The Bi-weekly Savings Plan Excel Template for Couples helps partners track and manage their savings efficiently by breaking down contributions every two weeks, ensuring consistent progress toward financial goals. This customizable template allows couples to monitor their joint expenses and savings, improving transparency and cooperation in financial planning. Easy-to-use charts and formulas automatically update balances, making it simple to stay on track without manual calculations.

Bi-weekly Savings Tracker for Couples

A Bi-weekly Savings Tracker for Couples is a financial document used to monitor and manage savings goals on a bi-weekly basis. It helps couples stay organized and accountable for their joint financial progress.

This type of tracker typically contains sections for income, expenses, savings contributions, and progress summaries. Including a clear goal reminder is important to keep motivation high and ensure successful savings outcomes.

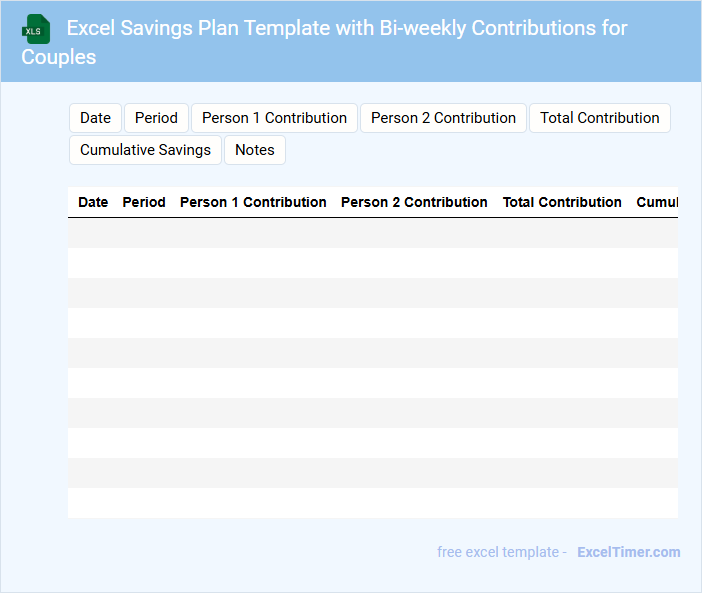

Excel Savings Plan Template with Bi-weekly Contributions for Couples

An Excel Savings Plan Template with bi-weekly contributions is designed to help couples systematically track their savings goals and monitor progress. It typically includes fields for income, expenses, contribution amounts, and timelines to ensure consistent saving habits.

Important considerations for couples using this template include clear communication about financial goals and regular updates to reflect changes in income or expenses. Having a shared understanding ensures both partners stay motivated and aligned throughout the savings journey.

