![]()

The Bi-weekly Expense Tracking Excel Template for Freelancers simplifies managing income and expenses with customizable categories and automatic calculations. This template helps freelancers maintain accurate financial records, ensuring timely tax preparation and budget control. Regular use of this tool improves cash flow visibility and supports better financial decision-making.

Bi-weekly Expense Tracking Excel Template for Freelancers

This document typically contains a structured format for freelancers to log and monitor their expenses every two weeks to better manage their finances.

- Detailed expense categories: It should include separate sections for different types of expenses such as supplies, travel, and software.

- Income versus expense tracking: It is important to have a clear comparison feature to ensure profitability within the bi-weekly period.

- Automated calculations: The template should have formulas for automatic summation and balance updates to reduce manual errors.

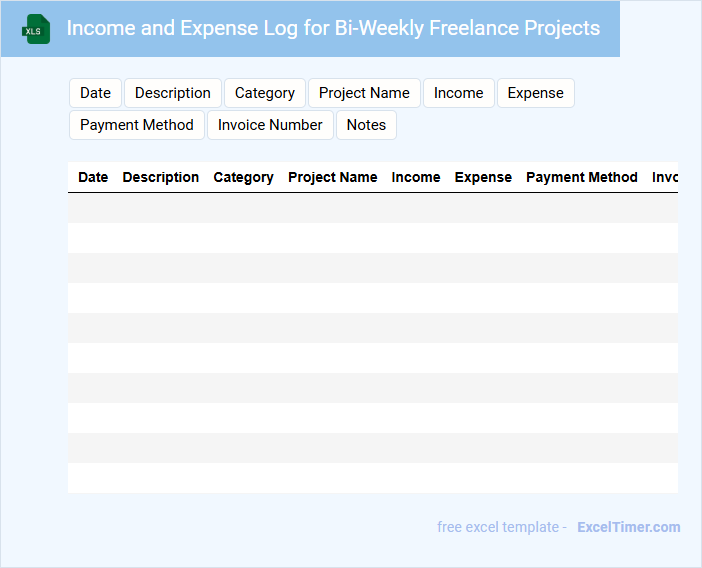

Income and Expense Log for Bi-Weekly Freelance Projects

An Income and Expense Log for Bi-Weekly Freelance Projects typically contains detailed records of all earnings and expenditures associated with freelance work over each two-week period. It helps freelancers track their financial performance, manage cash flow, and prepare for tax filing. Including categories like project names, payment dates, and expense types ensures better organization and accuracy.

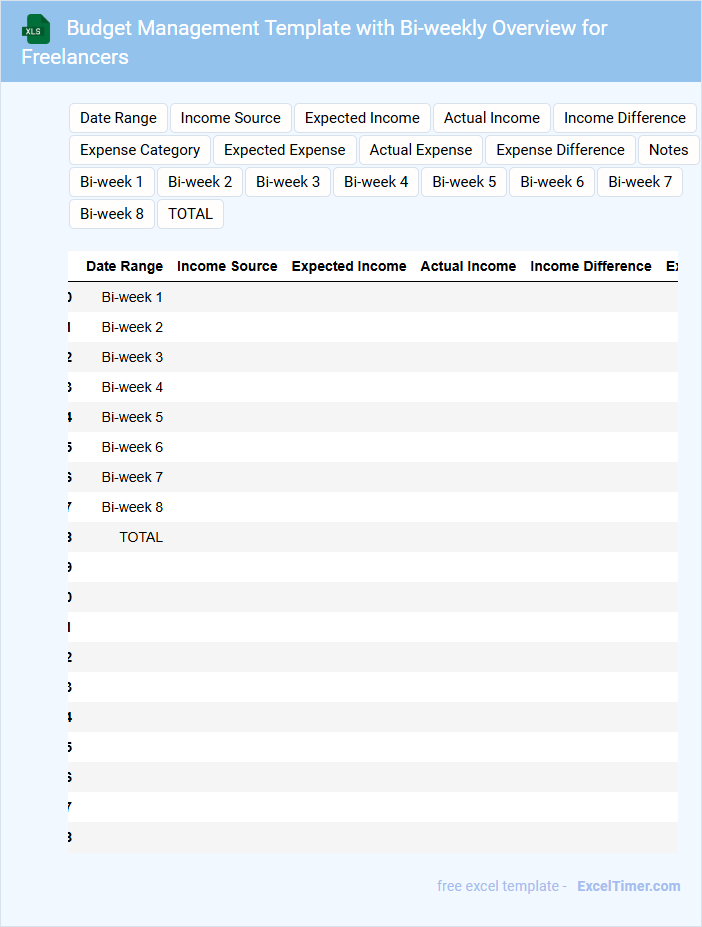

Budget Management Template with Bi-weekly Overview for Freelancers

A Budget Management Template with Bi-weekly Overview for Freelancers is a structured document designed to help freelancers track income, expenses, and savings on a two-week basis.

