The Bi-weekly Income and Expense Excel Template for Nonprofits provides a streamlined tool for tracking financial transactions on a bi-weekly basis, helping organizations maintain accurate records and manage cash flow efficiently. This template simplifies budgeting by categorizing income and expenses, ensuring nonprofit leaders can make informed decisions and prepare timely reports. Customizable features allow users to tailor the template to specific programs and funding sources, enhancing financial transparency and accountability.

Bi-Weekly Income and Expense Tracker for Nonprofits

A Bi-Weekly Income and Expense Tracker for nonprofits is a crucial document that records all financial transactions every two weeks, providing a clear overview of the organization's cash flow. It typically includes income sources, expense categories, and balances that help maintain fiscal responsibility. Regularly updating this tracker ensures accurate financial monitoring and accountability for stakeholders.

This document also assists in budget forecasting by identifying spending patterns and income trends over short periods. It is essential to categorize transactions clearly and reconcile entries with bank statements to prevent errors and fraud. Using this tracker empowers nonprofits to make informed financial decisions and maintain transparency.

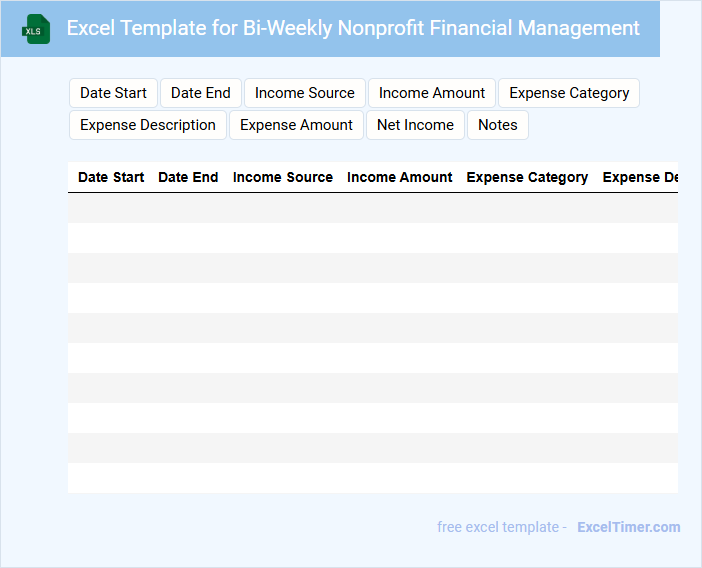

Excel Template for Bi-Weekly Nonprofit Financial Management

This document is an Excel template designed for bi-weekly financial management in nonprofit organizations. It helps track income, expenses, and budget adherence systematically over two-week periods.

- Include separate sheets for income sources, expense categories, and budget comparisons.

- Incorporate formulas for automatic totaling and variance calculations.

- Provide clear labels and instructions for ease of use by different users.

Bi-Weekly Income Statement with Expense Breakdown for Nonprofits

A Bi-Weekly Income Statement with an Expense Breakdown for Nonprofits typically contains detailed records of all revenues and expenditures over a two-week period. It emphasizes tracking donations, grants, and program-related expenses to ensure financial transparency. This document helps nonprofit organizations monitor cash flow and budget adherence.

It is crucial to include clear categorization of operational costs, program expenses, and administrative fees to provide a comprehensive view of financial health. Accuracy in recording and timely updates support effective decision-making and compliance with regulatory requirements. Regular review of this statement aids in identifying fundraising effectiveness and expense management opportunities.

Ensure the statement includes comparative data from previous periods for trend analysis, detailed notes explaining any unusual transactions, and summaries of key financial metrics like net income and cash reserves. Emphasizing transparency and accountability strengthens stakeholder trust and supports strategic planning.

