The Bi-weekly Budget Excel Template for Freelancers helps track income and expenses over two-week periods, enabling precise financial planning. This template simplifies managing fluctuating freelance earnings by categorizing costs and forecasting cash flow. Accurate budgeting with this tool supports timely payment of taxes and savings goals.

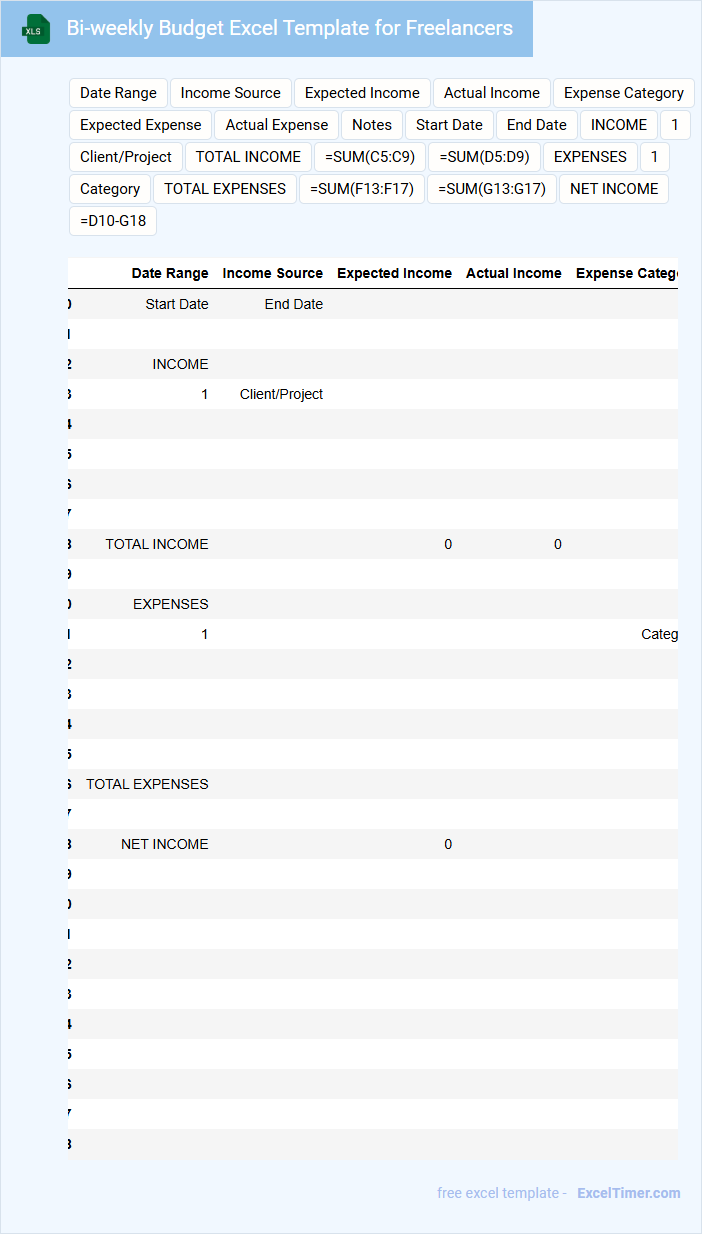

Bi-weekly Budget Excel Template for Freelancers

A Bi-weekly Budget Excel Template for Freelancers typically contains detailed income and expense tracking organized by two-week periods. It helps freelancers monitor cash flow, categorize expenses, and forecast future budgets efficiently. Including sections for invoicing, tax deductions, and savings goals is essential to maintain financial clarity and avoid surprises.

Income and Expenses Tracker for Freelancers (Bi-weekly)

An Income and Expenses Tracker for Freelancers (Bi-weekly) is a document designed to monitor earnings and expenditures on a two-week basis, helping maintain financial clarity. It is essential for managing cash flow and preparing for tax obligations effectively.

- Record all income streams and categorize expenses accurately.

- Update entries regularly to ensure up-to-date financial tracking.

- Use the tracker to identify spending patterns and optimize budgeting.

