The Bi-weekly Expense Report Excel Template for Freelancers helps track income and expenses efficiently every two weeks, ensuring accurate financial management. This template includes customizable categories tailored to freelance work, making budget monitoring and tax preparation simpler. Using this tool consistently can improve cash flow visibility and support better financial decision-making.

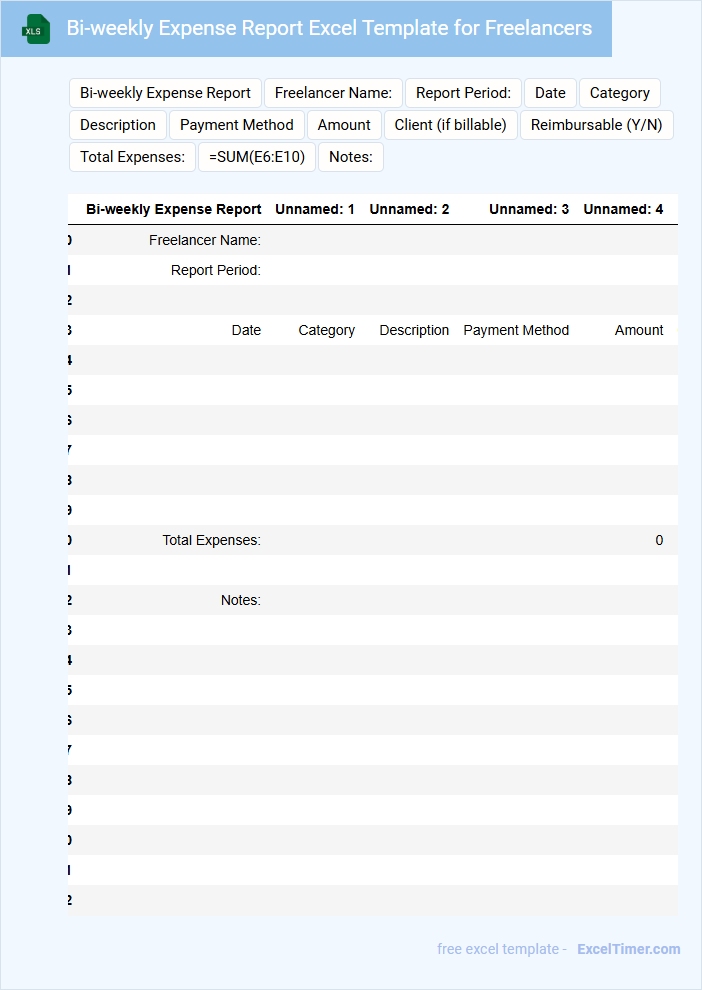

Bi-weekly Expense Report Excel Template for Freelancers

A Bi-weekly Expense Report Excel Template for freelancers is a structured document designed to track income and expenses over two-week periods. It helps individuals monitor spending, categorize costs, and maintain financial records efficiently. This template is essential for managing freelance finances and preparing accurate tax documents.

Bi-weekly Client Invoice Tracker for Freelancers

A Bi-weekly Client Invoice Tracker for Freelancers is a document that helps manage and record invoices sent to clients within a two-week period.

- Invoice Dates: Clearly mark the start and end dates of the bi-weekly billing cycle for accurate tracking.

- Client Details: Include client names, contact information, and project descriptions for easy reference.

- Payment Status: Track invoice amounts, due dates, and payment statuses to maintain timely cash flow.

