The Bi-weekly Debt Payment Excel Template for Individuals helps manage and track debt payments made every two weeks, ensuring faster repayment and interest savings. It calculates payment schedules automatically and provides a clear overview of outstanding balances and payoff dates. This tool is essential for individuals aiming to optimize debt repayment and improve financial planning.

Bi-Weekly Debt Payment Tracker for Individuals

A Bi-Weekly Debt Payment Tracker for Individuals is a document designed to help monitor and manage debt repayments efficiently over a two-week period.

- Payment Schedule: Clearly list all payment dates and amounts to ensure consistent tracking.

- Debt Summary: Include detailed information on each debt, such as creditor, balance, and interest rate.

- Progress Monitoring: Highlight remaining balances and improvements to encourage timely payments and debt reduction.

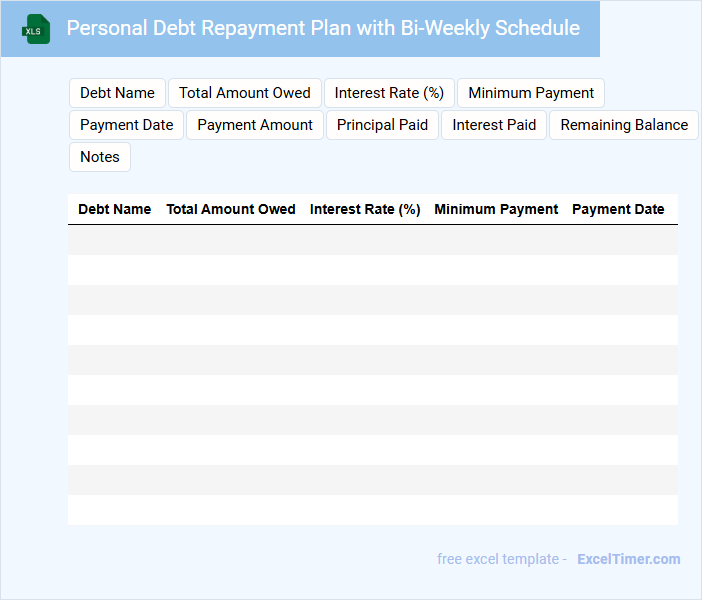

Personal Debt Repayment Plan with Bi-Weekly Schedule

A Personal Debt Repayment Plan with a bi-weekly schedule is a structured approach to manage and eliminate debt efficiently. It details the amounts to be paid every two weeks, helping individuals reduce interest and shorten the repayment period. This type of document typically includes a list of debts, payment timelines, and strategies for prioritizing high-interest debts.

Important elements to include are a clear budget overview, specific payment amounts, and due dates aligned with the bi-weekly schedule. Incorporating debt prioritization methods, such as the avalanche or snowball technique, can improve effectiveness. Additionally, regularly updating the plan and tracking progress are crucial for staying on target and adjusting to any financial changes.

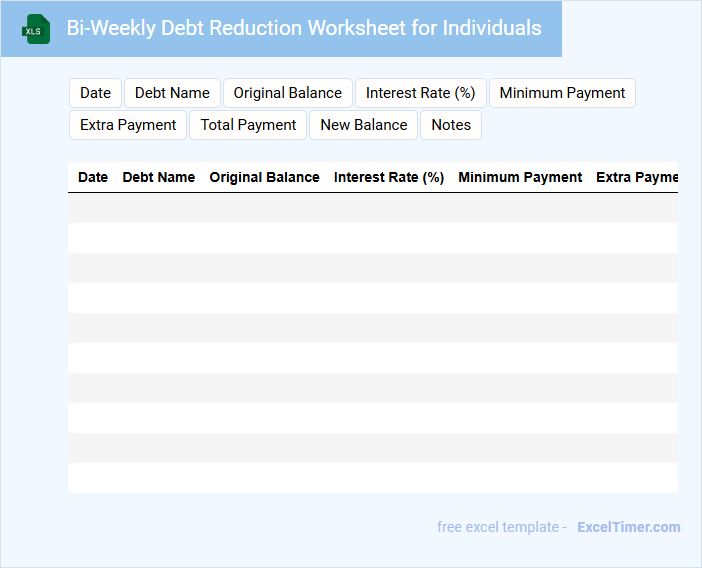

Bi-Weekly Debt Reduction Worksheet for Individuals

A Bi-Weekly Debt Reduction Worksheet for individuals typically contains detailed sections for tracking debts, payment dates, and amounts to be paid every two weeks. It helps users systematically plan repayments, monitor progress, and avoid missed payments. An important suggestion is to include fields for interest rates and payoff dates to maximize the effectiveness of debt reduction strategies.

