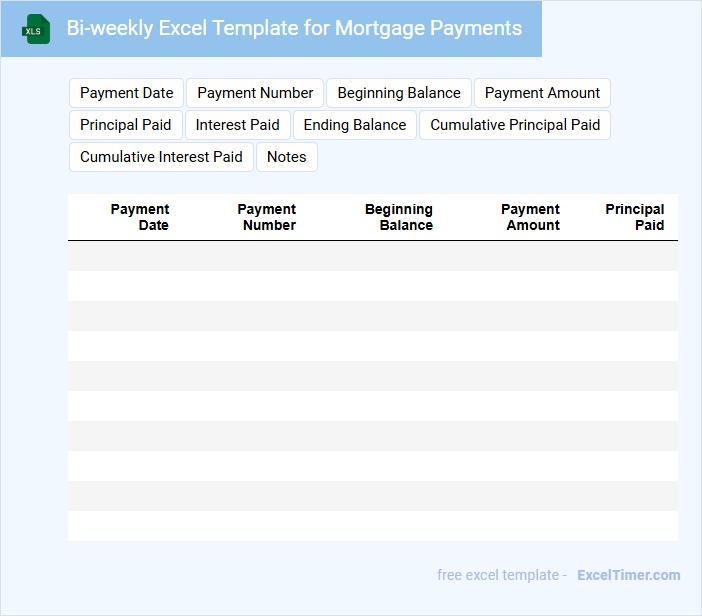

The Bi-weekly Excel Template for Mortgage Payments simplifies tracking and managing mortgage installments by allowing users to input payment dates and amounts systematically. This template helps reduce overall interest and shorten loan duration by facilitating payments every two weeks instead of monthly. Its customizable format ensures accurate forecasting and budgeting for homeowners aiming to optimize their mortgage repayment strategy.

Bi-weekly Excel Template for Mortgage Payments

This type of document usually contains a structured schedule and calculation framework for tracking bi-weekly mortgage payments efficiently.

- Payment Schedule: Clearly outline all bi-weekly payment dates and amounts.

- Interest Calculation: Incorporate accurate formulas to compute interest and principal portions.

- Summary Section: Provide a summary of total payments, remaining balance, and payoff timeline.

Mortgage Payment Tracker with Bi-weekly Schedule

A Mortgage Payment Tracker with Bi-weekly Schedule is a document designed to help homeowners manage their mortgage payments effectively by scheduling payments every two weeks instead of monthly. This tracker typically contains fields for payment dates, amounts paid, outstanding balance, and interest accrued. By using this approach, users can potentially save on interest and pay off their mortgage faster.

