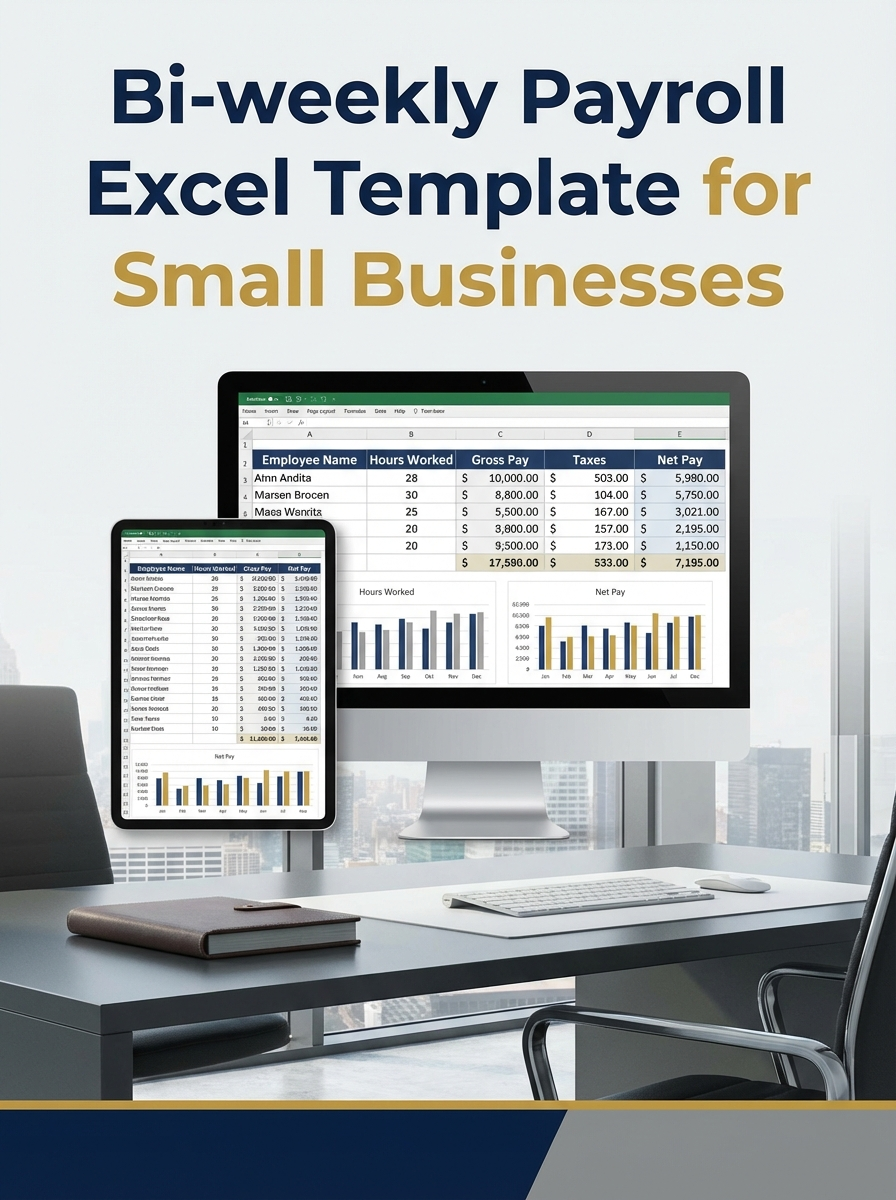

The Bi-weekly Payroll Excel Template for Small Businesses simplifies managing employee payments every two weeks by automating calculations of wages, taxes, and deductions. It ensures accuracy and compliance with tax regulations while saving time on manual payroll processing. Customizable fields allow small businesses to adapt the template to specific payroll needs and employee details.