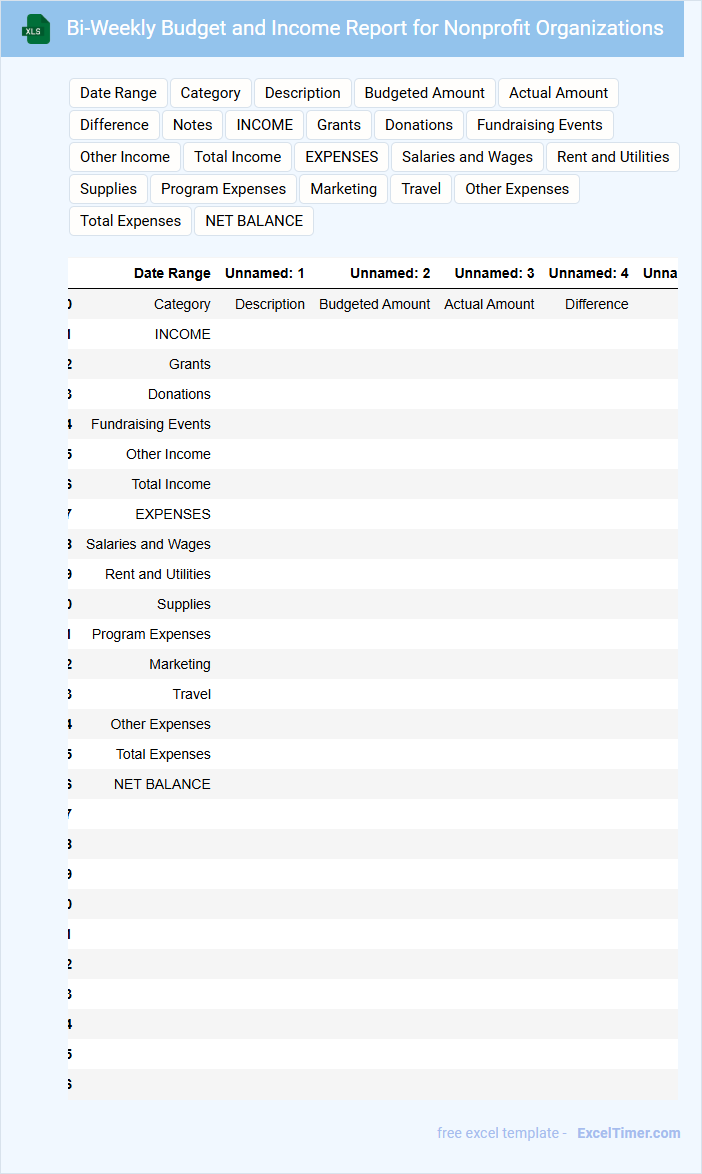

Bi-Weekly Budget and Income Report for Nonprofit Organizations

What information does a Bi-Weekly Budget and Income Report for Nonprofit Organizations usually contain? This report typically includes detailed records of income sources, expenses incurred, and budget allocations over a two-week period. It helps organizations track financial performance and maintain transparency with stakeholders.

Why is it important to include accurate income tracking and expense categorization in this report? Accurate tracking ensures proper allocation of funds and supports informed decision-making while demonstrating accountability to donors and grantors. Clear categorization also aids in identifying financial trends and potential areas for cost savings.

Income and Expense Log with Bi-Weekly Tracking for Nonprofits

An Income and Expense Log with bi-weekly tracking for nonprofits is a financial document that records all incoming funds and outgoing expenses within two-week intervals. It typically contains detailed entries such as date, description, amount, and category of each transaction, enabling accurate monitoring of cash flow. Ensuring regular updates and categorization of donations, grants, and operational costs is essential for transparent financial management and effective budgeting in nonprofit organizations.