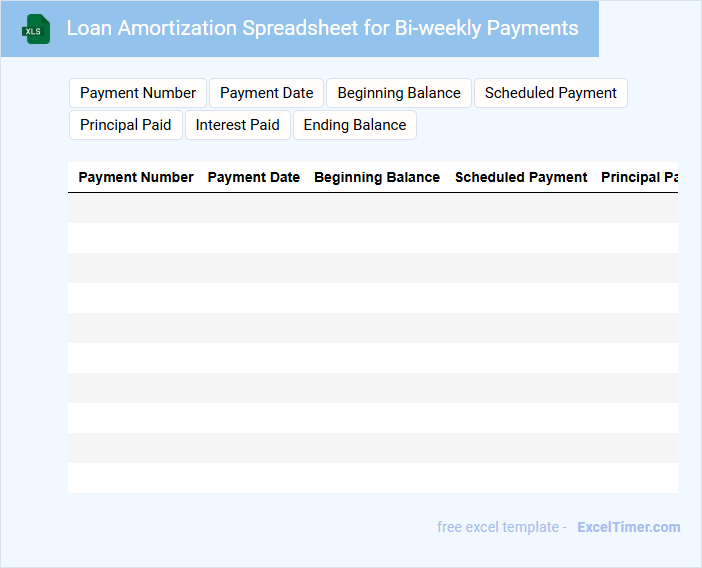

Loan Amortization Spreadsheet for Bi-weekly Payments

A Loan Amortization Spreadsheet for bi-weekly payments typically contains a detailed schedule that breaks down each payment into principal and interest components over the life of the loan. It helps track the reduction of the loan balance more frequently than monthly schedules, offering insights into interest savings and payoff acceleration. Key elements include payment dates, payment amounts, outstanding balance, and cumulative interest paid. When creating or using this spreadsheet, it is important to ensure accuracy in the payment frequency and interest calculations to reflect true financial obligations. Including a clear summary of total interest paid and the loan payoff date can provide valuable decision-making information. Additionally, adding a comparison between monthly and bi-weekly payment options can highlight potential benefits for users.

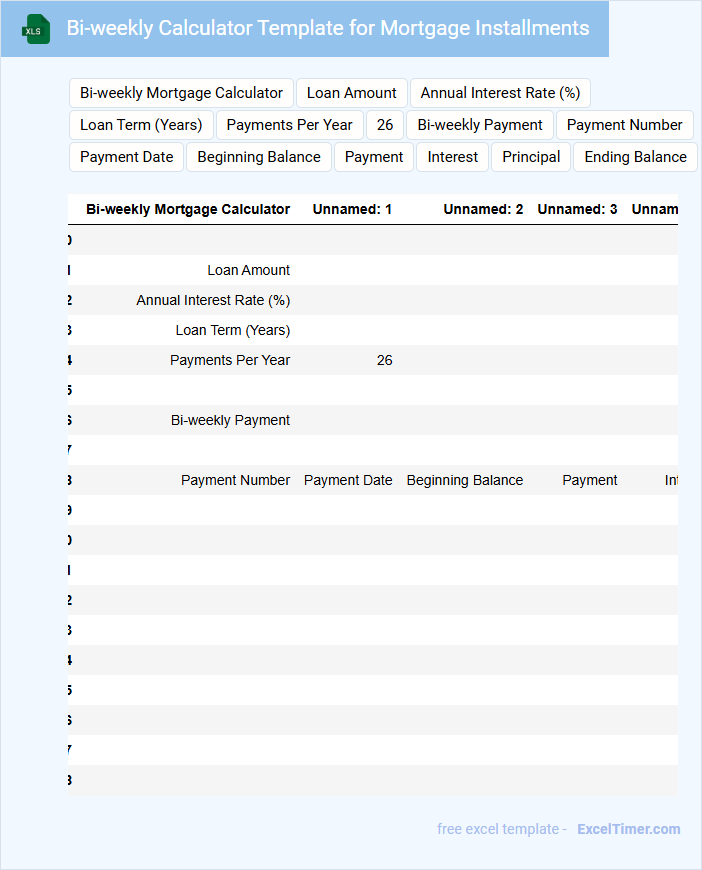

Bi-weekly Calculator Template for Mortgage Installments

A Bi-weekly Calculator Template for mortgage installments is designed to help users efficiently calculate their payment schedules based on bi-weekly contributions. This template typically includes input fields for loan amount, interest rate, and loan term to provide accurate installment amounts.

Key features include automatic amortization schedules and total interest saved when switching to bi-weekly payments. It is important to ensure the calculator allows customization for different mortgage terms and compounding frequencies.

