![]()

The Bi-weekly Savings Tracker Excel Template for Couples helps partners monitor their joint savings progress efficiently. It allows for easy input of bi-weekly income and expenses, providing clear insights into saving habits. This tool fosters financial transparency and goal-setting between couples.

Bi-weekly Savings Tracker Excel Template for Couples

A Bi-weekly Savings Tracker Excel Template for Couples is a practical tool designed to help partners manage and monitor their savings goals together on a bi-weekly basis. It typically includes sections for income, expenses, and savings contributions to maintain financial transparency.

- Ensure the template allows for clear input fields for both partners' incomes and expenses.

- Include visual charts or graphs to track progress and motivate consistent savings.

- Incorporate categories for shared and individual expenses to highlight budgeting needs.

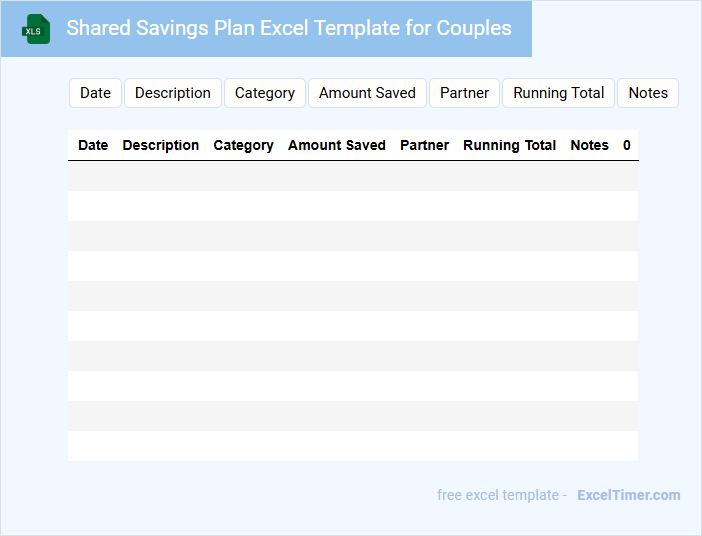

Shared Savings Plan Excel Template for Couples

A Shared Savings Plan Excel Template for couples is a practical tool designed to help partners collaboratively track their savings goals and progress. This type of document typically contains income sources, expense categories, and customizable savings targets. It is essential to ensure clear communication and regularly update the sheet to maintain accuracy and mutual accountability.

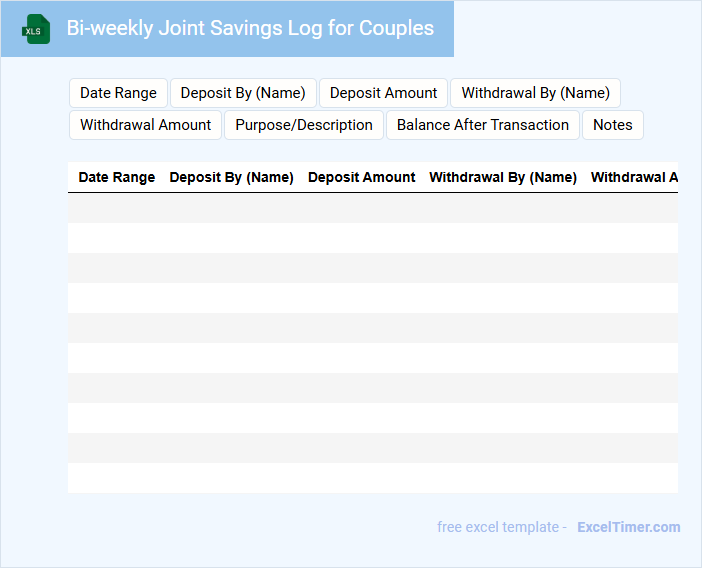

Bi-weekly Joint Savings Log for Couples

A Bi-weekly Joint Savings Log for Couples typically documents shared financial goals, contributions, and progress to enhance transparent and collaborative money management.

- Tracking Contributions: Regularly record the amount each partner saves every two weeks to maintain accountability.

- Setting Savings Goals: Define clear and achievable financial targets for both partners to work towards.

- Reviewing Progress: Periodically evaluate the log together to celebrate milestones and adjust plans if necessary.

Couples Bi-weekly Budget and Savings Tracker

A Couples Bi-weekly Budget and Savings Tracker is a financial document designed to help partners manage their income, expenses, and savings on a bi-weekly basis. It typically includes sections for tracking earnings, bills, discretionary spending, and contributions toward shared financial goals. This document encourages transparency and teamwork in managing household finances effectively.

