The Bi-weekly Payroll Excel Template for Small Business simplifies employee payment tracking by organizing work hours, deductions, and net pay in a clear, customizable format. This template ensures accurate calculations and compliance with tax regulations, helping small businesses streamline payroll processing. Easy to use and update, it saves time while reducing errors in payroll management.

Bi-weekly Payroll Tracker for Small Business

The Bi-weekly Payroll Tracker is a vital document used by small businesses to record employee wages and deductions for each pay period. It typically contains employee details, hours worked, gross pay, taxes, and net pay information. Maintaining accuracy ensures compliance with tax regulations and timely payments.

Important elements to include are employee names, pay dates, hours worked, tax withholdings, benefits deductions, and final net pay. Utilizing formulas to auto-calculate totals and taxes can minimize errors. Consistently updating the tracker helps streamline payroll processing and financial reporting.

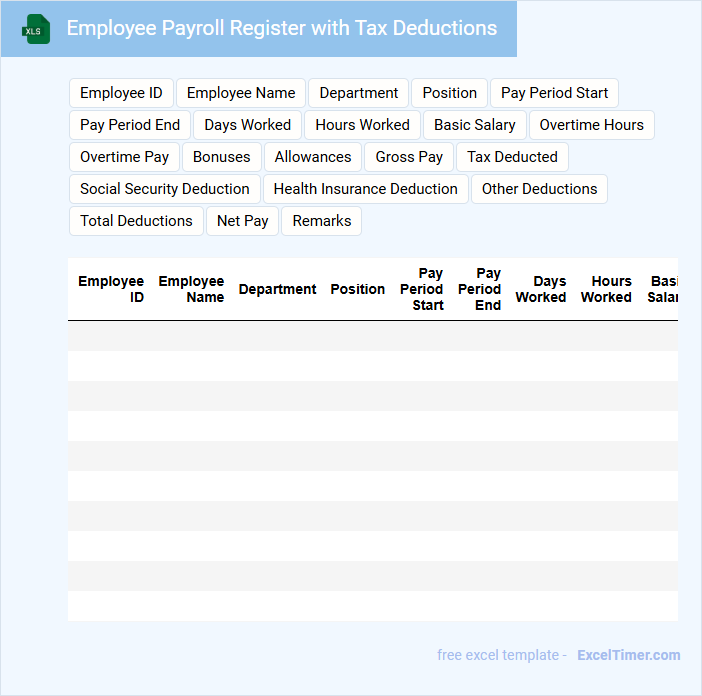

Employee Payroll Register with Tax Deductions

What information is typically included in an Employee Payroll Register with Tax Deductions? This document usually contains detailed records of employees' earnings, hours worked, and the applicable tax deductions such as federal, state, and local taxes. It serves as a comprehensive summary to ensure accurate payroll processing and tax compliance.

Why is it important to maintain accuracy in the Employee Payroll Register with Tax Deductions? Accurate documentation prevents errors in employee compensation and tax reporting, avoiding legal issues and penalties. Additionally, it supports transparent financial tracking and auditing processes within an organization.

Payroll Calculation Sheet for Small Teams

Payroll Calculation Sheets for Small Teams typically summarize employee earnings, deductions, and net pay over a specific period. They ensure accurate and transparent compensation management for employers and employees.

- This document usually contains employee details, hours worked, and salary rates.

- It includes deductions such as taxes, benefits, and other withholdings.

- Net pay calculations and payment dates are essential for timely and precise payroll processing.