- Income tracking: Record all sources of freelance revenue for accurate financial insights.

- Expense categorization: Organize expenses into categories to monitor spending habits effectively.

- Savings goals: Set and review savings targets regularly to ensure financial stability.

Bi-weekly Financial Tracker for Freelance Professionals

A Bi-weekly Financial Tracker for freelance professionals typically contains detailed records of income, expenses, invoices, and payment statuses updated every two weeks. This document helps in maintaining an organized overview of cash flow and financial health in short intervals. Freelancers can effectively manage budgets and forecast upcoming financial needs with this tool. Important elements include tracking client payments to ensure timely follow-ups, categorizing expenses accurately for tax purposes, and analyzing spending trends bi-weekly. Including sections for savings and tax set-asides can improve financial discipline. Regular reviews of this document support financial stability and enhance decision-making.

Expense Breakdown with Category Summary for Freelancers

This document typically contains a detailed analysis of expenses categorized to help freelancers track and manage their spending effectively.

- Detailed Expense Entries: Itemized costs with dates and descriptions for accurate record-keeping.

- Category Summary: Grouped expenses by category such as software, travel, or office supplies to identify spending patterns.

- Total Calculations: Summaries of total expenses per category and overall to assist with budgeting and tax preparation.

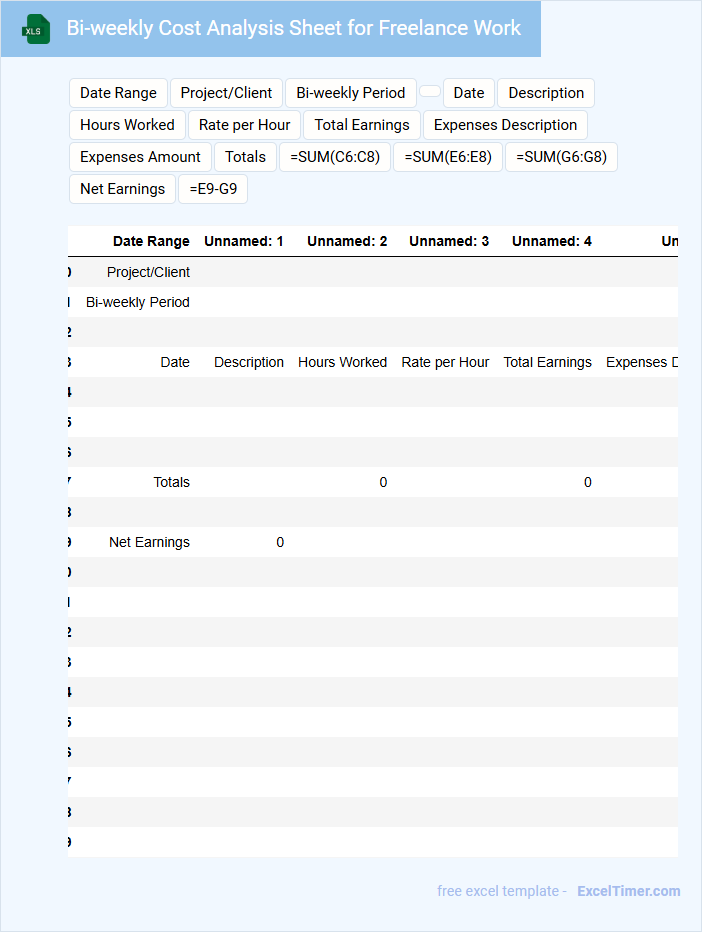

Bi-weekly Cost Analysis Sheet for Freelance Work

A Bi-weekly Cost Analysis Sheet for freelance work typically contains detailed records of expenses and earnings over a two-week period. It helps freelancers track their income sources, categorize costs, and evaluate profitability. Regular updates ensure accurate financial awareness and better budget management.

