Daily Cash Flow Excel Template for Small Businesses provides a simple yet effective way to track daily income and expenses, helping owners maintain a clear financial overview. This template enhances budgeting accuracy and assists in identifying cash shortages before they impact operations. Small businesses benefit from improved decision-making and streamlined financial management through its user-friendly design.

Daily Cash Flow Tracker for Small Businesses

A Daily Cash Flow Tracker is a vital document used to monitor the daily inflow and outflow of cash within a small business. It provides a clear snapshot of liquidity, helping owners make informed financial decisions quickly.

This type of document typically contains entries for daily sales, expenses, and cash balances, offering a detailed view of cash movement. Regularly updating this tracker is essential for maintaining accurate financial records and avoiding cash shortages.

Ensure the tracker includes categories for all income sources and expenditures, and review it daily to spot trends and manage cash effectively.

Simple Daily Cash Flow Sheet for Entrepreneurs

A Simple Daily Cash Flow Sheet for Entrepreneurs typically contains records of daily income and expenses, helping to monitor the business's liquidity. It serves as a tool to ensure that cash inflows and outflows are tracked accurately and timely.

- Include columns for date, description, income, expenses, and balance to maintain clarity.

- Update the sheet daily to capture real-time financial data and avoid discrepancies.

- Summarize weekly or monthly cash flow to identify trends and make informed decisions.

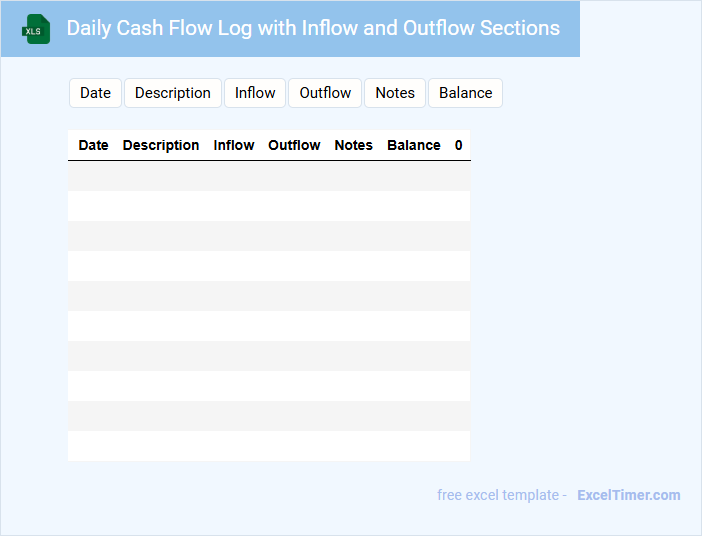

Daily Cash Flow Log with Inflow and Outflow Sections

A Daily Cash Flow Log is a financial document that tracks the movement of cash within a business or personal finance daily. It typically includes sections for both inflow and outflow transactions to provide a clear overview of cash position.

Its purpose is to help monitor liquidity and ensure accurate financial record-keeping. A crucial suggestion is to consistently update entries to avoid discrepancies and maintain transparency.

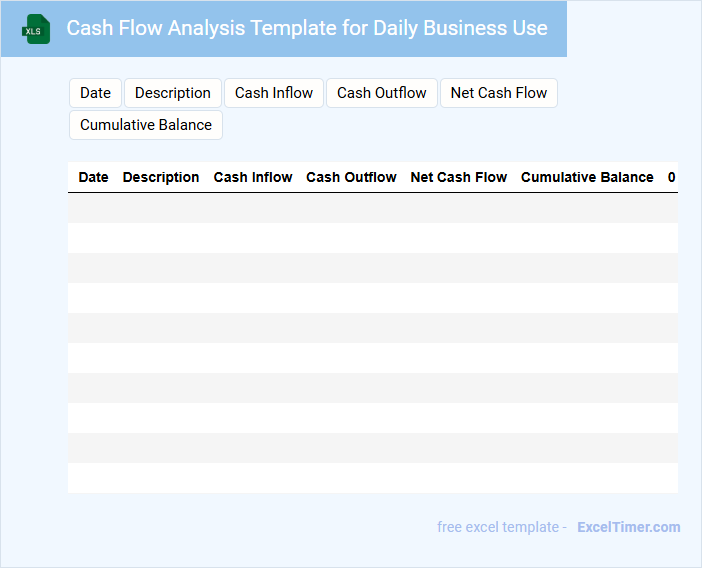

Cash Flow Analysis Template for Daily Business Use

The Cash Flow Analysis Template is a crucial document that tracks the inflow and outflow of cash within a business on a daily basis. It helps businesses maintain a clear view of their liquidity and financial health. Regular use of this template aids in identifying trends and potential cash shortages early.