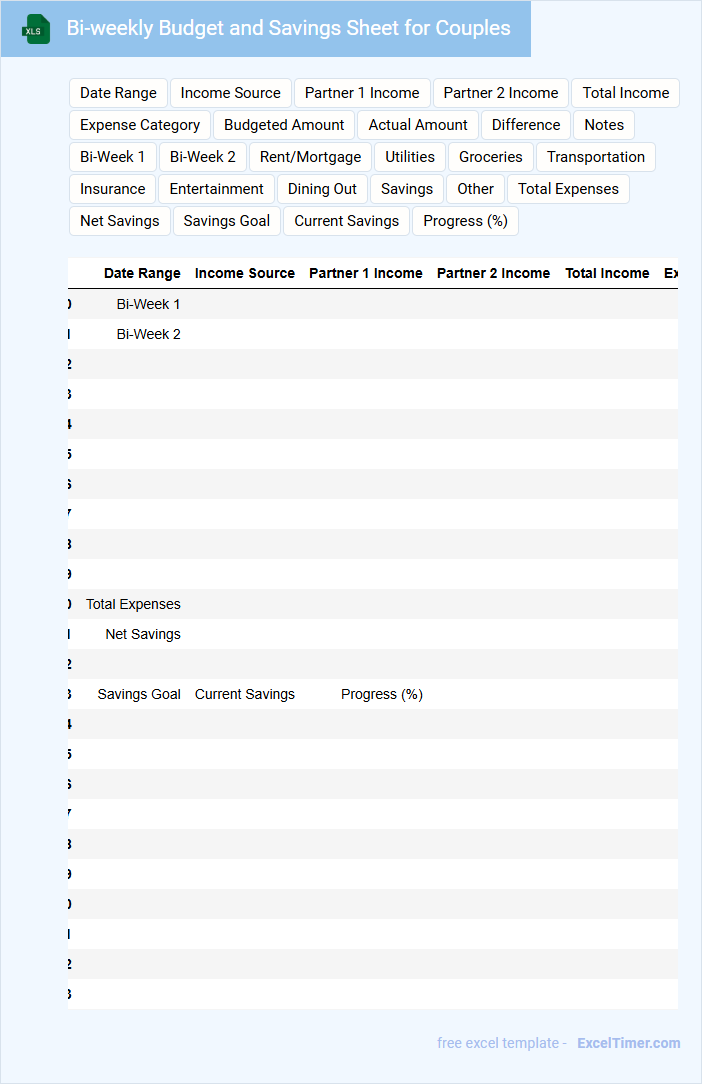

Bi-weekly Budget and Savings Sheet for Couples

What information is typically included in a Bi-weekly Budget and Savings Sheet for Couples?

This document usually contains detailed records of income, expenses, and savings contributions on a bi-weekly basis to help couples track their financial progress together. It also includes sections for setting financial goals and monitoring budget adherence to improve money management and achieve shared objectives efficiently.

It is important to regularly update the sheet with accurate figures and review it together to maintain transparency and adjust spending habits as needed for better financial health.

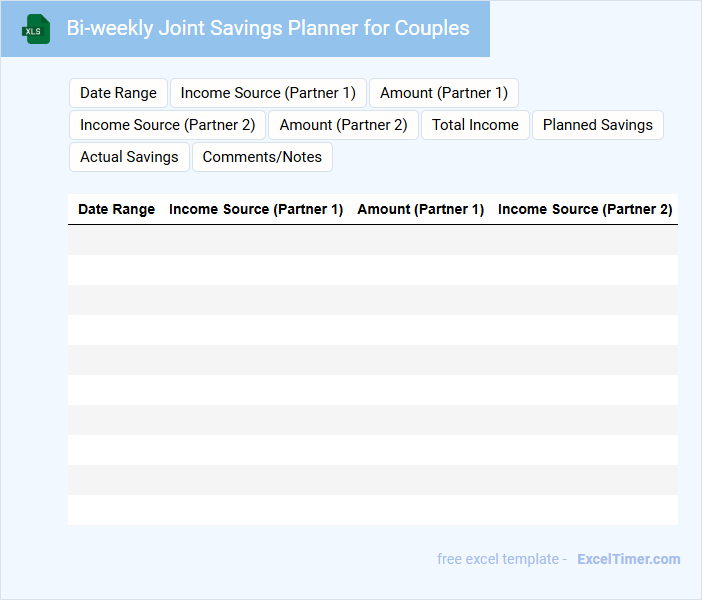

Bi-weekly Joint Savings Planner for Couples

A Bi-weekly Joint Savings Planner for Couples is a document designed to help partners collaboratively track and manage their savings goals on a bi-weekly basis.

- Clear budget allocation: Define how much each partner contributes every two weeks to ensure transparency.

- Shared financial goals: List and prioritize joint savings objectives to stay motivated and aligned.

- Regular progress tracking: Update savings status bi-weekly to monitor growth and make necessary adjustments.

Couples’ Bi-weekly Savings Plan with Goal Tracker

A Couples' Bi-weekly Savings Plan with Goal Tracker document typically contains a structured budget and timeline for saving money together, updated every two weeks. It includes detailed sections for setting financial goals, monitoring progress, and adjusting contributions to meet the targets efficiently. This type of document helps partners align their finances and motivates consistent savings toward shared aspirations.

