The Bi-weekly Income and Expense Report Excel Template for Nonprofit Organizations offers a streamlined approach to tracking financial transactions every two weeks. It simplifies budgeting and financial management by organizing income sources and expenses in a clear, customizable format. This template is essential for nonprofits seeking accurate, timely financial reporting to maintain transparency and support informed decision-making.

Bi-weekly Income and Expense Report Template for Nonprofit Organizations

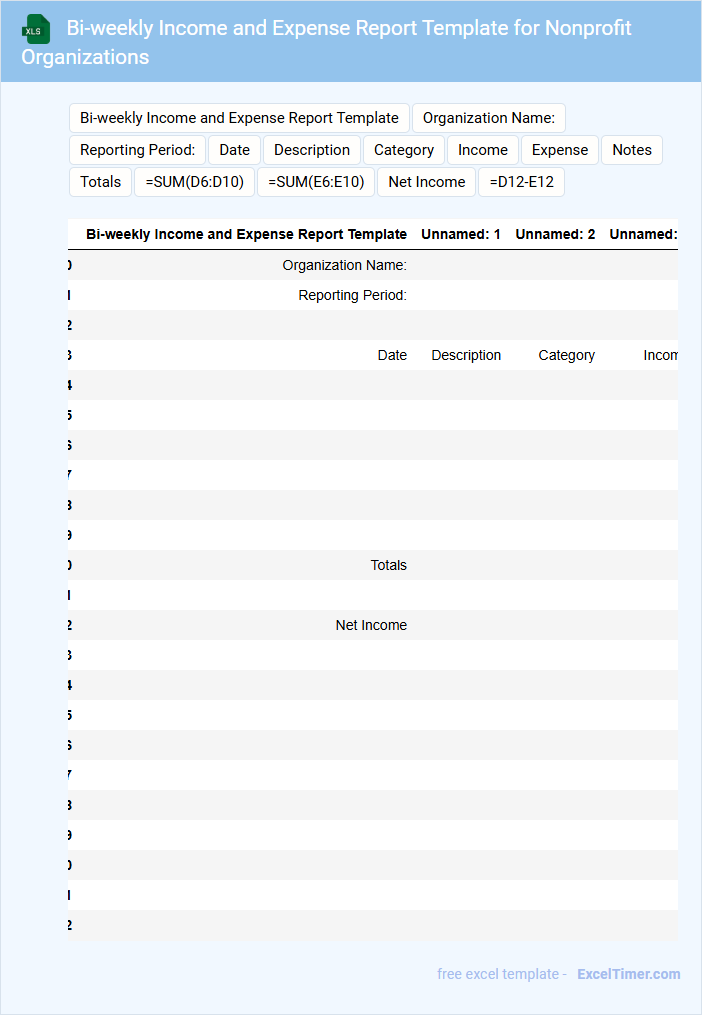

A Bi-weekly Income and Expense Report template for nonprofit organizations is designed to track financial transactions every two weeks. It typically contains sections for recording income sources, expense categories, and net balances. This helps organizations maintain transparency and manage their budgets effectively.

Important elements to include are clear income descriptions, categorized expenses, and a summary of totals. Additionally, incorporating notes for unusual transactions and comparing actual figures against budgeted amounts enhances financial oversight. Consistent and accurate reporting ensures compliance and supports informed decision-making.

Excel Tracker for Bi-weekly Income and Expenses of Nonprofits

An Excel tracker for bi-weekly income and expenses is a vital document used by nonprofits to monitor their financial activities. It typically contains detailed records of incoming funds and outgoing expenditures, categorized for better clarity. Maintaining accuracy and consistency in this tracker is crucial for transparent financial reporting and budgeting.