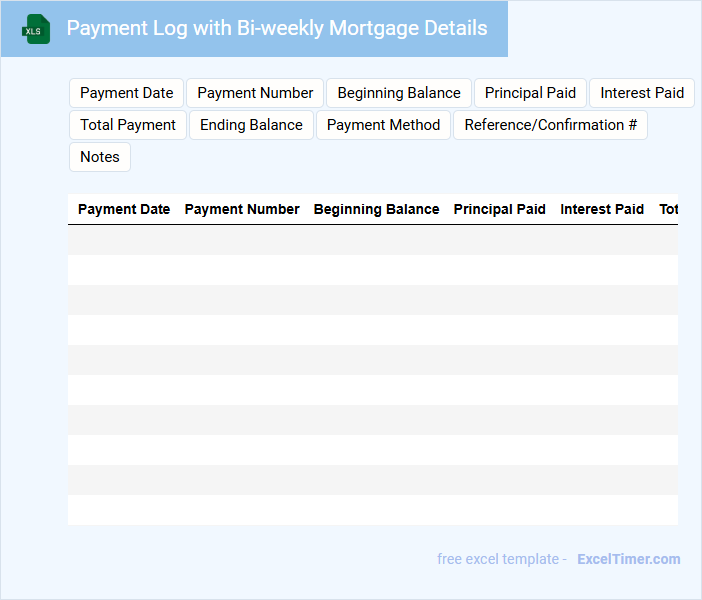

Payment Log with Bi-weekly Mortgage Details

What information is typically included in a Payment Log with Bi-weekly Mortgage Details? This document usually contains a record of bi-weekly mortgage payments, including payment dates, amounts, principal and interest breakdowns, and remaining balance. It helps homeowners track their progress, identify discrepancies, and manage their budget effectively.

Why is it important to maintain an accurate Payment Log with Bi-weekly Mortgage Details? Keeping precise entries allows for early detection of errors or missed payments, ensuring timely corrections and improved financial planning. Additionally, it provides clear documentation useful for tax purposes and refinancing considerations.

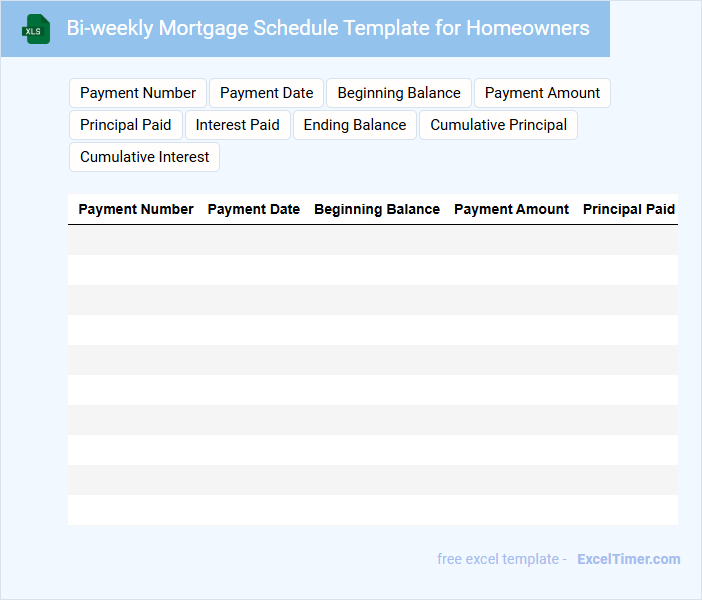

Bi-weekly Mortgage Schedule Template for Homeowners

What information is typically included in a Bi-weekly Mortgage Schedule Template for Homeowners? This document usually contains a detailed breakdown of mortgage payments made every two weeks, including principal and interest amounts, payment dates, and remaining loan balance. It helps homeowners track their progress toward paying off their mortgage efficiently.

What is an important consideration when using this template? Ensuring accuracy in payment dates and amounts is crucial to avoid discrepancies and to maximize interest savings. Regular updates and monitoring of the schedule can help homeowners stay on budget and reduce overall mortgage duration.