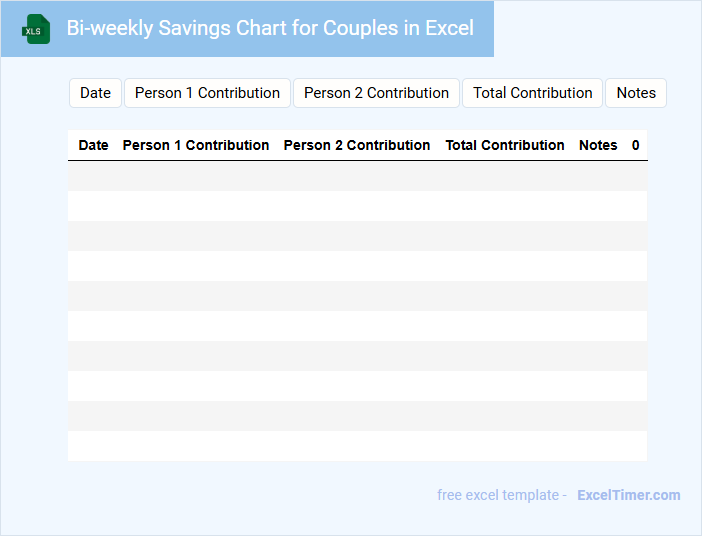

Bi-weekly Savings Chart for Couples in Excel

A Bi-weekly Savings Chart for Couples in Excel typically includes scheduled savings goals, tracked contributions, and progress visualization to help partners manage their finances efficiently. It is designed to promote consistent saving habits and transparent financial planning between couples.

- Include clear labels for each pay period and corresponding savings amounts.

- Utilize color coding to differentiate between planned and actual savings.

- Add formulas to automatically calculate cumulative savings over time.

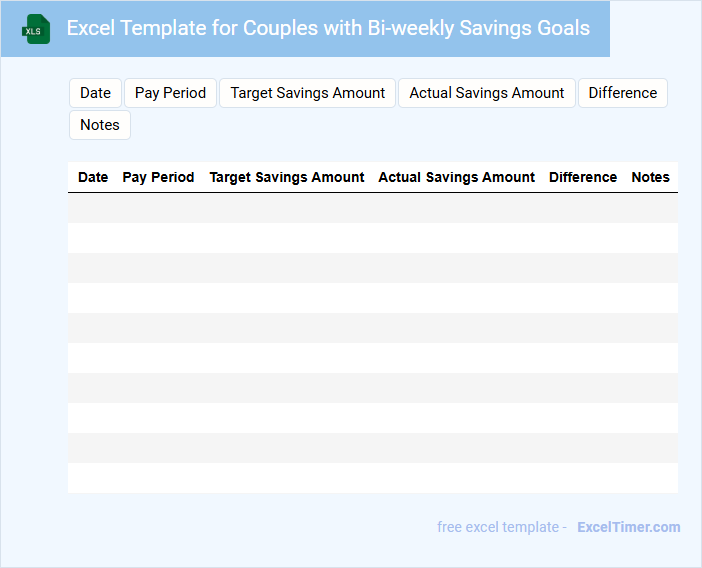

Excel Template for Couples with Bi-weekly Savings Goals

What information is typically included in an Excel template designed for couples with bi-weekly savings goals? This type of document usually contains sections for income tracking, expense categorization, and bi-weekly savings targets to help couples align their financial goals. It often includes automated calculations and visual progress indicators to maintain motivation and financial transparency.

What is an important feature to consider when creating a bi-weekly savings Excel template for couples? Incorporating customizable categories for both partners' contributions and expenses ensures flexibility, while a clear summary dashboard helps monitor joint progress and encourages regular communication about finances.

Bi-weekly Couples Savings and Expense Log

What is typically included in a Bi-weekly Couples Savings and Expense Log? This document usually contains categorized entries of all income, expenses, and savings made by the couple over a two-week period. It helps track spending habits, monitor budget adherence, and plan future financial goals effectively.

