The Bi-weekly Excel Template for Freelance Billing simplifies tracking income and expenses by organizing payments every two weeks. It ensures freelancers maintain accurate records for invoicing and tax purposes. Built-in formulas automate calculations, reducing errors and saving time.

Bi-weekly Excel Template for Freelance Billing

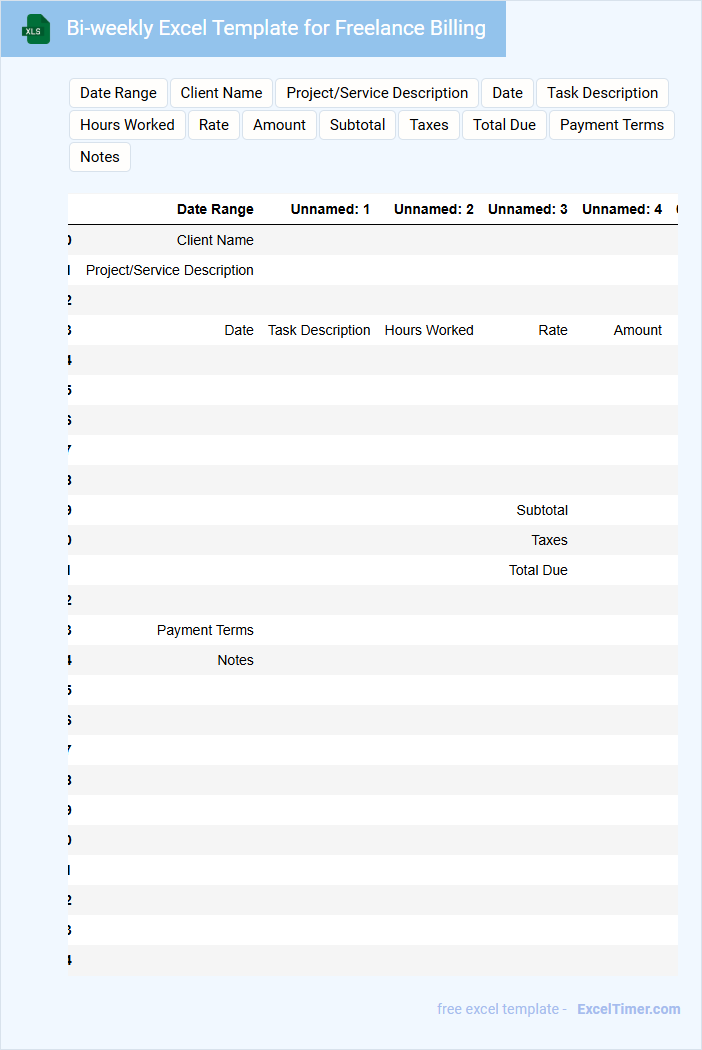

A Bi-weekly Excel Template for Freelance Billing typically contains sections for tracking hours worked, project details, and payment calculations. It helps freelancers organize their invoicing process on a consistent, two-week schedule. Including fields for client information, hourly rates, and payment status is essential for accurate financial management.

