The Bi-weekly Pay Slip Excel Template for Startups streamlines payroll management by providing a clear, customizable format to track employee earnings and deductions every two weeks. This easy-to-use template enhances accuracy and saves time, essential for startups aiming to maintain organized financial records. Ensuring compliance with tax regulations and transparent salary breakdowns is a key advantage of this tool.

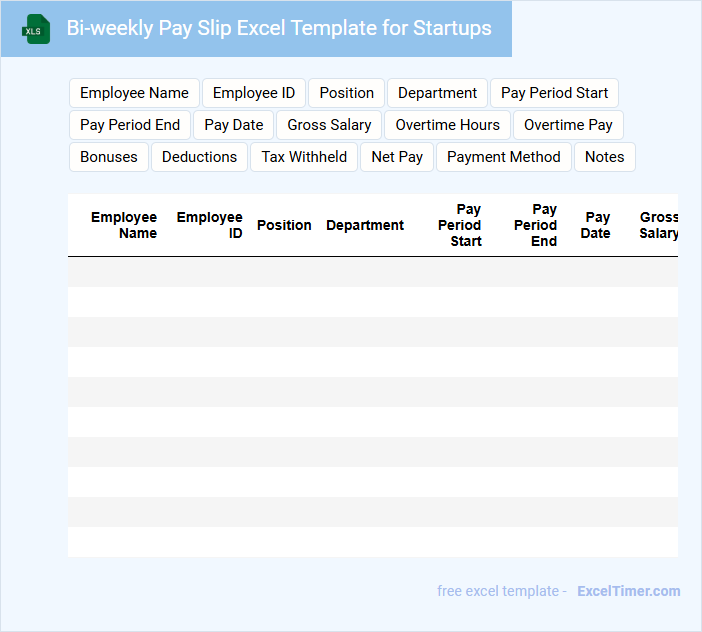

Bi-weekly Pay Slip Excel Template for Startups

The Bi-weekly Pay Slip Excel Template is designed to systematically record employee earnings and deductions every two weeks. It typically contains sections for gross pay, taxes, and net pay calculations to ensure accuracy.

For startups, this template helps maintain organized payroll management from the outset, reducing errors and saving time. Including employee details and pay period information is crucial for clarity and proper record-keeping.

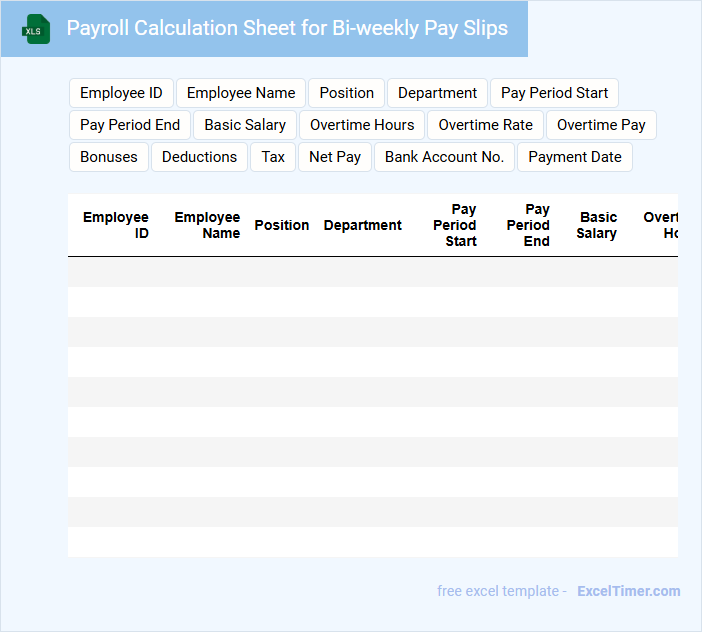

Payroll Calculation Sheet for Bi-weekly Pay Slips

A Payroll Calculation Sheet for Bi-weekly Pay Slips typically contains detailed employee earnings, deductions, and net pay for each pay period. It includes hours worked, overtime, tax withholdings, and benefits contributions, ensuring accurate compensation tracking. Maintaining precise records in this document is crucial for compliance and financial transparency.

