![]()

The Bi-weekly Payment Tracking Excel Template for Fitness Trainers helps organize and monitor client payments every two weeks, ensuring accurate financial records. It simplifies tracking income, outstanding balances, and payment dates, which is essential for managing cash flow. Using this template enhances efficiency and reduces errors in the payment process for fitness professionals.

Bi-weekly Payment Tracking Excel Template for Fitness Trainers

This Bi-weekly Payment Tracking Excel Template is designed to help fitness trainers efficiently monitor their income and expenses over a two-week period. It captures detailed payment records, including client names, payment dates, and amounts, ensuring accurate financial tracking.

Additionally, this template provides a clear overview of outstanding payments and total earnings, which supports budgeting and financial planning. To maximize its utility, regularly updating the template and reconciling it with bank statements is essential.

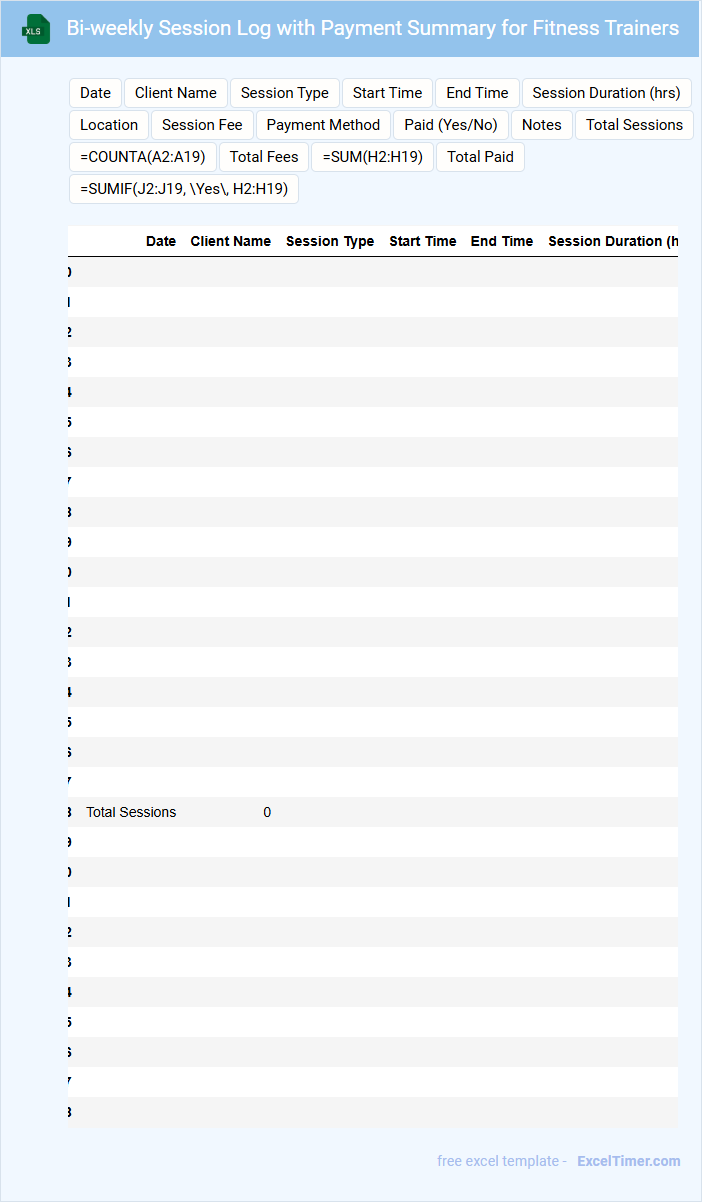

Bi-weekly Session Log with Payment Summary for Fitness Trainers

This Bi-weekly Session Log is designed to record all fitness training sessions conducted by a trainer over a two-week period. It typically includes details such as session dates, client names, and the exercises performed. Keeping accurate records helps track progress and manage scheduling efficiently.

The Payment Summary section consolidates all payments received and outstanding balances for the sessions logged. This overview aids in financial management and ensures transparency between trainers and clients. Including clear payment terms and methods is highly recommended for smooth transactions.

Payment Record Sheet for Fitness Trainers with Bi-weekly Tracking

A Payment Record Sheet for Fitness Trainers is a document that tracks payments made to trainers over a specific period, typically bi-weekly. It includes details such as trainer names, session dates, hours worked, and amounts earned.

