The Bi-weekly Payroll Excel Template for Contractors simplifies payment tracking by automating calculations for hours worked, rates, and deductions. This tool ensures accurate and timely compensation, reducing errors and saving administrative time. Its customizable format caters specifically to contractor payment schedules, making it ideal for freelance or project-based payroll management.

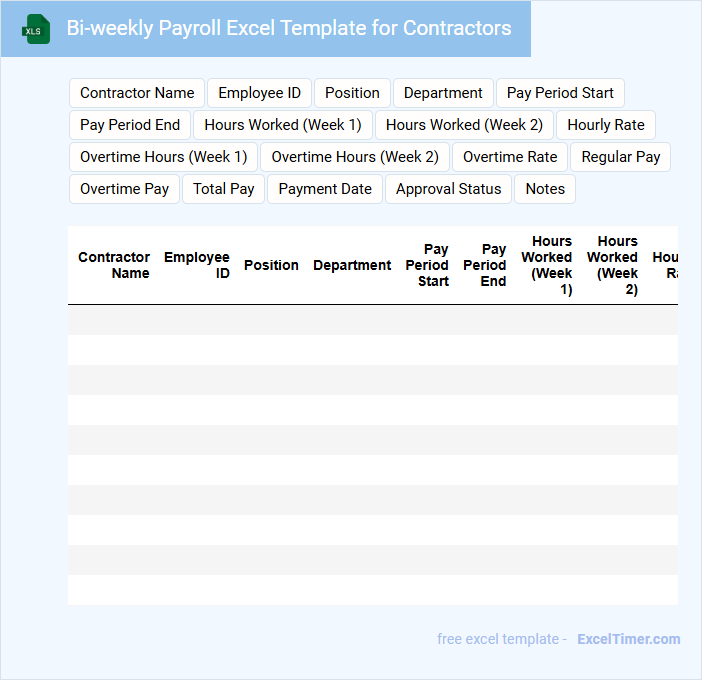

Bi-weekly Payroll Excel Template for Contractors

A Bi-weekly Payroll Excel Template for Contractors is typically used to track payments and hours worked over two-week periods. It helps ensure accurate and timely compensation for contract workers.

- Include detailed columns for contractor names, hours worked, pay rates, and total payments.

- Incorporate formulas to automatically calculate taxes, deductions, and net pay.

- Maintain a section for notes or contract terms to clarify payment conditions.

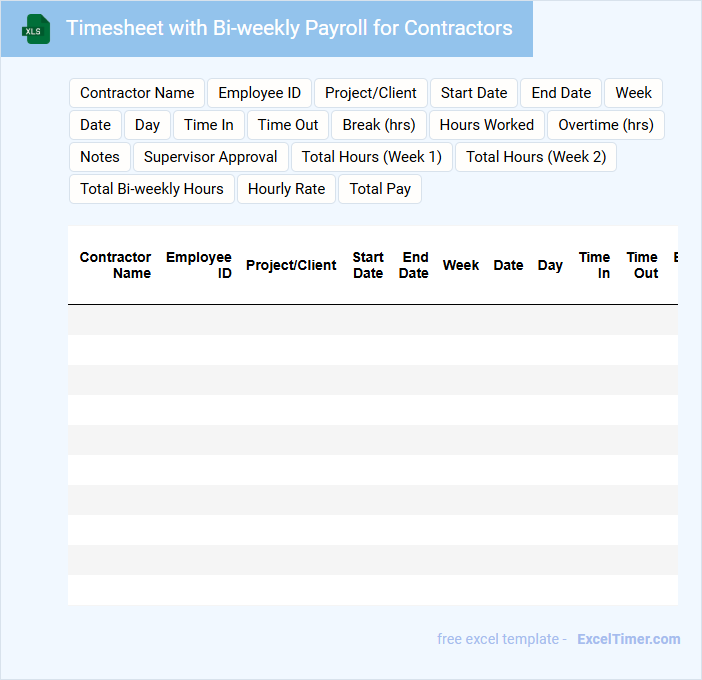

Timesheet with Bi-weekly Payroll for Contractors

What information is typically included in a timesheet with bi-weekly payroll for contractors? A timesheet with bi-weekly payroll for contractors usually contains detailed records of hours worked each day over a two-week period. It also includes wage rates, total pay, and any relevant project or task descriptions to ensure accurate compensation and proper tracking of contractor activities.

