The Bi-weekly Budget Excel Template for Nonprofits simplifies financial tracking by allowing organizations to manage income and expenses on a two-week basis. This template enhances accuracy and accountability, making it easier to monitor cash flow and plan future expenditures. Nonprofits benefit from its user-friendly design, which supports transparency and effective resource allocation.

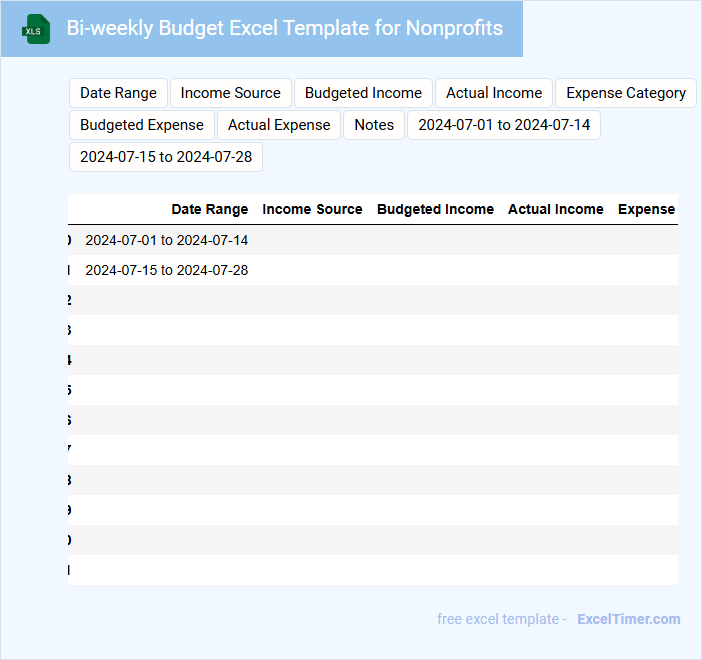

Bi-weekly Budget Excel Template for Nonprofits

A Bi-weekly Budget Excel Template for Nonprofits is designed to help organizations track and manage their income and expenses every two weeks. It typically includes sections for revenue, expenditures, and cash flow projections to ensure financial stability. This document assists nonprofits in maintaining transparency and accountability in their financial reporting.

Expense Tracking Spreadsheet for Nonprofit Bi-weekly Budgeting

An Expense Tracking Spreadsheet for nonprofit bi-weekly budgeting is a tool designed to monitor and manage the organization's financial outflows on a regular basis. It typically contains categorized expense entries, dates, and budget limits to ensure accurate recording and spending control. This document helps nonprofits maintain financial transparency and make informed decisions about resource allocation.

