The Daily Cash Flow Excel Template for Small Retailers is designed to track daily income and expenses, helping businesses maintain accurate financial records. It allows small retailers to monitor cash inflows and outflows efficiently, ensuring better budget management and financial planning. Key features include customizable categories, automated calculations, and clear visual summaries for quick cash flow analysis.

Daily Cash Flow Tracker for Small Retailers

A Daily Cash Flow Tracker for small retailers is a crucial document that records all cash inflows and outflows each day, helping to maintain an accurate financial overview. It typically includes sections for sales revenue, expenses, and opening and closing cash balances.

This document is essential for managing liquidity and ensuring that the business can meet daily operational costs without disruptions. To optimize its use, it is important to update the tracker consistently and reconcile it with bank statements regularly.

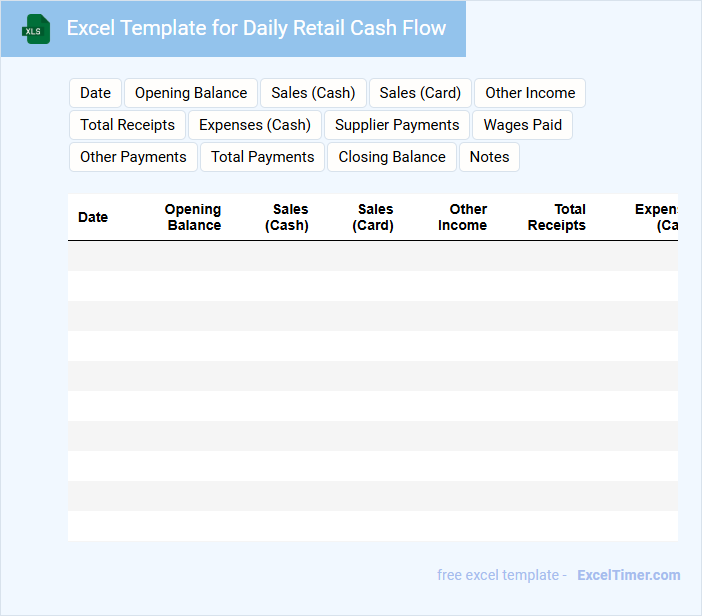

Excel Template for Daily Retail Cash Flow

An Excel Template for Daily Retail Cash Flow is typically used to track and manage daily cash transactions in a retail business. It contains fields for recording cash inflows, outflows, and balances to monitor liquidity. This document helps ensure accurate financial reporting and effective cash management.

Important elements to include are sections for opening and closing cash balances, detailed sales receipts, expense tracking, and automatic calculation of net cash flow. Incorporating date stamps and category breakdowns enhances clarity and usability. Additionally, using formulas and conditional formatting can improve accuracy and highlight discrepancies.

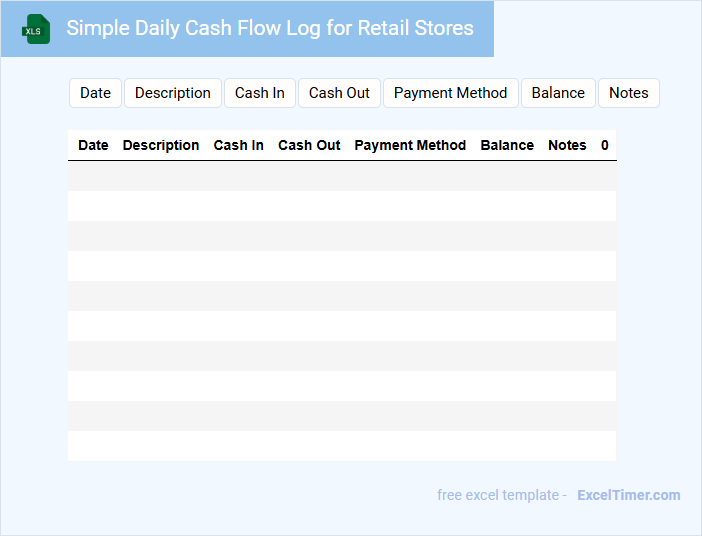

Simple Daily Cash Flow Log for Retail Stores

Simple Daily Cash Flow Log for Retail Stores typically contains records of daily cash transactions to monitor cash inflows and outflows, helping to maintain accurate financial tracking. It is essential for managing day-to-day finances and ensuring cash availability for operations.

- Record all cash sales and receipts promptly.

- Document cash payments and withdrawals accurately.

- Summarize daily totals to identify discrepancies quickly.

