The Bi-weekly Payroll Calculator Excel Template for Small Businesses streamlines payroll processing by automating employee wage calculations every two weeks, ensuring accuracy and efficiency. This template handles tax deductions, overtime, and benefits management, reducing errors and saving time for small business owners. Utilizing this tool helps maintain compliance with payroll regulations while providing clear financial records for payroll periods.

Bi-weekly Payroll Calculator Excel Template for Small Businesses

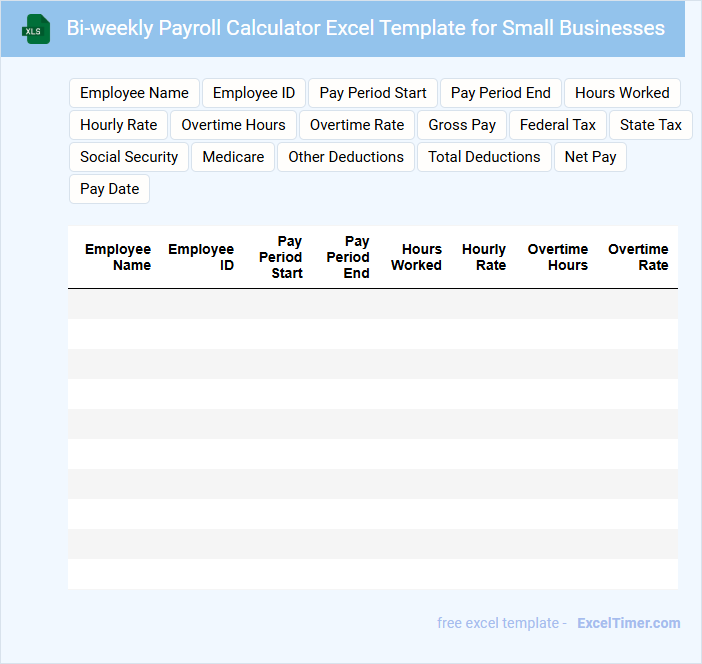

A Bi-weekly Payroll Calculator Excel Template is designed to help small businesses efficiently manage employee payroll by calculating wages, taxes, and deductions every two weeks. It typically includes fields for hours worked, pay rates, tax withholdings, and benefits contributions. This document ensures accuracy and compliance with payroll regulations.

Small businesses should prioritize including clear instructions and customizable tax parameters in the template to accommodate various employee scenarios and regional tax laws. Integration with time tracking and accounting systems can further streamline payroll processes. Maintaining updated tax tables is essential for precise payroll calculations.

Bi-weekly Payroll Tracker for Small Business Teams

A Bi-weekly Payroll Tracker document typically contains detailed records of employee work hours, salary calculations, and tax deductions for each two-week pay period. It helps small business teams maintain accurate and timely payroll processing, ensuring compliance with labor laws. To optimize its use, it is important to consistently update employee attendance and verify salary details before finalizing the payroll.

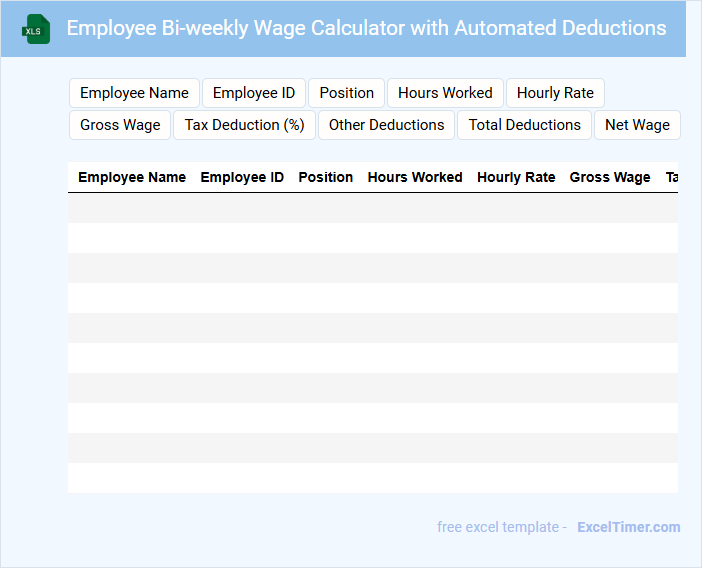

Employee Bi-weekly Wage Calculator with Automated Deductions

An Employee Bi-weekly Wage Calculator typically contains detailed information about an employee's hours worked, pay rates, and total earnings for each two-week period. It also includes automated deductions such as taxes, social security, and benefits contributions to arrive at the net pay. This document helps employers and employees easily track compensation and ensure accurate payroll processing.