Bi-weekly Invoice Template for Freelancers

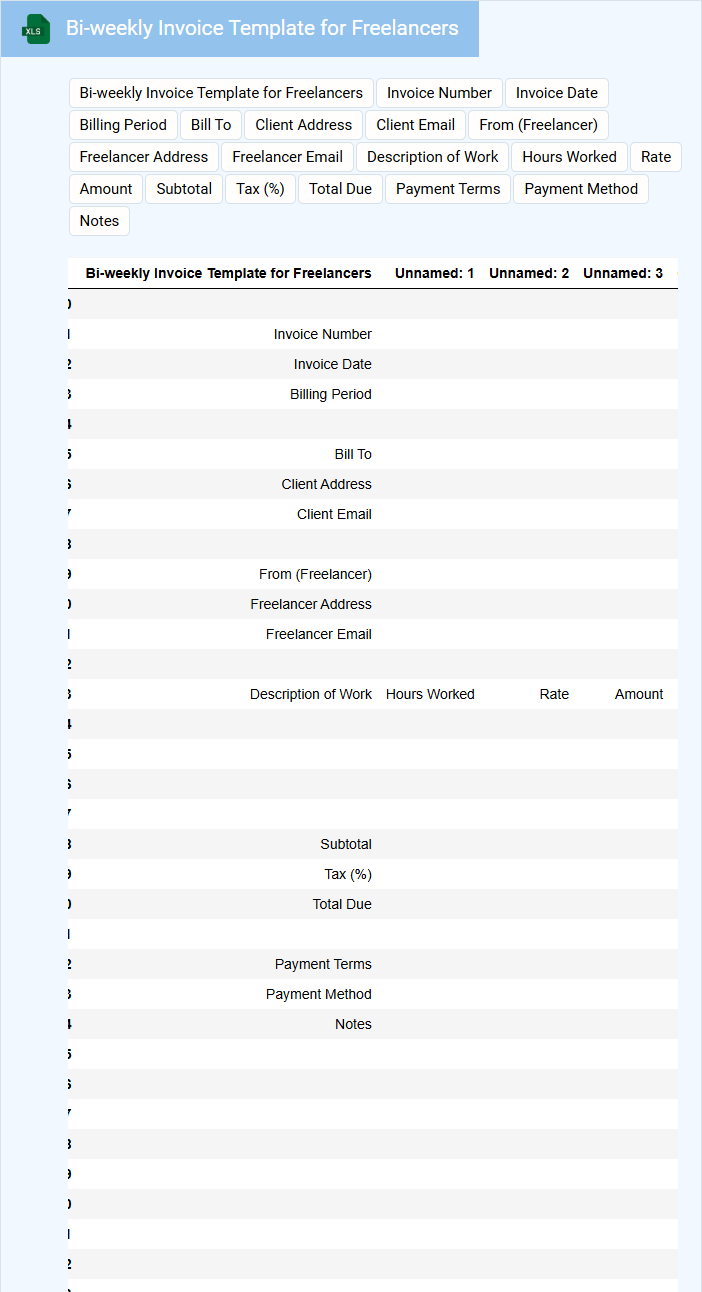

What does a bi-weekly invoice template for freelancers typically contain? This type of document usually includes detailed sections for the freelancer's contact information, client details, a list of services rendered, hours worked, and payment terms. It serves as a clear, professional record that helps ensure timely and accurate payments every two weeks.

What is an important consideration when using this invoice template? It is essential to include precise dates for the billing period and specify the payment due date to avoid any confusion or delays. Additionally, adding a clear description of each service and rate promotes transparency and strengthens client trust.

Timesheet with Bi-weekly Billing for Freelancers

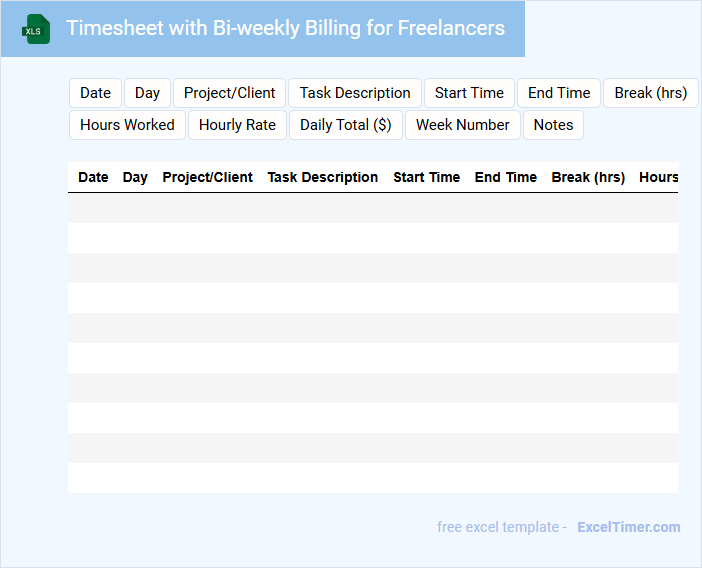

A Timesheet with Bi-weekly Billing is a document used by freelancers to record hours worked over two weeks, ensuring accurate tracking of time spent on various projects. It typically contains details such as date, hours worked per day, task descriptions, and hourly rates. To optimize its use, freelancers should ensure clarity, consistency, and transparency to support timely invoicing and payment processing.