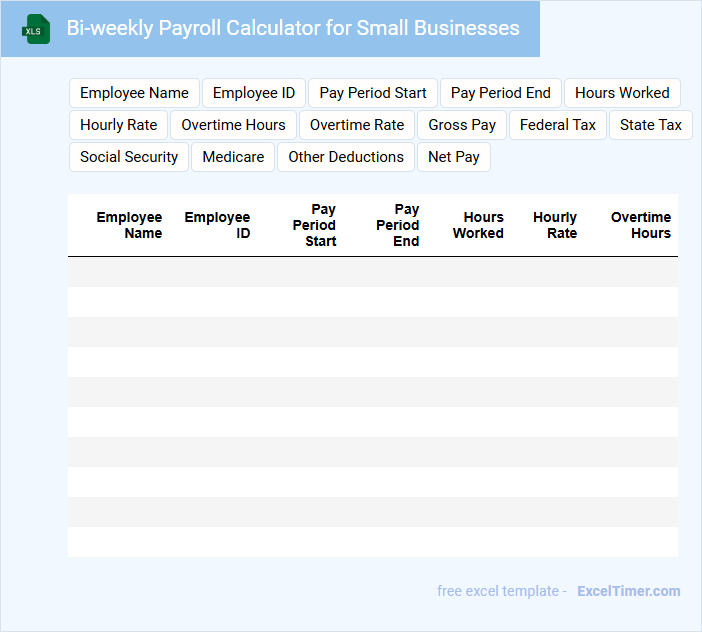

Bi-weekly Payroll Calculator for Small Businesses

A Bi-weekly Payroll Calculator is a document designed to help small businesses accurately calculate employee wages for every two-week pay period. It typically includes details such as hours worked, hourly rates, tax deductions, and net pay.

Important considerations for this document include ensuring compliance with tax regulations and accurately accounting for overtime and benefits. Using an updated and easy-to-use calculator can save time and prevent payroll errors.

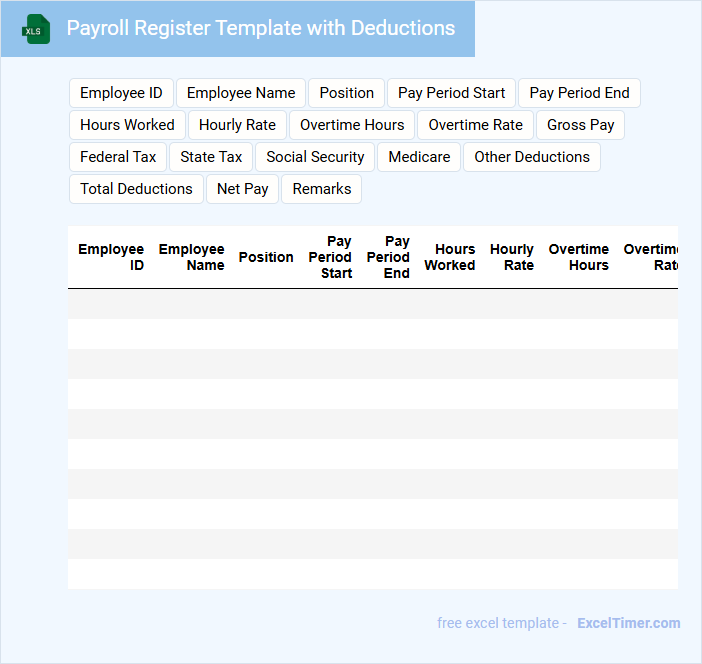

Payroll Register Template with Deductions

What information is typically included in a Payroll Register Template with Deductions? This document usually contains detailed employee earnings, tax withholdings, and various deductions such as benefits or retirement contributions. It helps businesses maintain accurate payroll records and ensures compliance with tax regulations.

Why is it important to include deductions in a Payroll Register Template? Including deductions provides transparency for both employers and employees, allowing for precise calculation of net pay. It is crucial to keep these records updated and categorized correctly to avoid payroll errors and legal issues.

