The Bi-weekly Bill Payment Excel Template for Households helps users efficiently track and manage their recurring expenses on a bi-weekly basis. It provides a clear overview of due dates, amounts, and payment statuses, ensuring bills are paid on time and avoiding late fees. This template enhances budgeting accuracy and simplifies household financial planning.

Bi-weekly Bill Payment Tracker for Households

A Bi-weekly Bill Payment Tracker for households is a document used to record and monitor all bill payments made every two weeks. It helps in maintaining financial discipline and ensuring bills are paid on time.

This document usually contains details such as bill types, due dates, payment amounts, and payment status. An important suggestion is to include reminders or alerts to avoid late payments and penalties.

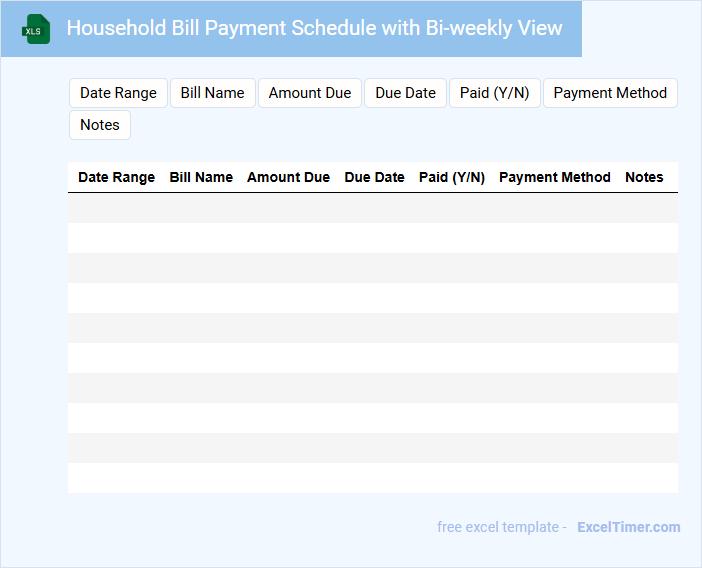

Household Bill Payment Schedule with Bi-weekly View

A Household Bill Payment Schedule with a bi-weekly view organizes your financial obligations by tracking bill due dates every two weeks. This document typically includes due dates, amounts, and payment methods to ensure timely settlements and avoid late fees. It is essential for budgeting and maintaining a clear overview of recurring expenses.

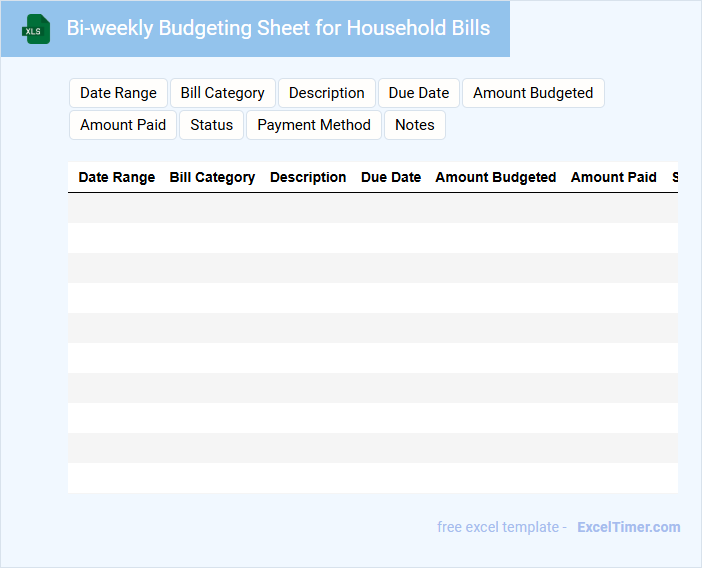

Bi-weekly Budgeting Sheet for Household Bills

A Bi-weekly Budgeting Sheet for Household Bills is a document used to track and manage household expenses on a bi-weekly basis to ensure timely payments and financial stability.

- Expense Categories: Clearly list all household bill categories such as utilities, rent/mortgage, groceries, and transportation.

- Payment Dates: Include specific due dates for each bill to avoid missed payments and late fees.

- Budget vs Actual: Track the budgeted amount against actual spending to identify areas for savings or adjustment.

