The Bi-weekly Excel Template for Small Business Salary Distribution streamlines payroll management by allowing accurate calculation and organization of employee salaries every two weeks. This template includes automatic deductions, tax calculations, and detailed salary breakdowns, ensuring compliance and reducing manual errors. Its user-friendly design supports small businesses in maintaining efficient and transparent payroll processes.

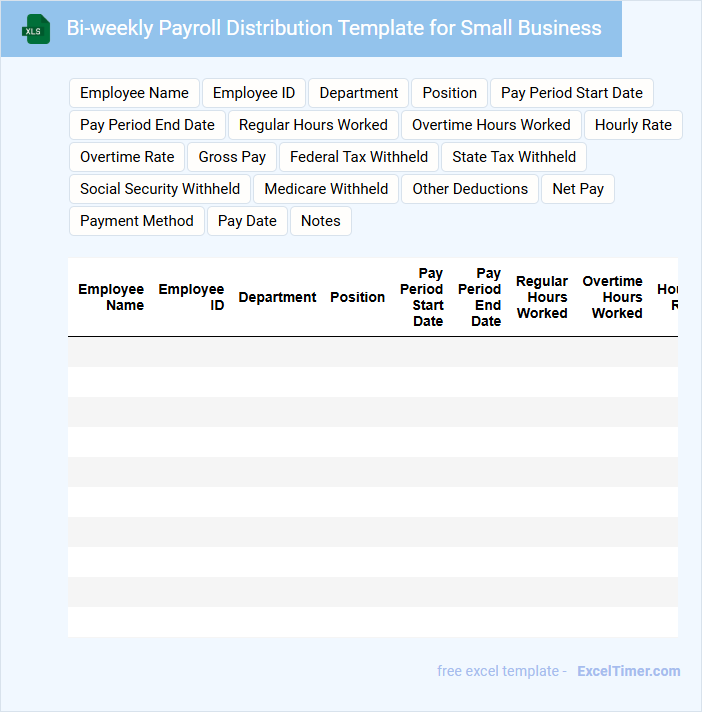

Bi-weekly Payroll Distribution Template for Small Business

A Bi-weekly Payroll Distribution Template is designed to streamline the process of paying employees every two weeks, ensuring accuracy and consistency in salary disbursements. This type of document typically includes employee details, hours worked, gross pay, deductions, and net pay for the pay period.

For small businesses, it is crucial to maintain clear records for tax compliance and benefit calculations using this template. Including a section for notes or adjustments can help manage exceptions and errors effectively.

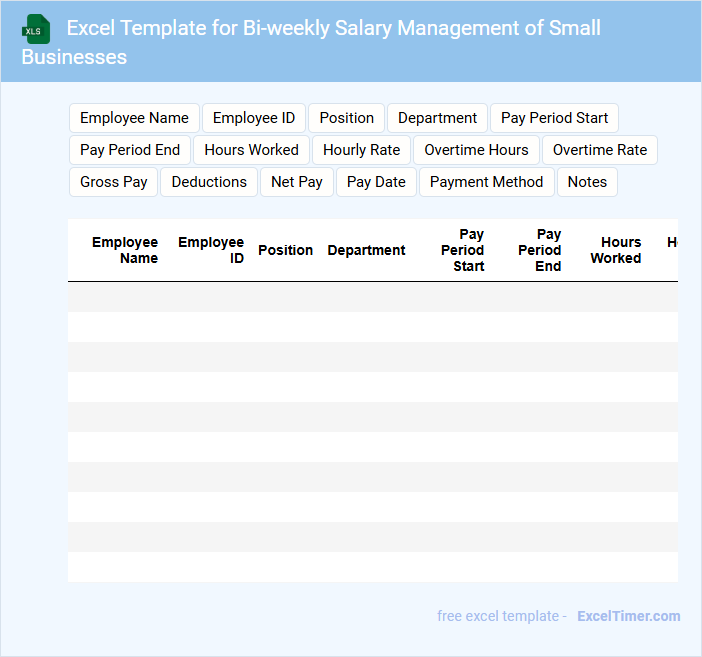

Excel Template for Bi-weekly Salary Management of Small Businesses

An Excel Template for Bi-weekly Salary Management is designed to streamline payroll processing for small businesses by organizing employee salary details efficiently. It typically contains sections for employee names, working hours, hourly rates, deductions, and final pay amounts. Utilizing such a template helps maintain accuracy and saves time, ensuring compliance with wage regulations.

