A Bi-weekly Budget Excel Template for Home Finance helps manage household expenses by organizing income and expenditures every two weeks, ensuring accurate tracking of cash flow. This template is essential for timely bill payments and savings goals, preventing overspending and improving financial discipline. Customizable categories and automatic calculations make it user-friendly and efficient for maintaining a balanced budget.

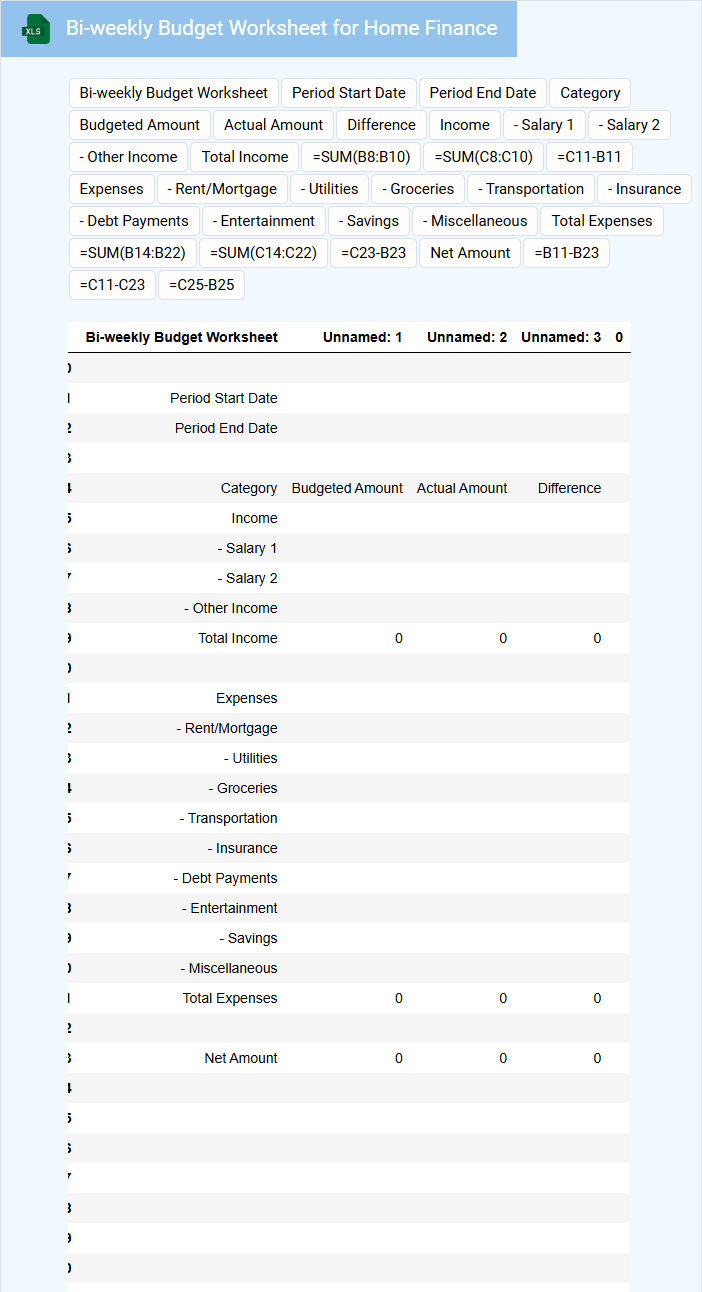

Bi-weekly Budget Worksheet for Home Finance

What information is typically included in a Bi-weekly Budget Worksheet for Home Finance? This document usually contains detailed records of income, expenses, and savings planned on a bi-weekly basis to help manage household finances effectively. It also provides a clear overview for tracking spending patterns and ensuring bills and savings goals are met consistently.

What is an important consideration when using this type of worksheet? It is crucial to update the worksheet regularly with actual expenses and income to maintain accuracy. Additionally, including categories for unexpected costs ensures better preparedness and financial stability throughout the budgeting period.

Home Finance Tracker with Bi-weekly Planning

Home Finance Tracker with Bi-weekly Planning is a document used to manage and monitor personal finances by organizing income, expenses, and savings on a bi-weekly schedule.

- Income Recording: Track all sources of income every two weeks to have a clear understanding of your cash flow.