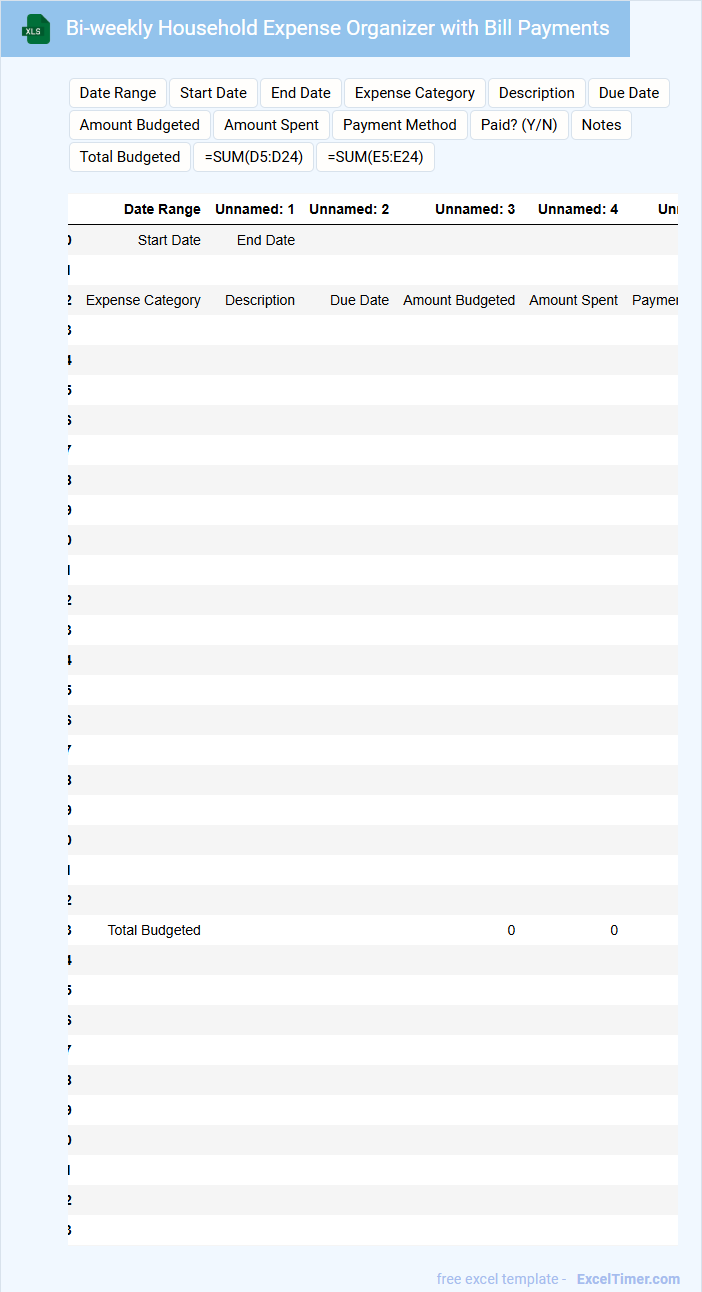

Excel Template for Bi-weekly Household Expense Tracking

Excel templates for bi-weekly household expense tracking typically contain categorized expense fields, a date column, and automatic sum calculations to help monitor spending habits. These templates often include sections for fixed bills, groceries, entertainment, and miscellaneous expenses to provide a comprehensive overview. Using a well-structured spreadsheet enables users to manage budgets effectively and identify saving opportunities.

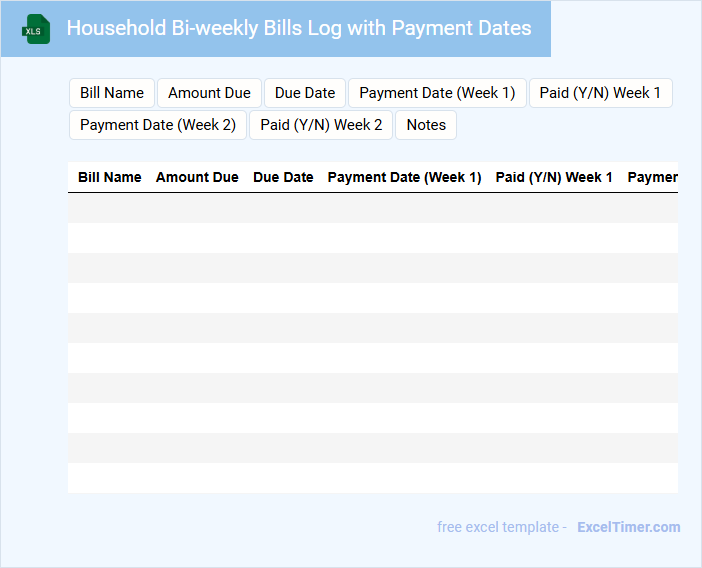

Household Bi-weekly Bills Log with Payment Dates

This document serves as a detailed record of household bills and their respective payment schedules over a two-week period. It helps track expenses and ensures timely payments.