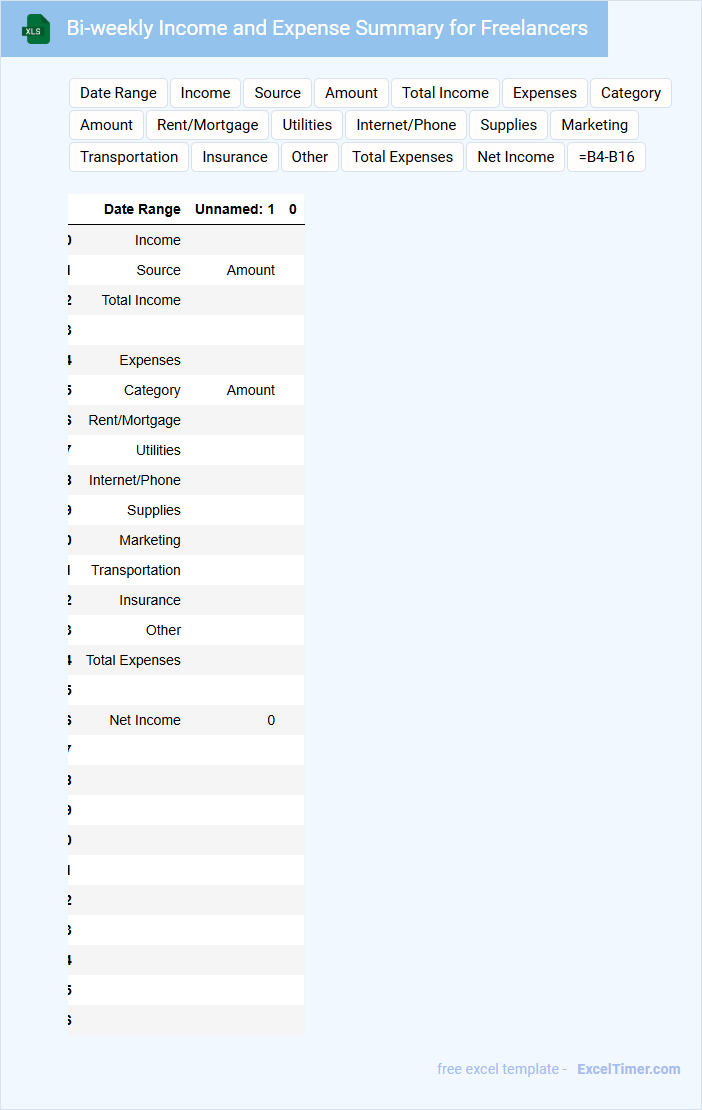

Bi-weekly Income and Expense Summary for Freelancers

A Bi-weekly Income and Expense Summary for freelancers typically contains detailed records of all earnings and expenditures within a two-week period. This document helps track financial performance and cash flow efficiently.

Important elements include accurate categorization of income sources and expense types to simplify budgeting and tax preparation. Maintaining organized records supports better financial decision-making and ensures compliance with tax regulations.