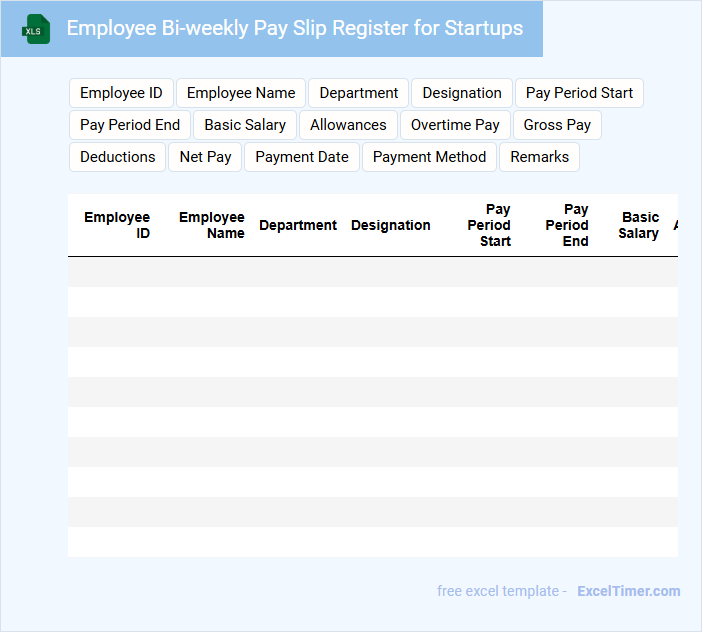

Employee Bi-weekly Pay Slip Register for Startups

The Employee Bi-weekly Pay Slip Register for startups is a crucial financial document detailing the salary disbursements made to employees every two weeks. It typically contains employee names, pay periods, gross pay, deductions, and net pay, ensuring transparent payroll management. For startups, maintaining accuracy and timeliness in this register is essential to build trust and comply with labor laws.

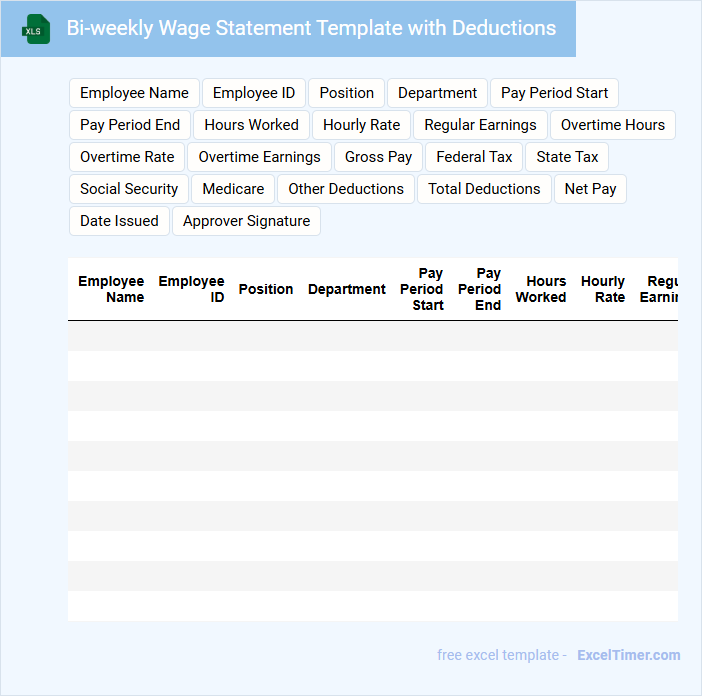

Bi-weekly Wage Statement Template with Deductions

A Bi-weekly Wage Statement typically includes detailed information about an employee's earnings over a two-week period. It outlines gross wages, deductions such as taxes and benefits, and the net pay.

This document helps maintain transparency and compliance with labor laws. It is important to ensure all deductions are clearly itemized for employee understanding and record-keeping purposes.

