![]()

The Bi-weekly Budget Tracker Excel Template for Freelancers helps monitor income and expenses every two weeks, ensuring financial stability. It simplifies cash flow management by categorizing earnings, bills, and savings goals in an easy-to-use format. Tracking finances regularly allows freelancers to make informed decisions and avoid overspending.

Bi-weekly Budget Tracker with Automated Calculations

A bi-weekly budget tracker document typically contains detailed income and expense records segmented into two-week periods to help manage finances efficiently. It usually includes automated calculations to quickly summarize spending, savings, and remaining budget, ensuring accurate financial tracking. Key elements include income sources, fixed and variable expenses, and summary totals for clear oversight and planning.

Excel Template for Bi-weekly Income and Expense Tracking

What information is typically included in an Excel template for bi-weekly income and expense tracking? This type of document usually contains sections for recording all sources of income and detailed expenses within each two-week period. It helps users monitor financial inflows and outflows systematically to maintain balanced budgets and improve financial planning.

Important elements to include are clearly labeled categories for income and expenses, date fields for accurate tracking, and summary rows for calculating total income, expenses, and net savings or deficit. Incorporating charts or graphs for visual representation can also enhance understanding and analysis of financial trends over time.

Bi-weekly Cash Flow Tracker for Freelancers

What information does a Bi-weekly Cash Flow Tracker for Freelancers typically contain? This document usually records all incoming payments and outgoing expenses over a two-week period, helping freelancers monitor their financial status regularly. It includes details like client payments, project expenses, and personal costs to provide a clear overview of cash movement.

Why is it important to track cash flow bi-weekly as a freelancer? Regular monitoring allows timely adjustments to spending and saving habits, ensuring financial stability throughout fluctuating income periods. Keeping detailed and categorized records also simplifies tax preparation and supports better budgeting decisions.

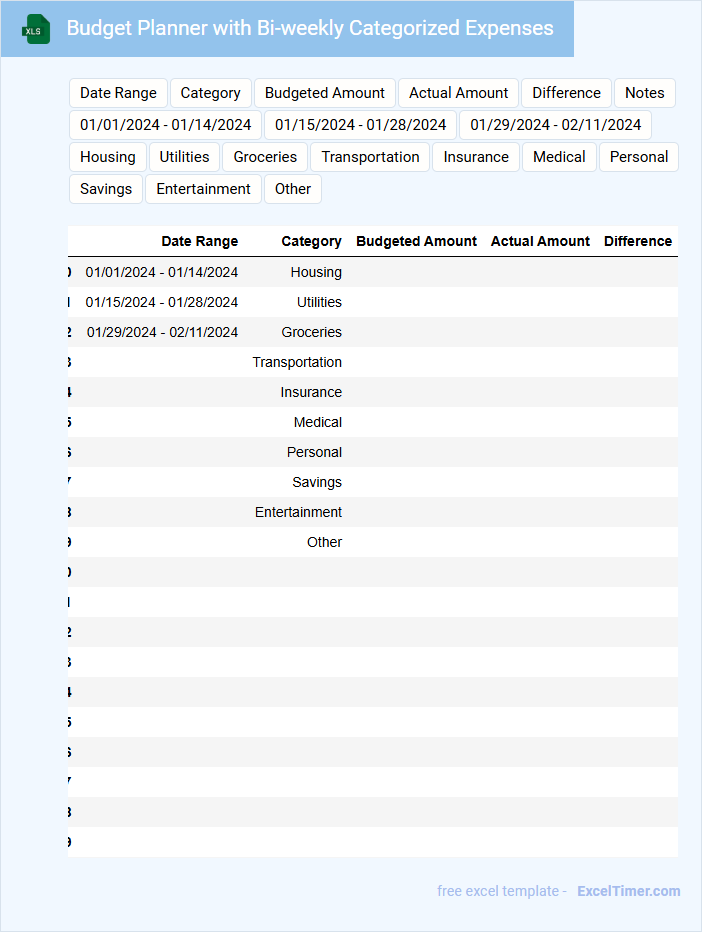

Budget Planner with Bi-weekly Categorized Expenses

A Budget Planner with Bi-weekly Categorized Expenses typically contains detailed income and expenditure records divided into two-week periods, helping users manage their finances more effectively. It organizes expenses by categories such as groceries, bills, and entertainment for clearer tracking.

- Include a clear summary of total income versus total expenses for each bi-weekly period.