- Expense Categorization: Categorize your expenses to identify spending patterns and control unnecessary costs.

- Savings Goals: Set and review bi-weekly savings targets to ensure consistent progress towards financial goals.

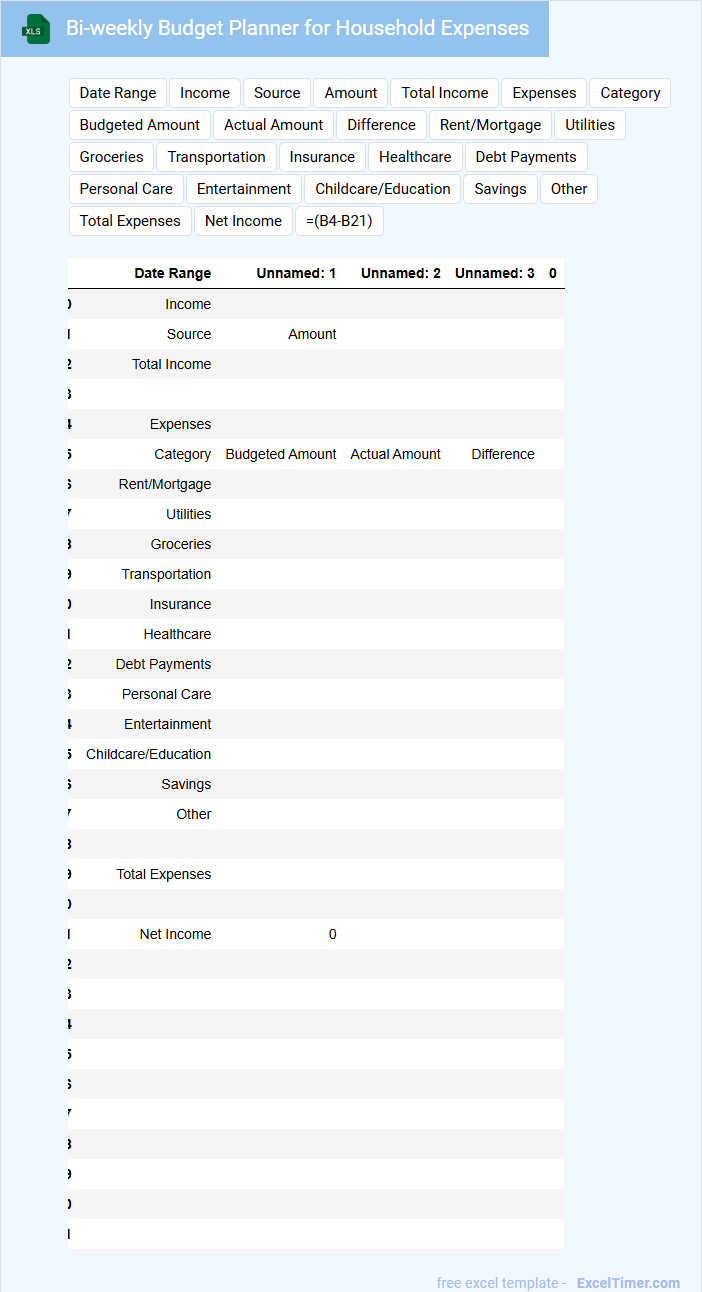

Bi-weekly Budget Planner for Household Expenses

A Bi-weekly Budget Planner for Household Expenses is a tool designed to help manage and track your finances every two weeks. It typically contains income sources, categorized expenses, and savings goals to ensure balanced spending. Using this planner regularly can help prevent overspending and promote better financial discipline within the household.

