The Bi-weekly Excel Template for Invoicing streamlines the invoicing process by allowing businesses to generate accurate bills every two weeks. This template includes customizable fields for client details, services rendered, and payment terms, ensuring clarity and professionalism. Automated calculations minimize errors, saving time and improving cash flow management.

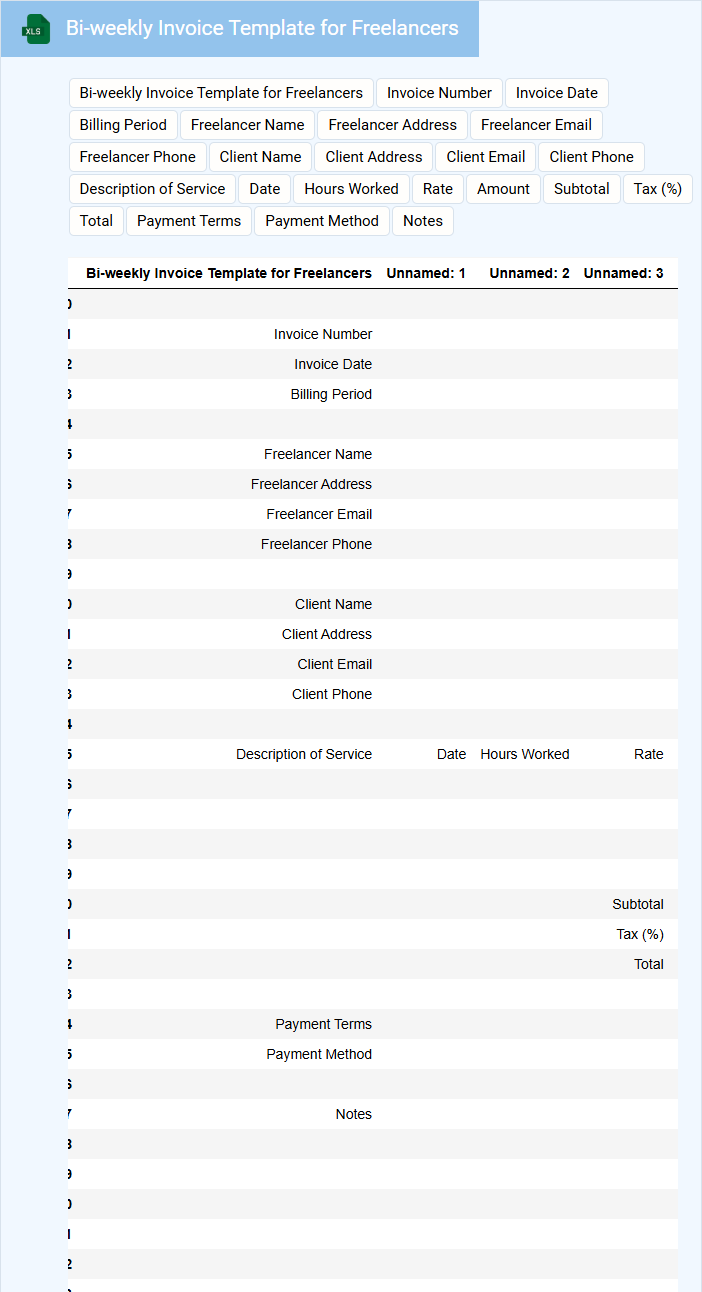

Bi-weekly Invoice Template for Freelancers

A bi-weekly invoice template for freelancers typically contains details of services rendered over two weeks, payment terms, and client information.

- Clear service descriptions help clients easily understand the billed work.

- Accurate date ranges ensure clarity on the invoicing period.

- Payment instructions facilitate timely and correct payments.

Bi-weekly Invoicing Spreadsheet for Small Business

A Bi-weekly Invoicing Spreadsheet for small businesses typically contains detailed records of invoices sent out every two weeks. It tracks client information, invoice dates, amounts, and payment status to maintain accurate financial oversight.