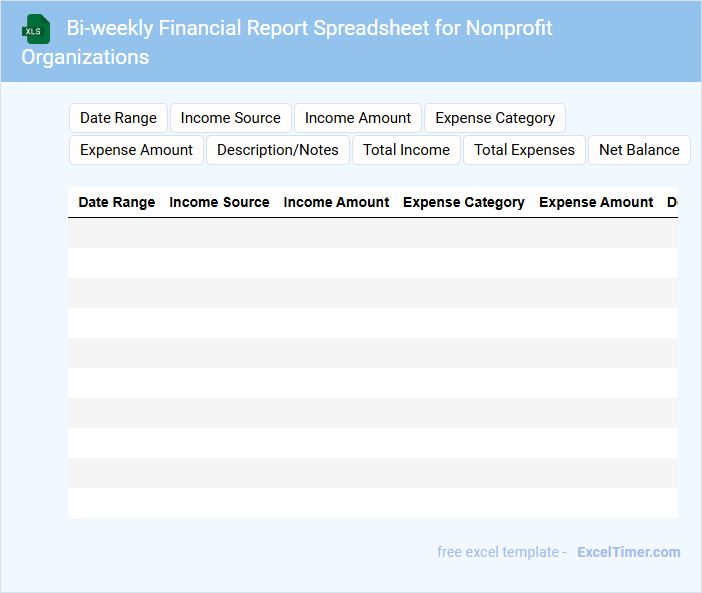

Bi-weekly Financial Report Spreadsheet for Nonprofit Organizations

Bi-weekly financial report spreadsheets for nonprofit organizations are essential tools that track financial activities and monitor budget adherence on a regular basis. These documents provide a concise overview of income, expenses, and fund allocations to ensure transparency and informed decision-making.

- Include detailed records of all incoming donations and grants received within the reporting period.

- Highlight expense categories to analyze spending trends and maintain budget compliance.

- Incorporate clear summary metrics such as net cash flow and fund balances for quick review.

Income and Expense Analysis Template with Bi-weekly Tracking for Nonprofits

What information is typically included in an Income and Expense Analysis Template with Bi-weekly Tracking for Nonprofits? This document usually contains detailed records of all income sources and expenses tracked on a bi-weekly basis, helping nonprofits monitor their financial health. It includes categorized sections for donations, grants, operational costs, and program expenses to provide clear insights into cash flow and budget adherence.

Why is it important to maintain bi-weekly tracking in this template? Bi-weekly tracking allows nonprofits to quickly identify financial trends, manage cash flow effectively, and make timely decisions for resource allocation. Consistent updates help in maintaining transparency and ensuring accountability to stakeholders and funders.

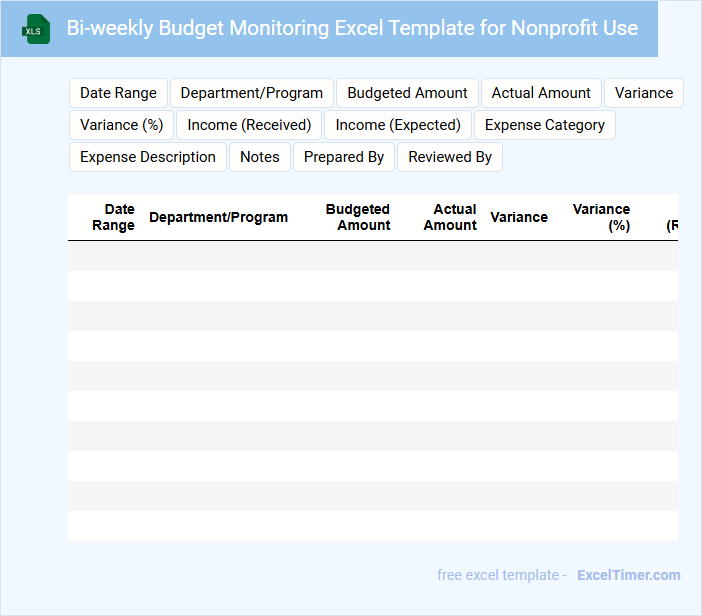

Bi-weekly Budget Monitoring Excel Template for Nonprofit Use

A Bi-weekly Budget Monitoring Excel Template for nonprofit use is designed to help organizations track income and expenses every two weeks, ensuring financial health and accountability. It typically includes sections for revenue sources, expense categories, and budget variances to provide clear insights.