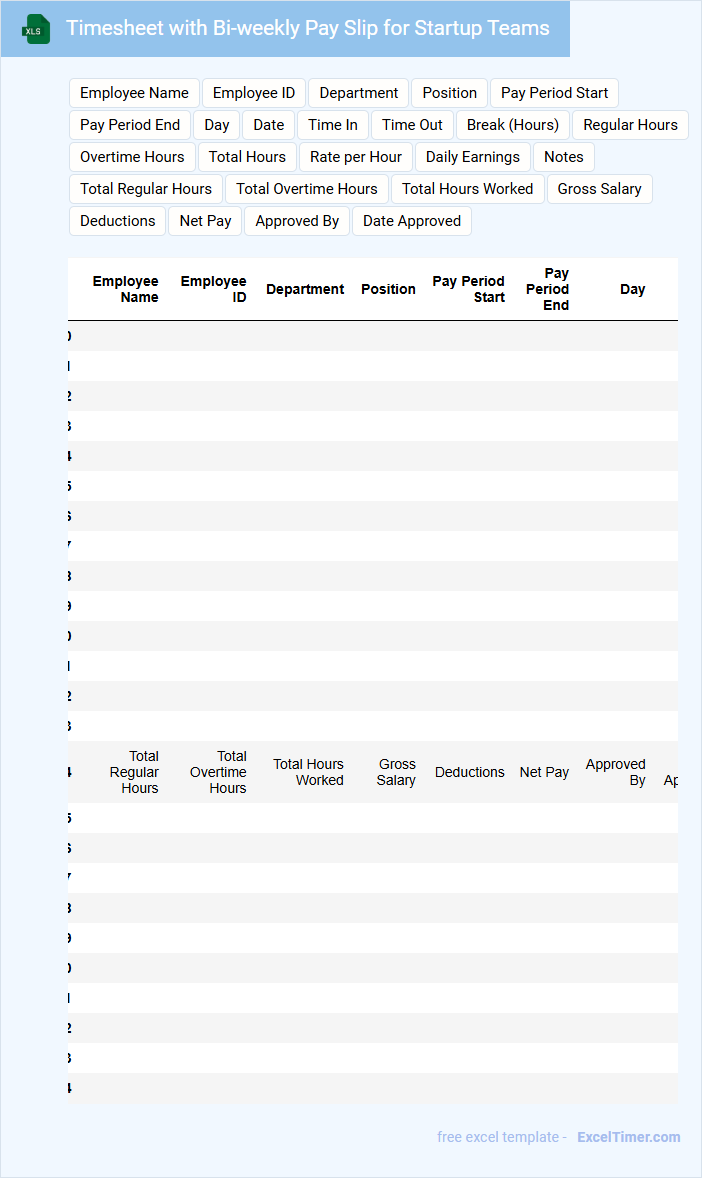

Timesheet with Bi-weekly Pay Slip for Startup Teams

A timesheet with bi-weekly pay slip typically contains detailed records of employee work hours and corresponding salary calculations for startups. It helps maintain accurate payroll data and ensures transparent compensation processes. For startup teams, it is crucial to include clear overtime tracking and deductions to prevent payroll discrepancies.

Simple Bi-weekly Pay Slip Tracker for Startups

A Simple Bi-weekly Pay Slip Tracker is a document used to record and organize employee salary details every two weeks. It typically contains employee names, pay periods, gross pay, deductions, and net pay. For startups, maintaining an accurate and easy-to-update tracker ensures payroll transparency and helps manage cash flow efficiently.

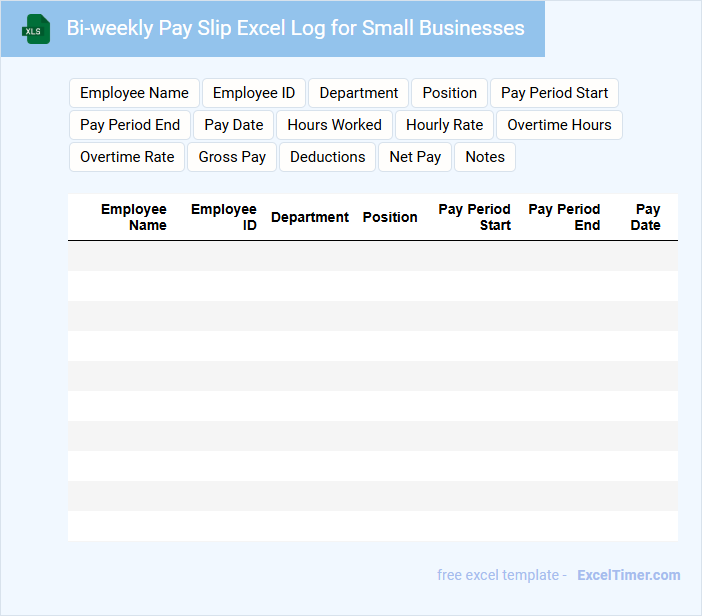

Bi-weekly Pay Slip Excel Log for Small Businesses

The Bi-weekly Pay Slip Excel Log is a crucial document for small businesses to systematically track employee payments every two weeks. It typically contains employee details, payment amounts, deductions, and net pay information for precise financial record-keeping. Maintaining accurate logs helps ensure compliance with payroll regulations and simplifies auditing processes.