This sheet helps ensure accurate compensation and financial transparency between the fitness center and its trainers. For effective use, it is important to regularly update the sheet and reconcile it with attendance and session logs.

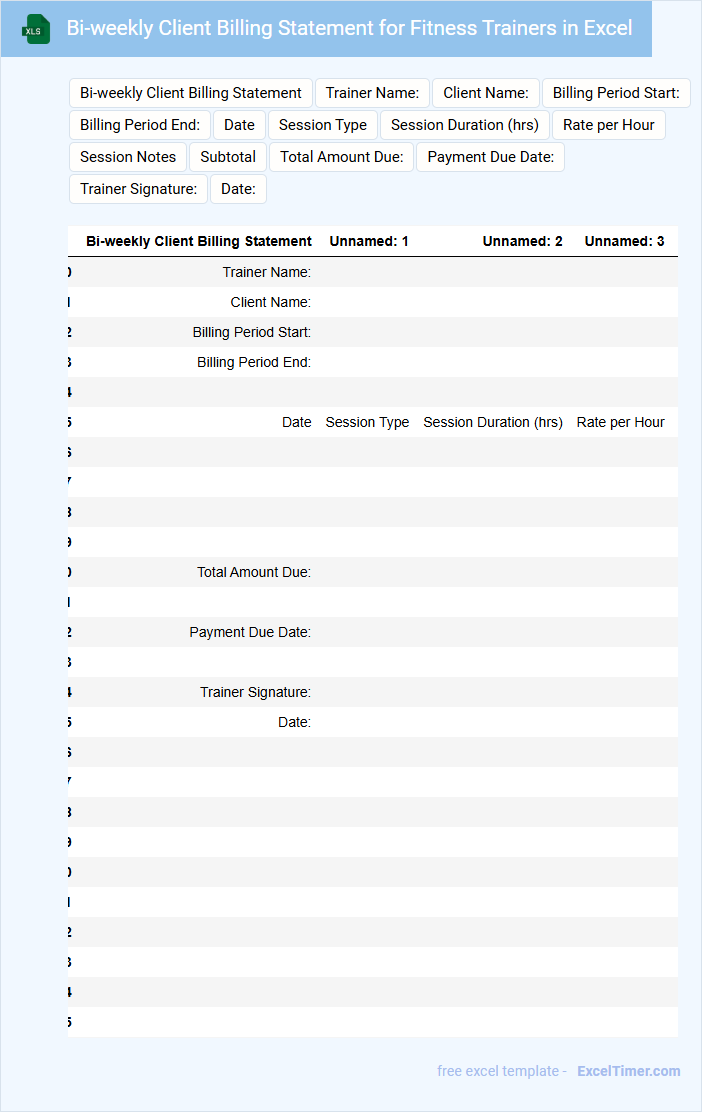

Bi-weekly Client Billing Statement for Fitness Trainers in Excel

The Bi-weekly Client Billing Statement typically contains detailed records of sessions, payment statuses, and client information for fitness trainers. It helps in tracking earnings, managing invoicing, and ensuring financial transparency over a two-week period. For maximum efficiency, ensure the statement includes clear dates, session counts, rates, and payment methods.

Excel Tracker for Bi-weekly Payments of Fitness Trainer Clients

What information is typically included in an Excel tracker for bi-weekly payments of fitness trainer clients? This document usually contains client names, payment dates, amounts paid, and outstanding balances to ensure accurate financial tracking. It helps fitness trainers maintain organized records and monitor timely payments efficiently.

What is an important suggestion for creating an effective bi-weekly payment tracker? It is essential to include automatic formulas for calculating totals and due amounts, as well as clear headers and consistent formatting to improve readability and reduce errors. Additionally, setting reminders for upcoming payments can enhance client management and cash flow stability.

