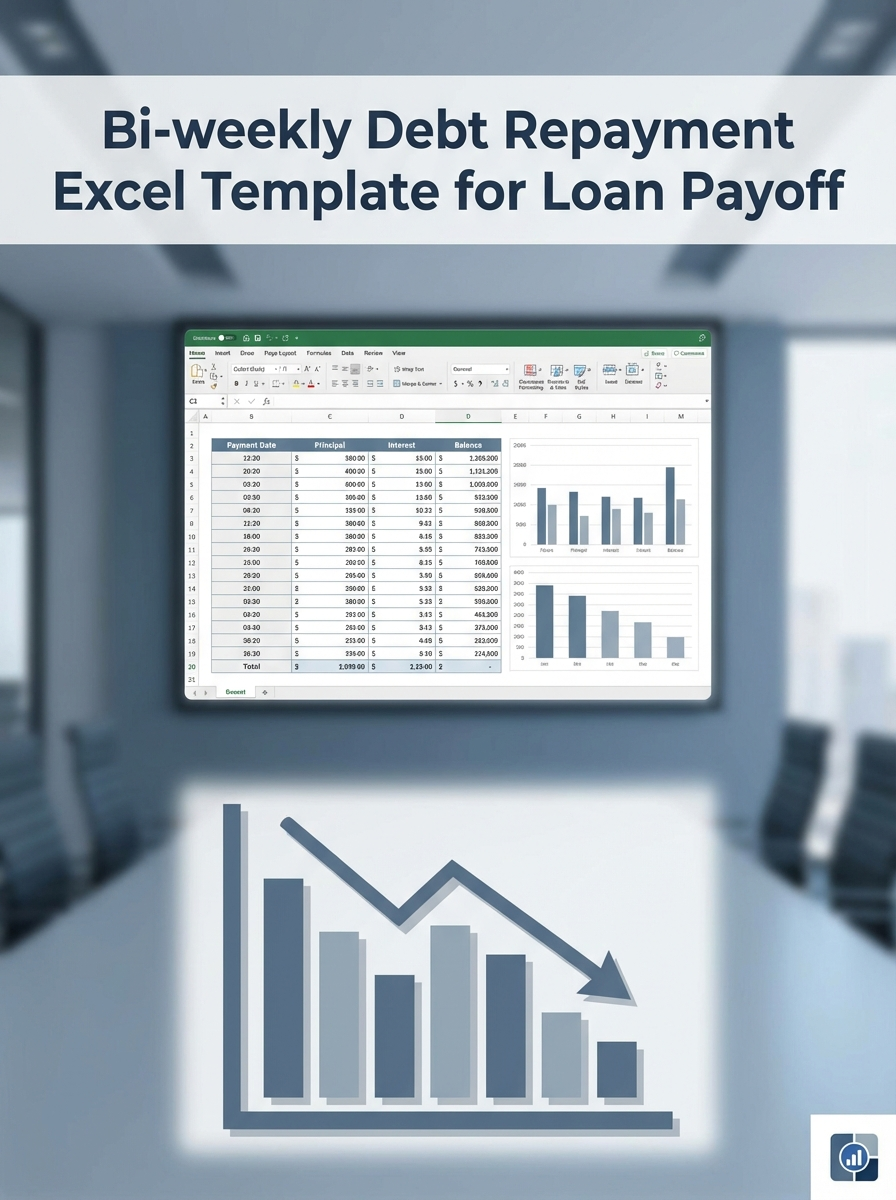

The Bi-weekly Debt Repayment Excel Template for Loan Payoff streamlines tracking loan payments and calculates accelerated repayment schedules, enabling users to save on interest and pay off debts faster. Its easy-to-use format automatically updates balances and adjusts payment timelines based on bi-weekly contributions. This tool is essential for managing multiple loans efficiently and visualizing progress towards financial freedom.