For optimal use, ensure the calculator is updated with current tax rates and deduction rules to maintain compliance. Including a clear summary of gross pay, deductions, and net pay improves transparency. Additionally, integrating overtime calculations and employee-specific benefits enhances accuracy and usefulness.

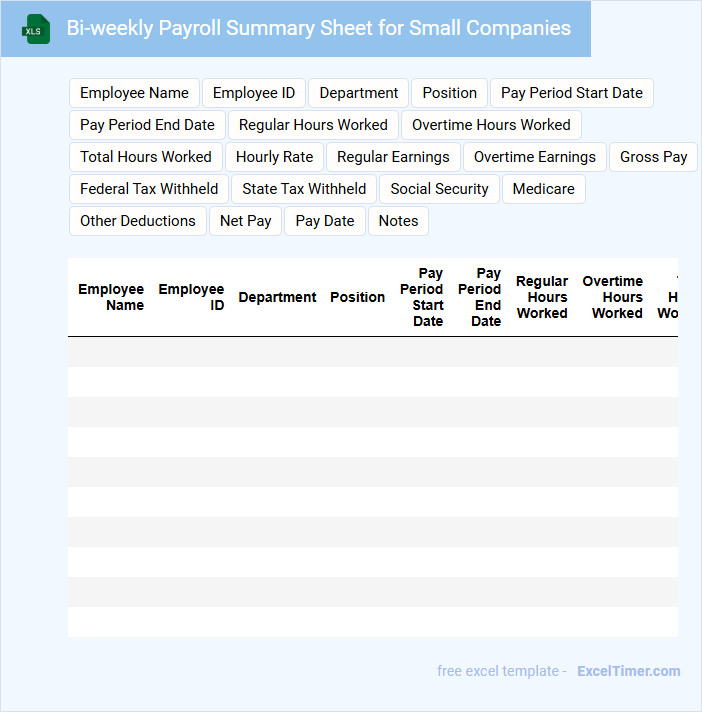

Bi-weekly Payroll Summary Sheet for Small Companies

A Bi-weekly Payroll Summary Sheet for small companies typically contains detailed records of employee hours worked, wages paid, and deductions for a two-week period. It serves as an essential tool for ensuring accurate payroll processing and compliance with tax regulations. Maintaining clear and organized payroll summaries helps in efficient financial management and auditing.

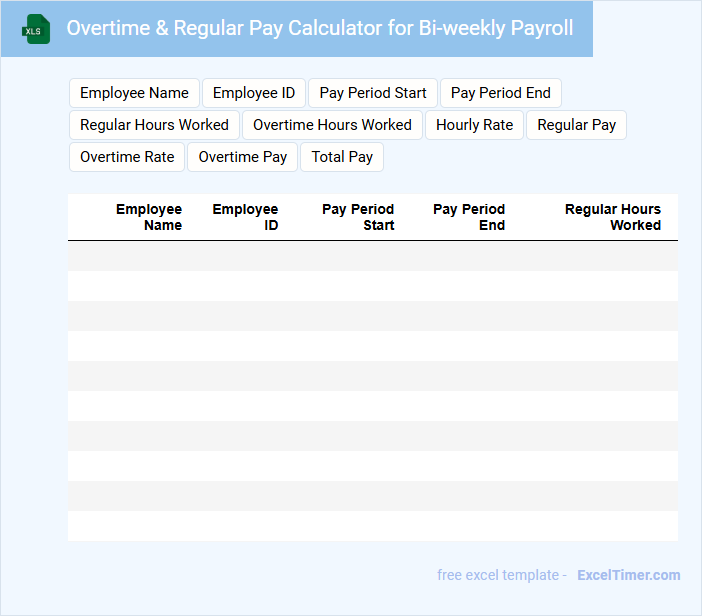

Overtime & Regular Pay Calculator for Bi-weekly Payroll

This document typically contains formulas and input fields for calculating both overtime and regular pay based on hours worked in a bi-weekly pay period. It ensures accurate payroll processing by distinguishing between standard and extra working hours.