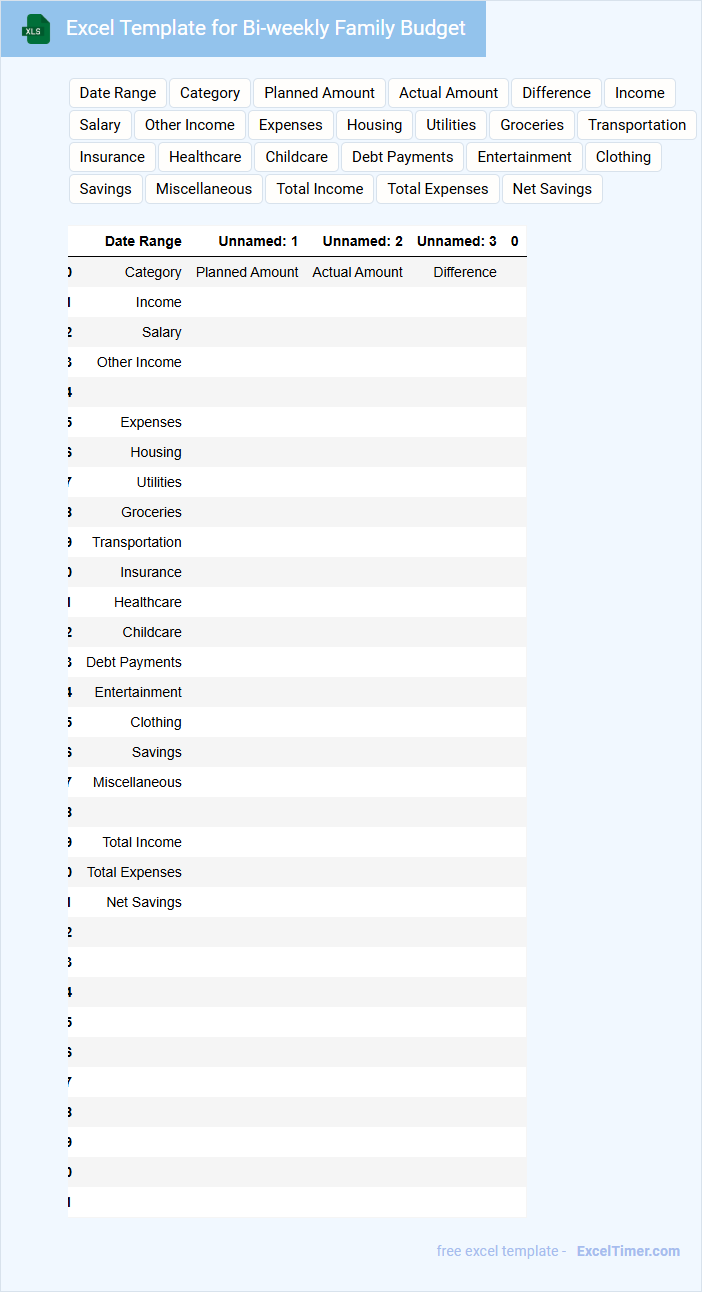

Excel Template for Bi-weekly Family Budget

An Excel template for bi-weekly family budget typically contains sections for income, fixed expenses, variable expenses, and savings goals. It is designed to track financial inflows and outflows every two weeks to ensure spending aligns with the family's financial plan.

Such templates often include categorized expense lists and automatic calculations for better clarity. A crucial recommendation is to update the document regularly and review spending patterns to adjust the budget effectively.