- Include columns for bill type, amount, due date, and payment status.

- Update the log regularly to avoid missed or late payments.

- Use color coding to highlight overdue or upcoming bills.

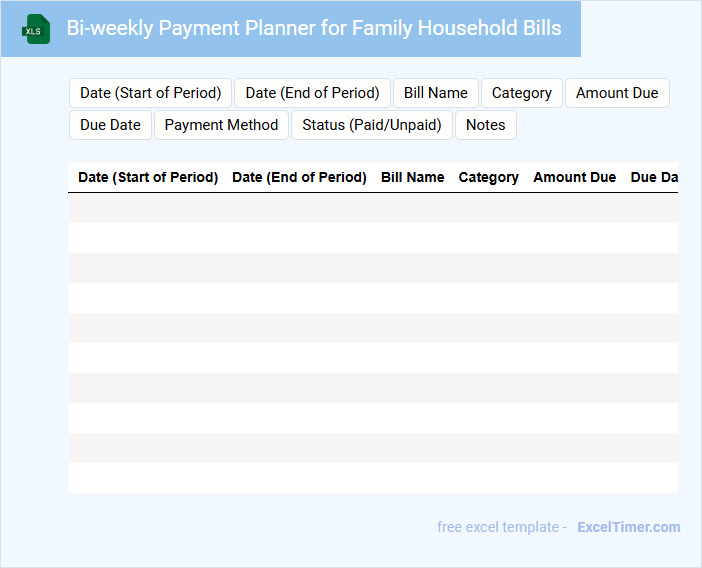

Bi-weekly Payment Planner for Family Household Bills

A Bi-weekly Payment Planner for family household bills is a document designed to organize and track payments scheduled every two weeks. It usually includes details such as due dates, payment amounts, and the responsible payer. This type of planner helps families manage their cash flow and avoid missed or late payments.

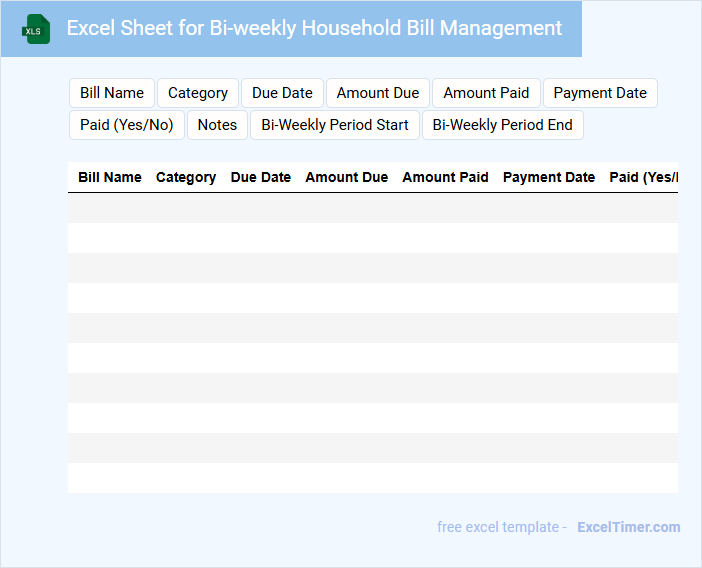

Excel Sheet for Bi-weekly Household Bill Management

An Excel Sheet for Bi-weekly Household Bill Management typically contains organized tables tracking expenses and payment dates over two-week periods. It includes columns for bill names, due dates, amounts, and payment status to ensure timely payments. Using this type of document helps maintain budget control and prevents missed bills.