Bi-Weekly Debt Repayment Tracker with Amortization Schedule

A Bi-Weekly Debt Repayment Tracker is typically a detailed document that helps individuals or businesses monitor their debt payments made on a bi-weekly basis, allowing for better financial management and faster debt elimination. It often includes an amortization schedule showing the breakdown of each payment towards principal and interest over time.

Such a document is essential for maintaining a clear overview of remaining balances, payment dates, and interest costs. Including reminders for due dates and periodic summaries of progress can significantly enhance its effectiveness.

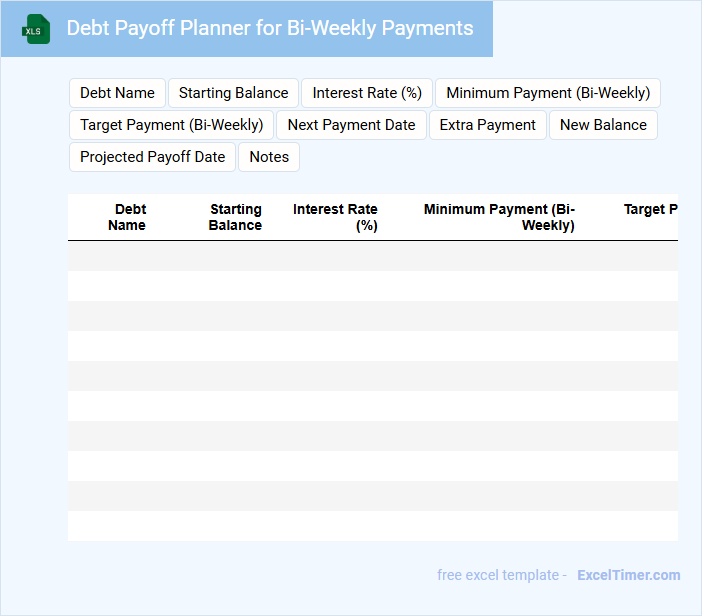

Debt Payoff Planner for Bi-Weekly Payments

A Debt Payoff Planner for Bi-Weekly Payments is a financial tool designed to help individuals strategize their debt repayment by splitting monthly payments into two smaller installments. This method often leads to faster debt elimination and reduced interest over time. Understanding the structure of your debts and payment schedule is crucial when using this planner.

Such documents typically contain a detailed payment calendar, balance tracking, and interest calculation based on bi-weekly contributions. They also emphasize consistency and allow adjustments for additional payments or changing interest rates. Including a reminder system and progress visualization can significantly enhance effectiveness.

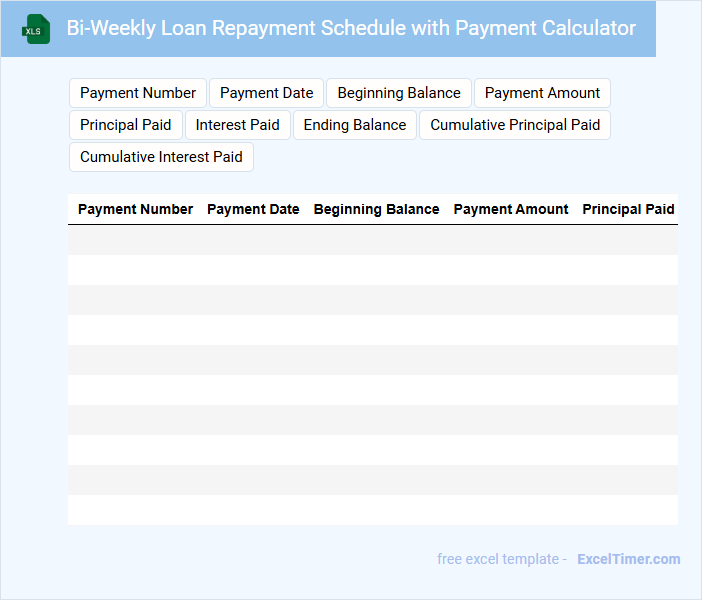

Bi-Weekly Loan Repayment Schedule with Payment Calculator

A Bi-Weekly Loan Repayment Schedule typically contains detailed information on repayment dates, amounts due, and interest calculations spread over two-week intervals. This document helps borrowers track their payment progress and understand how each installment affects the loan balance. Including a Payment Calculator enables quick adjustments to see how extra payments impact the loan term and total interest paid.

