Payroll Record for bi-weekly periods typically contains detailed employee work hours and corresponding wage calculations. It tracks clock-in and clock-out times, leave taken, and overtime to ensure accurate compensation.

Maintaining an accurate record helps streamline payroll processing and ensures compliance with labor laws. It is important to regularly verify entries and keep the data secure for audits and employee reviews.

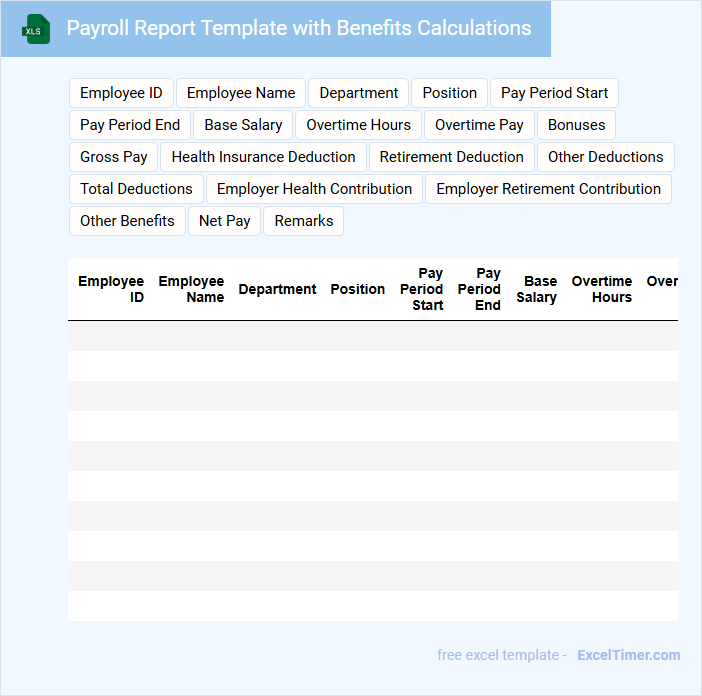

Payroll Report Template with Benefits Calculations

A Payroll Report Template with Benefits Calculations is typically used to document employee salaries, deductions, and the value of additional benefits. It contains detailed information such as gross pay, tax withholdings, and contributions towards health insurance or retirement plans. This type of document is essential for ensuring accuracy in employee compensation and compliance with legal requirements.

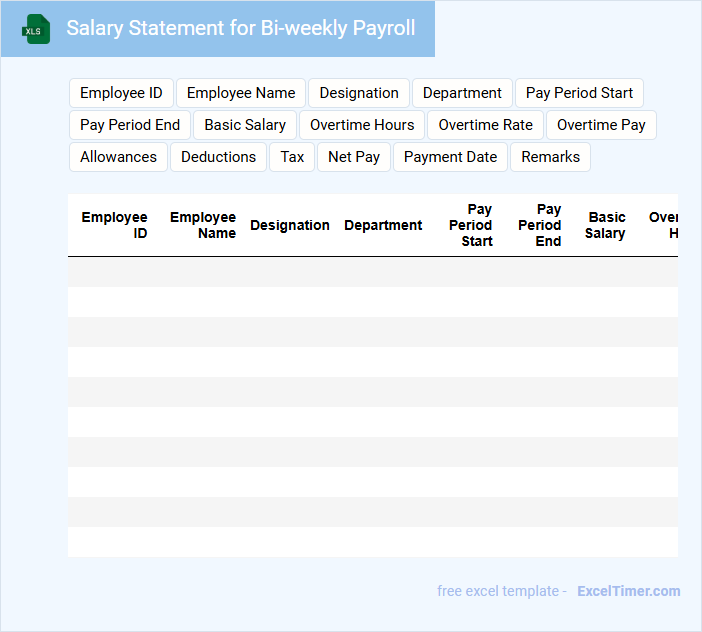

Salary Statement for Bi-weekly Payroll

A Salary Statement for Bi-weekly Payroll typically contains detailed information about an employee's earnings, deductions, and net pay for a two-week period. It ensures transparency and accuracy in documenting compensation.

