The Bi-weekly Financial Report Excel Template for Nonprofits is designed to streamline the tracking of income, expenses, and budget adherence every two weeks. It provides a clear snapshot of financial health, enabling timely decision-making and ensuring transparency for stakeholders. Customizable fields allow nonprofits to tailor the report to their specific funding sources and operational needs.

Bi-weekly Financial Report with Expense Tracking for Nonprofits

A Bi-weekly Financial Report for nonprofits typically contains detailed income and expense statements for a two-week period to provide concise and timely financial insights. It includes categorized expense tracking to help identify spending patterns and ensure funds are used according to the organization's mission. Accurate and transparent reporting is crucial for maintaining donor trust and regulatory compliance.

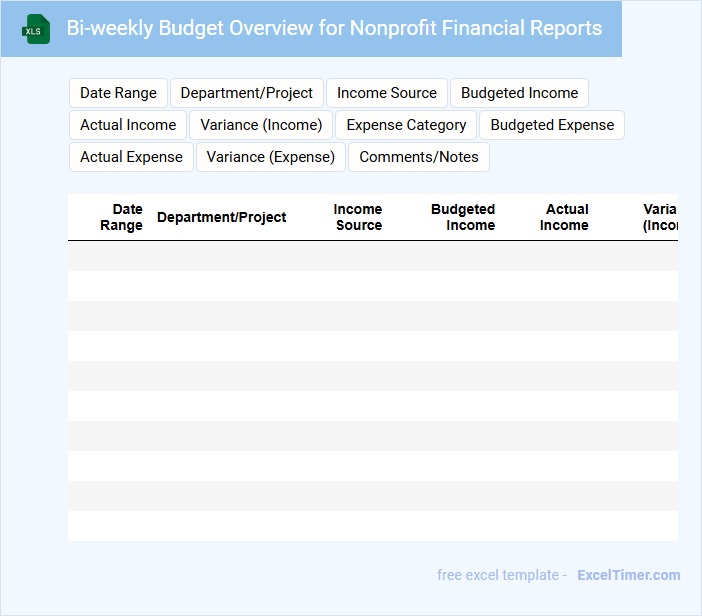

Bi-weekly Budget Overview for Nonprofit Financial Reports

What information is typically included in a Bi-weekly Budget Overview for Nonprofit Financial Reports? This document usually contains summaries of income, expenditures, and budget variances over a two-week period. It provides a clear snapshot of the organization's financial health, helping stakeholders track fund allocations and ensure accountability.

Why is it important to highlight key financial indicators and trends in this report? Emphasizing metrics like cash flow, donor contributions, and expense categories enables timely decision-making and strategic adjustments. Including visual aids such as charts or graphs can further enhance data comprehension and stakeholder engagement.