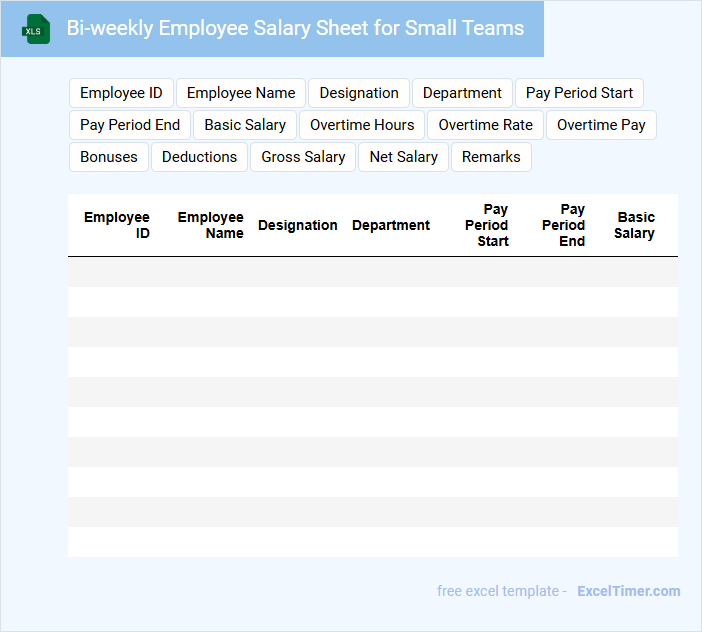

Bi-weekly Employee Salary Sheet for Small Teams

The Bi-weekly Employee Salary Sheet is a document used to record and track the salaries paid to employees every two weeks. It typically contains employee names, hours worked, pay rates, deductions, and net pay.

This document is crucial for ensuring accurate and timely payroll processing, especially in small teams where detailed tracking is essential. It helps maintain transparency and simplifies budgeting for small businesses.

Ensure the salary sheet is regularly updated, includes all necessary deductions, and is reviewed for accuracy to avoid payroll errors.

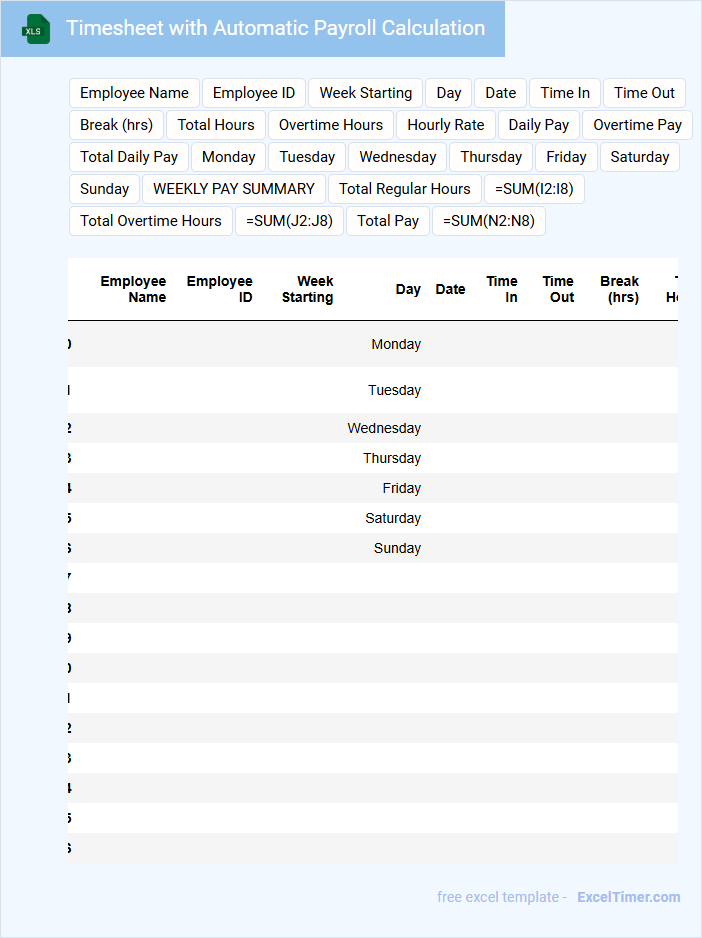

Timesheet with Automatic Payroll Calculation

Timesheets with automatic payroll calculation are documents used to track employee work hours and automatically compute corresponding wages. They streamline payroll management, ensuring accuracy and efficiency.

- Include precise clock-in and clock-out times for each workday.

- Incorporate overtime and leave adjustments automatically.

