The Bi-weekly Excel Template for Pay Schedule simplifies payroll management by organizing employee payment dates every two weeks, ensuring accuracy and timely compensation. This template allows easy customization to fit different payroll policies, reducing errors and improving financial tracking. Using this tool enhances efficiency in managing bi-weekly pay cycles, supporting businesses in maintaining consistent payment schedules.

Bi-weekly Excel Template for Pay Schedule

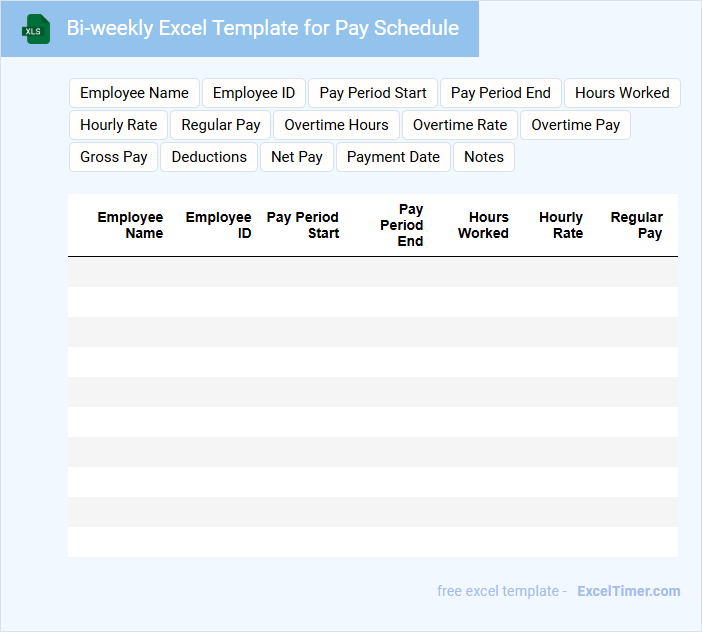

What information is typically included in a Bi-weekly Excel Template for Pay Schedule? This type of document usually contains employee names, pay periods, hours worked, and calculated wages. It helps in organizing and tracking payroll efficiently to ensure timely and accurate payments.

What is an important consideration for creating a Bi-weekly Excel Template for Pay Schedule? It is essential to include formulas that automatically calculate gross pay, deductions, and net pay. Additionally, incorporating clear date ranges and payment details improves clarity and reduces errors.

Pay Schedule Tracker with Bi-weekly Format

A Pay Schedule Tracker with a bi-weekly format is typically used to monitor employee payments that occur every two weeks. It contains detailed information about pay periods, payment dates, and hours worked during each cycle.

This document helps ensure accurate and timely payroll processing while maintaining clear records for both employees and employers. To optimize its use, it's important to include clear labels for pay periods and incorporate automatic date calculations.

