The Bi-weekly Bill Payment Excel Template for Personal Finance helps users efficiently track and manage their bills on a bi-weekly schedule, ensuring timely payments and avoiding late fees. This template allows for easy customization of bill categories, due dates, and payment amounts, offering a clear overview of cash flow. Maintaining consistent bi-weekly tracking with this tool significantly improves financial organization and budgeting accuracy.

Bi-Weekly Bill Payment Tracker for Personal Finance

A Bi-Weekly Bill Payment Tracker for Personal Finance is a document designed to help individuals monitor and manage their recurring expenses every two weeks efficiently.

- Expense Monitoring: It keeps track of due dates and amounts for all bi-weekly bills to avoid late payments.

- Budget Management: It helps allocate funds properly within each paycheck period.

- Financial Planning: It provides a clear overview for forecasting upcoming payments and adjustments.

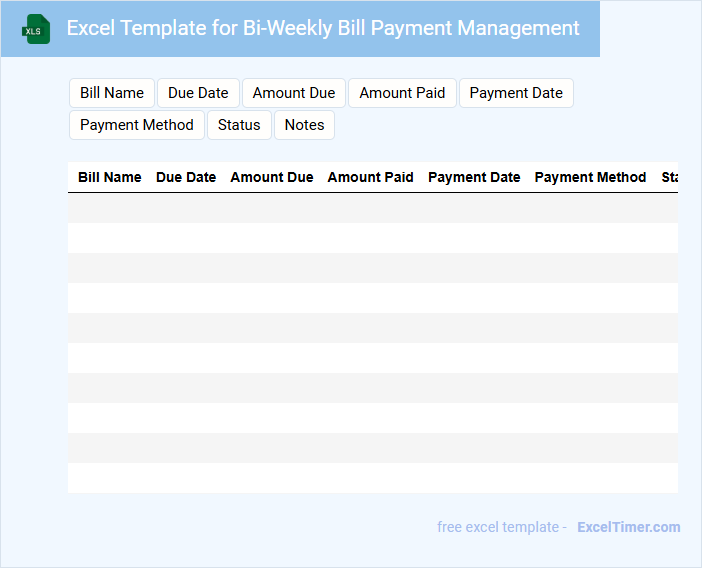

Excel Template for Bi-Weekly Bill Payment Management

What information is typically contained in an Excel Template for Bi-Weekly Bill Payment Management? This type of document usually includes fields for listing due bills, payment amounts, due dates, and payment status updates, helping to organize and track financial obligations efficiently. It often features automated calculations and reminders to ensure timely payments and avoid late fees.

What is an important aspect to consider when using this template? Maintaining accurate and up-to-date bill information is crucial, as is setting reminders for upcoming payments to manage cash flow effectively. Additionally, customizing categories and payment details can enhance clarity and improve financial planning.

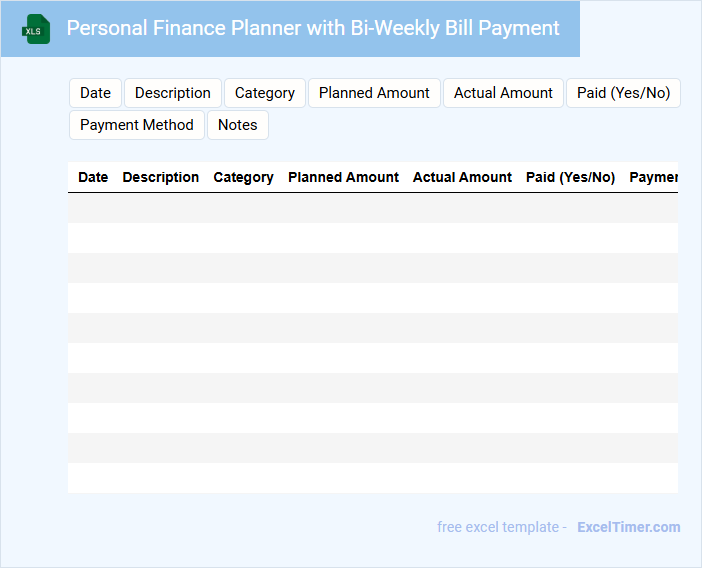

Personal Finance Planner with Bi-Weekly Bill Payment

What key information does a Personal Finance Planner with Bi-Weekly Bill Payment usually contain? This document typically includes a detailed schedule of income and expenses, specifically aligned with bi-weekly pay periods. It also tracks bill due dates, amounts, and payment methods to ensure timely and efficient management of finances.