Daily Cash Flow Register for Small Retail Stores

The Daily Cash Flow Register is a vital document that tracks all incoming and outgoing cash transactions on a daily basis. It helps small retail stores monitor their liquidity and maintain accurate financial records.

Typically, this register contains details such as opening cash balance, sales receipts, expenses, and closing cash balance. A crucial suggestion is to ensure all entries are recorded promptly and reviewed daily to prevent discrepancies and enhance financial control.

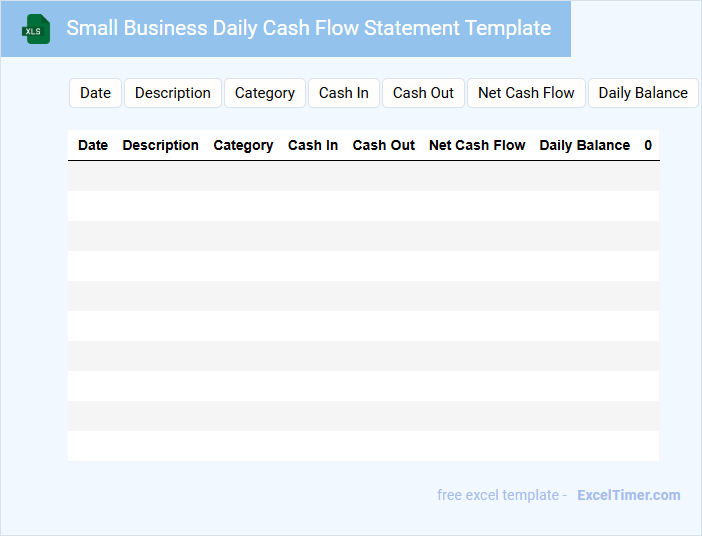

Small Business Daily Cash Flow Statement Template

What information is typically included in a Small Business Daily Cash Flow Statement Template?

This document usually contains daily records of cash inflows and outflows, including sales revenue, expenses, and payments. It provides a clear snapshot of the business's liquidity to help owners manage cash effectively. Important aspects to focus on are tracking daily sales, monitoring expenses closely, and maintaining accurate records to ensure financial stability and informed decision-making.

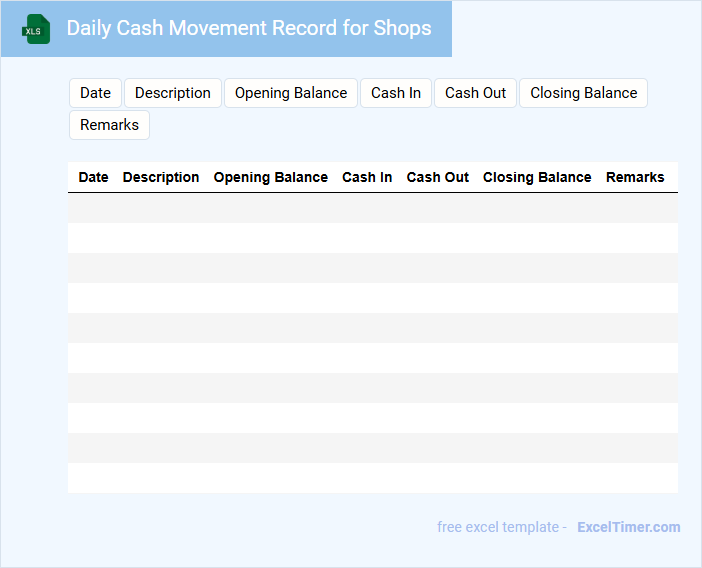

Daily Cash Movement Record for Shops

The Daily Cash Movement Record for shops is a crucial document that tracks all cash inflows and outflows throughout the day. It ensures accurate monitoring of transactions and helps prevent discrepancies.