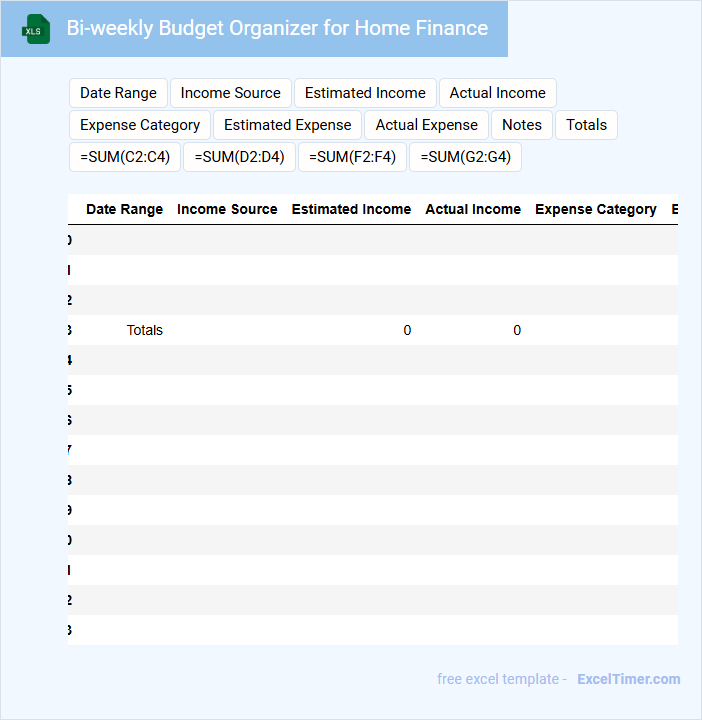

Bi-weekly Budget Organizer for Home Finance

A Bi-weekly Budget Organizer is a structured document designed to track income and expenses every two weeks, helping individuals maintain control over their finances. It usually contains sections for recording income sources, fixed and variable expenses, and savings goals. For home finance, an important feature to include is a clear summary of spending categories to identify areas for potential savings.

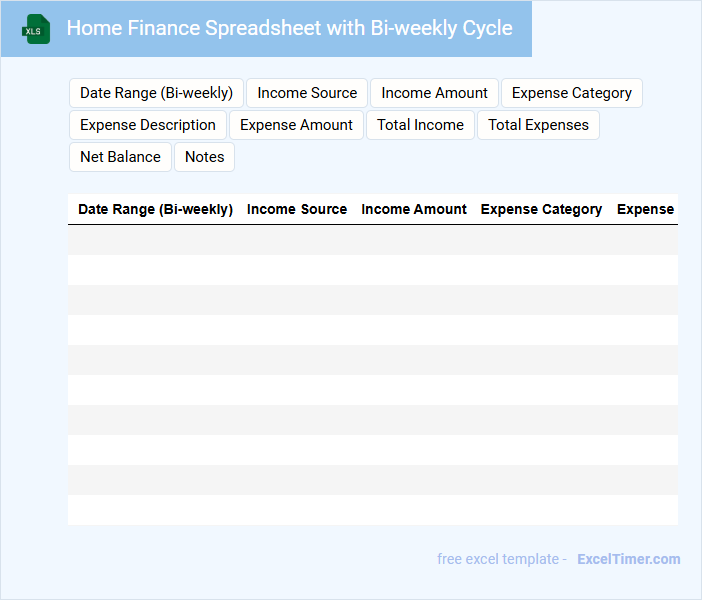

Home Finance Spreadsheet with Bi-weekly Cycle

What information does a Home Finance Spreadsheet with Bi-weekly Cycle typically contain? This type of document usually includes detailed records of income, expenses, and savings organized around a bi-weekly payment schedule. It helps users track their finances accurately by aligning cash flow with pay periods, improving budgeting and financial planning.

What is an important consideration when using this spreadsheet? It is crucial to regularly update all entries and categorize expenses correctly to gain clear insights into spending patterns. Additionally, incorporating automatic calculations for bi-weekly cycles ensures accuracy and helps avoid missing bill payments.

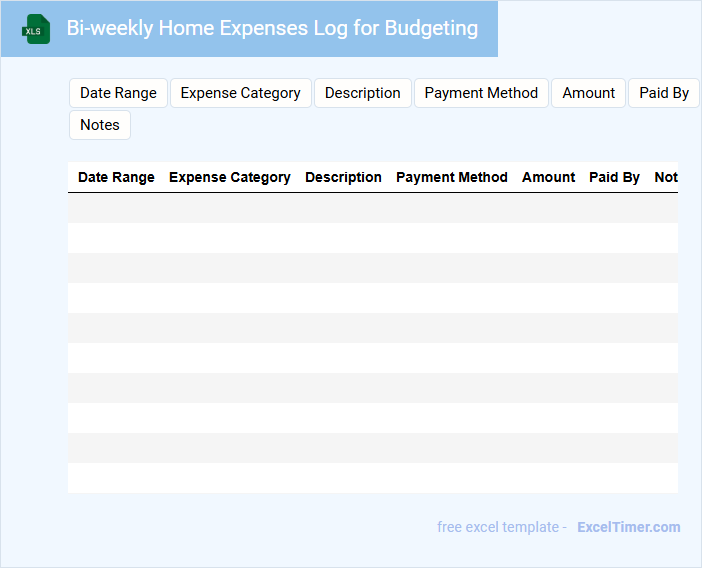

Bi-weekly Home Expenses Log for Budgeting

A Bi-weekly Home Expenses Log typically contains detailed records of all household expenditures recorded every two weeks, including bills, groceries, and miscellaneous purchases. It helps individuals track spending patterns systematically to manage finances effectively.