Bi-weekly Payment Tracker for Freelance Work

A Bi-weekly Payment Tracker for freelance work is a document designed to record and monitor payments received every two weeks. It typically contains details such as client names, payment dates, amounts, project descriptions, and payment statuses.

This type of tracker helps freelancers maintain an organized financial record and ensures timely follow-up on outstanding payments. To improve efficiency, include a column for notes and set reminders for upcoming payment due dates.

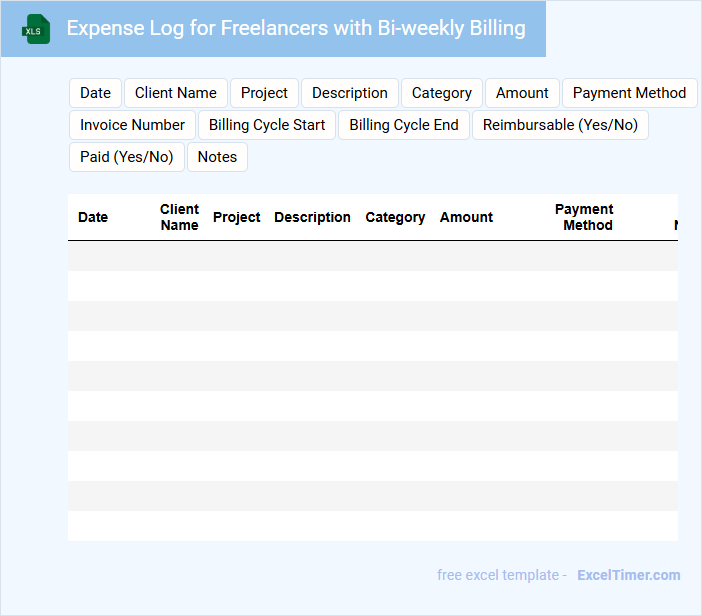

Expense Log for Freelancers with Bi-weekly Billing

An Expense Log for freelancers typically contains detailed records of all costs incurred during a project, including receipts, dates, and categories. This document helps maintain financial transparency and accuracy for billing purposes.

For freelancers with bi-weekly billing, the log should be updated regularly to ensure timely invoice preparation and payment tracking. Accurate expense documentation supports effective budget management and client communication.

Consider integrating digital tools to streamline expense tracking and categorization to avoid discrepancies and delays in billing cycles.