Excel Template for Tracking Bi-Weekly Debt Reduction

This Excel Template is designed to help individuals or households systematically track their debt payments on a bi-weekly basis. It typically contains fields for recording payment dates, amounts, and updated balances to monitor progress effectively.

Using this type of document ensures better financial discipline and visibility over debt reduction efforts. Important elements to include are clear categorization of debts, automatic calculations for remaining balances, and visual progress indicators.

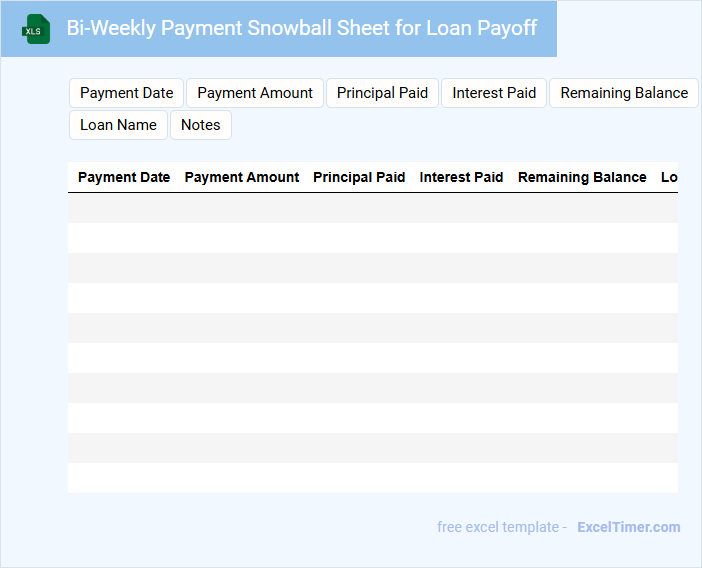

Bi-Weekly Payment Snowball Sheet for Loan Payoff

A Bi-Weekly Payment Snowball Sheet for Loan Payoff is typically used to track and accelerate the repayment of multiple loans by applying extra payments to the smallest balance first. This method helps in reducing total interest paid and shortens the loan term.

- List all outstanding loans with their balances and interest rates.

- Record bi-weekly payment amounts and track the payments applied to each loan.

- Highlight progress by showing reduced balances and updated payoff dates.

Debt Tracker with Bi-Weekly Payment Allocations

This document typically contains detailed information on debt balances, payment schedules, and allocation strategies for managing bi-weekly payments.

- Debt Overview: A comprehensive list of all outstanding debts including amounts and interest rates.

- Payment Schedule: A timeline showing bi-weekly payment dates and corresponding amounts.

- Allocation Strategy: Clear instructions on how payments are distributed across different debts to optimize payoff.