Such a document is crucial for budgeting, allowing users to evaluate income versus expenses and identify areas where savings can be made. Maintaining consistency and accuracy in entries ensures reliable financial insights.

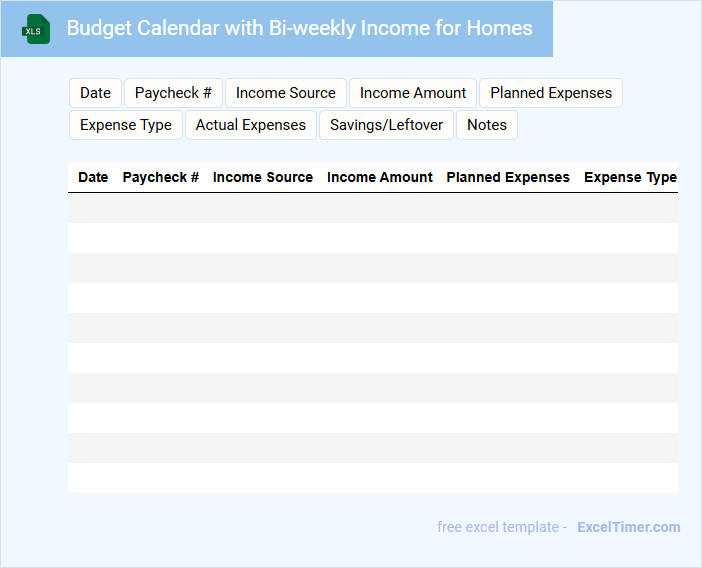

Budget Calendar with Bi-weekly Income for Homes

A Budget Calendar with Bi-weekly Income for Homes is a financial planning tool that helps households track income and expenses on a bi-weekly basis. It typically includes pay periods, bill due dates, and savings goals organized by date. This document aids in managing cash flow and ensuring timely payments to avoid debt.

Important elements to include are clear income entries, recurring and variable expense categories, and reminders for upcoming payments. Visual markers or color coding can highlight critical dates like rent or mortgage deadlines. Additionally, incorporating a savings tracker encourages financial discipline and goal achievement.

Bi-weekly Budget Tracker for Family Finance

A Bi-weekly Budget Tracker for Family Finance typically contains detailed records of income and expenses over two-week periods to help families manage their finances efficiently.

- Income Sources: Lists all family income streams to understand total earnings.

- Expense Categories: Tracks spending habits across essential and discretionary items.

- Savings Goals: Monitors progress toward financial targets for better future planning.

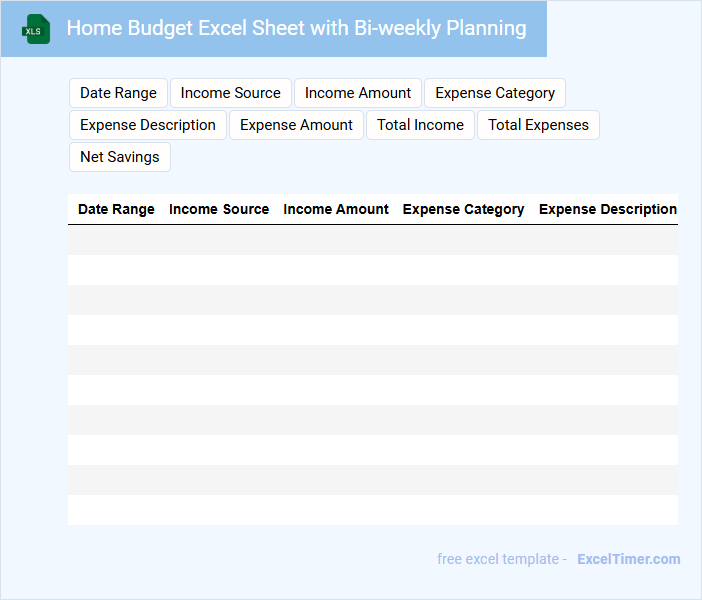

Home Budget Excel Sheet with Bi-weekly Planning

A Home Budget Excel Sheet with Bi-weekly Planning typically contains income sources, categorized expenses, and savings goals organized by bi-weekly periods. It helps track financial inflows and outflows efficiently, providing a clear overview of budgeting over every two weeks. This format is excellent for managing cash flow, especially for those paid on a bi-weekly schedule.