This record typically contains details such as opening cash balance, sales receipts, expenses paid in cash, and closing cash balance. Maintaining this document regularly is important for effective cash management and financial accountability.

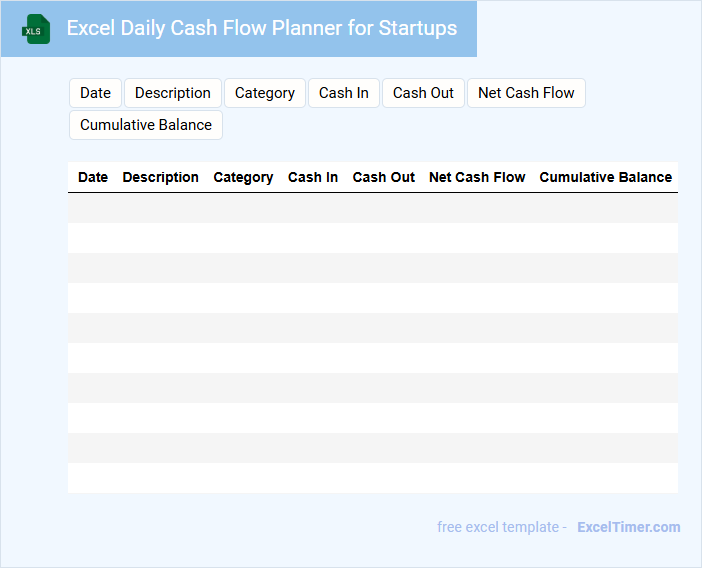

Excel Daily Cash Flow Planner for Startups

What kind of information is typically included in an Excel Daily Cash Flow Planner for Startups? This document usually contains detailed daily records of cash inflows and outflows to help startups monitor their liquidity efficiently. It provides a clear overview of expected revenue, expenses, and net cash position to ensure effective financial management.

What important elements should be included for better tracking? Key elements include categories for each type of income and expense, a running balance of cash available, and forecasted cash flow projections. Incorporating visual charts and alerts for low cash balances can greatly enhance decision-making for startup founders.

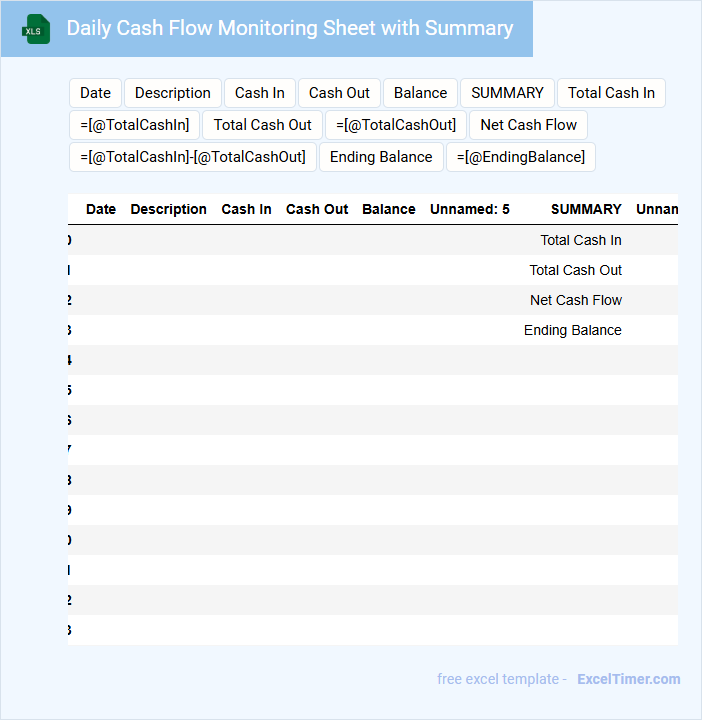

Daily Cash Flow Monitoring Sheet with Summary

A Daily Cash Flow Monitoring Sheet is a document used to track the inflow and outflow of cash on a daily basis, providing a clear view of a business's liquidity. It usually contains detailed entries of cash receipts, payments, and balances to help identify cash shortages or surpluses. Including a summary section allows for quick assessment of total cash movements and overall financial health.