It's important to include clear categories for income and expenses, date ranges, and client/project-specific details for precise analysis. Using formulas for automatic calculations, such as totals and averages, improves efficiency and reduces errors. Consistently reviewing this document aids in identifying trends and optimizing freelance business strategies.

Freelance Project Expense Report with Bi-weekly Tracking

A Freelance Project Expense Report with bi-weekly tracking is designed to systematically record and monitor all costs associated with freelance projects. It typically includes detailed entries of expenses, dates, and payment methods, ensuring clarity and transparency. This document helps freelancers manage their budget efficiently and prepare for tax or client billing.

Payment and Expense Tracker for Freelancers with Bi-weekly Intervals

This document typically contains detailed records of payments received and expenses incurred by freelancers, organized to align with bi-weekly intervals. It helps in maintaining accurate financial tracking and ensures timely invoice management. Freelancers benefit from categorizing income sources and tracking deductible expenses efficiently.

Key elements include income summaries, expense breakdowns, and date-specific entries to monitor cash flow over each two-week period. This structured approach supports budgeting and tax preparation. Regularly updating the tracker minimizes errors and improves financial clarity.

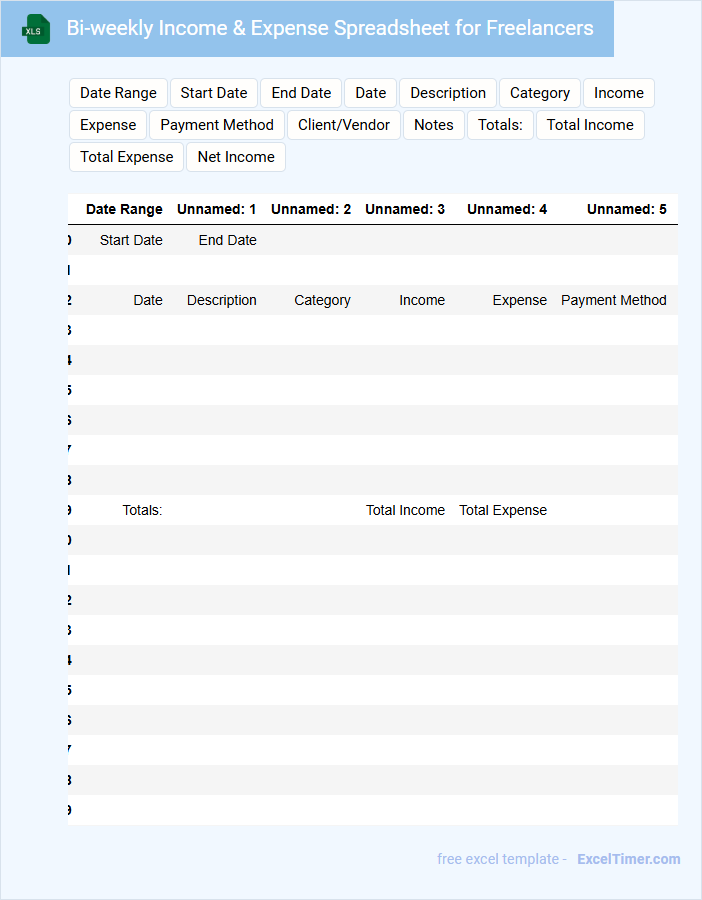

Bi-weekly Income & Expense Spreadsheet for Freelancers

A Bi-weekly Income & Expense Spreadsheet for Freelancers is a financial document designed to track earnings and expenditures every two weeks. It helps freelancers manage cash flow and stay organized for tax purposes.

- Record all sources of income and categorize expenses accurately.

- Update the spreadsheet regularly to maintain current financial status.

- Include sections for tax deductions to maximize savings.

Personalized Bi-weekly Expense Tracker with Charts for Freelancers

This document typically contains a detailed expense tracker designed to help freelancers monitor their spending on a bi-weekly basis. It includes categorized entries and timestamps to ensure accurate financial overview. Incorporating visual charts makes it easier to analyze patterns and manage budgets effectively.

Essential elements include sections for income sources, recurring expenses, and variable costs, tailored specifically for freelance work. It also suggests budget goals aligned with income fluctuations. Keeping the document updated regularly is crucial for maximizing financial control and planning.