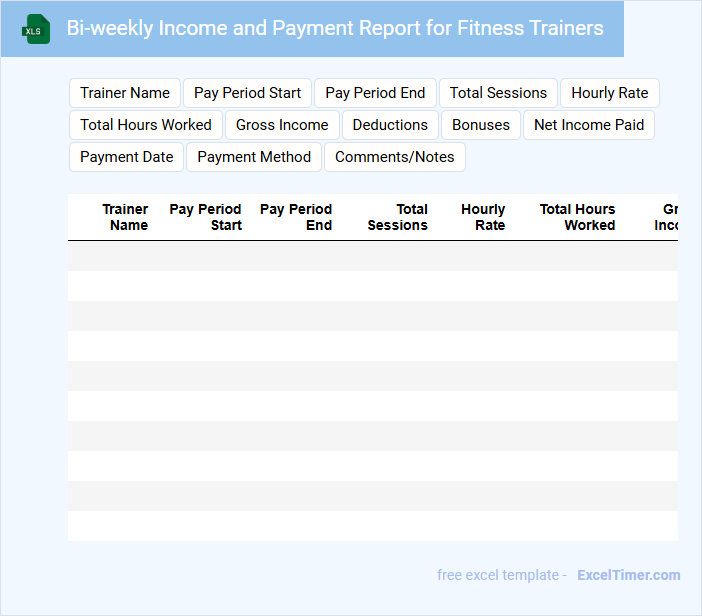

Bi-weekly Income and Payment Report for Fitness Trainers

A Bi-weekly Income and Payment Report for Fitness Trainers typically contains detailed financial records and payment statuses for a two-week period.

- Income Summary: Highlights total earnings from client sessions and any additional services provided.

- Payment Tracking: Lists all payments received and outstanding balances from clients or management.

- Expense Details: Includes any deductions, fees, or operational costs related to training activities.

Payment Tracking Spreadsheet with Bi-weekly Overview for Personal Trainers

A Payment Tracking Spreadsheet with a bi-weekly overview is designed to help personal trainers efficiently manage their income and client payments. It typically contains details such as client names, payment dates, amounts, and session counts. An important feature is the bi-weekly summary, which provides quick insight into earnings and outstanding payments to ensure timely follow-ups.

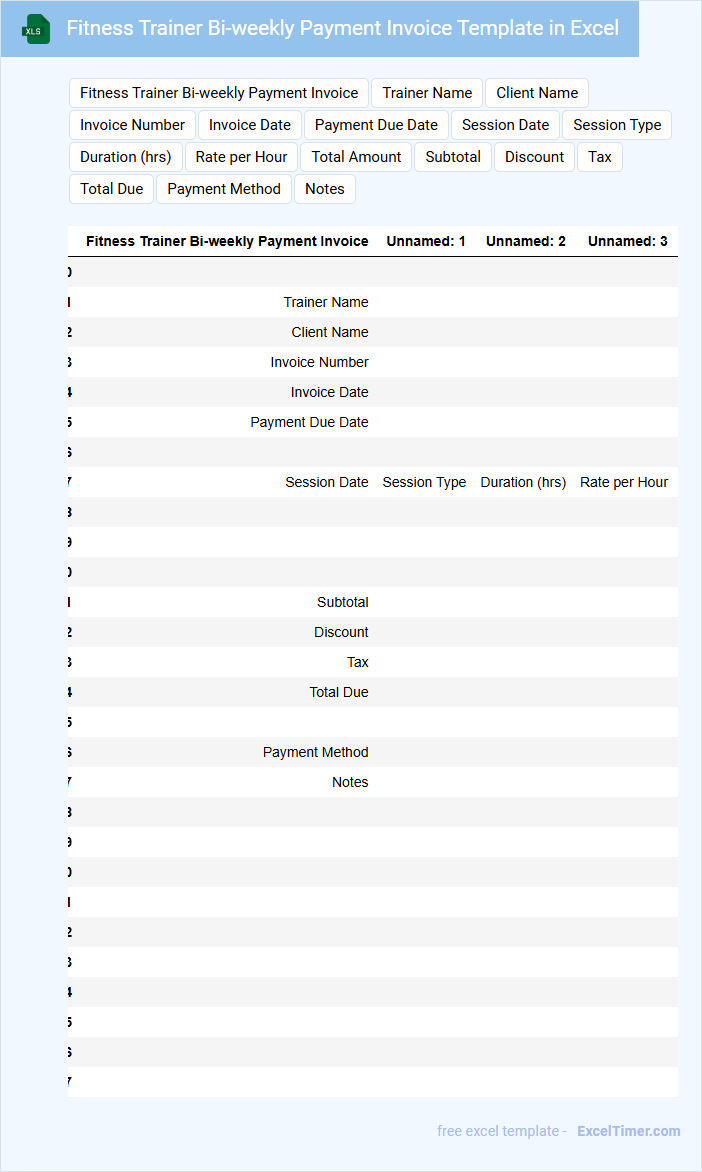

Fitness Trainer Bi-weekly Payment Invoice Template in Excel

This document typically contains detailed payment records and service descriptions to facilitate transparent and timely payments between fitness trainers and their clients.