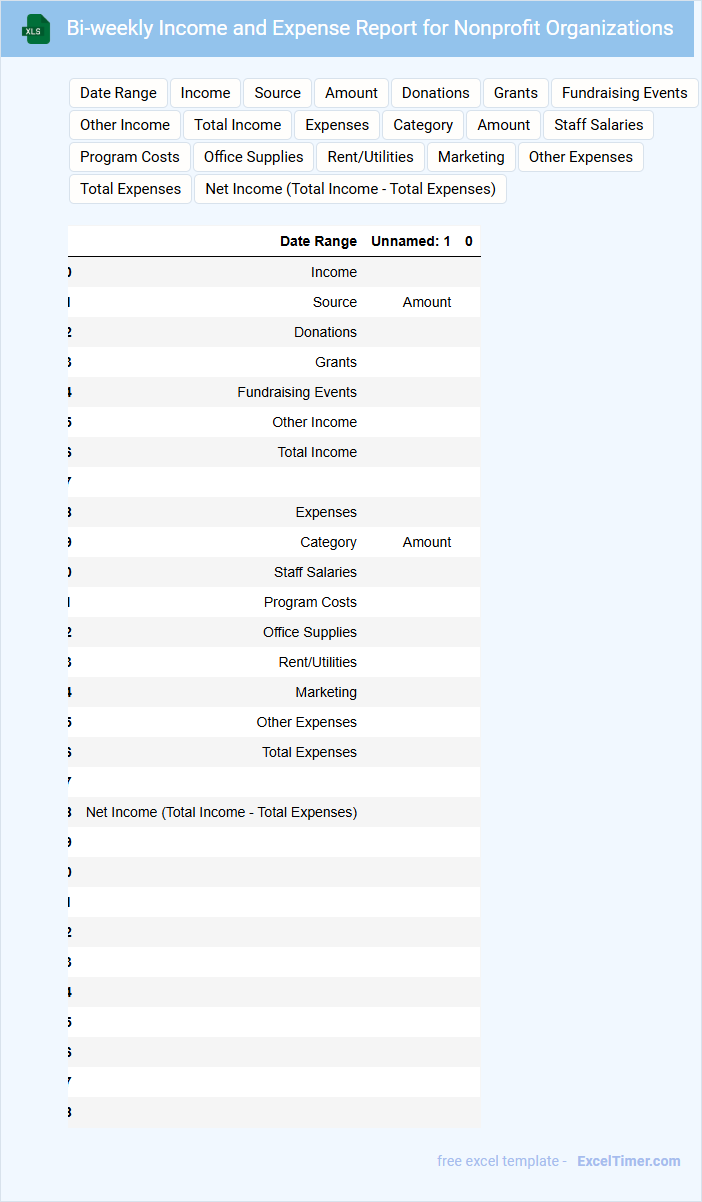

Bi-weekly Income and Expense Report for Nonprofit Organizations

The Bi-weekly Income and Expense Report for nonprofit organizations typically contains detailed records of all financial transactions within a two-week period. It includes income sources, such as donations and grants, alongside expenses like salaries, utilities, and program costs.

Maintaining accurate financial documentation helps ensure transparency and accountability to stakeholders and regulatory bodies. It is important to regularly review and reconcile these reports to detect discrepancies early and support effective budgeting.

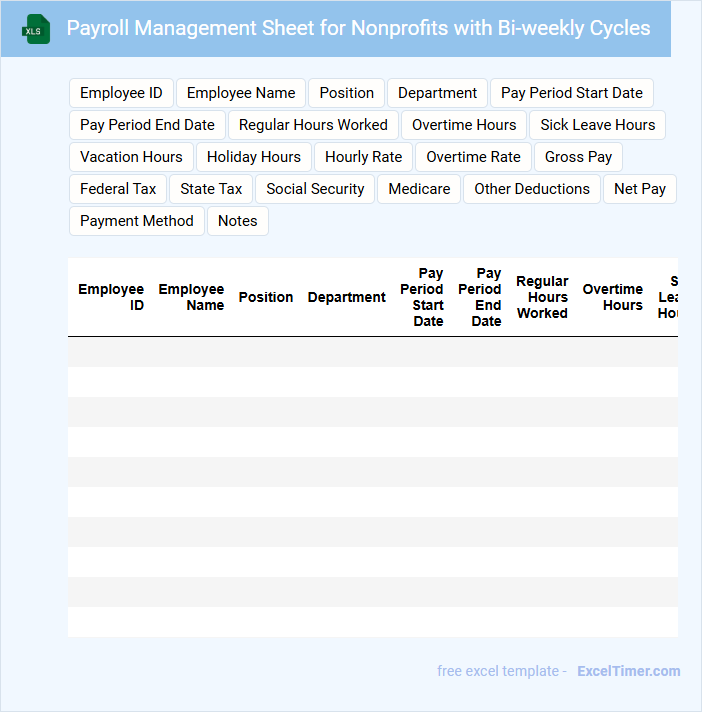

Payroll Management Sheet for Nonprofits with Bi-weekly Cycles

Payroll Management Sheets for Nonprofits with Bi-weekly Cycles are essential tools used to track employee wages, deductions, and payments within a set two-week period. They ensure accurate and timely salary disbursement while maintaining compliance with organizational policies and regulations.

- Include detailed employee information such as hours worked, pay rate, and tax deductions.

- Regularly update the sheet to reflect any changes in employee status or payroll laws.

- Maintain clear records for auditing and financial reporting purposes.