- Ensure integration with payroll systems for seamless salary processing.

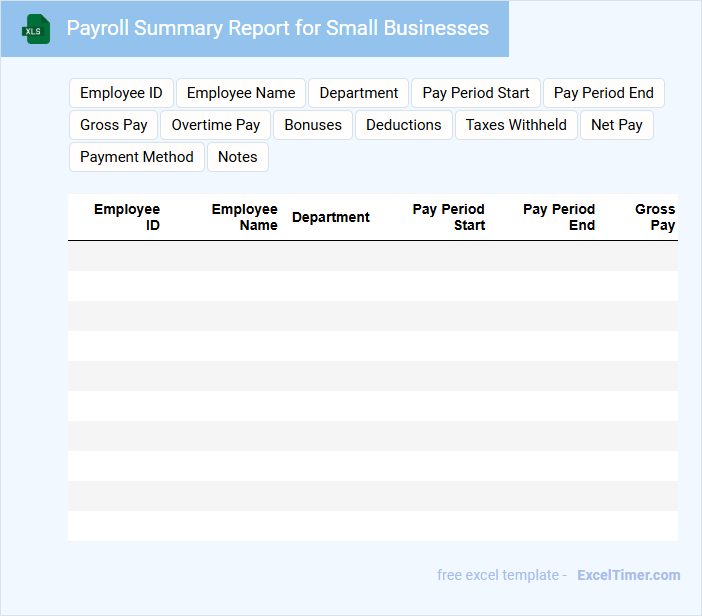

Payroll Summary Report for Small Businesses

The Payroll Summary Report for small businesses typically includes detailed information about employee wages, tax withholdings, and total payroll expenses. This document provides a consolidated view of all payroll transactions over a specific period, aiding in financial tracking and compliance. It is essential for small business owners to regularly review this summary to ensure accuracy and maintain proper record-keeping for tax and audit purposes.