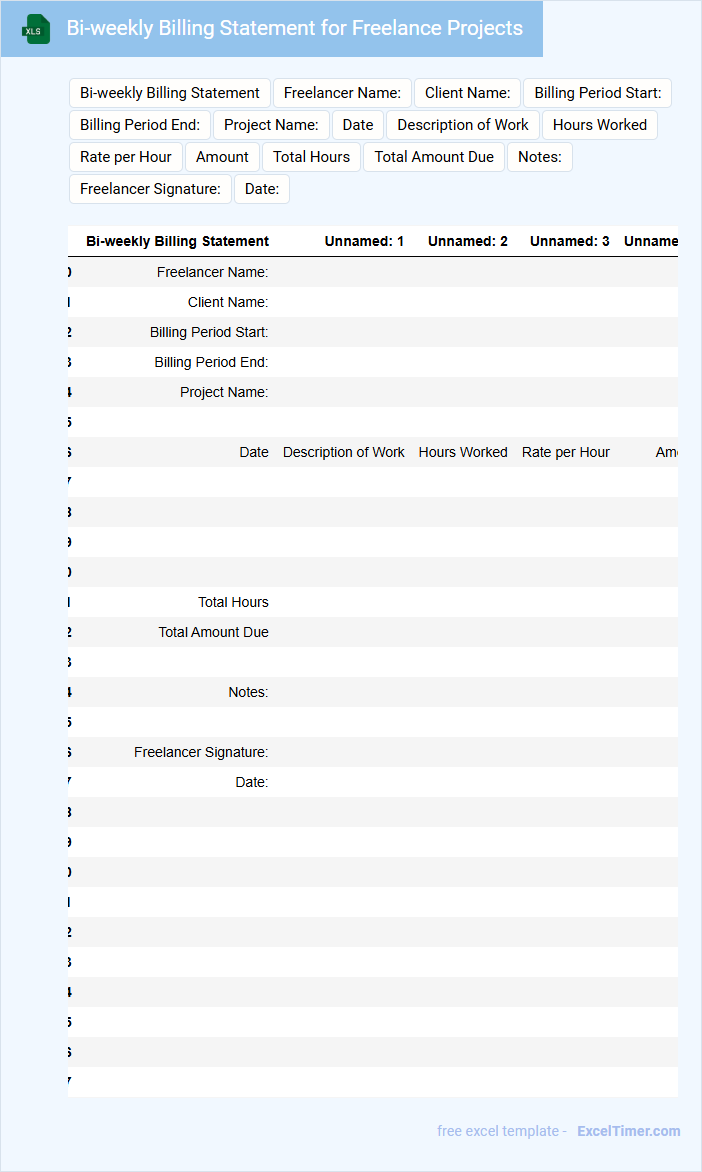

Bi-weekly Billing Statement for Freelance Projects

A Bi-weekly Billing Statement for freelance projects typically contains detailed records of hours worked, tasks completed, and corresponding payment amounts for the two-week period. It provides transparency between the freelancer and the client by outlining all billable activities and any additional expenses incurred. Including a clear summary of total charges and payment terms is essential to ensure timely and accurate compensation.

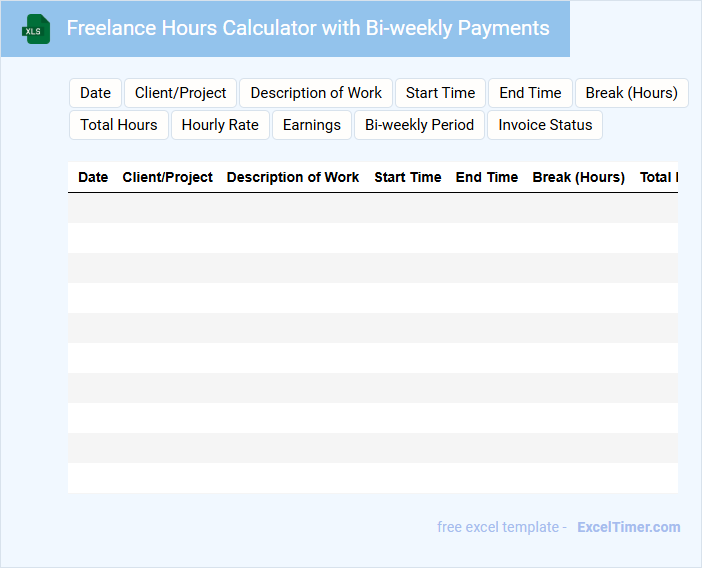

Freelance Hours Calculator with Bi-weekly Payments

A Freelance Hours Calculator with Bi-weekly Payments document typically includes a detailed log of hours worked by a freelancer, segmented by projects or tasks. It also outlines the bi-weekly payment schedule and calculates earnings based on agreed hourly rates. This document ensures transparent tracking of time and accurate payment processing between freelancers and clients.

Bi-weekly Income Tracker for Freelancers

This document serves as a bi-weekly income tracker tailored specifically for freelancers to monitor their earnings over two-week periods. It typically contains detailed entries of projects completed, payment dates, and received amounts. Keeping this organized helps freelancers manage cash flow and plan for taxes effectively.

Important elements to include are clear income categories, client names, invoice numbers, and due dates to ensure accuracy and facilitate follow-ups. Incorporating a running total and comparison to previous periods can provide valuable financial insights. Additionally, backing up this document regularly helps maintain data security and continuity.