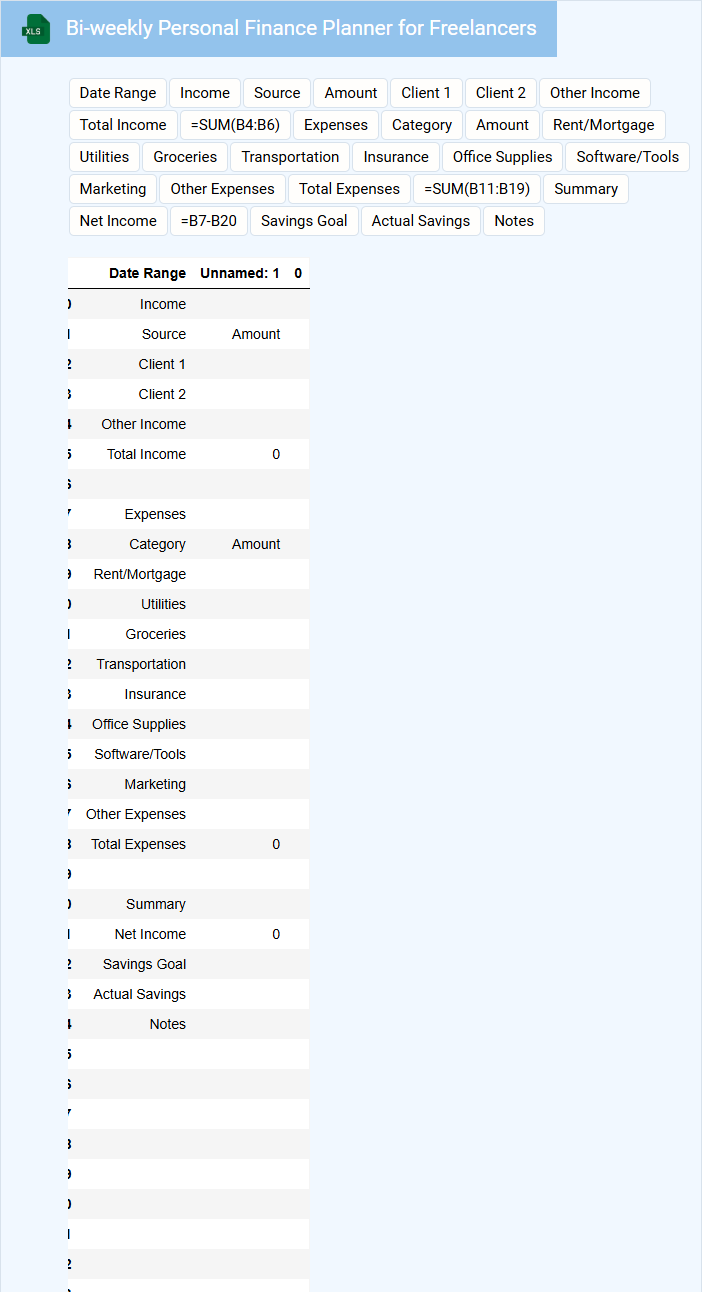

Bi-weekly Personal Finance Planner for Freelancers

The Bi-weekly Personal Finance Planner for freelancers typically contains sections for tracking income, expenses, and savings goals within each two-week period. It helps in managing irregular cash flow, planning for taxes, and budgeting for upcoming projects. Keeping detailed records ensures better financial stability and future growth.

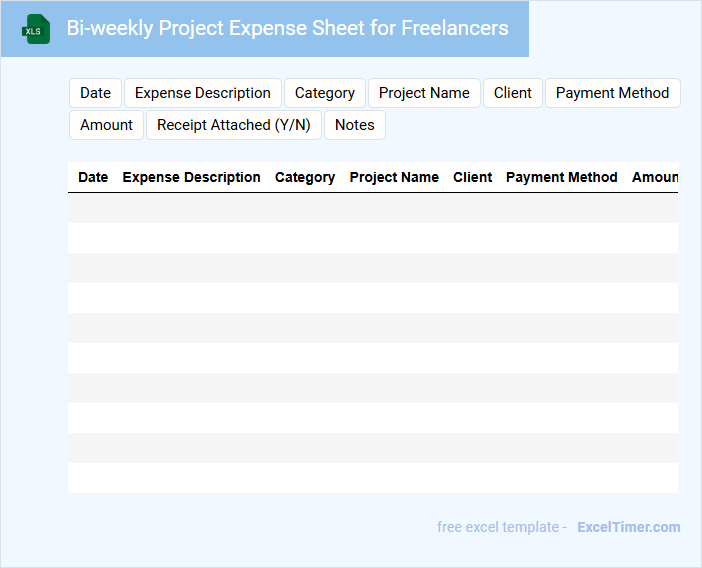

Bi-weekly Project Expense Sheet for Freelancers

A Bi-weekly Project Expense Sheet for freelancers typically contains detailed records of all expenses incurred over a two-week period related to specific projects. It includes categories such as materials, software subscriptions, travel costs, and miscellaneous expenses. Keeping this document accurate and up-to-date helps freelancers manage their finances and simplifies client billing.

Excel Template for Tracking Bi-weekly Mileage Expenses

An Excel Template for tracking bi-weekly mileage expenses is designed to help users systematically record and calculate travel distances related to work or personal activities. It usually contains fields for dates, starting and ending odometer readings, purpose of travel, and reimbursement rates.

The template often includes built-in formulas to automatically calculate total miles driven and corresponding expenses. For optimal use, ensure the template allows easy data entry and provides summary reports for quick expense analysis.