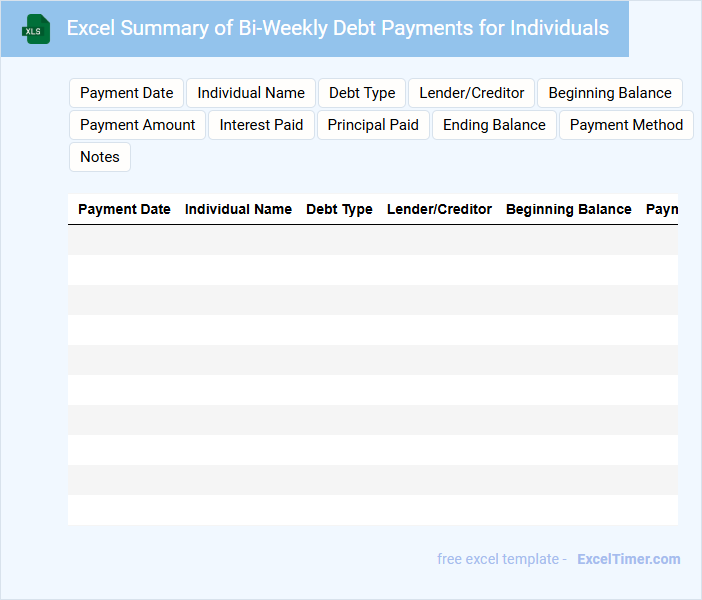

Excel Summary of Bi-Weekly Debt Payments for Individuals

This document typically contains a detailed overview of an individual's bi-weekly debt repayments, including payment amounts, schedules, and outstanding balances. It is used to track progress and manage debt efficiently over time.

- Include clear columns for payment dates, amounts, and remaining balances.

- Highlight any missed or late payments to identify potential issues.

- Summarize total payments made and remaining debt at the top for quick reference.