Important details include gross salary, tax withholdings, benefits, and any additional allowances or bonuses. Regular distribution and clear formatting help employees understand their pay structure effectively.

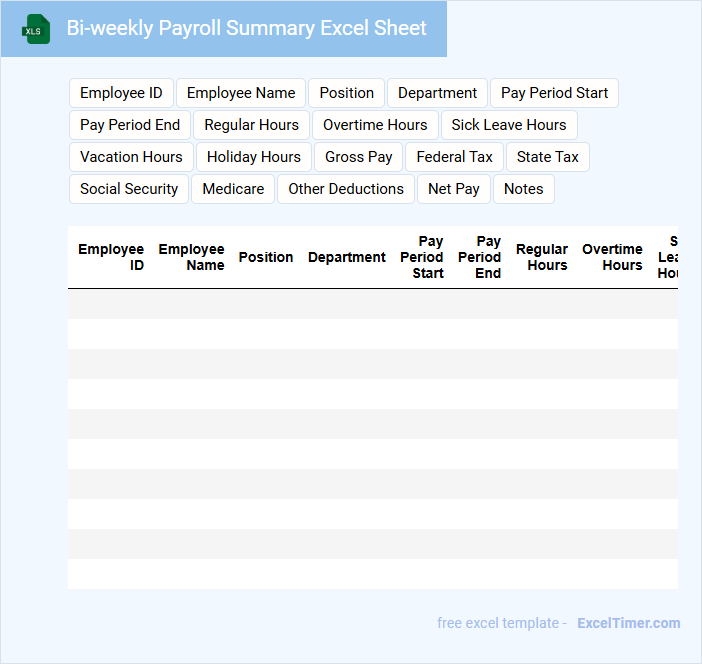

Bi-weekly Payroll Summary Excel Sheet

A Bi-weekly Payroll Summary Excel Sheet is a document used to compile and summarize employee earnings and deductions over a two-week period. It helps ensure accurate payroll processing and financial tracking for the company.

- Include employee names, total hours worked, and pay rates.

- Record all deductions such as taxes, benefits, and other withholdings.

- Summarize net pay and generate totals for the entire payroll period.

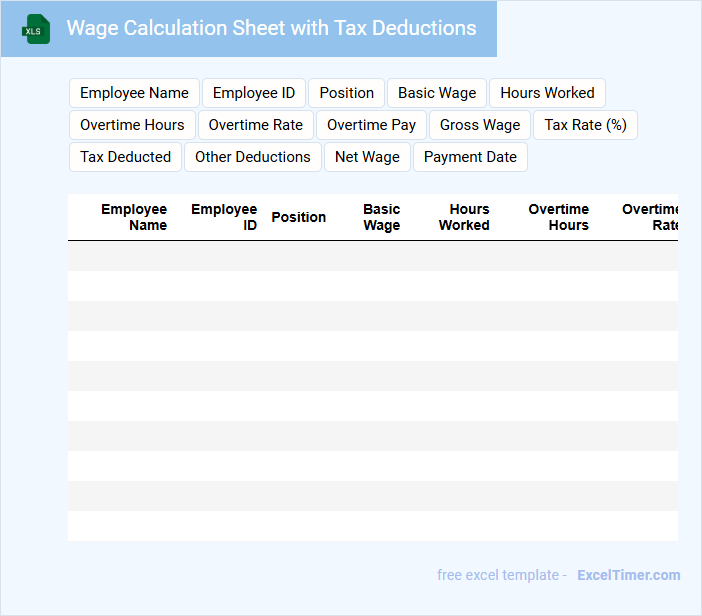

Wage Calculation Sheet with Tax Deductions

A Wage Calculation Sheet with Tax Deductions is a document used to detail an employee's earnings and the corresponding tax amounts withheld. It typically includes information such as gross wages, taxable income, and specific deductions like federal, state, and social security taxes. This sheet helps both employers and employees maintain transparent and accurate payroll records.

Important elements to include are clear breakdowns of all wage components, precise tax calculation methods, and space for notes on any additional deductions or benefits. Ensuring accuracy in tax rates and adherence to local regulations is essential for compliance and payroll accuracy. Regular updates to this document can prevent errors and facilitate smoother year-end reporting processes.