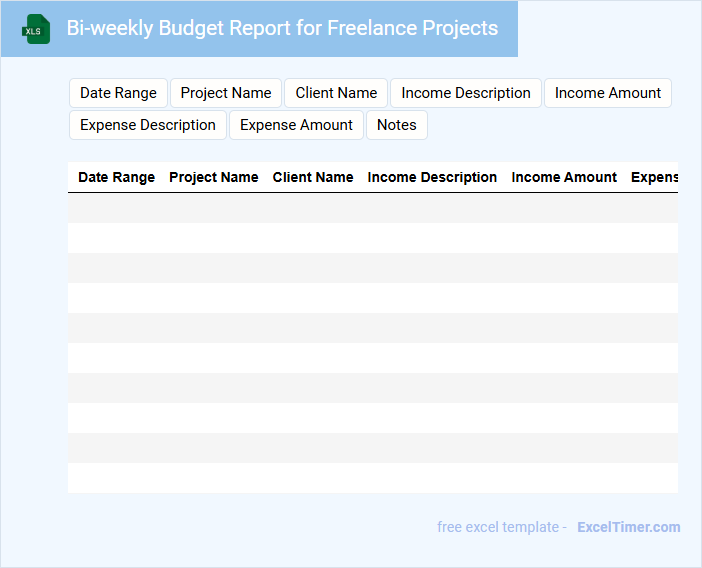

Bi-weekly Budget Report for Freelance Projects

A Bi-weekly Budget Report for freelance projects typically contains detailed tracking of income and expenses over a two-week period, helping freelancers monitor their financial health regularly. It includes sections for project earnings, costs incurred, and a summary of net profit or loss.

Important elements to highlight in this report are accurate expense categorization and timely updates to avoid financial discrepancies. Regular review of these reports enables better budgeting and informed decision-making for ongoing and future projects.

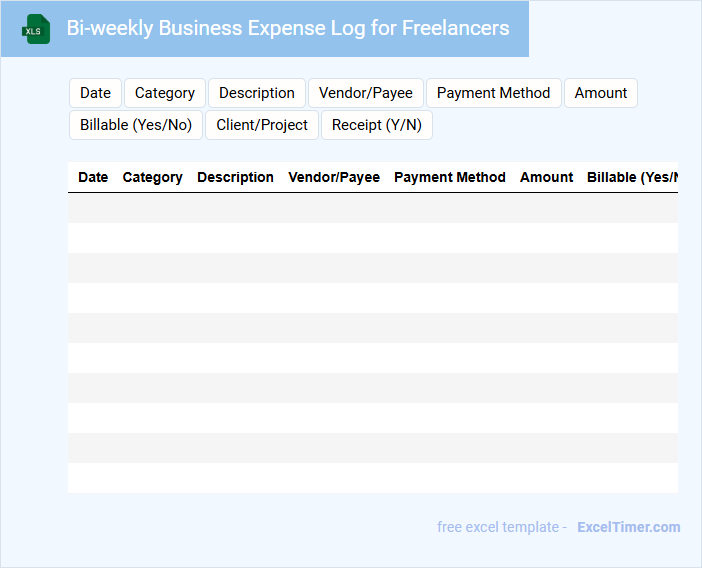

Bi-weekly Business Expense Log for Freelancers

A Bi-weekly Business Expense Log for freelancers is a document that tracks all business-related expenses incurred over a two-week period. It typically includes categories such as travel, supplies, and client-related costs to help maintain financial organization. Keeping this log updated ensures accurate budgeting and simplifies tax preparation.

Important elements to include are dates, detailed descriptions, amounts, and payment methods for each expense. Utilizing consistent categories and attaching receipts can enhance record accuracy. Regular review of the log can help identify spending patterns and opportunities for cost reduction.

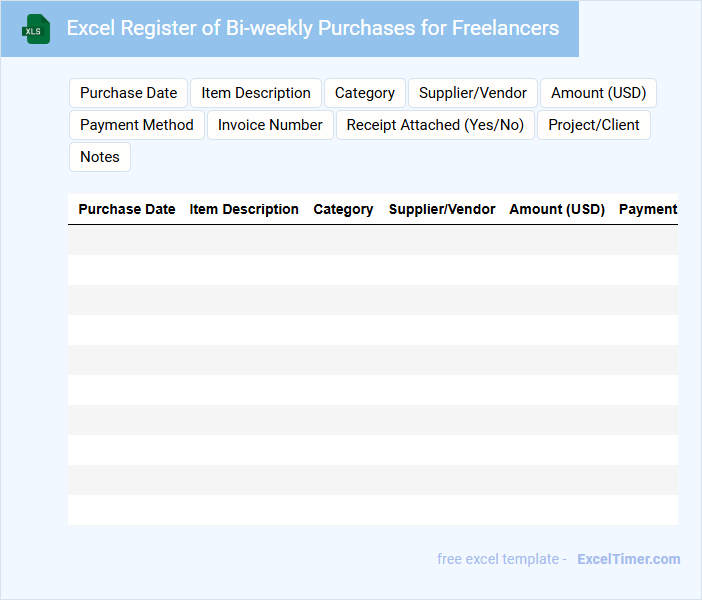

Excel Register of Bi-weekly Purchases for Freelancers

An Excel Register of Bi-weekly Purchases for Freelancers is typically a detailed spreadsheet that tracks all expenses incurred every two weeks. It usually contains columns for purchase date, item description, vendor name, amount spent, and payment method. This document helps freelancers maintain accurate financial records for budgeting and tax purposes.