Important considerations include including formulas for automatic calculations, clear documentation of tax and deduction rules, and customizable fields to accommodate different pay structures. Additionally, regular updates and secure data protection are crucial to ensure payroll integrity and confidentiality. Implementing this template can improve financial tracking and simplify salary management processes.

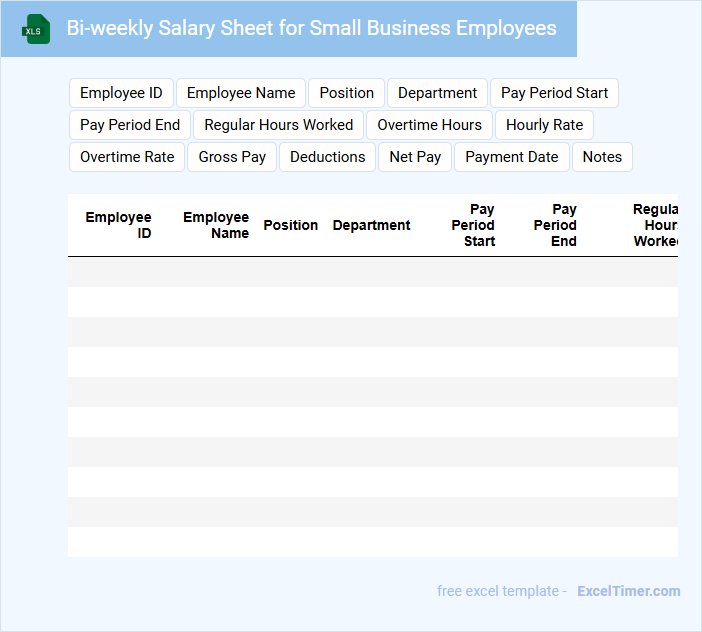

Bi-weekly Salary Sheet for Small Business Employees

A Bi-weekly Salary Sheet typically contains detailed records of employee earnings over a two-week period, including basic pay, overtime, deductions, and net salary. It helps small businesses keep track of payroll efficiently and ensures timely salary disbursement. Including accurate employee details and clear dates is crucial for maintaining transparency and compliance.

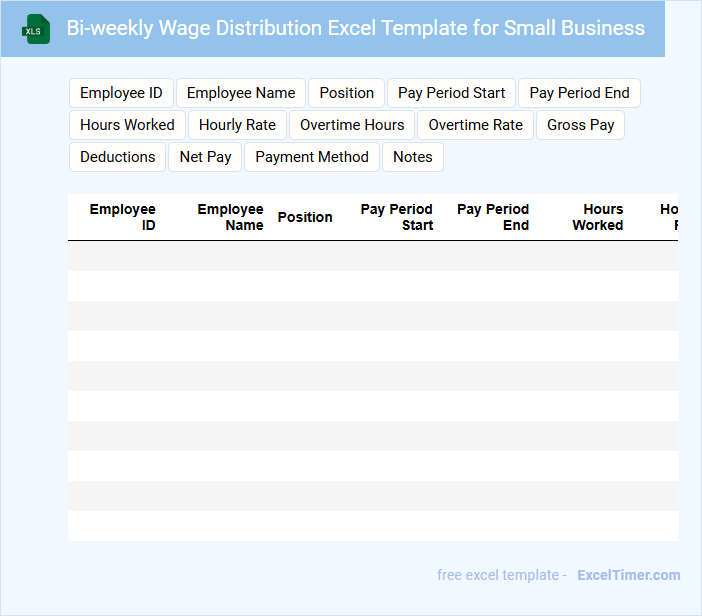

Bi-weekly Wage Distribution Excel Template for Small Business

What information is typically included in a Bi-weekly Wage Distribution Excel Template for Small Business? This type of document usually contains detailed employee wage data such as hours worked, pay rates, overtime, deductions, and net pay for each bi-weekly period. It helps small businesses efficiently track payroll, ensure accuracy in wage calculations, and maintain organized financial records.

What is an important consideration when using this template? It is crucial to regularly update employee information and tax rates within the template to comply with legal requirements and avoid payroll errors. Additionally, ensuring secure access controls protects sensitive employee wage details from unauthorized users.