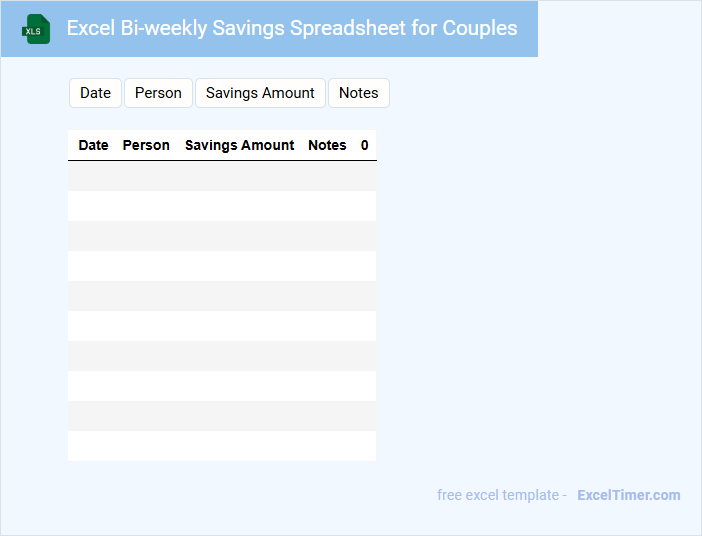

Excel Bi-weekly Savings Spreadsheet for Couples

An Excel Bi-weekly Savings Spreadsheet for Couples is a financial tool designed to track and manage savings goals collaboratively. It typically contains sections for income, expenses, savings contributions, and progress tracking. This document helps couples stay organized and motivated toward their shared financial objectives.

Key elements to include are clear categories for each partner's income and expenditures, automated calculations for bi-weekly totals, and visual charts that show progress over time. Incorporating reminders for setting aside savings and adjusting contributions can improve financial discipline. Ensuring the spreadsheet is user-friendly and regularly updated is essential for its effectiveness.

Couples’ Bi-weekly Money Management Tracker

This document typically contains a detailed record of income, expenses, and savings for both partners within a two-week period. It helps couples maintain transparency and track their financial habits effectively.

Important elements to include are clearly categorized budget allocations and joint financial goals to align spending priorities. Regular updates and honest communication are essential for this tracker's success.

Bi-weekly Savings and Expense Tracker for Couples

This type of document typically contains a detailed record of income, savings, and expenses tracked over two-week periods to help couples manage their finances collaboratively.

- Clear categories: Organize entries into income, savings, and various expense categories for better clarity.

- Consistent updates: Regularly update the tracker every two weeks to maintain accuracy and relevancy.

- Joint goals: Establish shared financial goals to encourage cooperation and accountability in saving and spending.

Bi-weekly Goal Savings Tracker Excel Sheet for Couples

A Bi-weekly Goal Savings Tracker Excel Sheet for Couples is a document designed to help partners organize and monitor their savings targets on a bi-weekly basis.

- Clear financial goals: Define specific savings objectives to maintain focus and motivation.

- Shared contributions: Track each partner's input consistently to ensure transparency and fairness.

- Progress visualization: Use charts or graphs for quick insight into how savings goals are advancing.

Couples’ Bi-weekly Income and Savings Tracker

Couples' Bi-weekly Income and Savings Tracker is typically used to monitor combined earnings and expenses over a two-week period to enhance financial planning and goal setting.

- Income Tracking: Record all sources of income to maintain accurate cash flow awareness.

- Savings Goals: Set clear targets to motivate consistent contributions towards joint savings.

- Expense Monitoring: Categorize expenses to identify spending patterns and areas for reduction.

Bi-weekly Financial Savings Tracker for Couples

A Bi-weekly Financial Savings Tracker for couples is a practical document used to monitor and record savings progress every two weeks. It typically contains income sources, expenses, and amounts saved during each period to help manage finances effectively. The tracker promotes transparency and teamwork, encouraging couples to achieve their savings goals together.