It is important to include clear categories for each type of purchase to simplify expense analysis and reporting. Ensuring consistent data entry and regular updates will increase the document's accuracy and usefulness. Additionally, linking this register to receipts or invoices can enhance financial transparency and accountability.

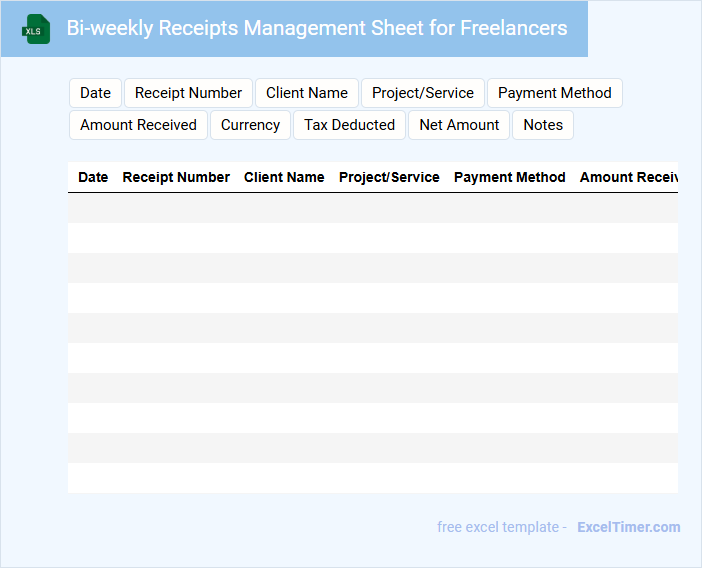

Bi-weekly Receipts Management Sheet for Freelancers

The Bi-weekly Receipts Management Sheet for freelancers is a document designed to systematically track and organize all incoming receipts within a two-week period. It typically contains details such as the date of transaction, description of services or items, and the amount paid. This organized approach helps freelancers maintain clear financial records and simplifies tax preparation.

An important suggestion for this document is to consistently update it soon after monetary transactions to avoid missing data. Additionally, categorizing receipts by client or project can enhance clarity and optimize expense analysis. Ensuring that the sheet includes columns for payment method and receipt status (paid, pending, reimbursed) can also be highly beneficial.

Bi-weekly Payment Tracker for Freelance Invoices

What information is typically included in a bi-weekly payment tracker for freelance invoices? This type of document usually contains details such as invoice numbers, client names, payment amounts, dates issued, and payment status updates. It helps freelancers monitor their cash flow and ensures timely follow-up on outstanding payments.

Why is it important to maintain this document accurately? Keeping an organized and up-to-date tracker prevents missed payments, aids in financial planning, and provides clear records for tax purposes and client disputes. Including columns for notes or payment methods can further enhance its usefulness.