Freelance Revenue and Cost Tracker with Bi-Weekly Format

A Freelance Revenue and Cost Tracker with a bi-weekly format is typically used to record and monitor income and expenses every two weeks, ensuring precise financial management for freelancers. This document often contains categories for project revenues, operational costs, and miscellaneous expenses, allowing for detailed tracking of financial health. It is essential to regularly update entries and reconcile totals to maintain accuracy and gain insights into profitability trends.

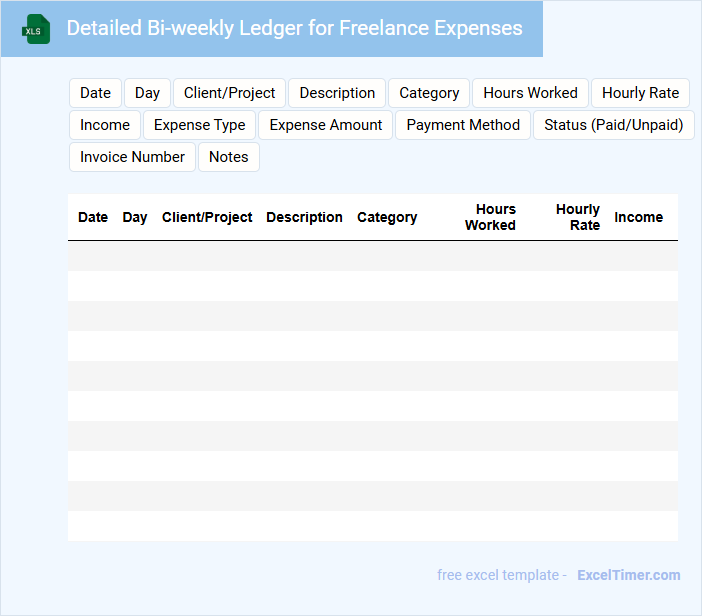

Detailed Bi-weekly Ledger for Freelance Expenses

A Detailed Bi-weekly Ledger for freelance expenses typically contains comprehensive records of all financial transactions made during a two-week period. This includes dates, descriptions, amounts, and categories of expenses for transparent tracking.

Maintaining such a ledger helps freelancers monitor cash flow and prepare for tax season efficiently. It is important to regularly update the ledger and include receipts or proof of expenditure for accurate financial management.

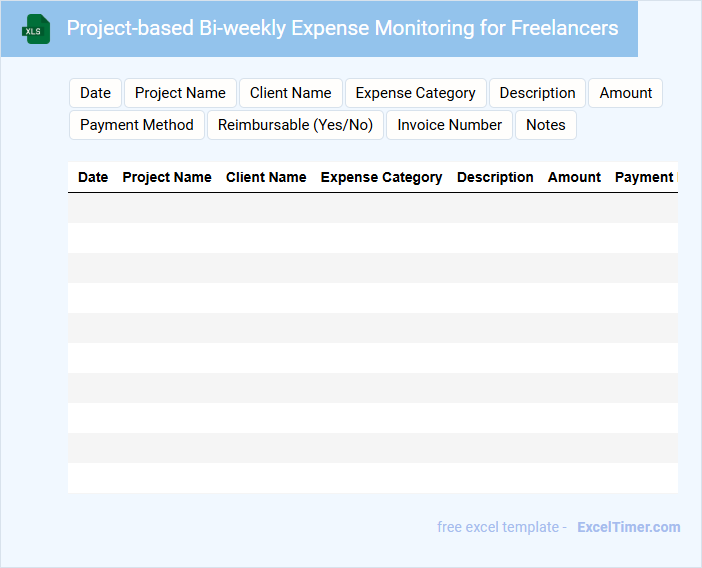

Project-based Bi-weekly Expense Monitoring for Freelancers

This document typically contains detailed records of expenses incurred by freelancers on a bi-weekly basis, organized by project to ensure accurate financial tracking.

- Expense Categorization: Clearly distinguish expenses by categories such as materials, software, and travel to streamline budgeting.

- Regular Updates: Maintain consistent bi-weekly entries to monitor spending patterns and avoid budget overruns.

- Project Allocation: Assign every expense to its respective project for precise cost analysis and invoicing.