This document is essential for managing cash flow, ensuring timely payments, and simplifying accounting processes. It is important to regularly update the spreadsheet and verify all entries for accuracy to avoid payment delays.

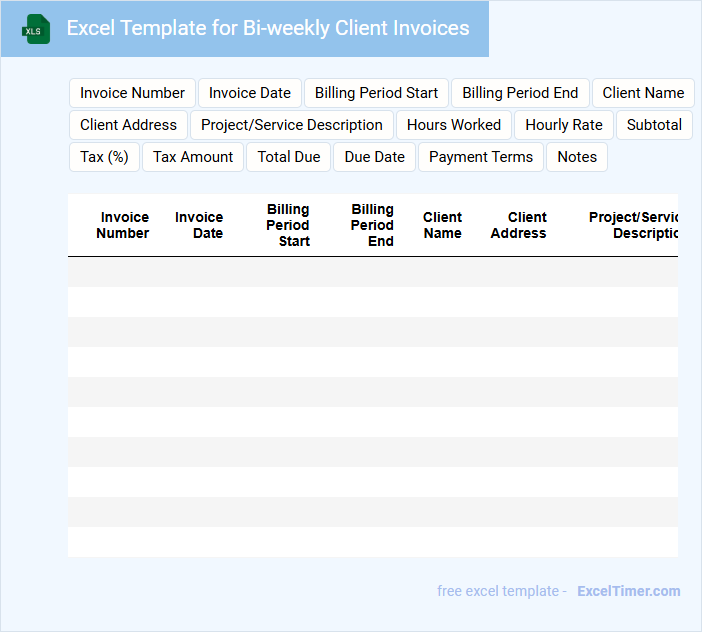

Excel Template for Bi-weekly Client Invoices

What information is typically found in an Excel template for bi-weekly client invoices? This document usually contains client details, invoice dates, itemized lists of services or products provided, quantities, rates, and total amounts due. It is designed to streamline billing by ensuring consistent and accurate invoicing every two weeks.

What important elements should be included in this template to enhance its effectiveness? Include clear client contact information, invoice numbers for tracking, payment due dates, and sections for taxes or discounts. Additionally, incorporating formulas to automatically calculate totals and reminders for payment terms improves accuracy and efficiency.

Bi-weekly Invoice Log with Payment Tracking

What information is typically included in a Bi-weekly Invoice Log with Payment Tracking?

This document usually contains details such as invoice numbers, dates issued, client names, amounts billed, payment due dates, and payment status updates. It helps businesses track outstanding invoices and payments received within a two-week period.

An important aspect to include is clear, up-to-date tracking of payment statuses and any overdue amounts to ensure timely follow-ups and accurate financial reporting.

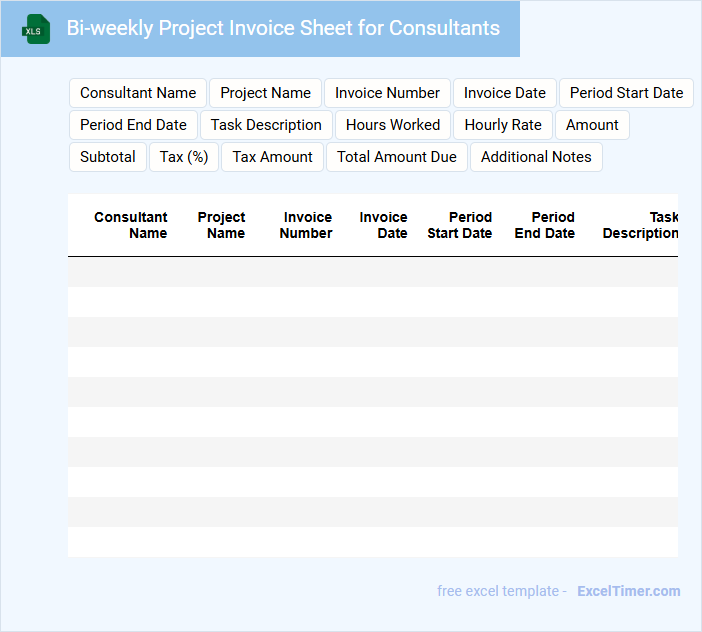

Bi-weekly Project Invoice Sheet for Consultants

A Bi-weekly Project Invoice Sheet for Consultants typically contains detailed records of services rendered and corresponding charges within a two-week period.