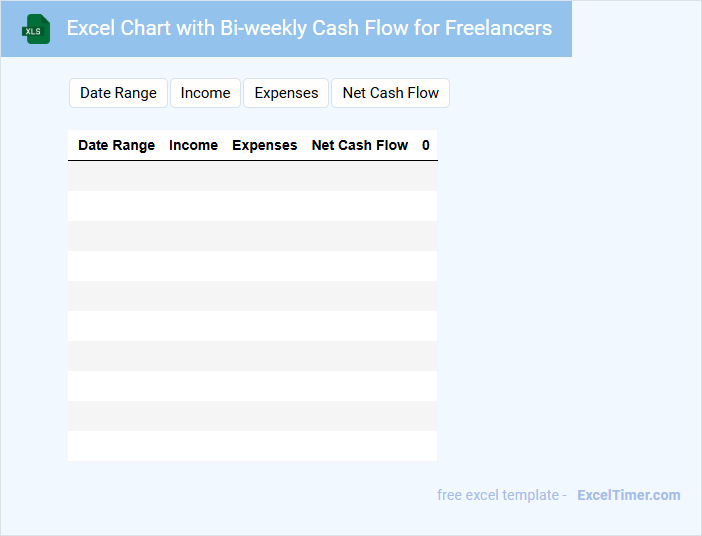

Excel Chart with Bi-weekly Cash Flow for Freelancers

An Excel Chart with Bi-weekly Cash Flow for Freelancers typically includes detailed inflows and outflows of cash over two-week periods, allowing for precise financial tracking. This document helps freelancers monitor their earnings against expenses to maintain a healthy cash flow. Important elements to include are categories for income, recurring expenses, and a summary for net cash flow each period.

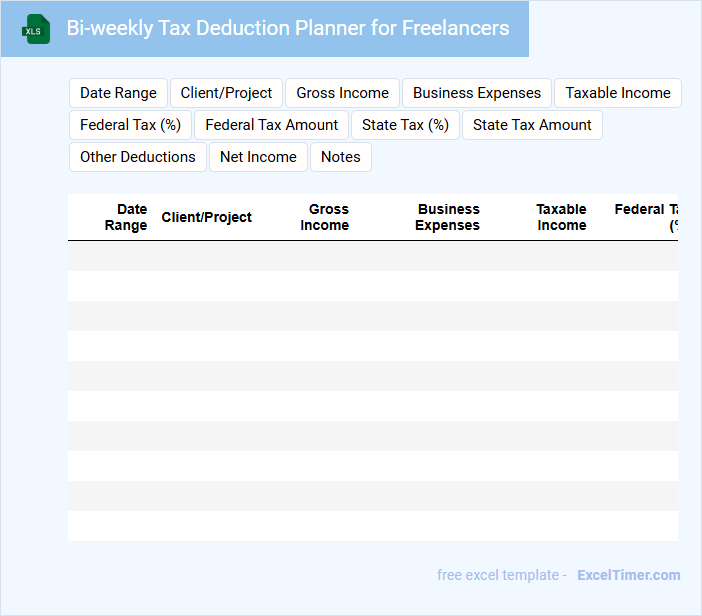

Bi-weekly Tax Deduction Planner for Freelancers

What key information does a Bi-weekly Tax Deduction Planner for Freelancers typically include? This document usually outlines the freelancer's income, estimated tax obligations, and scheduled tax deductions on a bi-weekly basis to ensure timely payments. It helps freelancers manage cash flow and avoid year-end tax surprises by providing a clear deduction timeline.

What important elements should freelancers consider when using this planner? Freelancers should accurately track all sources of income and related expenses, adjust tax deductions based on income fluctuations, and set aside sufficient funds for quarterly estimated tax payments. Including reminders for tax deadlines and updates on tax law changes is also critical for maintaining compliance and financial stability.

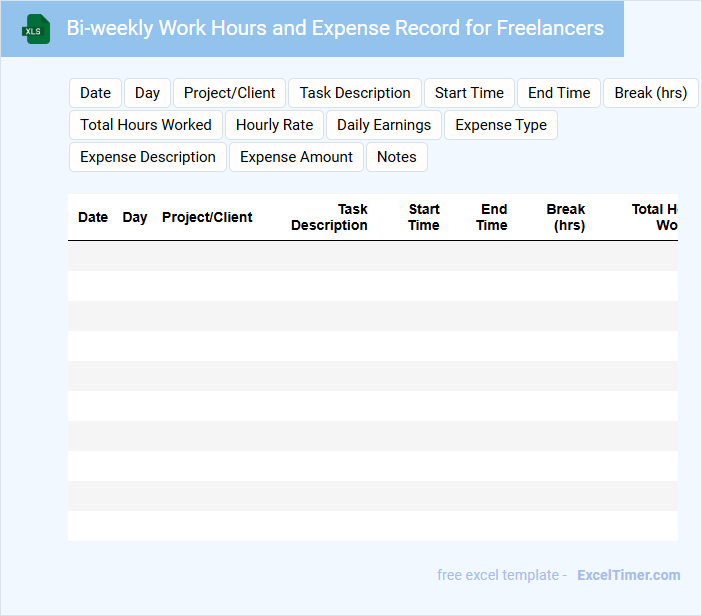

Bi-weekly Work Hours and Expense Record for Freelancers

What does a Bi-weekly Work Hours and Expense Record for Freelancers typically contain? This document usually includes detailed entries of hours worked each day, tasks performed, and related expenses incurred over a two-week period. It helps freelancers track their productivity and manage reimbursements efficiently.