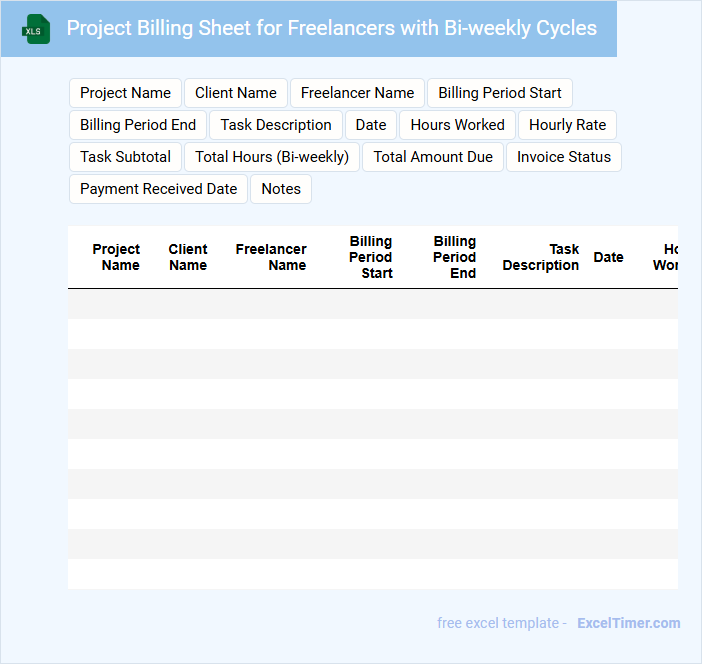

Project Billing Sheet for Freelancers with Bi-weekly Cycles

A Project Billing Sheet for Freelancers with Bi-weekly Cycles typically contains detailed records of services rendered, payment calculations, and timeline tracking for accurate and timely invoicing.

- Client Details: Essential information about the client including name, contact, and project specifics.

- Work Log: Clear entries of tasks completed, hours worked, and rates applied for each bi-weekly period.

- Payment Summary: Total amounts due, payment terms, and due dates to ensure proper financial management.

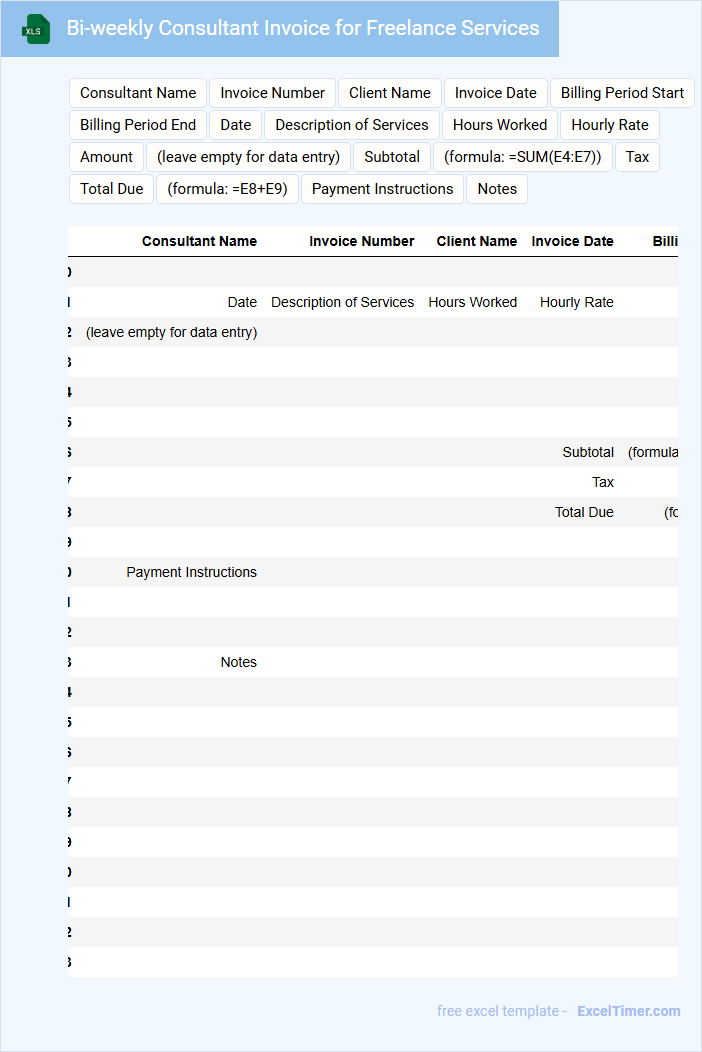

Bi-weekly Consultant Invoice for Freelance Services

A Bi-weekly Consultant Invoice is a document that details the services provided by a freelance consultant over a two-week period. It usually contains information such as service descriptions, hours worked, rates, and total payment due. Including clear payment terms and contact details is important to ensure smooth transactions.