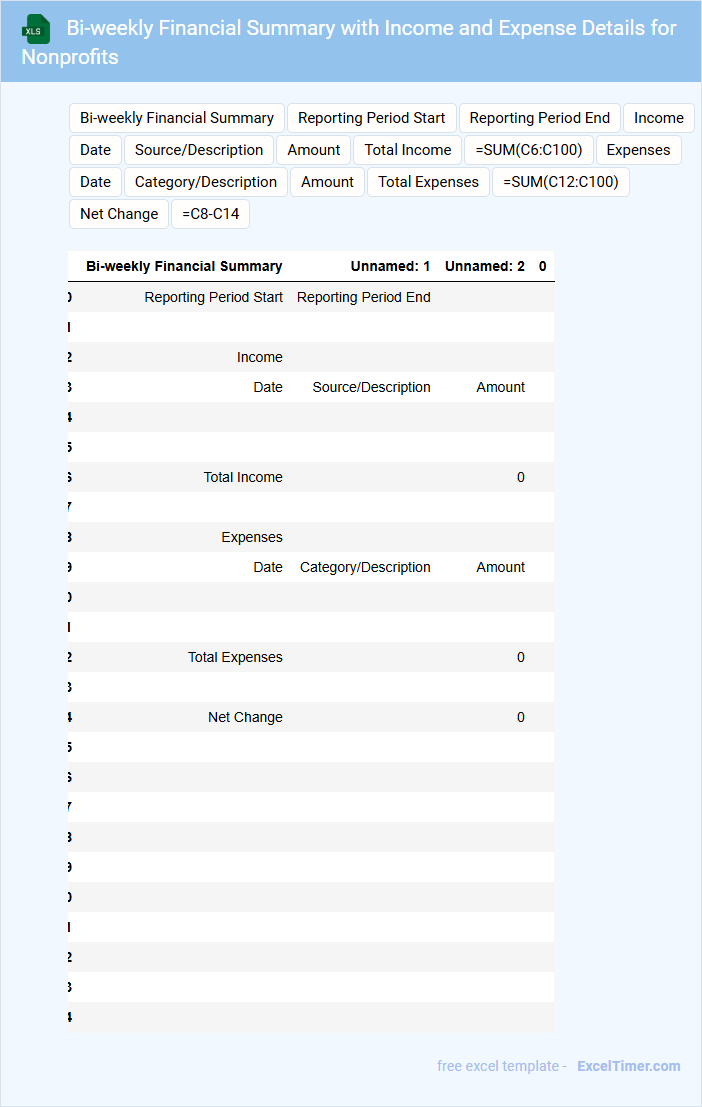

Bi-weekly Financial Summary with Income and Expense Details for Nonprofits

What information does a Bi-weekly Financial Summary with Income and Expense Details for Nonprofits typically contain? This document usually includes detailed records of all income sources and expenditures within a two-week period, providing a clear snapshot of the nonprofit's financial health. It helps stakeholders track cash flow, monitor budget adherence, and make informed decisions for future planning.

What are important considerations when preparing this document? Accuracy and clarity are essential, as precise data supports transparency and accountability. Additionally, categorizing income and expenses appropriately and including comparative analysis against budget forecasts can enhance the report's effectiveness for strategic financial management.

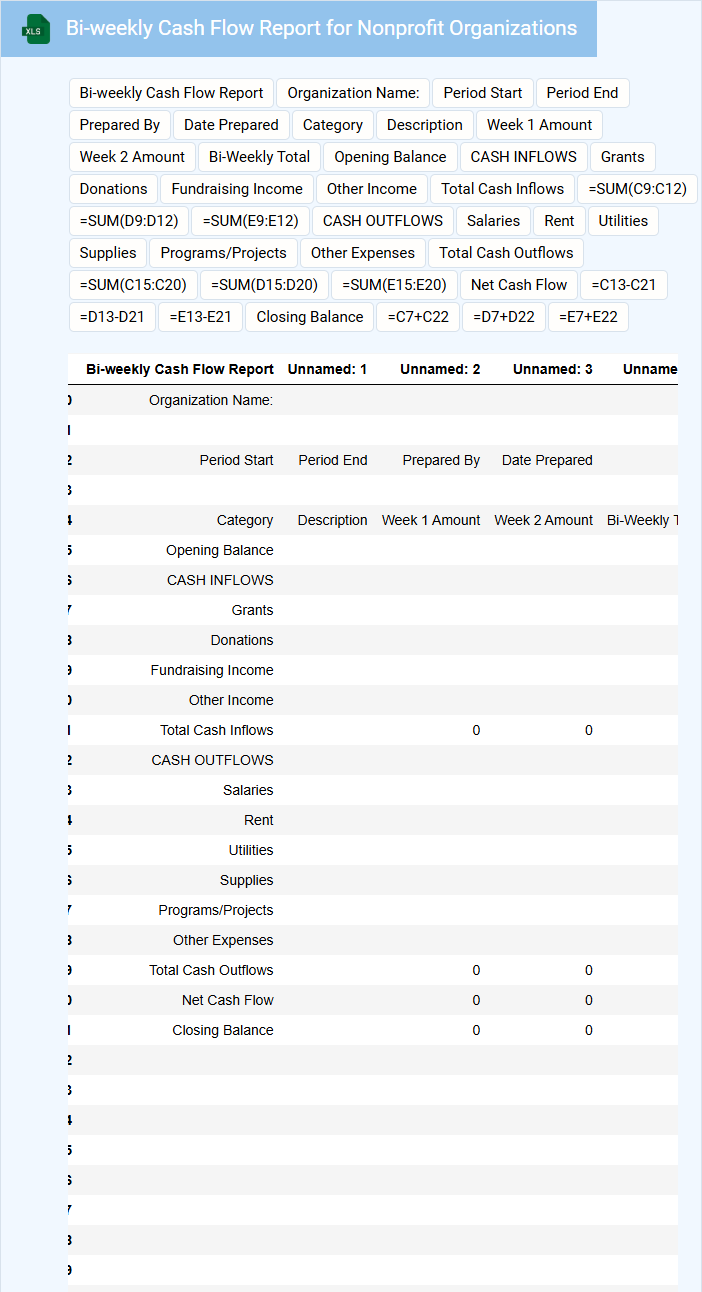

Bi-weekly Cash Flow Report for Nonprofit Organizations

A Bi-weekly Cash Flow Report for Nonprofit Organizations provides a detailed overview of cash inflows and outflows over a two-week period. It helps ensure the organization maintains sufficient liquidity to meet its operational needs.