Important elements to include are categorized cash inflows and outflows, opening and closing balances for each day, and a concise summary highlighting net cash position. Consistent daily updates ensure accurate tracking that supports better financial planning and decision-making. Including notes for unusual transactions or discrepancies is also recommended for improved transparency.

Daily Cash Tracking Workbook for Small Offices

A Daily Cash Tracking Workbook for Small Offices is typically a document designed to monitor and record daily cash transactions to ensure accurate financial management.

- Transaction Records: It should include detailed entries of all cash inflows and outflows for the day.

- Cash Reconciliation: The workbook must provide a section to reconcile the recorded cash against the actual cash on hand to identify discrepancies.

- Summary Reports: A daily summary or report highlighting total cash received, spent, and remaining balance is essential for quick review.

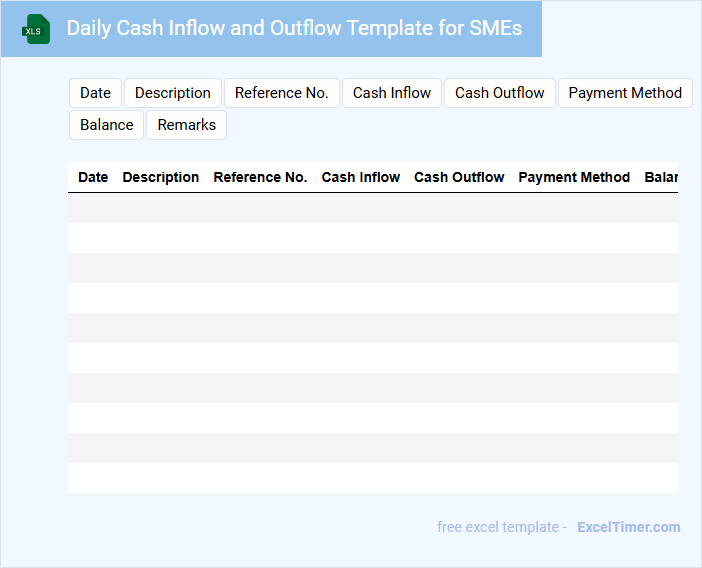

Daily Cash Inflow and Outflow Template for SMEs

A Daily Cash Inflow and Outflow Template for SMEs typically contains detailed records of all the money entering and leaving a business on a daily basis. It includes entries such as sales receipts, expenses, and other financial transactions, helping businesses track their liquidity. This document is crucial for maintaining accurate financial management and ensuring operational stability.

Important suggestions for using this template include consistently updating it at the end of each business day, categorizing transactions clearly for easy analysis, and regularly reviewing cash flow patterns to forecast future financial needs. Accurate entries and timely updates help SMEs avoid cash shortages and make informed decisions. Integration with accounting software can further optimize financial tracking and reporting.

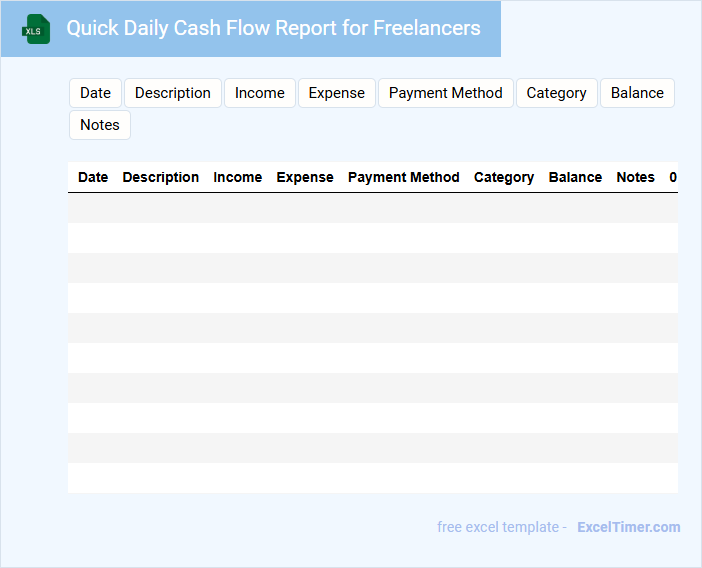

Quick Daily Cash Flow Report for Freelancers

A Quick Daily Cash Flow Report for Freelancers typically contains a concise summary of daily income and expenses to help manage financial stability efficiently.