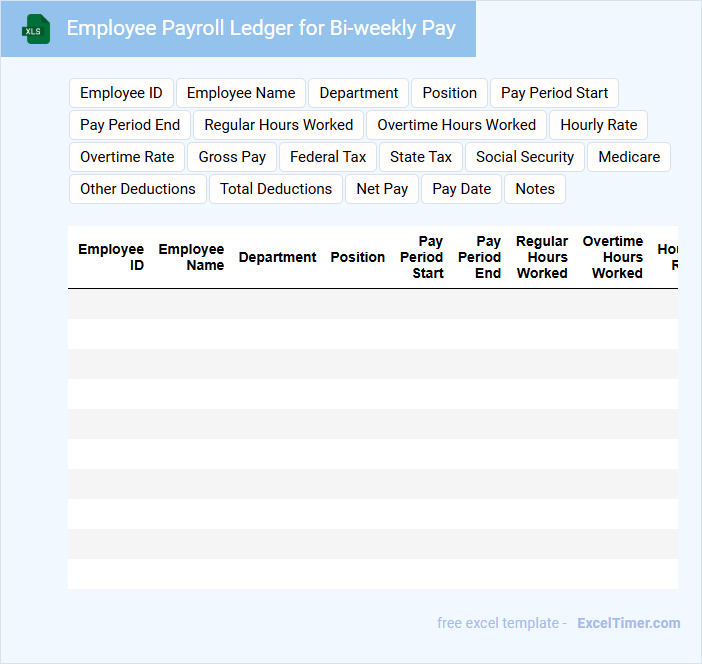

Employee Payroll Ledger for Bi-weekly Pay

What information is typically contained in an Employee Payroll Ledger for Bi-weekly Pay? This document usually records each employee's earnings, deductions, and net pay for every pay period within the bi-weekly cycle. It provides a detailed and organized account of payroll transactions, ensuring accurate tracking and compliance with payroll regulations.

What important considerations should be made when maintaining this ledger? It is crucial to consistently update the ledger with complete and accurate data, including overtime, taxes, and benefits. Additionally, implementing strong data security measures protects sensitive employee payroll information from unauthorized access.

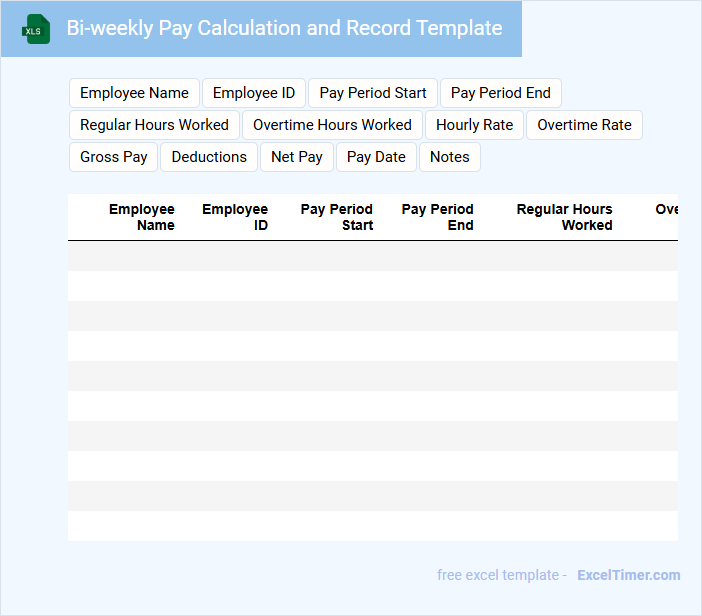

Bi-weekly Pay Calculation and Record Template

The Bi-weekly Pay Calculation document typically contains detailed records of employee work hours, hourly rates, and deductions for every two-week period. It accurately calculates the total earnings and taxes withheld to ensure correct payroll processing.

This template is essential for maintaining transparent and organized payroll records, helping employers comply with labor laws and tax regulations. Including overtime calculations and leave adjustments is also crucial in this template for precise payroll management.