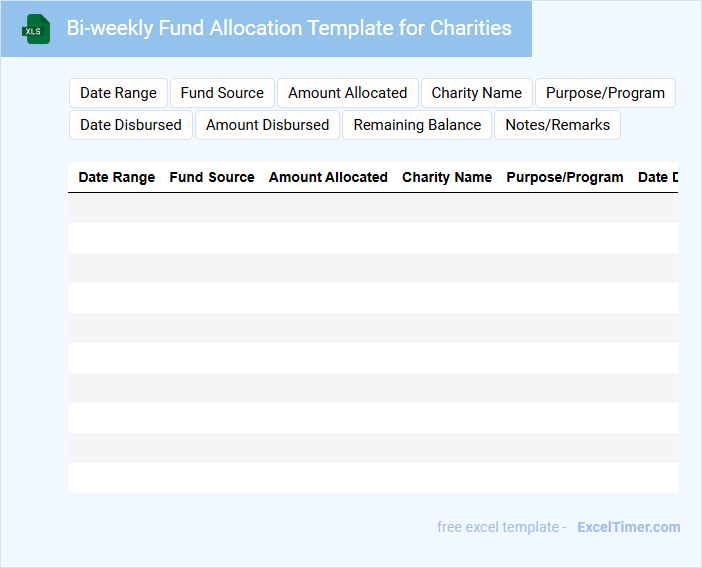

Bi-weekly Fund Allocation Template for Charities

The Bi-weekly Fund Allocation Template for charities is a structured document used to organize and track the distribution of financial resources every two weeks. It typically contains sections for income sources, allocated amounts for various projects, and expense tracking. Including clear categories and timelines ensures transparent and efficient fund management.

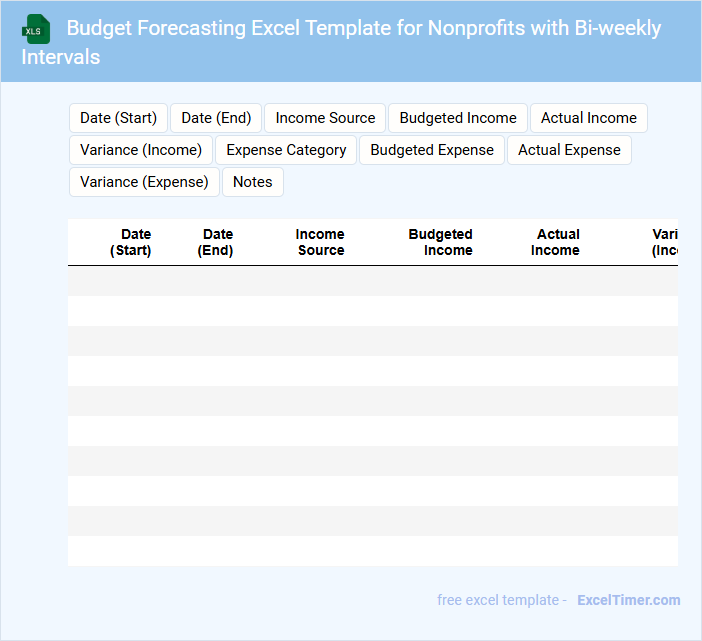

Budget Forecasting Excel Template for Nonprofits with Bi-weekly Intervals

A Budget Forecasting Excel Template for nonprofits with bi-weekly intervals is typically used to project income and expenses over short, consistent periods. This document helps organizations monitor cash flow and plan financial strategies proactively to ensure sustainability.

It usually contains detailed sections for anticipated revenue sources, fixed and variable costs, and timing of payments aligned to the bi-weekly schedule. Important considerations include regularly updating actual figures and adjusting forecasts to reflect grant cycles, fundraising events, and seasonal variations.

Bi-weekly Grant Spending Tracker for Nonprofit Projects

The Bi-weekly Grant Spending Tracker is a document used to monitor and record the expenditures of grants received by nonprofit projects on a regular, two-week basis. It ensures transparency and accountability in financial management by providing detailed updates on spending activities.

This tracker typically contains sections for recording dates, expense categories, amounts spent, and remaining grant balances to maintain accurate financial oversight. For effective use, it is important to regularly reconcile the tracker with actual receipts and donor requirements to avoid discrepancies.