- Accurate Time Entries: Ensure all hours and tasks are precisely logged to reflect actual work done.

- Clear Client Details: Include client name, project information, and billing address for proper identification.

- Payment Terms: Specify payment deadlines and accepted methods to facilitate timely transactions.

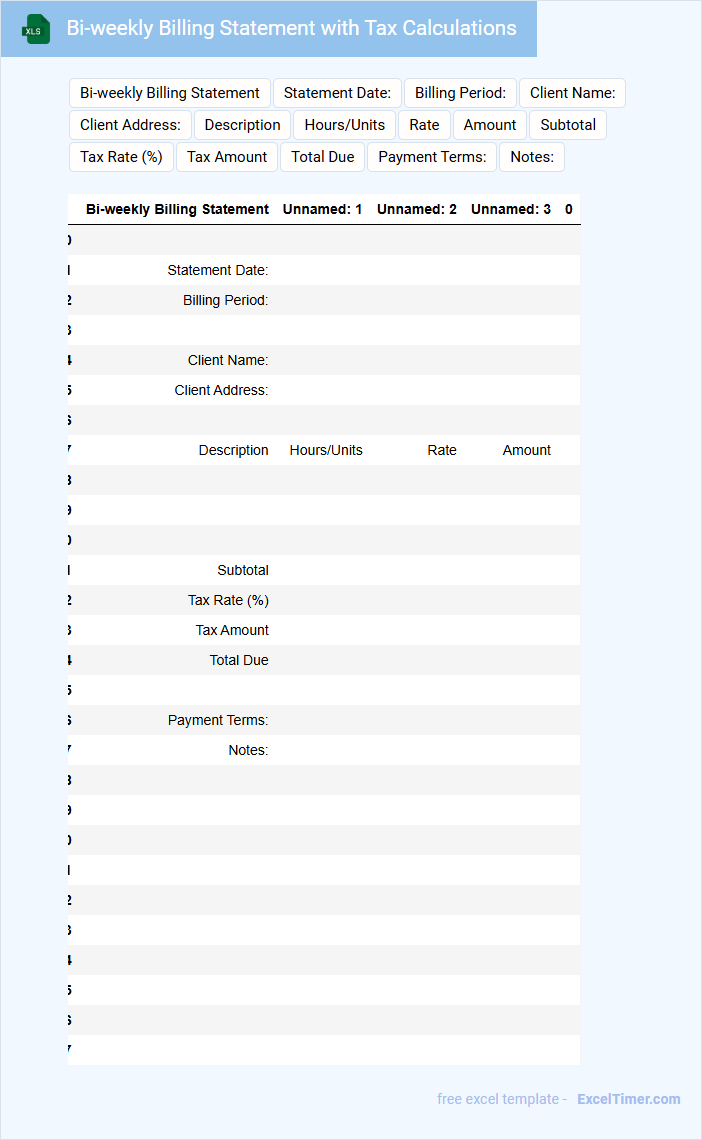

Bi-weekly Billing Statement with Tax Calculations

A Bi-weekly Billing Statement with Tax Calculations is a document summarizing charges and payments over a two-week period, including detailed tax computations.

- Payment Details: Clear breakdown of amounts due, paid, and outstanding balances to ensure transparency.

- Tax Information: Accurate calculation and itemization of applicable taxes for compliance and verification.

- Due Dates and Contact Info: Prominent display of payment deadlines and customer service contacts for prompt resolution.