- Client Information: Clearly list the client's name and contact details to ensure accurate billing.

- Service Details: Include dates, session frequencies, and types of training provided for precise tracking.

- Payment Summary: Provide a clear breakdown of amounts due, payment methods, and deadlines to avoid misunderstandings.

Bi-weekly Earnings Log for Fitness Trainers with Client Details

This document typically records the earnings of fitness trainers on a bi-weekly basis along with detailed client information to track income and client sessions effectively. It serves as a financial and client management tool for trainers and gyms.

- Include client names and session dates for accurate tracking.

- Record payment amounts and types for each session.

- Summarize total earnings per trainer at the end of each period.

Payment Schedule with Bi-weekly Tracker for Fitness Professionals

A Payment Schedule with Bi-weekly Tracker is a vital document that outlines the timing and amounts of payments for fitness professionals. It typically contains detailed records of payment dates, amounts received, and outstanding balances. This helps ensure accurate financial management and timely compensation for services rendered.

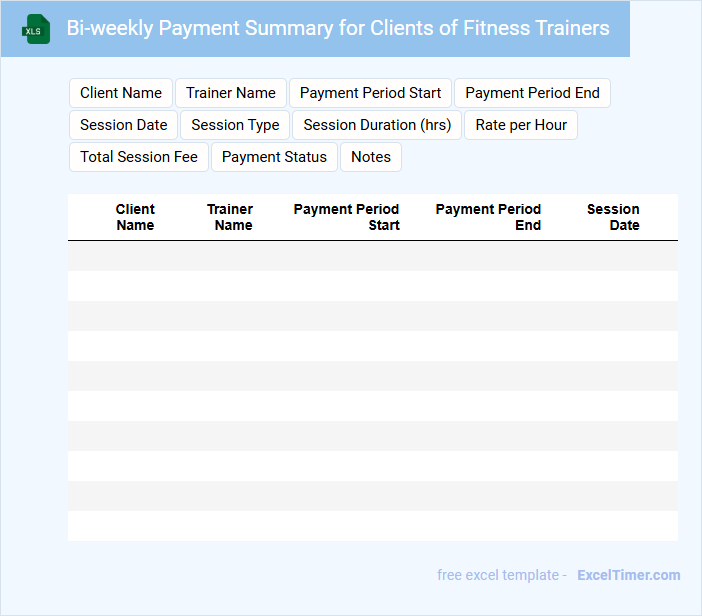

Bi-weekly Payment Summary for Clients of Fitness Trainers

The Bi-weekly Payment Summary is a crucial document that details all financial transactions between fitness trainers and their clients over a two-week period. It typically includes the total payments received, pending amounts, and any applicable deductions or bonuses. Ensuring clear and accurate summaries helps maintain transparency and trust between trainers and clients.

Important elements to include are the client's name, session dates, payment status, and a breakdown of fees for each service provided. Incorporate clear payment deadlines and contact information for any billing queries. Additionally, providing a summary of total hours or sessions attended can improve client satisfaction and record-keeping.

Excel Ledger for Tracking Bi-weekly Payments of Fitness Trainer Services

What information is typically included in an Excel ledger for tracking bi-weekly payments of fitness trainer services? This document usually contains details such as client names, payment dates, amounts paid, and service descriptions to ensure accurate financial records. It helps both the trainer and clients monitor payments efficiently and maintain transparent transaction histories.

What are important considerations when designing this ledger? It is essential to include clear headers, consistent date formats, and automatic calculation fields for totals and balances to reduce errors. Additionally, incorporating conditional formatting to highlight overdue payments can improve tracking and management of pending invoices.

Expense and Bi-weekly Payment Tracking Template for Fitness Coaches

An Expense and Bi-weekly Payment Tracking Template for fitness coaches is designed to meticulously record all financial transactions, including client payments and operational costs. This document helps maintain clarity and ensures consistent cash flow management for the coaching business.

It typically contains sections for tracking income from client sessions, expenses such as equipment or marketing, and scheduled payment dates every two weeks. Using this template, fitness coaches can easily monitor profitability and budget effectively to grow their practice.