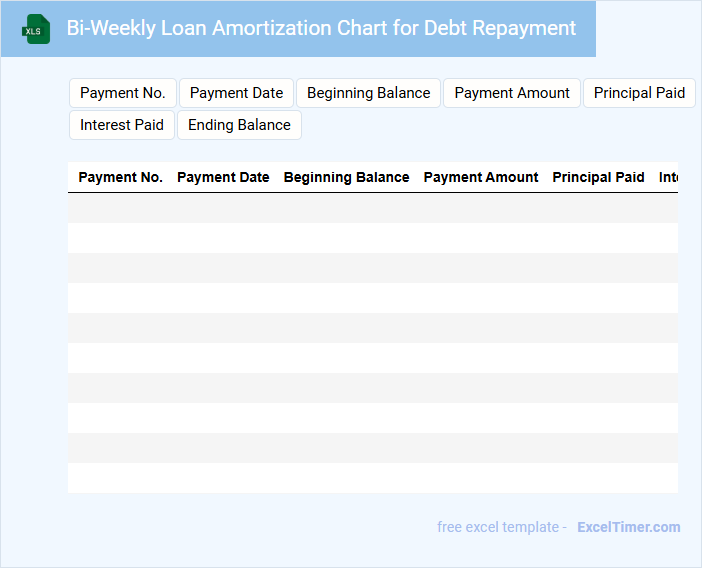

Bi-Weekly Loan Amortization Chart for Debt Repayment

A Bi-Weekly Loan Amortization Chart typically contains a detailed schedule of payments made every two weeks, showing how each payment is applied towards principal and interest. It helps borrowers track their progress in paying down debt over time effectively.

This document is important for managing debt repayment by offering clear visibility of remaining balances and interest savings compared to monthly payments. Maintaining accuracy and updating it regularly ensures successful financial planning and goal achievement.

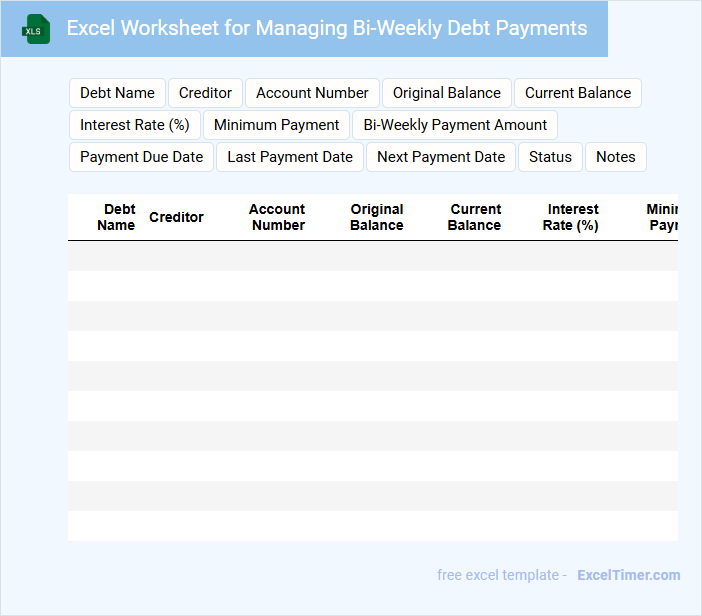

Excel Worksheet for Managing Bi-Weekly Debt Payments

An Excel Worksheet for managing bi-weekly debt payments typically contains sections for tracking payment schedules, outstanding balances, and interest accruals. It allows users to input their debt details, calculate payment amounts, and monitor progress over time efficiently. Maintaining accurate and up-to-date information is crucial for effective debt management and financial planning.