- Track all sources of income including donations, grants, and fundraising events.

- Monitor expenses such as salaries, program costs, and administrative fees.

- Analyze cash flow trends to anticipate potential shortfalls or surpluses.

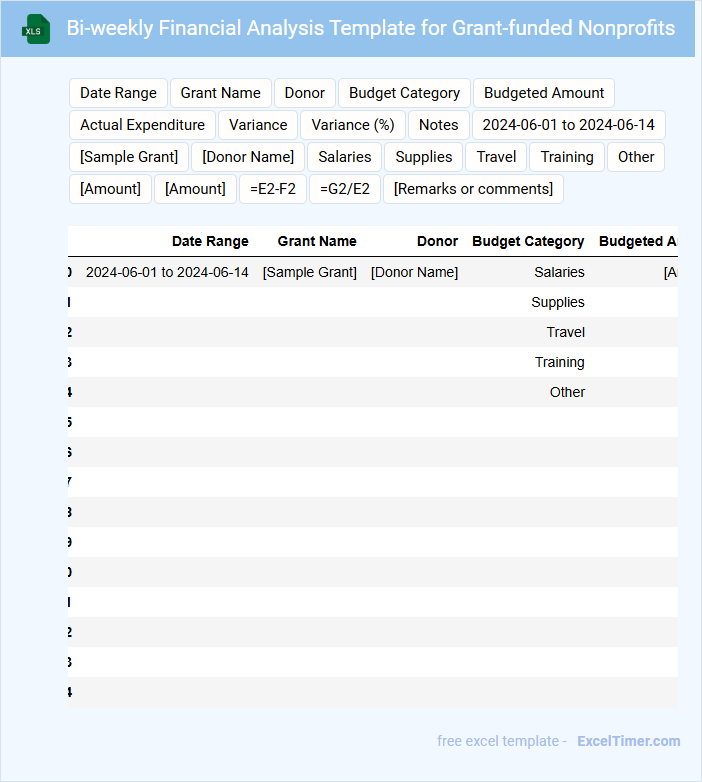

Bi-weekly Financial Analysis Template for Grant-funded Nonprofits

This Bi-weekly Financial Analysis Template is designed to help grant-funded nonprofits systematically track their income and expenses. It typically contains sections detailing grant disbursements, program expenditures, and cash flow summaries. Regular updates ensure accurate financial oversight and informed decision-making.

Key elements to include are detailed budget comparisons, funding source breakdowns, and notes on any variances or financial risks. Ensuring clarity and transparency in reporting helps maintain compliance with grant requirements. Emphasizing cash flow management and timely data entry enhances operational stability and supports sustainable growth.