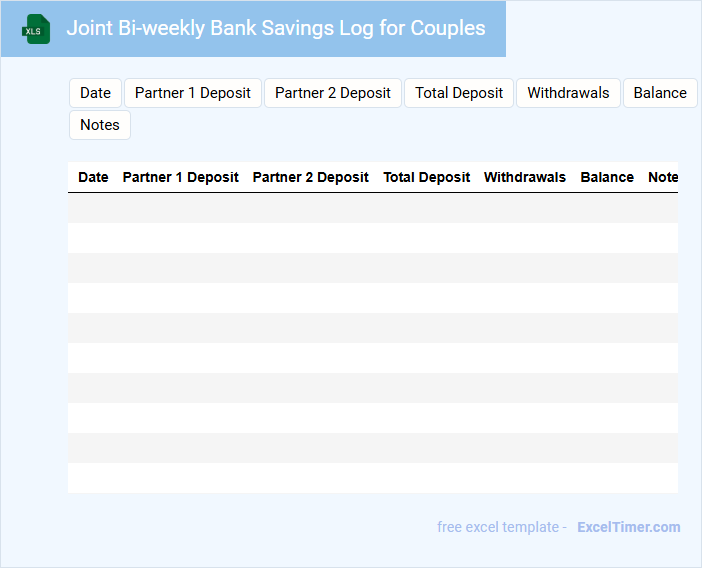

Joint Bi-weekly Bank Savings Log for Couples

The Joint Bi-weekly Bank Savings Log for couples is a financial document designed to track and manage combined savings efforts on a bi-weekly basis. It typically contains details such as deposit dates, amounts saved by each partner, and cumulative balances. This log helps couples maintain transparency, set savings goals, and monitor progress together.

Important elements to include are clear date entries, individual and total savings columns, and notes for extraordinary transactions or adjustments. It is also beneficial to define specific targets and deadlines to keep the savings plan focused and motivated. Consistent updates and reviews ensure the log remains accurate and useful for financial planning.

Excel Tracker for Couples’ Bi-weekly Savings Plan

An Excel Tracker for Couples' Bi-weekly Savings Plan is a detailed spreadsheet designed to monitor and manage savings contributions made every two weeks. It typically contains sections for recording dates, amounts saved, and cumulative totals. This document helps couples stay organized and motivated by visualizing their progress over time.

His & Hers Bi-weekly Savings Tracker for Couples

What does a His & Hers Bi-weekly Savings Tracker for Couples typically contain? This document usually includes sections to record individual and combined savings amounts every two weeks, along with goals and progress notes. It helps couples monitor their financial habits and stay motivated towards achieving shared savings objectives.

Couples’ Bi-weekly Family Savings Tracker

A Couples' Bi-weekly Family Savings Tracker is a financial document designed to record and monitor savings progress every two weeks. It helps couples stay organized and focused on their financial goals collaboratively.

This tracker usually contains fields for income, expenses, savings targets, and actual savings amounts. For effectiveness, it is important to regularly update and review the tracker to ensure accuracy and motivation.

Bi-weekly Progress Tracker for Couples’ Savings

The Bi-weekly Progress Tracker is a document used by couples to monitor their savings growth every two weeks. It typically contains sections for recording income, expenses, and amount saved during each period.

This tool helps in maintaining financial discipline and achieving shared monetary goals efficiently. Important elements to include are target savings goals, actual amount saved, and notes on any financial adjustments.

How can couples efficiently categorize and label savings goals using the Bi-weekly Savings Tracker in Excel?

Couples can efficiently categorize savings goals in the Bi-weekly Savings Tracker Excel by creating distinct columns for each category such as "Emergency Fund," "Vacation," and "Debt Repayment." Using data validation lists ensures consistent labeling and easy filtering of savings entries. Conditional formatting highlights progress toward each goal, enhancing visual tracking and motivation.

What formulas are essential for automatically calculating bi-weekly savings progress and remaining targets?

Essential formulas for a Bi-weekly Savings Tracker for couples include SUMIFS to calculate total savings per period, and a formula like =TargetAmount - SUM(SavingsRange) to determine remaining savings needed. Use IF statements to track if bi-weekly goals are met, such as =IF(BiWeeklySavings >= Goal, "On Track", "Behind"). Incorporating these formulas ensures automatic calculation of progress and remaining targets.

How should income differences be accounted for in a shared Excel bi-weekly savings document?

Account for income differences in a shared bi-weekly savings Excel tracker by allocating savings contributions proportionally based on each partner's net income. Use formulas to calculate each partner's percentage share of total combined income and automate savings targets accordingly. This approach ensures equitable savings efforts aligned with individual financial capacities.

What chart or visualization features can best illustrate savings trends for couples over time?

Line charts effectively illustrate bi-weekly savings trends by displaying data points for each period, allowing couples to track progress over time. Stacked area charts can highlight individual and combined savings contributions, emphasizing joint financial growth. Heatmaps provide a visual intensity of saving frequency and amounts, revealing patterns and peak savings periods.

How can couples securely collaborate and update the tracker in real-time using Excel?

Couples can securely collaborate on the Bi-weekly Savings Tracker by using Excel Online with OneDrive, enabling real-time updates and version control. Setting permissions ensures only authorized partners can edit or view the document, maintaining data privacy. Excel's built-in autosave and change history features help track modifications and prevent data loss during collaborative use.