- Include clear distinctions between regular hours and overtime hours to avoid calculation errors.

- Incorporate fields for pay rates that can be easily updated for different employees or pay scales.

- Provide a summary section showing total earnings, taxes, and deductions for transparency.

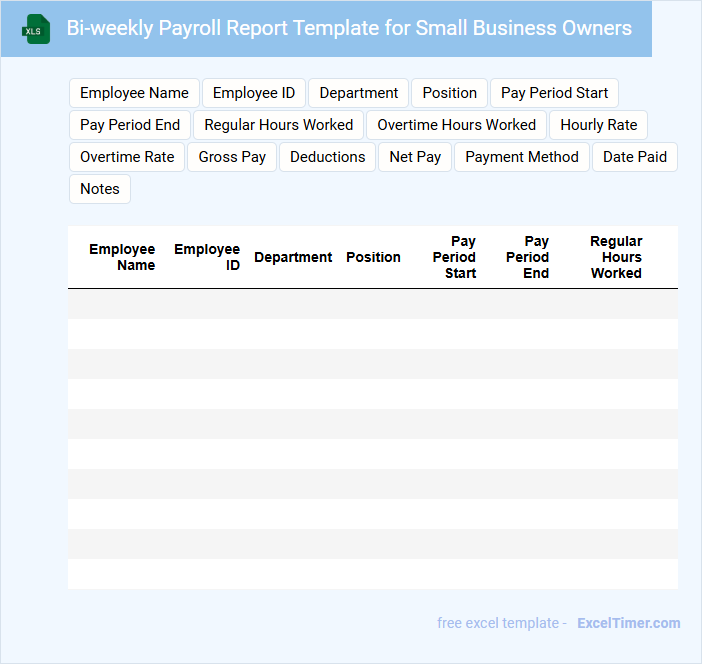

Bi-weekly Payroll Report Template for Small Business Owners

The Bi-weekly Payroll Report is an essential document for small business owners to track employee wages and deductions accurately. It typically contains detailed information about hours worked, payment amounts, and applicable taxes for each employee over a two-week period. Maintaining this report helps ensure regulatory compliance and aids in efficient financial planning.

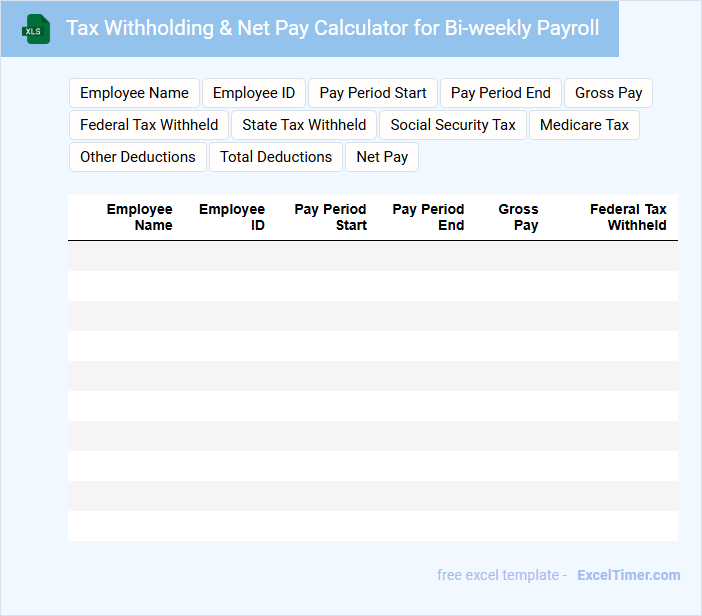

Tax Withholding & Net Pay Calculator for Bi-weekly Payroll

This document typically contains detailed information about tax withholding amounts and the calculation of net pay for employees paid on a bi-weekly schedule. It breaks down earnings, deductions, and applicable tax rates to ensure accurate payroll processing.