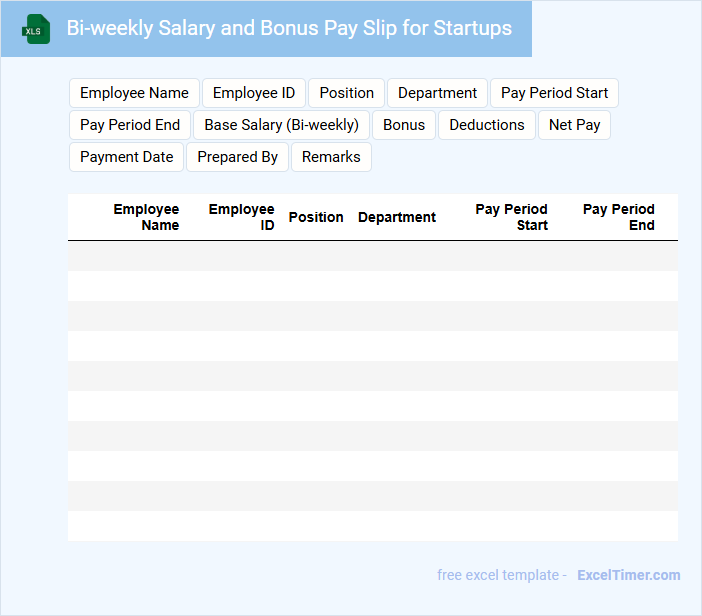

Bi-weekly Salary and Bonus Pay Slip for Startups

A Bi-weekly Salary and Bonus Pay Slip document typically contains detailed information about an employee's earnings for a two-week period, including base salary, bonuses, deductions, and net pay. This ensures transparency and accurate record-keeping for both employers and employees in startups.

For startups, it is important to clearly highlight any performance-based bonuses to motivate employees and maintain trust. Including a breakdown of all components helps prevent disputes and supports financial planning.

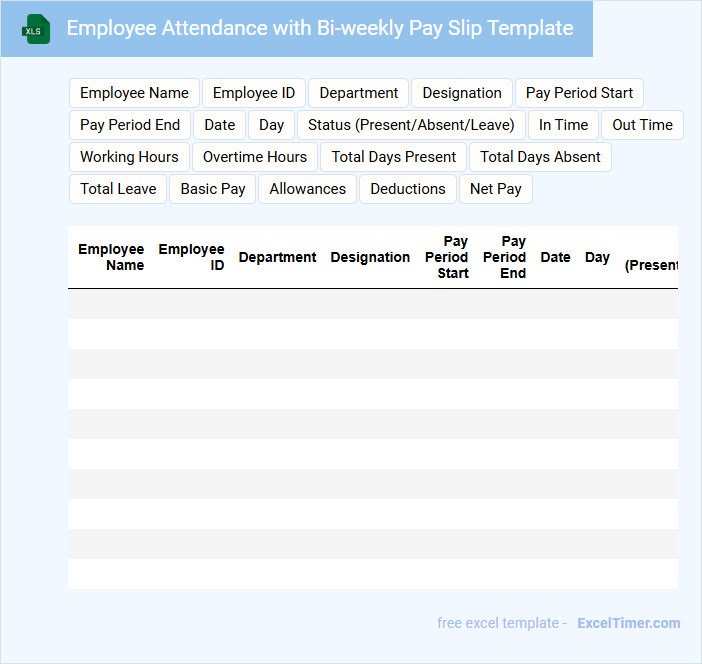

Employee Attendance with Bi-weekly Pay Slip Template

Employee Attendance with Bi-weekly Pay Slip Template typically contains detailed records of an employee's attendance combined with payment information for a two-week period. It serves as an essential document for payroll processing and attendance tracking.

- Include accurate dates and total hours worked for each day within the bi-weekly period.