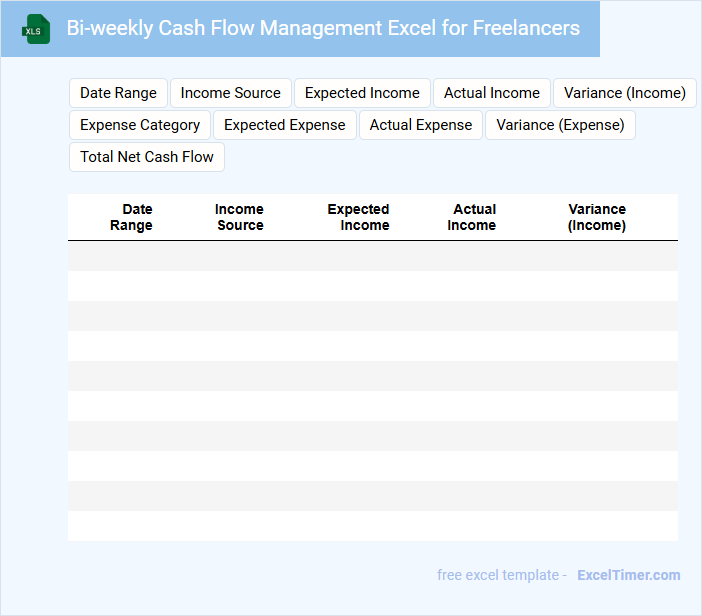

Bi-weekly Cash Flow Management Excel for Freelancers

The Bi-weekly Cash Flow Management Excel document is designed to help freelancers track their income and expenses every two weeks, ensuring accurate financial monitoring. It typically contains sections for recording payments received, bills due, and anticipated costs within each bi-weekly period.

Effective use of this template promotes better budgeting and prevents cash shortages by giving a clear overview of cash inflows and outflows. Freelancers should prioritize regularly updating their entries and reviewing future financial obligations to maintain a healthy cash flow.

Bi-weekly Personal Finance Tracker for Freelancers

This bi-weekly personal finance tracker is designed to help freelancers monitor their income and expenses regularly. It helps maintain a clear overview of cash flow, ensuring timely bill payments and budgeting.

Key sections typically include income sources, expense categories, and savings goals. Including reminders for tax obligations and invoice due dates is also important for efficient financial management.

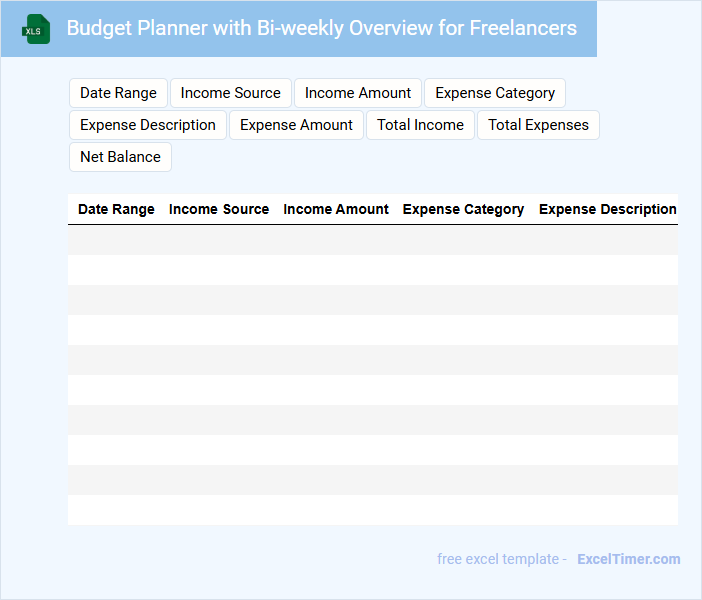

Budget Planner with Bi-weekly Overview for Freelancers

A Budget Planner with Bi-weekly Overview for freelancers is a practical document designed to help manage income and expenses on a regular basis. It typically includes sections for tracking earnings, fixed and variable costs, and savings goals. This tool enables freelancers to maintain financial stability and plan ahead effectively.