Effective budget monitoring helps nonprofits manage funds efficiently and plan future activities with accuracy. Including regular updates and notes on funding changes is essential for maintaining transparency and strategic financial management.

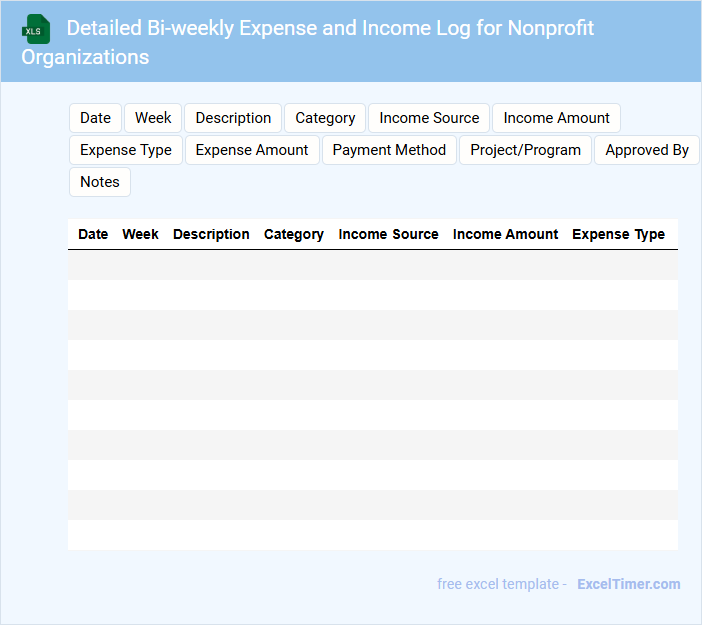

Detailed Bi-weekly Expense and Income Log for Nonprofit Organizations

A Detailed Bi-weekly Expense and Income Log for nonprofit organizations typically contains comprehensive records of all financial transactions within a two-week period, including donations received, grants, operational expenses, and program-specific costs. This document ensures transparency and accurate financial tracking necessary for compliance and reporting.

Maintaining a detailed log helps in budgeting, monitoring cash flow, and preparing financial statements efficiently. It is important to include categorized entries and supporting documentation to enhance clarity and accountability.