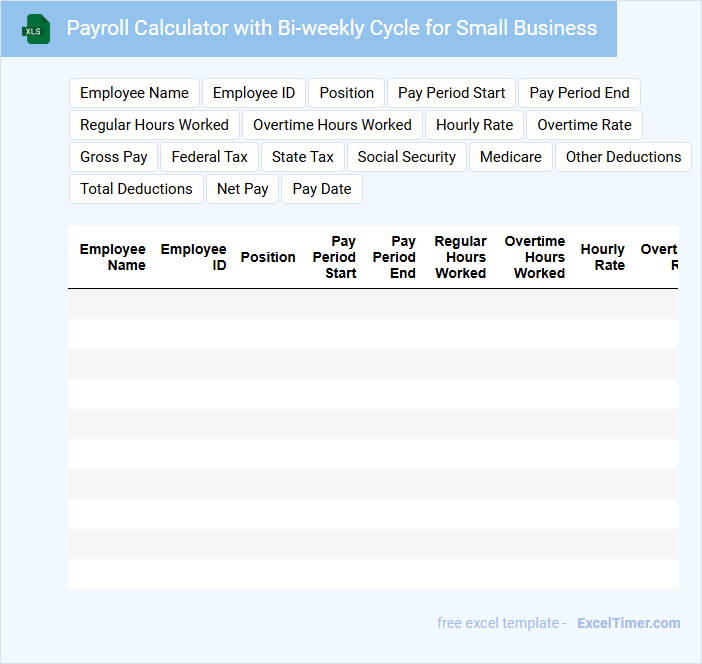

Payroll Calculator with Bi-weekly Cycle for Small Business

A Payroll Calculator with a bi-weekly cycle is a vital tool for small businesses to accurately compute employee wages and deductions every two weeks. This document typically contains employee information, hours worked, tax withholdings, and benefit contributions to ensure compliance with payroll laws. It is important to include clear instructions on tax rates, overtime calculations, and pay schedule adherence for efficient payroll management.

Small Business Bi-weekly Salary Payment Tracker

What information does a Small Business Bi-weekly Salary Payment Tracker typically contain? This document usually records employee names, payment dates, amounts paid, and any deductions or bonuses applied. It helps ensure accurate and timely salary payments, maintaining clear financial records and compliance with labor laws.

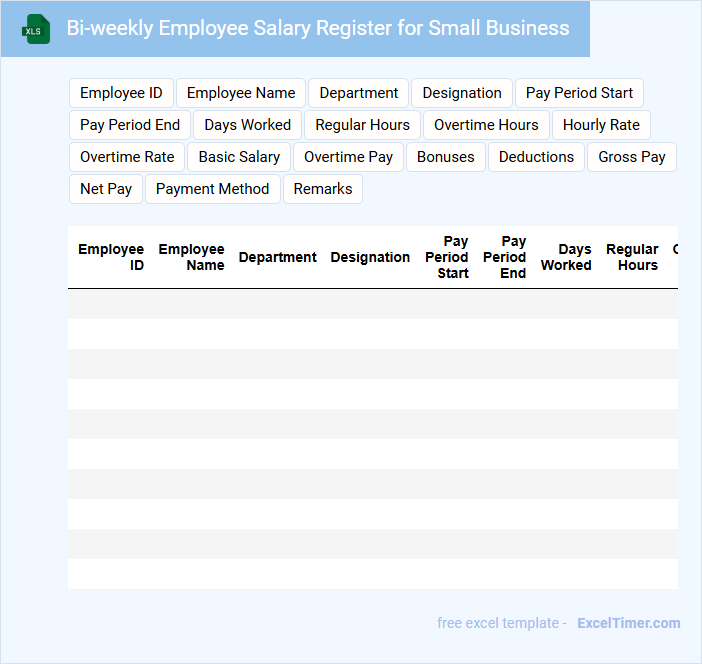

Bi-weekly Employee Salary Register for Small Business

A Bi-weekly Employee Salary Register for Small Business typically contains detailed records of employee earnings and deductions for each pay period.

- Accurate Employee Information: Ensure all employee details such as name, ID, and position are clearly listed.

- Clear Salary Breakdown: Include basic salary, overtime, bonuses, and deductions for transparency.

- Consistent Update Schedule: Maintain updates every two weeks to track payroll correctly and avoid discrepancies.

Payroll Distribution Log for Bi-weekly Salary of Small Business

What information is typically included in a Payroll Distribution Log for Bi-weekly Salary of a Small Business? This document usually contains details such as employee names, pay periods, hours worked, gross pay, deductions, and net pay. It helps ensure accurate and timely payments while maintaining proper records for financial tracking and compliance.