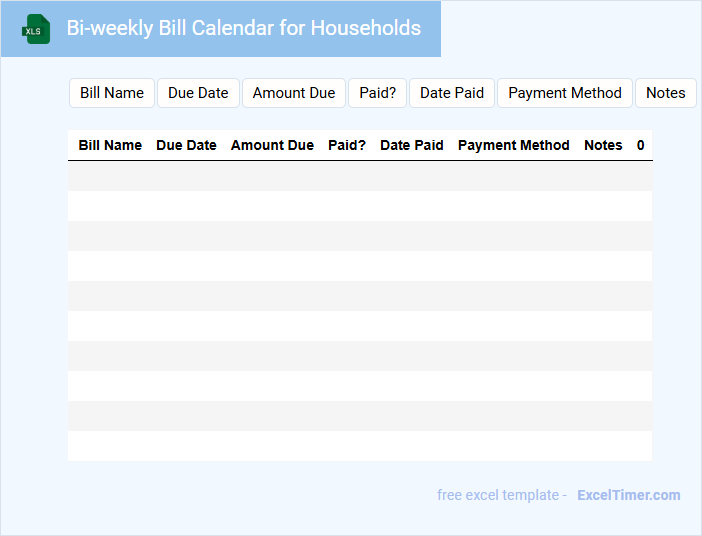

Bi-weekly Bill Calendar for Households

A Bi-weekly Bill Calendar for households is a scheduling tool designed to help track and manage bill payments every two weeks efficiently. It usually contains due dates, payment amounts, and methods for various household expenses. This calendar ensures timely payments, preventing late fees and maintaining good financial health.

Household Bi-weekly Bill Checklist with Payment Tracker

This document is a Household Bi-weekly Bill Checklist, designed to help individuals manage and organize their recurring expenses efficiently. It typically includes a list of all regular bills, payment due dates, and amounts to be paid, ensuring nothing is overlooked.

Additionally, it features a Payment Tracker to record each payment's status and date, promoting timely bill settlement and avoiding late fees. This tool is essential for maintaining financial discipline and achieving budgeting goals.

For better results, prioritize updating the checklist immediately after each payment and review it regularly to stay on top of your financial obligations.

Bi-weekly Tracking Sheet for Household Bills and Expenses

A Bi-weekly Tracking Sheet for household bills and expenses is a valuable tool for managing and organizing your financial obligations every two weeks. It typically contains categories for various bills such as utilities, rent or mortgage, groceries, and other recurring expenses. Maintaining this document helps ensure timely payments and provides a clear overview of your spending habits.

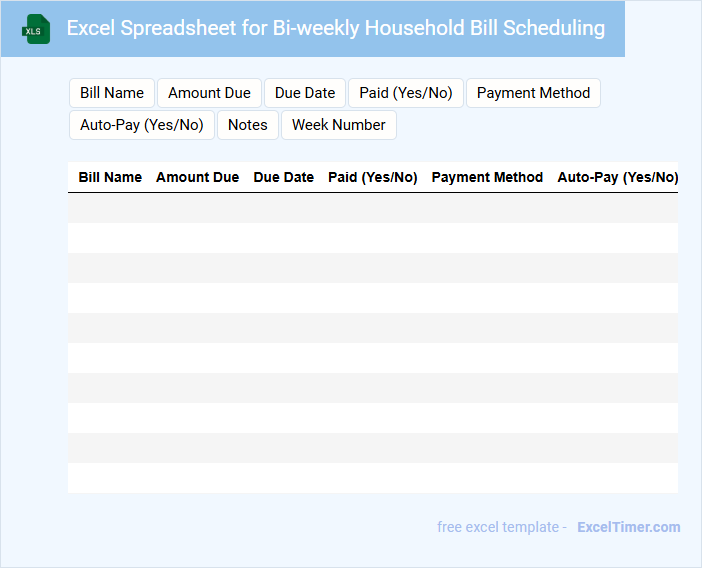

Excel Spreadsheet for Bi-weekly Household Bill Scheduling

What information is typically included in an Excel spreadsheet for bi-weekly household bill scheduling? This type of document usually contains a detailed list of recurring household expenses such as rent, utilities, groceries, and subscriptions. It also includes dates, payment amounts, due dates, and payment status to help track and organize bills effectively.

What important features should be considered when creating this spreadsheet? It is essential to incorporate automatic calculations, clear labeling, and reminders for upcoming bills to avoid late payments. Using color-coded cells and summary sections can further enhance clarity and ensure efficient financial management.