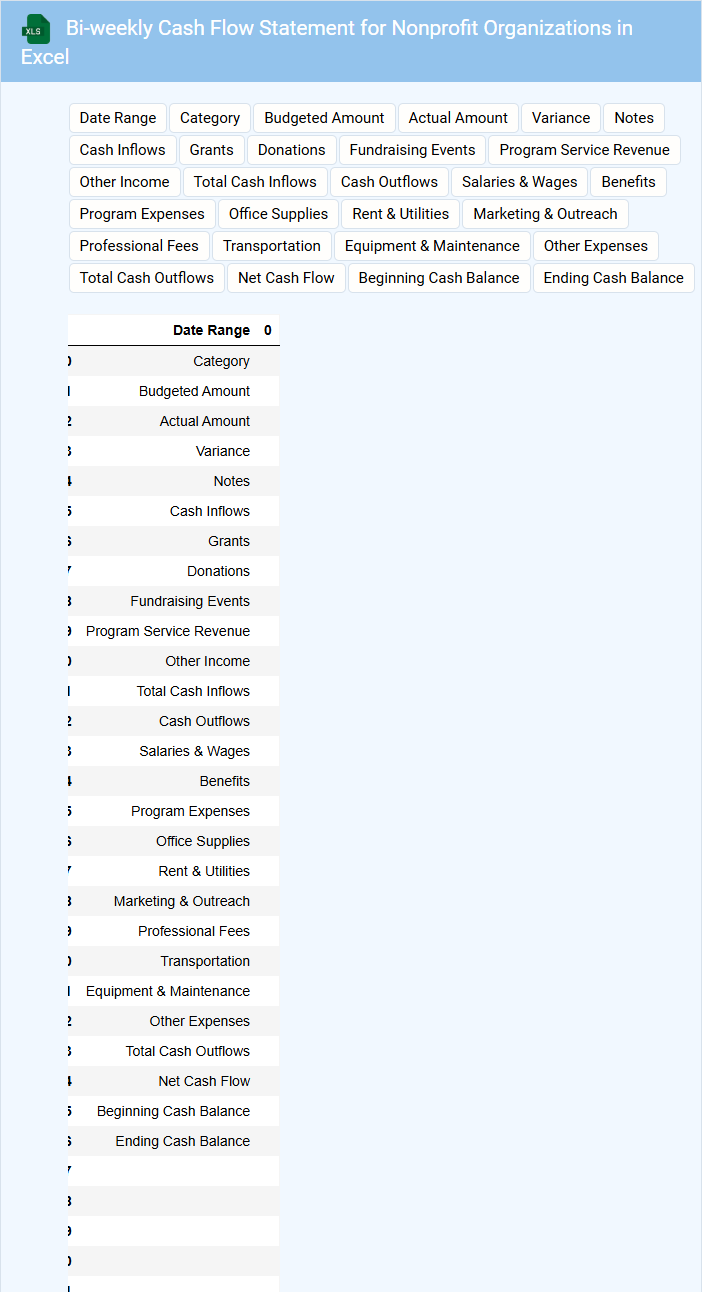

Bi-weekly Cash Flow Statement for Nonprofit Organizations in Excel

What information is typically included in a bi-weekly cash flow statement for nonprofit organizations created in Excel? This document usually details the inflows and outflows of cash over a two-week period, helping nonprofits track their liquidity and financial health. It often includes sections for donations, grants, operating expenses, and other financial activities summarized to provide clear insights into available cash resources. For optimal use, it is important to regularly update the statement with accurate transaction data and include clear notes for any unusual or one-time cash movements to maintain transparency and aid decision-making.

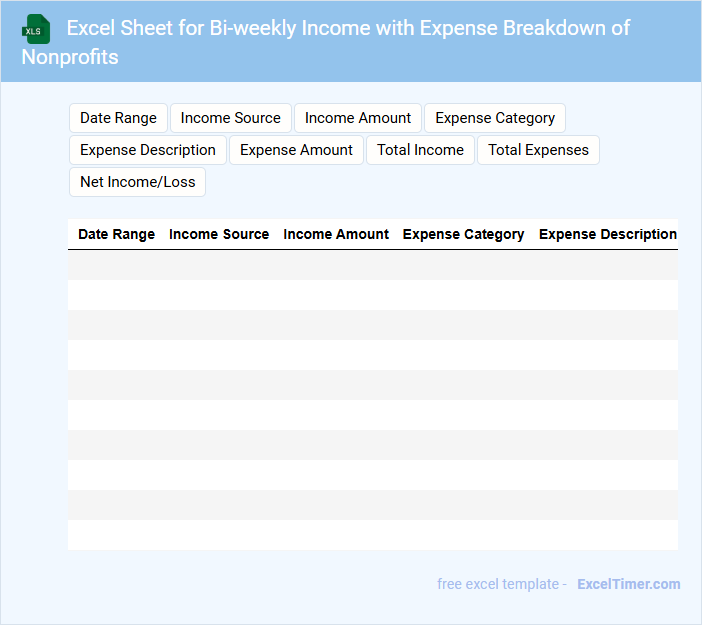

Excel Sheet for Bi-weekly Income with Expense Breakdown of Nonprofits

An Excel Sheet for Bi-weekly Income with Expense Breakdown of nonprofits typically contains detailed records of all incoming funds and outgoing costs within a two-week period. It usually includes categories for various income sources such as donations and grants, alongside expense categories like program costs, salaries, and administrative fees. This structure helps organizations monitor financial health and ensure transparent reporting to stakeholders.