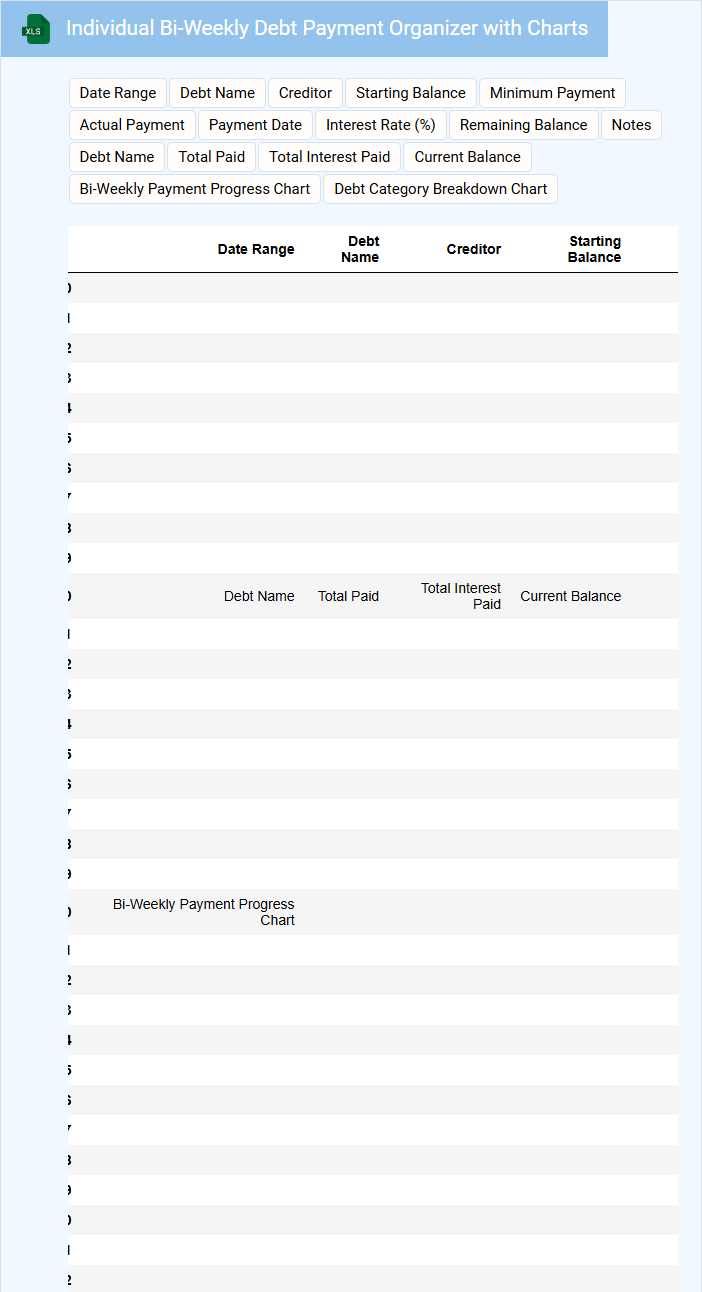

Individual Bi-Weekly Debt Payment Organizer with Charts

What information is typically included in an Individual Bi-Weekly Debt Payment Organizer with Charts? This document usually contains detailed records of bi-weekly debt payments, including amounts, due dates, and the remaining balance for each debt. It also features visual charts that help track payment progress and outstanding debt reduction over time, making it easier to manage finances effectively.

What important aspects should be considered when creating this organizer? It is essential to include clear categories for each debt type, consistent payment schedules, and regularly updated charts to reflect accurate financial status. Additionally, incorporating reminders for due dates and potential interest savings with bi-weekly payments can enhance the organizer's usefulness.