What important features should be included in this log? It is crucial to have clear categories for different types of expenses and savings, a summary section for total income versus expenses, and a notes area for any unexpected costs or financial decisions made during the period. Maintaining accuracy and consistency ensures better financial clarity and mutual accountability.

Savings Milestone Tracker with Bi-weekly Payments for Couples

A Savings Milestone Tracker with Bi-weekly Payments for Couples is a document designed to monitor and manage joint financial goals. It typically includes sections for recording individual contributions, tracking progress toward savings targets, and scheduling bi-weekly payment intervals. This tool helps couples stay organized and motivated while working collaboratively on their savings objectives.

Shared Bi-weekly Savings Register for Couples

A Shared Bi-weekly Savings Register for Couples is a document used to track and manage joint savings contributions made every two weeks. It helps couples stay organized and aligned on their financial goals.

- Record the date and amount of each contribution to maintain accuracy.

- Include a running balance to monitor progress toward savings targets.

- Add notes for any special expenses or exceptional contributions.

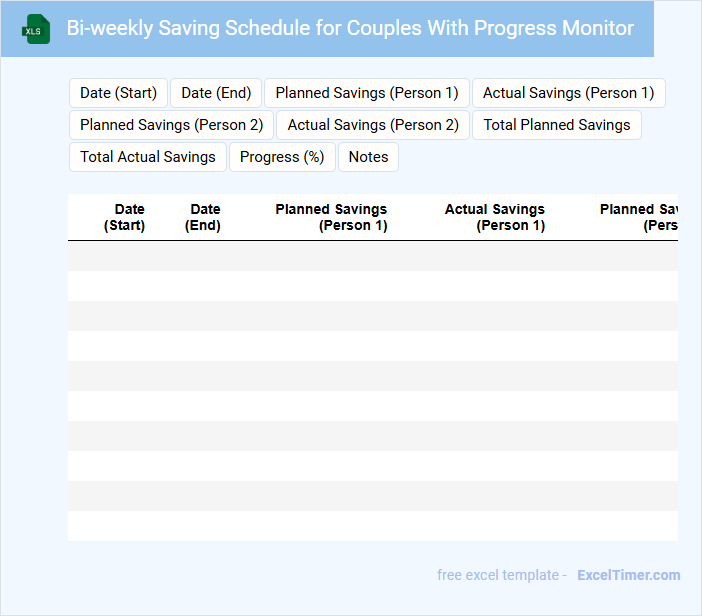

Bi-weekly Saving Schedule for Couples With Progress Monitor

The Bi-weekly Saving Schedule for Couples is designed to help partners systematically save money together every two weeks. This document typically contains a detailed timeline of deposits, target savings goals, and a progression tracker to monitor financial growth. It is essential for couples to coordinate their saving amounts and regularly review their progress to stay motivated and aligned with their financial plans.

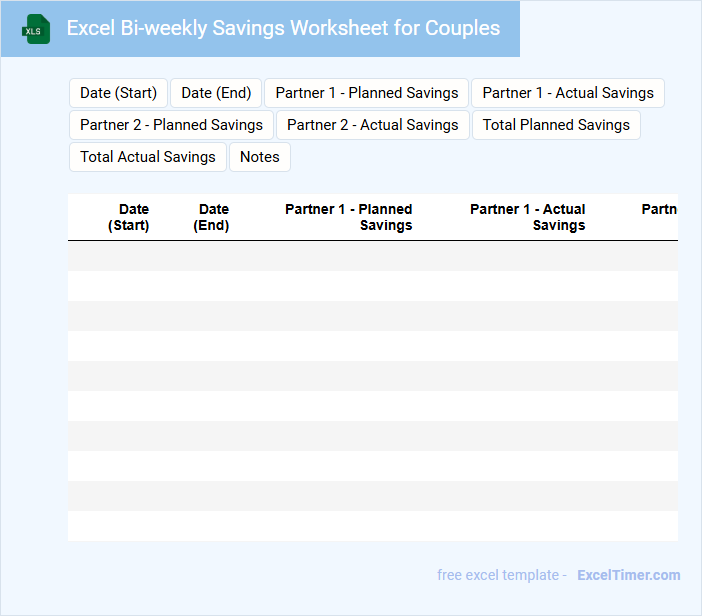

Excel Bi-weekly Savings Worksheet for Couples

What information is typically included in an Excel Bi-weekly Savings Worksheet for Couples? This type of document usually contains detailed inputs of income, expenses, and savings goals organized on a bi-weekly basis. It helps couples track their combined savings progress systematically and adjust their financial plans accordingly.