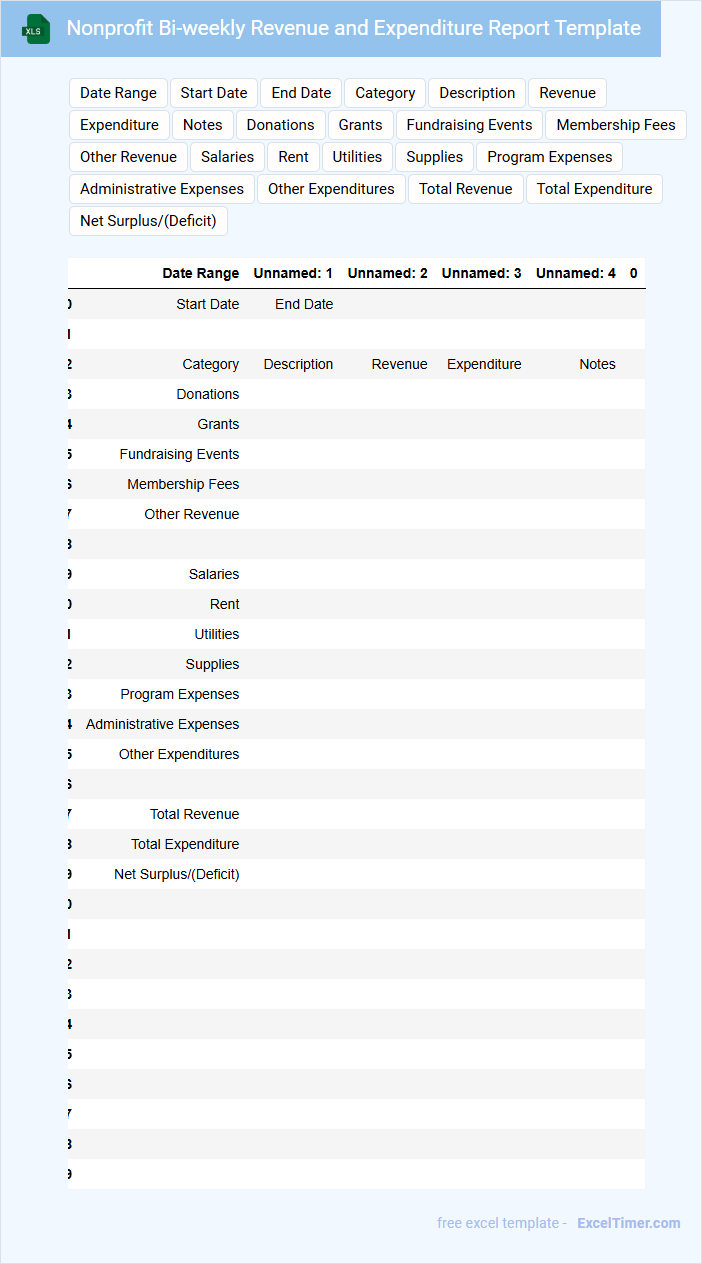

Nonprofit Bi-weekly Revenue and Expenditure Report Template

The Nonprofit Bi-weekly Revenue and Expenditure Report typically contains detailed records of income and expenses within a two-week period, facilitating transparent financial tracking. It includes categorized revenue sources such as donations and grants, alongside expenditure details like program costs and administrative expenses. This document is crucial for monitoring financial health and ensuring accountability to stakeholders.

When preparing this report, it is important to ensure accuracy in data entry, maintain clear categorization of funds, and provide timely updates to aid effective decision-making and compliance with regulatory standards.