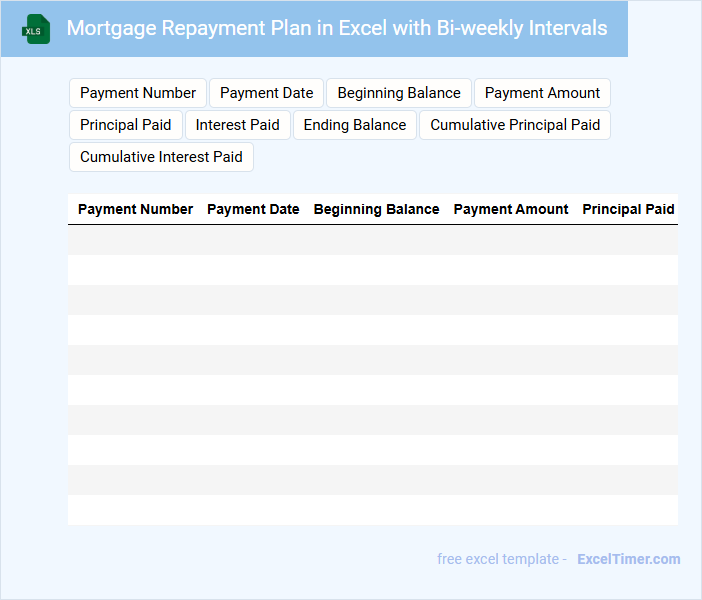

Mortgage Repayment Plan in Excel with Bi-weekly Intervals

Mortgage Repayment Plan in Excel with Bi-weekly Intervals typically contains detailed loan information, payment schedules, and calculations to help manage and track mortgage repayments effectively.

- Loan Details: Includes principal amount, interest rate, and loan term.

- Bi-weekly Payment Schedule: Displays payment dates and amounts to facilitate more frequent payments.

- Amortization Calculations: Shows remaining balance, interest paid, and overall savings over time.

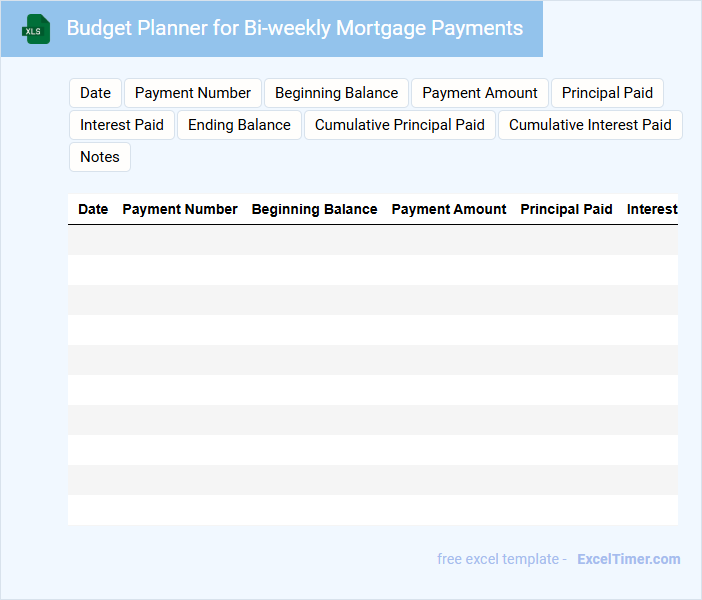

Budget Planner for Bi-weekly Mortgage Payments

What information is typically included in a Budget Planner for Bi-weekly Mortgage Payments? This document usually contains detailed categories for income, expenses, and mortgage payment schedules broken down into bi-weekly amounts. It helps to track and manage finances to ensure timely payments and avoid additional interest charges.

What important considerations should be made when using this type of budget planner? It is crucial to accurately calculate your bi-weekly income and mortgage obligations to prevent shortfalls. Additionally, including savings for emergencies and potential interest rate changes can improve financial stability.