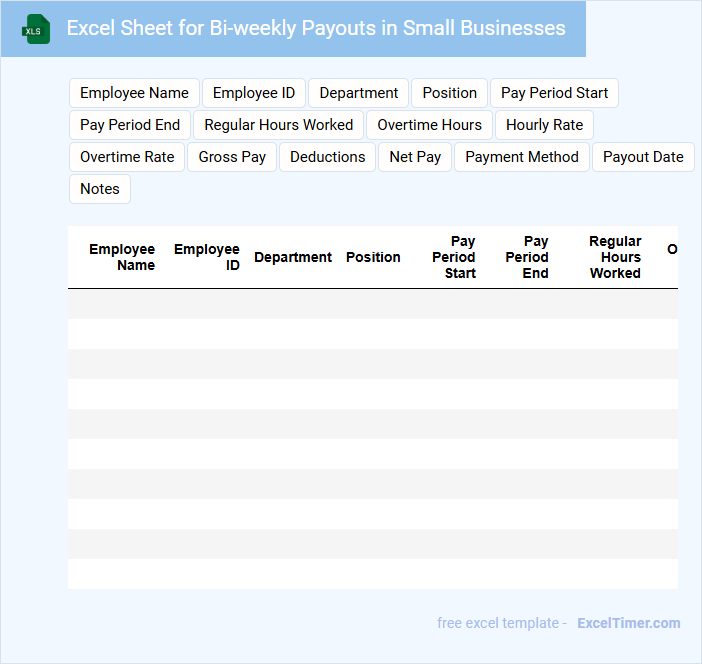

Excel Sheet for Bi-weekly Payouts in Small Businesses

An Excel Sheet for Bi-weekly Payouts in Small Businesses is typically used to track and calculate employee payments every two weeks. It helps ensure accurate and timely compensation management.

- Include columns for employee names, hours worked, and pay rates for clarity.

- Incorporate formulas to automatically calculate total earnings and deductions.

- Maintain a summary section to review overall payroll expenses per period.

Bi-weekly Salary Payment Record with Tax Breakdown for Small Business

What information is typically included in a Bi-weekly Salary Payment Record with Tax Breakdown for Small Business? This document usually contains detailed records of employee salaries paid every two weeks, including gross pay, deductions, and net pay. It also provides a tax breakdown, showing federal, state, and other applicable tax withholdings to ensure accurate payroll processing and compliance.

Why is it important to maintain accurate bi-weekly salary payment records with tax details? Keeping precise records helps small businesses track payroll expenses, manage cash flow effectively, and meet legal tax reporting requirements. It is also essential for resolving employee payment queries and preparing for tax audits or financial reviews.

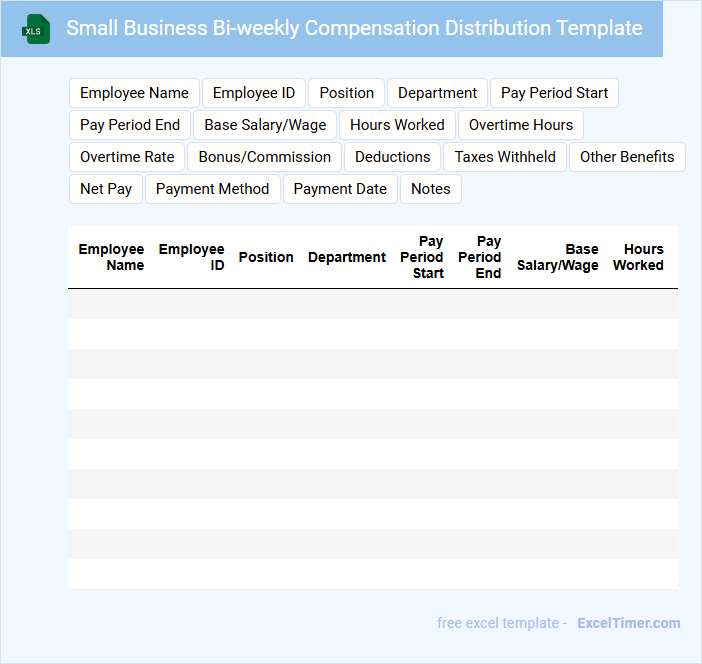

Small Business Bi-weekly Compensation Distribution Template

A Small Business Bi-weekly Compensation Distribution Template typically contains detailed records of employee earnings, deductions, and net pay for each pay period. It ensures accurate tracking and timely distribution of salaries every two weeks.