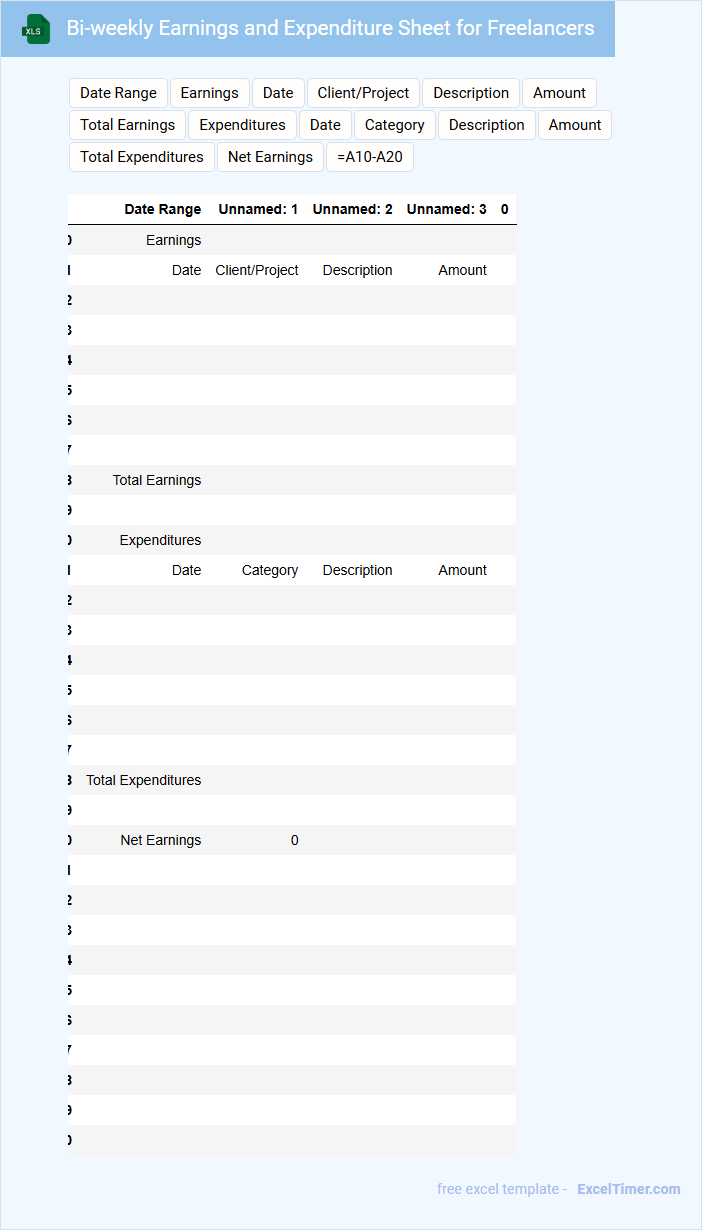

Bi-weekly Earnings and Expenditure Sheet for Freelancers

The Bi-weekly Earnings and Expenditure Sheet for freelancers is a crucial document that records income and expenses over a two-week period. It typically includes items such as project payments, invoices, receipts, and cost tracking to ensure financial clarity. Maintaining this document helps freelancers manage cash flow and plan for taxes effectively.