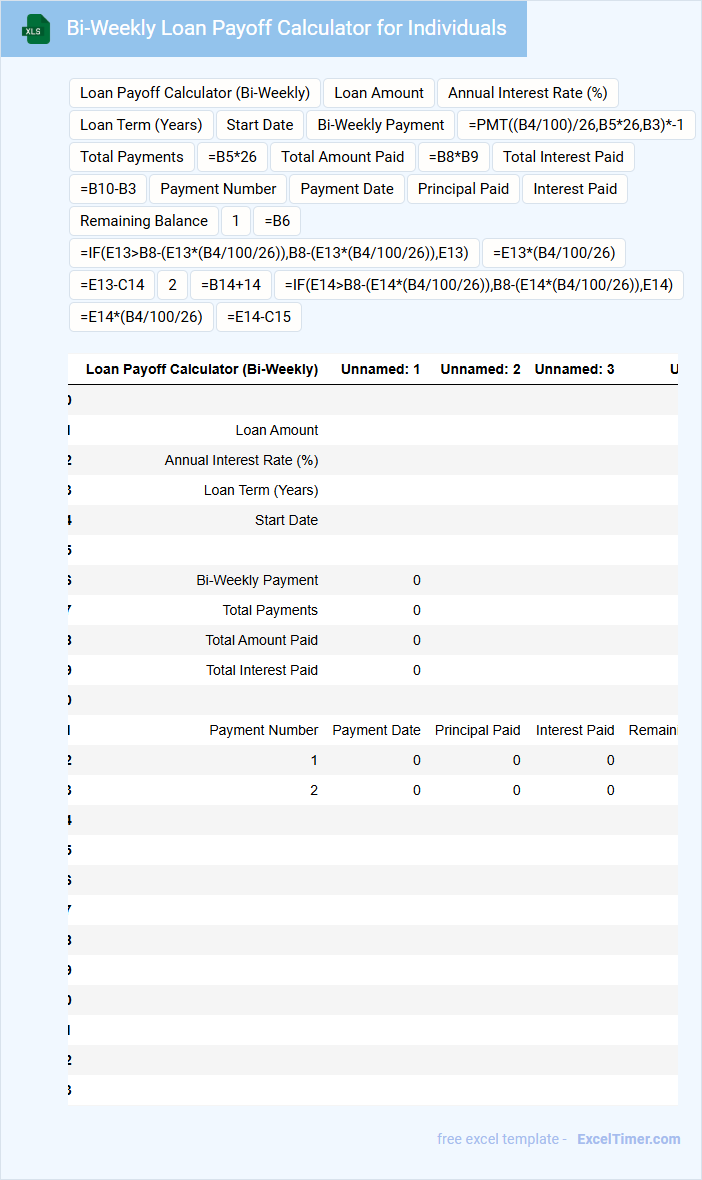

Bi-Weekly Loan Payoff Calculator for Individuals

This document typically contains a bi-weekly loan payoff calculator designed to help individuals manage and track their loan repayment schedules more effectively. It includes input fields for loan amount, interest rate, and payment frequency, facilitating precise payoff timeline calculations.

A key feature is the visualization of interest savings and early payoff benefits from bi-weekly payments, promoting better financial planning. It is important to ensure accurate data input and clear instructions for user-friendly navigation.

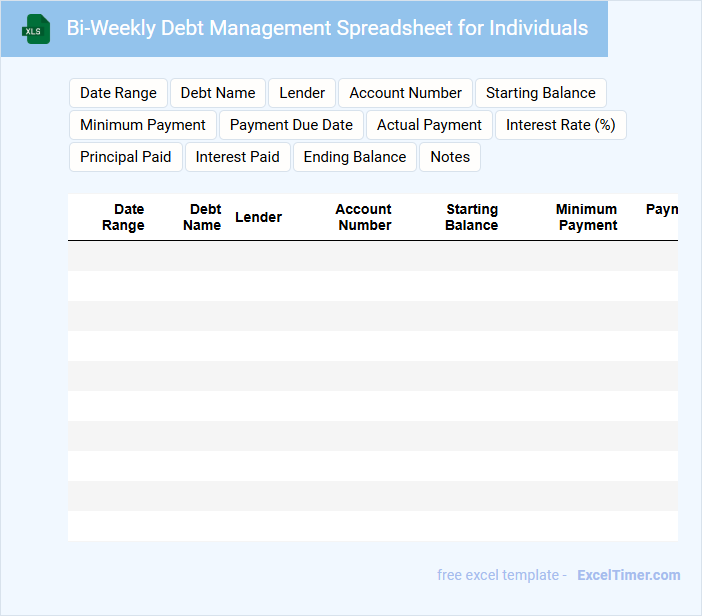

Bi-Weekly Debt Management Spreadsheet for Individuals

A Bi-Weekly Debt Management Spreadsheet for Individuals is typically used to track and organize debt payments on a bi-weekly basis to improve financial planning and debt reduction.

- Payment Schedule: It clearly outlines bi-weekly payment dates and amounts to ensure timely debt repayment.

- Debt Overview: It includes details of all debts, such as balances, interest rates, and minimum payments, for comprehensive tracking.

- Progress Monitoring: It provides visual summaries or charts to monitor debt reduction progress over time.

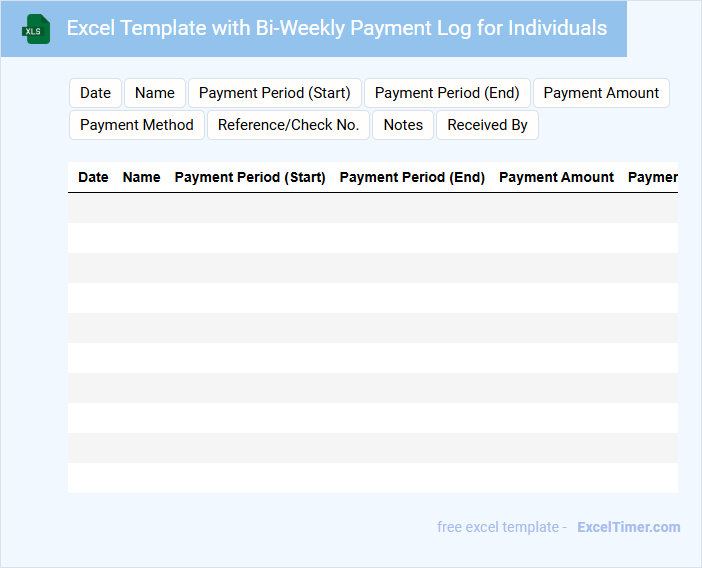

Excel Template with Bi-Weekly Payment Log for Individuals

This document typically contains a structured Excel template designed to track bi-weekly payments for individuals. It helps users manage and record payment dates, amounts, and related details efficiently.