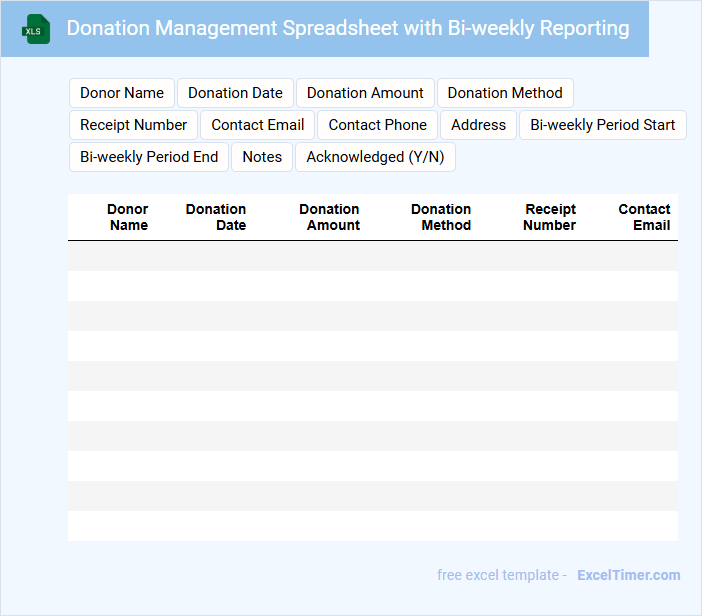

Donation Management Spreadsheet with Bi-weekly Reporting

What information is typically included in a Donation Management Spreadsheet with Bi-weekly Reporting? This document usually contains detailed records of donor information, donation amounts, and dates of contributions. It is designed to track and organize donations efficiently while enabling regular bi-weekly analysis of fundraising progress and trends.

What important elements should be considered for such a spreadsheet? It is essential to include clear categories for donor contact details, donation status, and payment methods. Additionally, integrating summary sections and visual charts in the bi-weekly reports can help stakeholders quickly understand donation patterns and make informed decisions.

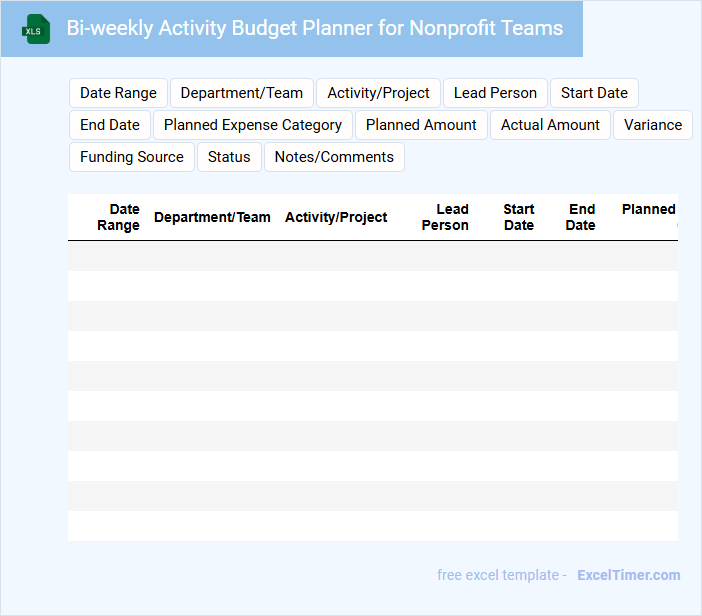

Bi-weekly Activity Budget Planner for Nonprofit Teams

This document outlines a Bi-weekly Activity Budget Planner designed for nonprofit teams to efficiently allocate resources and track expenditures. It typically includes sections for planned activities, estimated costs, and actual spending within each two-week period.

Key elements involve categorizing expenses by activity and ensuring alignment with organizational goals to maintain financial transparency. Incorporating clear budget limits and regular review checkpoints is important for staying on track and optimizing fundraising efforts.