- Income tracking: Record all sources of daily payments from clients to monitor revenue.

- Expense logging: Document any daily expenditures related to work to keep accurate financial records.

- Cash balance overview: Provide a clear snapshot of available funds to ensure liquidity for ongoing projects.

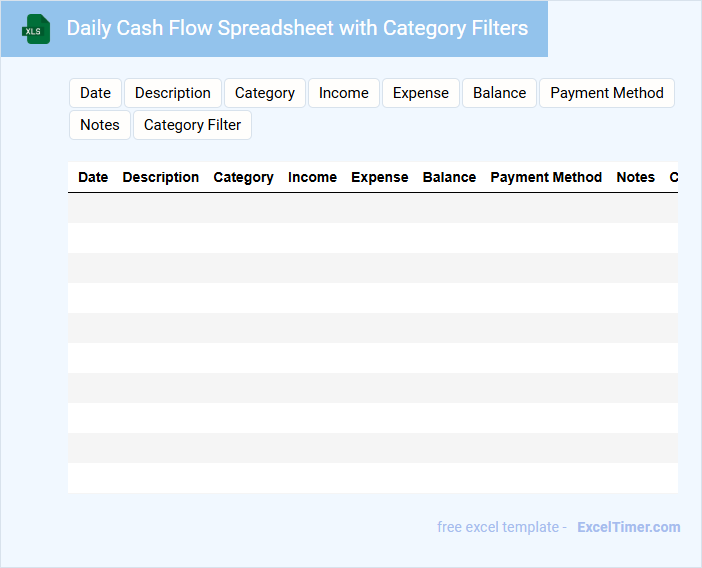

Daily Cash Flow Spreadsheet with Category Filters

A Daily Cash Flow Spreadsheet with Category Filters is a financial document used to track daily income and expenses, categorized for better analysis. It helps individuals or businesses monitor cash movement efficiently and identify spending patterns.

- Include detailed daily entries for all cash inflows and outflows to ensure accuracy.

- Use clear and consistent categories to filter and analyze specific types of transactions.

- Regularly update and review the spreadsheet to maintain up-to-date financial insights and prevent errors.

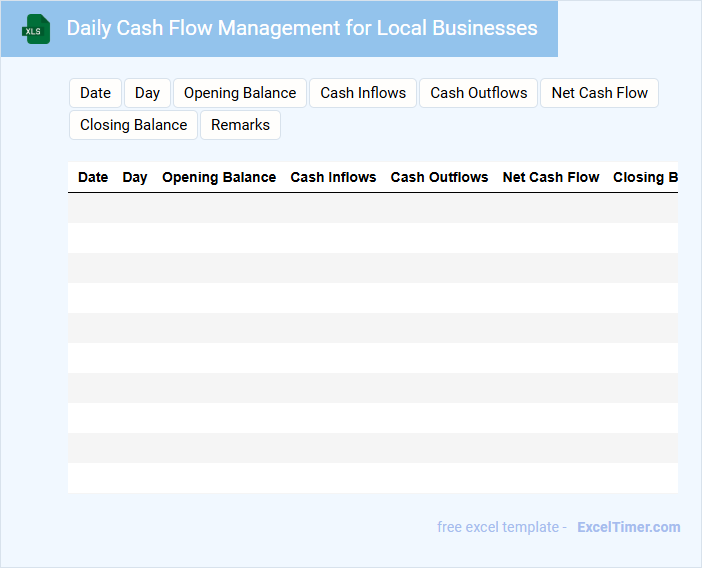

Daily Cash Flow Management for Local Businesses

Daily cash flow management is crucial for local businesses to monitor their incoming and outgoing funds effectively. This type of document typically contains detailed records of daily sales, expenses, and cash balances. Maintaining accurate cash flow records helps businesses ensure liquidity and make informed financial decisions.