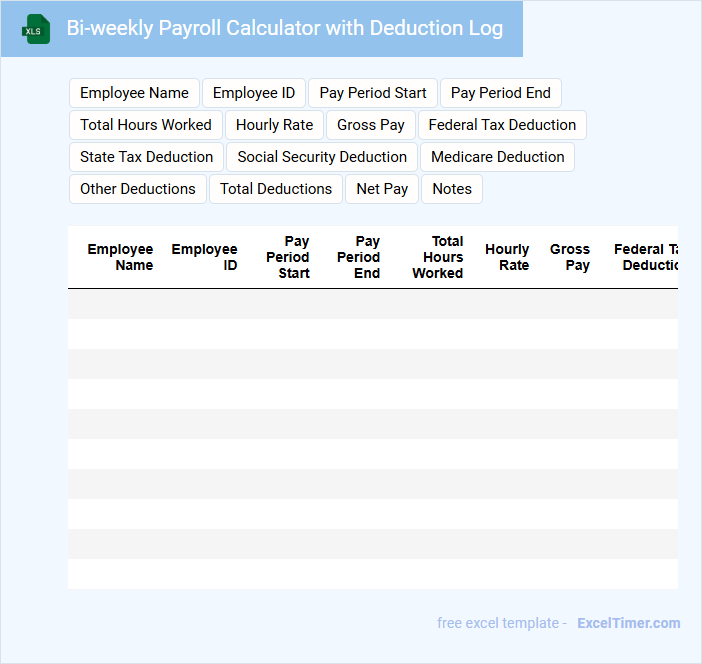

Bi-weekly Payroll Calculator with Deduction Log

A Bi-weekly Payroll Calculator with Deduction Log is a document designed to accurately track employee earnings and deductions over a two-week pay period. It typically contains details such as gross pay, tax withholdings, benefit deductions, and net pay. Ensuring completeness and accuracy in recording these elements is crucial for payroll compliance and employee satisfaction.

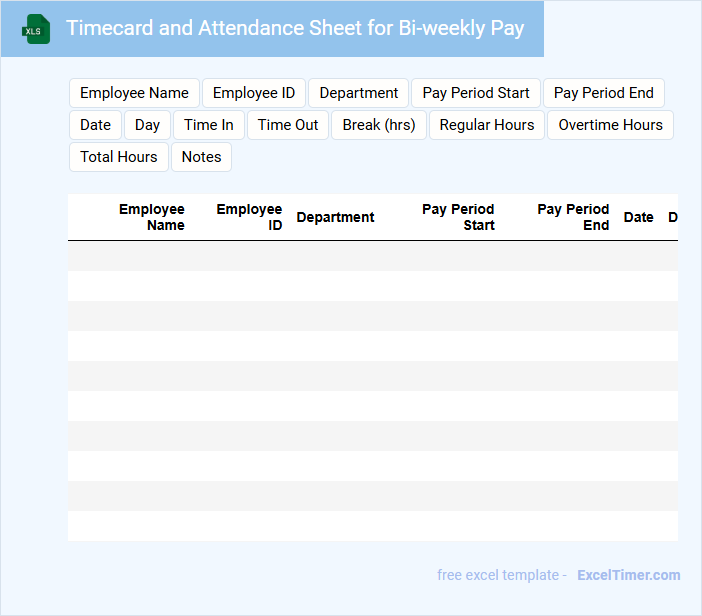

Timecard and Attendance Sheet for Bi-weekly Pay

A Timecard and Attendance Sheet for Bi-weekly Pay is a document used to record employee work hours and attendance over a two-week period. It typically includes sections for clock-in and clock-out times, breaks, total hours worked, and any overtime. This document is essential for accurate payroll processing and ensuring compliance with labor regulations.

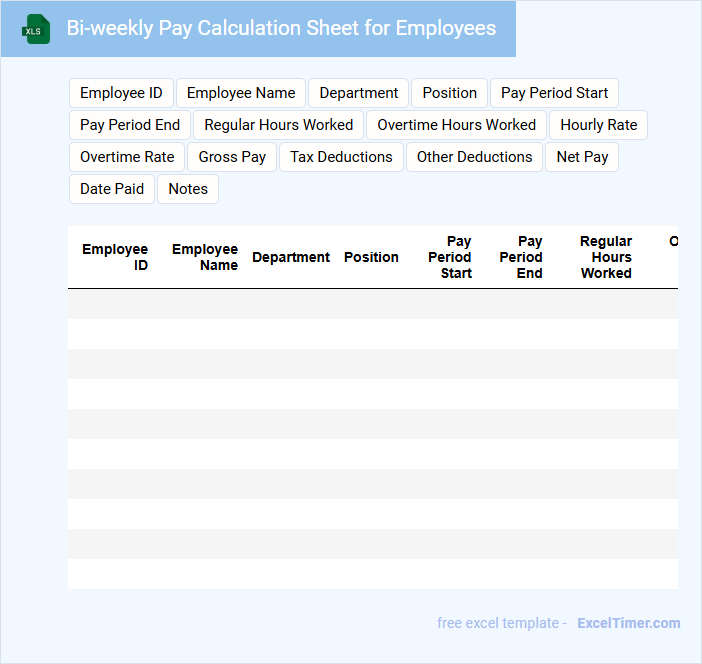

Bi-weekly Pay Calculation Sheet for Employees

A Bi-weekly Pay Calculation Sheet for Employees typically contains detailed records of employee earnings, deductions, and net pay for each two-week period.