Important elements include employee names, hours worked, wage rates, taxes withheld, and total compensation amounts. Maintaining compliance with labor laws and updating tax rates regularly are essential for smooth payroll processing.

Employee Roster with Bi-weekly Salary Tracking for Small Business

Employee Roster with Bi-weekly Salary Tracking for Small Business typically contains employee details, work hours, and salary calculations to manage payroll efficiently.

- Employee Details: It includes names, contact information, and job titles for easy identification.

- Work Hours: Tracks hours worked each day to calculate bi-weekly pay accurately.

- Salary Calculations: Summarizes earnings, deductions, and net pay to ensure transparent payroll processing.

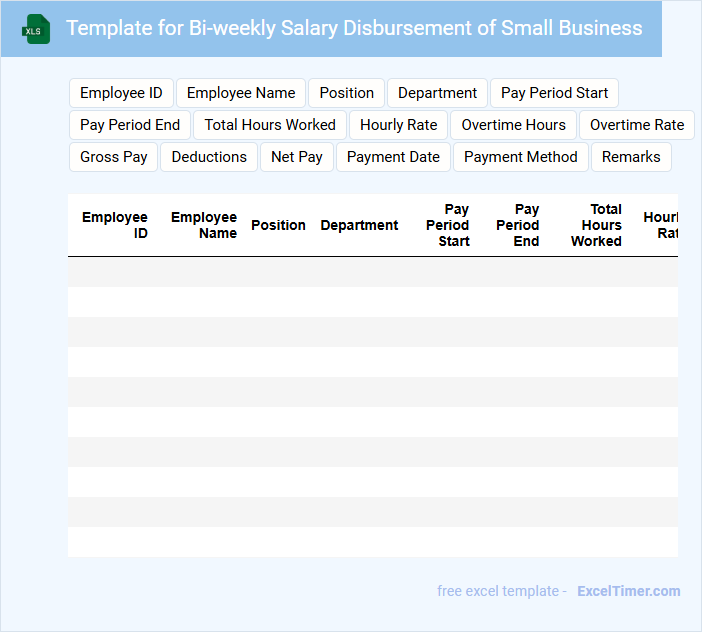

Template for Bi-weekly Salary Disbursement of Small Business

What information is typically included in a template for bi-weekly salary disbursement of a small business? This document usually contains employee details, pay period dates, gross salary, deductions, and net salary. It ensures accurate and timely payments while maintaining clear records for both the employer and employees.

What is one important suggestion to consider when creating this template? It is crucial to include clear breakdowns of salary components and deductions, along with proper formatting for easy reading and auditing. This helps prevent errors and facilitates transparent communication between the business and its staff.

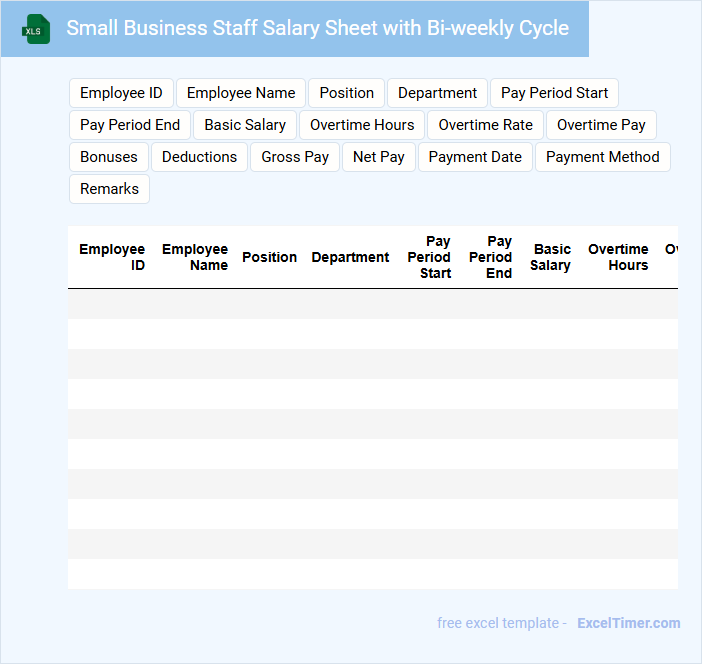

Small Business Staff Salary Sheet with Bi-weekly Cycle

A Small Business Staff Salary Sheet with a bi-weekly cycle typically contains detailed records of employee wages, hours worked, and deductions for each pay period. It ensures accurate and consistent tracking of payroll for every two-week interval.