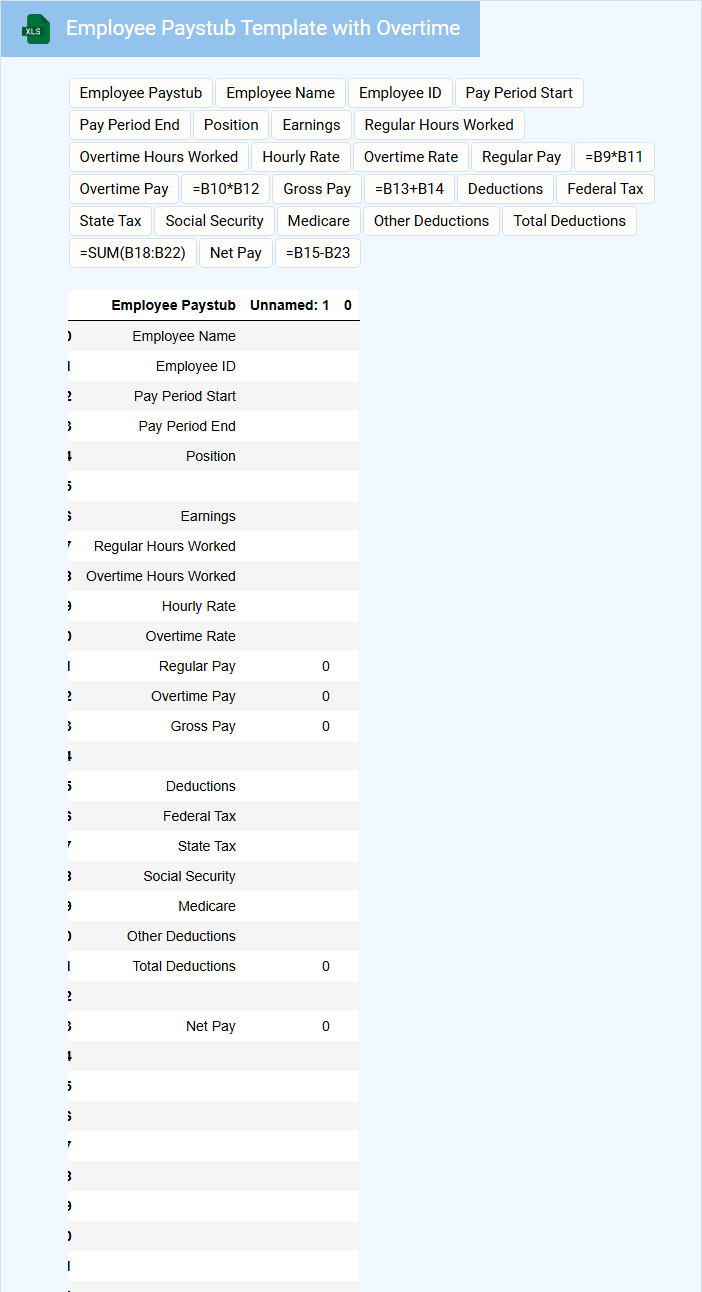

Employee Paystub Template with Overtime

What information is typically included in an Employee Paystub Template with Overtime? This type of document usually contains detailed earnings data including regular hours worked, overtime hours, pay rates, and total gross pay. It also includes deductions such as taxes and benefits, along with net pay, ensuring employees clearly understand their compensation and deductions.

What important elements should be highlighted in an Employee Paystub Template with Overtime? It is essential to accurately display overtime calculations and rates separately from regular hours to maintain transparency. Additionally, including a summary of taxable wages and year-to-date totals helps employees track their earnings and comply with tax regulations.

Attendance Tracker for Bi-weekly Payroll

An Attendance Tracker for bi-weekly payroll typically contains detailed records of employee attendance, including check-in and check-out times, absences, and leave taken within the two-week period. This document ensures accurate calculation of hours worked for timely and precise payroll processing.

It is important to maintain clear and consistent data to avoid discrepancies in salaries or overtime payments. Regular updates and verification by supervisors help keep the attendance information reliable and up-to-date.

Bi-weekly Payroll Tracker for Multiple Employees

A Bi-weekly Payroll Tracker is a document used to record and manage employee payments every two weeks. It typically contains employee names, hours worked, pay rates, deductions, and the net pay for accurate financial tracking. Ensuring timely updates and clear data organization is crucial for payroll accuracy and compliance.

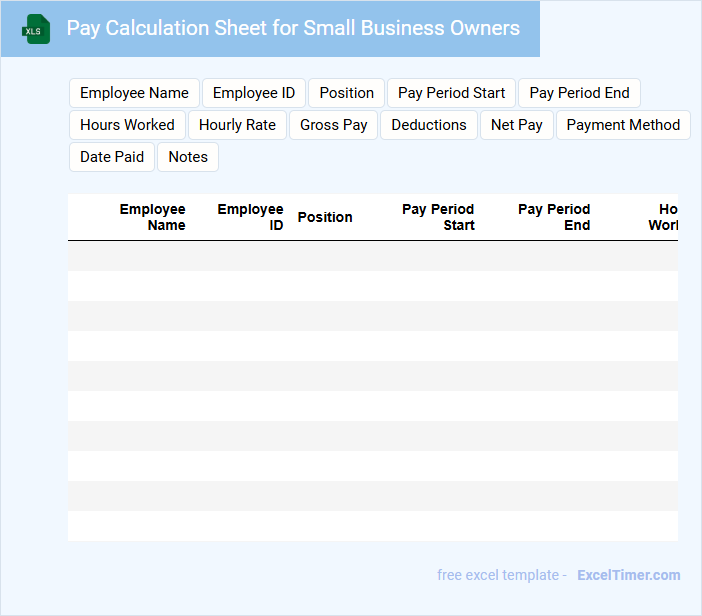

Pay Calculation Sheet for Small Business Owners

Pay Calculation Sheets for Small Business Owners typically contain detailed records of employee wages, work hours, and deductions necessary for accurate payroll management.

- Employee Details: This section includes essential information such as names, job titles, and employee identification numbers.

- Work Hours and Rates: It records total hours worked, overtime, and the corresponding pay rates for precise compensation calculation.

- Deductions and Taxes: This part itemizes taxes, benefits, and other deductions to ensure correct net pay.