- Accurate Hours Worked: Record total hours and overtime for precise wage calculation.

- Clear Deduction Details: List all deductions like taxes, insurance, and benefits transparently.

- Employee Identification: Include employee names and identification numbers for easy reference.

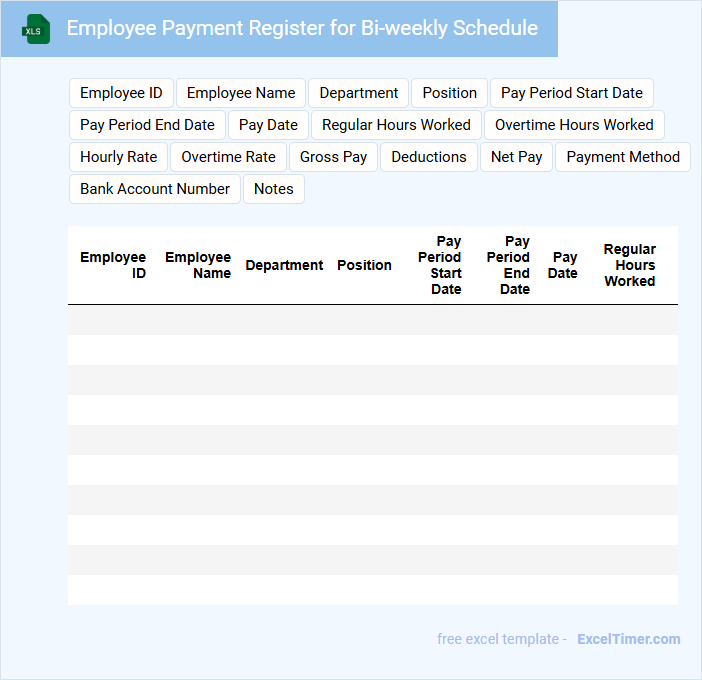

Employee Payment Register for Bi-weekly Schedule

What information is typically included in an Employee Payment Register for a Bi-weekly Schedule? This type of document usually contains detailed records of employees' earnings, deductions, and net pay over each two-week period. It is essential for tracking payroll accuracy and ensuring compliance with tax and labor regulations.

What important elements should be emphasized in this register? Accurate employee identification, precise recording of hours worked, overtime calculations, and proper categorization of deductions are crucial to maintain transparency and accountability in payroll processing.

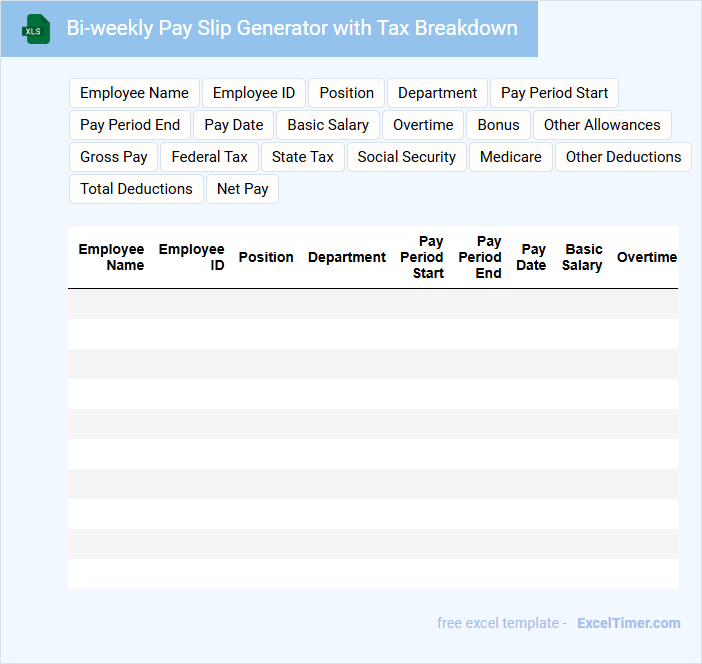

Bi-weekly Pay Slip Generator with Tax Breakdown

A Bi-weekly Pay Slip Generator typically contains detailed information about an employee's earnings over a two-week period, including gross pay, deductions, and net salary. It also provides a clear tax breakdown showing federal, state, and local taxes withheld.