- Ensure categories are customizable to fit individual spending habits.

- Provide space for notes or adjustments to accommodate unexpected costs.

Bi-weekly Budget Spreadsheet for Freelance Projects

A bi-weekly budget spreadsheet for freelance projects typically contains detailed financial tracking, including income, expenses, and project-specific costs over a two-week period. It helps freelancers maintain clear visibility on cash flow and project profitability. Accurate categorization of expenses is crucial for effective budget management.

This document often includes sections for client names, payment due dates, invoice status, and project timelines to streamline financial organization. A well-structured spreadsheet ensures timely invoicing and reduces the risk of missed payments. Regular updates are essential to keep the budget aligned with actual expenses.

Freelancers’ Bi-weekly Financial Tracker with Charts

A Freelancers' Bi-weekly Financial Tracker is a document designed to monitor income, expenses, and savings on a two-week basis. It helps freelancers maintain real-time awareness of their financial health and plan accordingly.

This type of tracker often includes charts for visualizing cash flow trends and budget adherence over time. Incorporating key metrics such as total earnings, outstanding invoices, and tax estimates is highly recommended for comprehensive financial management.

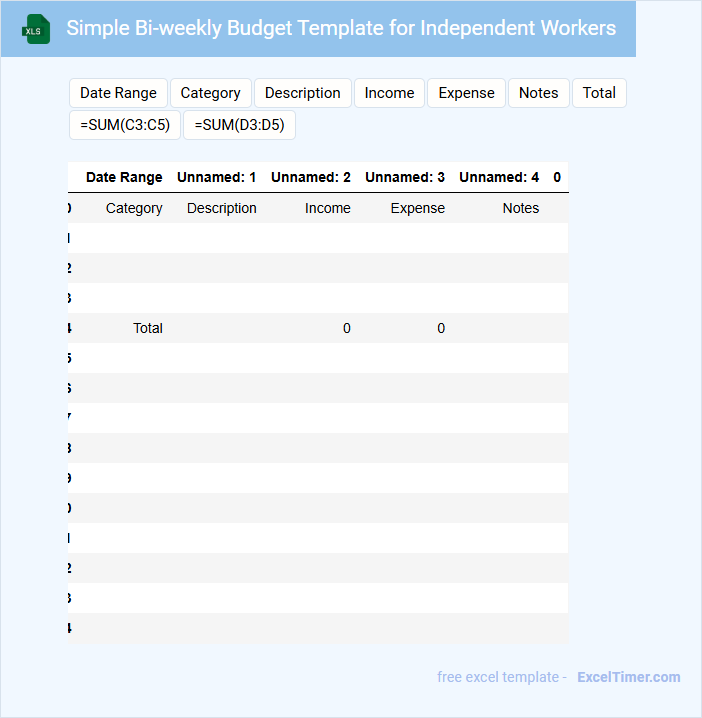

Simple Bi-weekly Budget Template for Independent Workers

A Simple Bi-weekly Budget Template is commonly used to track income and expenses for independent workers on a two-week basis. This type of document helps in managing irregular earnings and ensuring timely payments of bills. It typically contains sections for income, fixed and variable expenses, savings, and notes.

Important elements to include are a clear categorization of income sources, detailed expense tracking, and a summary of net savings or deficits. Including a section for tax set-asides and emergency funds is crucial for financial stability. Regularly updating and reviewing the template ensures better financial control and planning.

Excel Budget Tracker for Freelancers with Income Streams

An Excel Budget Tracker for freelancers typically contains detailed records of income streams and expenses, helping to monitor financial health. It includes categories such as client payments, project expenses, and recurring costs for clear budgeting.

Tracking multiple income streams allows freelancers to manage diverse revenue sources effectively. This document ensures accurate cash flow analysis and financial planning.

Important suggestions include regularly updating entries and categorizing transactions consistently to maintain accuracy and usefulness.