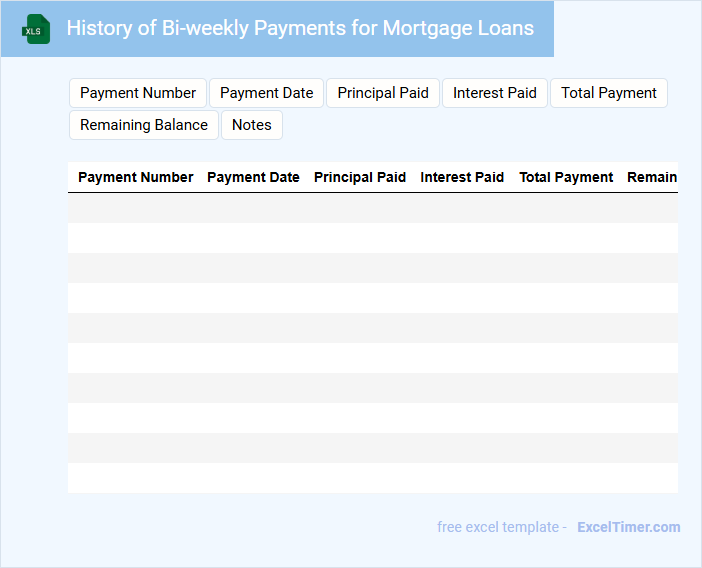

History of Bi-weekly Payments for Mortgage Loans

This document typically contains a detailed overview of the history and evolution of bi-weekly payment plans for mortgage loans. It outlines how these payment structures have been implemented over time to help borrowers pay off their mortgages faster and save on interest. Important suggestions include emphasizing the benefits of early repayments and understanding potential fees related to bi-weekly schedules.

Excel Sheet with Graphs for Bi-weekly Mortgage Tracking

An Excel Sheet with Graphs for Bi-weekly Mortgage Tracking typically contains detailed financial data including payment dates, amounts, interest rates, and remaining balances. It visually represents trends and progress using graphs, helping users easily monitor their mortgage payoff status. For effective tracking, it's important to regularly update the sheet with accurate payment entries and highlight any deviations from the planned payment schedule.

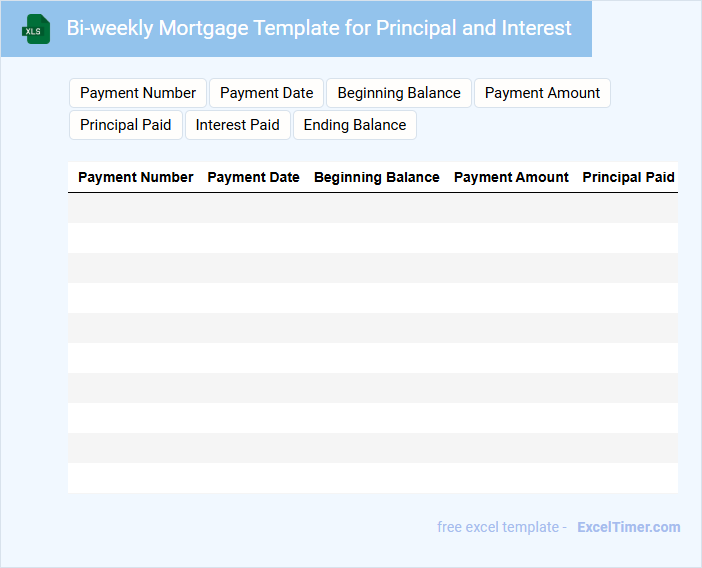

Bi-weekly Mortgage Template for Principal and Interest

A Bi-weekly Mortgage Template for Principal and Interest typically contains a detailed breakdown of payment schedules, including principal repayment and interest calculations. It helps borrowers track their mortgage payments every two weeks, rather than monthly, to reduce interest over time.

This document often includes fields for payment dates, amounts, outstanding balance, and cumulative interest paid. Ensuring accurate interest rate input and consistent bi-weekly payment tracking is essential for maximizing savings and loan payoff efficiency.