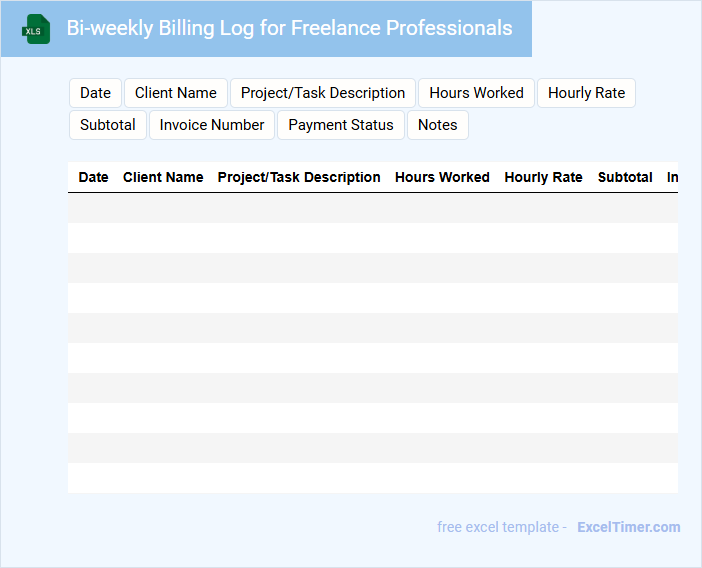

Bi-weekly Billing Log for Freelance Professionals

What information is typically included in a Bi-weekly Billing Log for Freelance Professionals? This document usually contains detailed records of hours worked, tasks completed, and corresponding payment amounts for each billing period. It helps freelancers maintain accurate financial tracking and ensures timely invoicing for services rendered.

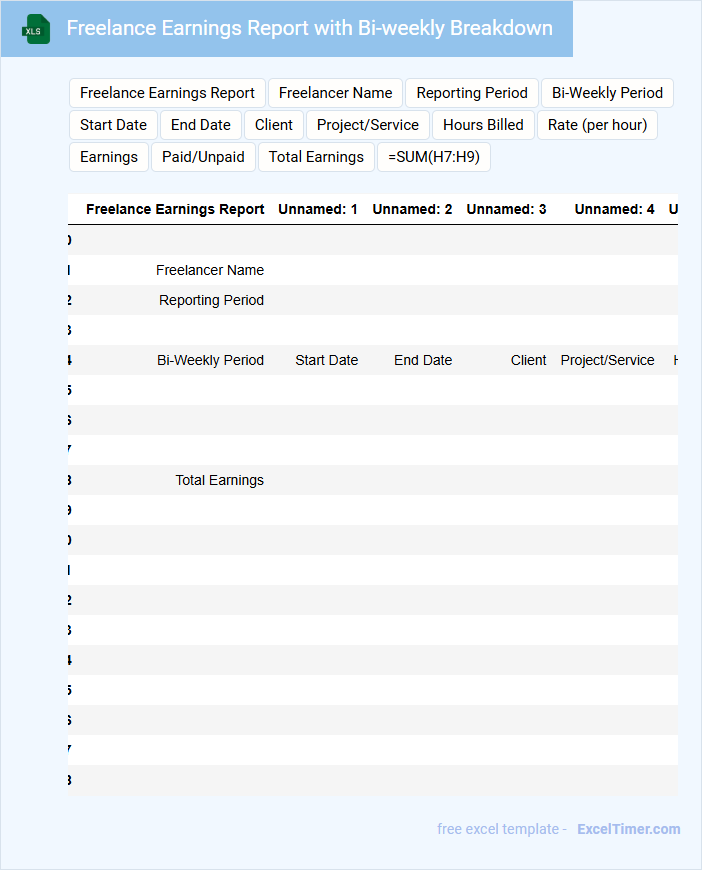

Freelance Earnings Report with Bi-weekly Breakdown

What information is typically included in a Freelance Earnings Report with Bi-weekly Breakdown? This document usually contains detailed records of income earned by a freelancer over two-week periods, including client names, project descriptions, payment dates, and amounts. It helps freelancers track their earnings systematically and identify trends or fluctuations in their income streams.

What important elements should be considered when creating this report? Key factors include ensuring accuracy in recording payment details, categorizing earnings by project or client, and incorporating visual summaries such as charts to highlight income patterns. Additionally, noting any outstanding payments or expected income can enhance financial planning and cash flow management.