These documents help employees track their income and understand their tax contributions accurately. Including employee details, pay period dates, and year-to-date totals are essential for clarity and record-keeping.

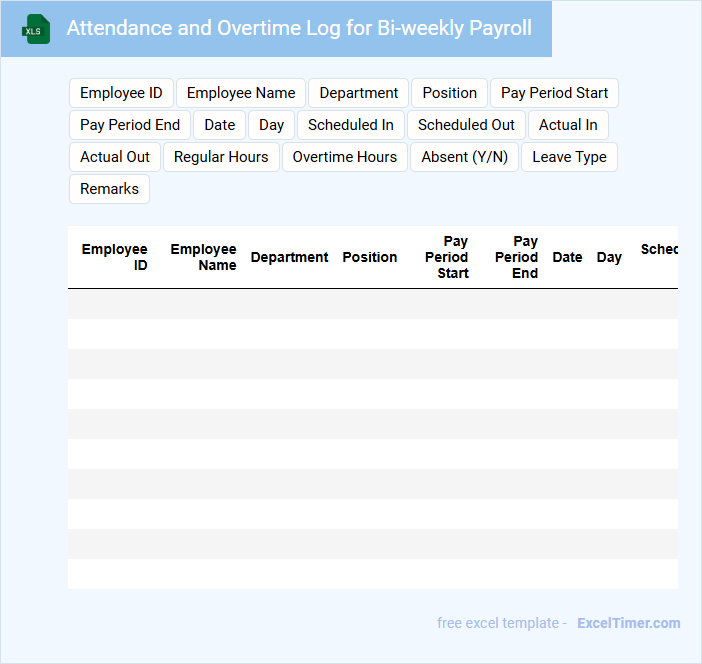

Attendance and Overtime Log for Bi-weekly Payroll

The Attendance and Overtime Log is a document that records the hours employees have worked, including regular attendance and any overtime. It is essential for ensuring accurate payroll calculations and compliance with labor laws.

This log typically contains employee names, dates, clock-in and clock-out times, total hours worked, and overtime hours. Maintaining clear and detailed records helps prevent disputes and supports efficient payroll processing.

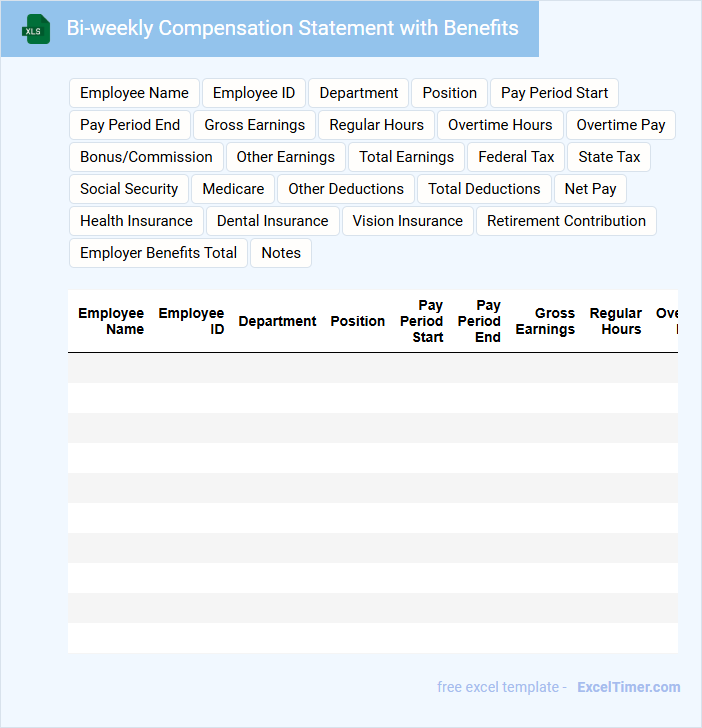

Bi-weekly Compensation Statement with Benefits

A Bi-weekly Compensation Statement with Benefits typically outlines an employee's earnings and deductions over a two-week period. It includes detailed information about salary, taxes, and additional benefits received.