What important elements should be considered when managing bi-weekly payroll timesheets for contractors? It's crucial to ensure precise time tracking, clear documentation of work performed, and timely submission to avoid payment delays. Additionally, verifying overtime eligibility and compliance with contract terms helps maintain transparency and accuracy in payroll processing.

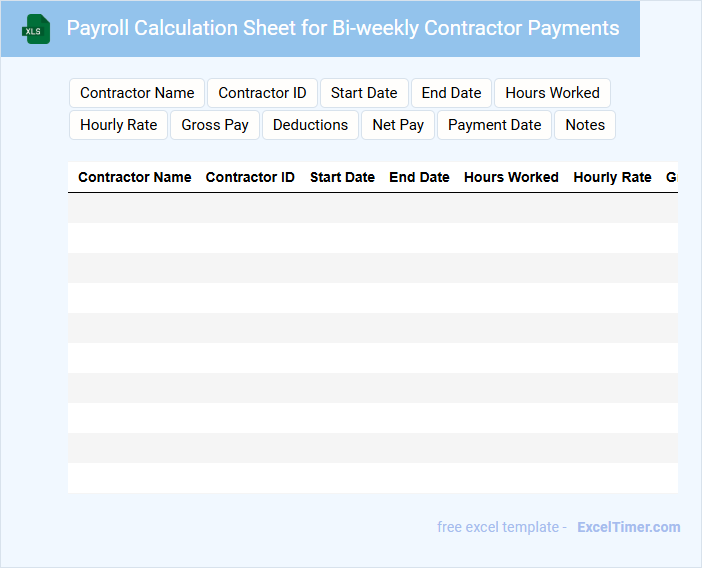

Payroll Calculation Sheet for Bi-weekly Contractor Payments

A Payroll Calculation Sheet for bi-weekly contractor payments typically includes detailed records of hours worked, hourly rates, and total pay for each contractor. It ensures accurate and timely compensation while maintaining compliance with tax and labor regulations.

Important elements include clear identification of payment periods, deductions, and any applicable bonuses or reimbursements. Proper documentation and verification processes are essential to avoid errors and disputes.

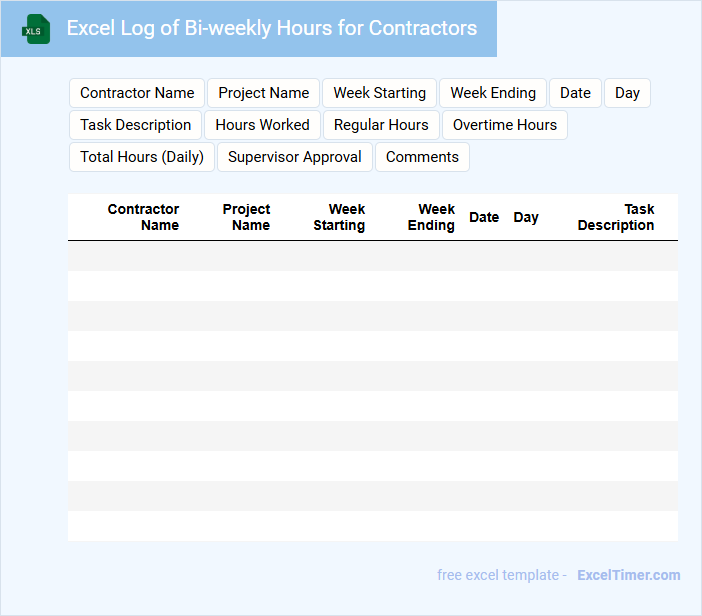

Excel Log of Bi-weekly Hours for Contractors

An Excel Log of Bi-weekly Hours for Contractors is a document used to track the number of hours contractors work within a two-week period. It typically contains detailed entries such as dates, hours worked each day, and total hours calculated for payroll and project management. Ensuring accuracy and timely submission of this log is important for both contractors and employers to maintain clear records and comply with contractual agreements.

Contractor Payment Tracker with Bi-weekly Pay Periods

The Contractor Payment Tracker is a vital document used to monitor payments made to contractors over specific periods, typically bi-weekly. It consolidates payment dates, amounts, and contractor details to ensure accuracy and transparency.

Maintaining an organized bi-weekly pay period structure helps in timely and consistent payments, preventing discrepancies. Keeping records updated and reviewing entries regularly is essential for financial management.