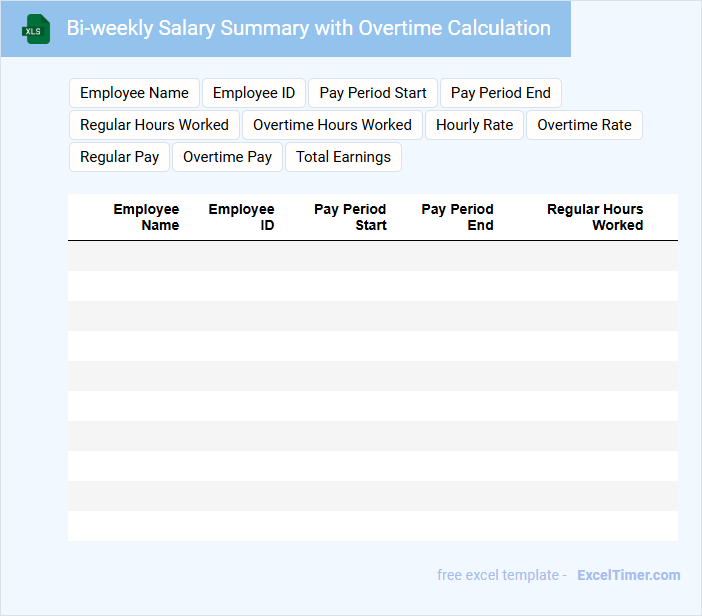

Bi-weekly Salary Summary with Overtime Calculation

The Bi-weekly Salary Summary document typically contains detailed earnings information for employees over a two-week period, including base salary and any additional compensation. It also includes overtime hours worked and appropriate calculations, ensuring accurate payment. This summary is essential for both payroll accuracy and employee transparency.

Payroll Management Template for Startups

This document typically contains structured information and tools to effectively manage employee compensation in a startup environment.

- Employee Salary Details: Includes base pay, bonuses, and deductions to accurately calculate net pay.

- Tax and Compliance Information: Ensures adherence to legal requirements such as tax withholdings and labor laws.

- Payment Schedule and Records: Tracks pay periods and maintains historical payroll records for transparency and auditing.

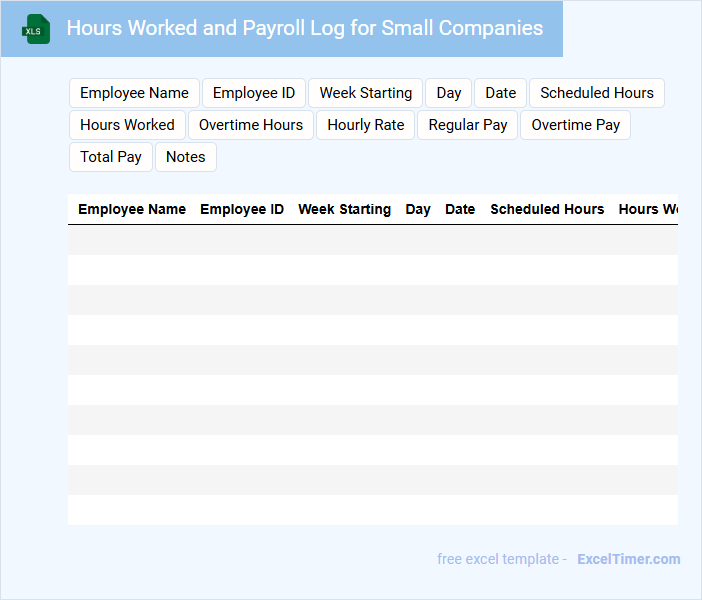

Hours Worked and Payroll Log for Small Companies

This type of document typically contains detailed records of hours worked by employees, including start and end times for each shift. It also tracks payroll information such as wages, deductions, and total pay for small companies. Maintaining accurate logs is essential for compliance with labor laws.

Important elements to include in an Hours Worked and Payroll Log are employee names, dates, hourly rates, and overtime calculations. Regular updates ensure transparency and simplify payroll processing. Small businesses should also consider digital tools for efficient record-keeping.