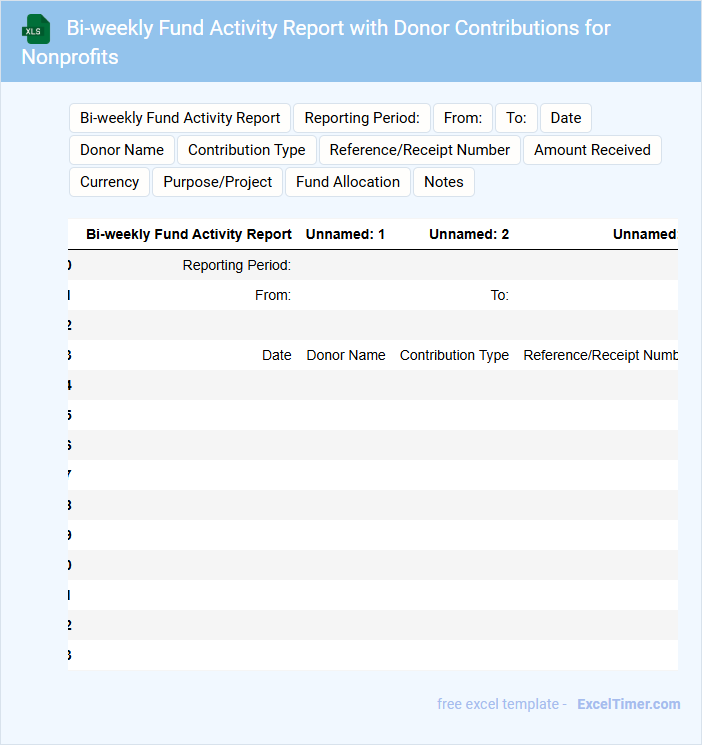

Bi-weekly Fund Activity Report with Donor Contributions for Nonprofits

The Bi-weekly Fund Activity Report for nonprofits provides a detailed overview of financial transactions within a two-week period, highlighting all incoming donations and their sources. It helps organizations track donor contributions and assess funding trends effectively.

These reports typically include summaries of total funds raised, donor engagement metrics, and allocation of resources to various programs. For accuracy and transparency, it is important to regularly update contribution records and clearly distinguish restricted from unrestricted funds.

Bi-weekly Expenditure Tracking for Nonprofit Financial Management

This document typically contains detailed records of expenses incurred every two weeks, helping nonprofits maintain accurate financial oversight. It categorizes spending by program, operational costs, and unexpected expenditures for clarity and accountability. Consistent tracking ensures budget adherence and informed decision-making.

Key elements include date, amount, vendor, purpose, and approval status to support transparency and compliance. The report also highlights trends and potential financial risks, offering insights for strategic adjustments. Prioritizing timely data entry and verification is crucial for effective management.

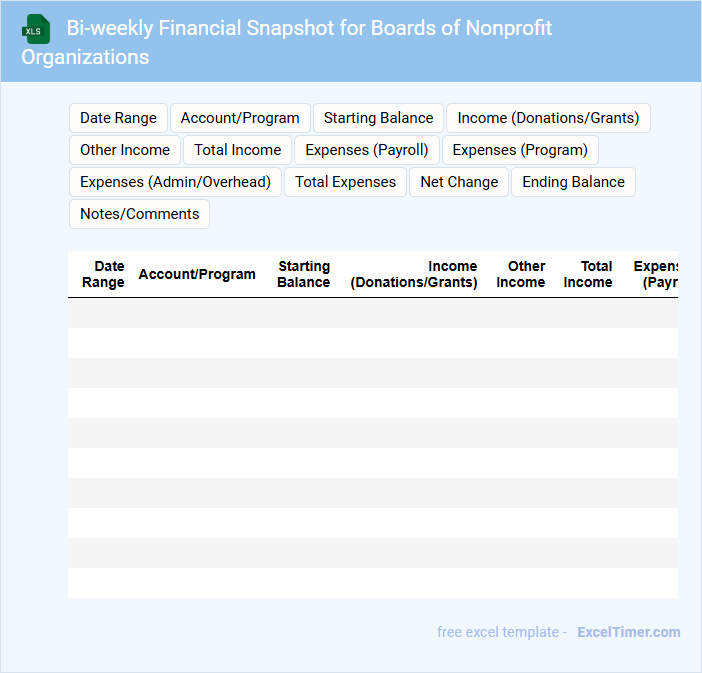

Bi-weekly Financial Snapshot for Boards of Nonprofit Organizations

A Bi-weekly Financial Snapshot for Boards of Nonprofit Organizations typically contains a concise overview of the organization's financial status and key performance indicators to facilitate informed decision-making.

- Income and Expenses: A clear summary of all revenues and expenditures during the past two weeks, highlighting any significant variances.

- Cash Flow Position: Current cash balances and liquidity status to ensure the organization can meet its short-term obligations.

- Fundraising and Grants Update: Overview of recent donations, grant disbursements, and any pending funding opportunities.