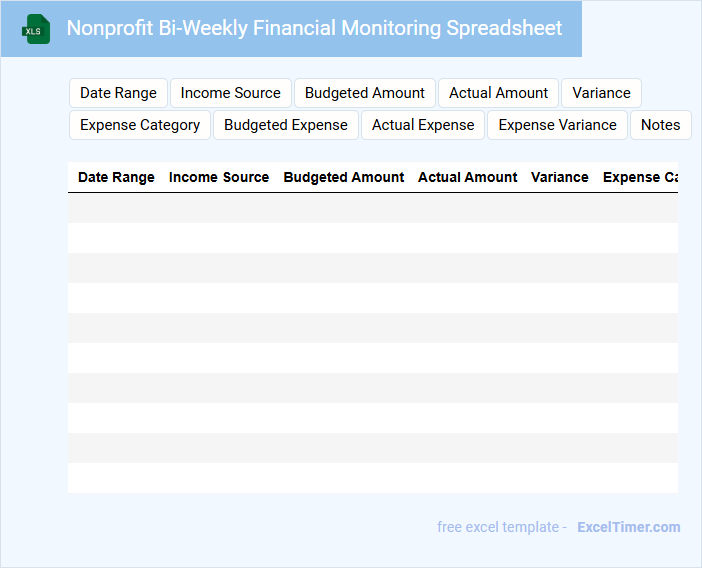

Nonprofit Bi-Weekly Financial Monitoring Spreadsheet

A Nonprofit Bi-Weekly Financial Monitoring Spreadsheet typically contains detailed entries of income, expenses, and budget allocations recorded every two weeks to track financial health accurately.

It helps organizations maintain transparency and ensure funds are used according to mission objectives. Regular updates improve decision-making processes and financial accountability.

Important elements include clear categorization of donations, grants, operating costs, and a section for variance analysis to compare budgeted versus actual figures.

Excel Sheet for Bi-Weekly Income and Expense of Nonprofit Groups

What information is typically included in an Excel sheet for bi-weekly income and expense tracking of nonprofit groups? This document usually contains detailed records of all incoming funds and outgoing expenses over each two-week period, allowing for precise financial monitoring. It helps nonprofit organizations maintain transparency and manage their budgets efficiently, ensuring that funds are used according to their mission.

What are the most important elements to include in this Excel sheet? Key elements should be clearly labeled categories for income sources and expense types, dates for each transaction, and a running balance to track financial health. Including notes or comments sections for explanations and ensuring proper data validation to avoid errors are also essential for accuracy and accountability.

Bi-Weekly Expense Analysis for Nonprofit Fund Management

What does a Bi-Weekly Expense Analysis for Nonprofit Fund Management typically include? This document generally contains detailed records of expenditures over a two-week period, categorized by type and purpose to maintain transparency and accountability. It helps nonprofit organizations monitor their spending closely, ensuring funds are used efficiently to support their mission.

Why is accuracy crucial in this report? Accurate tracking of expenses allows nonprofits to make informed budget adjustments and sustain donor trust by demonstrating responsible management of donated funds. Including clear summaries and identifying any unusual costs are important to highlight areas for potential savings or reallocation.

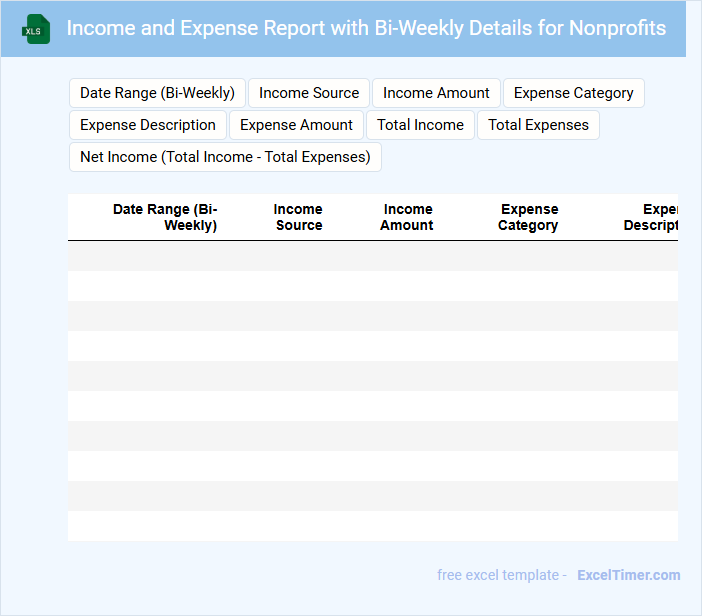

Income and Expense Report with Bi-Weekly Details for Nonprofits

Income and Expense Reports with Bi-Weekly Details for Nonprofits provide a clear overview of financial activities within a specific two-week period, helping organizations track their cash flow accurately. These reports are essential for maintaining transparency and ensuring funds are used effectively to support the nonprofit's mission.

- Include detailed income sources and categorize expenses to monitor financial health across bi-weekly intervals.

- Use consistent formats to facilitate comparison between reporting periods and improve budget planning.