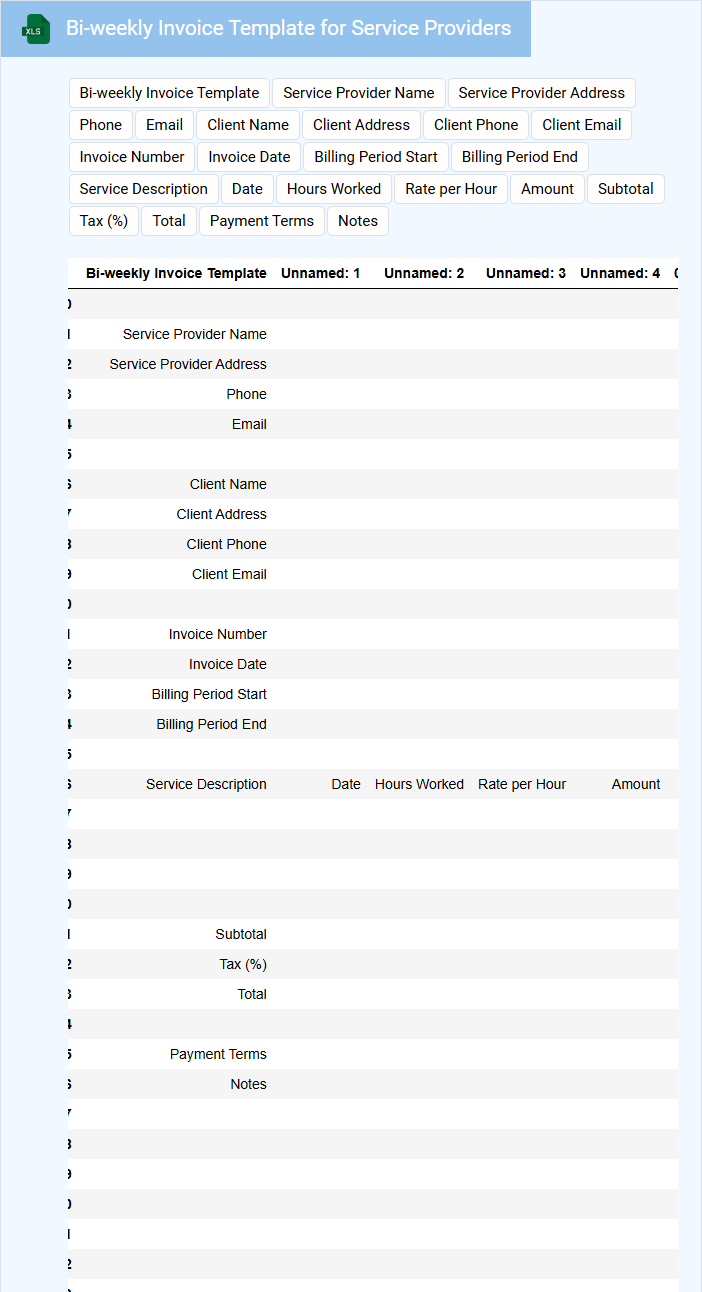

Bi-weekly Invoice Template for Service Providers

What information is typically included in a bi-weekly invoice template for service providers? This type of document usually contains essential details such as the service provider's name, client information, invoice number, billing period, a detailed list of services provided, hours worked, rates, and the total amount due. Including clear payment terms and contact information is important to ensure timely and accurate payment processing.