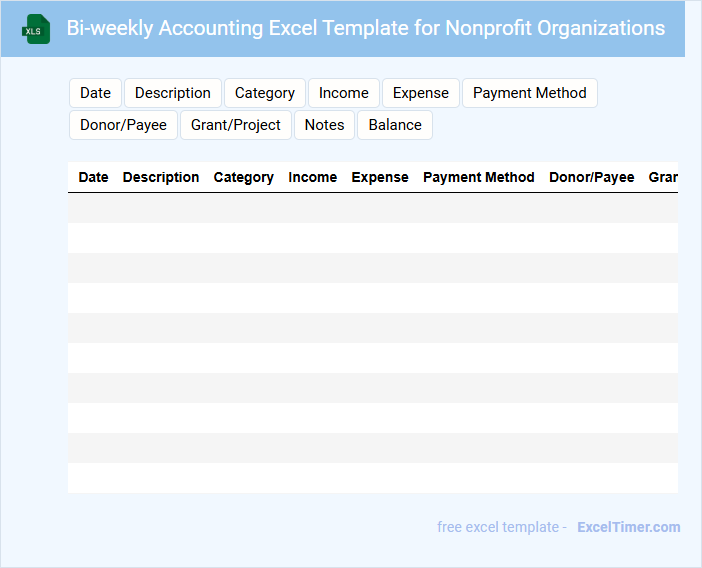

Bi-weekly Accounting Excel Template for Nonprofit Organizations

A Bi-weekly Accounting Excel Template for Nonprofit Organizations is designed to streamline financial tracking on a bi-weekly basis, capturing income, expenses, and budgeting data efficiently. It helps nonprofits maintain accurate financial records and facilitates timely reporting to stakeholders.

The template typically contains categories for donations, grants, operational costs, and payroll, tailored to meet nonprofit accounting standards. Ensuring data accuracy and consistency in each entry is crucial for reliable financial analysis and compliance.

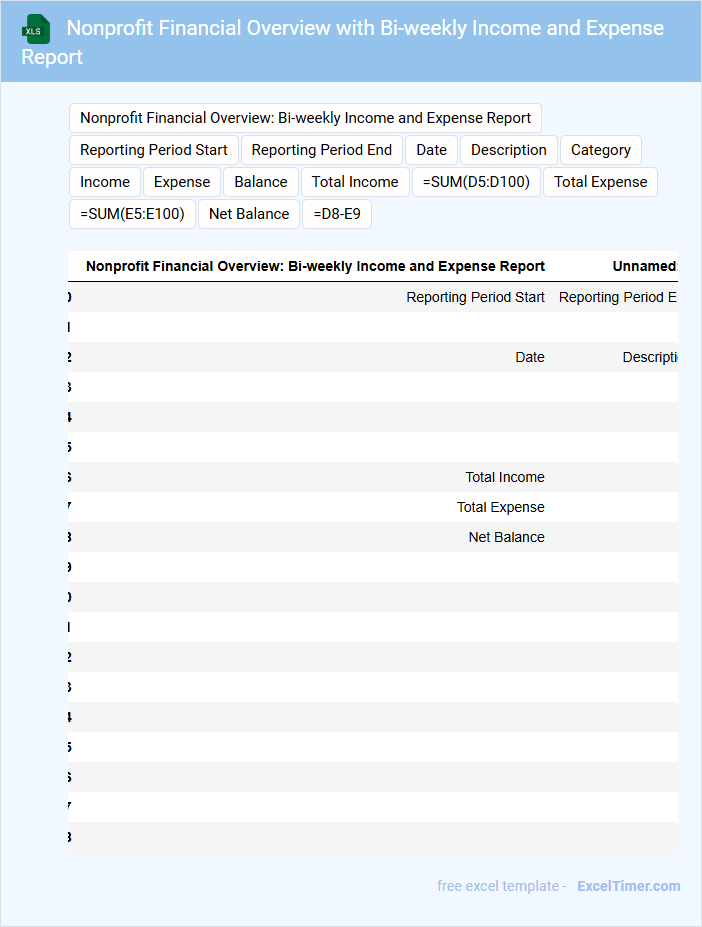

Nonprofit Financial Overview with Bi-weekly Income and Expense Report

What information is typically included in a Nonprofit Financial Overview with Bi-weekly Income and Expense Report? This document usually contains detailed summaries of the nonprofit's financial activities over two-week periods, including income sources such as donations, grants, and fundraising events, as well as all expenses related to operations and projects. It helps organizations track their financial health, ensure transparency, and make informed budgeting decisions.

What is an important consideration when managing this type of report? Maintaining accuracy and timely updating of all financial data is crucial to provide a clear picture of cash flow and to identify any discrepancies early. Consistent categorization of income and expenses also aids in effective financial analysis and compliance with regulatory requirements.