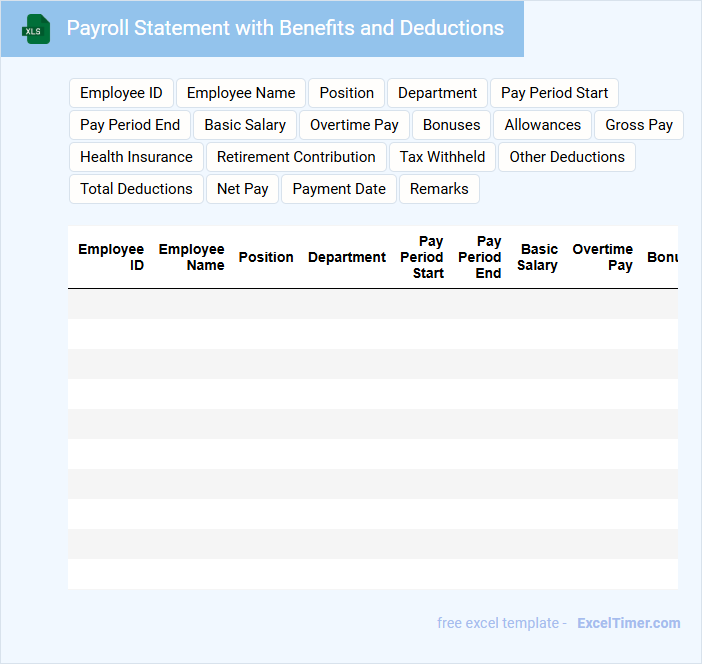

Payroll Statement with Benefits and Deductions

A Payroll Statement with Benefits and Deductions details an employee's earnings, along with any benefits provided and deductions taken from their salary. It serves as an official record of payment and financial adjustments for each pay period.

- Check for accuracy in reported hours worked and salary calculations.

- Review all listed benefits to understand their impact on total compensation.

- Ensure deductions such as taxes and contributions are correctly applied.

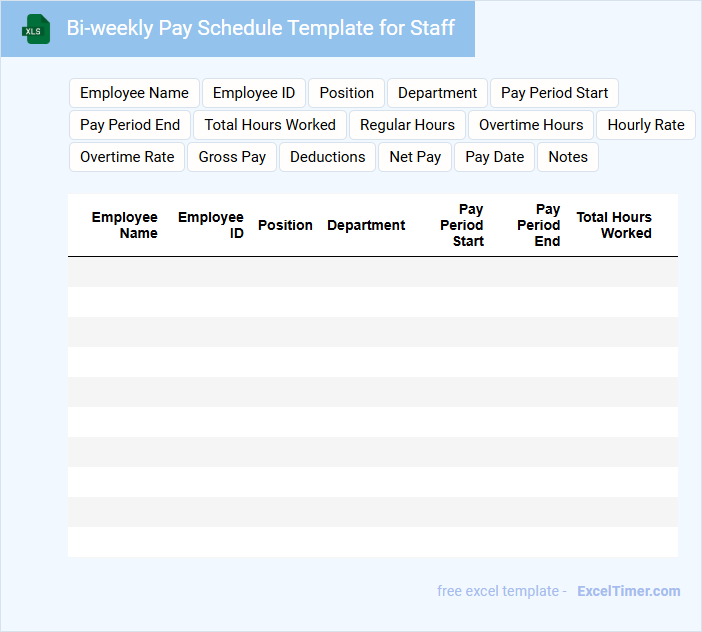

Bi-weekly Pay Schedule Template for Staff

What information is typically included in a Bi-weekly Pay Schedule Template for Staff? Such a document usually contains the pay periods, payment dates, and details on the calculation of wages based on hours worked or salary. It helps staff and management track payroll timing consistently and ensures timely payments.

What important elements should be included in this template? Clear labels for pay periods, exact pay dates, and fields for employee details and hours worked are essential to avoid confusion and maintain accurate financial records.

Wage Payment Tracker for Small Business Owners

What information does a Wage Payment Tracker for Small Business Owners typically contain? This document usually includes detailed records of employee names, payment dates, wage amounts, and payment methods to ensure accurate tracking of payroll. It helps business owners maintain compliance with labor laws and monitor cash flow effectively.

What is an important aspect to focus on in a Wage Payment Tracker? Consistency and accuracy in recording wage payments are crucial to avoid disputes and legal issues. Regular updates and clear documentation of deductions, bonuses, and overtime payments enhance transparency and financial management.