What important elements should be considered when creating this worksheet? It is essential to incorporate clear categories for different expense types, set realistic savings targets, and include automatic calculations to summarize totals and progress visually. Additionally, flexibility for updating income changes or unexpected expenses ensures the worksheet remains accurate and useful over time.

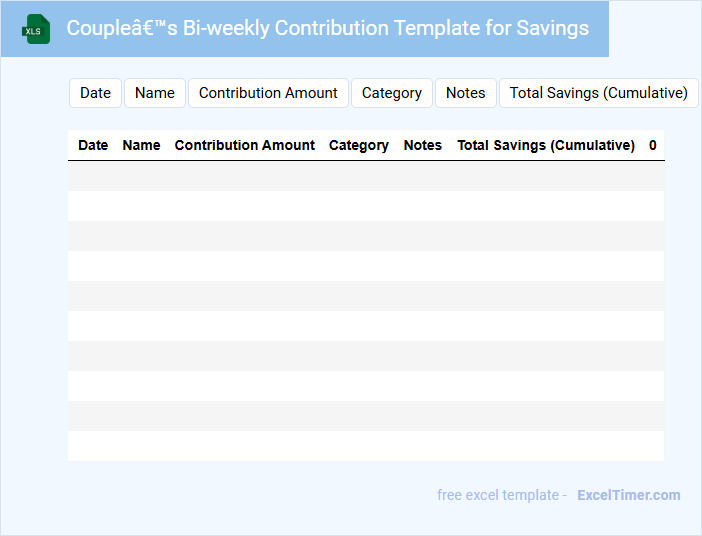

Couple’s Bi-weekly Contribution Template for Savings

A Couple's Bi-weekly Contribution Template for Savings is a financial document designed to help couples systematically allocate funds toward their shared savings goals. It typically includes fields for tracking individual contributions, total savings, and progress over time. This template ensures transparency and encourages consistent saving habits between partners.