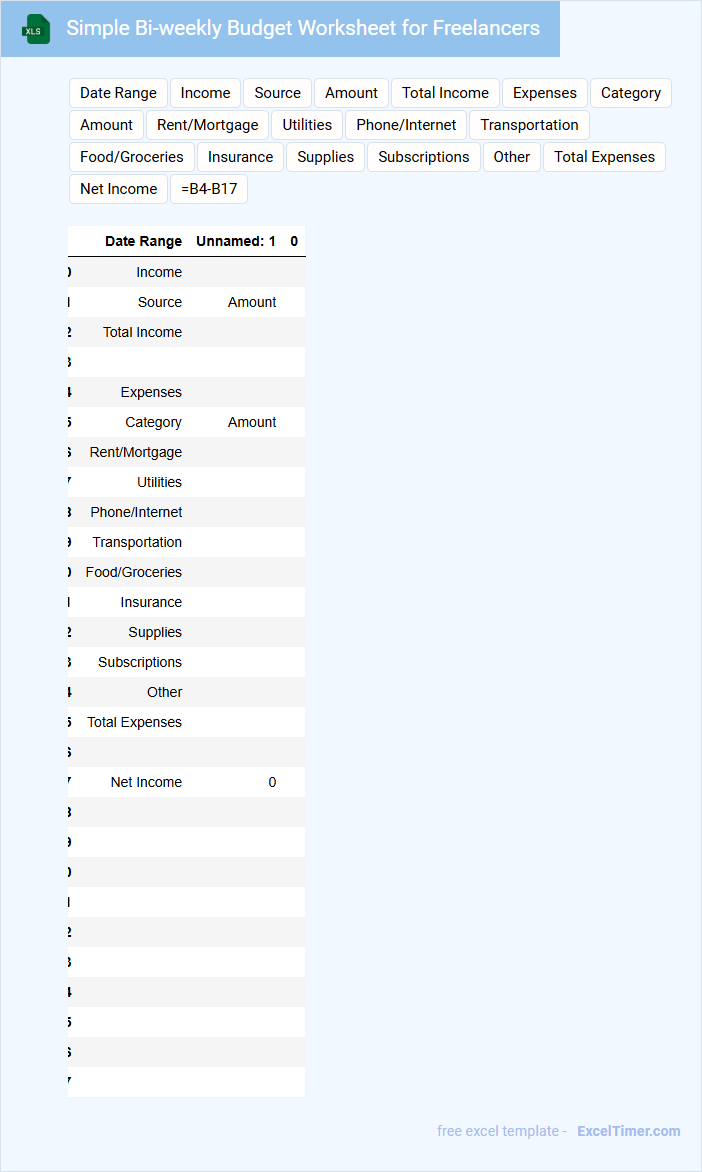

Simple Bi-weekly Budget Worksheet for Freelancers

A Simple Bi-weekly Budget Worksheet for Freelancers typically contains a detailed overview of income sources and categorized expenses. It helps freelancers track their cash flow on a regular basis, ensuring they stay financially organized and prepared for upcoming payments.

This document also includes sections for savings goals and tax estimations to maintain financial health. Regular updates are important to adapt the budget according to fluctuating income and business needs.