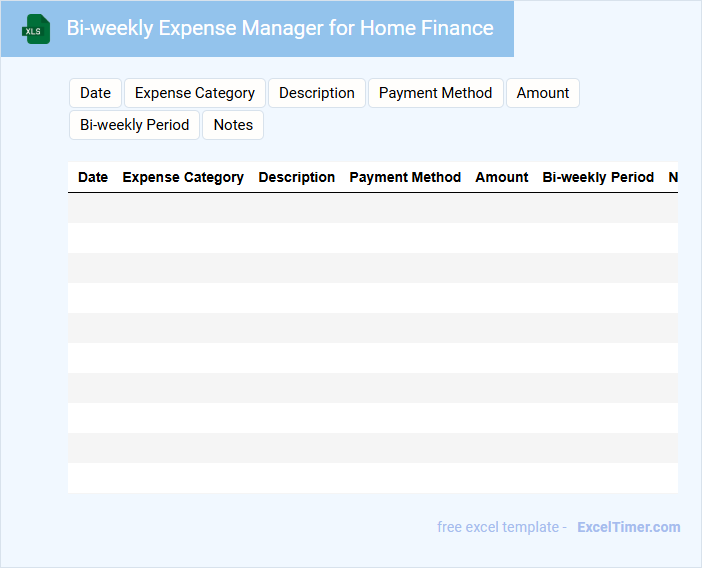

Bi-weekly Expense Manager for Home Finance

The Bi-weekly Expense Manager is a document designed to track and organize home finances by recording expenses every two weeks. It typically contains categorized spending entries, payment dates, and budget limits to help users manage their cash flow effectively. This tool is essential for maintaining financial discipline and ensuring timely bill payments.

Important aspects to include are clear categories for expenses, a summary of total spending versus budget, and sections for notes or upcoming expenses. Additionally, integrating reminders for bill due dates and savings goals can enhance financial planning. Keeping this document updated regularly maximizes its effectiveness in managing household finance.

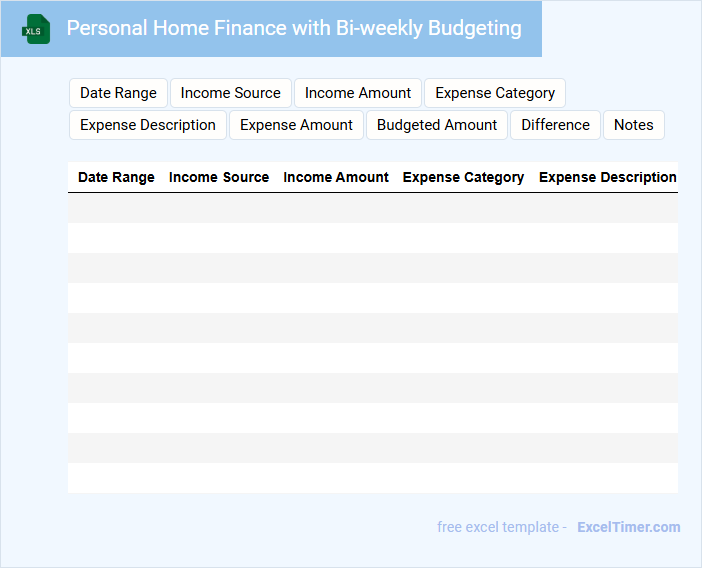

Personal Home Finance with Bi-weekly Budgeting

A Personal Home Finance document typically contains a detailed overview of an individual's income, expenses, and savings goals. It tracks all financial transactions to help maintain a balanced budget and ensure timely bill payments. Using a bi-weekly budgeting approach allows better alignment with paychecks and helps avoid overspending.