- Highlight variances between projected and actual figures to identify areas needing attention or adjustment.

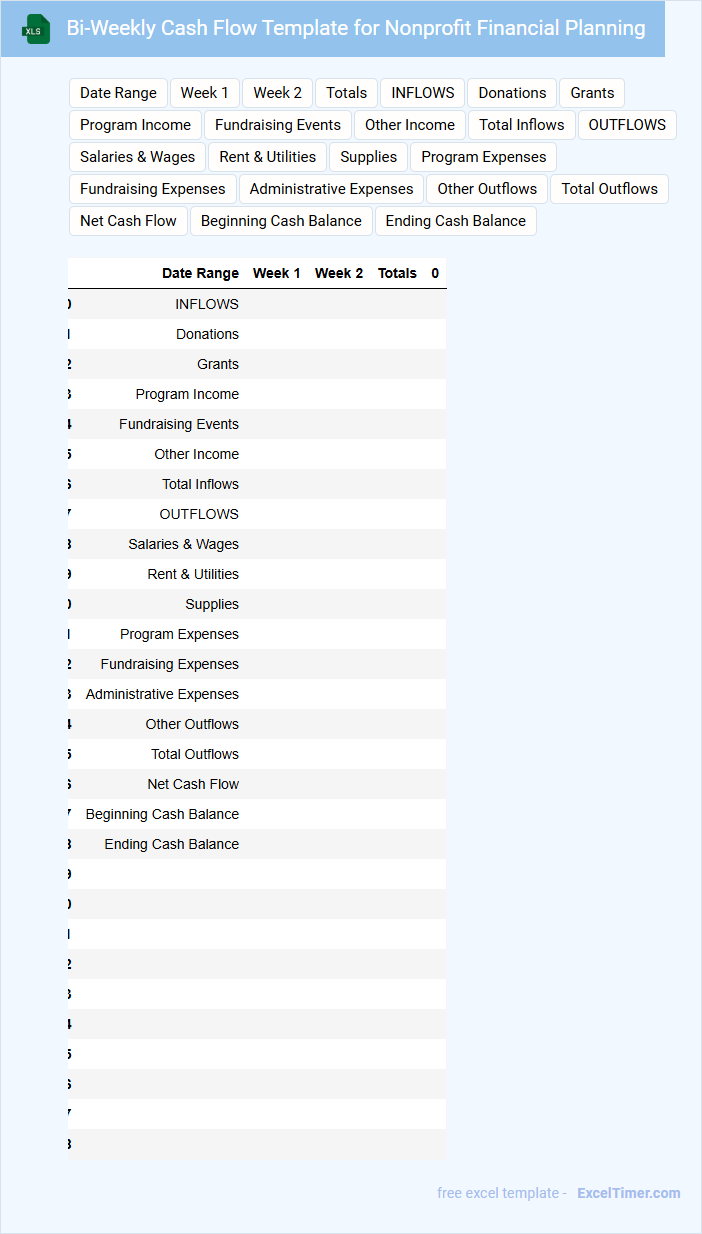

Bi-Weekly Cash Flow Template for Nonprofit Financial Planning

A Bi-Weekly Cash Flow Template for Nonprofit Financial Planning is a document designed to track and manage the inflow and outflow of funds every two weeks. It helps nonprofits ensure they have adequate liquidity to meet their obligations and plan for future expenses.

- Include detailed categories for income sources and expense types to maintain clarity.

- Regularly update projections based on actual cash flows to improve accuracy.

- Incorporate contingency planning for unexpected financial shortfalls or surpluses.