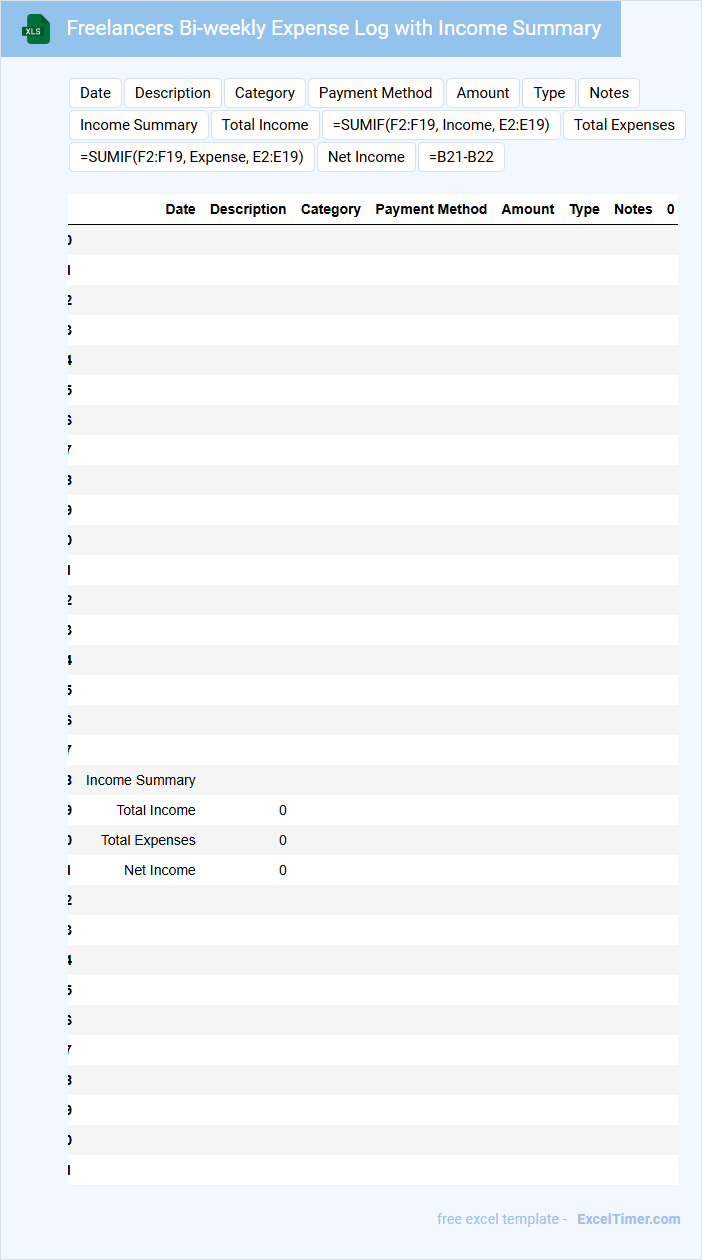

Freelancers Bi-weekly Expense Log with Income Summary

What information is typically included in a Freelancers Bi-weekly Expense Log with Income Summary? This document usually contains detailed records of all expenses incurred by the freelancer over a two-week period, alongside a summary of income earned during the same timeframe. It helps freelancers track their financial activities accurately, ensuring clear visibility of cash flow and aiding in budget management.

What important aspects should be considered when creating this log? It is essential to categorize expenses properly, include dates and descriptions for each entry, and reconcile income with invoices or payments received. Additionally, maintaining accuracy and updating the log regularly supports better tax preparation and financial planning.

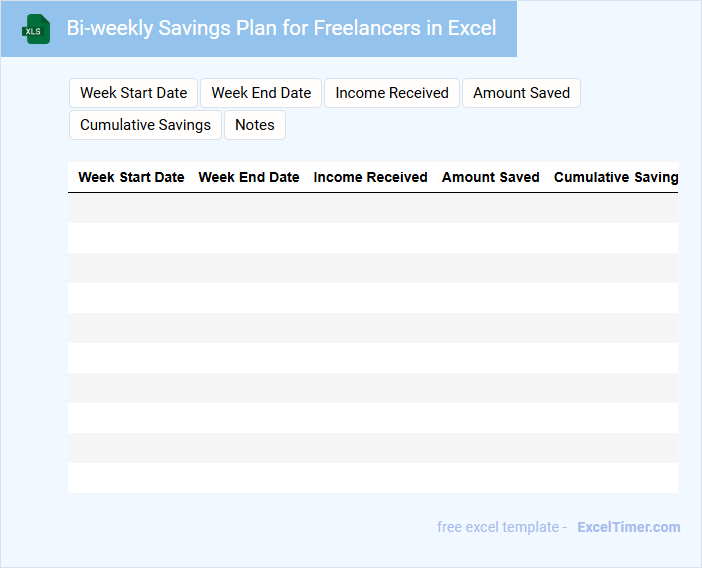

Bi-weekly Savings Plan for Freelancers in Excel

A Bi-weekly Savings Plan for Freelancers in Excel typically contains detailed schedules of income and expenses mapped over two-week intervals to help manage irregular cash flow. It includes columns for tracking earned income, savings goals, actual savings, and adjustments for fluctuating freelance payments. This type of document is essential for maintaining financial discipline and ensuring consistent contributions towards savings despite variable earnings.

Key considerations when creating or using this plan include accurately forecasting income, setting realistic savings targets, and regularly updating the spreadsheet to reflect true financial status. Implementing automated formulas in Excel can simplify calculations and provide quick insights into financial progress. Additionally, including emergency fund tracking and tax withholding estimates can enhance financial preparedness for freelancers.