- Ensure it clearly displays gross and net pay for transparency.

- Include a breakdown of all applicable benefits and contributions.

- Verify accuracy in tax withholdings and other deductions.

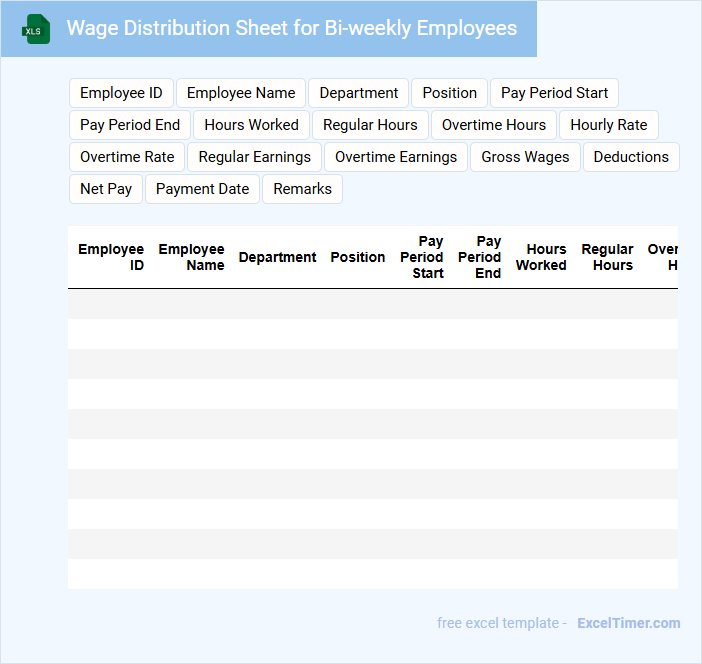

Wage Distribution Sheet for Bi-weekly Employees

A Wage Distribution Sheet for bi-weekly employees is a detailed document that records the wages paid to employees over a two-week period. It typically includes employee names, hours worked, hourly rates, and total payments. Accuracy and clarity are crucial to ensure proper payroll processing and compliance with labor laws.

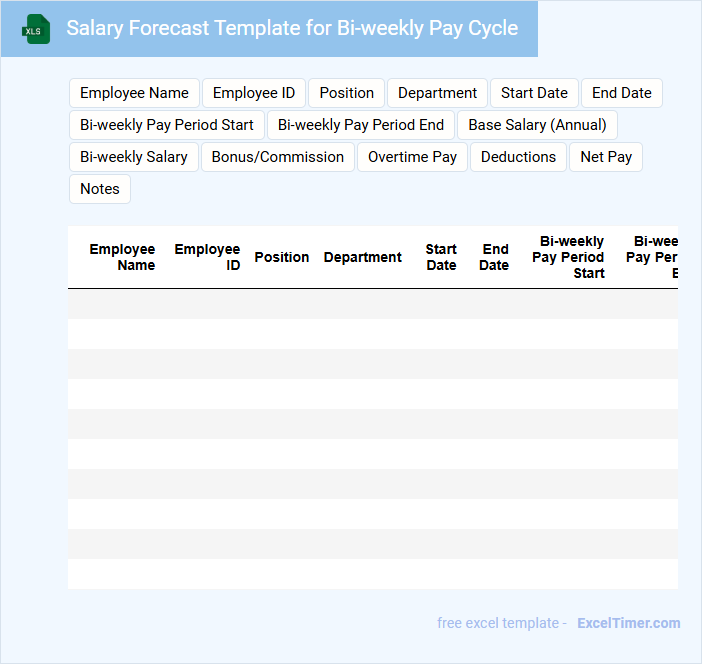

Salary Forecast Template for Bi-weekly Pay Cycle

A Salary Forecast Template for a Bi-weekly Pay Cycle typically contains projections of employee earnings based on a two-week period to aid in budget planning and payroll management.

- Accurate Pay Periods: Ensure all bi-weekly intervals are correctly represented to prevent miscalculations.