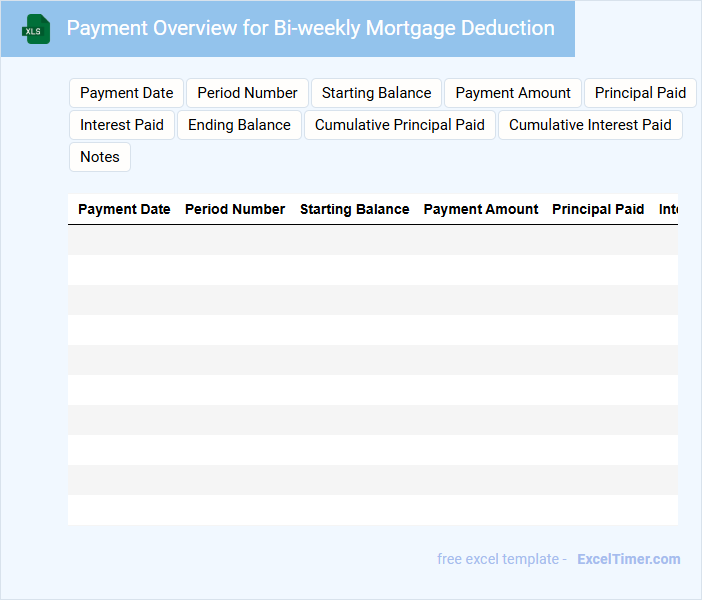

Payment Overview for Bi-weekly Mortgage Deduction

This Payment Overview document typically details the bi-weekly deduction amounts applied to a mortgage payment schedule. It includes a breakdown of principal and interest components, along with any additional fees or escrow contributions. This overview helps borrowers understand how their payments impact the loan balance over time.

Important elements to consider in this document are the exact deduction dates, total payment amounts, and how each payment affects the remaining mortgage term. Clear identification of any changes to payment amounts or schedules should also be highlighted. These points ensure transparency and aid in effective financial planning.

Reviewing this document regularly ensures accuracy and helps avoid any missed or incorrect deductions. It is also advisable to monitor how early payments may reduce interest costs or shorten the loan term. Staying informed supports better mortgage management and financial stability.

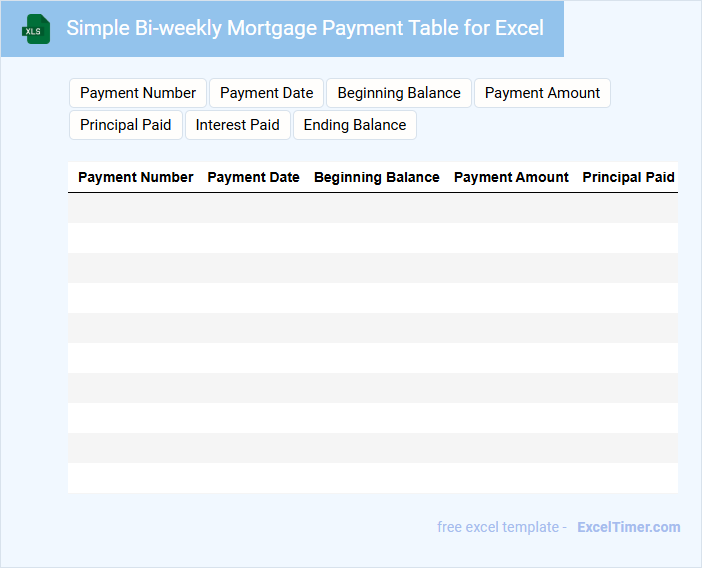

Simple Bi-weekly Mortgage Payment Table for Excel

A Simple Bi-weekly Mortgage Payment Table for Excel typically contains a schedule of payment dates, amounts, and remaining balances based on bi-weekly payments. It helps users track their mortgage payoff progress and interest savings over time.

- Include columns for payment number, payment date, payment amount, principal paid, interest paid, and remaining balance.

- Ensure formulas automatically update balances and interest calculations accurately for each bi-weekly period.

- Highlight total interest saved compared to monthly payments to visualize benefits clearly.