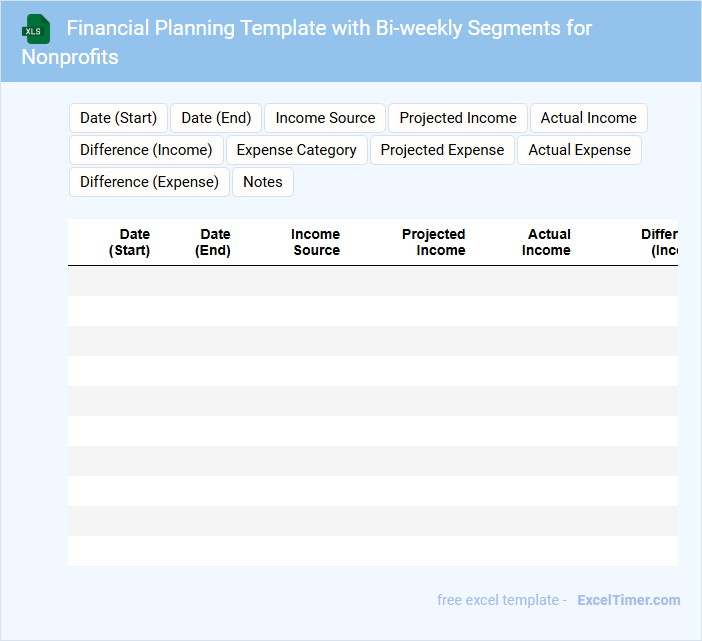

Financial Planning Template with Bi-weekly Segments for Nonprofits

Financial Planning Templates with bi-weekly segments for nonprofits typically include detailed income and expense projections tailored to the organization's fiscal cycles. These documents help manage cash flows, budget allocations, and monitor fundraising efforts systematically.

- Ensure clear categorization of all revenue streams and expenditures for accuracy.

- Include periodic review checkpoints to adjust forecasts based on actual performance.

- Incorporate donor and grant tracking to align with funding restrictions and timelines.

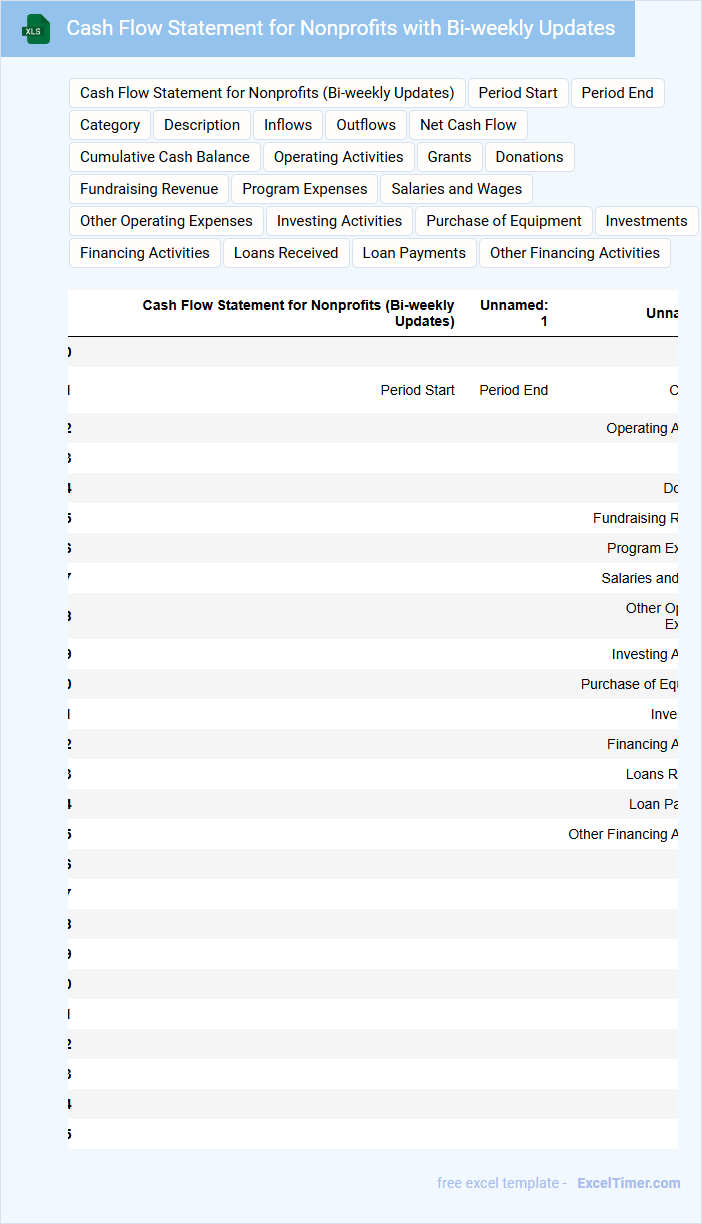

Cash Flow Statement for Nonprofits with Bi-weekly Updates

A Cash Flow Statement for Nonprofits with Bi-weekly Updates tracks the inflow and outflow of cash to maintain financial health and support effective decision-making. It provides a timely overview of the organization's liquidity on a regular basis.

- Include detailed records of cash receipts and payments every two weeks.

- Highlight unrestricted and restricted fund movements separately for clarity.

- Regularly compare actual cash flow against budgeted projections to identify discrepancies early.