Daily Cash Position Sheet for Retailers

A Daily Cash Position Sheet for retailers is a critical financial document that tracks the daily inflow and outflow of cash. It provides a clear snapshot of the available cash balance at the end of each day. Retailers use this sheet to manage liquidity, ensure accurate cash handling, and make informed financial decisions.

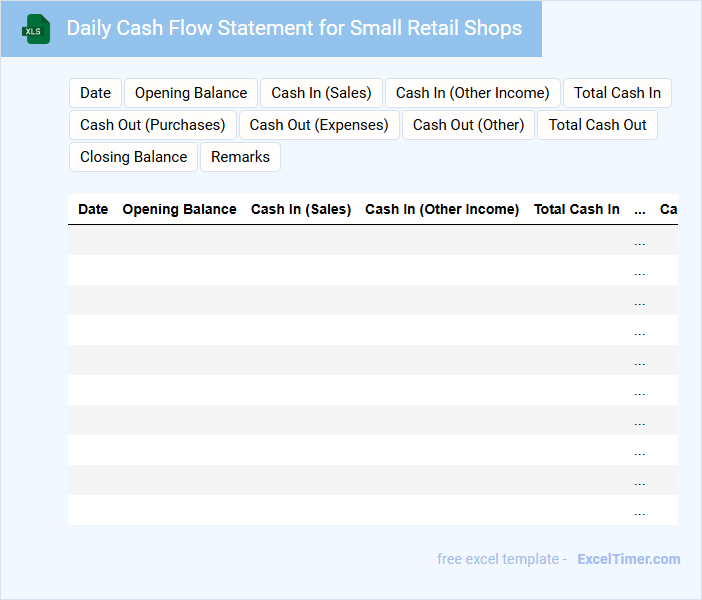

Daily Cash Flow Statement for Small Retail Shops

The Daily Cash Flow Statement is a crucial financial document for small retail shops, summarizing daily inflows and outflows of cash. It helps owners monitor liquidity and manage operational expenses effectively. Regular updates ensure accurate tracking of sales, purchases, and petty cash usage.

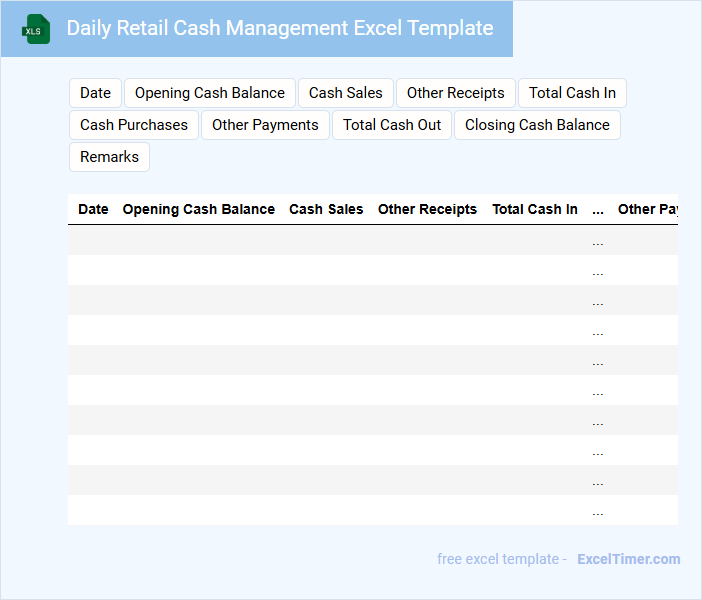

Daily Retail Cash Management Excel Template

The Daily Retail Cash Management Excel Template is typically used to track and record daily cash transactions, including sales, expenses, and cash deposits. It helps in maintaining accurate financial records for retail businesses.

Key features often include cash flow summaries, discrepancy tracking, and reconciliation reports to ensure accountability. For effective use, it is important to update the template daily and regularly verify entries against actual cash on hand.