- Include Deductions and Taxes: Account for mandatory withholdings to provide a realistic salary outlook.

- Employee Information: Maintain updated records such as names, roles, and pay rates for precise forecasting.

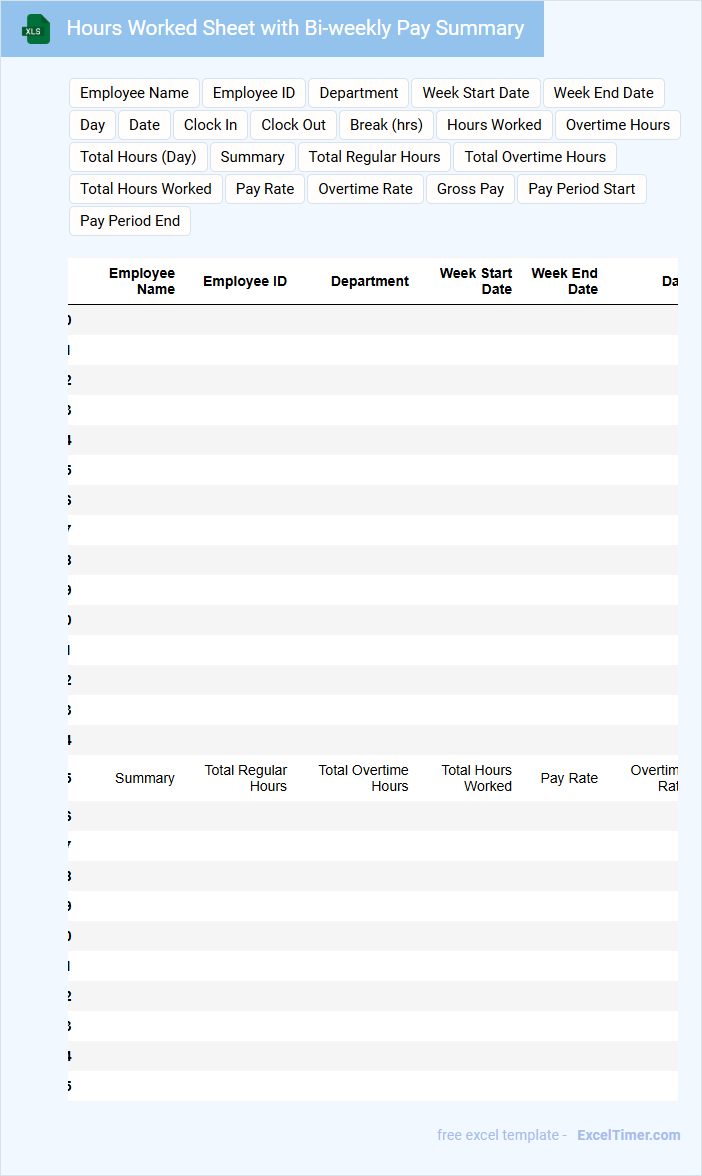

Hours Worked Sheet with Bi-weekly Pay Summary

An Hours Worked Sheet typically contains detailed records of the number of hours an employee has worked each day within a specific pay period, usually including start and end times along with break durations. It is essential for ensuring accurate payroll processing and compliance with labor laws.

The Bi-weekly Pay Summary summarizes total hours worked, deductions, and net pay for every two-week period. This document helps both employees and employers track earnings and verify payment accuracy.