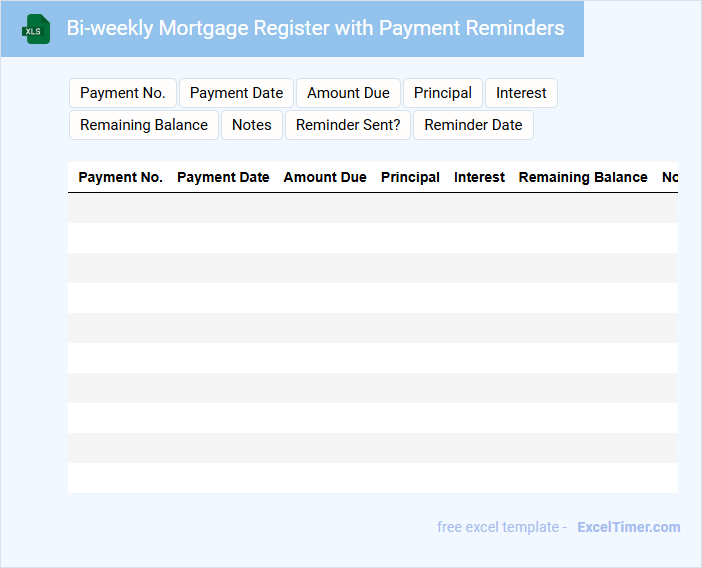

Bi-weekly Mortgage Register with Payment Reminders

The Bi-weekly Mortgage Register is a document that tracks mortgage payments made every two weeks, helping borrowers maintain a clear schedule of their financial obligations. It typically contains detailed records of payment dates, amounts, and outstanding balances, alongside reminders for upcoming due payments. Including payment reminders ensures timely payments, preventing late fees and improving credit scores.

Progress Tracker for Bi-weekly Mortgage Payments

A Progress Tracker for bi-weekly mortgage payments is a document that helps borrowers monitor their payment schedule and outstanding mortgage balance. It typically includes payment dates, amounts paid, and remaining loan balance to ensure timely and consistent payments.

This type of document is important for maintaining financial discipline and visualizing the impact of bi-weekly payments on loan payoff. Including reminders for due dates and cumulative interest saved can enhance the tracker's effectiveness.

What is the main advantage of choosing bi-weekly mortgage payments over monthly payments?

Choosing bi-weekly mortgage payments reduces your loan term and total interest paid by making extra payments each year. You effectively make one additional monthly payment annually, accelerating principal reduction. This strategy leads to significant long-term savings on your mortgage.

How does a bi-weekly payment schedule impact the total interest paid over the life of a mortgage?

A bi-weekly payment schedule reduces the total interest paid over the life of a mortgage by accelerating principal repayment. Making 26 half-payments annually equates to one extra full payment each year, shortening the loan term. This payment strategy can save thousands in interest and pay off the mortgage faster compared to monthly payments.

How do you calculate the number of extra payments made per year with a bi-weekly schedule in Excel?

To calculate extra mortgage payments per year using a bi-weekly schedule in Excel, divide the total number of bi-weekly payments by 26, then subtract 12 to account for monthly payment equivalence. Use the formula: =INT(Total_BiWeekly_Payments/26)-12. This shows the number of additional monthly payments made annually through bi-weekly payments.

Which Excel formula can be used to compare the payoff time between monthly and bi-weekly payment plans?

Use the NPER function in Excel to compare payoff times by calculating the number of periods for both monthly and bi-weekly payments. For monthly payments, apply =NPER(monthly_interest_rate, -monthly_payment, loan_amount). For bi-weekly payments, use =NPER(biweekly_interest_rate, -biweekly_payment, loan_amount). This comparison reveals the time difference in loan payoff between the two payment schedules.

What are the required columns and key data points to include in an Excel amortization table for bi-weekly mortgage payments?

Your bi-weekly mortgage payment amortization table should include columns for Payment Number, Payment Date, Beginning Balance, Bi-Weekly Payment Amount, Principal Paid, Interest Paid, and Ending Balance. Key data points are the loan amount, interest rate, loan term, and payment frequency to accurately calculate the gradual reduction of your mortgage balance. This setup helps you track your payment schedule and see the impact of bi-weekly payments on loan payoff time.