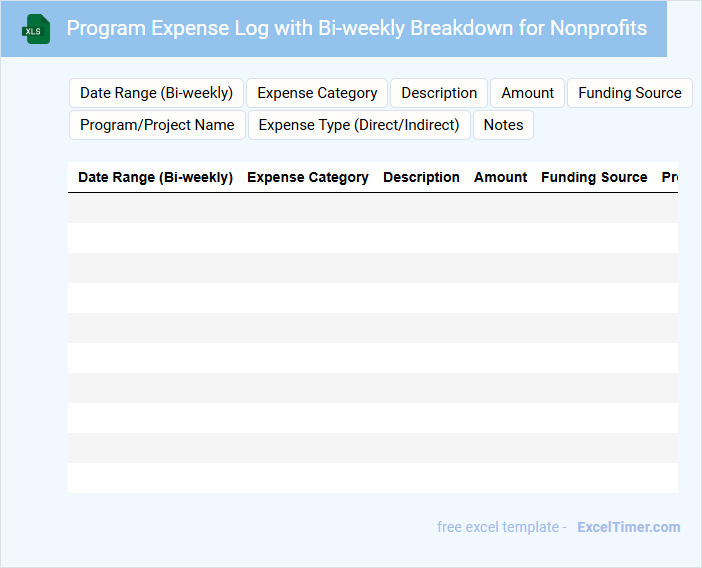

Program Expense Log with Bi-weekly Breakdown for Nonprofits

What information is typically recorded in a Program Expense Log with Bi-weekly Breakdown for Nonprofits? This document usually contains detailed records of all expenses related to specific programs, organized on a bi-weekly basis to track costs efficiently. It helps nonprofits maintain transparency, ensure accurate budgeting, and monitor financial progress over time.

Why is it important to include a clear categorization of expenses and maintain timely updates? Clear categorization allows for easier analysis of spending patterns and resource allocation, while timely updates ensure current financial data for informed decision-making. Consistent documentation supports accountability and aids in grant reporting or auditing processes.

Bi-weekly Event Budget Tracker for Nonprofit Fundraisers

A Bi-weekly Event Budget Tracker for nonprofit fundraisers is a document used to monitor and manage expenses and income related to fundraising events on a two-week basis. It helps organizations maintain financial control and ensure funds are allocated efficiently throughout the event planning process.

This type of document typically includes sections for tracking expenditures, donations, and budget adjustments, allowing for clear visibility of the event's financial status. An important suggestion is to regularly update the tracker and review it with the fundraising team to prevent overspending and maximize fundraising impact.

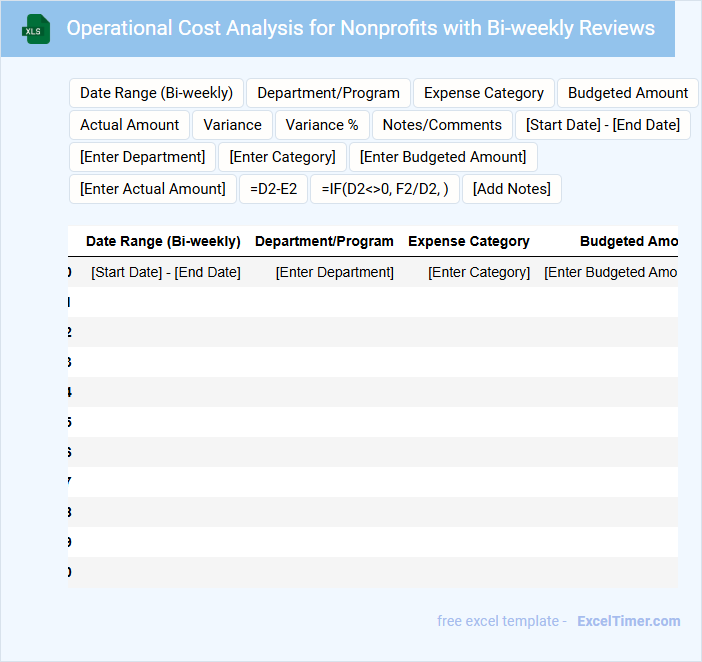

Operational Cost Analysis for Nonprofits with Bi-weekly Reviews

An Operational Cost Analysis document for nonprofits typically includes a detailed breakdown of all expenses related to daily operations and program implementation. It highlights key cost drivers and identifies opportunities for budgeting efficiencies.