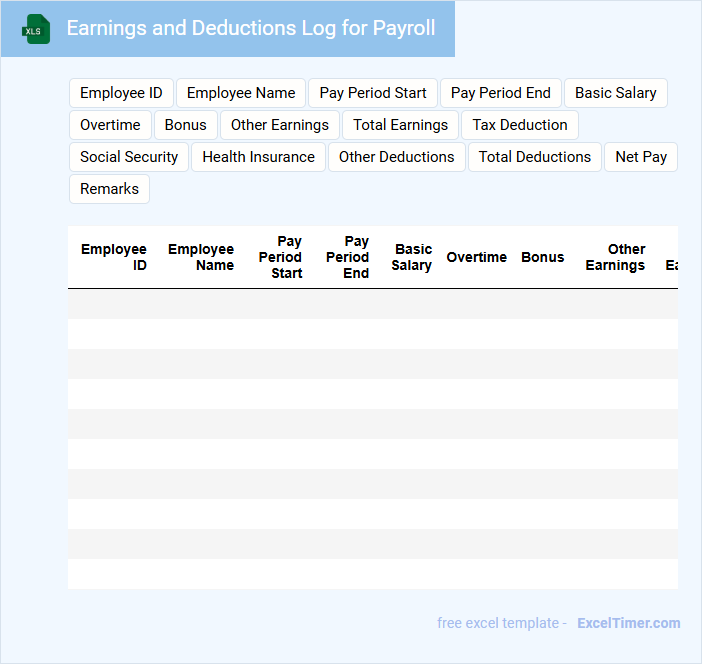

Earnings and Deductions Log for Payroll

The Earnings and Deductions Log is a crucial document used in payroll management to record all employee earnings and applicable deductions. It typically contains detailed entries such as salary, bonuses, taxes, insurance contributions, and other withholdings. Maintaining accurate logs ensures compliance with tax laws and facilitates transparent payroll processing.

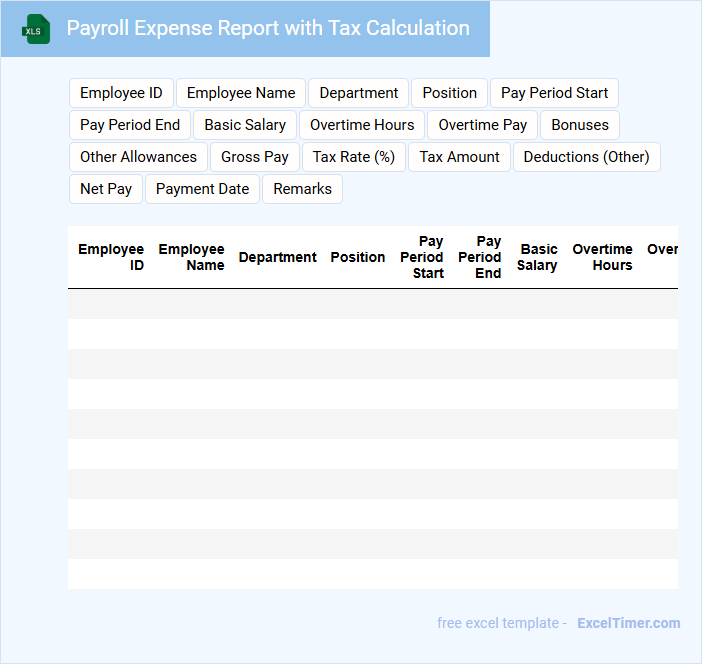

Payroll Expense Report with Tax Calculation

A Payroll Expense Report with Tax Calculation typically contains detailed information about employee wages, tax deductions, and net pay for a specified period. This document is crucial for ensuring accurate financial records and compliance with tax regulations. It should also highlight any variations in tax rates applied to different income brackets to provide a clear overview of payroll liabilities.