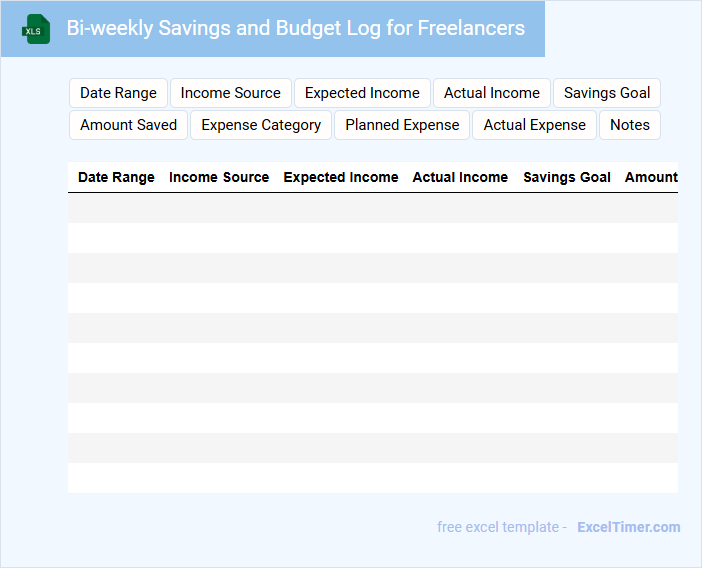

Bi-weekly Savings and Budget Log for Freelancers

The Bi-weekly Savings and Budget Log is a document designed to help freelancers track their income and expenses every two weeks, ensuring financial stability and clear visibility over cash flow. It usually contains detailed records of earnings, categorized expenditures, and savings contributions within each bi-weekly period.

Maintaining this log assists freelancers in budgeting effectively and planning for irregular income periods. An important suggestion is to consistently update the log to reflect actual transactions and review it regularly to adjust financial goals accordingly.

Bi-weekly Personal Finance Tracker with Taxes for Freelancers

A Bi-weekly Personal Finance Tracker for freelancers typically contains detailed records of income and expenses updated every two weeks. It helps in managing irregular cash flows and ensures accurate budgeting over short periods.

Including tax calculations in the tracker is essential to estimate and set aside funds for quarterly tax payments. Keeping receipts and categorizing expenses properly enhances tax deductions and financial clarity.

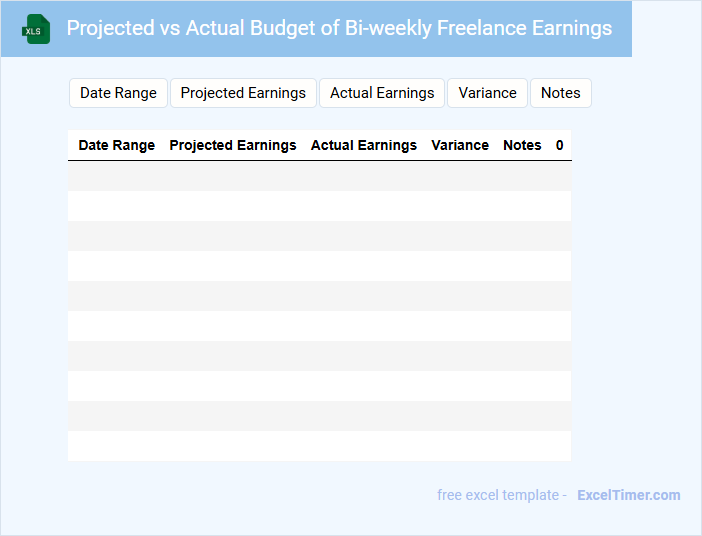

Projected vs Actual Budget of Bi-weekly Freelance Earnings

This type of document typically contains a detailed comparison between the estimated and real income earned from freelance projects on a bi-weekly basis.

- Clear Budget Categories: Organize earnings by project or task for accurate tracking and analysis.

- Regular Updates: Consistently update actual earnings to reflect real-time financial status.

- Variance Analysis: Highlight differences between projected and actual figures to improve future budgeting.

Excel Sheet for Bi-weekly Expense Tracking by Category

An Excel Sheet for Bi-weekly Expense Tracking by Category typically contains detailed records of expenses categorized by type, such as groceries, utilities, and transportation. It allows users to input and analyze spending patterns over two-week periods for better budget management. This document also often includes summary tables and charts to visualize spending trends and highlight areas for potential savings.

Bi-weekly Budget Tracker for Side Hustles and Freelancers

A Bi-weekly Budget Tracker for side hustles and freelancers typically contains detailed records of income and expenses over a two-week period. It helps in monitoring cash flow, ensuring that earnings and costs are aligned with financial goals.

Important elements to include are categorized income sources, expense tracking, and savings goals for each period. Regular updates and reviewing trends are crucial for maintaining financial health and making informed decisions.