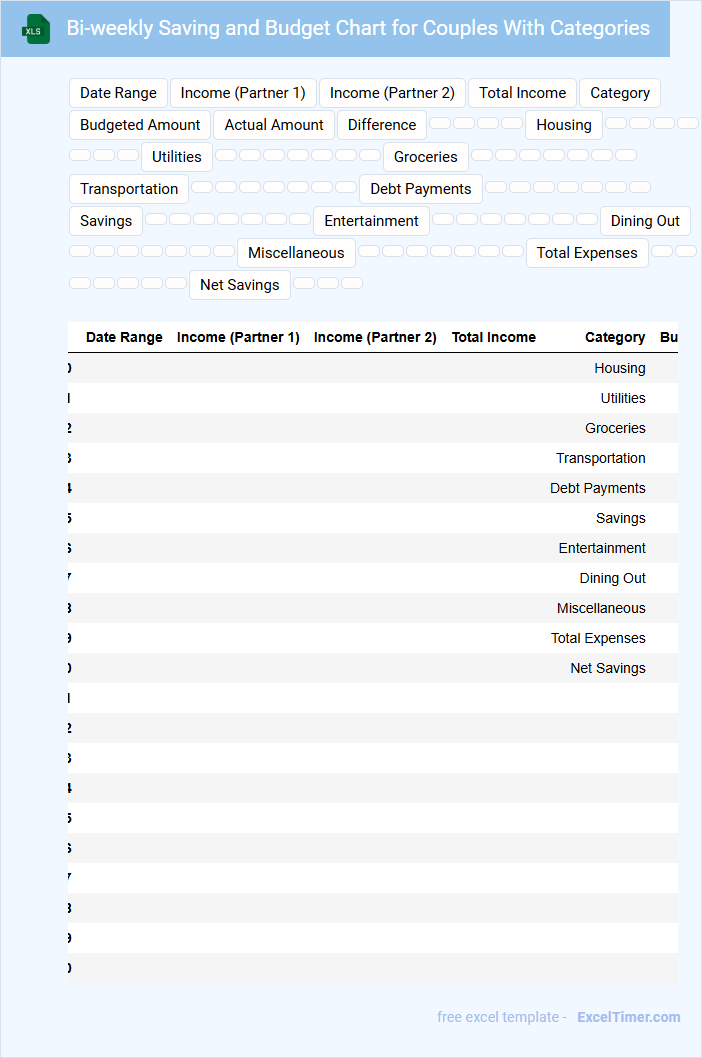

Bi-weekly Saving and Budget Chart for Couples With Categories

This bi-weekly saving and budget chart for couples is designed to organize and track finances effectively. It usually contains categories like income, expenses, savings goals, and debt repayments to help manage money collaboratively.

Using clearly defined budget categories such as groceries, utilities, and entertainment allows couples to pinpoint spending habits accurately. This chart encourages regular financial check-ins and adjustments every two weeks for better money management.

Including a section for shared financial goals and emergency funds is highly recommended to ensure long-term stability and mutual accountability.

Couples’ Savings Plan with Bi-weekly Deposit Tracker

What information is typically included in a Couples' Savings Plan with Bi-weekly Deposit Tracker? This document usually contains detailed sections for setting joint financial goals and recording bi-weekly deposit amounts to monitor progress. It helps couples stay organized and motivated by providing a clear overview of their savings timeline and contributions.

What are important aspects to consider when using this type of document? It is crucial to regularly update deposits and review goals together to ensure alignment and accountability. Additionally, including notes for unexpected expenses or adjustments can enhance flexibility and long-term success.

What are the key benefits of a bi-weekly savings plan for couples when tracked in an Excel document?

A bi-weekly savings plan for couples tracked in an Excel document enhances financial transparency and accountability by clearly displaying contribution amounts and dates. Excel's customizable charts and formulas facilitate real-time progress monitoring and goal adjustments. The plan supports disciplined savings habits and optimized cash flow management through automated calculations and visual summaries.

How can couples set shared financial goals and monitor their progress using Excel's budgeting templates?

Couples can set shared financial goals by using Excel's budgeting templates to input income, expenses, and savings targets, creating a clear bi-weekly savings plan. Excel's built-in charts and formulas automatically track progress, highlighting areas where adjustments are needed. Your consistent updates enable effective monitoring, ensuring both partners stay aligned and motivated toward their financial objectives.

What Excel formulas are essential for automating bi-weekly savings calculations and tracking contribution history?

Essential Excel formulas for a bi-weekly savings plan include SUM for totaling contributions, PMT to calculate consistent savings amounts based on interest rates and time, and IF to track and validate contribution dates. The VLOOKUP or INDEX-MATCH functions help retrieve specific contribution history entries, while DATE and WEEKDAY functions automate scheduling bi-weekly deposits. These formulas ensure accurate tracking and seamless calculation of savings growth over time.

How can conditional formatting be used in Excel to visually highlight savings milestones or inconsistencies?

Conditional formatting in Excel can highlight savings milestones for couples by applying color scales or icon sets when savings reach specific thresholds, such as $500 or $1,000. It can also flag inconsistencies by using data bars or red fill colors to identify missed contributions or amounts below the planned bi-weekly target. This visual approach enhances tracking progress and quickly identifying deviations in the bi-weekly savings plan.

What strategies can be implemented in Excel to ensure transparency and accountability between partners in their bi-weekly savings plan?

Implement shared Excel sheets with real-time updates and version history to maintain transparency in the bi-weekly savings plan for couples. Use conditional formatting to highlight missed contributions or discrepancies, ensuring accountability. Incorporate automated formulas and charts to track progress towards savings goals clearly and efficiently.