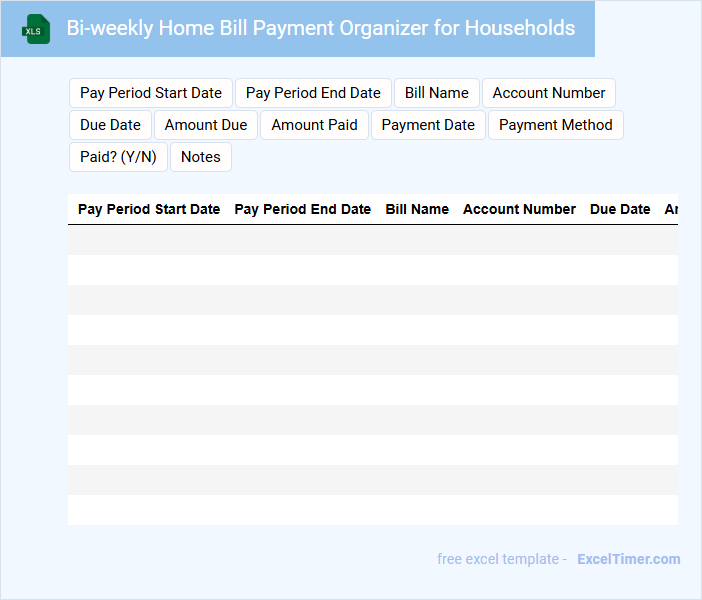

Bi-weekly Home Bill Payment Organizer for Households

This document helps households efficiently manage and track their bi-weekly bill payments to avoid late fees and maintain financial stability. It typically includes due dates, amounts, and payment methods for recurring household expenses.

- Include a clear schedule of payment due dates for all recurring bills.

- Track payment status to ensure timely completion and avoid missed payments.

- Record payment methods and confirmation numbers for future reference.

Household Budget Planner with Bi-weekly Bill Tracker

A Household Budget Planner with Bi-weekly Bill Tracker is a document designed to help manage income, expenses, and bill payments efficiently on a bi-weekly basis.

- Income Tracking: Record all sources of household income for accurate budget planning.

- Expense Categorization: Categorize expenses to identify spending patterns and areas for savings.

- Bill Payment Schedule: Track bills due bi-weekly to avoid late payments and maintain financial stability.

Bi-weekly Household Expense Organizer with Bill Payments

A Bi-weekly Household Expense Organizer with Bill Payments is a document designed to track and manage household expenses and bill payments every two weeks efficiently.

- Expense Tracking: Maintain detailed records of all expenditures to monitor spending habits.

- Bill Payment Deadlines: Clearly list due dates to avoid late fees and service interruptions.

- Budget Adjustments: Regularly review and adjust your budget to stay within financial limits.

Excel Template for Tracking Bi-weekly Bill Payments of Households

An Excel Template for tracking bi-weekly bill payments is designed to organize and monitor household expenses efficiently. It typically contains columns for dates, bill types, amounts due, and payment status. This tool helps users avoid missed payments and manage their budgets effectively.

What is the primary benefit of a bi-weekly bill payment schedule for household budgeting in Excel?

A bi-weekly bill payment schedule in Excel helps households manage cash flow by aligning payment dates with paychecks, reducing the risk of late fees. Tracking payments every two weeks improves budgeting accuracy and ensures timely bill settlements. Excel's structured format enables automated calculations and visual tracking of expenses over time.

How can you set up automated reminders in an Excel document for recurring bi-weekly payments?

Create a column in your Excel sheet to list all bi-weekly payment due dates starting from the initial payment date using the formula =A2+14, where A2 is the first payment date. Use conditional formatting to highlight upcoming due dates within a specified range, such as 3 days, by applying a rule like =AND(A2>=TODAY(), A2<=TODAY()+3). Set Excel notifications or pair the sheet with Outlook through VBA scripting to send automated email reminders for each upcoming payment date.

Which Excel formulas efficiently track and calculate upcoming bi-weekly payment due dates?

Use the Excel formula =EDATE(start_date, 0) to set your initial payment date, then apply =start_date+14 to calculate each subsequent bi-weekly bill payment due date efficiently. Combine with =IF(TODAY()>due_date, "Payment Due", "Upcoming") for real-time status tracking. These formulas optimize your bi-weekly bill payment schedule and ensure timely payments for your household.

How does an Excel document help visualize cash flow patterns when using bi-weekly payments versus monthly payments?

An Excel document allows you to track and compare bi-weekly versus monthly bill payments by organizing dates and amounts in clear tables and charts. This visualization highlights cash flow patterns, showing how bi-weekly payments can reduce interest costs and accelerate debt payoff. Using Excel's formulas and graphs provides precise insight into your household's payment schedule and financial progress.

What are key data columns and fields to include in an Excel tracker for effective bi-weekly household bill management?

Key data columns for a bi-weekly household bill payment Excel tracker include Bill Name, Due Date, Payment Amount, Payment Status, Payment Date, and Payment Method. Including columns for Account Number, Bill Category, and Notes enhances detailed tracking and categorization. Implementing conditional formatting on Payment Status can visually highlight upcoming or overdue bills for effective management.