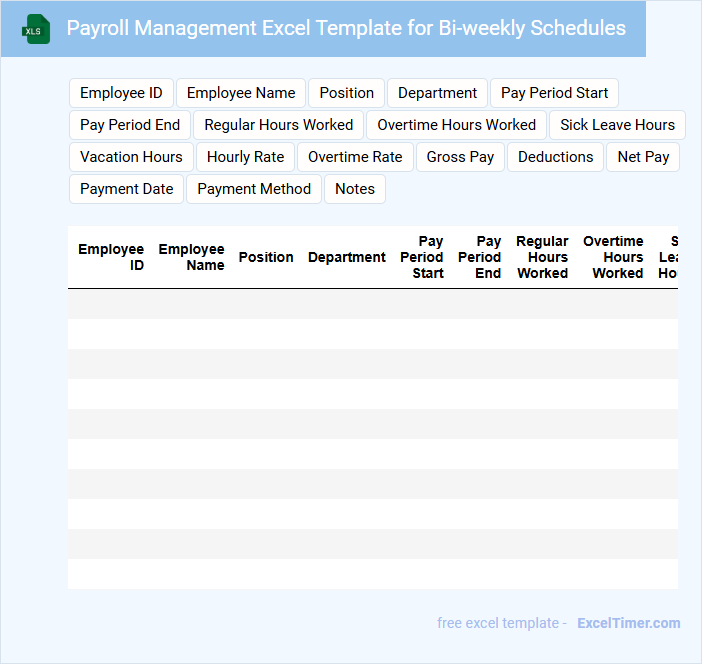

Payroll Management Excel Template for Bi-weekly Schedules

A Payroll Management Excel Template for Bi-weekly Schedules typically contains employee details, hours worked, pay rates, deductions, and net pay calculations. It ensures accurate and timely processing of payments for each bi-weekly period, reducing manual errors and saving time.

Important elements to include are automated formulas for tax deductions, overtime calculations, and clear fields for bonuses or other adjustments. This template should also allow easy export and printing for record-keeping and compliance purposes.

What is the correct formula to calculate bi-weekly gross pay for each employee in Excel?

Use the formula `=Annual_Salary/26` to calculate bi-weekly gross pay, assuming 26 pay periods per year. Replace `Annual_Salary` with the cell reference containing the employee's yearly salary. This formula evenly distributes annual earnings across bi-weekly paychecks for accurate payroll calculations.

How do you set up a bi-weekly pay period date range column for payroll tracking in Excel?

To set up a bi-weekly pay period date range column in Excel for payroll tracking, input the start date of the first pay period and use the formula =A2+14 to calculate subsequent pay period start dates, where A2 is the initial date. Create a corresponding end date column with the formula =A2+13 to define each 14-day pay period. Your Excel sheet will dynamically display bi-weekly date ranges, ensuring accurate payroll tracking every two weeks.

Which Excel function can you use to automatically calculate overtime hours for a bi-weekly pay period?

The Excel function SUMIFS can be used to automatically calculate overtime hours for a bi-weekly pay period by summing hours that exceed regular work thresholds. Your spreadsheet can reference daily hours worked and apply criteria for hours beyond standard limits within the pay period. This function ensures accurate and efficient tracking of overtime directly in your payroll document.

How can you use conditional formatting to highlight employees due for bi-weekly payments in your payroll sheet?

Use conditional formatting in Excel by applying a formula that checks if the payment date falls within the current bi-weekly period. Highlight rows where the payroll date matches the due payment dates based on your bi-weekly schedule. This approach ensures you can quickly identify employees requiring payments in your payroll sheet.

What are essential columns to include for an accurate bi-weekly payroll sheet (e.g., Employee ID, Hours Worked, Deductions)?

Essential columns for an accurate bi-weekly payroll sheet include Employee ID, Employee Name, Pay Period Start and End Dates, Hours Worked, Overtime Hours, Pay Rate, Gross Pay, Federal and State Tax Deductions, Social Security and Medicare Contributions, Other Deductions (such as health insurance or retirement), and Net Pay. Including Department and Job Title can enhance reporting accuracy. Accurate tracking of these data points ensures compliance with payroll regulations and precise salary calculations.