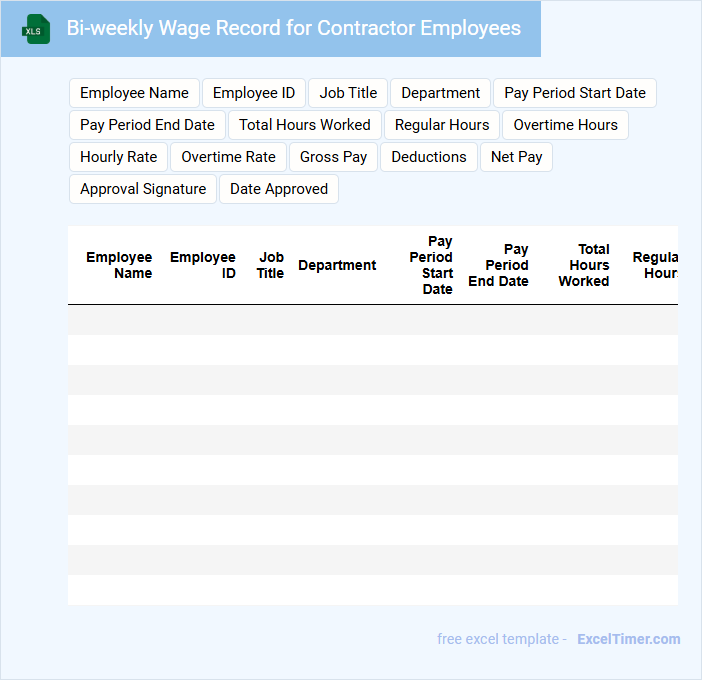

Bi-weekly Wage Record for Contractor Employees

The Bi-weekly Wage Record for contractor employees is a detailed document that tracks all payments made within a two-week period. It typically contains employee names, hours worked, wage rates, and total earnings. Accurate record-keeping ensures compliance and facilitates payroll audits.

Important elements include precise timekeeping, verification of contractor status, and timely updates to avoid discrepancies. This document also serves as proof for tax reporting and payment reconciliation. Maintaining clear and consistent records helps protect both employer and employee rights.

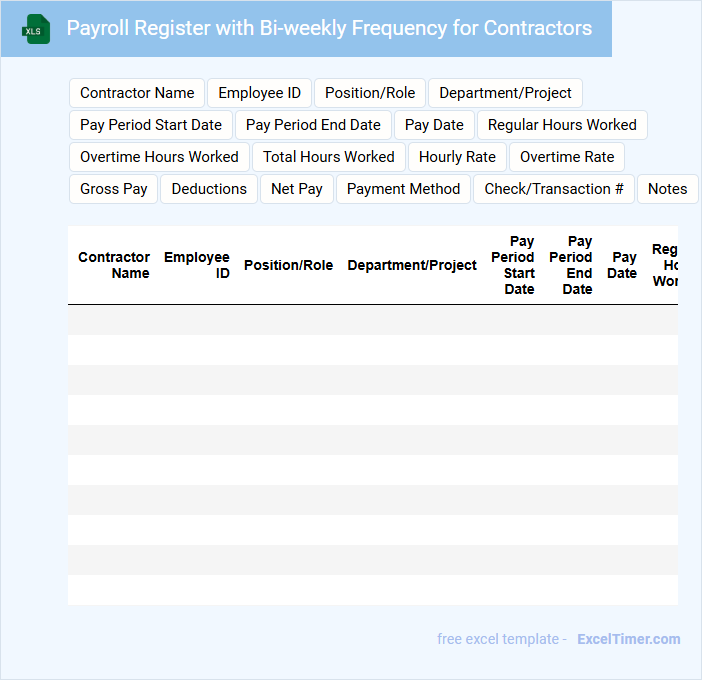

Payroll Register with Bi-weekly Frequency for Contractors

Payroll Register with Bi-weekly Frequency for Contractors is a crucial document that records detailed payment information for contractors paid every two weeks. It typically contains employee names, hours worked, rates, deductions, and net pay. Ensuring accuracy in tax withholdings and contractor classification is vital to maintain legal compliance and proper financial tracking.