- Clearly display the calculated wages, including any overtime or deductions.

- Provide space for employee and employer signatures to verify the documented attendance and payment.

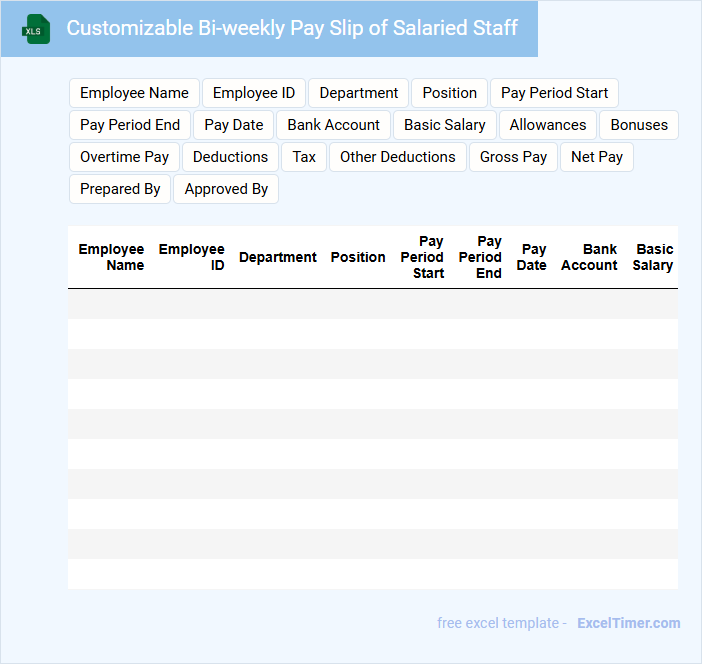

Customizable Bi-weekly Pay Slip of Salaried Staff

The Customizable Bi-weekly Pay Slip is a financial document detailing the earnings and deductions of salaried staff for each two-week period. It typically contains employee information, gross pay, taxes, benefits, and net pay.

Ensuring accuracy and clarity in the pay slip helps maintain employee trust and facilitates easy verification of salary components. Important to include is a clear breakdown of deductions and employer contributions.

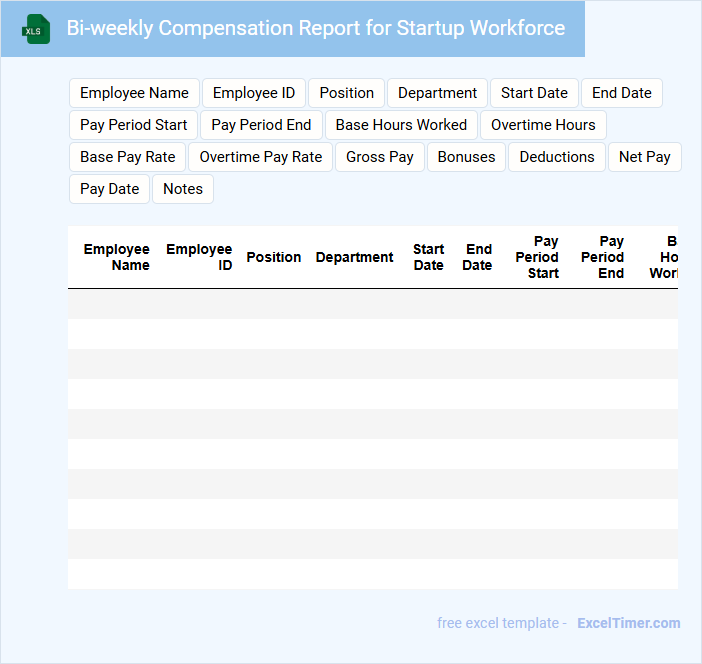

Bi-weekly Compensation Report for Startup Workforce

The Bi-weekly Compensation Report typically contains detailed information about employee earnings, including salaries, bonuses, and deductions for a two-week period. This document helps startups maintain accurate payroll records and ensures compliance with financial regulations.

It also tracks changes in compensation, allowing management to analyze trends and adjust benefits or salaries accordingly. Including clear summary tables and employee classifications is important for clarity and effective decision-making.