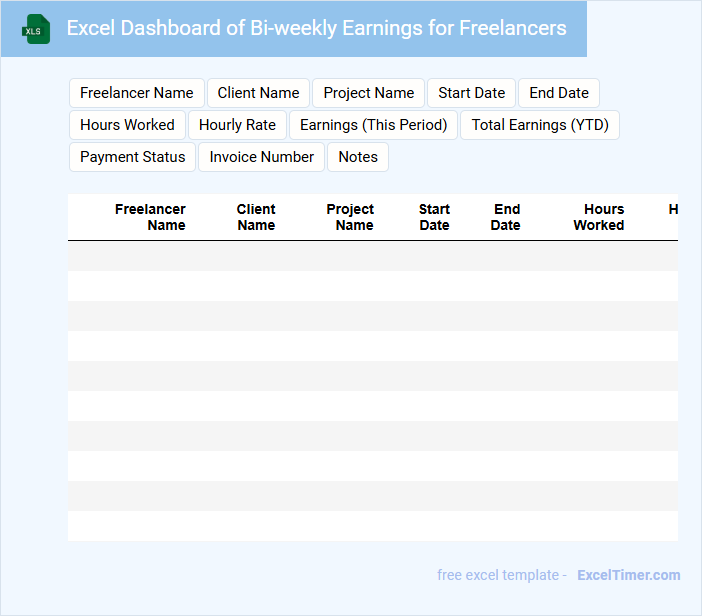

Excel Dashboard of Bi-weekly Earnings for Freelancers

This document typically contains a detailed summary of freelancers' earnings over two-week periods, providing insights into income trends and payment schedules. It is designed to help freelancers track their financial progress efficiently.

- Include clear and concise category labels for different income streams.

- Incorporate visual elements like charts to highlight earnings fluctuations.

- Ensure data is updated regularly to maintain accuracy and relevance.

What are the key columns to include in a bi-weekly expense report for freelancers in Excel?

Key columns for a bi-weekly expense report for freelancers in Excel include Date, Expense Category, Description, Vendor/Payee, Payment Method, Amount, and Receipt Attached. Adding Project or Client Name helps track expenses by work assignment. A Total Expenses column provides a quick summary for the two-week period.

How should you categorize and tag different expenses for tax and analysis purposes?

Categorize freelance expenses into key groups such as Office Supplies, Software Subscriptions, Travel, Meals, and Communication for accurate tax filing and detailed analysis. Tag each expense with specific project codes, payment methods, and dates to enhance tracking and reporting efficiency. Use consistent naming conventions and apply tax-relevant labels like deductible or non-deductible to streamline financial review and compliance.

What formulas and functions can automate total, average, and category-based calculations?

Your Bi-weekly Expense Report in Excel can automate total calculations using the SUM function, average expenses with the AVERAGE function, and category-based totals via SUMIF or SUMIFS formulas. These functions streamline tracking by automatically updating values as you input data into your freelancer expense sheet. Leveraging these formulas ensures accurate and efficient financial management for your freelance projects.

How can you efficiently track reimbursable vs. non-reimbursable expenses in the document?

Use separate columns labeled "Reimbursable" and "Non-Reimbursable" with clear checkboxes or dropdown lists to categorize each expense. Implement formulas like SUMIF to automatically calculate totals for each category, ensuring accurate financial tracking. Include filters to quickly view and analyze reimbursable expenses for streamlined reporting and invoicing.

What Excel features (filters, tables, conditional formatting) enhance data clarity and usability?

Excel features like filters help you quickly sort and locate specific expense entries, while tables organize data into structured, easily manageable rows and columns. Conditional formatting highlights important trends and anomalies, such as overdue invoices or budget overruns, enhancing visual clarity. These tools collectively improve your expense tracking efficiency and accuracy in the bi-weekly report.