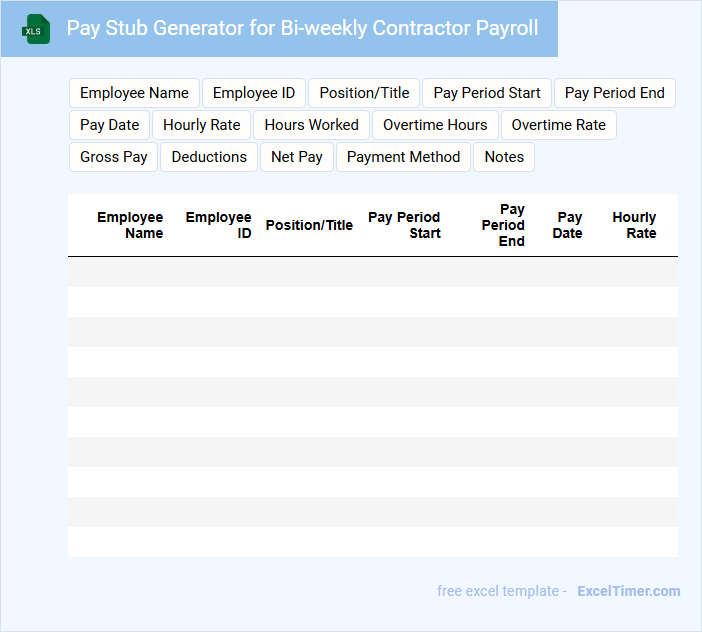

Pay Stub Generator for Bi-weekly Contractor Payroll

A Pay Stub Generator for bi-weekly contractor payroll typically contains detailed earnings, deductions, and net pay information for each pay period. It includes essential data such as contractor hours worked, pay rates, tax withholdings, and any benefits or reimbursements. Accurate record-keeping and clarity are crucial for both contractors and employers to ensure transparency and compliance.

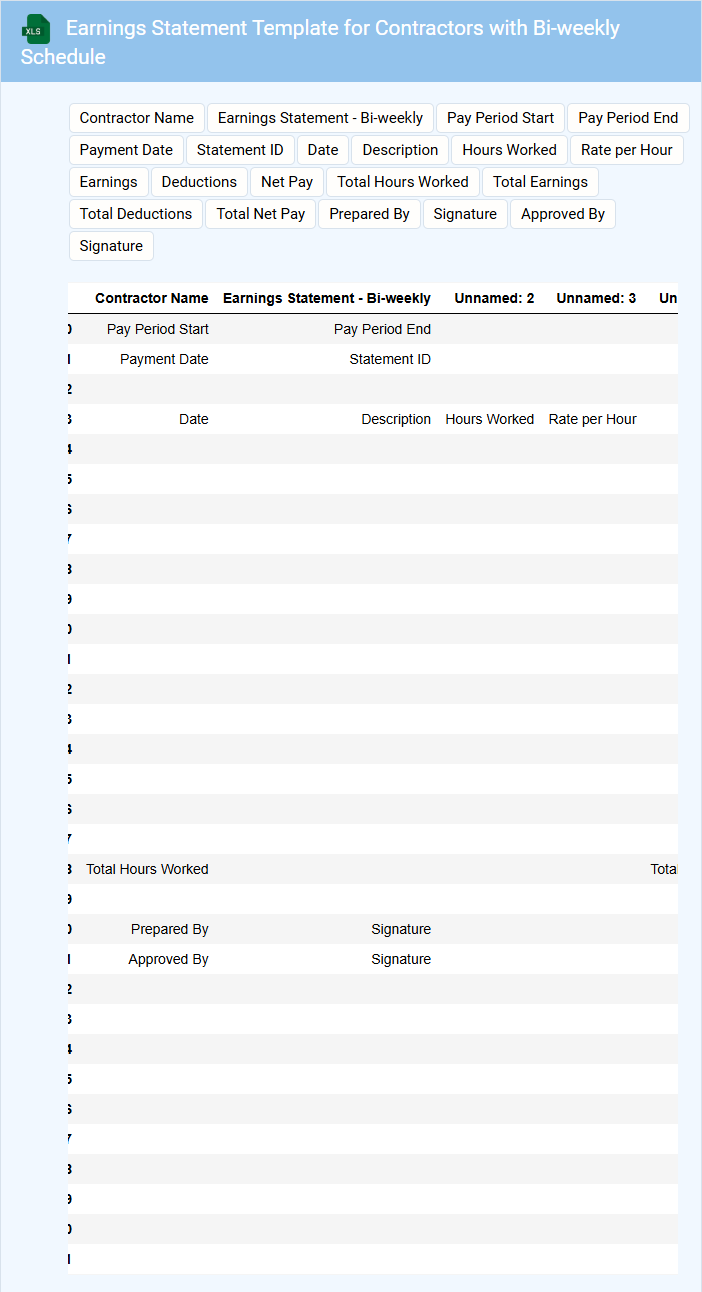

Earnings Statement Template for Contractors with Bi-weekly Schedule

An earnings statement template for contractors with a bi-weekly schedule typically includes detailed records of income earned over two weeks. It breaks down hours worked, rates, deductions, and net pay to provide clear financial documentation.