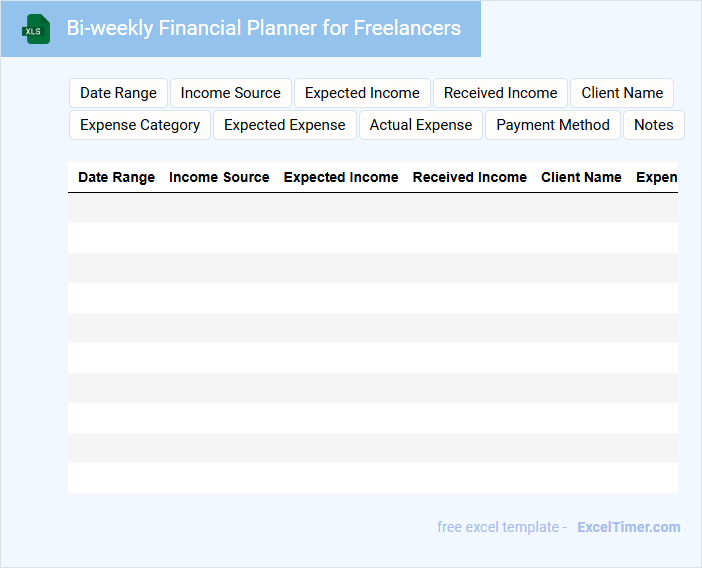

Bi-weekly Financial Planner for Freelancers

The Bi-weekly Financial Planner for freelancers typically contains sections for tracking income, expenses, and savings every two weeks. It helps freelancers manage irregular cash flows and plan for upcoming bills and tax obligations. Important elements include budgeting tools, invoice tracking, and reminders for important financial deadlines.

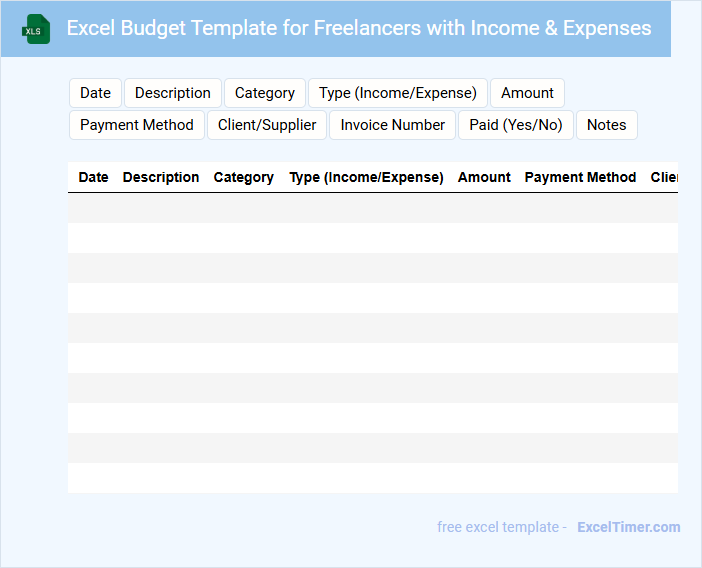

Excel Budget Template for Freelancers with Income & Expenses

An Excel Budget Template for Freelancers is designed to help independent professionals manage their finances effectively. It typically contains sections for tracking both income streams and various expenses related to their freelance work.

This document allows freelancers to monitor cash flow, set financial goals, and plan for taxes. Including categories for tax deductions and saving goals is crucial for comprehensive financial management.