Why is it important to focus on bill synchronization and savings goals in this planner? Synchronizing bill payments with your bi-weekly income helps avoid late fees and cash flow issues. Additionally, setting clear savings targets within the planner promotes disciplined financial habits and long-term stability.

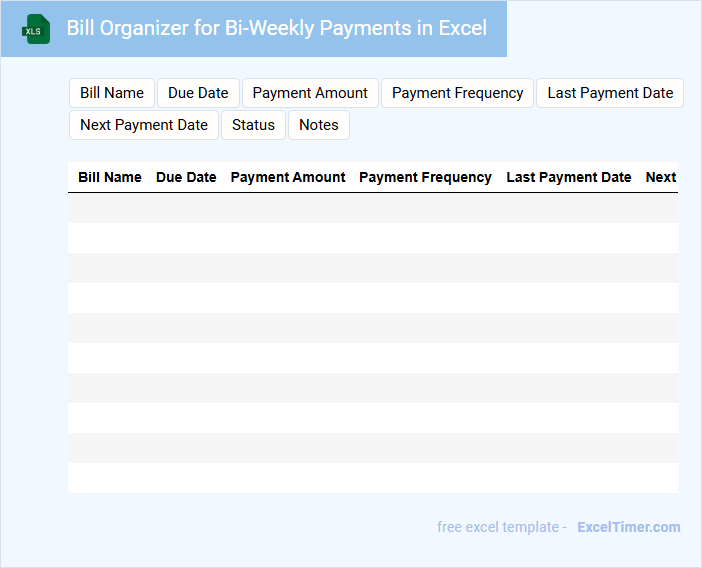

Bill Organizer for Bi-Weekly Payments in Excel

A Bill Organizer for Bi-Weekly Payments in Excel is designed to help manage and track bills that are paid every two weeks. It typically includes columns for due dates, payment amounts, and payment status to ensure timely payments. This tool is essential for maintaining financial accuracy and avoiding late fees.

Key features should include automated calculations for bi-weekly intervals, clear categorization of expenses, and reminders for upcoming payments. Customizable templates can enhance usability for different bill types and personal budgets. Consistent updating and reviewing the organizer ensures effective financial management.

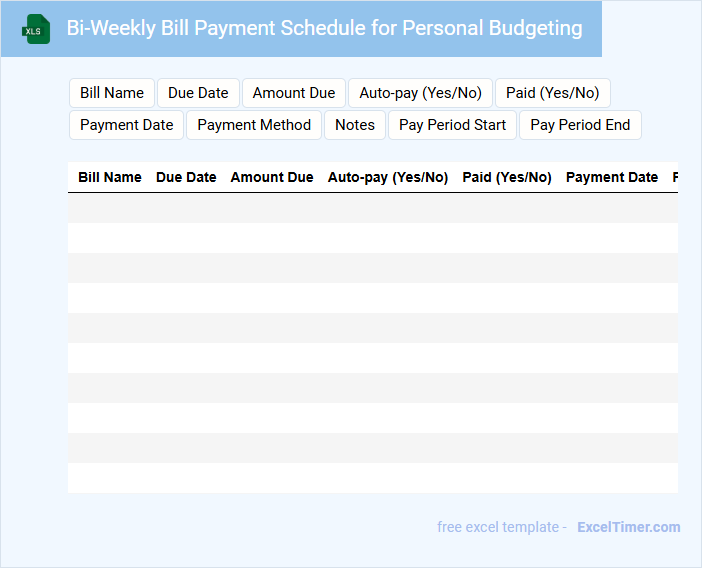

Bi-Weekly Bill Payment Schedule for Personal Budgeting

A Bi-Weekly Bill Payment Schedule is a document designed to track and organize all recurring payments made every two weeks. It helps individuals manage their personal finances by aligning bill due dates with pay periods, preventing missed or late payments. This schedule enhances budgeting accuracy and financial planning, ensuring timely bill settlements and improved cash flow management.