Such a document ensures transparency and accurate tracking of payments for both contractors and clients. It is important to include tax withholdings, overtime calculations, and clear identification details for legal and accounting purposes.

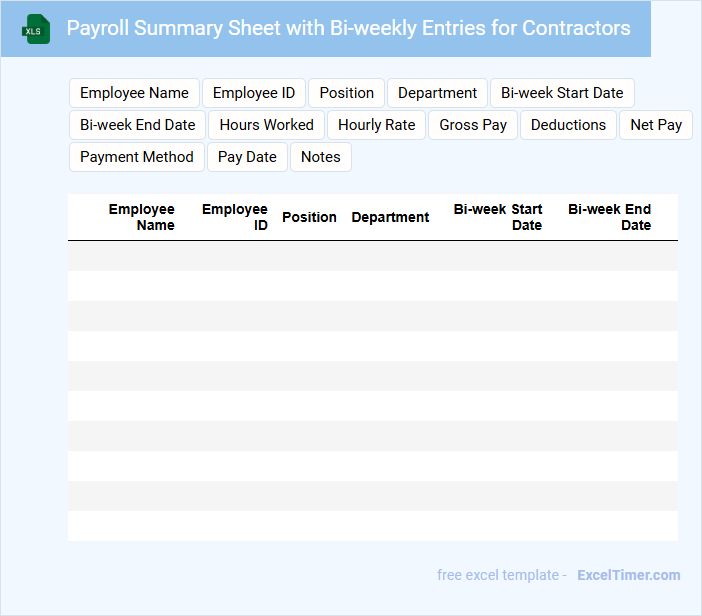

Payroll Summary Sheet with Bi-weekly Entries for Contractors

What information is typically included in a Payroll Summary Sheet with Bi-weekly Entries for Contractors? This document usually contains a detailed record of payment amounts, hours worked, and contractor identification for each bi-weekly period. It serves as a crucial tool for accurate financial tracking and compliance with tax regulations.

What important considerations should be kept in mind when preparing this document? Ensuring accuracy in hours reported, payment rates, and contractor details is essential to avoid discrepancies. Additionally, timely updates and clear breakdowns help facilitate smooth audits and contractor payment processes.

Bi-weekly Invoice Tracker for Contractor Payments

A Bi-weekly Invoice Tracker for contractor payments is a crucial document designed to organize and monitor payment schedules efficiently. It typically contains invoice dates, payment amounts, contractor details, and payment statuses to ensure timely settlements. This tool helps maintain clear financial records and supports budget management for ongoing projects.

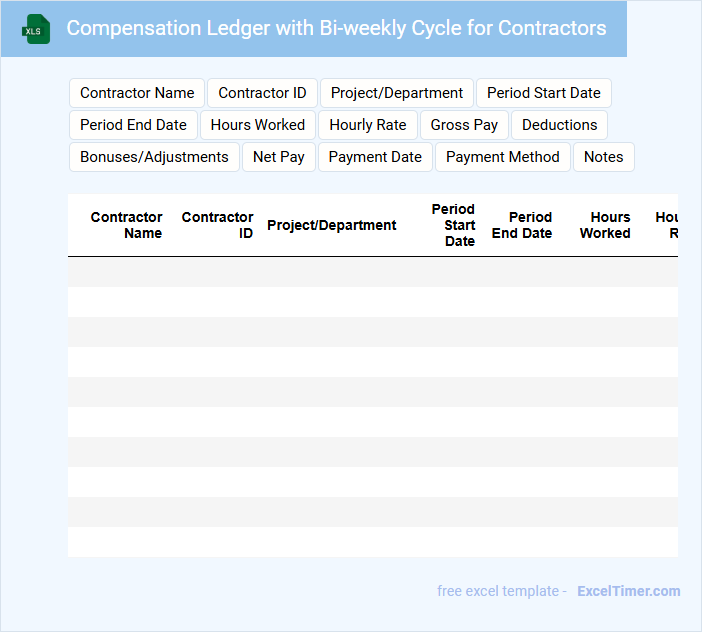

Compensation Ledger with Bi-weekly Cycle for Contractors

A Compensation Ledger with a Bi-weekly Cycle for Contractors is a detailed record tracking payments and work hours within a two-week period. It ensures accurate and timely compensation for contractors based on their contracted terms.