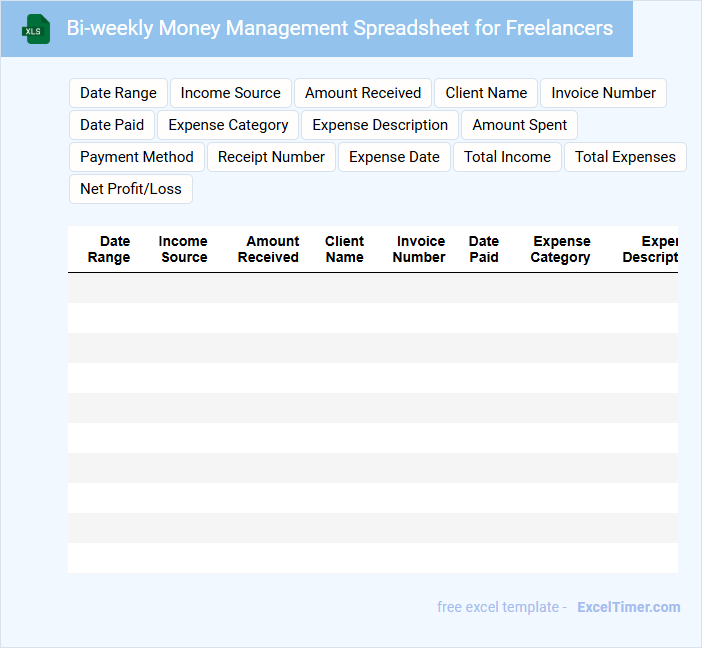

Bi-weekly Money Management Spreadsheet for Freelancers

A Bi-weekly Money Management Spreadsheet for Freelancers typically contains detailed income and expense tracking designed for managing finances over two-week periods.

- Income Recording: Accurately document all sources of freelancer income received every two weeks.

- Expense Categorization: Organize and track essential expenses to monitor cash flow effectively.

- Budget Planning: Set realistic budget goals based on bi-weekly earnings for improved financial stability.

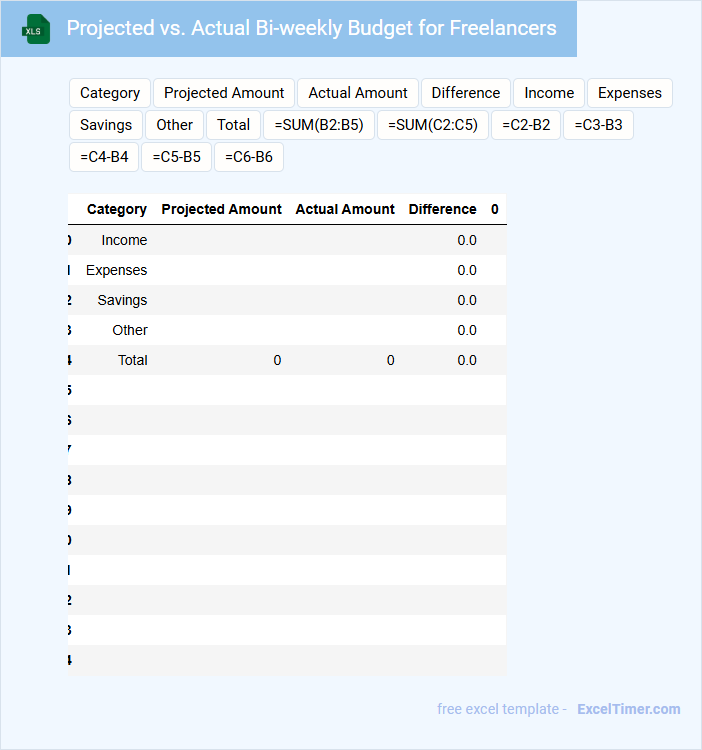

Projected vs. Actual Bi-weekly Budget for Freelancers

This document typically compares the planned bi-weekly budget against actual expenses incurred by freelancers to track financial accuracy and resource allocation.

- Budget Variance: Identifies discrepancies between projected and actual costs to manage overspending.

- Expense Categories: Breaks down costs by type to highlight specific areas impacting the budget.

- Freelancer Hours: Tracks hours worked versus planned to ensure alignment with budgeted allocations.

Bi-weekly Invoice and Payment Record for Freelancers

A Bi-weekly Invoice and Payment Record for Freelancers typically contains detailed billing information and payment tracking to ensure clarity and timely transactions.

- Invoice Details: Clearly list services provided, hours worked, and rates applied for accurate billing.

- Payment Schedule: Specify payment due dates and methods to avoid delays and misunderstandings.

- Record Keeping: Maintain thorough records of all invoices sent and payments received for financial tracking and tax purposes.