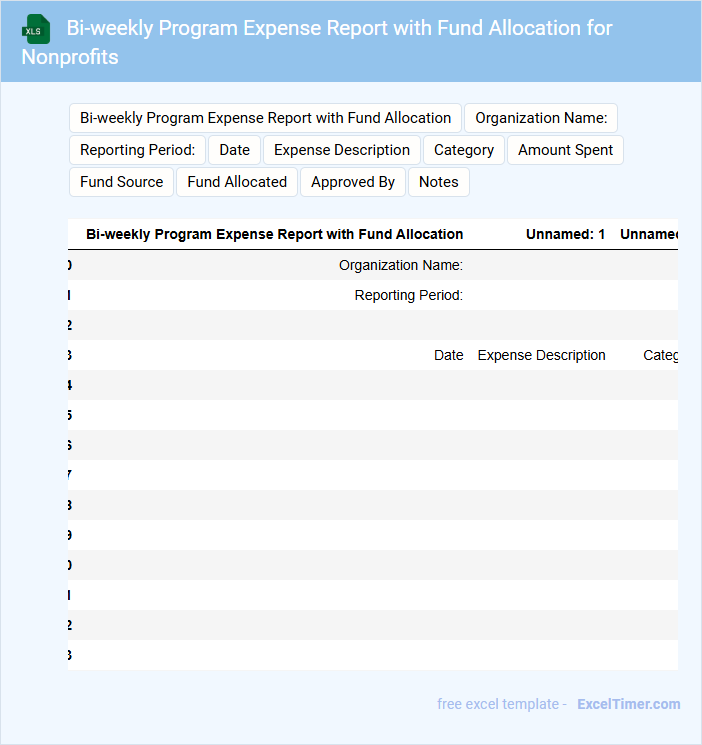

Bi-weekly Program Expense Report with Fund Allocation for Nonprofits

The Bi-weekly Program Expense Report is a crucial document used by nonprofits to track and monitor expenditures within a specific two-week period. It typically contains detailed records of all program-related expenses, categorized by fund allocation to ensure transparency and accountability. This report helps organizations assess financial efficiency and make informed budget adjustments to support their mission effectively.

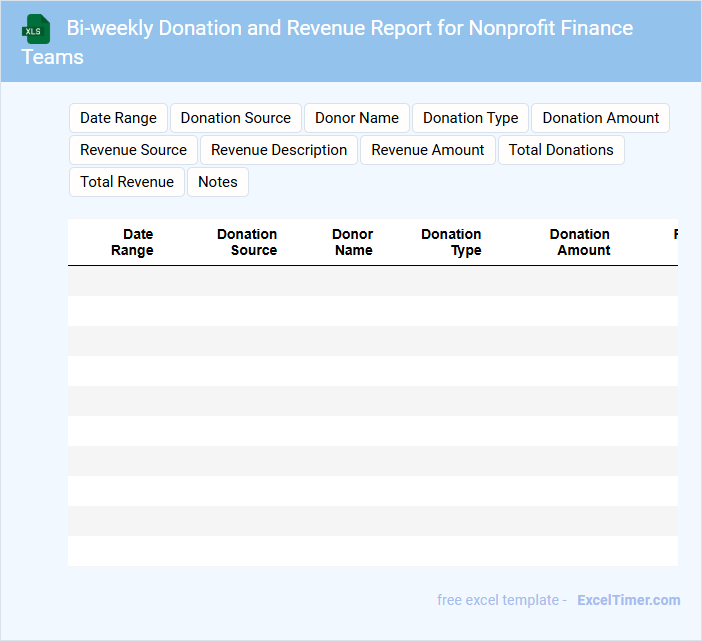

Bi-weekly Donation and Revenue Report for Nonprofit Finance Teams

The Bi-weekly Donation and Revenue Report typically contains detailed information about incoming donations, funding sources, and revenue streams. It highlights trends and variances compared to previous periods to provide financial clarity.

For nonprofit finance teams, this report is essential for monitoring cash flow and ensuring transparency to stakeholders. Regular updates help in making informed budgeting and fundraising decisions more effectively.

Key recommendations include tracking donor demographics and segmenting revenue sources for targeted financial analysis.