- Include clear contractor identification and contract details for transparency.

- Record hours worked and pay rates precisely for accurate calculations.

- Ensure timely updates and reconciliations to avoid payroll discrepancies.

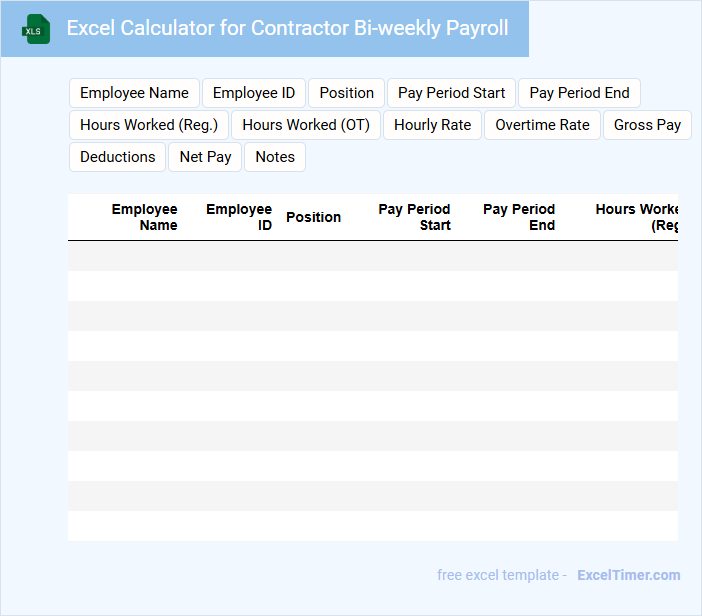

Excel Calculator for Contractor Bi-weekly Payroll

What does an Excel Calculator for Contractor Bi-weekly Payroll typically contain?

This document usually contains input fields for hours worked, hourly rates, and tax deductions to accurately calculate net pay. It also includes formulas for automatic calculations, summaries of earnings, and space for notes on project codes or payment adjustments.

Important Suggestions

Ensure clear labeling of all input areas to avoid errors and streamline data entry. Include sections for federal and state tax rates, as well as options for overtime and bonuses, to provide comprehensive and accurate payroll calculations.

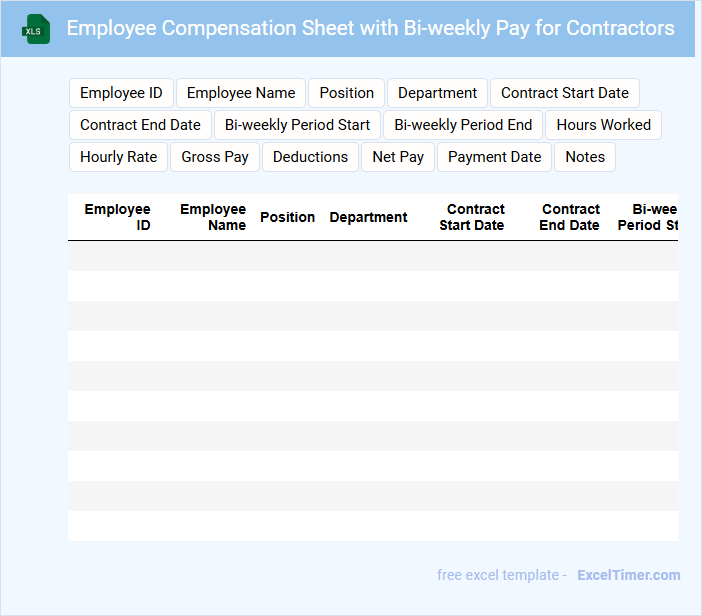

Employee Compensation Sheet with Bi-weekly Pay for Contractors

An Employee Compensation Sheet with bi-weekly pay for contractors typically contains detailed records of payments made to contractors every two weeks. It includes essential information such as hours worked, pay rates, deductions, and net pay. This document ensures transparency and accurate tracking of contractor compensation.