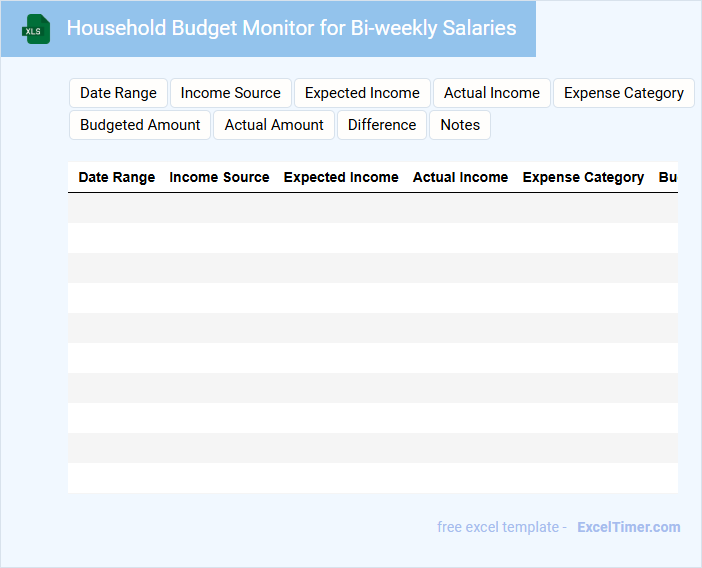

Household Budget Monitor for Bi-weekly Salaries

A Household Budget Monitor for bi-weekly salaries is a financial document designed to track income and expenses on a consistent two-week schedule. It helps individuals or families manage their cash flow by categorizing spending and identifying savings opportunities. Regularly updating this monitor ensures better control over finances and prepares users for upcoming bills and discretionary spending.

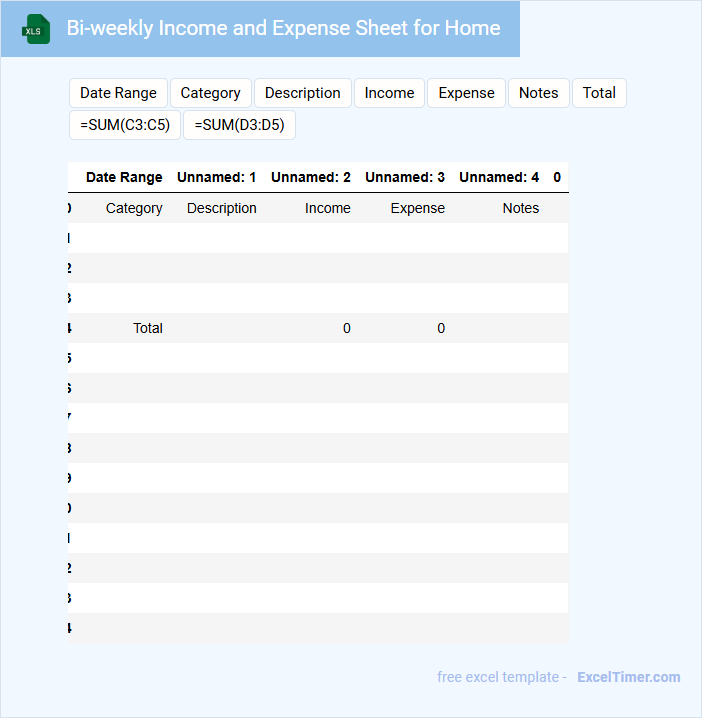

Bi-weekly Income and Expense Sheet for Home

The Bi-weekly Income and Expense Sheet is a financial document designed to track earnings and expenditures over a two-week period. It typically contains detailed listings of income sources and categorized expenses, helping individuals monitor their cash flow effectively. Using this sheet allows for better budgeting and financial planning at home.