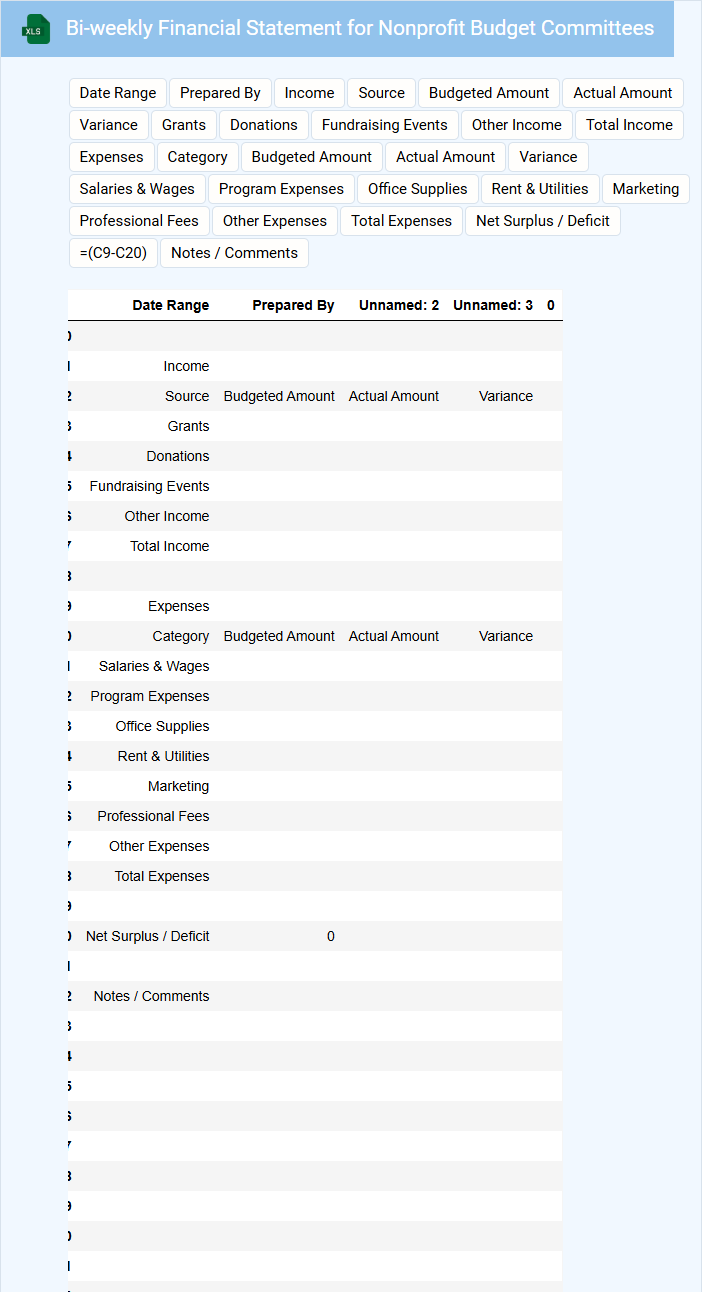

Bi-weekly Financial Statement for Nonprofit Budget Committees

A Bi-weekly Financial Statement for Nonprofit Budget Committees typically contains detailed summaries of income, expenses, and cash flow to provide a clear snapshot of the organization's financial health. This document helps monitor budget adherence and identify any financial discrepancies early. It is essential for informed decision-making and strategic planning within the nonprofit.

To maximize its effectiveness, the statement should include clear, concise categories for all transactions and highlight any significant variances from the budget. Visual aids like charts or graphs can also help budget committees quickly understand financial trends. Regular updates and transparency are crucial for maintaining trust and accountability in nonprofit financial management.