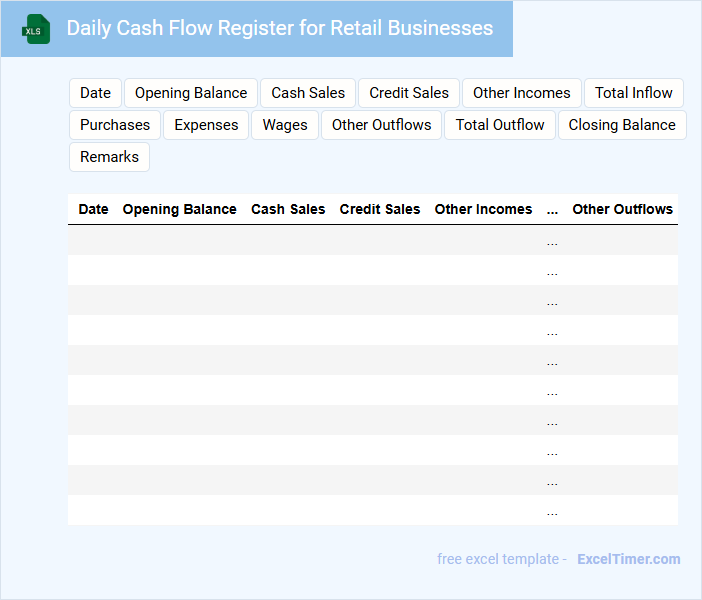

Daily Cash Flow Register for Retail Businesses

What information does a Daily Cash Flow Register for Retail Businesses typically contain? This document records all cash transactions including sales, expenses, and cash on hand, providing a clear daily overview of cash inflows and outflows. It helps retail businesses maintain accurate financial tracking and ensures accountability through detailed entries of daily cash activities.

What is an important consideration when maintaining a Daily Cash Flow Register? Consistent and accurate recording of every transaction is crucial to avoid discrepancies and detect any cash shortages or surpluses early. Additionally, regularly reconciling the register with physical cash counts and bank deposits ensures financial integrity and helps in effective cash management.

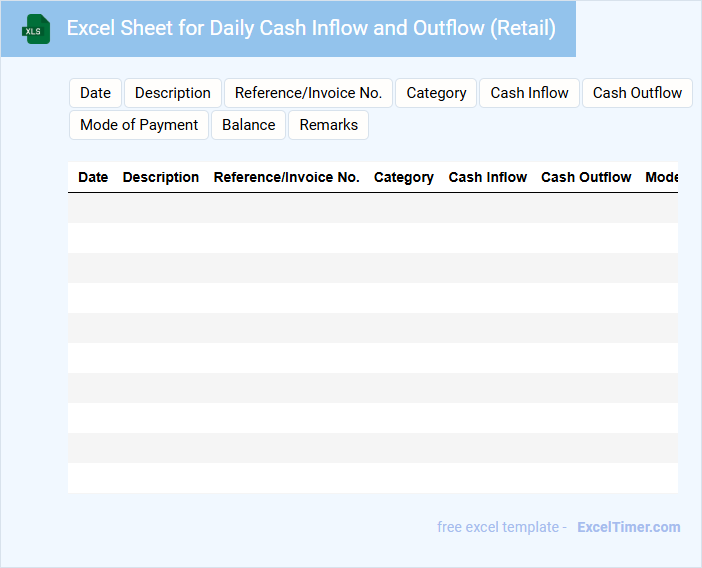

Excel Sheet for Daily Cash Inflow and Outflow (Retail)

The Excel Sheet for Daily Cash Inflow and Outflow in retail is primarily designed to track the financial transactions related to cash movement within a business on a daily basis. It helps in monitoring the cash received from sales and cash paid out for expenses or purchases effectively.

This document usually contains detailed records of dates, transaction descriptions, amounts of cash inflow and outflow, and running cash balances. To enhance accuracy and usefulness, it is important to include a clear categorization of transaction types and ensure timely data entry.

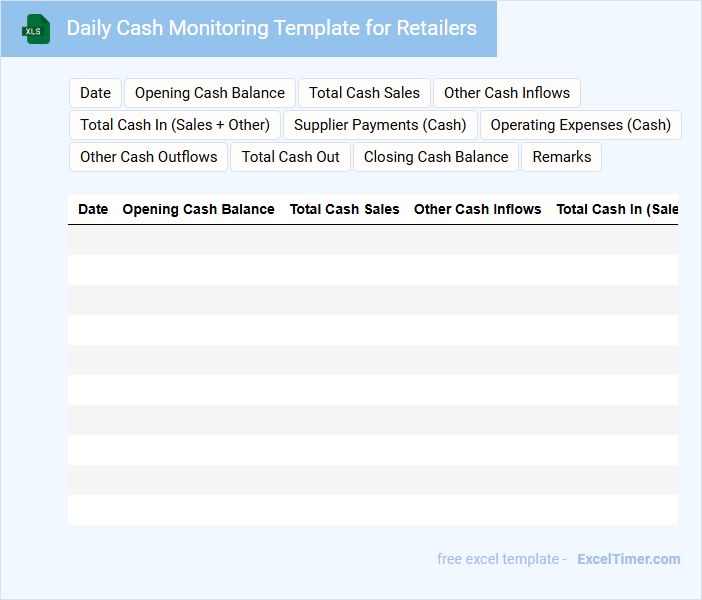

Daily Cash Monitoring Template for Retailers

This type of document typically contains detailed records of daily cash transactions for retail businesses.