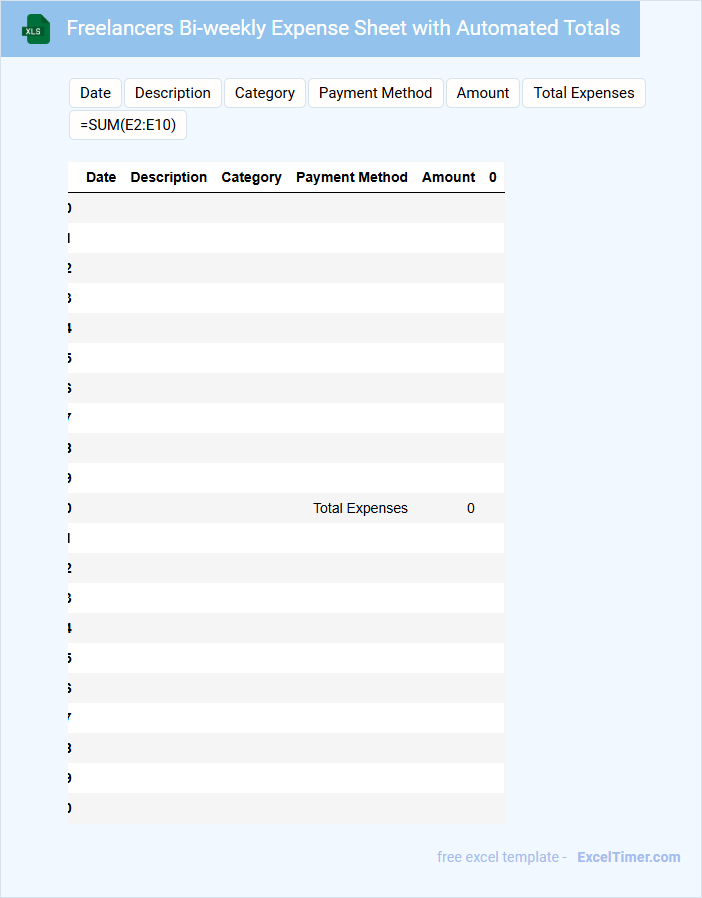

Freelancers Bi-weekly Expense Sheet with Automated Totals

A Freelancers Bi-weekly Expense Sheet is a document used to track and manage expenses incurred by freelancers over a two-week period. It typically includes categories like travel, supplies, meals, and project-related costs.

With Automated Totals, the sheet calculates expenses automatically, reducing manual errors and saving time. This feature ensures accurate financial tracking for budgeting and tax purposes.

Ensure to regularly update the sheet with receipts and categorize expenses properly to maintain clear records and support financial transparency.

What are the essential income and expense categories to include in a bi-weekly freelancer budget Excel sheet?

Essential income categories for a bi-weekly freelancer budget include client payments, project bonuses, and passive income sources. Key expense categories cover software subscriptions, equipment costs, marketing expenses, and tax savings. Tracking these categories ensures accurate cash flow management and financial planning for freelancers.

How can you accurately track variable income and irregular payments in your bi-weekly Excel budget?

To accurately track variable income and irregular payments in your bi-weekly Excel budget, use separate income categories with date-stamped entries for each payment. Utilize Excel functions like SUMIF and FILTER to dynamically calculate totals based on payment dates and amounts. This method ensures your budget reflects real-time fluctuations in freelance earnings and cash flow.

What Excel formulas help automate surplus or deficit calculations for each bi-weekly period?

Excel formulas like =SUM() calculate total income and expenses, while =B2-C2 determines surplus or deficit for each bi-weekly period. Using =IF() formulas helps flag negative balances to indicate deficits automatically. Your bi-weekly budget tracking becomes efficient with these automated calculations.

How do you set up savings goals and emergency funds within your bi-weekly budget spreadsheet?

Set savings goals by allocating a fixed percentage of your bi-weekly income into designated savings categories within your spreadsheet. Create separate emergency fund categories with clear target amounts to track progress over time. Use formulas to automate transfers and monitor balances to ensure consistent contributions toward financial stability.

What visual tools (charts, conditional formatting) can highlight spending patterns or financial risks in your Excel document?

Use bar charts and line graphs to visualize income versus expenses and identify spending patterns over bi-weekly periods. Apply conditional formatting with color scales or data bars to highlight overspending, budget variances, and financial risks. Incorporate pivot tables combined with slicers for dynamic analysis of expense categories and trends.