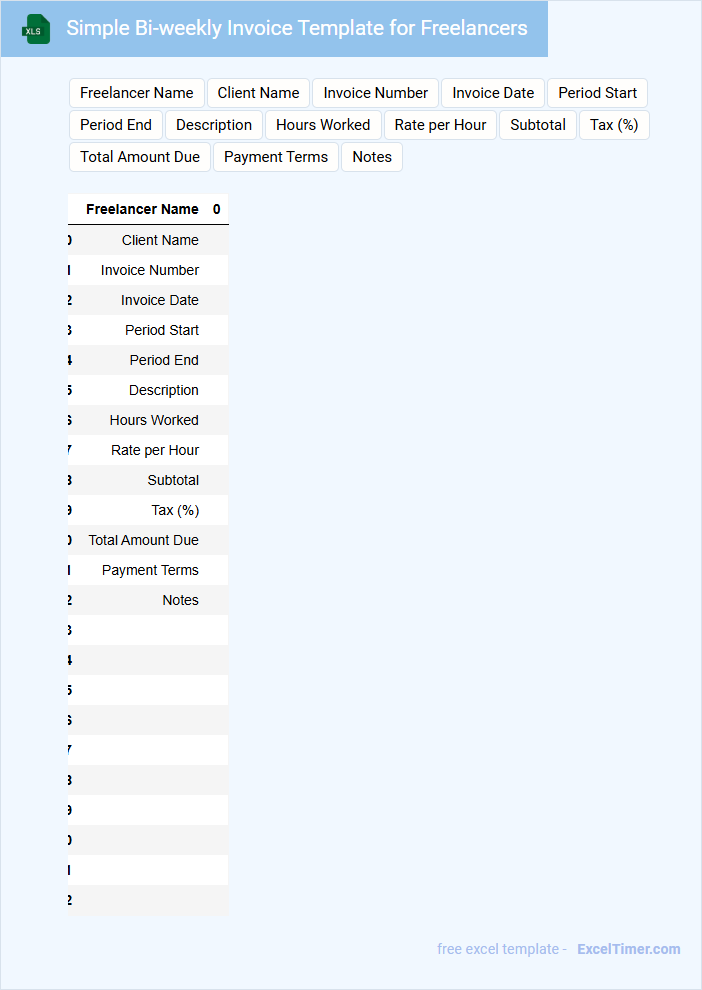

Simple Bi-weekly Invoice Template for Freelancers

A Simple Bi-weekly Invoice Template for Freelancers typically contains the freelancer's contact information, client details, list of services provided, hours worked, and payment amount due for the two-week period. It also includes invoice number, date, and payment terms to ensure clarity and professionalism in the billing process.

Using such a template helps freelancers maintain consistent financial records and ensures timely payments by providing clear, concise documentation. It is important to include a breakdown of tasks performed and specify the payment methods accepted to avoid any confusion.

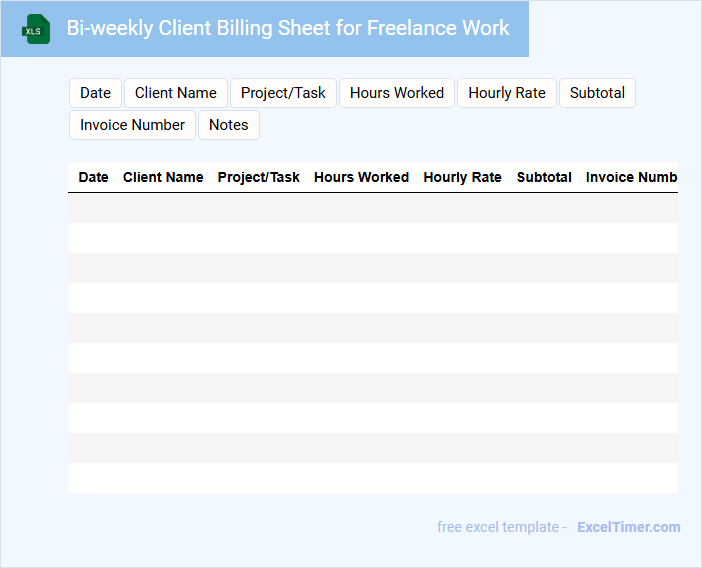

Bi-weekly Client Billing Sheet for Freelance Work

What is a Bi-weekly Client Billing Sheet for Freelance Work?