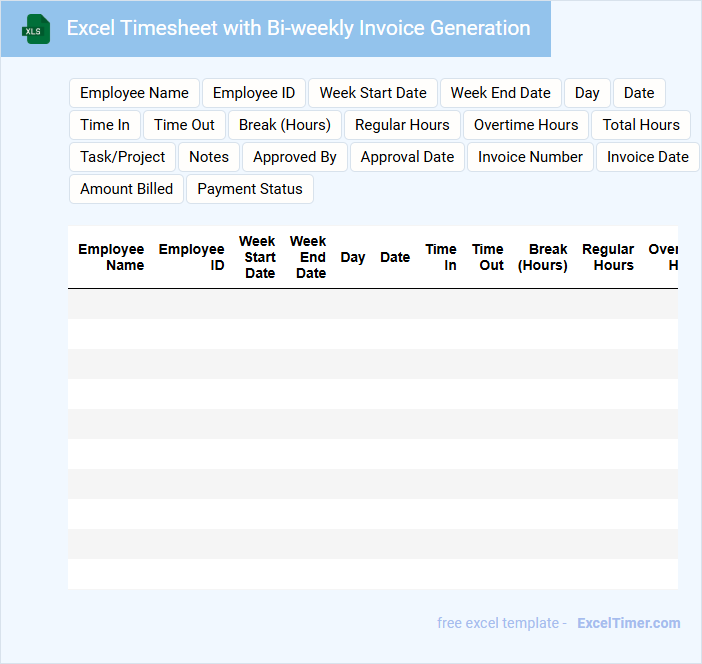

Excel Timesheet with Bi-weekly Invoice Generation

This document typically contains structured time tracking data and automated billing calculations for efficient payroll and invoicing.

- Time entries: Detailed records of hours worked per day or task for accurate time management.

- Bi-weekly summary: Consolidated data of hours and rates generated every two weeks for invoicing.

- Invoice generation: Automated creation of billing statements based on hours logged and agreed rates.

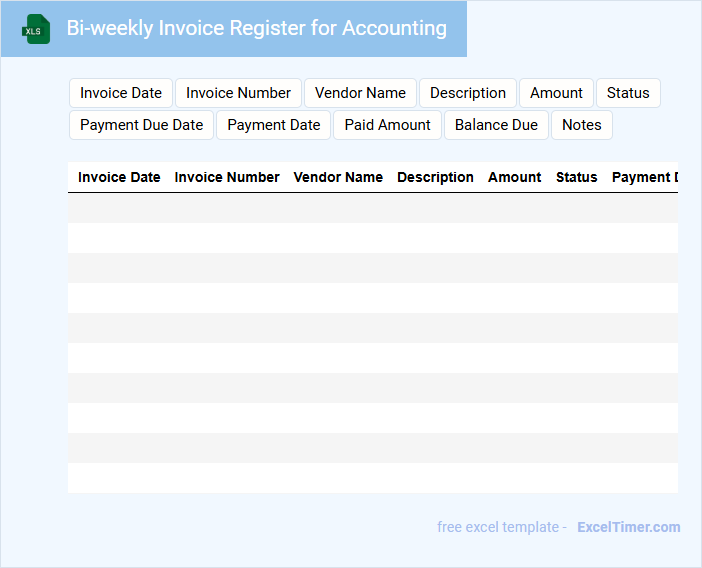

Bi-weekly Invoice Register for Accounting

A Bi-weekly Invoice Register for Accounting is typically a document listing all invoices issued within a two-week period, helping track payments and outstanding balances. It streamlines financial monitoring and reconciliations for businesses.

- Include invoice numbers, dates, and amounts to maintain clear records.

- Ensure proper categorization by clients or projects for easier analysis.

- Regularly update the register to reflect payments received and pending invoices.