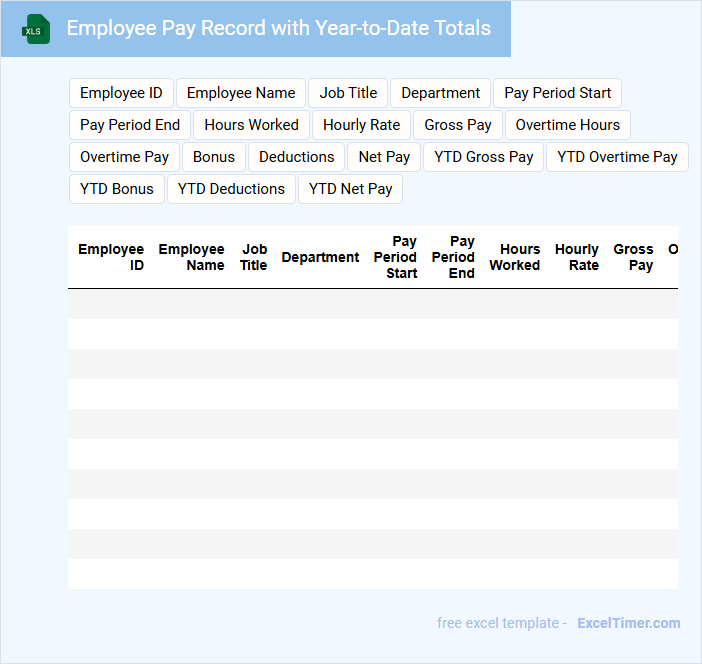

Employee Pay Record with Year-to-Date Totals

An Employee Pay Record with Year-to-Date Totals typically contains detailed information about an employee's earnings, including regular wages, overtime, bonuses, and deductions. It tracks cumulative totals for taxes withheld, benefits contributions, and net pay throughout the year. This document is essential for both payroll management and tax reporting purposes.

It is important to ensure accuracy in recording all payment entries and deductions to maintain compliance with legal and tax regulations. Keeping this record updated regularly helps in resolving payroll disputes and verifying year-end tax forms like W-2 or 1099. Additionally, safeguarding employee data privacy within these records is crucial.

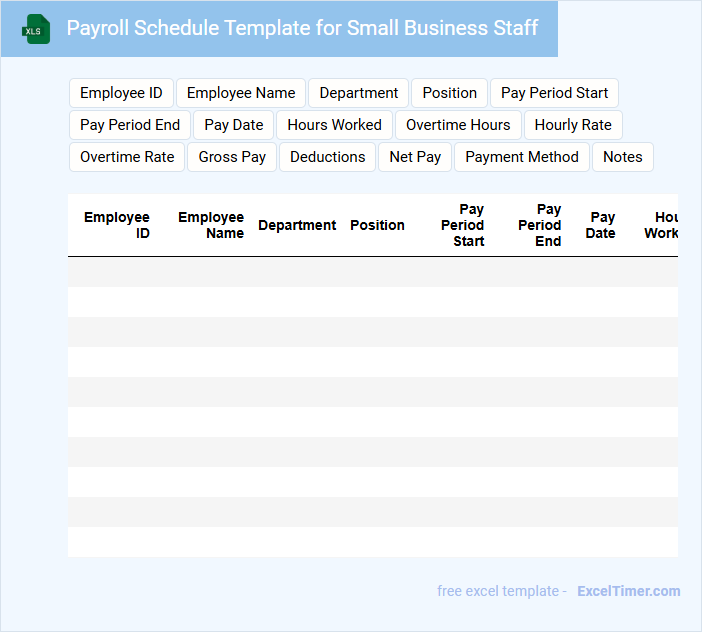

Payroll Schedule Template for Small Business Staff

A Payroll Schedule Template for small business staff typically contains detailed information about pay periods, pay dates, and employee compensation. It organizes the timing and frequency of salary payments to ensure consistent and accurate payroll processing.

Important elements include employee names, hours worked, gross pay, deductions, and net pay. Using this template helps maintain compliance with labor laws and improves financial planning for the business.