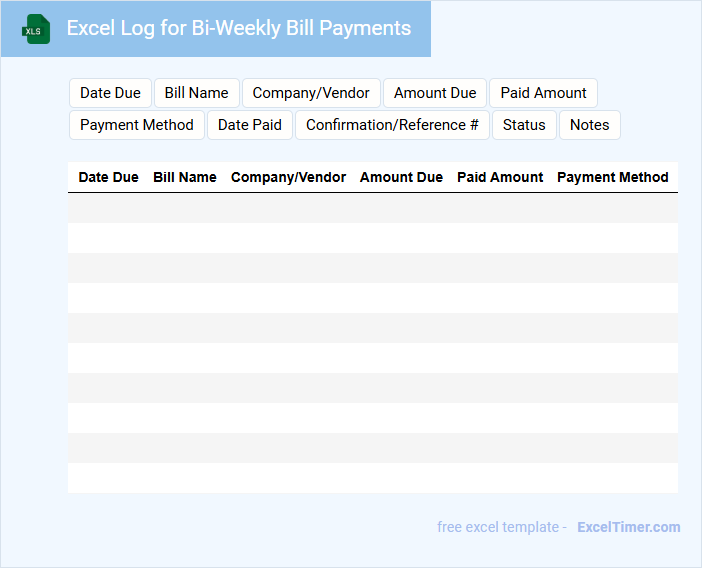

Excel Log for Bi-Weekly Bill Payments

An Excel log for bi-weekly bill payments typically contains organized records of payment dates, amounts, and statuses to ensure timely financial management.

- Accurate Date Tracking: Consistently record payment dates to avoid missed or late payments.

- Clear Payment Status: Mark payments as pending, completed, or overdue for easy monitoring.

- Comprehensive Amount Details: Include exact payment amounts and any notes for discrepancies or adjustments.

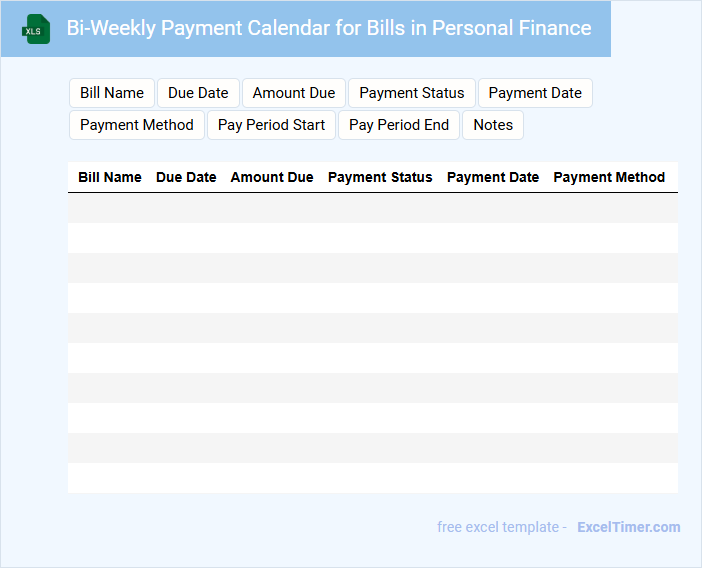

Bi-Weekly Payment Calendar for Bills in Personal Finance

A Bi-Weekly Payment Calendar for bills is a crucial tool in personal finance that helps individuals track their expenses and payment due dates every two weeks. This document typically contains dates, bill names, amounts due, and payment status to ensure timely payments. An important suggestion is to include reminders and prioritize high-interest bills to avoid late fees and improve credit health.

Personal Finance Worksheet with Bi-Weekly Bill Tracking

What information is typically included in a Personal Finance Worksheet with Bi-Weekly Bill Tracking? This document usually contains detailed sections for income, expenses, and bills organized on a bi-weekly basis to help users monitor their cash flow effectively. It provides a clear overview of financial obligations and assists in budgeting by tracking due dates and payment amounts every two weeks.

Why is bi-weekly bill tracking important in personal finance management? Tracking bills every two weeks aligns with many payroll schedules, allowing for better planning and timely payments to avoid late fees. It also helps individuals identify spending patterns and areas where they can save money or adjust their budget.