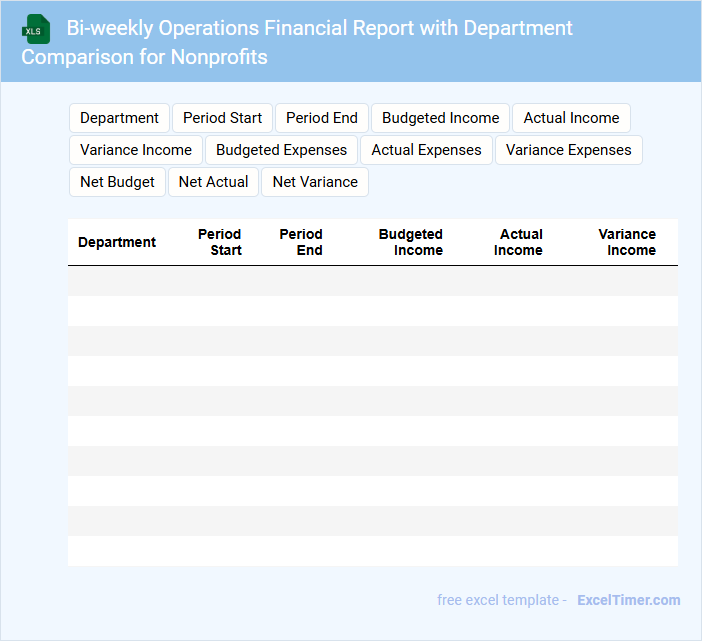

Bi-weekly Operations Financial Report with Department Comparison for Nonprofits

What key information does a Bi-weekly Operations Financial Report with Department Comparison for Nonprofits typically contain? This report usually includes detailed financial data segmented by departments, highlighting income, expenses, and budget variances over a two-week period. It helps nonprofit organizations track financial performance, compare departmental efficiency, and identify areas for improvement.

What important features should be included in this report? The report should include clear departmental summaries, graphical comparisons, explanations for significant variances, and actionable recommendations to support informed decision-making and enhance operational transparency.

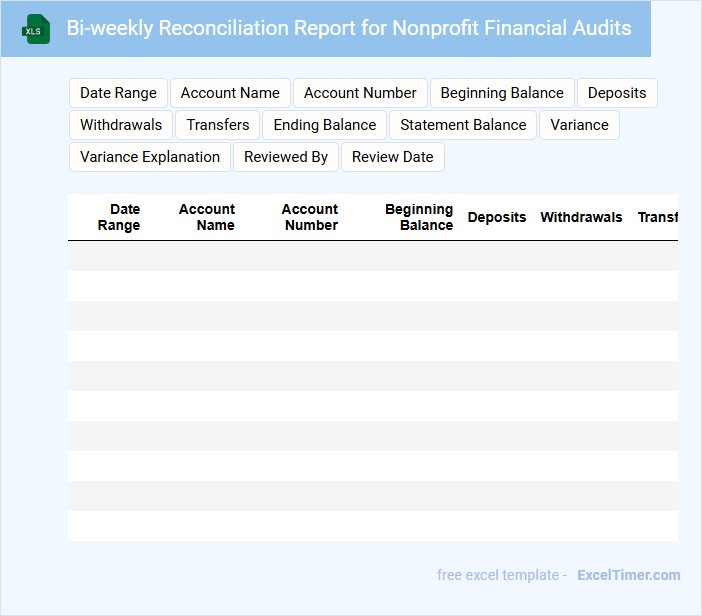

Bi-weekly Reconciliation Report for Nonprofit Financial Audits

What does a Bi-weekly Reconciliation Report for Nonprofit Financial Audits typically contain? This report usually includes a detailed comparison of recorded financial transactions against bank statements or other financial records over a two-week period. It helps identify discrepancies, ensures accurate accounting, and supports transparency in nonprofit financial management.

Which important elements should be emphasized in this report? Key components such as transaction dates, amounts, descriptions, discrepancies, and corrective actions are essential. Additionally, clear audit trails and consistent documentation enhance accountability and facilitate smoother external financial audits for the nonprofit.

Bi-weekly Grants Financial Tracking for Nonprofit Activities

Bi-weekly Grants Financial Tracking for Nonprofit Activities is a document designed to monitor and record the allocation and usage of grant funds within a two-week period, ensuring transparency and accountability.

- Budget Reconciliation: Regularly compare actual expenses against the allocated budget to identify discrepancies early.

- Grant Compliance: Document all expenditures to ensure they align with the specific requirements set by the grant provider.

- Reporting Accuracy: Maintain detailed records to support accurate and timely financial reports to stakeholders and auditors.