- Ensure the template includes columns for payment date, amount, and payment status.

- Incorporate formulas to automatically calculate total payments and pending amounts.

- Design the layout for easy data entry and clear visual tracking of payment history.

Debt Payment Timeline for Individuals with Bi-Weekly Tracking

A Debt Payment Timeline for individuals with bi-weekly tracking outlines the schedule and plan for repaying debts by making payments every two weeks. It helps in organizing debt obligations and predicting payoff dates.

This document typically contains detailed payment dates, amounts due, outstanding balances, and interest calculations. Including a visual timeline or calendar enhances clarity and motivation for staying on track.

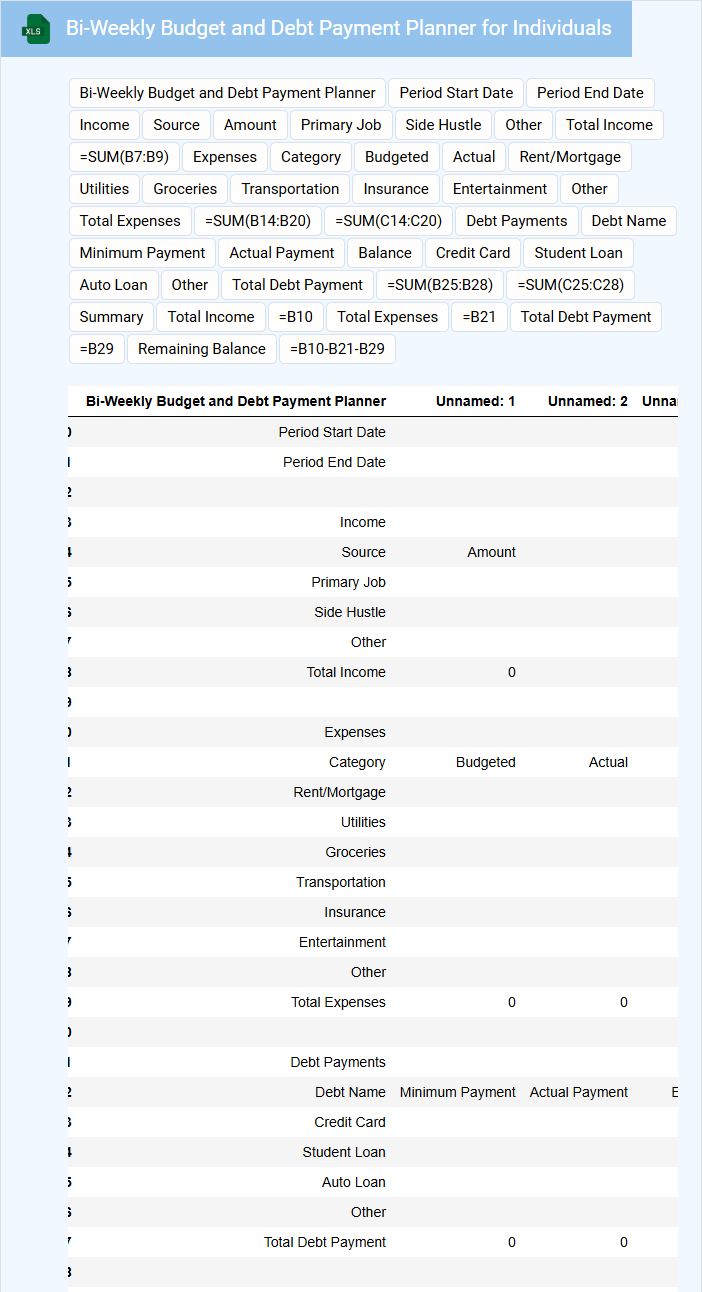

Bi-Weekly Budget and Debt Payment Planner for Individuals

This document usually contains detailed tracking of income, expenses, debts, and payment schedules to help individuals manage their finances effectively.

- Income and Expense Tracking: Lists all sources of income and categorizes monthly expenses to monitor cash flow.