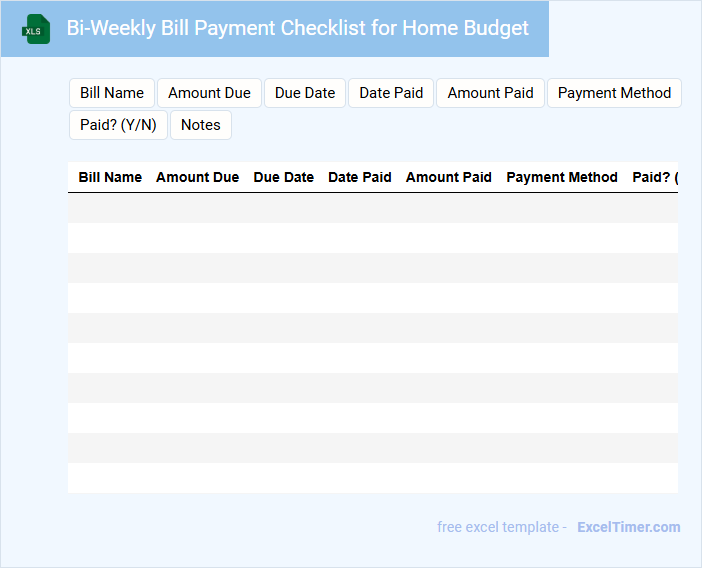

Bi-Weekly Bill Payment Checklist for Home Budget

What does a Bi-Weekly Bill Payment Checklist for Home Budget usually contain and why is it important? This type of document typically lists all recurring bills and expenses that need to be paid every two weeks, helping individuals manage their finances efficiently. It serves as a crucial tool to avoid missed payments and maintain a balanced budget.

Important suggestions for this checklist include clearly categorizing bills by priority, due date, and payment method to streamline organization. Additionally, including a section for tracking payment confirmations and noting any changes in amounts helps ensure accuracy and accountability.

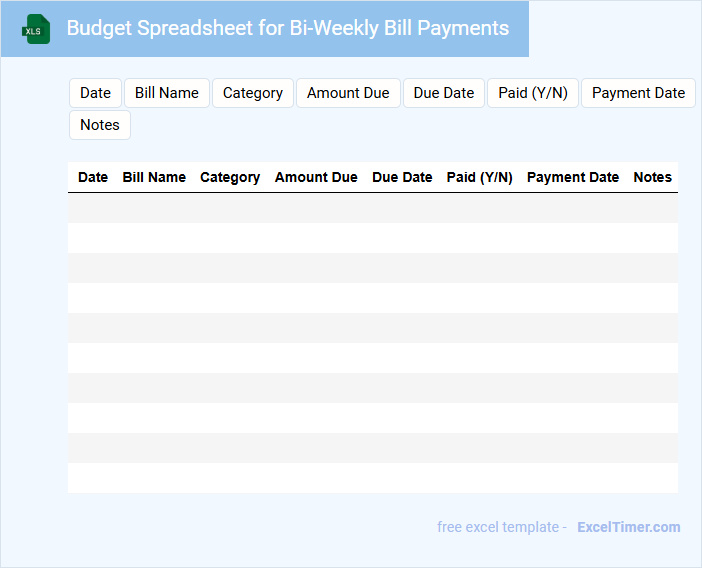

Budget Spreadsheet for Bi-Weekly Bill Payments

A Budget Spreadsheet for Bi-Weekly Bill Payments typically contains organized financial data to help manage expenses and track payment schedules efficiently.

- Payment Dates: Clearly list all bi-weekly due dates to avoid missing any bills.

- Expense Categories: Categorize each bill to monitor spending patterns and prioritize payments.

- Balance Tracking: Include running totals to ensure there are sufficient funds for upcoming payments.

Bi-Weekly Bill Payment Tracker with Due Dates

A Bi-Weekly Bill Payment Tracker is a tool designed to help individuals or households organize their bill payments on a bi-weekly schedule. It typically contains columns for the bill name, amount due, due date, and payment status to ensure timely payments and avoid late fees. An important suggestion is to regularly update the tracker immediately after making payments to maintain accuracy and stay on top of financial obligations.