- Accurate cash inflow and outflow tracking to ensure accountability.

- Regular reconciliation entries to detect discrepancies early.

- Clear categorization of sales and expenses for financial clarity.

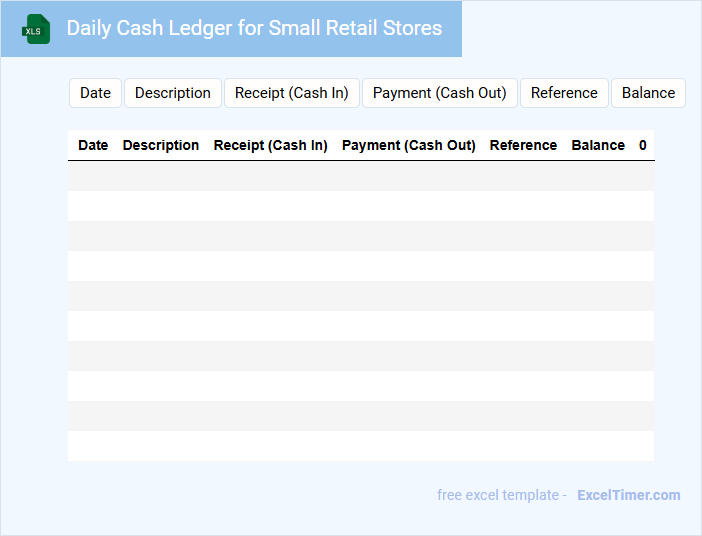

Daily Cash Ledger for Small Retail Stores

A Daily Cash Ledger for Small Retail Stores is a record-keeping document used to track daily cash transactions. It helps in maintaining accurate financial accountability and loss prevention.

- Include the opening cash balance at the start of each day to monitor cash flow accurately.

- Record every cash receipt and payment with a clear description for transparency.

- Reconcile the closing cash balance daily to detect discrepancies promptly.

Daily Retail Sales and Cash Flow Tracker

What information does a Daily Retail Sales and Cash Flow Tracker typically include? This document usually contains detailed records of daily sales transactions and cash inflows and outflows, providing a clear overview of a retail business's financial health. It helps monitor revenue, track expenses, and ensure accurate cash management for informed decision-making.

What are important elements to consider when maintaining this tracker? It is essential to consistently update daily sales figures, categorize cash movements accurately, and reconcile cash on hand regularly. Additionally, including sections for notes on discrepancies or unusual transactions enhances error detection and improves financial transparency.

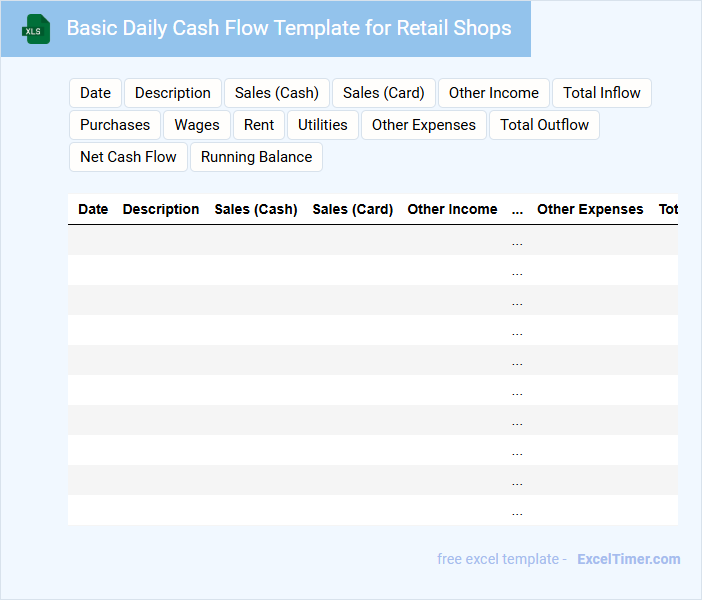

Basic Daily Cash Flow Template for Retail Shops

What information does a Basic Daily Cash Flow Template for retail shops typically contain? This document usually includes daily sales revenue, cash inflows, and outflows such as expenses and payments. It helps track the shop's liquidity and ensures proper cash management throughout the day.

What is an important aspect to consider when using this template? Accuracy in recording all cash transactions is crucial to maintain reliable data. Additionally, regularly reviewing and comparing actual cash flow against projections can help identify discrepancies and improve financial planning.