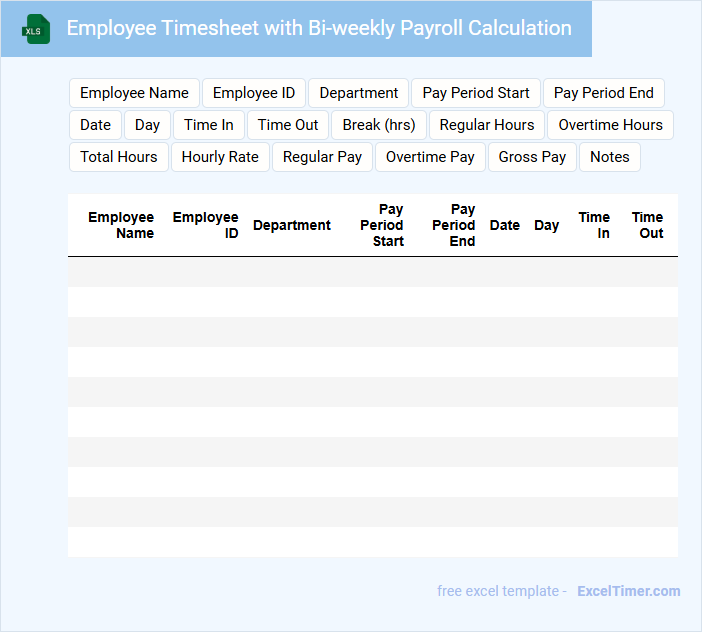

Employee Timesheet with Bi-weekly Payroll Calculation

An Employee Timesheet typically records the hours worked by employees across specific days, serving as a fundamental tool for payroll processing. It ensures accurate tracking of regular and overtime hours, allowing employers to calculate wages precisely.

For Bi-weekly Payroll Calculation, the document consolidates two weeks of work data for each employee to determine gross pay, including deductions and taxes. Properly formatted timesheets help prevent errors and streamline the payment process.

Including clear sections for employee details, daily hours, overtime, and approval signatures is essential for accuracy and accountability.

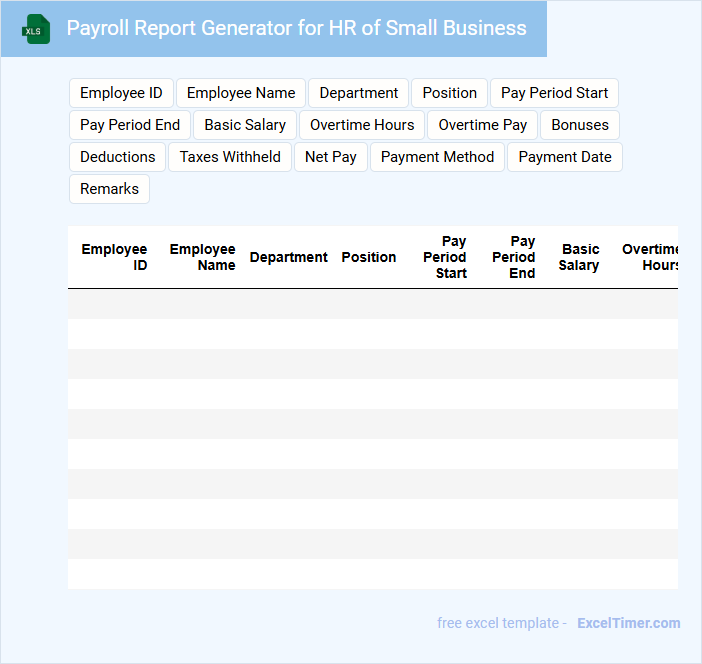

Payroll Report Generator for HR of Small Business

What information is typically included in a Payroll Report Generator for HR of Small Business? A Payroll Report Generator usually contains employee wage details, tax deductions, and total payable amounts. It helps HR efficiently manage payroll processing, ensuring accuracy and compliance with tax regulations.

What important features should be considered for an effective Payroll Report Generator? The tool should support automated calculations, customizable report formats, and secure data handling to protect employee privacy and streamline payroll management.