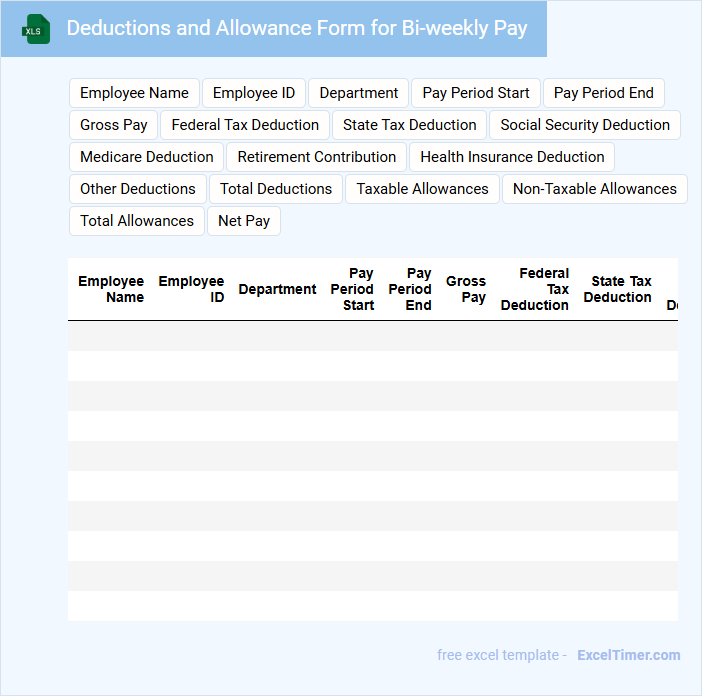

Deductions and Allowance Form for Bi-weekly Pay

This document primarily contains details about an employee's deductions such as taxes, insurance, and retirement contributions that are to be subtracted from their gross pay on a bi-weekly basis. It also includes information on any allowances granted, which can affect the taxable income and net pay.

Careful attention must be given to accurately inputting all relevant details to ensure correct payroll processing. Always verify the employee's withholding status and any changes in allowances before submission.

Overtime Tracking Template for Bi-weekly Schedule

An Overtime Tracking Template for a bi-weekly schedule helps organizations systematically record the extra hours employees work beyond their regular shifts. It typically includes dates, employee names, hours worked, and approval status to ensure accurate payroll processing.

Using a bi-weekly format allows for consistent tracking aligned with payroll cycles and helps managers control labor costs effectively. Ensuring clear guidelines on overtime authorization and regular updates are important to maintain accuracy and compliance.

Paycheck Tracker with Bi-weekly Payment Details

A Paycheck Tracker with Bi-weekly Payment Details is typically used to monitor income and deductions received every two weeks. It helps individuals keep accurate records of their earnings and manage their finances effectively.

- Include fields for gross pay, taxes, and net pay for each pay period.

- Track deductions such as health insurance, retirement contributions, and taxes.

- Summarize total earnings and deductions to visualize financial trends.

What does a bi-weekly pay schedule mean in terms of pay periods per year in Excel documentation?

A bi-weekly pay schedule means employees are paid every two weeks, resulting in 26 pay periods per year. This schedule is commonly used to simplify payroll processing and budgeting. Excel documents tracking bi-weekly pay periods typically include 26 rows or entries corresponding to each pay period.

How do you calculate bi-weekly pay dates automatically in an Excel sheet using formulas?

To calculate bi-weekly pay dates automatically in Excel, use the formula =START_DATE + 14 * (ROW() - 1), where START_DATE is your first pay date. Replace START_DATE with your initial pay date, and drag the formula down to generate subsequent dates. This formula ensures Your bi-weekly pay schedule updates accurately without manual entry.

What Excel formula can you use to determine an employee's gross pay on a bi-weekly schedule?

Use the formula =Hours_Worked * Hourly_Rate to calculate gross pay for a bi-weekly pay schedule. Replace Hours_Worked with total hours worked in the two-week period and Hourly_Rate with the employee's pay rate. This formula accurately computes gross pay based on hours and pay rate within each bi-weekly cycle.

How do you track and summarize total hours for each bi-weekly period using Excel functions?

Use the SUMIFS function in Excel to total hours by specifying the date range for each bi-weekly period. Apply the formula =SUMIFS(HourRange, DateRange, ">=StartDate", DateRange, "<=EndDate") to aggregate hours within the bi-weekly timeframe. Ensure date cells are formatted consistently to accurately filter and summarize hours.

What is the best method to highlight or organize bi-weekly pay periods within an Excel calendar?

Use conditional formatting with a formula that identifies dates occurring every 14 days from the initial pay date to highlight bi-weekly pay periods. Organize the calendar by grouping pay period start dates in a separate column for easy reference and filtering. Incorporate named ranges and structured tables to enhance clarity and automation of the pay schedule.