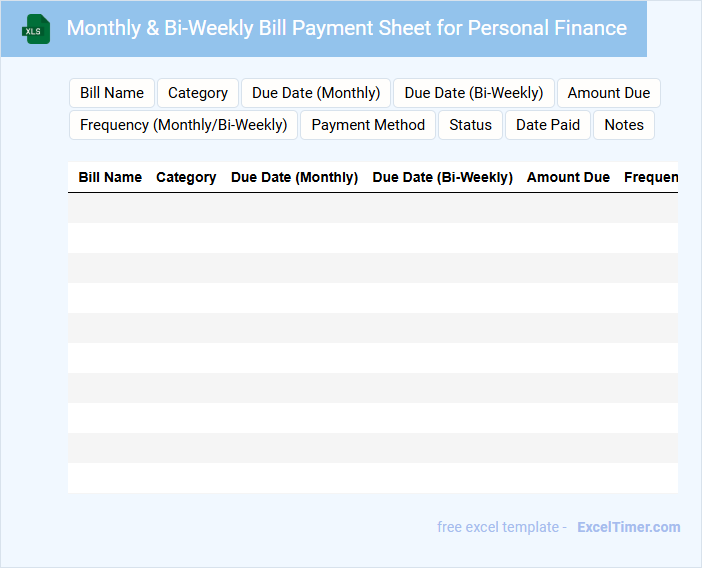

Monthly & Bi-Weekly Bill Payment Sheet for Personal Finance

A Monthly & Bi-Weekly Bill Payment Sheet for Personal Finance typically contains a detailed record of all recurring expenses categorized by payment frequency to help manage and track personal financial obligations efficiently.

- Bill Categories: Clearly list all bills such as utilities, rent, subscriptions, and loans to ensure nothing is overlooked.

- Payment Dates: Include exact due dates to avoid late fees and maintain a consistent payment schedule.

- Payment Status: Track each bill's status as paid or pending to monitor cash flow and budget accurately.

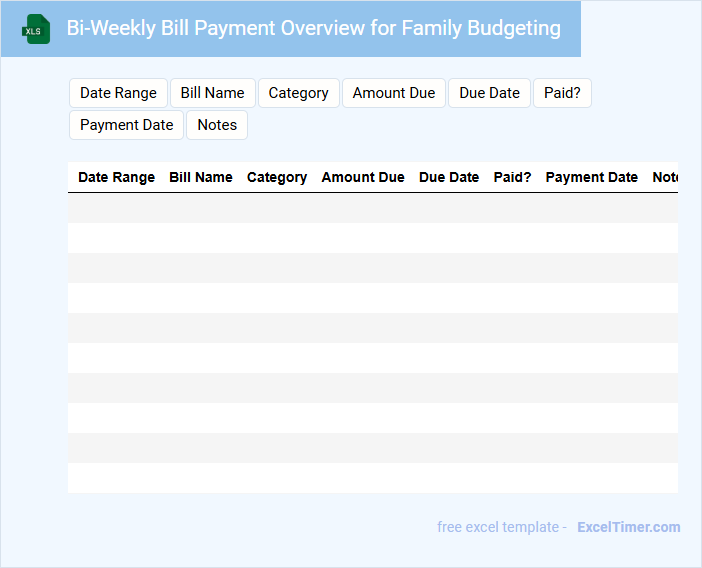

Bi-Weekly Bill Payment Overview for Family Budgeting

A Bi-Weekly Bill Payment Overview document typically contains a detailed summary of all recurring expenses scheduled every two weeks. It helps families track payment dates, amounts, and due dates to avoid missed payments and manage cash flow effectively. Including categories such as utilities, rent, subscriptions, and loan payments is essential for accurate budgeting.

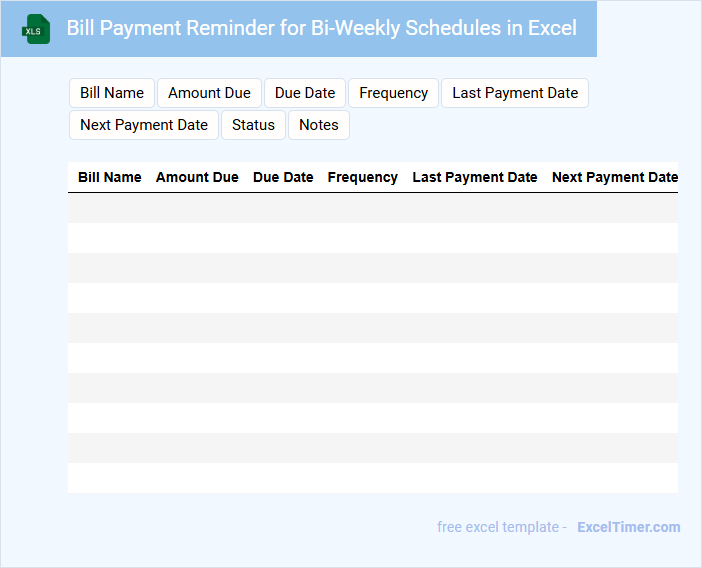

Bill Payment Reminder for Bi-Weekly Schedules in Excel

A Bill Payment Reminder document typically contains scheduled dates for upcoming payments, amounts due, and the payee's details. It helps ensure timely payments, avoiding late fees and maintaining good credit.