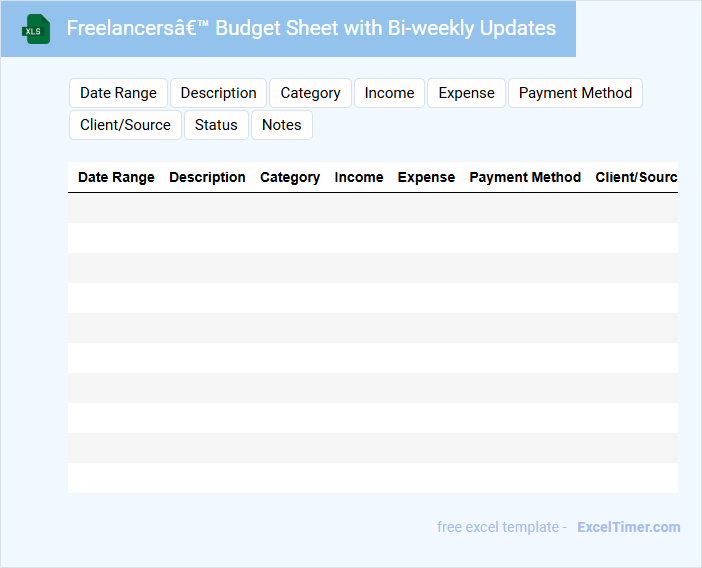

Freelancers’ Budget Sheet with Bi-weekly Updates

Freelancers' Budget Sheets with Bi-weekly Updates typically contain detailed income and expense tracking to help manage finances effectively.

- Income Tracking: Record all client payments and expected invoices within the bi-weekly period.

- Expense Monitoring: Track all business-related costs such as software subscriptions, equipment, and office supplies.

- Financial Summary: Provide a clear overview of net earnings and budget variances to adjust future spending.

Bi-weekly Expense Log and Invoice Tracker for Freelancers

What information does a Bi-weekly Expense Log and Invoice Tracker for Freelancers typically contain? This document usually includes detailed records of expenses incurred and invoices issued within a two-week period. It helps freelancers keep track of their financial transactions systematically and ensures timely payments and budgeting.

What is the most important aspect to focus on when using this tracker? Accuracy in recording dates, amounts, and descriptions is crucial for maintaining clear financial records. Additionally, regularly updating the tracker and categorizing expenses and invoices properly can significantly enhance financial management and reporting.

How do you categorize and label bi-weekly income and expenses for efficient tracking in Excel?

Create separate columns for bi-weekly income and expense categories such as "Client Payments," "Software Subscriptions," and "Office Supplies" to ensure clear labeling. Use date stamps for each entry and apply consistent naming conventions to streamline data sorting and filtering. Implement Excel tables and pivot charts to visualize trends and simplify financial analysis over bi-weekly periods.

What formulas or functions can automate the calculation of recurring freelance expenses every two weeks?

Use the SUMIFS function to total expenses based on date ranges occurring every two weeks. Apply the EDATE function to dynamically generate bi-weekly intervals for tracking recurring payments. Incorporate IF formulas to flag and categorize expenses corresponding to each bi-weekly period automatically.

How can you set up conditional formatting to quickly identify overspending or budget deviations in a bi-weekly Excel sheet?

To set up conditional formatting for overspending in a bi-weekly expense tracking Excel sheet, select the expense cells and create a rule using "Format cells that are greater than" your predefined budget limit. Use color scales or distinct fill colors like red to highlight budget deviations visually. Apply data bars or icon sets for quick, intuitive identification of spending trends and overspending periods.

What is the best way to visualize cash flow and expense trends for each bi-weekly period in Excel?

Use Excel's PivotTables combined with line and bar charts to visualize cash flow and expense trends for each bi-weekly period clearly. Organize your data by date and category to enable dynamic filtering and detailed analysis. Your bi-weekly expense tracking improves significantly when trends are displayed through customizable charts that highlight inflows and outflows over time.

How can you securely back up and protect sensitive financial data within an Excel bi-weekly expense tracker?

Securely back up and protect sensitive financial data in your Excel bi-weekly expense tracker by enabling password protection and using built-in encryption features. Regularly save encrypted copies to trusted cloud storage services with two-factor authentication for enhanced security. Implement consistent data backup schedules and avoid sharing files over unsecured networks to maintain your financial privacy.