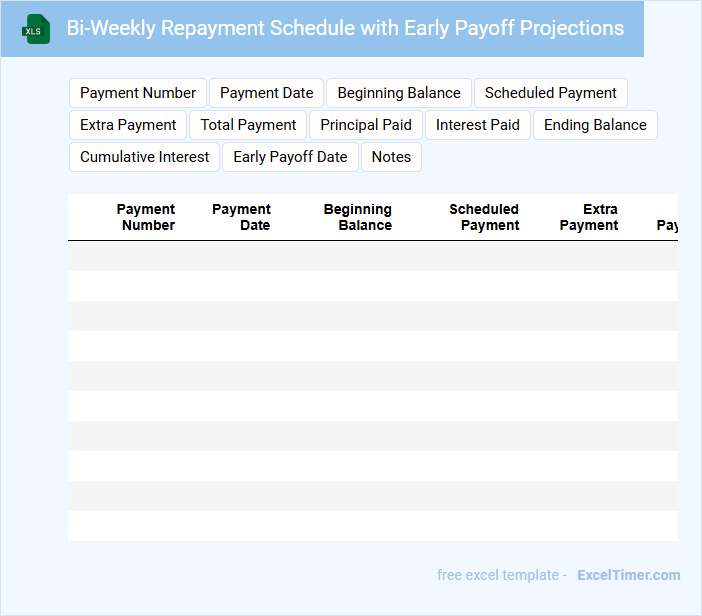

Bi-Weekly Repayment Schedule with Early Payoff Projections

A Bi-Weekly Repayment Schedule is a financial document outlining payment plans made every two weeks to reduce loan terms and interest costs. It typically includes detailed payment dates, principal and interest portions of each payment, and cumulative balances. Additionally, early payoff projections display potential savings and the timeline impact when extra payments are made ahead of schedule.

Debt Reduction Planner with Bi-Weekly Payment Tracker

A Debt Reduction Planner with a Bi-Weekly Payment Tracker is a tool designed to help individuals manage and accelerate their debt repayment process. It typically contains sections to list outstanding debts, record payment amounts and dates, and calculate interest savings over time. This document is essential for visualizing progress and staying motivated towards becoming debt-free.

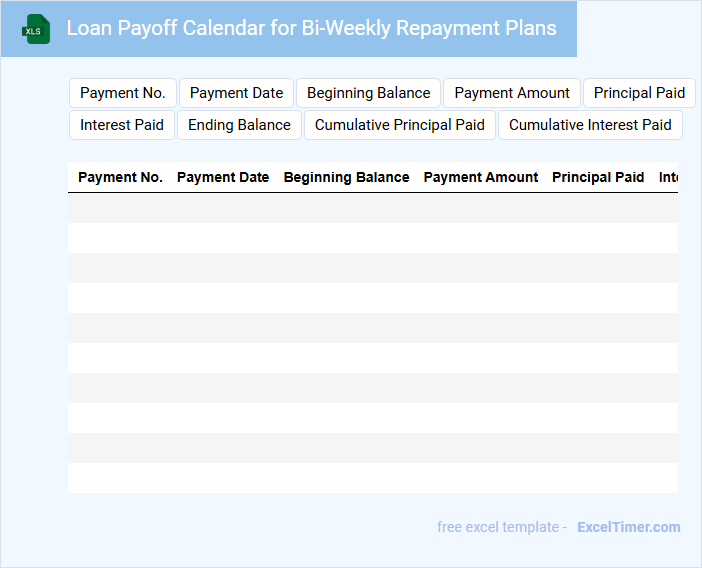

Loan Payoff Calendar for Bi-Weekly Repayment Plans

A Loan Payoff Calendar for Bi-Weekly Repayment Plans typically outlines the scheduled payments and helps borrowers track their progress toward paying off the loan faster.

- Payment Schedule: Clearly lists the bi-weekly payment dates and amounts to ensure timely repayments.

- Interest Savings: Highlights the reduction in interest costs by making bi-weekly payments instead of monthly ones.

- Principal Reduction: Shows the incremental decrease in the loan principal with each payment, accelerating payoff time.