Important elements to include are daily cash receipts, payments, petty cash usage, and updates on outstanding receivables or payables. It is also recommended to include a summary section highlighting cash flow trends and any discrepancies that need attention. Consistent documentation supports better cash forecasting and financial stability for the business.

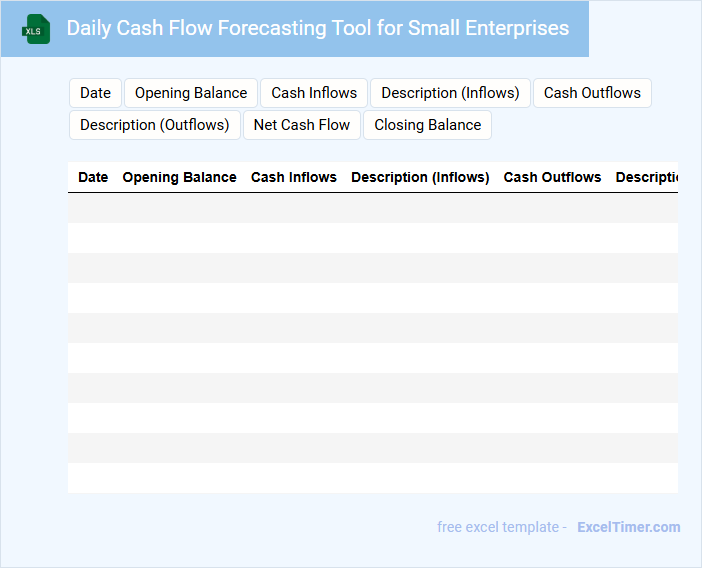

Daily Cash Flow Forecasting Tool for Small Enterprises

What information is typically contained in a Daily Cash Flow Forecasting Tool for Small Enterprises? This type of document usually includes daily projected cash inflows and outflows, helping businesses anticipate liquidity needs and avoid cash shortages. It details expected receipts, payments, and the resulting cash balance to ensure effective financial management.

What is an important consideration when using a Daily Cash Flow Forecasting Tool for Small Enterprises? Accuracy in estimating cash transactions is crucial to provide reliable forecasts, and regular updates should be made to reflect changes in operations or market conditions. Additionally, including contingency plans for unexpected expenses enhances the tool's effectiveness.

What are the essential data fields to track daily cash inflows and outflows in an Excel cash flow document for small businesses?

Your Excel document for Daily Cash Flow should include essential data fields such as Date, Description, Cash Inflows, Cash Outflows, and Balance to accurately track daily transactions. Including categories like Sales Revenue, Loans Received, Operational Expenses, Payroll, and Miscellaneous Payments ensures detailed monitoring of financial activity. This structured approach helps small businesses maintain clear visibility of cash movements and supports effective financial management.

How can Excel formulas be used to automatically calculate ending daily cash balances?

Excel formulas like SUM and SUMIF automate ending daily cash balances by adding daily inflows and subtracting outflows. Using cell references linked to cash transactions ensures real-time updates of balances. This approach improves accuracy and efficiency in monitoring small business cash flow daily.

What methods can be implemented in Excel to visually monitor cash flow trends over time?

Excel offers various methods to visually monitor cash flow trends over time, including line charts that display daily revenue and expenses, and conditional formatting to highlight cash flow fluctuations. Pivot tables combined with slicers enable dynamic analysis of cash inflows and outflows by date or category. These tools help ensure your daily cash flow data is easily interpreted and actionable for small business management.

How can Excel help identify recurring expenses and income sources impacting daily cash flow?

Excel helps identify recurring expenses and income sources by using functions like SUMIF and PivotTables to categorize and analyze transaction data. Conditional formatting highlights regular patterns, making it easier to spot trends affecting daily cash flow. Automated templates track dates and amounts, enabling small businesses to forecast cash flow and manage financial stability effectively.

What safeguards can be set up in Excel to minimize errors and ensure the accuracy of daily cash flow records?

Setting up data validation rules in Excel restricts entries to specific formats, reducing input errors in your Daily Cash Flow records. Using conditional formatting highlights unusual transactions or discrepancies, enabling quicker identification of potential mistakes. Implementing formulas that cross-check totals and automate calculations ensures accuracy and consistency throughout your cash flow document.