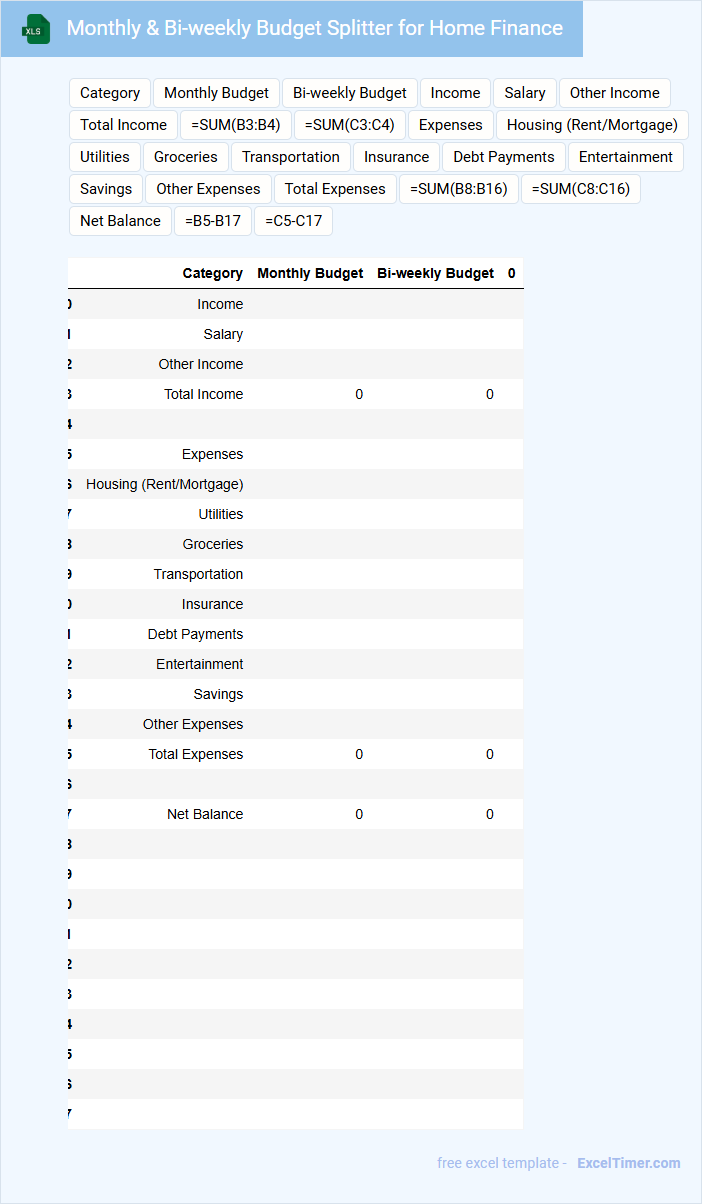

Monthly & Bi-weekly Budget Splitter for Home Finance

This document typically contains detailed tracking and allocation of income and expenses to manage household finances effectively.

- Income Sources: Clear categorization of all household income streams for accurate budgeting.

- Expense Categories: Detailed breakdown of recurring and variable expenses to monitor spending habits.

- Budget Allocation: Suggested splits and limits for each category to maintain financial balance and savings goals.

What key categories should be included in a bi-weekly budget for home finance?

A bi-weekly budget for home finance should include key categories such as income, fixed expenses (mortgage or rent, utilities, insurance), variable expenses (groceries, transportation, entertainment), savings (emergency fund, retirement), and debt payments (credit cards, loans). Tracking these categories ensures accurate allocation of funds every two weeks, helping manage cash flow effectively. Including periodic expenses like property taxes or home maintenance ensures comprehensive budget planning.

How can you track and record recurring bi-weekly expenses and income in Excel?

Use Excel formulas like SUMIF to categorize and total bi-weekly recurring expenses and income by date intervals. Create separate columns for transaction date, description, category, and amount to organize entries clearly. Employ conditional formatting to highlight due dates and ensure accurate budget tracking for home finance management.

What formulas are essential for calculating totals and balances in a bi-weekly budget worksheet?

Essential formulas for a bi-weekly budget worksheet include SUM to calculate total income and expenses, SUMIF for categorizing specific expense types, and subtraction formulas like =Income - Expenses to determine balances. The use of IF statements helps track overspending by comparing actual expenses against budgeted amounts. Incorporating these formulas ensures accurate tracking of funds and financial planning.

How can conditional formatting highlight overspending or remaining balances in your bi-weekly budget Excel document?

Conditional formatting in your bi-weekly budget Excel document can highlight overspending by automatically changing cell colors when expenses exceed allocated amounts, making it easy to spot budget overruns. It also visually indicates remaining balances by applying gradient fills or color scales based on spending progress. These features help you quickly assess financial status and manage home finances more effectively.

What methods improve accuracy and automation for updating bi-weekly budget entries in Excel?

Using Excel formulas such as SUMIF and VLOOKUP enhances data accuracy in bi-weekly budget updates. Implementing macros and VBA scripts automates repetitive entry tasks, reducing manual errors. Linking Excel with external financial data sources enables real-time budget adjustments and improved financial tracking.