Important considerations include ensuring correct tax codes are applied and verifying inputs such as gross pay and withholding allowances. Regular updates to tax tables and compliance with current regulations are essential for accuracy.

Utilizing this calculator helps employers and employees understand paycheck deductions and final take-home pay clearly.

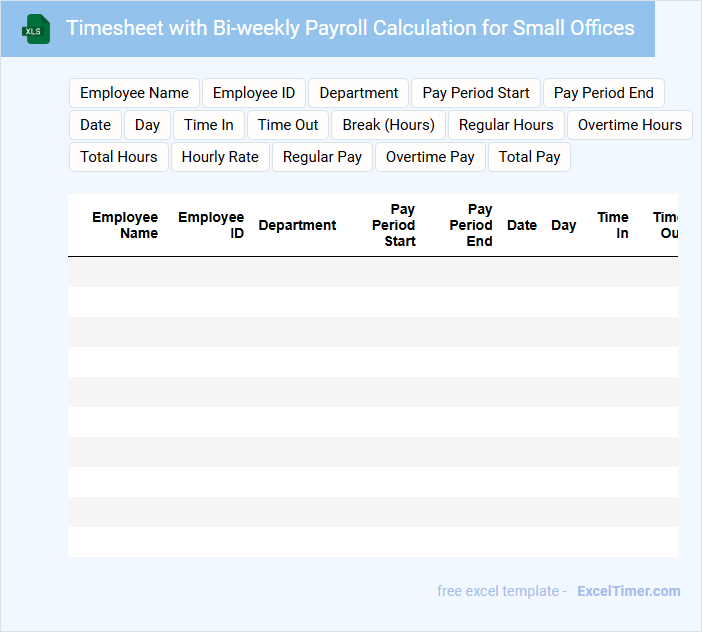

Timesheet with Bi-weekly Payroll Calculation for Small Offices

What information is typically included in a timesheet with bi-weekly payroll calculation for small offices? This document usually contains detailed records of employee working hours, including start and end times for each day, overtime, and break periods. It also includes calculations for total hours worked within a two-week pay period, helping businesses accurately process payroll, manage labor costs, and ensure compliance with labor laws.

What important elements should be considered when creating this type of timesheet? It is crucial to include clear date ranges, employee identification details, and an accurate method for totaling hours and computing pay rates. Additionally, integrating overtime rules, tax deductions, and space for supervisor approval enhances the reliability and legal validity of the payroll process.