- Debt Payment Schedule: Details debt balances, interest rates, and planned payment dates to prioritize repayments.

- Budget Planning: Sets spending limits and savings goals on a bi-weekly basis to ensure financial discipline and reduce debt.

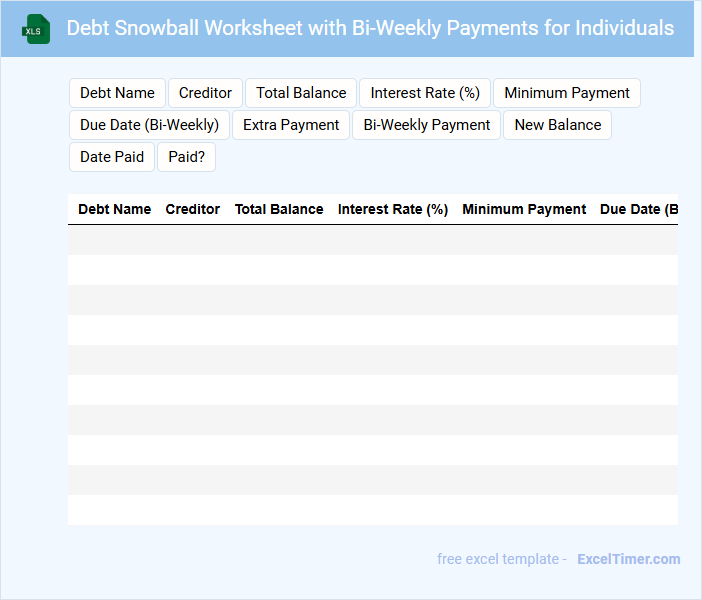

Debt Snowball Worksheet with Bi-Weekly Payments for Individuals

A Debt Snowball Worksheet with bi-weekly payments is a financial tool designed to help individuals systematically pay down their debts. It typically contains a detailed list of debts, including balances, interest rates, and minimum payments, organized to prioritize the smallest balances first. This worksheet assists in tracking extra payments made every two weeks to accelerate debt reduction and improve budgeting efficiency.

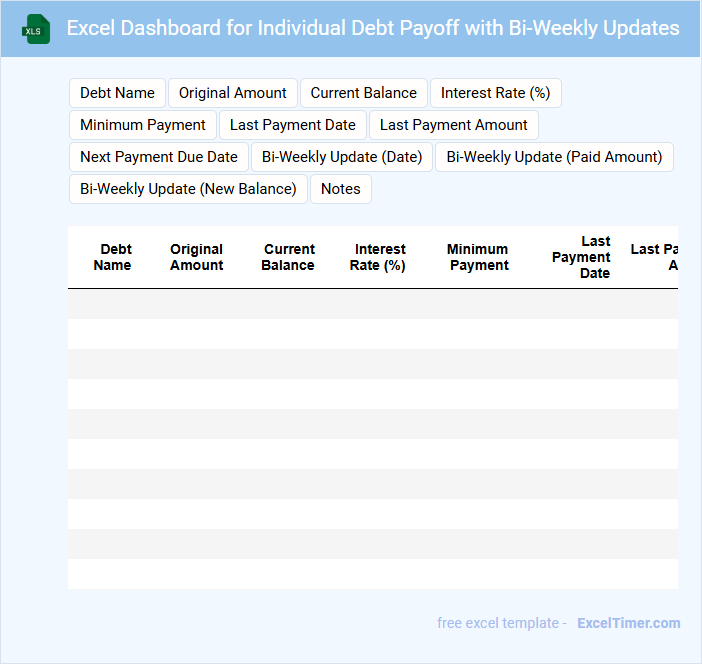

Excel Dashboard for Individual Debt Payoff with Bi-Weekly Updates

An Excel Dashboard for Individual Debt Payoff typically contains a comprehensive overview of debts, payment schedules, and progress tracking. It includes bi-weekly updates to reflect the most current financial status and payment applications. This enables users to monitor their debt reduction strategies effectively and make informed financial decisions.

Important elements to include are a clear breakdown of each debt, the remaining balance, interest rates, projected payoff dates, and visual progress indicators like graphs or charts. Incorporating automated bi-weekly update features ensures timely data refresh and accuracy. Additionally, setting reminders or notifications for upcoming payments helps maintain consistent payoff momentum.