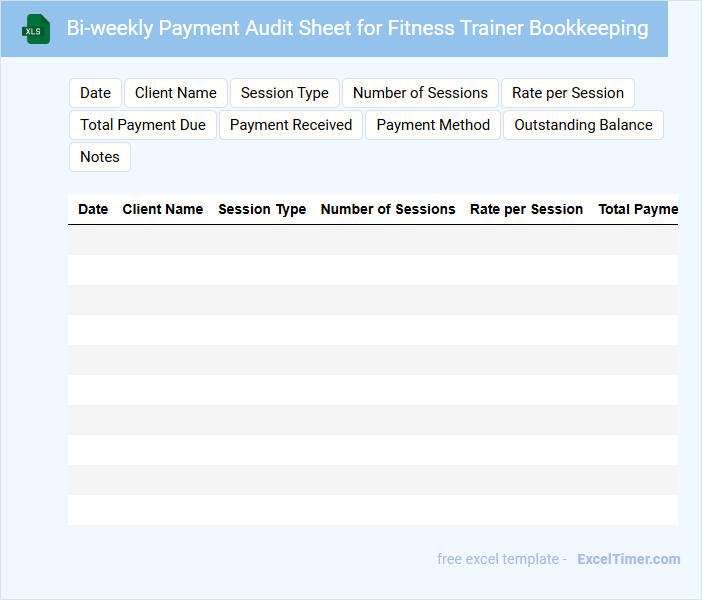

Bi-weekly Payment Audit Sheet for Fitness Trainer Bookkeeping

A Bi-weekly Payment Audit Sheet for Fitness Trainer Bookkeeping is a document used to track and verify payments made to fitness trainers every two weeks. It helps ensure accuracy in compensation and maintains transparent financial records.

- Include detailed records of each trainer's hours worked and sessions conducted.

- Verify payment amounts against agreed rates and contracts.

- Note any discrepancies or adjustments for future reference.

Excel Register with Bi-weekly Payment Tracking for Fitness Instructors

An Excel Register with Bi-weekly Payment Tracking for Fitness Instructors typically contains detailed records of payments, schedules, and instructor information.

- Accurate Payment Records: Ensure all bi-weekly payments are clearly logged with dates and amounts to maintain transparency.

- Instructor Details: Include names, contact information, and class schedules for easy reference and communication.

- Automated Calculations: Use formulas to automatically update totals and track outstanding payments to minimize errors.

What formula can you use to automatically calculate total bi-weekly earnings from individual session payments?

Use the SUM formula to automatically calculate total bi-weekly earnings from individual session payments in your Excel document. For example, =SUM(B2:B15) adds all session payments listed in cells B2 through B15. This formula efficiently tracks your overall income based on recorded session fees.

How can conditional formatting help highlight missed or pending client payments?

Conditional formatting in an Excel Bi-weekly Payment Tracking document for Fitness Trainers can automatically highlight missed or pending client payments using color codes based on payment due dates and status. This visual cue enables trainers to quickly identify overdue payments without manually checking each entry. Utilizing rules like "Cell Value less than TODAY()" or specific text matches ensures effective monitoring and prompt follow-up.

Which Excel chart type best visualizes income trends over multiple bi-weekly periods?

A line chart best visualizes income trends over multiple bi-weekly periods, clearly showing fluctuations and growth for fitness trainers. Your bi-weekly payment tracking will benefit from its ability to highlight patterns and compare earnings across different time frames. Using a line chart in Excel enables easy analysis of income trends to optimize financial planning.

How can data validation be used to standardize entry of client names and session dates?

Data validation in Excel can standardize client names by creating a dropdown list linked to a predefined roster, ensuring consistent and error-free entries. For session dates, applying date-specific validation rules restricts inputs to valid calendar dates within the bi-weekly period. These techniques improve data accuracy and streamline bi-weekly payment tracking for fitness trainers.

What is the benefit of using Excel tables for managing and filtering bi-weekly payment records?

Excel tables streamline bi-weekly payment tracking for fitness trainers by organizing data into structured, easily filterable formats that enhance accuracy and efficiency. Automated sorting and filtering features enable quick access to specific payment records, reducing errors and saving time during payroll review. Integration with formulas supports dynamic calculations for totals, deductions, and commissions, ensuring precise financial management.