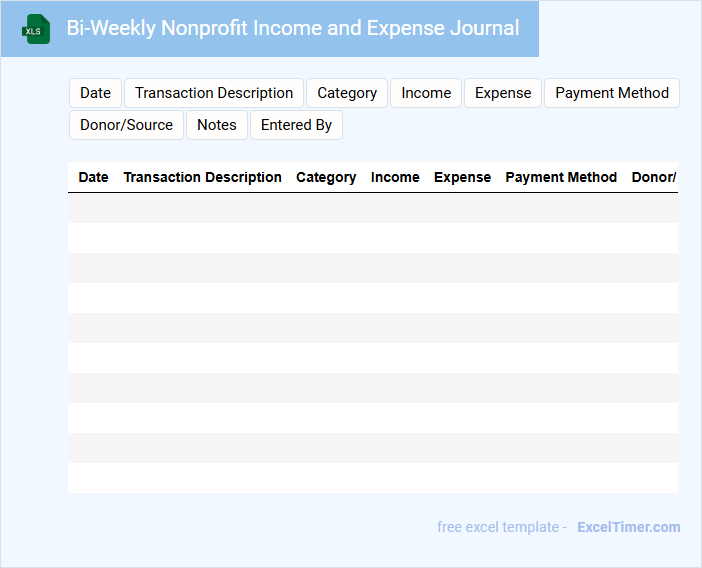

Bi-Weekly Nonprofit Income and Expense Journal

What information is typically recorded in a Bi-Weekly Nonprofit Income and Expense Journal? This document usually contains detailed entries of all income received and expenses incurred within a two-week period, helping track financial activities systematically. It serves as a crucial tool for maintaining accurate records, ensuring transparency, and managing the nonprofit's budget effectively.

What important considerations should be taken when using this journal? It is essential to include clear descriptions, dates, and categories for each transaction to facilitate easy review and reporting. Consistent updates and cross-checking with bank statements will help maintain accuracy and accountability in the nonprofit's financial management.

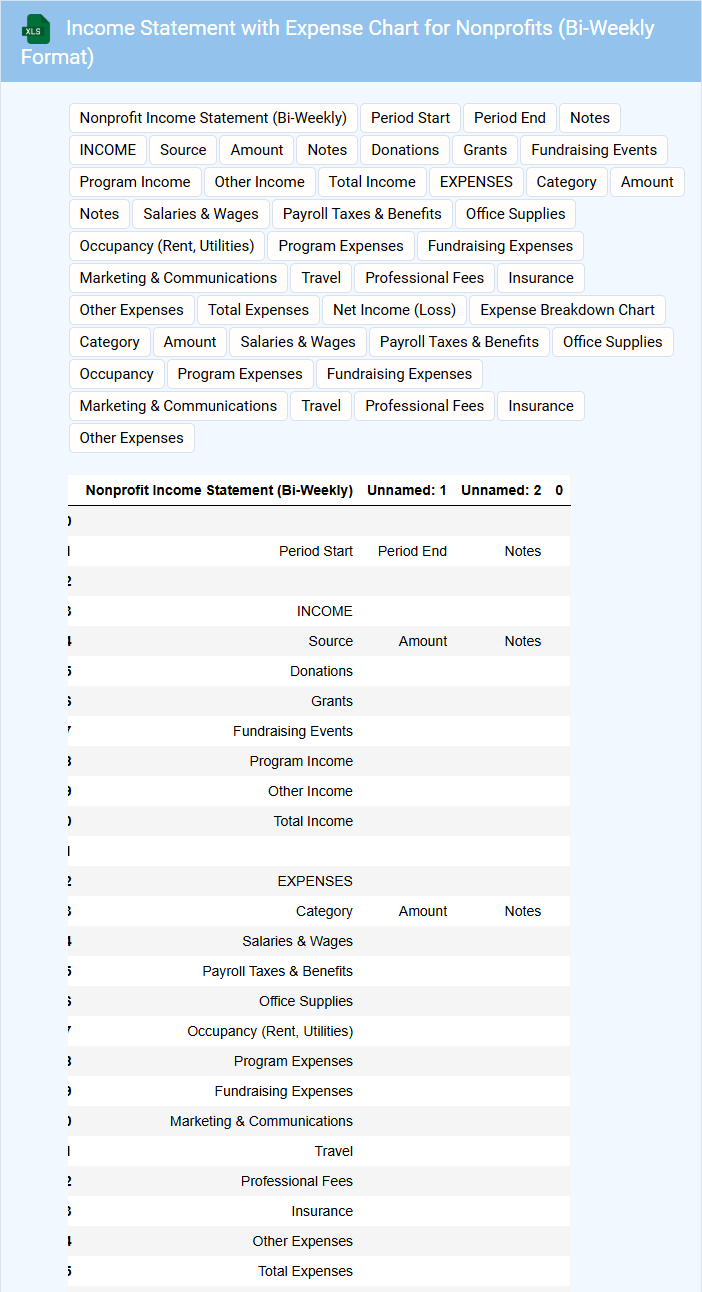

Income Statement with Expense Chart for Nonprofits (Bi-Weekly Format)

The Income Statement for nonprofits summarizes revenues and expenses over a specific period, providing insight into financial performance. The bi-weekly format allows for more frequent financial tracking, enhancing short-term budgeting and decision-making. An accompanying expense chart visually breaks down costs, aiding quick analysis.