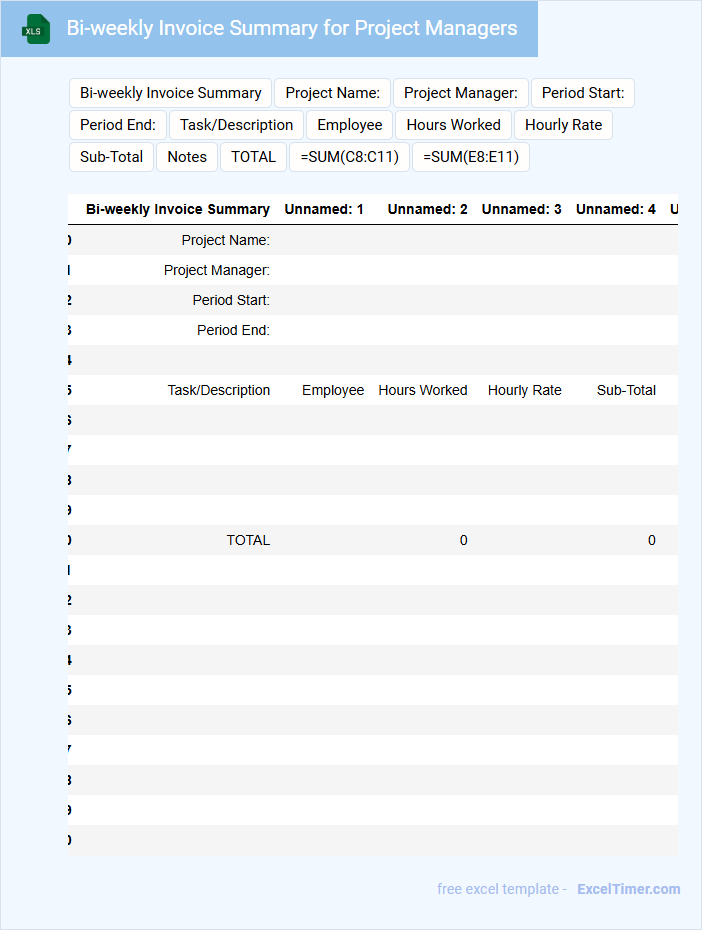

Bi-weekly Invoice Summary for Project Managers

A Bi-weekly Invoice Summary for Project Managers typically contains a detailed record of all invoices generated and payments received within the two-week period. It helps in tracking project expenses and ensuring timely payment processing.

- Include a clear breakdown of invoices by client or project to facilitate easy reference.

- Highlight any outstanding or overdue payments to prioritize follow-up actions.

- Provide a summary of total amounts invoiced and received to monitor cash flow effectively.

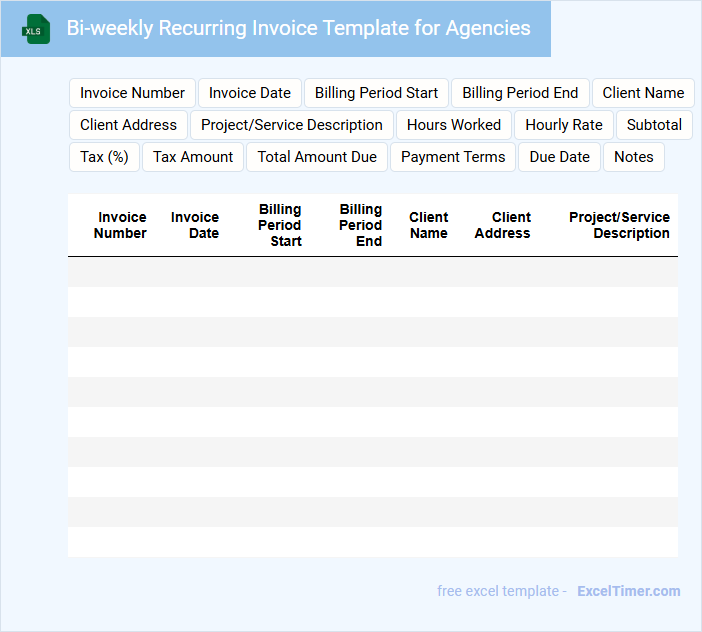

Bi-weekly Recurring Invoice Template for Agencies

A Bi-weekly Recurring Invoice Template for agencies typically contains detailed billing information scheduled every two weeks, including client details, invoice number, service descriptions, rates, and total amounts. It ensures consistent and timely payment tracking for ongoing projects or retainer agreements.

To optimize its use, it is important to include clear payment terms and a breakdown of services to avoid disputes. Automating reminders and including agency contact information can enhance professionalism and promptness in payments.