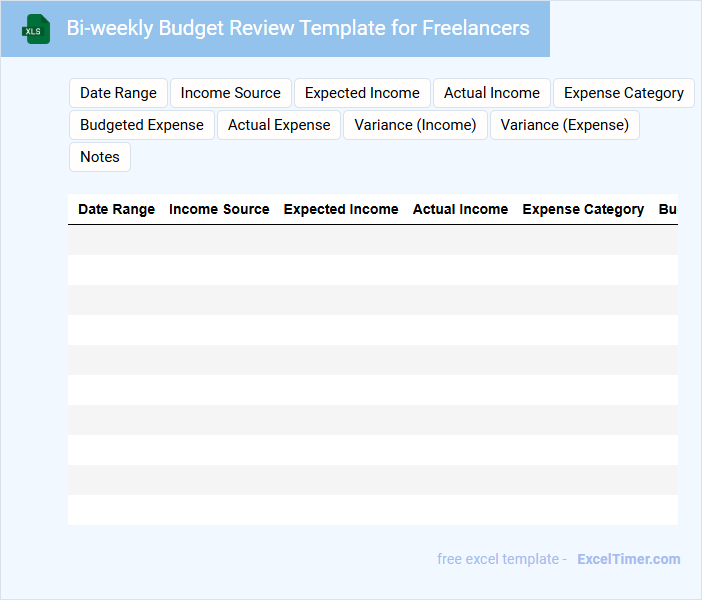

Bi-weekly Budget Review Template for Freelancers

What information does a Bi-weekly Budget Review Template for Freelancers typically include? This document usually contains a detailed overview of all income and expenses recorded over a two-week period, allowing freelancers to track their cash flow accurately. It also highlights budget variances and savings opportunities to help freelancers stay financially organized and meet their financial goals consistently.

What are the important elements to include in such a template? Key components should feature sections for recording project income, fixed and variable expenses, savings contributions, and any outstanding invoices. Additionally, including a summary for net income and a comparison to the projected budget will enable freelancers to adjust their spending habits effectively.

Income and Expense Tracker with Bi-weekly Report for Freelancers

This document typically contains a detailed record of all income and expenses for freelancers, organized bi-weekly to help manage finances effectively.

- Comprehensive Income Recording: Track all sources of freelance income with dates and amounts.

- Expense Categorization: Document and categorize expenses to identify tax deductions and spending patterns.

- Bi-weekly Reporting: Summarize financial activity every two weeks to maintain accurate cash flow awareness.

How does the Bi-weekly Budget Tracker categorize income and expenses specific to freelance work?

The Bi-weekly Budget Tracker categorizes income by project payments, client invoices, and miscellaneous freelance earnings, while expenses are sorted into business costs, software subscriptions, and tax-related fees. Your budget overview highlights cash flow patterns specific to freelancing cycles, making financial management more precise. This structure helps track profitability and plan for taxes effectively.

What formulas or functions are used to calculate net profit and track cash flow over each bi-weekly period?

The Bi-weekly Budget Tracker for Freelancers uses SUM and SUMIF functions to calculate total income and expenses, while the net profit is determined by subtracting total expenses from total income using a simple formula. Cash flow tracking employs the cumulative SUM function to monitor the balance across each bi-weekly period. Your document leverages these formulas to provide accurate financial insights and manage budgeting effectively.

How does the tracker accommodate irregular payment schedules and variable income sources?

The Bi-weekly Budget Tracker for Freelancers adapts to irregular payment schedules by allowing customizable income entry dates and flexible income categories. It supports variable income sources through dynamic input fields that capture diverse payment amounts and frequencies. This ensures your financial planning remains accurate and responsive to fluctuating earnings.

What visual tools (charts, conditional formatting) are included to help freelancers quickly assess financial health?

The Bi-weekly Budget Tracker for Freelancers includes bar charts to visualize income versus expenses and pie charts for spending category breakdowns. Conditional formatting highlights overspending by turning budget cells red when limits are exceeded. These visual tools enable freelancers to quickly assess cash flow trends and identify areas needing budget adjustment.

How does the budget tracker handle tax estimations and savings allocations unique to freelancers?

The Bi-weekly Budget Tracker for Freelancers incorporates customizable tax estimation fields based on freelance income brackets and expense categories. It allocates savings by setting aside predetermined percentages for taxes, emergency funds, and retirement, tailored to freelance cash flow variability. This ensures accurate financial planning aligned with the unique fiscal responsibilities of freelancers.