This document typically contains detailed revenue sources, categorized expenses, and net income or loss figures. It is important to ensure accurate data entry and consistent categorization to maintain clarity and usefulness for stakeholders. Regular review helps identify spending patterns and financial health trends promptly.

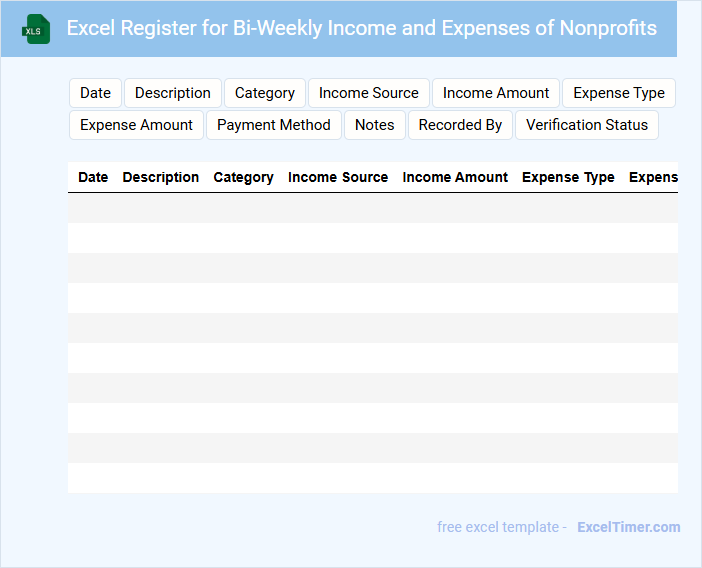

Excel Register for Bi-Weekly Income and Expenses of Nonprofits

An Excel Register for Bi-Weekly Income and Expenses of Nonprofits is a structured document used to meticulously track financial transactions occurring every two weeks. It ensures accurate recording of both incoming funds and outgoing expenses.

This register supports transparency and accountability within nonprofit organizations by organizing data in a clear, accessible format. Regular updates and reconciliations are crucial to maintain financial integrity and support effective budgeting.

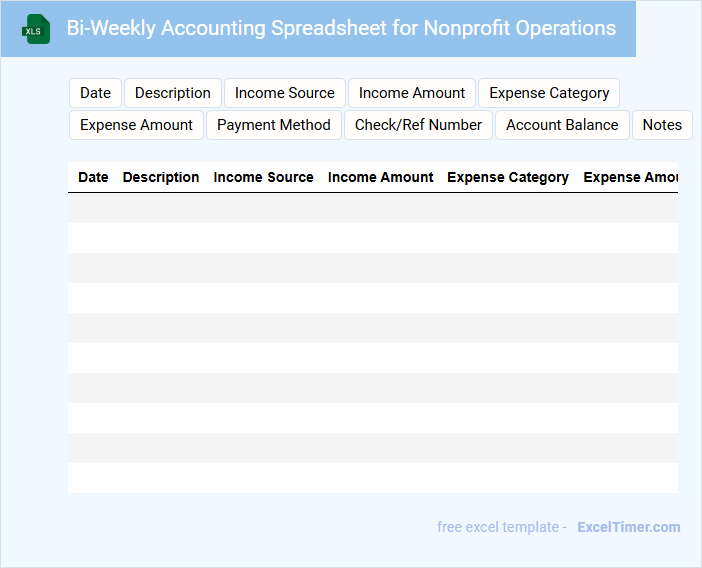

Bi-Weekly Accounting Spreadsheet for Nonprofit Operations

This Bi-Weekly Accounting Spreadsheet is designed to track financial transactions and monitor the budget of nonprofit operations regularly. It typically contains entries for income, expenses, grants, and donations during each two-week period.