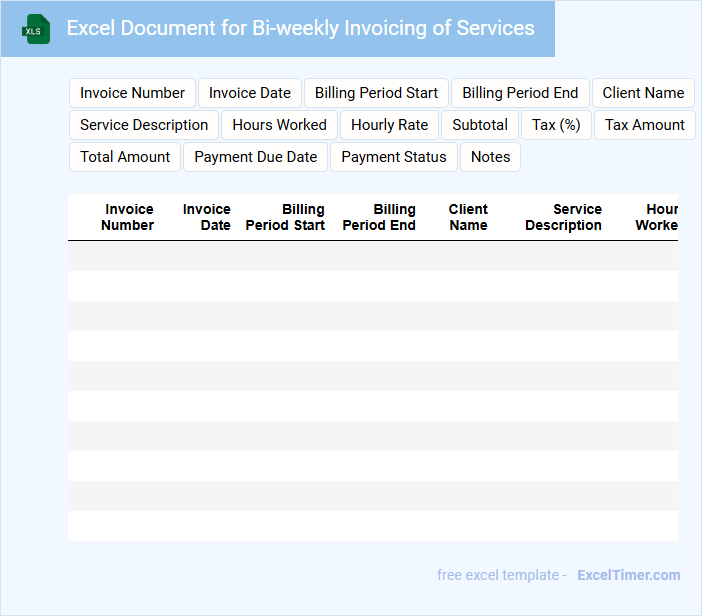

Excel Document for Bi-weekly Invoicing of Services

An Excel document for bi-weekly invoicing of services typically contains detailed records of provided services, including dates, descriptions, and associated costs, updated every two weeks. It is designed to ensure accurate billing and streamline financial tracking for both service providers and clients.

- Include clear timestamps and service descriptions for transparency.

- Use formulas to automate total cost calculations and tax deductions.

- Maintain consistent formatting for easy readability and data validation.

Bi-weekly Payment Request Template with Expense Tracker

A Bi-weekly Payment Request Template with Expense Tracker is a structured document designed to facilitate accurate and timely payment requests every two weeks. It typically contains sections for listing expenses, tracking payments, and summarizing totals to ensure transparency and accountability. This template helps streamline financial processes for both employees and employers.

Important elements to include are clearly defined expense categories, date and description fields, and a summary section for total amounts requested. Incorporating a built-in expense tracker allows for easy monitoring and reconciliation of expenditures. Ensuring the template is user-friendly and customizable enhances its effectiveness in various business contexts.

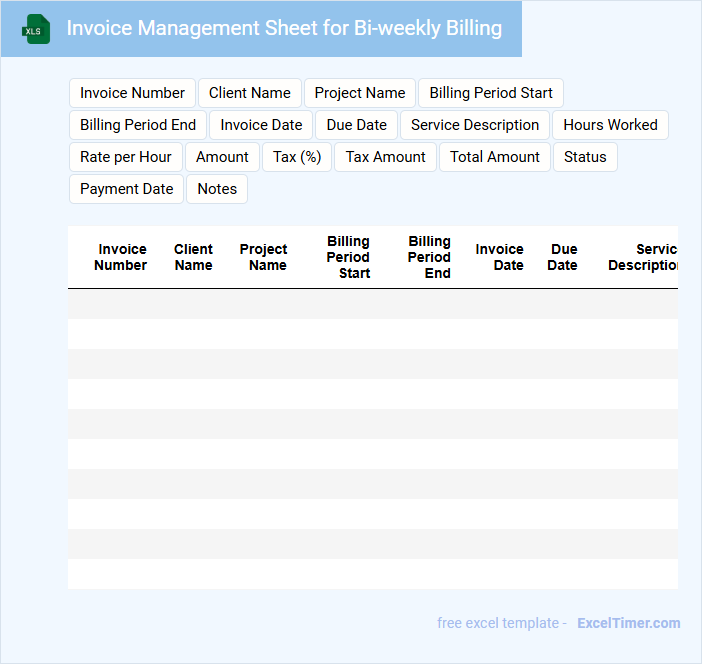

Invoice Management Sheet for Bi-weekly Billing

What information is typically included in an Invoice Management Sheet for Bi-weekly Billing? This document usually contains details of all invoices generated within a two-week period, including invoice numbers, client names, billing dates, amounts, and payment statuses. It serves as a centralized record to track and manage billing cycles efficiently, ensuring timely payments and accurate financial reporting.