A Bi-weekly Client Billing Sheet for Freelance Work is a document used to track and invoice hours worked and services provided every two weeks. It helps freelancers maintain accurate records of their work, ensuring transparency and timely payments from clients. Suggested important elements include detailed descriptions of tasks, hours logged, rates applied, and a clear summary of the total amount due.

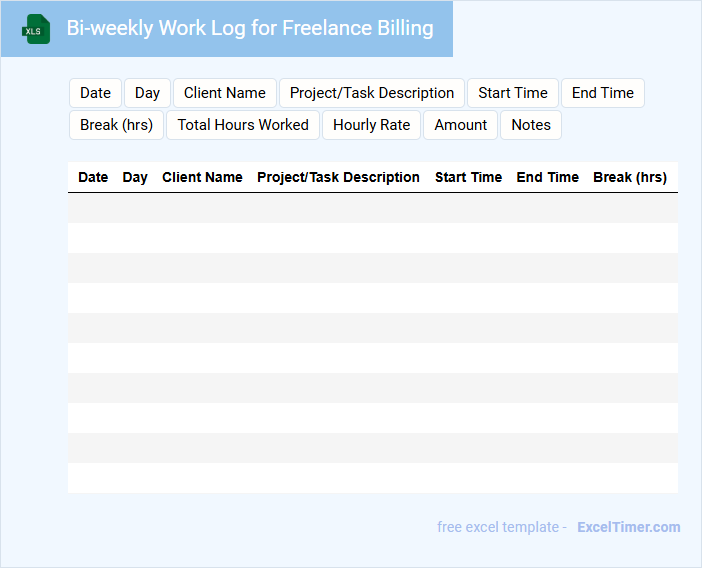

Bi-weekly Work Log for Freelance Billing

A Bi-weekly Work Log for Freelance Billing typically contains a detailed record of tasks completed and hours worked within a two-week period. It serves as a transparent document for invoicing clients accurately.

- Include precise dates and descriptions of each task performed.

- Record total hours worked daily to support billing accuracy.

- Highlight any milestones or deliverables completed during the period.

What formula can be used to calculate total bi-weekly hours billed in Excel?

To calculate total bi-weekly hours billed in Excel, use the SUMIF formula targeting the date range for each two-week period. For example, =SUMIF(DateRange, ">=StartDate", HoursRange) - SUMIF(DateRange, ">EndDate", HoursRange) efficiently sums hours within the bi-weekly timeframe. You can customize the date criteria to match your billing cycles for accurate freelance billing summaries.

How can you automate recurring bi-weekly invoice creation in an ?

Automate recurring bi-weekly invoice creation in Excel by using VBA macros to generate new invoices every two weeks based on a master template. Set up formulas to update invoice dates dynamically and link client data from a centralized sheet for seamless billing. Incorporate drop-down lists and conditional formatting to ensure accuracy and streamline the invoicing process.

What column structure best organizes bi-weekly dates and payment periods in Excel?

An effective Excel column structure for bi-weekly freelance billing includes "Start Date," "End Date," "Billing Period" (e.g., Week 1-2, Week 3-4), "Hours Worked," "Rate per Hour," and "Total Payment." Use date formulas to automatically calculate bi-weekly periods and ensure accurate payment tracking. This structure streamlines invoice creation and financial analysis for freelance projects.

How do you set up conditional formatting to highlight overdue bi-weekly payments?

To set up conditional formatting for overdue bi-weekly freelance billing payments in Excel, select the payment date cells and apply a rule using the formula =TODAY() > (Your cell reference + 14). This formula highlights payments that are more than 14 days past the due date. Use a distinct fill color to easily identify overdue invoices in your bi-weekly billing schedule.

What method ensures accurate bi-weekly rate calculations for variable hourly rates in Excel?

Use a formula that multiplies the total hours worked each week by the respective hourly rates, then sums these amounts for the two-week period. Implement Excel functions like SUMPRODUCT to handle variable rates and hours efficiently. Applying named ranges for hours and rates improves formula clarity and accuracy in bi-weekly billing calculations.