Such a document helps ensure transparency and fiscal responsibility within the organization. Important elements to include are clear categorization of funds, date-stamped records, and updated running totals for accurate financial analysis.

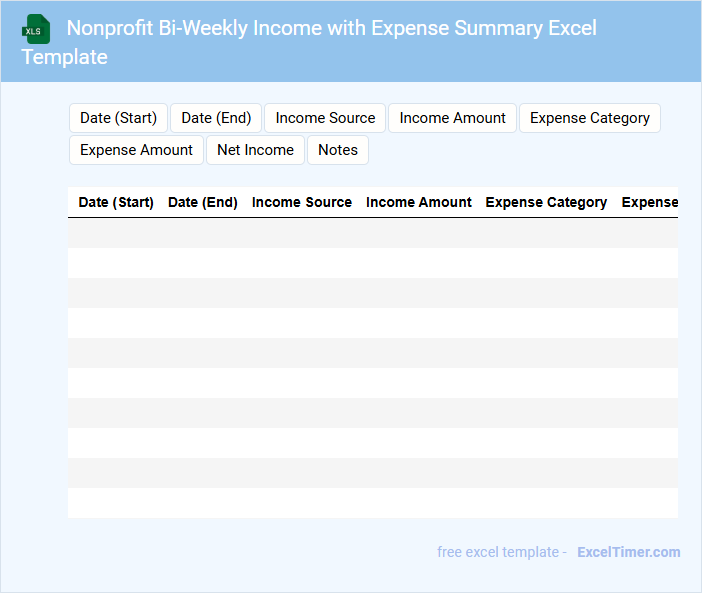

Nonprofit Bi-Weekly Income with Expense Summary Excel Template

This Nonprofit Bi-Weekly Income with Expense Summary Excel Template is designed to track and manage the financial inflows and outflows of a nonprofit organization over a two-week period. It typically contains detailed sections for recording donations, grants, program expenses, and administrative costs to ensure accurate financial monitoring.

The template helps nonprofits maintain transparency and accountability by summarizing income and expenses in an organized manner, facilitating budget adjustments and financial planning. Regular updates and categorization of transactions are important to capture a clear financial picture for reporting and decision-making purposes.

Ensure consistent data entry and review financial summaries regularly to support effective nonprofit fund management and compliance with regulatory requirements.

How is bi-weekly income tracked and categorized in the nonprofit's Excel document?

In the nonprofit's Excel document, bi-weekly income is tracked by inputting all revenue sources within a two-week period, categorized by donor type, grant, or fundraising event. Your entries are organized into predefined columns for date, amount, and income category to ensure accurate and efficient reporting. This system enables clear analysis of financial inflows every two weeks to support budgeting and financial planning.

What expense categories are included for bi-weekly tracking in the spreadsheet?

Your bi-weekly income and expense spreadsheet for nonprofits includes categories such as payroll, utilities, program supplies, rent, and fundraising costs. Income sections track donations, grants, and event revenue to provide a comprehensive financial overview. This layout ensures accurate monitoring of financial health and resource allocation every two weeks.

Which Excel formulas are used to calculate net bi-weekly income for the nonprofit?

Excel formulas such as SUM and SUMIF are essential for calculating your nonprofit's total bi-weekly income and expenses. The formula =SUM(IncomeRange) adds all income entries while =SUM(ExpensesRange) totals all expenses within the bi-weekly period. To find net bi-weekly income, use =SUM(IncomeRange)-SUM(ExpensesRange) for precise financial tracking.

How can users visualize bi-weekly income versus expenses using Excel charts?

Users can visualize bi-weekly income versus expenses in Excel by creating a clustered column chart that displays income and expense values side by side for each bi-weekly period. Setting the bi-weekly dates as the horizontal axis labels enhances clarity and comparison. Applying data labels and color-coding income and expenses improves readability and highlights financial trends effectively.

What method is used to flag anomalies or over-budget spending in bi-weekly reports?

Your bi-weekly income and expense reports for nonprofits use conditional formatting and variance analysis to flag anomalies or over-budget spending. This method highlights transactions that deviate significantly from budgeted amounts or historical patterns. Automated alerts help identify irregularities early for effective financial management.