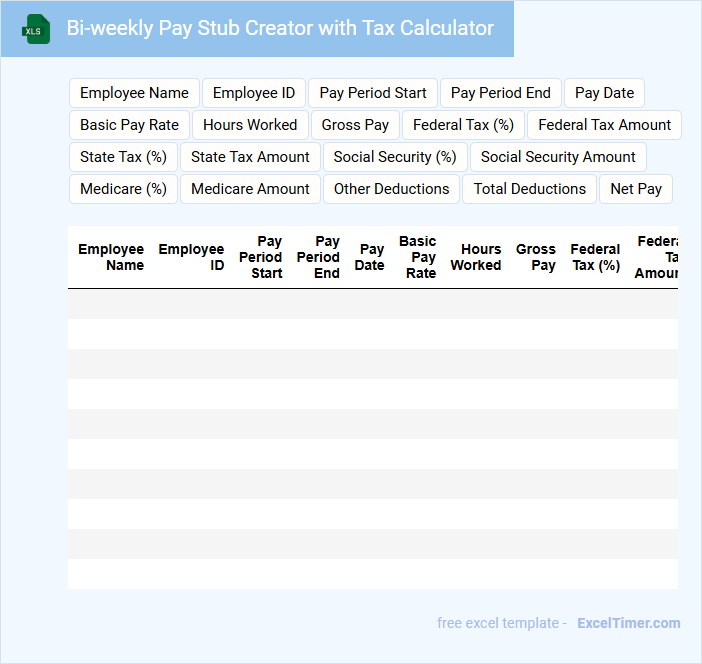

Bi-weekly Pay Stub Creator with Tax Calculator

A Bi-weekly Pay Stub Creator with Tax Calculator is a document designed to help employees track their earnings and deductions every two weeks. It provides a detailed breakdown of gross income, taxes withheld, and net pay to ensure financial transparency.

- Include accurate tax rates and deduction categories to reflect current regulations.

- Display both employer and employee contributions clearly for social security and benefits.

- Provide a summary section highlighting total earnings and total deductions for easy review.

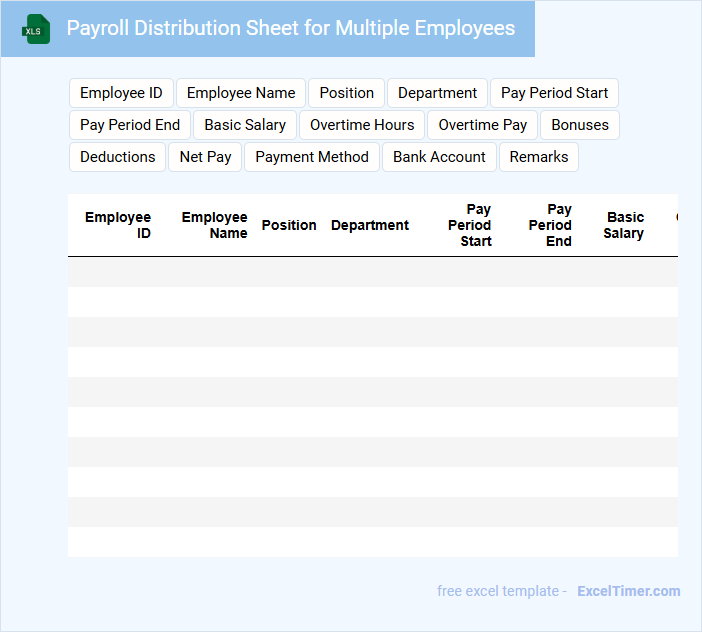

Payroll Distribution Sheet for Multiple Employees

A Payroll Distribution Sheet for multiple employees typically contains detailed information about employee salaries, deductions, and net pay. It consolidates data such as hours worked, pay rates, tax withholdings, and benefits to ensure accurate compensation. This document is essential for maintaining transparent and organized payroll records. Important considerations include regularly verifying employee details, ensuring compliance with tax regulations, and maintaining confidentiality of sensitive information.

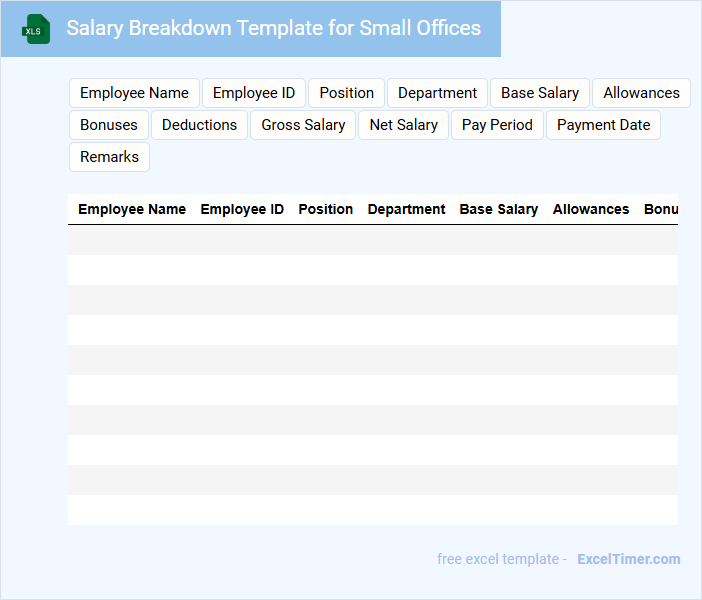

Salary Breakdown Template for Small Offices

A Salary Breakdown Template for small offices typically contains detailed information about employee compensation, including base salary, bonuses, deductions, and net pay. It helps in maintaining transparent payroll management and accurate financial records.