Bi-weekly reviews ensure timely tracking of financial performance, enabling swift adjustments to avoid overspending and optimize resource allocation. Consistent monitoring supports transparency and informed decision-making within the organization.

It is important to focus on accurate data collection, stakeholder engagement, and clear performance metrics to maximize the effectiveness of the analysis and reviews.

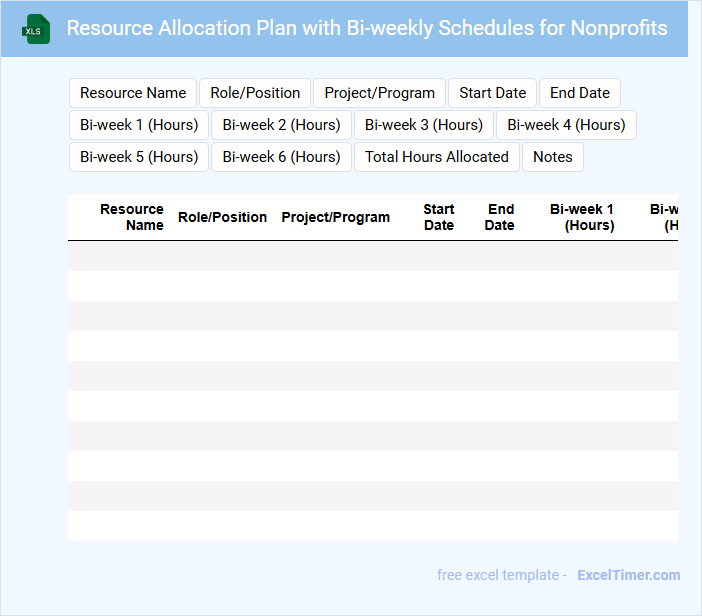

Resource Allocation Plan with Bi-weekly Schedules for Nonprofits

A Resource Allocation Plan with Bi-weekly Schedules for Nonprofits typically outlines how resources are distributed and scheduled over two-week periods to optimize project execution and impact.

- Clear Resource Identification: Define all human, financial, and material resources to ensure transparency and effective utilization.

- Bi-weekly Schedule Breakdown: Segment tasks and resource assignments by two-week intervals to maintain flexibility and timely progress tracking.

- Priority Alignment: Align resource allocation with the nonprofit's strategic goals to maximize mission-driven outcomes.

What are the essential income and expense categories to include in a bi-weekly budget for nonprofits?

Essential income categories in a bi-weekly budget for nonprofits include grants, donations, fundraising events, and membership fees. Key expense categories cover salaries, program costs, administrative expenses, and marketing efforts. Your budget should accurately track these to ensure financial stability and transparency.

How do you accurately track and update bi-weekly budget changes in an Excel document?

To accurately track and update bi-weekly budget changes in an Excel document, create separate columns for income, expenses, and category breakdowns for each two-week period. Use formulas like SUMIF and VLOOKUP to automatically aggregate and analyze budget adjustments. Incorporate data validation and conditional formatting to ensure data accuracy and highlight significant variances.

What formulas and functions in Excel can automate the calculation of remaining funds per category?

To automate the calculation of remaining funds per category in a bi-weekly budget for nonprofits, use the formula =BudgetedAmount - SUM(ExpensesRange) for each category. Implement the SUM function to total expenses within specified date ranges and categories. Employ conditional functions like SUMIFS to accurately subtract expenses aligned with both category and bi-weekly periods.

How can you visually represent bi-weekly budget trends and variances using Excel charts or conditional formatting?

Use line charts in Excel to visually display bi-weekly budget trends by plotting actual versus projected expenses over time, highlighting fluctuations clearly. Implement conditional formatting with color scales or data bars to emphasize budget variances, such as overspending or underspending within each bi-weekly period. Combining these methods provides nonprofits with intuitive, real-time insights into financial performance and budget adherence.

What strategies help ensure bi-weekly budget compliance and transparency for nonprofit stakeholders using Excel?

Using Excel, you can implement automated templates with pre-set formulas to track income and expenses bi-weekly, ensuring accurate budget compliance for nonprofit stakeholders. Incorporate detailed categorization and real-time data visualization to enhance transparency and facilitate stakeholder understanding. Regularly updating and sharing these Excel reports fosters accountability and informed decision-making.