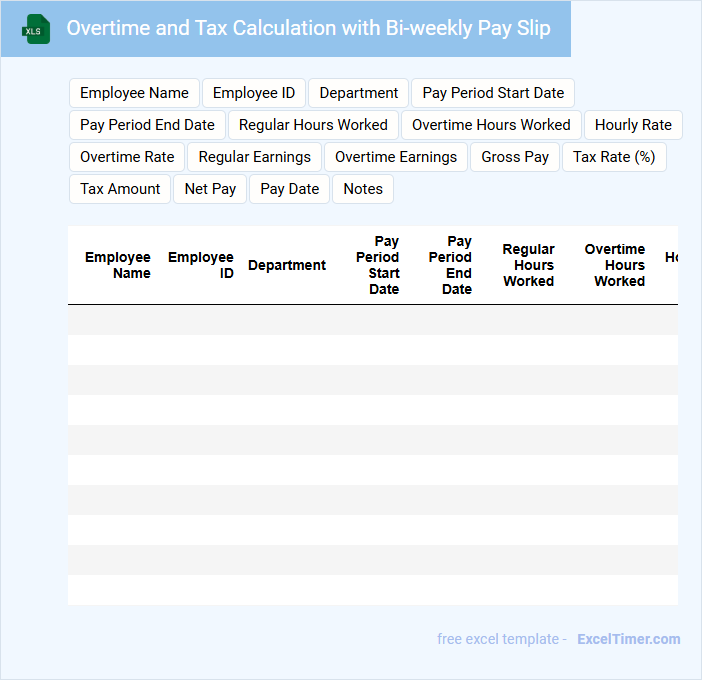

Overtime and Tax Calculation with Bi-weekly Pay Slip

This type of document typically contains details on overtime hours worked by an employee and how those hours are compensated according to company policy and labor laws. It also includes a breakdown of tax deductions based on income and filing status, ensuring accurate withholding.

The document is generated on a bi-weekly basis, reflecting earnings and deductions for that pay period. Important considerations include verifying the correct calculation of overtime rates and ensuring compliance with all applicable tax regulations.

Bi-weekly Earnings Statement for Startup Employees

A Bi-weekly Earnings Statement for Startup Employees typically outlines the detailed compensation and deductions for a two-week pay period. It helps employees keep track of their earnings, taxes, and benefits accurately.

- Include gross wages, taxes withheld, and net pay clearly.

- Specify any startup-specific bonuses or stock options earned.

- Provide contact information for payroll inquiries.

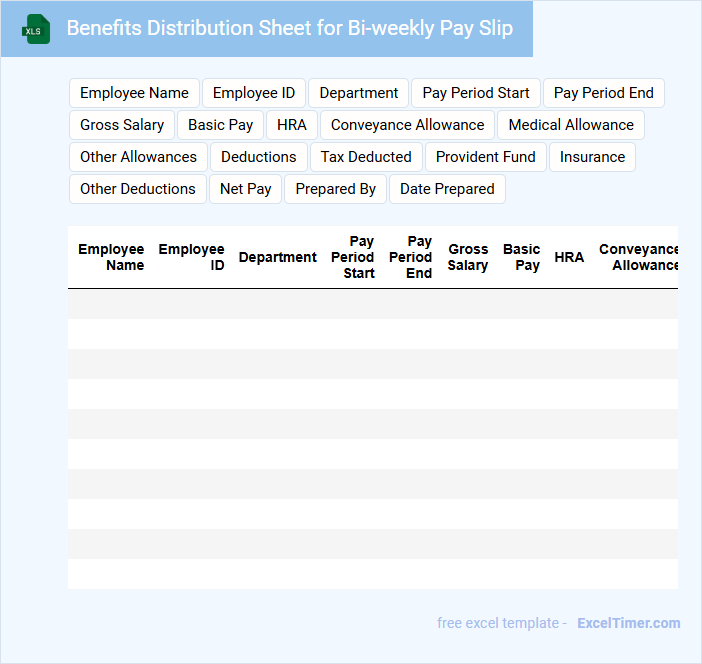

Benefits Distribution Sheet for Bi-weekly Pay Slip

The Benefits Distribution Sheet is a detailed record outlining the allocation of various employee benefits within a bi-weekly pay period. It includes information such as insurance contributions, retirement fund deductions, and other allowances.

Accurate tracking of benefits allocation ensures transparency and correct financial management for both employers and employees. Including clear identifiers for each benefit type aids in easy reconciliation and audit processes.