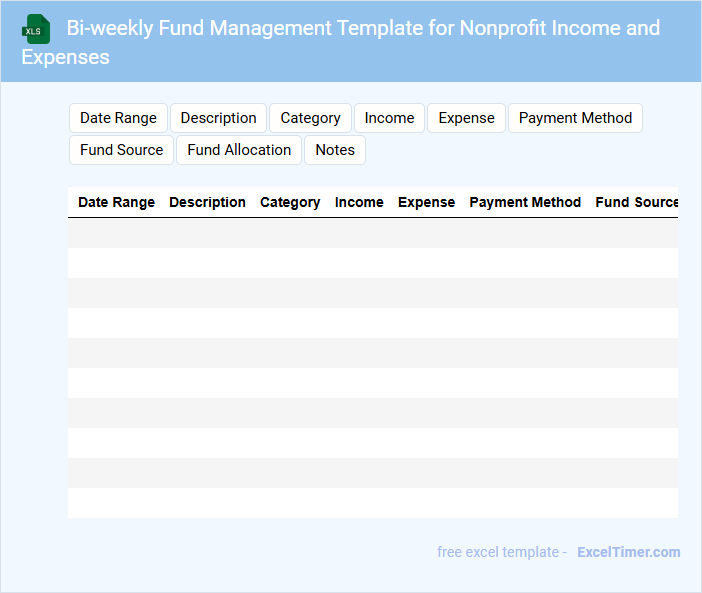

Bi-weekly Fund Management Template for Nonprofit Income and Expenses

This Bi-weekly Fund Management Template is designed to help nonprofits systematically track and manage their income and expenses every two weeks. It provides a clear overview of financial inflows, outflows, and budget adherence.

Key components include detailed income sources, categorized expenses, and summary reports for informed decision-making. For best results, ensure accurate data entry and regular reconciliation with bank statements.

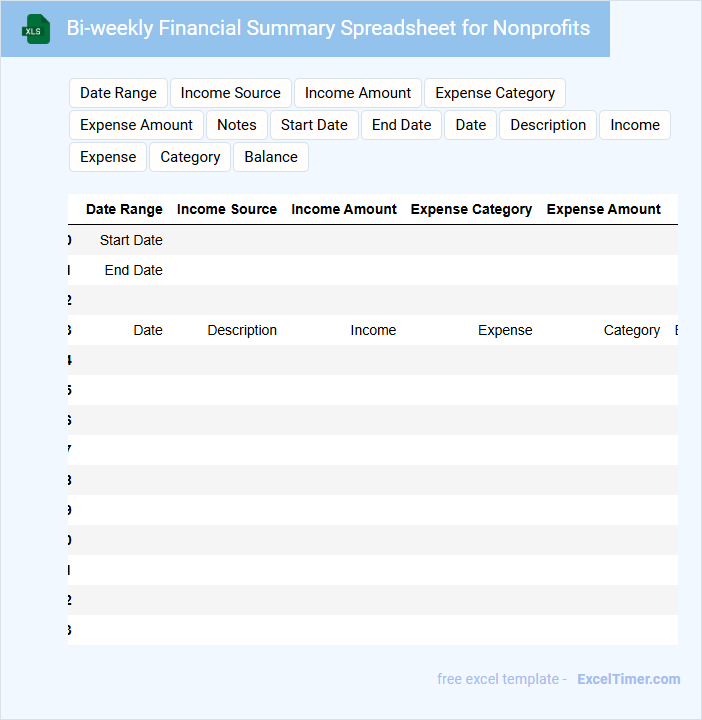

Bi-weekly Financial Summary Spreadsheet for Nonprofits

What information is typically included in a Bi-weekly Financial Summary Spreadsheet for Nonprofits? This document usually contains detailed records of all income and expenses over a two-week period, providing a clear overview of the organization's financial status. It helps track donations, grants, operational costs, and program expenditures to ensure transparency and effective budget management.

What is an important consideration when creating this financial summary? Ensuring accuracy and consistency in data entry is crucial to maintain reliable records. Additionally, including comparative metrics like budget vs. actual figures can aid in identifying trends and making informed financial decisions for the nonprofit.

Excel Template for Tracking Bi-weekly Income and Expense of Nonprofit Groups

This type of document typically contains detailed records of bi-weekly income and expenses to help nonprofit groups manage their finances effectively. It provides a clear overview of financial inflows and outflows over specific periods.