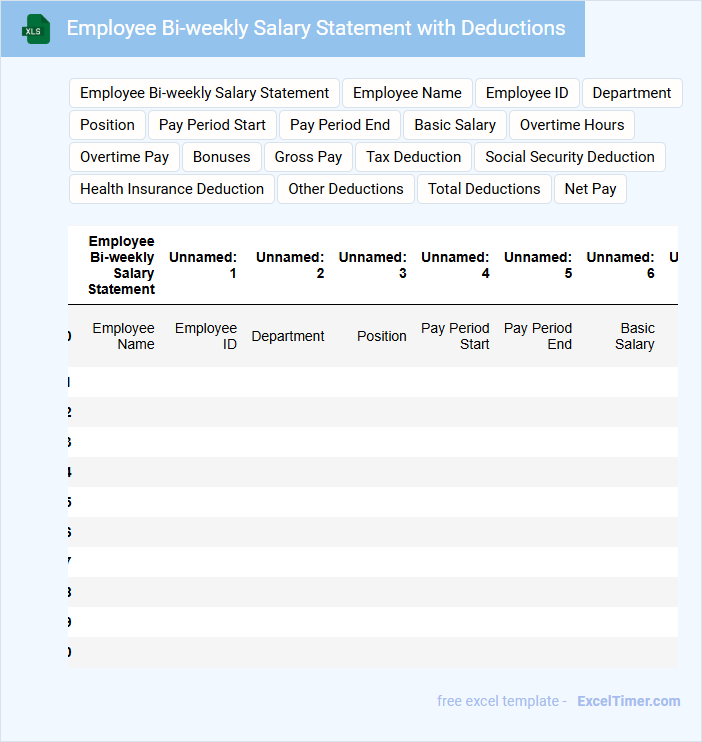

Employee Bi-weekly Salary Statement with Deductions

An Employee Bi-weekly Salary Statement typically contains detailed information about an employee's earnings over a two-week period, including gross pay, net pay, and various deductions. It outlines mandatory deductions such as taxes and social security, as well as voluntary deductions like retirement contributions or health insurance premiums. Ensuring accuracy and transparency in this document is crucial for both employer and employee to maintain trust and compliance with labor regulations.

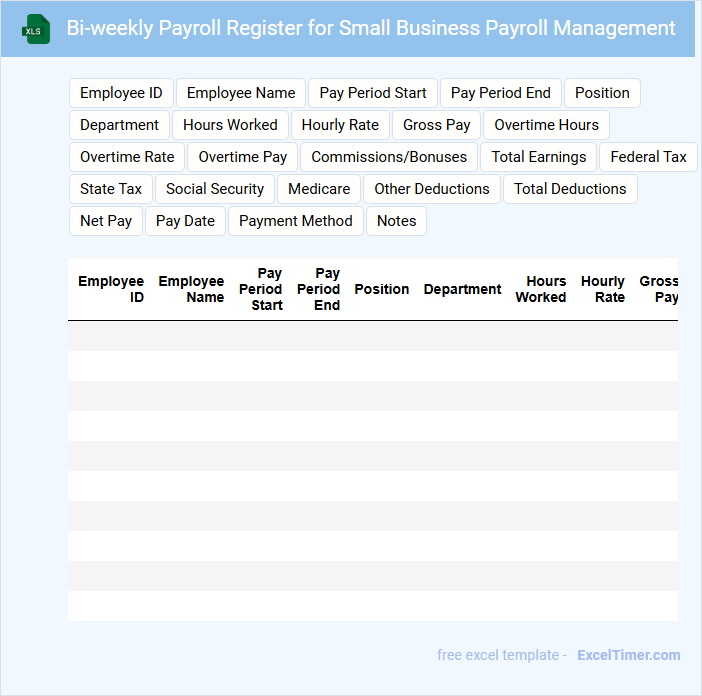

Bi-weekly Payroll Register for Small Business Payroll Management

What information does a Bi-weekly Payroll Register for Small Business Payroll Management typically contain? This document usually lists employee details, hours worked, wages, deductions, and net pay for each bi-weekly period. It serves as a comprehensive record for tracking payroll expenses and ensuring accurate employee compensation.

Why is using a Bi-weekly Payroll Register important for small business payroll management? Maintaining this register helps streamline payroll processing, maintain compliance with tax regulations, and provides an audit trail for financial accountability. It is important to ensure accuracy in data entry and regularly reconcile payroll totals to avoid errors and discrepancies.