For Bi-Weekly Schedules in Excel, the document is organized to track payments every two weeks, aligning with pay cycles or budget plans. Including automated formulas for due dates and alerts enhances efficiency and accuracy.

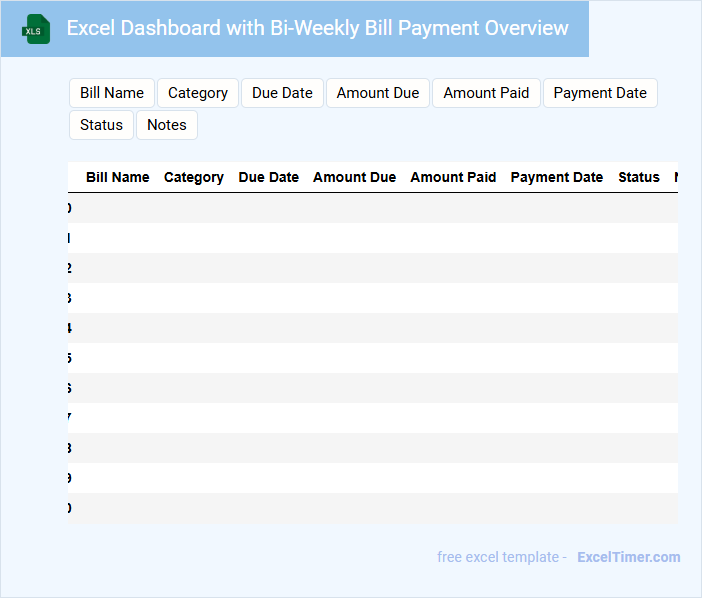

Excel Dashboard with Bi-Weekly Bill Payment Overview

What information is typically contained in an Excel Dashboard with a Bi-Weekly Bill Payment Overview?

This document usually includes a summary of all bills due within each bi-weekly period, payment statuses, and total amounts paid or pending. It provides a clear visual tracking system to ensure timely payments, highlighting any overdue or upcoming bills for effective financial management.

It is important to incorporate dynamic charts, clear labels, and conditional formatting to quickly identify payment trends and outstanding bills. Additionally, including automated date ranges and reminders can enhance accuracy and usability for ongoing financial oversight.

How does bi-weekly bill payment impact interest savings on personal loans or mortgages?

Bi-weekly bill payments reduce the loan principal faster by making 26 half-payments annually, equivalent to 13 full payments. This accelerated repayment schedule lowers the outstanding balance more quickly, resulting in significant interest savings over the loan term. Personal loans and mortgages benefit from decreased total interest costs and shorter payoff periods.

What is the calculation method for scheduling bi-weekly payments in an Excel document?

To schedule bi-weekly payments in an Excel document, use the formula =Start_Date + 14 * (Payment_Number - 1), where Start_Date is the date of the first payment and Payment_Number is the sequence of payments. This calculation adds 14 days for each payment interval, ensuring payments occur every two weeks. Excel's DATE and ROW functions can automate this process for dynamic schedules.

Which Excel functions help track bi-weekly payment due dates and amounts?

Excel functions like DATE, EDATE, and IF support tracking bi-weekly payment due dates by calculating recurring dates based on a start date. SUMIFS allows summing payment amounts within specific date ranges for precise financial analysis. VLOOKUP or INDEX-MATCH efficiently retrieves corresponding payment details from organized records, streamlining bi-weekly bill management.

How can Excel be used to compare total payments between monthly and bi-weekly payment strategies?

Excel can calculate and compare total payments by creating separate columns for monthly and bi-weekly payments with corresponding payment amounts, interest rates, and loan terms. Using formulas like SUMPRODUCT and PMT, Excel computes total interest and principal paid over time for each strategy. Visualization tools such as charts highlight differences in total payments, enabling clear comparison of financial impact between monthly and bi-weekly plans.

What are key columns and data points to include in an Excel spreadsheet for efficient bi-weekly bill payment tracking?

Key columns for a bi-weekly bill payment Excel spreadsheet include Bill Name, Due Date, Payment Amount, Payment Date, Payment Status (Paid/Pending), Payment Method, and Notes. Include data points such as bill frequency, auto-pay status, and total amount paid per period for comprehensive tracking. Use conditional formatting to highlight upcoming due dates and overdue payments for efficient management.