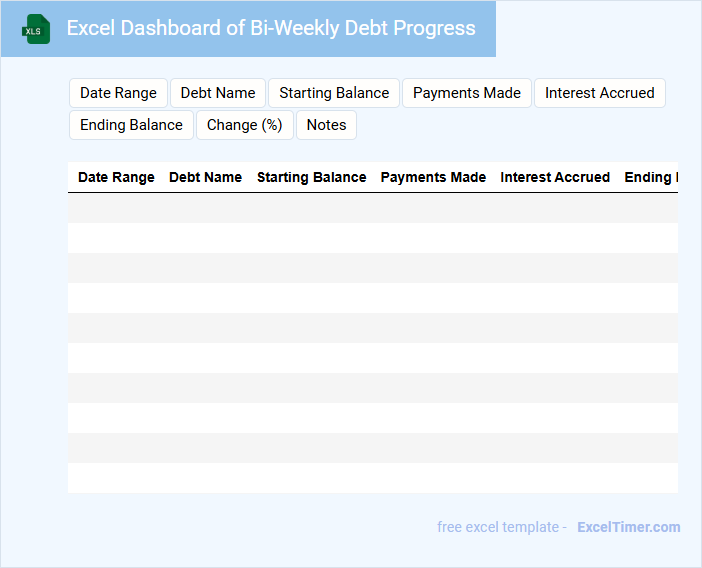

Excel Dashboard of Bi-Weekly Debt Progress

This type of document typically contains summarized financial data and visual representations tracking debt progress over a fortnightly period.

- Clear Metrics: Display key debt indicators such as total balance, payments made, and remaining amounts.

- Visual Charts: Use graphs or gauges to easily depict progress and trends.

- Consistent Updates: Ensure data is refreshed bi-weekly to maintain accuracy and relevance.

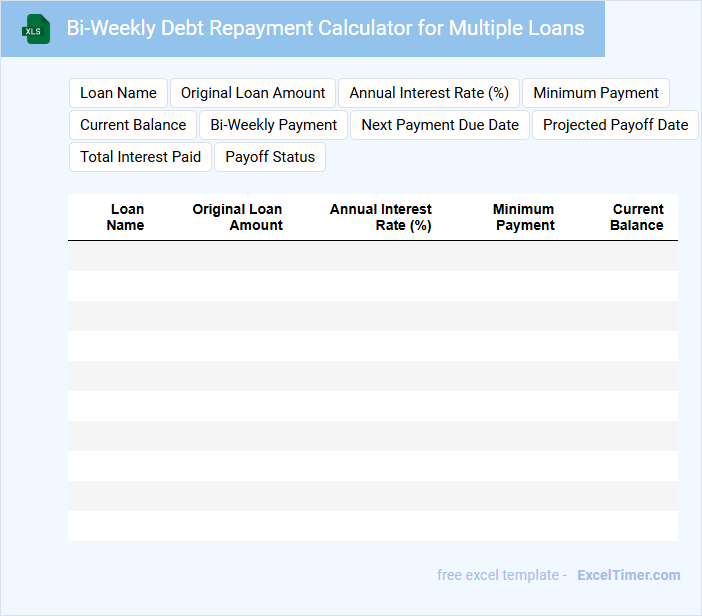

Bi-Weekly Debt Repayment Calculator for Multiple Loans

This Bi-Weekly Debt Repayment Calculator for Multiple Loans document typically contains essential details to track and manage debt repayment effectively by calculating bi-weekly payments for various loans.

- Loan details: Includes loan amounts, interest rates, and terms for each loan to ensure accurate calculations.

- Payment schedule: Outlines the bi-weekly payment dates and amounts for organized repayment tracking.

- Summary of savings: Highlights potential interest savings and early payoff timelines compared to standard monthly payments.

Payoff Tracker with Bi-Weekly Payment Timeline

A Payoff Tracker with a Bi-Weekly Payment Timeline is a financial management tool designed to monitor loan or debt repayment progress. It helps users visualize how their bi-weekly payments reduce the principal faster than monthly payments.

This type of document usually contains detailed payment schedules, outstanding balance updates, and interest calculations. Including reminders and motivational milestones is important to keep users engaged and on track.