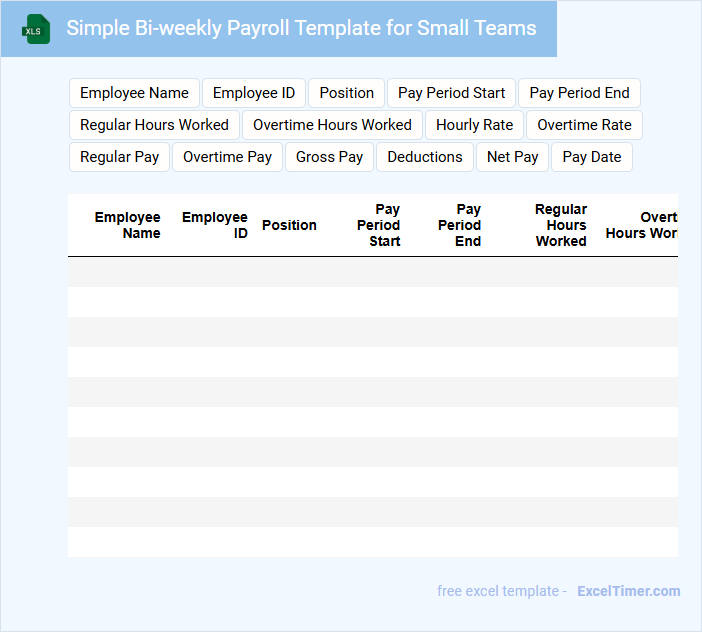

Simple Bi-weekly Payroll Template for Small Teams

This Simple Bi-weekly Payroll Template for small teams is designed to streamline the payroll process by tracking employee hours, calculating wages, and managing deductions efficiently. Typically, this document contains fields for employee names, hours worked, pay rates, tax withholdings, and net pay. It is important to ensure accuracy in tax calculations and timely updates to pay rates to maintain compliance and employee satisfaction.

Bi-weekly Pay Period Hours Tracker with Gross-Net Calculation

A Bi-weekly Pay Period Hours Tracker is a document designed to record and monitor the number of hours worked by an employee over a two-week span. It typically contains daily work hours, total hours worked, and both gross and net pay calculations. This document is essential for accurate payroll processing and ensuring compliance with labor regulations.

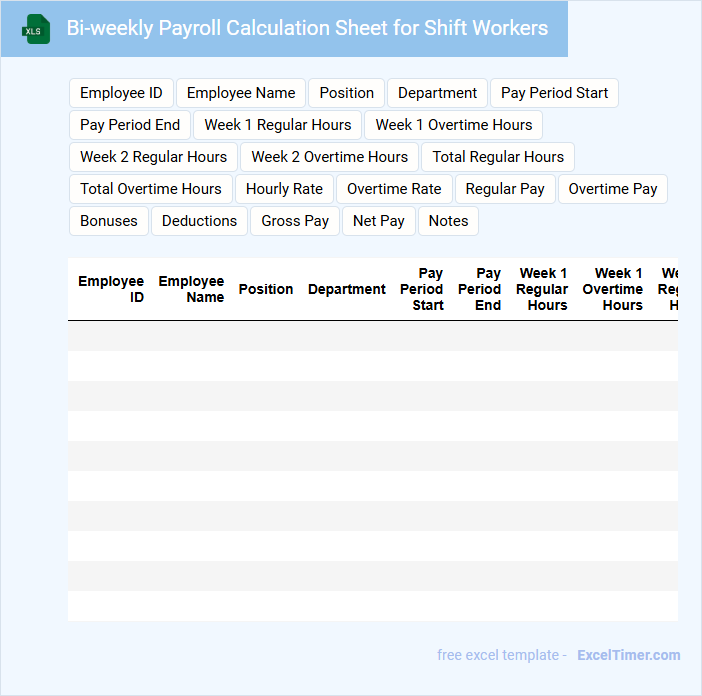

Bi-weekly Payroll Calculation Sheet for Shift Workers

What information is typically contained in a Bi-weekly Payroll Calculation Sheet for Shift Workers? This document usually includes detailed records of hours worked, shift differentials, and overtime calculations for each employee over a two-week period. It is essential for ensuring accurate and timely compensation based on varying shift schedules and labor regulations.

What important details should be included in this payroll sheet? Key components include employee identification, exact hours worked per shift, pay rates according to shifts, deductions, and total payable amounts. Including clear notes on shift premiums and compliance with labor laws enhances transparency and accuracy in payroll processing.