It is important to include clear contractor identification, payment periods, and any applicable taxes or benefits. Ensuring compliance with labor laws and contract terms is crucial in maintaining fair and legal compensation practices. Regular updates and audits of the sheet help prevent payroll errors and disputes.

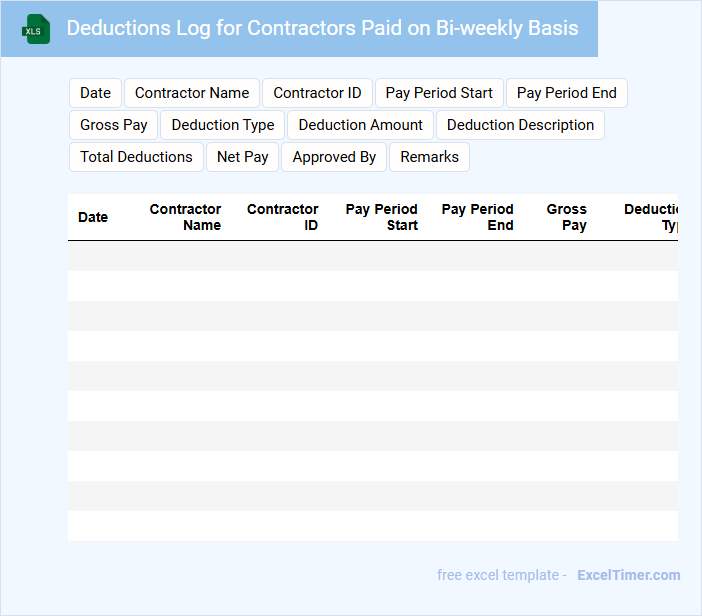

Deductions Log for Contractors Paid on Bi-weekly Basis

The Deductions Log for contractors paid on a bi-weekly basis is a detailed record of all amounts withheld from their payments. It typically includes tax withholdings, benefits contributions, and any other authorized deductions. This document ensures transparency and accuracy in financial transactions.

Maintaining an up-to-date deductions log helps both contractors and employers track payment adjustments clearly. It is important to regularly review the log to avoid discrepancies and ensure compliance with contractual and legal obligations. Proper documentation supports smooth payroll processing and audit readiness.

What key columns are necessary in an Excel document to accurately record bi-weekly payroll for contractors?

Key columns for bi-weekly contractor payroll in Excel include Contractor Name, Contract ID, Pay Period Start Date, Pay Period End Date, Hours Worked, Hourly Rate or Fixed Contract Amount, Gross Pay, Deductions (if any), Net Pay, and Payment Date. Including columns for Tax Withholdings and Payment Method improves accuracy and compliance. A unique identifier column for each transaction ensures precise record-keeping and easy audits.

How should contractor hours and rates be structured for efficient bi-weekly payroll calculation in Excel?

Contractor hours should be recorded daily and summarized for each bi-weekly period in Excel, with separate columns for regular and overtime hours. Your hourly rates must be clearly defined per contractor to enable precise multiplication and automatic payroll calculation. Use Excel formulas like SUMPRODUCT to efficiently calculate total pay based on hours worked and assigned rates.

What formula can automate gross pay computation for each contractor per pay period in Excel?

Use the formula =Hours_Worked * Hourly_Rate to automate gross pay calculation in Excel for each contractor per pay period. Replace Hours_Worked with the cell reference of total hours worked and Hourly_Rate with the hourly pay rate cell. This ensures accurate bi-weekly payroll computation for contractors.

How can payment status and invoice numbers be tracked within the bi-weekly payroll spreadsheet for contractors?

In a bi-weekly payroll spreadsheet for contractors, payment status can be tracked using a dedicated column with status indicators such as "Paid," "Pending," or "Overdue." Invoice numbers should be recorded in a specific column adjacent to each contractor's entry, ensuring easy reference and cross-checking against payments. Utilizing filters and conditional formatting enhances visibility and management of invoice and payment tracking within the payroll document.

What are best practices for securing sensitive contractor payroll data in an Excel document?

Protect sensitive contractor payroll data in an Excel document by enabling password protection and restricting access through file encryption. Use Excel's built-in features such as worksheet protection and data validation to limit unauthorized edits and reduce errors. Regularly back up the file to secure locations and avoid sharing it via unsecured channels to maintain data confidentiality.