What important elements should be emphasized in an Invoice Management Sheet for Bi-weekly Billing? It is crucial to highlight due dates, payment terms, and any outstanding amounts to prevent delays and disputes. Additionally, including a clear summary and categorization by client or project helps maintain organized and transparent billing processes.

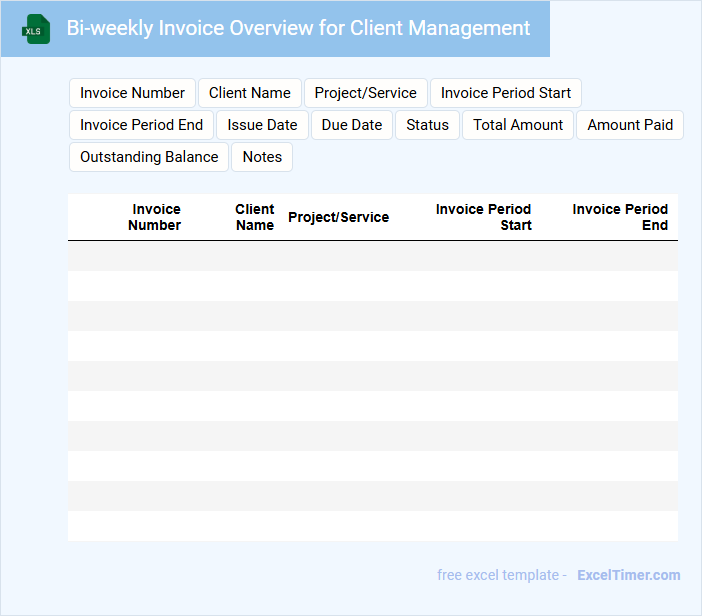

Bi-weekly Invoice Overview for Client Management

A Bi-weekly Invoice Overview for Client Management typically contains a summary of billing details and payment statuses for a two-week period.

- Invoice Summary: Clear itemization of services rendered and corresponding charges.

- Payment Status: Updated records showing paid, pending, and overdue invoices.

- Client Communication: Notes or reminders regarding client inquiries or follow-ups.

What does "bi-weekly" mean in the context of invoice generation in Excel?

In the context of invoice generation in Excel, "bi-weekly" refers to creating invoices every two weeks, resulting in 26 billing cycles per year. This schedule ensures consistent cash flow and helps track payments efficiently over a fixed period. Excel templates can automate bi-weekly invoice dates and calculations to streamline the invoicing process.

How do you set up date ranges for bi-weekly invoicing in an Excel document?

To set up date ranges for bi-weekly invoicing in an Excel document, enter the start date of your first billing period in one cell and use a formula like =A1+14 to generate subsequent periods automatically. Format the cells to display dates clearly, ensuring each range covers exactly 14 days to maintain consistency. Your invoice schedule will update dynamically, helping you manage billing cycles efficiently.

Which Excel formulas can help calculate the total amount due for each bi-weekly period?

Excel formulas like SUMIFS and EOMONTH help calculate the total amount due for each bi-weekly period by summing invoice amounts based on date ranges. Using SUMIFS, you can specify the invoice dates within each bi-weekly period to get accurate totals. Your spreadsheet can dynamically update totals as new invoices are added by leveraging structured date criteria and ranges.

How can you automate bi-weekly invoice reminders or tracking using Excel features?

You can automate bi-weekly invoice reminders in Excel by using formulas like TODAY() combined with conditional formatting to highlight upcoming due dates. Set up a dynamic schedule with the EDATE function to track invoice periods every two weeks. Incorporate Excel's built-in notification features through VBA macros or Power Automate for timely invoice tracking and reminders.

What is the best way to organize and filter bi-weekly invoicing records within an Excel spreadsheet?

Organize bi-weekly invoicing records in Excel by creating columns for invoice date, client name, invoice number, amount, and payment status. Use Excel's filtering and sorting features to quickly view specific bi-weekly periods or client invoices. Your spreadsheet will enhance tracking and ensure timely invoicing by applying date filters and using tables for dynamic data management.