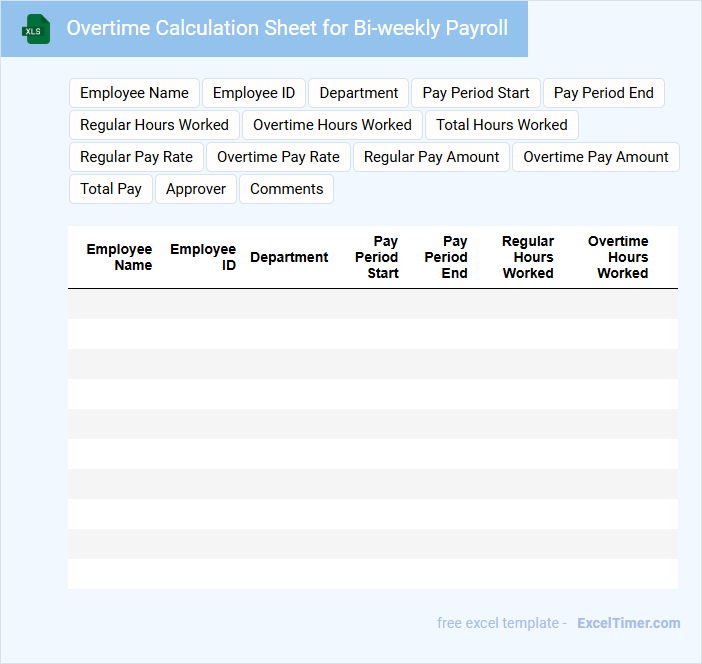

Overtime Calculation Sheet for Bi-weekly Payroll

An Overtime Calculation Sheet for bi-weekly payroll is a document used to track and calculate the extra hours worked by employees beyond their regular schedule. It typically contains employee details, hourly rates, total hours worked, and calculated overtime pay based on company policy or labor laws.

Accurate record-keeping in this sheet ensures correct payroll processing and compliance with labor regulations. It is crucial to include clear overtime rules, approval signatures, and date ranges for each bi-weekly period.

Wage Sheet with Benefits and Deductions Tracking

A Wage Sheet with Benefits and Deductions Tracking is a detailed record that captures employee earnings, including base pay and additional compensations. It systematically tracks all benefits provided and deductions applied during a specific pay period.

This document is essential for ensuring accurate payroll processing and compliance with labor laws. Including clear categories for benefits and deductions helps streamline financial audits and employee queries.

What essential data fields should be included in a bi-weekly payroll for small businesses?

Your bi-weekly payroll Excel template should include essential data fields such as Employee Name, Employee ID, Pay Period Start and End Dates, Hours Worked, Pay Rate, Gross Pay, Taxes Withheld, Deductions, and Net Pay. Including these fields ensures accurate calculations and compliance with payroll regulations. Tracking these key data points helps small businesses manage employee compensation efficiently.

How should employee overtime be calculated and documented within the Excel payroll sheet?

Employee overtime should be calculated at 1.5 times the regular hourly wage for hours worked beyond 40 per week and clearly documented in a dedicated overtime column within the Excel payroll sheet. You can use formulas to automatically compute overtime pay based on entered hours, ensuring accurate and transparent payroll processing. Maintaining separate columns for regular hours, overtime hours, and corresponding pay enhances clarity and compliance with labor regulations.

Which formula can automate gross pay calculations based on hours worked and hourly rates?

You can use the formula =HoursWorked * HourlyRate to automate gross pay calculations in your bi-weekly payroll Excel document. This formula multiplies the total hours worked by the hourly rate, ensuring accurate and efficient payroll processing for small businesses. Implementing this automation reduces errors and saves time during payroll management.

How can mandatory deductions (taxes, benefits) be efficiently tracked and summarized in the Excel document?

Use Excel formulas such as SUMIFS and pivot tables to automatically track and summarize mandatory deductions like taxes and benefits by employee and pay period. Create dedicated columns for each deduction category and link them to payroll entries to ensure accurate aggregation. Implement data validation and conditional formatting to maintain data consistency and quickly identify discrepancies.

What methods can be used to maintain data accuracy and prevent errors in a bi-weekly Excel payroll system?

Implement data validation rules and use protected cells to restrict unauthorized edits in the bi-weekly Excel payroll system for small businesses. Leverage built-in Excel functions such as IFERROR and conditional formatting to identify anomalies and prevent calculation errors. Regularly audit the payroll data with reconciliation processes comparing timesheets and payment records to ensure accuracy.