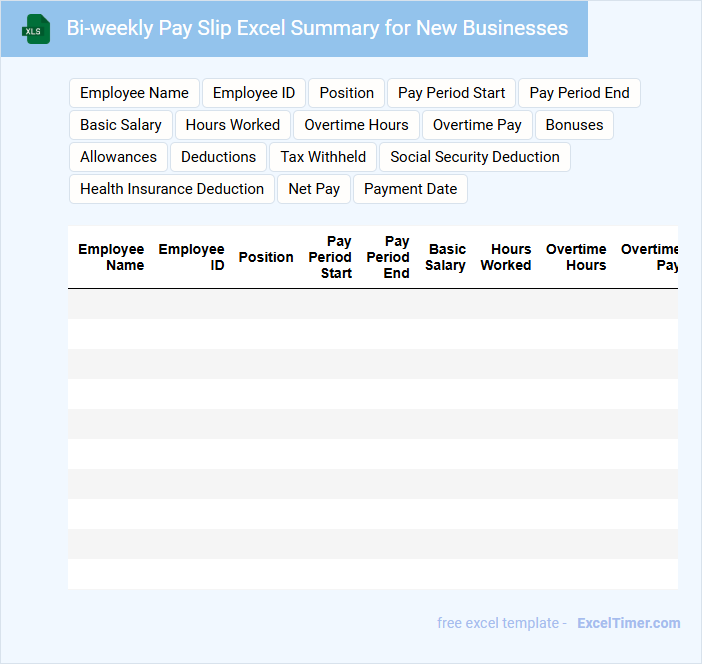

Bi-weekly Pay Slip Excel Summary for New Businesses

What information is typically included in a Bi-weekly Pay Slip Excel Summary for New Businesses? This document usually contains employee payment details such as gross pay, deductions, and net pay for each bi-weekly period. It also summarizes total payroll expenses and tax contributions to help new businesses manage their financial records efficiently.

What is the most important thing to consider when creating this summary? Accuracy in data entry and consistency in formatting are crucial to avoid payroll errors and ensure compliance with tax regulations. Additionally, including clear labels and automated calculations improves usability and helps business owners track employee compensation effortlessly.

What are the essential components included in a bi-weekly pay slip for startups?

A bi-weekly pay slip for startups typically includes employee details, pay period dates, gross earnings, deductions such as taxes and benefits, and net pay. It also highlights hours worked, overtime, and year-to-date totals. Accurate and clear presentation ensures compliance and transparency for startup payroll management.

How does a bi-weekly pay schedule affect payroll calculations and employee deductions in Excel?

A bi-weekly pay schedule divides the annual salary into 26 pay periods, requiring precise calculations for each period to ensure accurate payroll processing. Your Excel document can automate deductions such as taxes, benefits, and retirement contributions based on each bi-weekly paycheck. This ensures consistent and error-free employee compensation management tailored for startups.

Which formulas ensure accurate gross-to-net pay calculations on a bi-weekly pay slip document?

Accurate gross-to-net pay calculations on a bi-weekly pay slip document use formulas such as SUM to total earnings, and subtraction formulas deduct taxes and benefits. VLOOKUP or INDEX-MATCH functions retrieve tax rates and deduction values from reference tables. The NET PAY is calculated as Gross Pay minus total deductions, ensuring precise payroll processing for startups.

What key compliance details (e.g., tax rates, statutory deductions) must be reflected on the pay slip?

Your bi-weekly pay slip for startups must accurately reflect key compliance details including federal and state tax rates, Social Security and Medicare deductions, unemployment insurance contributions, and any applicable local taxes. Statutory deductions like health insurance premiums, retirement contributions, and wage garnishments also need clear itemization. Ensuring these elements are transparently listed helps startups meet legal payroll requirements and maintain employee trust.

How can Excel be structured to automatically update year-to-date totals with each bi-weekly pay run?

Structuring your Excel bi-weekly pay slip for startups involves setting dynamic formulas that reference each pay period's data, enabling automatic year-to-date total updates. Use SUMIFS or dynamic range functions to aggregate earnings and deductions from each bi-weekly entry, ensuring your spreadsheet reflects up-to-date totals after every pay run. This approach streamlines payroll tracking and enhances financial accuracy for your startup's HR and accounting processes.