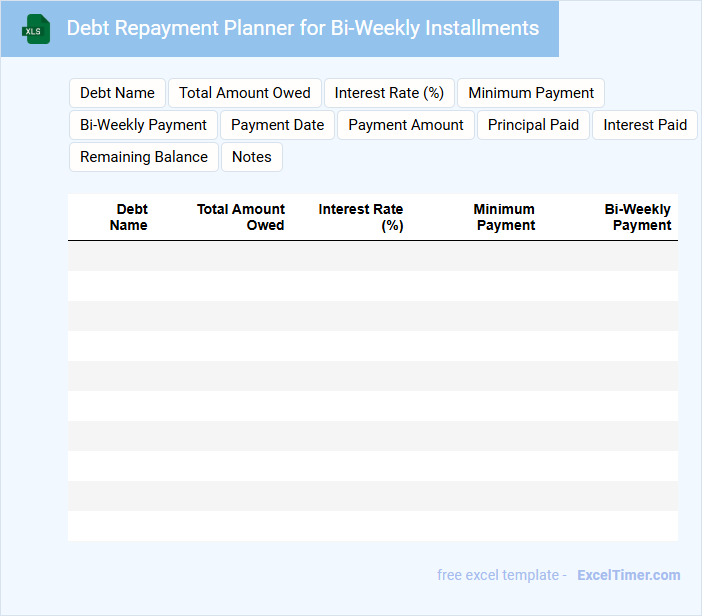

Debt Repayment Planner for Bi-Weekly Installments

A Debt Repayment Planner for Bi-Weekly Installments is a tool designed to help individuals manage their debt by breaking down payments into smaller, more frequent amounts. This type of document typically contains a detailed schedule of payment dates, amounts due, and remaining balances. It also includes strategies to accelerate debt payoff while minimizing interest charges.

Important elements to include are a clear breakdown of each bi-weekly installment, total debt amount, interest rates, and a summary of potential savings from bi-weekly payments versus monthly payments. Additionally, tracking progress and setting reminders can enhance effectiveness and motivation. Ensuring the planner is easy to update and understand will help maintain consistent repayment habits.

How does switching to a bi-weekly debt repayment schedule impact the total interest paid on a loan in Excel?

Switching to a bi-weekly debt repayment schedule in Excel reduces the total interest paid by accelerating principal reduction and increasing the number of payments per year from 12 to 26. This method shortens the loan term and decreases the accrued interest calculated in the amortization schedule. Excel formulas can model this by adjusting payment frequency and recalculating interest based on bi-weekly intervals.

What Excel formulas can accurately calculate the new loan payoff date with bi-weekly payments?

Use the formula `=NPER(rate/26, -payment, principal)` to calculate the number of bi-weekly periods needed for loan payoff. Apply `=original_loan_date + (NPER_result*14)` to find the new loan payoff date, where `rate` is the annual interest rate, `payment` is the bi-weekly payment, and `principal` is the remaining loan balance. Adjust these formulas based on loan terms to optimize debt repayment scheduling in Excel.

How does the frequency of bi-weekly payments affect the amortization table generated in Excel?

Bi-weekly payments reduce the loan term and total interest paid by increasing the number of payments compared to monthly schedules. The amortization table in Excel reflects this with more frequent payment entries and a faster principal balance reduction. This accelerated payoff strategy results in a shorter loan duration and lower cumulative interest costs.

What key variables must be adjusted in an Excel loan spreadsheet to model bi-weekly debt repayment effectively?

To model bi-weekly debt repayment effectively in your Excel loan spreadsheet, adjust the payment frequency to 26 periods per year and update the payment amount to reflect half of your monthly payment. Modify the interest calculation formula to apply the appropriate rate per bi-weekly period, ensuring accurate amortization. Tracking these variables allows you to simulate faster loan payoff and interest savings.

How can Excel be used to compare the total cost and payoff time of standard monthly versus bi-weekly loan repayment options?

Excel can calculate and compare total interest paid and loan payoff duration by setting up separate amortization schedules for monthly and bi-weekly payments. Using formulas like PMT and cumulative SUM, users can track principal reduction and interest accumulation over time. Conditional formatting and charts then visualize differences in cost savings and early payoff benefits between the two repayment plans.