Important elements to include are clear categories for earnings and deductions, as well as space for notes on tax or benefits adjustments. This ensures clarity and compliance with local wage regulations.

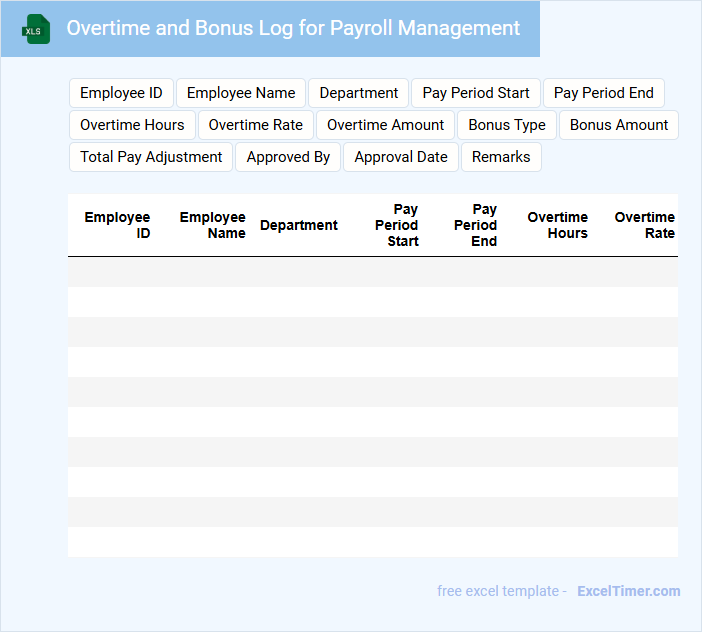

Overtime and Bonus Log for Payroll Management

Overtime and Bonus Logs are essential documents for payroll management, tracking extra hours worked and additional compensation accurately. They typically contain employee details, hours of overtime, bonus amounts, and approval signatures. Maintaining this log ensures transparency and helps in calculating correct payroll amounts efficiently.

What are the key steps to setting up a bi-weekly payroll schedule in Excel for a small business?

Setting up a bi-weekly payroll schedule in Excel for a small business involves creating columns for employee names, pay periods, hours worked, and wages. You must calculate earnings based on hours and pay rates, including deductions such as taxes and benefits. Use formulas to automate calculations and ensure accuracy in your payroll processing.

Which Excel formulas are most effective for calculating gross and net pay in bi-weekly payroll?

Effective Excel formulas for bi-weekly payroll calculations include SUMPRODUCT to compute gross pay by multiplying hours worked by hourly rates. Use IF statements to handle overtime rates accurately when hours exceed standard limits. Deduct taxes and benefits with fixed percentage formulas like =GrossPay*TaxRate to determine net pay efficiently.

How can Excel be used to track and manage tax withholdings and deductions for employees on a bi-weekly pay cycle?

Excel can be used to track and manage tax withholdings and deductions for employees on a bi-weekly pay cycle by creating formulas that calculate federal, state, and local taxes based on current withholding tables. The spreadsheet can include columns for gross pay, pre-tax deductions, taxable income, and specific deduction categories such as Social Security, Medicare, and retirement contributions. Automated updates and data validation ensure accurate, real-time payroll processing and compliance with tax regulations for small businesses.

What essential data fields should be included in an Excel payroll template for accurate bi-weekly reporting?

An Excel payroll template for accurate bi-weekly reporting should include employee ID, full name, pay period start and end dates, hourly rate or salary, total hours worked, gross pay, tax deductions, benefits contributions, and net pay. Including fields for overtime hours and paid time off ensures comprehensive tracking of earnings and deductions. Your template must be designed to capture these details consistently for precise payroll management.

How can Excel support compliance with local, state, and federal payroll regulations for small businesses running bi-weekly payroll?

Excel supports compliance with local, state, and federal payroll regulations for small businesses by enabling accurate calculation of wages, taxes, and deductions based on current tax tables and labor laws. You can customize formulas and templates to track employee hours, benefits, and tax withholdings, ensuring timely and precise payroll processing. Built-in data validation and audit functions help reduce errors and maintain regulatory records for audits and reporting.