Important elements include employee names, job titles, pay rates, total hours, gross pay, taxes, and net pay. Maintaining this sheet helps businesses manage their finances efficiently and comply with labor regulations.

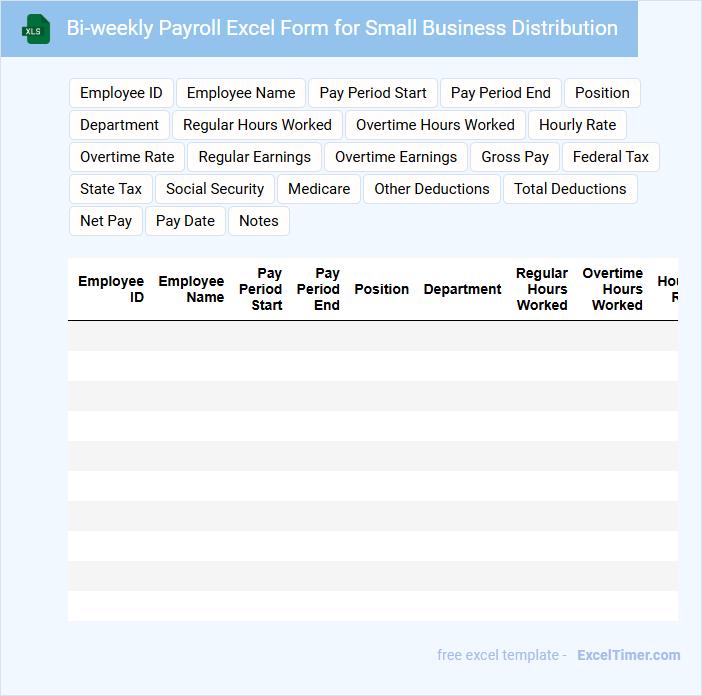

Bi-weekly Payroll Excel Form for Small Business Distribution

A Bi-weekly Payroll Excel Form for Small Business Distribution typically contains employee salary details calculated every two weeks to ensure accurate and timely payments.

- Employee Information: Includes names, employee IDs, and job titles for clear identification.

- Earnings and Deductions: Captures gross pay, taxes, benefits, and other deductions for precise net pay calculations.

- Distribution Summary: Summarizes total payroll expenses and payment distribution details for record-keeping and budgeting.

What are the key benefits of using a bi-weekly salary distribution for small businesses in Excel?

Using a bi-weekly salary distribution in Excel allows your small business to accurately track payroll expenses every two weeks, improving cash flow management. This method provides clear visibility into employee compensation, aiding in budget forecasting and financial planning. Excel's customizable templates help automate calculations, reducing errors and saving time on payroll processing.

How does the bi-weekly frequency affect payroll calculation and record-keeping in an Excel document?

Bi-weekly payroll calculation in an Excel document requires precise formulas to ensure accurate salary distribution every 14 days, totaling 26 pay periods annually. Your Excel records must track each pay period's gross pay, deductions, and net salary to maintain compliance and financial accuracy. Automating calculations and creating detailed bi-weekly summaries improves payroll management for small businesses.

Which essential columns should be included in a bi-weekly salary distribution Excel sheet for clear tracking?

Include essential columns such as Employee Name, Employee ID, Pay Period Start Date, Pay Period End Date, Hours Worked, Hourly Rate or Salary, Gross Pay, Tax Deductions, Other Deductions, and Net Pay. These columns enable precise tracking of individual earnings, deductions, and accurate net salary calculations for each bi-weekly cycle. Incorporate department or job title columns for detailed analysis and reporting.

What formulas are commonly used in Excel to automate bi-weekly payroll totals and deductions?

Common Excel formulas for automating bi-weekly payroll totals include SUM to aggregate earnings and deductions, IF for conditional calculations based on employee status, and VLOOKUP or INDEX-MATCH for retrieving tax rates and deduction values. The formula =SUM(range) calculates total pay, while =IF(condition, value_if_true, value_if_false) can adjust for benefits or taxes. Excel functions like PMT or custom formulas help compute loan or benefit deductions automatically within bi-weekly salary distribution sheets.

How can small businesses ensure compliance and accuracy when managing bi-weekly salary data in Excel?

Small businesses can ensure compliance and accuracy in bi-weekly salary distribution by using Excel templates with built-in formulas for tax calculations and overtime pay. Implementing regular data validation and audit trails helps minimize errors and maintain regulatory adherence. Automating payroll processes in Excel reduces manual entry risks and improves salary data consistency.