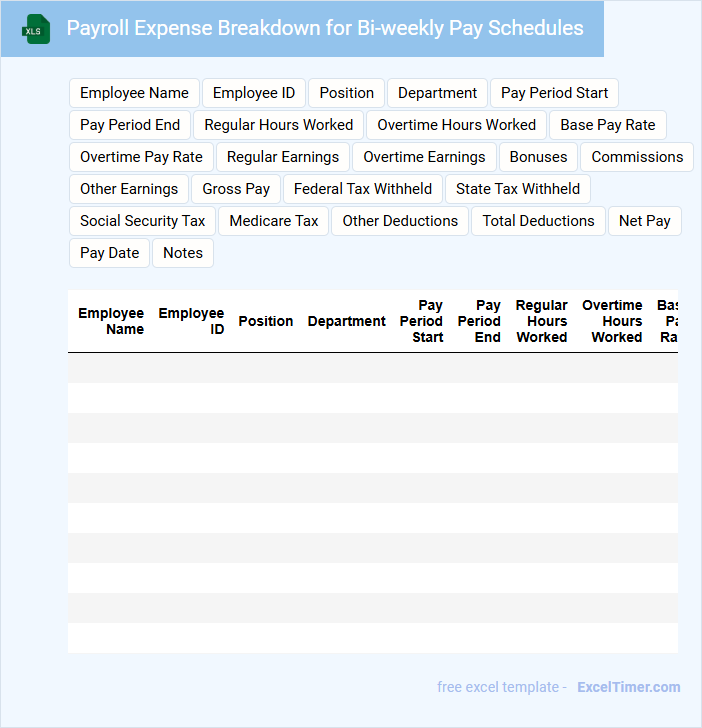

Payroll Expense Breakdown for Bi-weekly Pay Schedules

A Payroll Expense Breakdown for bi-weekly pay schedules typically contains detailed information on gross wages, deductions, and net pay for each pay period. It also includes taxes, benefits, and other withholdings to provide a comprehensive view of employee compensation costs. This document is essential for accurate financial reporting and budgeting.

Monthly Summary Report of Bi-weekly Payroll for Small Businesses

The Monthly Summary Report for bi-weekly payroll consolidates payroll data from two pay periods into a single comprehensive overview. It typically contains employee wage details, tax deductions, and total payroll expenses to help track business financials. Including accurate hours worked and benefits details is crucial for small business accounting and compliance.

What essential data fields must be included in a bi-weekly payroll calculator for small businesses using Excel?

A bi-weekly payroll calculator for small businesses in Excel must include essential data fields such as employee names, hours worked, pay rate, gross pay, tax deductions, and net pay. Incorporating overtime hours and benefits deductions ensures accurate payroll calculation. Your payroll process becomes efficient and error-free with these critical data inputs.

How can formulas be used to accurately calculate gross and net pay for each employee in a bi-weekly period?

Formulas in a bi-weekly payroll calculator use employee wage rates, hours worked, and tax rates to compute accurate gross pay by multiplying hourly rates with total hours. Deductions such as federal, state taxes, Social Security, and benefits are subtracted to calculate net pay precisely. Incorporating automated tax brackets and fixed contribution rates ensures consistent bi-weekly payroll accuracy for small businesses.

What built-in Excel functions are vital for automating deductions (taxes, benefits, etc.) in the payroll calculator?

Key Excel functions for automating payroll deductions include SUMPRODUCT for calculating tax based on multiple rates, IF for conditional benefit deductions, and VLOOKUP or XLOOKUP to reference tax tables and benefit rates dynamically. ROUND ensures accurate currency formatting for final net pay amounts. Using these functions streamlines bi-weekly payroll calculations in small business payroll templates.

How can you ensure data integrity and minimize errors when managing employee hours and pay rates in the Excel document?

Use data validation rules in the Excel Bi-weekly Payroll Calculator to restrict input types for employee hours and pay rates, ensuring consistent and accurate entries. Implement locked and protected worksheet cells to prevent accidental changes to formulas and critical data. Regularly audit calculations with built-in Excel functions like SUM and IFERROR to detect and correct discrepancies in payroll amounts.

What methods can be implemented to track and update payroll history and changes for compliance purposes?

Your Bi-weekly Payroll Calculator for Small Businesses can implement automated record-keeping methods such as version-controlled spreadsheets and encrypted cloud storage to track payroll history and changes securely. Incorporating timestamped audit logs and detailed change tracking features ensures compliance with regulatory requirements. Regular backups and integration with accounting software streamline updates and maintain accurate payroll documentation.