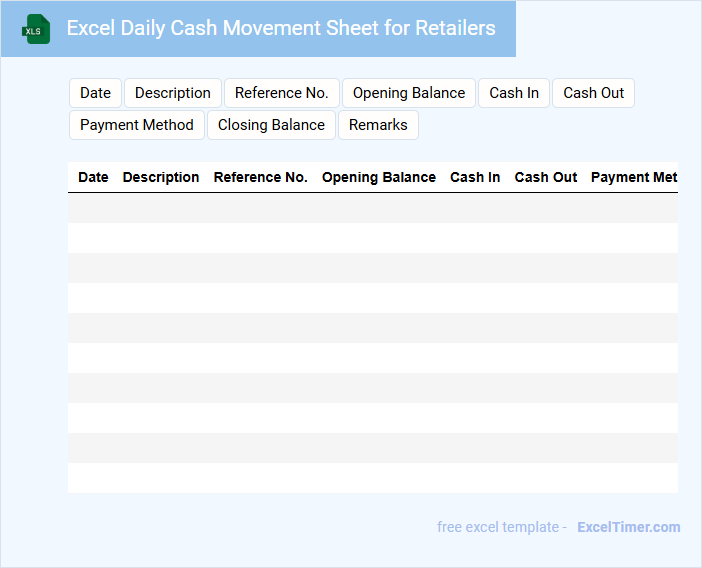

Excel Daily Cash Movement Sheet for Retailers

What information is typically included in an Excel Daily Cash Movement Sheet for Retailers? This document usually contains detailed records of daily incoming and outgoing cash transactions, helping retailers track cash flow accurately. It includes columns for opening balance, sales, expenses, cash deposits, withdrawals, and closing balance to ensure financial transparency and accountability.

What are important considerations when using this type of sheet? Accuracy and timely updates are crucial to maintain real-time financial status and identify discrepancies quickly. Additionally, implementing consistent formatting and clear categorization enhances usability and supports effective decision-making for cash management.

Small Retail Daily Cash Flow Record Sheet

A Small Retail Daily Cash Flow Record Sheet is a document used to track the daily cash transactions within a retail business. It helps monitor sales, expenses, and cash on hand to ensure accurate financial management.

- Record all cash inflows and outflows with timestamps for transparency.

- Include opening and closing cash balances to verify daily cash accuracy.

- Note any discrepancies or unusual transactions for further review.

Daily Retail Cash Flow and Expense Tracker

The Daily Retail Cash Flow and Expense Tracker document typically contains detailed records of daily cash inflows and outflows. It includes sections for sales income, petty cash expenses, and any other financial transactions that occur within the retail environment.

This document is essential for monitoring overall financial health and making informed business decisions. Regular updates ensure accurate tracking of profit margins and help identify trends or discrepancies. Consistently reviewing this tracker is crucial for effective retail cash management.

What key components should be included in a daily cash flow document for small retailers?

A daily cash flow document for small retailers should include key components such as total sales revenue, cash expenses, and opening and closing cash balances to track liquidity accurately. You must also record collections from receivables and payments made to suppliers to maintain a clear picture of daily financial movements. These elements help ensure effective cash management and timely decision-making for your business.

How can accuracy in recording daily cash inflows and outflows impact retail business decisions?

Accurate recording of daily cash inflows and outflows provides a clear financial snapshot essential for effective cash flow management in small retail businesses. Your ability to track precise cash movements enables better budgeting, inventory control, and timely payments to suppliers, reducing the risk of cash shortages. This financial clarity supports informed decision-making, helping to optimize profitability and sustain business growth.

Why is tracking daily cash balances essential for small retailers' financial health?

Tracking daily cash balances is essential for small retailers to maintain liquidity and ensure they can cover operational expenses such as inventory purchases and payroll. Accurate daily cash flow monitoring helps identify trends, prevent overdrafts, and optimize working capital management. Consistent cash balance tracking supports better financial planning and timely decision-making to sustain business growth.

What methods can retailers use in Excel to categorize and summarize different types of cash transactions?

Small retailers can use Excel's PivotTables to categorize and summarize daily cash flow by transaction type, enabling quick analysis of sales, expenses, and returns. Implementing drop-down lists with Data Validation standardizes transaction entry, improving data consistency and accuracy. Conditional Formatting highlights key cash flow trends and anomalies, facilitating efficient financial monitoring and decision-making.

How does monitoring daily cash flow help in identifying cash shortages or surpluses early?

Monitoring daily cash flow provides real-time insight into cash inflows and outflows, enabling small retailers to detect cash shortages or surpluses promptly. Early identification assists in making informed decisions about inventory purchases, expense management, and financing needs. Accurate daily tracking prevents liquidity crises and supports sustained business operations.