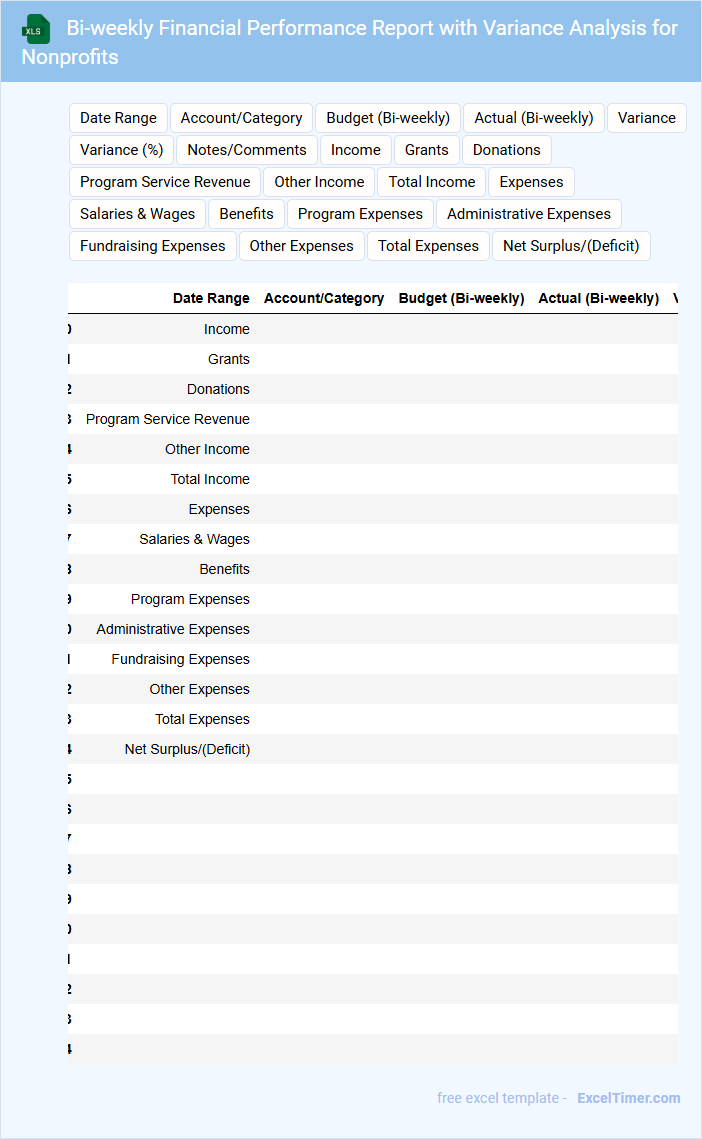

Bi-weekly Financial Performance Report with Variance Analysis for Nonprofits

The Bi-weekly Financial Performance Report for nonprofits typically contains detailed insights into income, expenditures, and cash flow over a two-week period. It highlights budget versus actual spending to provide a clear picture of financial health.

This report includes Variance Analysis, which identifies discrepancies between projected and actual financial outcomes, helping organizations make data-driven decisions. Key metrics such as donation trends and program expenses are emphasized for transparency.

Suggestion: Ensure accurate and timely data collection to enhance the report's reliability and use clear visualizations to communicate financial performance effectively to stakeholders.

What are the essential revenue and expense categories to include in a bi-weekly financial report for nonprofits?

Your bi-weekly financial report for nonprofits should include essential revenue categories such as donations, grants, fundraising events, and membership fees. Expense categories must cover program costs, salaries and wages, office supplies, and administrative expenses. Tracking these categories ensures accurate monitoring of your organization's financial health and sustainability.

How should restricted and unrestricted funds be presented in the bi-weekly financial report?

Restricted and unrestricted funds should be clearly separated in the bi-weekly financial report to maintain transparency and compliance with donor requirements. Present restricted funds in a dedicated section indicating their specific purposes and usage limitations. Display unrestricted funds separately to show available resources for general operations and discretionary spending within the nonprofit.

What key performance indicators (KPIs) are most relevant for tracking financial health in a nonprofit's bi-weekly report?

Tracking liquidity ratios such as the current ratio and quick ratio provides insight into a nonprofit's ability to meet short-term obligations in a bi-weekly financial report. Monitoring revenue trends, including donation growth rate and grant disbursement schedules, helps assess funding stability. Expense management KPIs like program expense ratio and administrative cost percentage reveal operational efficiency critical for nonprofit sustainability.

How can the bi-weekly report highlight variance analysis between budgeted and actual finances?

The Bi-Weekly Financial Report for Nonprofits clearly highlights variance analysis by comparing budgeted figures against actual revenues and expenses within each period. It uses color-coded indicators and detailed line-item breakdowns to enable quick identification of significant deviations. Your timely insights into these variances support informed decision-making and financial accountability.

What data visualization tools in Excel best communicate trends and insights for nonprofit stakeholders?

Excel's PivotCharts and sparklines effectively highlight financial trends and key metrics for nonprofit stakeholders. Conditional formatting enhances data interpretation by visually emphasizing variances and performance patterns. Your Bi-weekly Financial Report benefits from clustered column and line charts to clearly communicate donations, expenses, and budget progress.