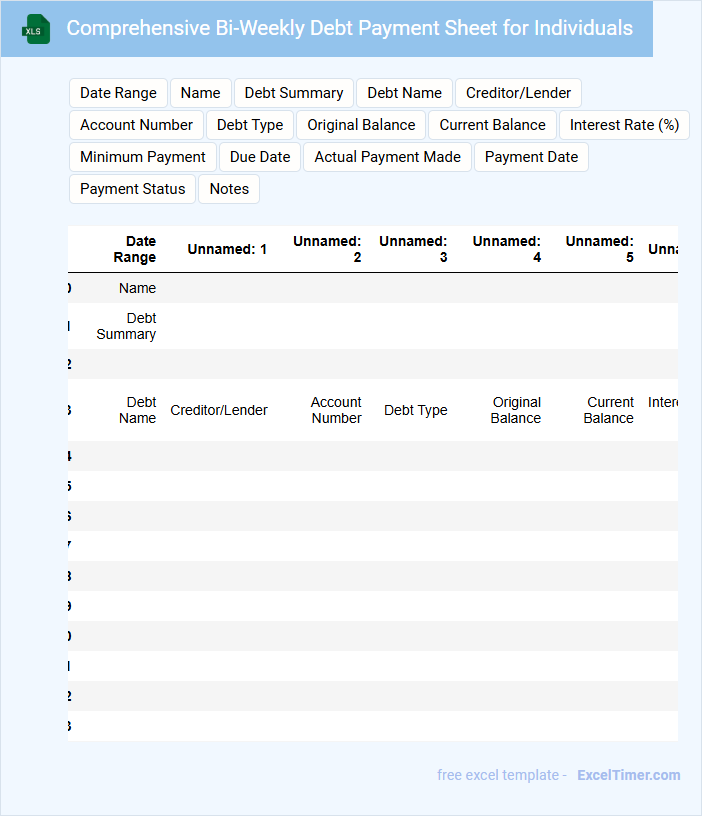

Comprehensive Bi-Weekly Debt Payment Sheet for Individuals

A Comprehensive Bi-Weekly Debt Payment Sheet for Individuals typically contains detailed records of all debts, payment schedules, and outstanding balances. It is designed to help individuals manage and track their debt payments systematically every two weeks.

- Include all debts with creditor names and interest rates.

- Track bi-weekly payment amounts and due dates clearly.

- Update balances after each payment to monitor progress.

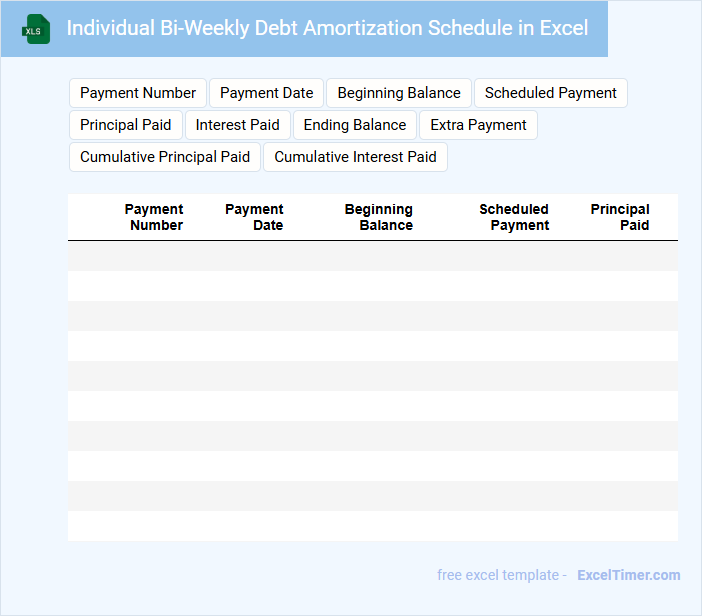

Individual Bi-Weekly Debt Amortization Schedule in Excel

An Individual Bi-Weekly Debt Amortization Schedule in Excel typically contains a detailed breakdown of payments made every two weeks toward a specific debt. It includes columns for payment dates, principal, interest, and remaining balance to track the loan payoff progress accurately. This document helps users visualize how debt decreases over time with bi-weekly payments, potentially reducing interest and loan term. Important considerations include ensuring payment accuracy, updating interest rates if variable, and verifying the schedule aligns with the lender's terms for optimal repayment planning.