- Include categories for different income sources and expense types for accurate tracking.

- Ensure automatic calculations to summarize totals and balances efficiently.

- Incorporate notes or comments sections for additional context on transactions.

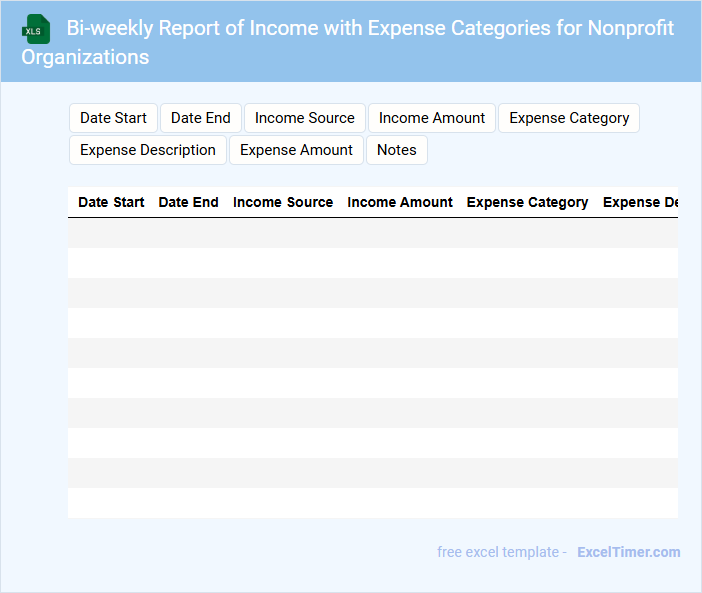

Bi-weekly Report of Income with Expense Categories for Nonprofit Organizations

A Bi-weekly Report of Income with Expense Categories for nonprofit organizations typically contains detailed financial records over a two-week period, including incoming funds and categorized expenses. This document helps track cash flow, ensuring financial transparency and accountability to stakeholders. It is important to include accurate categorization and timely updates to support effective budgeting and resource allocation.

How do you categorize and label income and expense sources in a bi-weekly report for a nonprofit?

In your bi-weekly income and expense report for a nonprofit, categorize income by sources such as donations, grants, fundraising events, and program service revenue. Label expenses according to operational costs, program expenses, administrative fees, and fundraising expenditures. Use clear, consistent categories to track financial performance and ensure transparent reporting.

What formulas can be used to automatically calculate bi-weekly totals and net balances in Excel?

To automatically calculate bi-weekly totals in Excel, you can use the SUM formula to add income and expense values within each two-week period. Apply the formula =SUM(range) where "range" includes the cells for bi-weekly entries. For net balances, subtract total expenses from total income using =SUM(income_range) - SUM(expense_range) to help you track Your nonprofit's financial health efficiently.

Which Excel features help ensure data accuracy and prevent duplicate entries in income and expense items?

Data validation in Excel restricts entries to predefined lists or ranges, enhancing data accuracy in bi-weekly income and expense reports for nonprofit organizations. The Conditional Formatting feature highlights duplicate income and expense items, preventing redundant entries. Named ranges and dynamic tables facilitate organized data management, reducing errors and improving report reliability.

How can you visualize bi-weekly financial trends and variances using charts or graphs in Excel?

Use line charts to track bi-weekly income and expense trends over time, highlighting patterns and fluctuations. Employ bar graphs to compare category-specific expenses against incomes, revealing variances within each period. Incorporate pivot charts paired with slicers to dynamically filter data by date ranges or expense types, enabling interactive trend analysis for nonprofit financials.

What are the essential columns and data validations needed for effective auditing of a nonprofit's bi-weekly report?

For effective auditing of a nonprofit's bi-weekly income and expense report, essential columns include Date, Transaction Description, Income Source, Expense Category, Amount, Payment Method, and Approval Status. Data validations should enforce date formats, restrict income and expense categories to predefined lists, and ensure amount entries are positive numbers. Your report's accuracy relies on these validations and clear, consistent data entry.