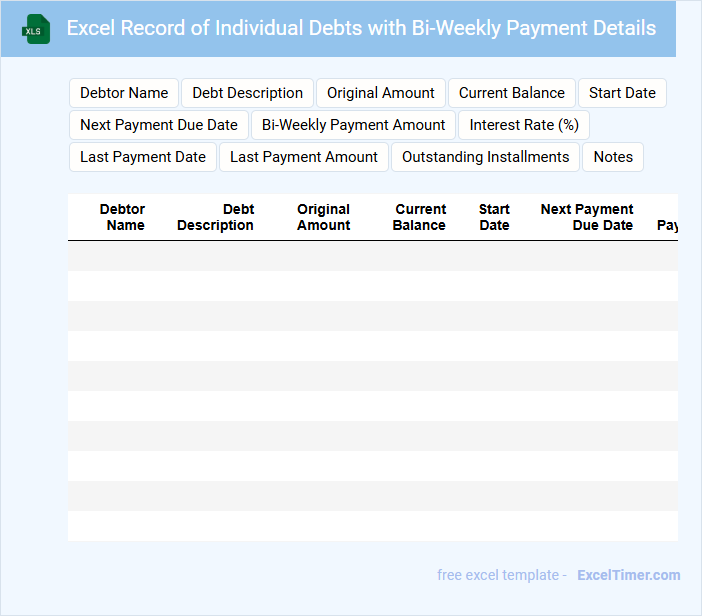

Excel Record of Individual Debts with Bi-Weekly Payment Details

What information is typically included in an Excel Record of Individual Debts with Bi-Weekly Payment Details? This document usually contains detailed entries of each debt's principal amount, interest rate, and payment schedule. It systematically tracks bi-weekly payments, outstanding balances, and due dates to help manage debt repayment efficiently.

What important elements should be considered when creating this Excel record? It is essential to ensure accuracy in payment dates and amounts, clearly separate each debt, and include formulas to automatically update remaining balances after each payment. Adding conditional formatting to highlight overdue payments can greatly enhance usability and monitoring.

What is the primary advantage of using a bi-weekly debt payment schedule in personal finance?

A bi-weekly debt payment schedule accelerates loan repayment by making 26 half-payments per year, equivalent to 13 full payments instead of 12. This reduces the overall interest paid and shortens the loan term. Individuals benefit from faster debt elimination and increased financial savings.

How does a bi-weekly payment method reduce total interest paid compared to monthly payments?

Bi-weekly debt payments reduce total interest by making 26 half-payments annually, equivalent to 13 full monthly payments instead of 12. This extra payment accelerates principal reduction, decreasing the loan term and cumulative interest. Faster principal paydown minimizes interest accrual, resulting in significant savings over the loan's life.

What Excel functions can be used to calculate accelerated debt payoff with bi-weekly payments?

Excel functions such as PMT, IPMT, and PPMT are essential for calculating accelerated debt payoff with bi-weekly payments by determining payment amounts, interest portions, and principal reductions. The NPER function helps estimate the number of payment periods needed to fully pay off the debt. Combining these functions with adjusted interest rates for bi-weekly periods enables precise debt payoff acceleration modeling.

How do you set up formulas in Excel to track and compare monthly vs. bi-weekly debt reduction?

Set up columns for payment dates, bi-weekly amounts, and cumulative debt balance in Excel. Use the SUMIFS function to total payments within each month for monthly totals and simple SUM for bi-weekly totals. Create a comparison table calculating the difference between monthly and bi-weekly debt reductions, enabling effective tracking and analysis.

What potential errors should individuals watch for when automating bi-weekly debt payments in an Excel document?

You should watch for errors such as incorrect formula references, inconsistent payment schedules, and failure to update interest rates in your bi-weekly debt payment Excel sheet. Missing or duplicated payment dates can distort your debt amortization calculations, leading to inaccurate balances. Ensuring precise cell linking and regular data validation helps maintain accurate tracking of your debt repayments.